Freight Brokerage Market Size and Forecast 2025 to 2034

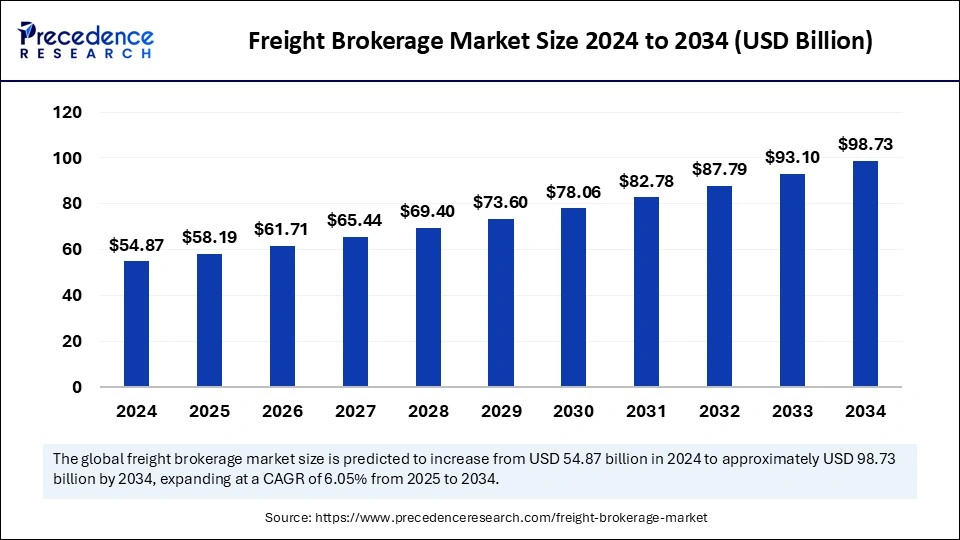

The global freight brokerage market size was calculated at USD 54.87 billion in 2024 and is predicted to increase from USD 58.19 billion in 2025 to approximately USD 98.73 billion by 2034, expanding at a CAGR of 6.05% from 2025 to 2034. The market growth is attributed to the rising demand for digitally connected freight solutions that enhance shipment efficiency, transparency, and cost optimization.

Freight Brokerage Market Key Takeaways

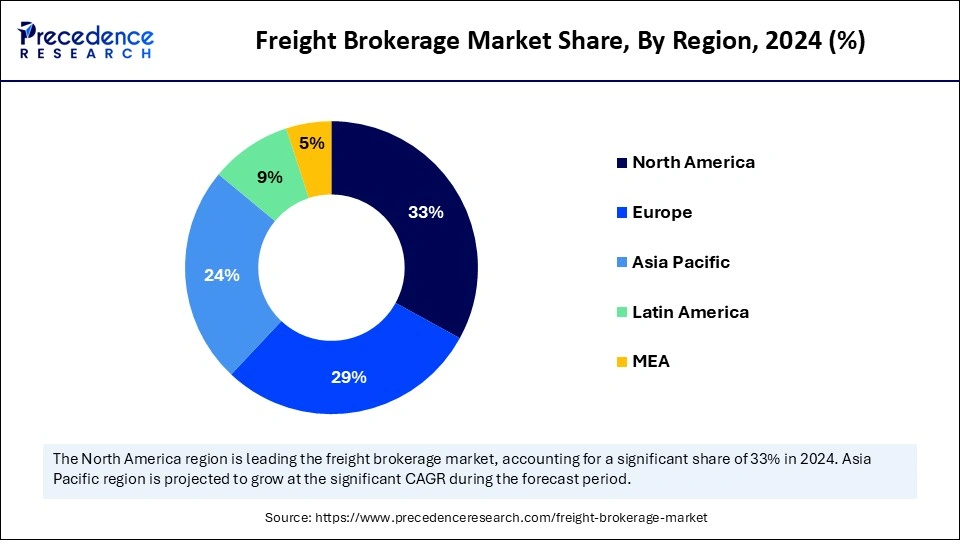

- North America dominated the global market with the largest market share in 33% in 2024.

- Asia Pacific is anticipated to experience the fastest growth during the forecast period.

