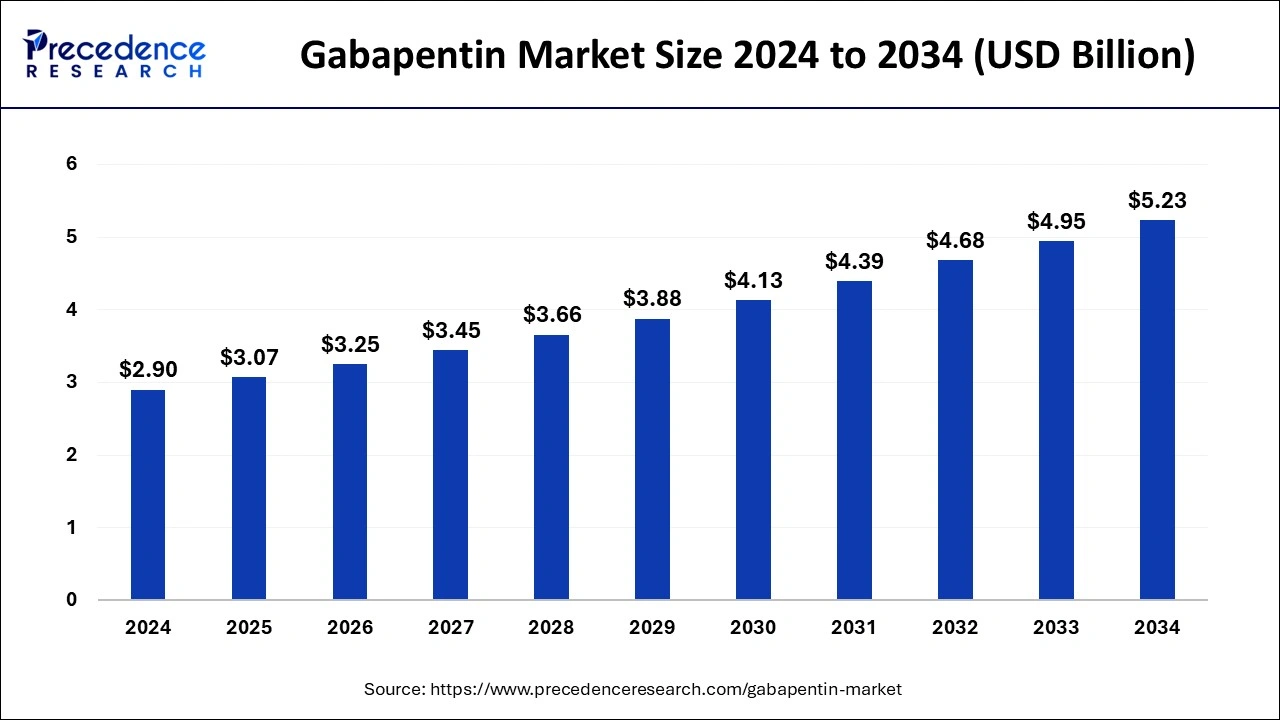

The global gabapentin market size is estimated at USD 3.07 billion in 2025 and is forecasted to worth around USD 5.23 billion by 2034, accelerating at a CAGR of 6.07% from 2025 to 2034. The North America gabapentin market size crossed USD 1.07 billion in 2024 and is expanding at a CAGR of 6.10% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global gabapentin market size accounted for USD 2.90 billion in 2024 and it is projected to surpass around USD 5.23 billion by 2034, registering a CAGR of 6.07% during the forecast period from 2025 to 2034. Increasing health awareness among people, such as diabetes and neuropathy due to continuously changing lifestyles, is influencing the demand for gabapentin market.

AI has influenced the gabapentin market as it contributes to market analysis, personalized treatment, and drug development. The growing research and development of drugs in the pharmaceutical sector result in the preparation of advanced formulations; such huge datasets are analyzed by AI algorithms to identify the potential of the drugs. These artificial intelligence tools are also useful in predicting market demand, which helps pharmaceutical companies decide whether to produce drugs that lead to the reduction of wastage. It can detect early if there are any side effects of the drugs to any patient.

