November 2024

Food Technology Market (By Component: Hardware, Software, Services; By Industry: Fish, Meat, and Seafood, Fruits and Vegetables, Grain and Oil, Dairy Products, Beverages, Bakery and Confectionery, Others; By Application: Food Science, Kitchen & Restaurant Tech, Delivery, Supply Chain, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

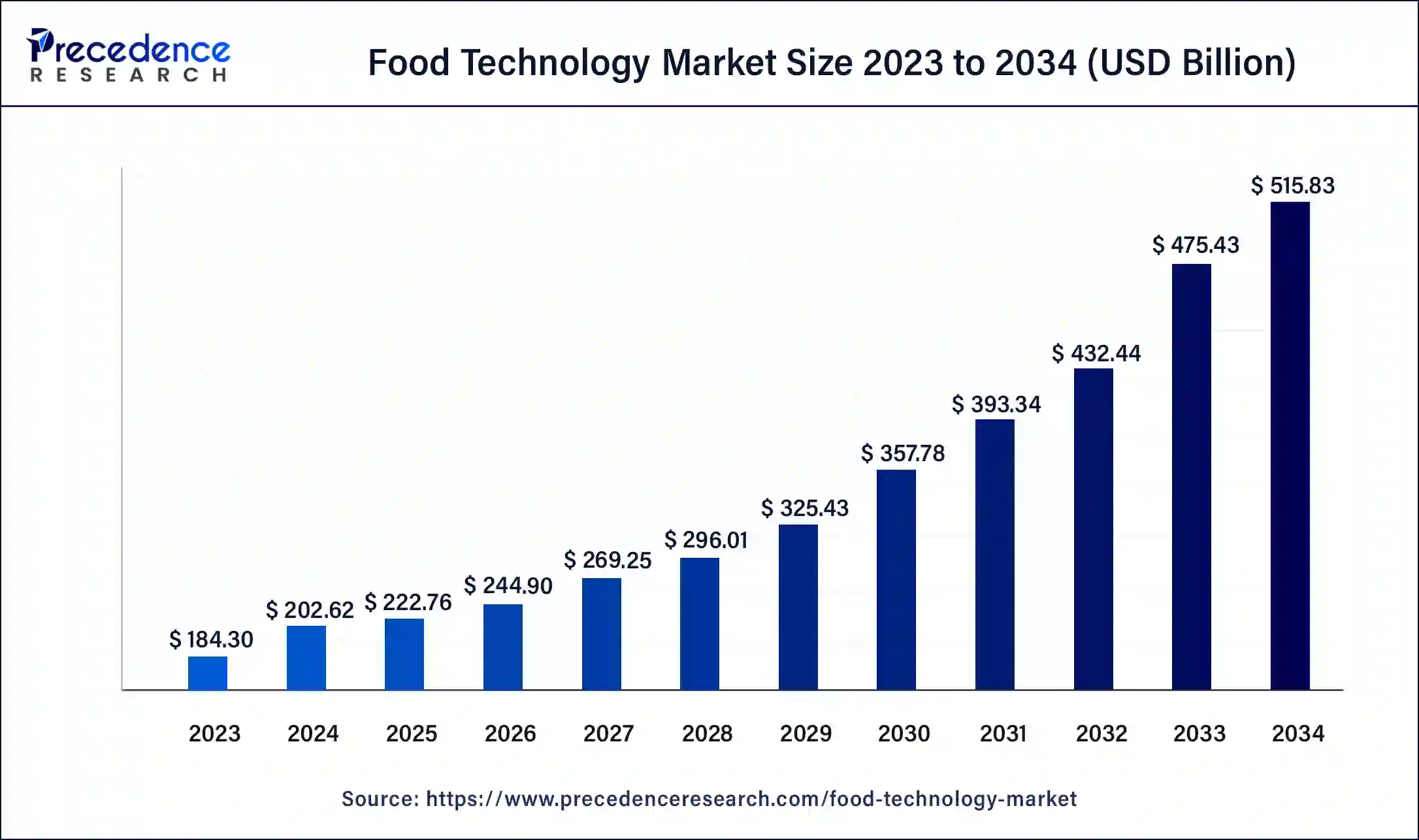

The global food technology market size was USD 184.30 billion in 2023, calculated at USD 202.62 billion in 2024 and is expected to reach around USD 515.83 billion by 2034, expanding at a CAGR of 9.79% from 2024 to 2034.