- By service, the intermodal segment held the biggest market share in 2024.

- By service, the truckload segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By customer type, the B2B segment accounted for a considerable share of 59% in 2024.

- By customer type, the B2C segment is projected to grow at the highest CAGR over the years studied.

- By mode of transport, the waterways segment led the global market in 2024.

- By mode of transport, the roadways segment is projected to expand rapidly in the coming years.

- By industry vertical, the manufacturing segment dominated the worldwide market in 2024.

- By industry vertical, the retail & e-commerce segment is expected to grow at the fastest CAGR in the near future.

Impact of Artificial Intelligence on the Freight Brokerage Market

The freight brokerage industry experiences revolutionary changes through artificial intelligence (AI), which optimizes operations and decision processes and reduces costs. Real-time load-carrier matchmaking through AI-enabled platforms has become standard practice for logistics companies, thus reducing human involvement and response time. Predictive analytics assist brokers in forecasting future needs by analyzing weather patterns and traffic flow alongside historical data, helping them optimize routes and reduce operational threats. Technological innovations optimize resource management, reduce operational spending, and enhance the precision of delivery services. AI algorithms analyze vast amounts of data to match shippers with the most suitable carriers, optimizing routes.

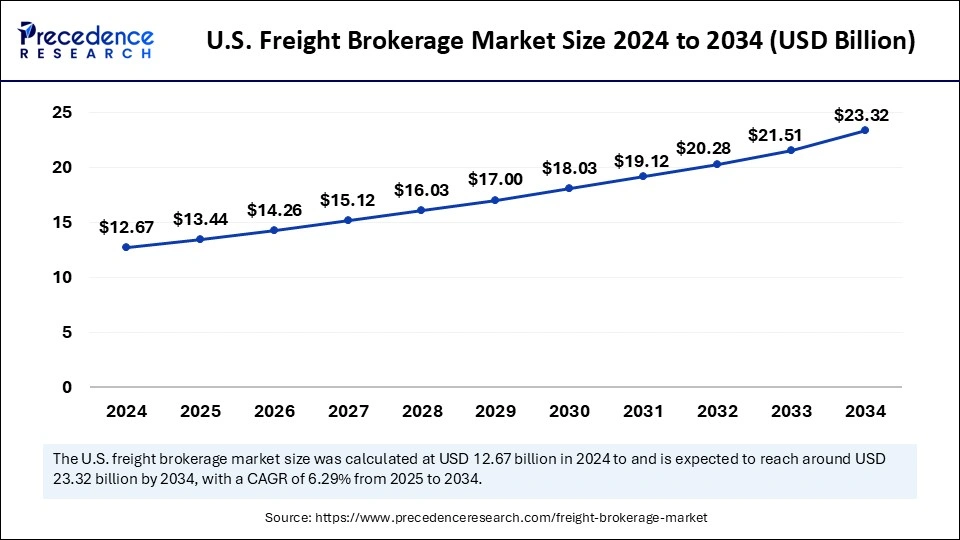

U.S. Freight Brokerage Market Size and Growth 2025 to 2034

The U.S. freight brokerage market size was evaluated at USD 12.67 billion in 2024 and is projected to be worth around USD 23.32 billion by 2034, growing at a CAGR of 6.29% from 2025 to 2034.

North America led the freight brokerage market by capturing the largest share in 2024. This is mainly due to the established logistics system with advanced digital technology and effective transportation between different areas within the region. Road-based brokerage services play a crucial role in North American commerce because trucks transport products worth more than 70% of the annual domestic freight volume, based on figures from the U.S. Bureau of Transportation Statistics (BTS) Freight Facts and Figures 2024. Digital freight platforms have gained immense popularity as brokers use them to better connect shipments with carriers, customize transportation routes, and interact with carriers more effectively.

The U.S.–Mexico–Canada Agreement (USMCA) provided additional momentum to freight movement across national borders, thereby strengthening North America's ability to meet the needs of the brokerage sector. The Mexican market saw growing brokerage operations as it received increasing nearshoring volume, particularly in electronics and automotive freight transport between the border locations of Monterrey and Tijuana. Furthermore, the gradual recovery from a recession with technological progress and supply chain durability enabled the expansion of brokerage activities, strengthening supply chain performance throughout the region.