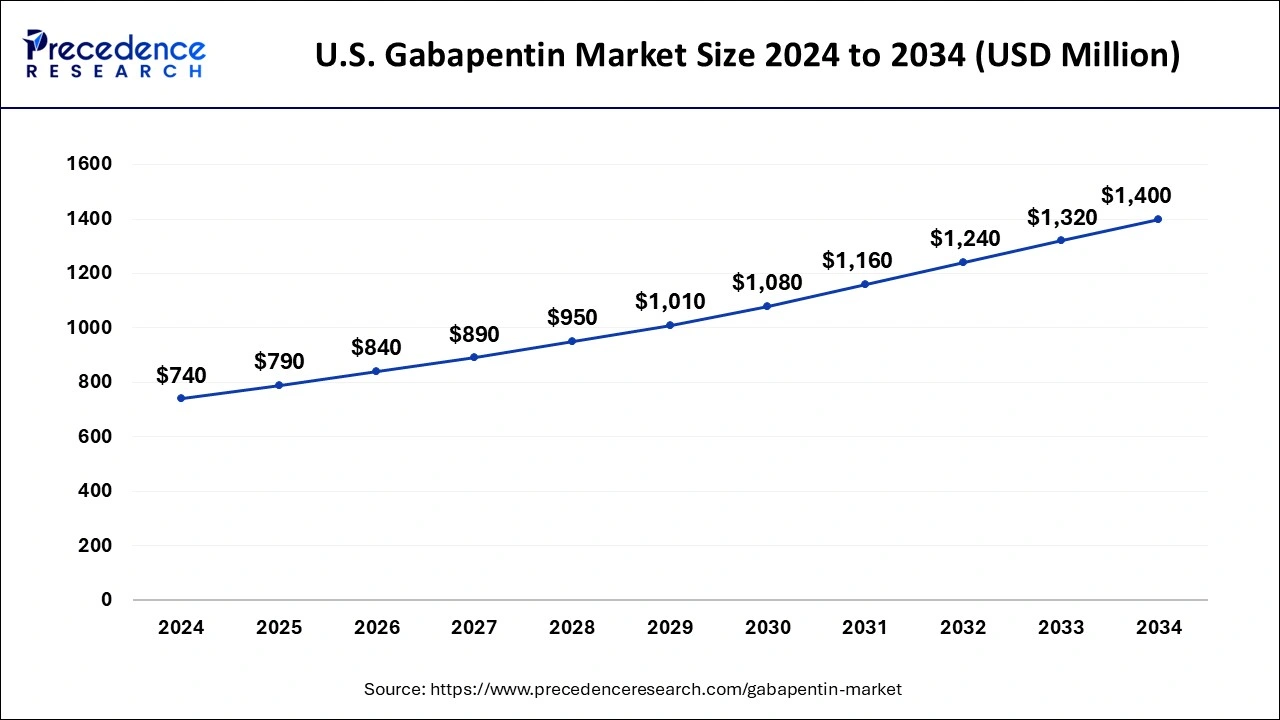

The U.S. gabapentin market size accounted for USD 740 million in 2024 and is estimated to reach around USD 1,400 million by 2034, growing at a CAGR of 6.58% from 2025 to 2034.

