December 2024

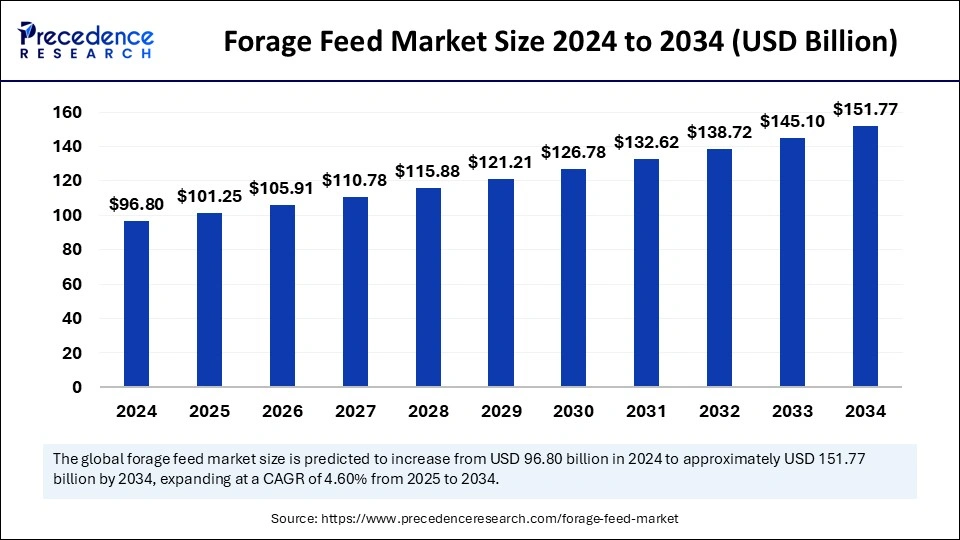

The global forage feed market size is calculated at USD 101.25 billion in 2025 and is forecasted to reach around USD 151.77 billion by 2034, accelerating at a CAGR of 4.60% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global forage feed market size was calculated at USD 96.80 billion in 2024 and is predicted to increase from USD 101.25 billion in 2025 to approximately USD 151.77 billion by 2034, expanding at a CAGR of 4.60% from 2025 to 2034. The market is driven by increasing livestock product requirements, ecological farming practices, and technical improvements in forage farming systems.

The integration of artificial intelligence in the forage feed market optimizes processes and improves products while creating more eco-friendly production standards. Through data analysis, AI facilitates effective management of forage crops, aiding in the optimization of harvest schedules and identifying regions with crop damage. AI systems analyze visual data and information to produce suggestions about when to harvest and how to manage storage and feeding practices, enhancing overall effectiveness in forage management. The use of AI technology enables data-informed decisions that provide various benefits for sustainability, operational efficiency, and product yield in the forage feed industry

Forage feed consists of plant-based products containing legumes, grasses, and additional vegetation that serve as dietary content for livestock. The nutritional composition of forage feed provides both essential minerals and abundant fibers, which preserve animal well-being while aiding their digestion and facilitating growth development. Forage stands out as a sustainable animal feed since its cultivation needs minimal resources while it helps protect soils as well as allocate carbon into the environment.

The forage feed market expansion is due to the expanding public understanding of sustainable animal feed solutions. Technological progress in forage cultivation through precision agriculture with biotechnology delivers better production efficiency and higher yield. Worldwide meat consumption growth creates a rising demand for animal feed products with an emphasis on forage seeds because they serve as important nutrients for livestock. With the increasing interest in sustainable agriculture, many farms choose forage-based animal nutrition, which represents an essential component for livestock farming's future development.

| Report Coverage | Details |

| Market Size by 2034 | USD 151.77 Billion |

| Market Size in 2025 | USD 101.25 Billion |

| Market Size in 2024 | USD 96.80 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.60% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Products, animal type, and Regions |

| Regions Covered | America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing livestock population

The increasing global livestock population serves as a key driver for the growth of the forage feed market. Livestock fundamentally relies on forage as it supplies essential roughage components and fiber, which are vital for their health and productivity, especially in dairy cows. Ruminants obtain the vital calories, fiber, and protein they need from high-quality hay, silage, and premium forage options. Forage consumption leads to better milk levels and strengthens animal health outcomes. Higher livestock numbers enhance market demand for efficient, sustainable feeds of high quality, which accelerates market expansion.

As reported by the USDA in 2023, India's livestock sector, an important component of the agricultural economy, has seen notable expansion, with the cattle population estimated at approximately 307.5 million, positioning India as the nation with the largest cattle population in the world.

Technological innovations in forage feed

The forage feed industry is experiencing a transformation because technological developments enhance feed quality and production volume. Seed advancements, mechanical farm equipment, and farming systems have created efficient production methods for forage feed. Modern innovations enhance forage efficiency, which allows farmers to manage increasing animal feed requirements. These evolving technologies boost both market expansion of forage feed and improve livestock farming sustainability, operational profitability, and productivity. The adoption of these technological advancements enables the forage feed industry to establish highly efficient sustainable practices.

Climate change and environmental factors

Unstable environmental conditions and climate change represent a substantial barrier to the forage feed market. The growth and yield of forage crops experience negative impacts from temperature changes, regular droughts, and extreme rainfall occurrences. The forage feed industry experiences difficulties across its production lines to maintain constant output, because of which product shortages emerge, leading to higher prices. The farmers who lack sufficient water supply and irrigation infrastructure face problems when adapting to these new situations.