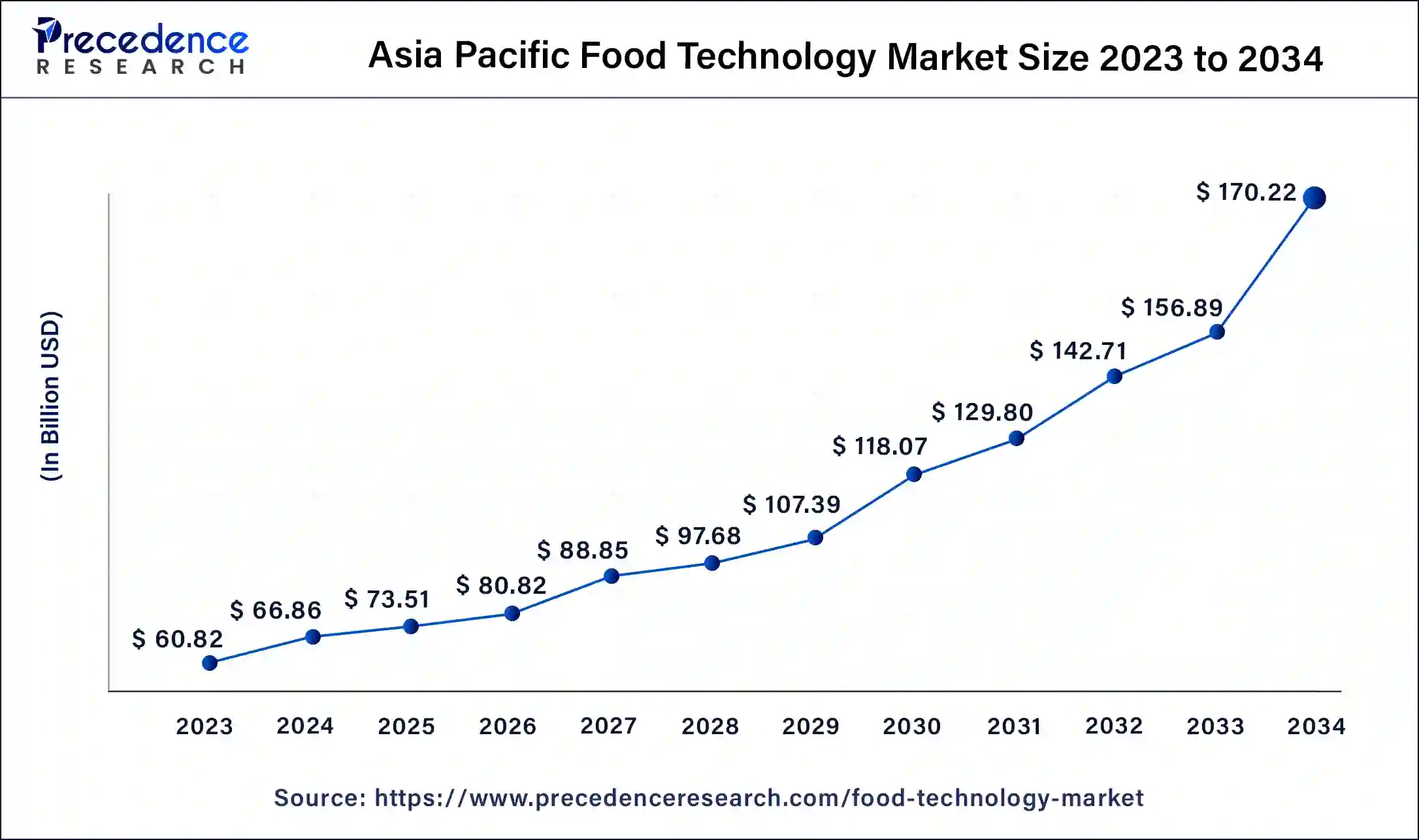

The Asia Pacific Food Technology market size was estimated at USD 60.82 billion in 2023 and is projected to surpass around USD 170.22 billion by 2034 at a CAGR of 10% from 2024 to 2034.

