September 2024

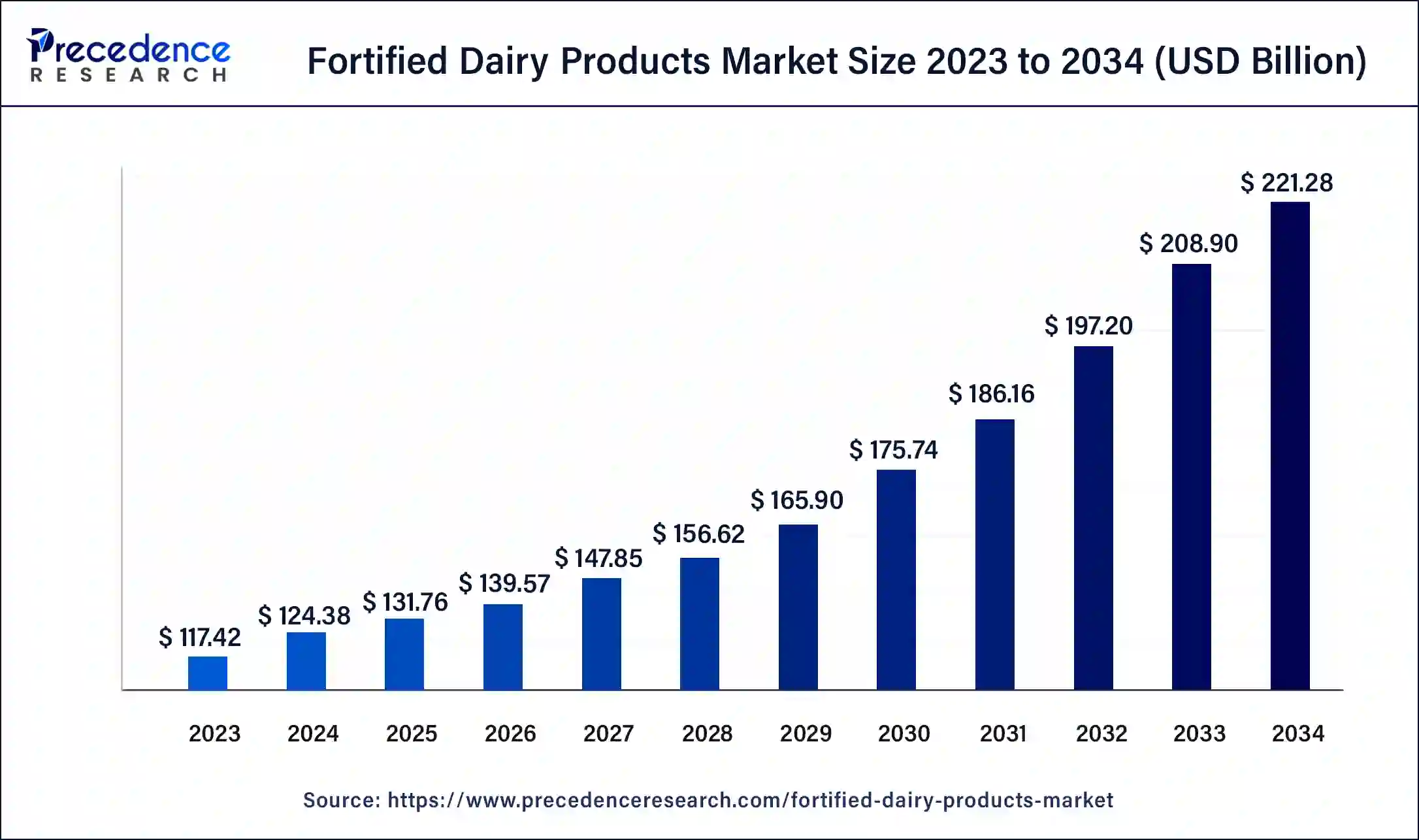

The global fortified dairy products market size surpassed USD 117.42 billion in 2023 and is estimated to increase from USD 124.38 billion in 2024 to approximately USD 221.28 billion by 2034. It is projected to grow at a CAGR of 5.93% from 2024 to 2034.

The global fortified dairy products market size is worth around USD 124.38 billion in 2024 and is anticipated to reach around USD 221.28 billion by 2034, growing at a CAGR of 5.93% over the forecast period 2024 to 2034. The growing health awareness and nutritional deficiencies are the key factors driving the fortified dairy products market growth.