Increasing R&D investments by government and private bodies

Research and development activities play a key role in advancing the forage feed market because government and private organizations are allocating more funds to improve their operations. Organizations make investments to enhance the efficient production and nutritional worth of sustainable forage feed. Modern research and development activities work toward creating new forage crop varieties that demonstrate enhanced tolerance. Technological advancements are helping to improve processes for forage feed storage and preservation, as well as feed quality enhancement and waste reduction. The investments lead to growth opportunities within the market, which simultaneously delivers advantages to farmers and livestock producers together with the entire agricultural sector.

The stored forage segment contributed the largest share of the forage feed market in 2024. The worldwide need for animal feed has driven growth because of expanding human populations with rising protein consumption from animal sources. A dependable method for animal forage supply is essential for farmers who need feeds during times without fresh forage access, such as winter or dry seasons. Preserved forms of forage, such as hay and silage, together with other stored varieties, maintain their nutritional quality for extended periods.

New technology, such as silage bags and bale wrappers, enables farmers to keep their forage fresh for longer periods while maintaining nutritional content. Farmer planning of feed supplies becomes more effective through this process, so animals always get proper nutrition during challenging periods. Storing forage through preservation methods enables livestock owners to keep feeding their animals with steady diets and promote animal health while enhancing their ability to benefit from excess forage supply.

The fresh forage segment shows strong indications of becoming a major segment in the forage feed market. Farm livestock consume fresh forage, which comprises grasses, legumes, and natural plants that exist in their raw state. This feed contains ample proteins, necessary vitamins, and minerals that sustain the health of cattle together with sheep and goats. Fresh forage has become the main interest of farmers because it delivers essential minerals to animals as they occur in nature, leading to superior development and production capabilities.

The need for better environmental practices has led farming communities to adopt fresh forage from organic and sustainable feeding sources. Fresh forage stands as an economical, sustainable feed source that is particularly valuable in areas where it is readily accessible and available at a low cost. Hay farmers benefit from fresh forage because it decreases their dependency on stored hay sources yet allows them to provide vital nutrients to their animals for health outcomes.

The ruminants segment accounted for the largest share of the forage feed market. Ruminate animals require forage feed to acquire nutritive elements since the resulting dairy product fetches enhanced quality. The livestock industry heavily depends on milk production; thus, the need for premium forage feed continues to escalate because milk consumption keeps increasing across developing nations. People have become aware of milk and animal product health advantages, and the increasing demand for dairy and meat drives the requirement for top-quality forage feed.

Agricultural producers work to supply their cattle with supreme feed sources because this enhances milk quality and meat quality. The market for ruminant forage feed is expanding since both world populations increase and consumers require protein-rich products like milk and meat that need good feed to fulfill their nutritional requirements.

The poultry is expected to grow substantially within the study period of the forage feed market. The expansion occurs because customers increasingly purchase fresh and nutritious poultry meat items, including chicken, turkey, duck, and eggs. The feeding mix for poultry contains grains, seeds, and plant proteins because these components support poultry growth and health and produce high-quality eggs. The increasing worldwide consumption of poultry foods leads to an increasing demand for specialized forage feed products targeted at poultry.

The poultry market expands because of growing populations, improved financial prosperity, and consumer preference changes towards protein-source diets. The rising market for poultry meat and eggs demands farmers to supply balanced nutritious forage feed to maintain their health and operational output.

North American Market Trends

North America held the dominating share of the forage feed market in 2024. The well-established agricultural industry, boosted by modern farming technologies and efficient feed systems in North America, drives a stronger demand for forage feed. Sustainable farming practices and rising animal dietary requirements in North America position this region as the main power behind the market. The strong development of livestock and agricultural industries forms the backbone that drives this market.

The United States produces large amounts of beef cattle in its agricultural sector, hence requiring significant amounts of forage feed as livestock nutrition. Quality feed distribution across the United States has become more accessible because of the extensive, well-developed network of feed manufacturers and distributors operating within the country.

Asia Pacific Market Trends

Asia Pacific is expected to witness the fastest rate of growth during the predicted timeframe. High demand for dairy products and livestock products drives market expansion in this region. The market keeps growing because government subsidies and agricultural sector support programs, particularly for dairy farming and animal product demands, fuel this expansion. The demand for superior forage feed is expected to expand at a fast pace due to the major cattle-producing countries such as India and China leading the market.

Chinese cattle producers rank among the top in the world, which leads to an increasing requirement for forage to supply nutritional needs for their expanding dairy and meat production sectors. The dairy and agricultural industries have gained substantial support from government funding programs, which propelled forage feed demand elevation.

According to the USDA, the total cattle and buffaloes inventory of China reached about 105 million units at the conclusion of 2023.

European Market Trends

The European market for forage feed is expanding because customers are increasingly looking for these items. The strong poultry industries within these nations elevate the market demand for premium quality feed forage, which delivers the required nutritional content to their livestock. Larger areas of grazing lands for fodder cultivation drive the production of forage feed. The market demand for organic and nutrient-rich forage feed has expanded because customers select sustainable and health-based food choices.

In March 2023, Barenbrug made a strategic agreement to purchase the well-known UK seed specialist Watson Group, which aims to strengthen its UK market position. Barenbrug supports its grass-seed market expansion through the acquisition of Scottish markets, where Watson maintains a dominant position.

By products

By animal type

By region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

February 2025