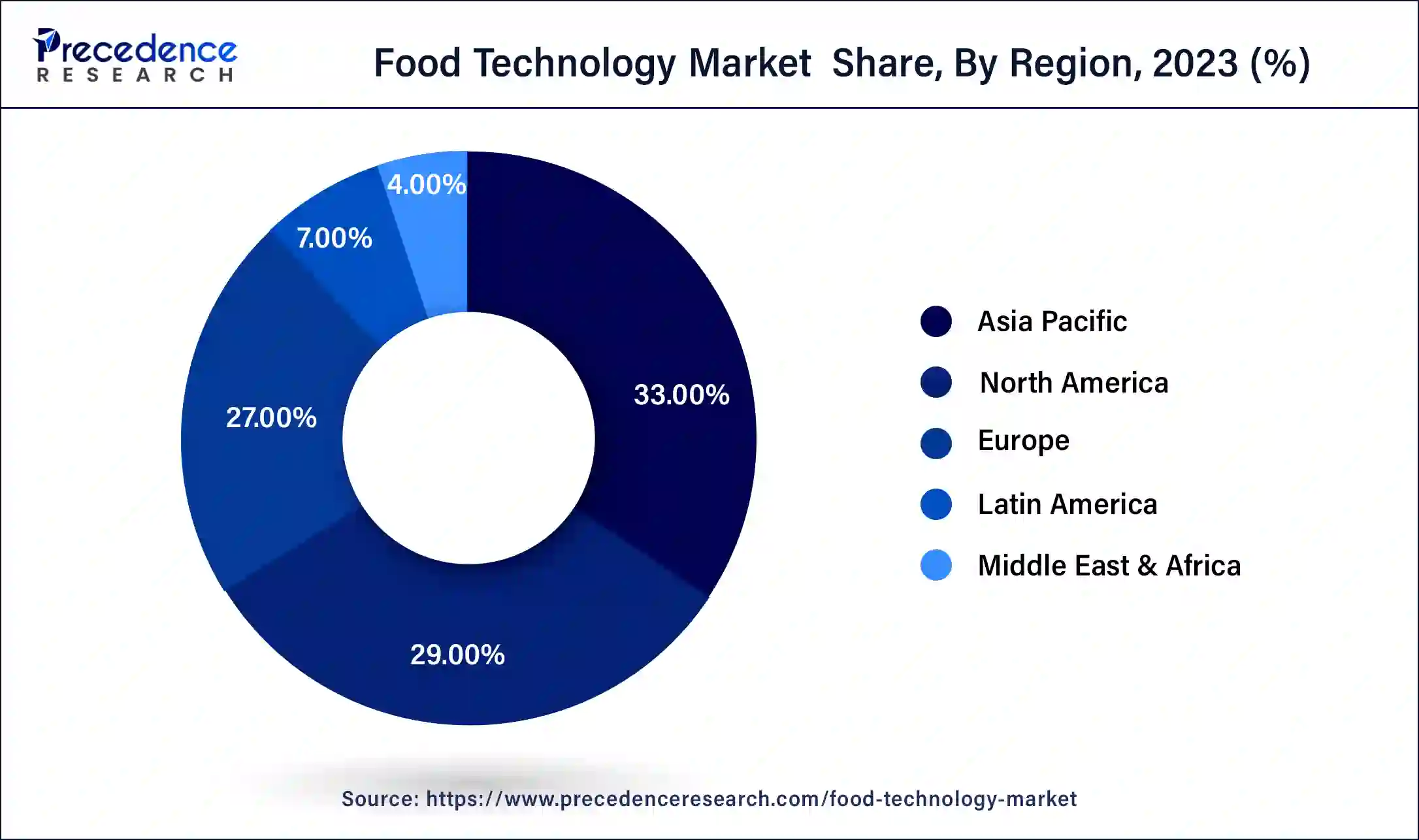

Asia-Pacific held a share of 31% in the food technology market in 2023 due to several factors. Firstly, rapid urbanization and rising disposable incomes in countries like China, India, and Japan have led to increased demand for processed and convenience foods. Additionally, the region's large population creates a vast consumer base for food technology products and services. Furthermore, government initiatives to modernize agriculture and food processing industries, coupled with technological advancements and innovations, further contribute to the region's dominance in the market.

North America is experiencing rapid growth in the food technology market due to several key factors. Firstly, there is a strong culture of innovation and technological advancement in the region, fostering the development and adoption of cutting-edge food technologies. Additionally, shifting consumer preferences towards healthier and more sustainable food options are driving demand for innovative solutions. Furthermore, the presence of established food tech companies and robust investment in research and development contribute to the region's leadership in this market. These factors collectively propel the rapid growth of the food technology industry in North America.

Meanwhile, Europe is experiencing notable growth in the food technology market due to several factors. Firstly, increasing consumer demand for healthy, sustainable, and convenient food options has driven innovation and investment in the region. Additionally, supportive government initiatives and regulations promoting food safety, sustainability, and innovation have created a conducive environment for the growth of the food technology sector. Furthermore, Europe's robust infrastructure, skilled workforce, and strong research and development capabilities have contributed to its position as a leading hub for food technology innovation and entrepreneurship.

Food technology involves applying scientific knowledge and techniques to improve the way we produce, process, package, and distribute food. It encompasses various areas, including food engineering, biotechnology, and nutrition science. In simple terms, it is about using innovation to make food safer, tastier, and more sustainable. Food technologists work on developing new food products, finding ways to extend shelf life, and enhancing nutritional value. They also focus on improving