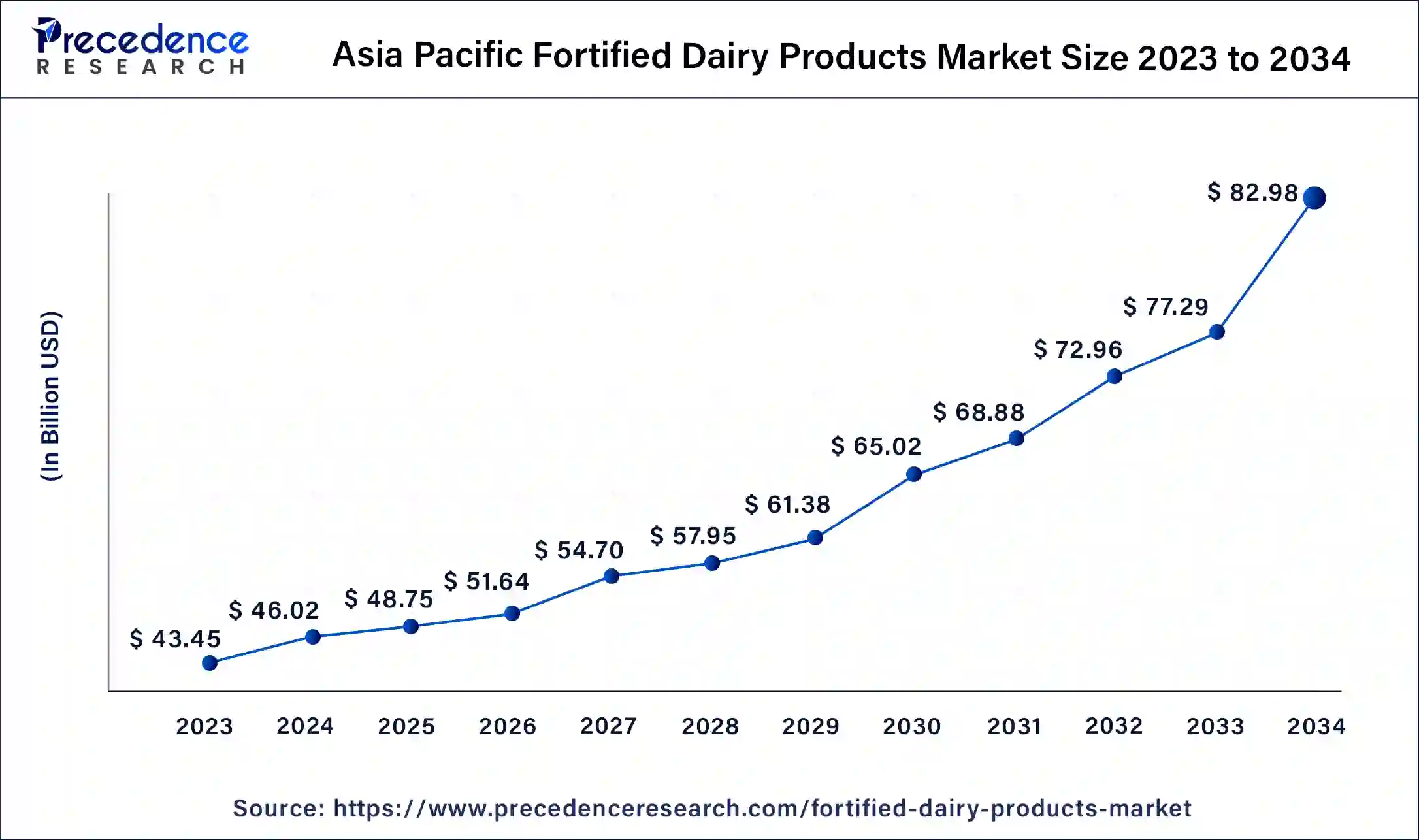

The Asia Pacific fortified dairy products market size was exhibited at USD 43.45 billion in 2023 and is projected to cross around USD 82.98 billion by 2034, poised to grow at a CAGR of 6.05% from 2024 to 2034.