Asia Pacific is anticipated to witness the fastest growth during the forecast period, owing to the rapid industrial industrialization and expansion of e-commerce. Various Asian countries are investing in smart logistics corridors and digital freight networks, with port capacity development in China, India, Vietnam, and Indonesia. The Asian Development Bank (ADB) Transport Sector Report 2024 demonstrates that regional freight demand increased mainly because of increased manufacturing output and trade agreements under the Regional Comprehensive Economic Partnership (RCEP).

The Belt and Road Initiative of China continued its upgrade of international rail routes and seaports, which enabled significant freight movements to and from Guangzhou, Shenzhen, and Chengdu. In Vietnam, partnerships between government entities and private logistics companies compelled them to enhance digital brokerage platforms, and Indonesia fast-tracked its National Logistics Ecosystem program to unite different freight transportation methods. These factors position Asia Pacific at the forefront of providing advanced freight brokerage operations.

Europe is expected to see notable growth in the coming years. The growth of the freight brokerage market in Europe can be attributed to the rising focus on sustainable logistics practices among manufacturers and the expansion of trading operations across EU borders. Through the Connecting Europe Facility (CEF) program, there is a high investment in establishing advanced transport infrastructure between different networks while streamlining traffic flow at main freight centers. Germany's rapid advancement of hydrogen-powered freight corridors provides brokers with enhanced capabilities to meet emission-free targets. Additionally, the latest technological improvements maintain Europe as a key foundational hub serving modern freight brokerage services that advance at each step.

Market Overview

The increasing need for real-time freight conditions boosts the demand for brokerage systems across worldwide logistics networks. The freight brokerage operation connects shippers with carriers through digital platforms, enabling efficient multi-modal freight transfer, which depends on automation, GPS tracking, and cloud systems. Implemented systems to enable efficient load booking functions, optimal route planning, and regulatory requirements management to enhance shipment visibility. The U.S. Department of Transportation Freight Analysis Framework (2024) demonstrates that more than 20.2 billion tons of products traveled through the U.S. supply chain in 2023. Furthermore, the increase in demand for emission cuts with faster delivery times drives the quick adoption of platform-based freight brokerage models.

Freight Brokerage Market Growth Factors

- Growing Urbanization: Rapid urbanization in developing economies is expected to increase the demand for efficient, technology-driven freight brokerage solutions.

- High Smartphone Penetration: The rising use of smartphones and mobile apps among truckers and shippers is projected to enhance digital brokerage platform usage.

- Increasing Third-Party Logistics (3PL) Adoption: A rapid shift of businesses to outsourced logistics strategies is anticipated to boost the demand for brokerage services.

- Surging Small Business Participation: The rise of small and medium-sized enterprises in global trade is likely to drive scalable freight brokerage partnerships.

High Investment in Supply Chain Automation: A growing emphasis on digital automation across logistics operations is expected to support brokerage platform integration. - Expanding Cold Chain Networks: Growth in temperature-sensitive goods transportation is projected to increase reliance on brokers for specialized logistics coordination.

- Rising Focus on Just-in-Time Delivery: The increasing need for time-sensitive freight solutions is anticipated to boost real-time brokerage demand across sectors.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 98.73 Billion |

| Market Size by 2025 | USD 58.19 Billion |

| Market Size by 2024 | USD 54.87 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.05% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Services, Customer Type, Mode of Transport, Industry Vertical, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for Real-Time Freight Visibility

The demand for real-time freight visibility is increasing, which is a key factor driving the growth of the freight brokerage market. Currently, shippers and logistic services providers are seeking solutions that deliver complete tracking functionalities, transparent data, and performance insights to enhance delivery reliability measures. Digital freight platforms achieve end-to-end supply chain visibility through GPS, IoT sensors, and AI algorithms that track shipments. The transparent tracking capabilities enable faster problem identification and better communication between customers and stakeholders, strengthening trust relationships.