food safety measures to prevent contamination and ensure that food meets regulatory standards. Additionally, food technology plays a crucial role in addressing global food challenges by developing solutions to increase food production efficiency and reduce food waste. Overall, food technology plays a vital role in shaping the future of our food supply, making it more accessible, nutritious, and environmentally friendly.

Food Technology Market Data and Statistics

| Report Coverage | Details |

| Global Market Size by 2034 | USD 515.83 Billion |

| Global Market Size in 2023 | USD 184.30 Billion |

| Global Market Size in 2034 | USD 202.62 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 9.79% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Industry, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing consumer demand for healthier and sustainable food options

The increasing consumer demand for healthier and sustainable food options has driven a surge in the market demand for food technology solutions. Consumers are becoming more aware of the impact of their food choices on their health and the environment, leading them to seek out products that align with their values. As a result, food companies are under pressure to innovate and develop products that meet these evolving preferences.

Food technology plays a crucial role in meeting this demand by enabling the development of healthier and more sustainable food products. Through advancements in food processing, packaging, and ingredient innovation, companies can create products with reduced sugar, salt, and fat content, as well as incorporate sustainable sourcing practices and environmentally friendly packaging materials. By leveraging technology, food companies can respond to consumer demands for transparency, traceability, and ethical production practices, ultimately driving growth in the food technology market.

Limited consumer acceptance of novel food technologies

Limited consumer acceptance of novel food technologies acts as a significant restraint on the market demand for the food technology industry. When consumers are hesitant or skeptical about new food technologies, they may be reluctant to purchase products that incorporate these innovations. This reluctance stems from factors such as unfamiliarity with the technology, concerns about safety and health implications, or simply a preference for traditional or familiar food options.