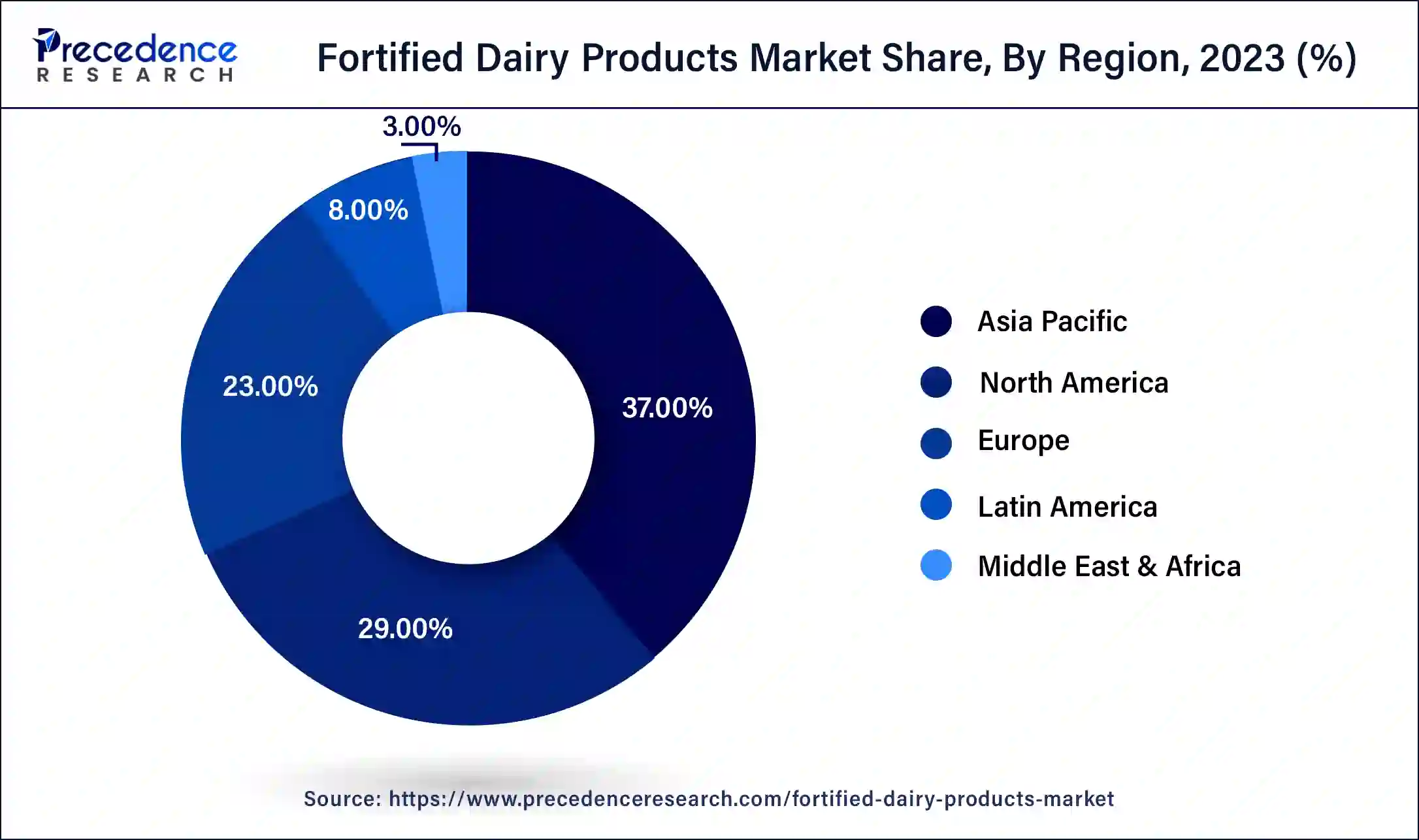

Asia Pacific dominated the fortified dairy products market in 2023. The dominance of the region can be attributed to the rising concerns about nutrient deficiencies, particularly in developing nations, which are enabling consumers to seek out fortified methods for key vitamins and minerals. Furthermore, changing dietary patterns also leads to a higher consumption of dairy products. Advancements in product formulations and flavors can make fortified dairy more appealing.

Europe is expected to show the fastest growth in the fortified dairy products market over the studied period. This is because the European market benefits from efficient retail networks involving health food stores and supermarkets, which provide good access to an extensive range of fortified dairy products. Moreover, strict regulatory standards, along with diverse consumer preferences, make fortified dairy more appealing in the region.

Fortified dairy products are the kind of dairy products that are rich with micronutrients like minerals and vitamins that are lacking in consumers of different age groups. Because of its various applications and strong nutritional value milk is the most consumed dairy product across the globe. Many diseases can be cured by consuming fortified milk such as night blindness, anaemia, osteoporosis, and exophthalmia.