Companies that adopt real-time information delivery methods cut down detention periods together with service-level infractions and reach precise order delivery times. The U.S. Department of Transportation released its Freight and Logistics Supply Chain Assessment in 2024 to show how real-time visibility technology improved transportation movement while eliminating bottlenecks in vital U.S. transportation corridors. The European Commission, under its Sustainable and Smart Mobility Strategy in 2024, specified the importance of digital freight visibility tools for building a sustainable logistics system. Furthermore, real-time freight visibility stands as a fundamental capability for organizations to reach operational excellence through resilient supply chain management as supply chain intricacy escalates.

Restraint

High Initial Investments

Smaller freight operators and independent brokers often face financial barriers that are expected to restrain the growth of the freight brokerage market. The deployment of AI systems, with real-time tracking and automated booking systems, requires substantial investments in hardware acquisitions, staff training, and software purchases. Companies working with minimal profit margins avoid implementing these technologies, as they reduce their readiness to shift from their current traditional operations to modern formats. The reluctance to accept modern freight brokerage standards pushes back their popular adoption.

Opportunity

Spurring Investments in Logistics Infrastructure

Rising investments in logistics infrastructure are anticipated to support regional brokerage expansion, thus creating immense opportunities for the players competing in the market. Public and private organizations focus on investing in building advanced transportation systems and warehouse spaces with smart mobility systems to enhance resource delivery. Upgraded infrastructure systems shorten delivery times while extending accessible travel paths, which increases the number of stakeholders joining brokerage operations. Enhanced intermodal hubs, improved digital corridors, and better roads help brokers streamline carrier onboarding processes for improved network optimization. Such improvements help regional brokerage companies grow their market reach by satisfying increasing freight needs.

Following a 2024 evaluation, the U.S. Department of Transportation received additional federal funds through its National Freight Strategic Plan to enhance freight routes and minimize traffic delays. The Logistics Performance Index 2024 shows that countries that modernize their logistics sector achieve superior capabilities in regional trade efficiency with improved freight reliability. Furthermore, the unified infrastructure development strategies ensure the development of robust brokerage systems that respond quickly and withstand challenges.

Service Insights

The intermodal segment dominated the freight brokerage market in 2024 as shippers are continually seeking logistics solutions that combine sustainability with cost-effective operational measures. The intermodal freight brokerage employs rail and truck transportation with maritime assets to achieve reduced fuel usage and emission reduction and optimized transit times. According to the U.S. Environmental Protection Agency, through its 2024 SmartWay Program report, intermodal freight operations produce 65% less greenhouse gas emissions than standard long-haul trucking. Furthermore, the time-sensitive coordination capabilities between modes justify intermodal freight brokerage services as a modern and forward-thinking business decision, thus fueling the segment.

The truckload segment is expected to grow at the fastest rate in the coming years. This is mainly due to the rising demand for cost-effective transportation to move large volumes of goods. Truckload brokerage moves massive shipments across extensive distances while meeting steady customer requirements from retail sectors with manufacturing and automotive businesses. Brokers landed multi-truckload service agreements from shipping companies, as these arrangements helped customers cut down their shipping costs per vessel and gain swifter route deliveries. Furthermore, the trailers moving under truckload brokerage services showed better operational visibility, as growing digital tracking capabilities made this option the main choice for high-capacity transportation.

Customer Type Insights

The B2B segment held the largest share of the freight brokerage market in 2024. This is mainly due to the heightened demand for high-level services from the manufacturing, pharmaceutical, construction, and agriculture industries. These industries often need repeated bulk deliveries requiring meticulous delivery schedules that motivated B2B-oriented brokerage operations. Security within B2B client relations depended on freight brokers who established dedicated carrier networks, handled customized contracts, and implemented efficient route optimization methods. The U.S. freight corridors carried most of their tonnage as industrial and commercial freight movements, according to Freight Facts and Figures 2024 by the U.S. Department of Transportation.

The B2C segment is projected to grow at the highest CAGR in the coming years, owing to the e-commerce expansion alongside consumer demands for enhanced delivery efficiencies and visibility. High-volume small-package logistics require substantial help from freight brokers to support e-commerce platforms, particularly before important retail periods and promotional events. The World Trade Organization published its 2024 digital trade report, which highlighted logistics as a critical support system for worldwide e-commerce trade during its brief while stressing the necessity of dependable last-mile delivery. Additionally, the quick delivery scheduling with live order tracking maintains its role as the main competitive advantage, which allows B2C-oriented brokers to pursue growth within an evolving digital marketplace.