Additionally, consumer acceptance plays a crucial role in driving demand for food technology products and services. If consumers are not receptive to new food technologies, companies may face challenges in marketing and selling their innovative products, leading to slower adoption rates and lower market demand. Therefore, addressing consumer concerns and educating the public about the benefits and safety of novel food technologies is essential for overcoming this restraint and fostering greater acceptance and demand in the food technology market.

Integration of blockchain technology for supply chain transparency

The integration of blockchain technology for supply chain transparency is creating significant opportunities in the food technology market. By leveraging blockchain, companies can track and record every step of the food supply chain, from farm to table, in an immutable and transparent manner. This enhanced traceability helps build consumer trust by providing verifiable information about the origin, production methods, and quality of food products. Moreover, blockchain technology enables more efficient and secure supply chain management, reducing the risk of fraud, contamination, and foodborne illnesses. With increased transparency and visibility into the supply chain, companies can quickly identify and address issues such as recalls, spoilage, or unethical practices, thus improving overall food safety and quality.

As consumers become more concerned about where their food comes from and how it's produced, the adoption of blockchain technology offers a competitive advantage for companies looking to meet these demands and differentiate themselves in the market.

The hardware segment held the highest market share of 42% in 2023. In the food technology market, the hardware segment comprises physical devices and equipment used in food processing, packaging, and distribution. This includes machinery such as food processors, packaging machines, refrigeration units, and sensors for monitoring temperature and humidity. Trends in the hardware segment include the adoption of automation and robotics to streamline production processes, the development of smart packaging solutions with integrated sensors, and the use of IoT-enabled devices for real-time monitoring and control of food processing operations.

The software segment is anticipated to witness rapid growth at a significant CAGR of 11.1% during the projected period. In the food technology market, the software segment encompasses various digital solutions and platforms used to manage and optimize food-related processes. This includes software for inventory management, supply chain logistics, quality control, and recipe formulation. Recent trends in this segment include the integration of artificial intelligence and machine learning algorithms for predictive analytics, as well as the development of cloud-based software as a service (SaaS) platforms for enhanced scalability and accessibility. Additionally, there is a growing emphasis on software solutions that enable traceability and transparency throughout the food supply chain.

The fish, meat, and seafood segment held a 19% market share in 2023. In the food technology market, the fish, meat, and seafood segment refers to the processing, preservation, and distribution of these protein-rich food products. Trends in this segment include the adoption of advanced processing techniques such as high-pressure processing (HPP) and sous-vide cooking, as well as the development of plant-based alternatives and lab-grown meat. Additionally, there is a growing emphasis on sustainability, with initiatives focusing on responsible sourcing, waste reduction, and eco-friendly packaging solutions.

The dairy products segment is anticipated to witness rapid growth over the projected period. The dairy products segment within the food technology market encompasses the production, processing, and distribution of milk-based products such as cheese, yogurt, and butter. Key trends in this segment include the adoption of innovative processing techniques to enhance product quality and extend shelf life, the development of dairy alternatives to cater to lactose-intolerant and vegan consumers, and the integration of digital solutions for improved dairy farm management and supply chain efficiency.

The food science segment has held a 26% market share in 2023. In the food technology market, the food science segment encompasses the study and application of scientific principles to understand the properties and behavior of food. This includes areas such as food chemistry, microbiology, and engineering, aimed at improving food quality, safety, and production processes. Recent trends in food science within the technology sector include advancements in food preservation techniques, development of novel ingredients, and the integration of biotechnology for sustainable food production and nutrition enhancement.

The delivery segment is anticipated to witness rapid growth over the projected period. In the food technology market, the delivery segment refers to the technological solutions and services used to facilitate the distribution and delivery of food products to consumers. This includes online food delivery platforms, delivery logistics software, and meal delivery apps. A notable trend in this segment is the rapid growth of food delivery services driven by consumer demand for convenience and the increasing adoption of digital platforms for ordering food. This trend is expected to continue as more consumers embrace online ordering and delivery options.

Segments Covered in the Report

By Component

By Industry

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

September 2024

July 2024

October 2024