Top 10 Countries by Milk Production (2022)

| Country | Milk Production in Tonnes |

| India | 213,779,230 |

| United States | 102,747,320 |

| Pakistan | 62,557,950 |

| China | 39,914,930 |

| Brazil | 35,944,056 |

| Germany | 33,188,890 |

| Russia | 32,977,956 |

| France | 25,028,850 |

| Turkey | 21,563,492 |

| New Zealand | 21,051,000 |

How is AI Changing the Fortified Dairy Products Market?

There are many applications of AI in the fortified dairy products market, including drones, robots, 3D printing, virtual reality, and artificial neural networks (ANN). The dairy industry utilizes AI robots for different applications to enhance effectiveness and reduce the production cost. Furthermore, as per certain researchers, productivity in the food industry can be increased by up to 25% by using robots instead of human chains. The application of AI in the dairy industry can change the whole dairy sector in upcoming years.

| Report Coverage | Details |

| Market Size by 2034 | USD 221.28 Billion |

| Market Size in 2023 | USD 117.42 Billion |

| Market Size in 2024 | USD 124.38 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.93% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Ingredient, Flavour, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Expansion of probiotic-fortified dairy products

The probiotic-fortified dairy products market is experiencing strong growth as the link between gut health and the normal well-being of an individual. Additionally, rising consumer interest in probiotics is fueled by scientific research underscoring the advantages of a healthy gut microbiome, which include better digestion, enhanced immunity, and potential mental health benefits. These advancements are making probiotic-fortified yogurts more appealing and effective.

High cost and lactose intolerance

The cost of fortified dairy products market products is generally higher than regular dairy products, which can be a significant challenge for the global market. Additionally, there is an increasing prevalence of lactose intolerance among young adults.

Rising demand for vitamin-fortified dairy products

The demand for vitamin-fortified dairy products is experiencing a notable surge in the fortified dairy products market as consumers become more aware of their nutritional intake. Vitamin fortification solves deficiencies common in a variety of populations. Furthermore, Fortified milk is a main product in this category, providing improved levels of these important vitamins.

The milk segment dominated the fortified dairy products market in 2023. The dominance of the segment can be attributed to the rising health consciousness among most consumers, along with the added nutritional benefits of fortified milk, such as minerals and vitamins. Moreover, Health issues like vitamin D deficiencies and osteoporosis are becoming more prevalent, enabling consumers to look for more safe dietary options.

The ice cream segment is anticipated to grow at the fastest rate in the fortified dairy products market over the forecast period. This is because consumers are seeking indulgent treats that provide nutritional benefits like minerals, vitamins, and probiotics, which is fueling the segment's growth further. Furthermore, Innovations in food technology can be able to make fortified ice cream by maintaining its original taste and texture.

The vitamin segment led the global fortified dairy products market 2023. The segment's growth can be linked to increasing consumer awareness about nutrition and health. Consumers are also seeking products that offer key health benefits, such as items fortified with vitamins A, B12, and D, which are necessary for bone health and immune function.

The protein segment is expected to grow at the fastest rate in the fortified dairy products market during the forecast period. This is due to increasing health awareness and the popularity of high-protein diets, such as paleo and keto, which are propelling consumers to find protein-enriched dairy products. Also, people are becoming more aware of protein's benefits for muscle growth and overall health management. Athletes and fitness freaks also seek protein-fortified dairy products for performance enhancement.