Mode of Transport Insights

The waterways segment dominated the freight brokerage market in 2024, as it offers economical bulk cargo handling alongside environmental sustainability targets. Transportation of huge and non-hurry goods through ports and inland waterways functions as a crucial delivery network that reduces road system complexity. Maritime freight emits 90% fewer COâ‚‚ per ton-mile than road freight. This level of carbon reduction makes maritime transportation an environmental choice for shipping. Furthermore, the shipping brokers who establish maritime routes to support worldwide emission reduction initiatives benefit by obtaining affordable shipping rates for moving big volumes of cargo, thus fueling segment growth.

The roadways segment is projected to expand rapidly during the forecast period as trucks provide flexible, unrestricted access to regional and international trade routes. The main reason brokers selected road transport is its efficiency for fast delivery and its service optimization for various products and direct shipping solutions. According to the European Commission, road transportation proved to be the dominant mode in EU inland freight transport since it accounted for 76.4% of the total volume in 2022. Road transport stood out through its flexibility to change routes and ability to move shipments faster than other transport methods for deliveries within the country.

Industry Vertical Insights

The manufacturing segment held the dominant share of the freight brokerage market in 2024. Manufacturing companies often require high-volume outbound shipments with just-in-time supply chain practices. The shipping needs of chemical, machine, electronics, and building material manufacturers have increased. These manufacturing companies often require freight brokers to deliver materials and products in a timely manner. Furthermore, the automation of freight platforms helped manufacturers monitor shipments as well as control their transportation costs, leading to improved relationships with brokers.

The retail & e-commerce segment is expected to grow at the fastest rate over the projection period, owing to the growing demand for faster, more trackable, and flexible deliveries. The digital retail transformation created new opportunities for freight brokers to provide services in last-mile logistics with reverse logistics and seasonal surge management. According to the World Trade Organization's Digital Trade Statistics Report (2024), cross-border e-commerce remained resilient, particularly in the U.S. and India, as well as in Southeast Asia. Moreover, brokers offer omnichannel retail strategies with adaptive logistics solutions, supporting segmental growth.

Freight Brokerage Market Companies

- AIT Worldwide Logistics

- BDP International

- DB Schenker

- DSV

- Expeditors International

- Flexport

- H. Robinson Worldwide

- Hellmann Worldwide Logistics

- Hoyer Group

- Kerry Logistics

- Kuehne+Nagel

- Markline

- Nippon Express

- Sinotrans

- XPO Logistics

Latest Announcement by Industry Leader

- In March 2025, Freight Technologies, Inc., a company focused on logistics management innovations, announced the launch of its advanced AI Tendering Bot. This innovative solution is designed to automate and streamline the load tendering process for shippers and freight brokers. "Our new AI Tendering Bot marks a significant milestone in Fr8Tech's digital transformation journey," said Javier Selgas, CEO of Fr8Tech. "By automating the load tendering process, we aim to reduce operational costs while providing faster and more reliable service to our customers,” he added.

Recent Developments

- In February 2025, at Manifest 2025 (The Venetian), Cleo launched the Shipper Relationship Manager. This solution enables 3PLs, freight brokers, and carriers to manage their performance against shippers' expectations through real-time insights and scorecarding, enhancing relationships and improving revenue capture.

- In November 2024,Uber Freight introduced Broker Access, allowing brokers to digitally book and execute loads on its carrier network while remaining the sole broker. This service improves productivity and business growth for brokers of all sizes.

- In June 2024, Flexport expanded its Convoy Platform for brokers, providing easy access to thousands of reliable carriers, streamlining freight execution, and lowering operating costs.

Segments Covered in the Report

By Services

- Truckload

- Intermodal

- Less than Truckload

By Customer Type

- B2C

- B2B

By Mode of Transport

- Roadways

- Waterways

- Others

By Industry Vertical

- Automotive

- Healthcare

- Manufacturing

- Retail & E-commerce

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content