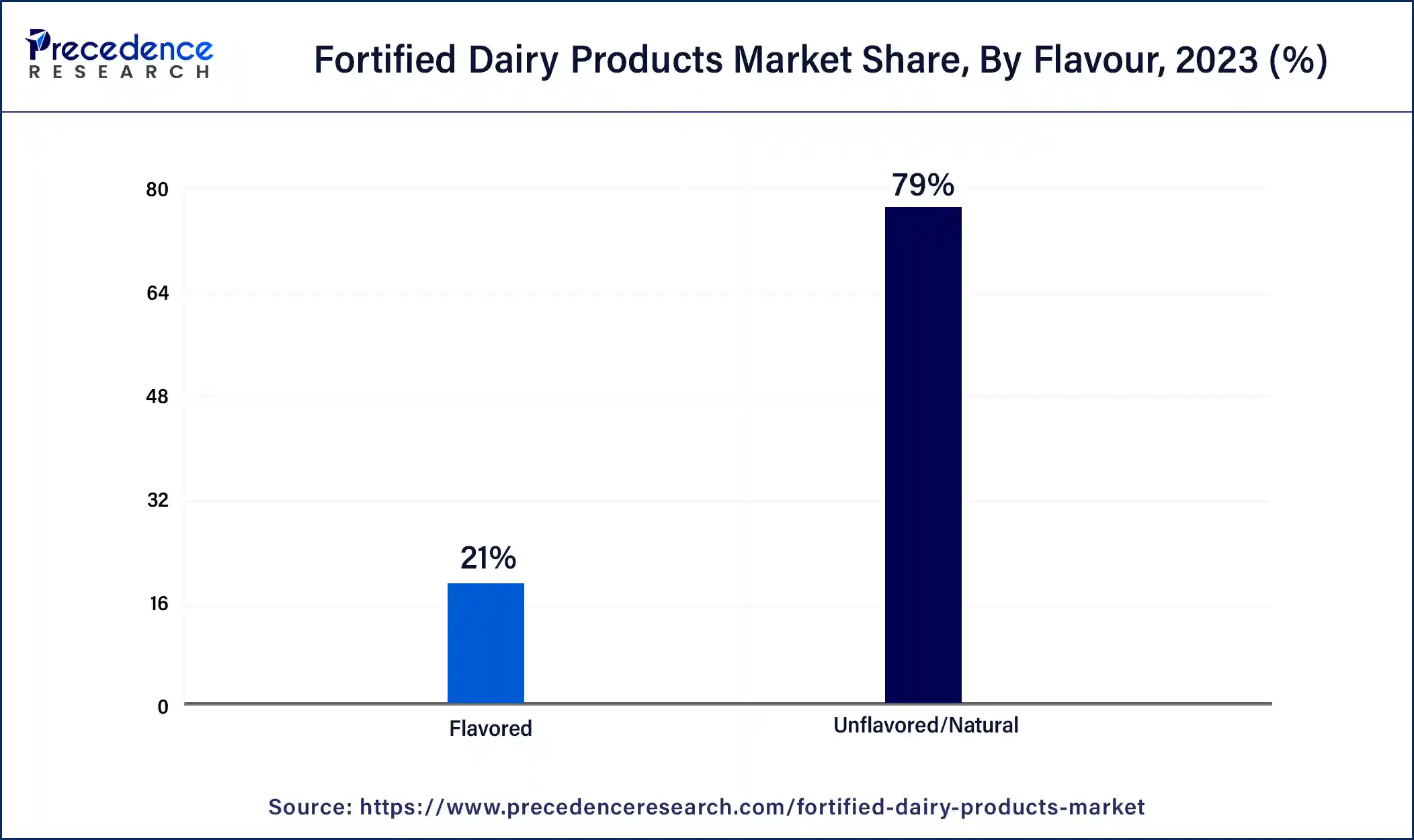

The unflavoured/natural segment dominated the fortified dairy products market in 2023. Unflavoured fortified dairy products give a versatile and pure base, which is needed for greater flexibility in meal preparation and cooking. Additionally, there is a growing demand for maintaining a natural diet, which enhances interest in dairy products with essential nutrients and natural flavors.

The flavoured segment is expected to grow at the fastest rate in the fortified dairy products market during the projected period. The growth of the segment can be linked to the rising consumer awareness regarding nutritional benefits and flavored taste experiences, boosting interest in products that combine key nutrients with various flavors. Furthermore, flavored fortified dairy products provide an efficient way to fuel nutrient intake without compromising on taste.

The hypermarkets & supermarkets segment led the fortified dairy products market in 2023. The dominance of the segment is driven by the increasing foot traffic and wide reach of hypermarkets and supermarkets in urban cities. These stores often provide prominent marketing strategies that underscore the health benefits of fortified dairy products. These retail channels also offer a wide range of fortified dairy products, which makes it convenient for consumers to choose from and access various options.

The online segment will witness the fastest growth in the fortified dairy products market over the forecast period. This is because online shopping gives unparalleled convenience, allowing consumers to purchase and browse fortified dairy products from any location. However, the increase in subscription services, along with the direct-to-consumer models, further enhances customer convenience and loyalty.

Segments Covered in the Report

By Product

By Ingredient

By Flavour

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Fortified Dairy Products Market

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

April 2024

January 2025

January 2025