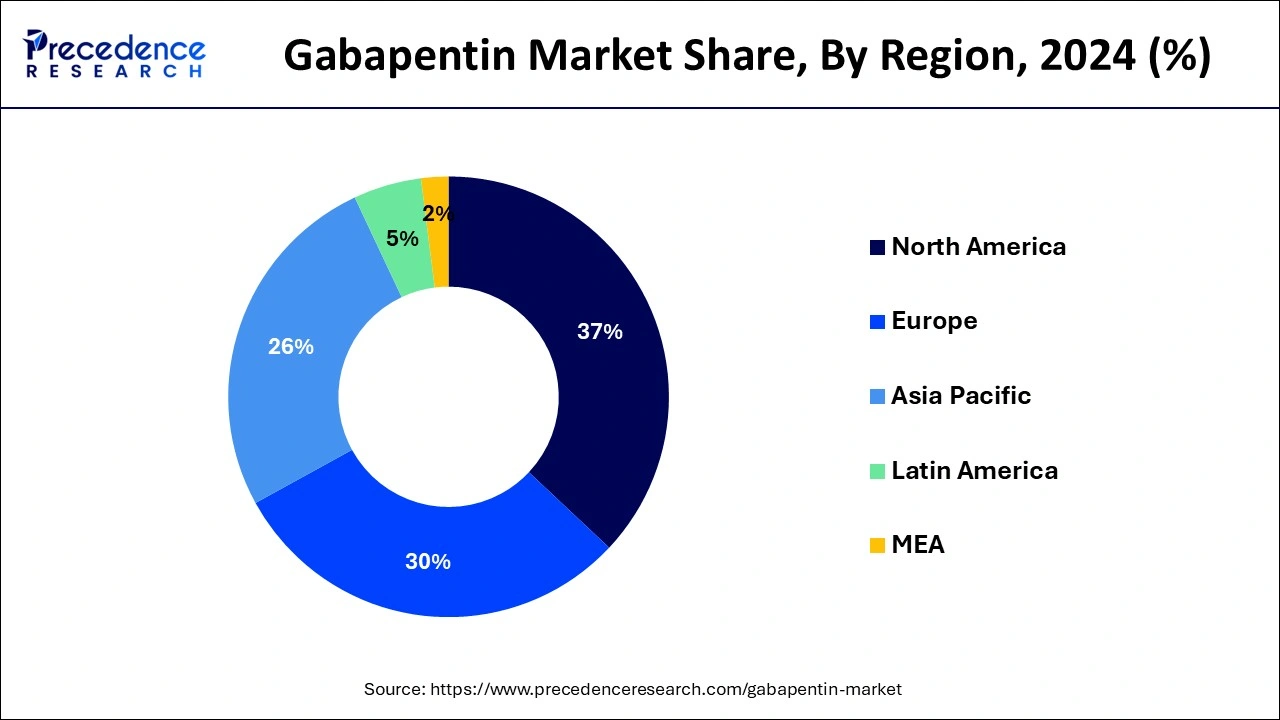

North America has held the largest revenue share 37% in 2024. In North America, the gabapentin market exhibits several notable trends. The region witnesses a continued demand for gabapentin, driven by the rising prevalence of neuropathic pain conditions, such as diabetic neuropathy and post-herpetic neuralgia. Additionally, an aging population prone to neurological disorders contributes to sustained market growth. Regulatory scrutiny and efforts to combat misuse and abuse of Gabapentin have also shaped prescription practices in this region, emphasizing the importance of careful medication management.

Asia-Pacific is estimated to observe the fastest expansion. In the Asia-Pacific region, the gabapentin market is witnessing notable trends. The market is expanding due to the region's growing aging population, leading to increased cases of neurological disorders and chronic pain conditions. Additionally, improved access to healthcare services and rising awareness about Gabapentin's efficacy are driving its demand. However, the market also faces challenges related to regulatory variations across countries. Overall, Asia-Pacific presents significant growth potential for the gabapentin market, driven by demographic shifts and healthcare advancements.

Gabapentin is a pharmaceutical drug used in the management of neurological conditions, particularly epilepsy and neuropathic pain. It operates by modulating nerve activity in the brain and nervous system. This medication is a vital component in the healthcare sector, aiding in the treatment of a variety of conditions marked by abnormal nerve signaling.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.07% |

| Market Size in 2025 | USD 3.07 Billion |

| Market Size by 2034 | USD 5.23 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Dosage, By Type, By Application, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing neuropathic pain prevalence amplifies the demand for gabapentin due to its recognized effectiveness in managing such pain conditions. Gabapentin's recognized efficacy in managing neuropathic pain makes it a sought-after medication, offering relief and improved quality of life to those suffering from these conditions. Consequently, the increasing incidence of neuropathic pain fuels the demand for gabapentin within the healthcare sector.

Moreover, the expanding use of gabapentin in epilepsy treatment significantly surges market demand. With the increasing prevalence of epilepsy, a neurological disorder characterized by recurrent seizures, Gabapentin's effectiveness in seizure control has become increasingly recognized. Physicians are prescribing gabapentin as an integral component of epilepsy management. This growing demand is fueled by the imperative need for safe and reliable therapies, positioning gabapentin as a key pharmaceutical choice in addressing this neurological condition.

Patient non-compliance presents a significant restraint on the gabapentin market. Non-compliance with prescribed gabapentin treatment regimens can hinder optimal therapeutic outcomes, potentially worsening patients' medical conditions. Reasons for non-compliance vary and may include forgetfulness, concerns regarding side effects, or a lack of comprehension about the critical role of consistent medication adherence in managing their health conditions. This non-adherence can impact the effectiveness of gabapentin treatment and overall patient well-being. This hindrance to treatment effectiveness not only impacts patient health but also limits the market's growth potential as the full benefits of gabapentin may not be realized.

Moreover, Side effects associated with gabapentin can act as a restraint on market demand. These side effects can result in patient discomfort and non-compliance, affecting treatment outcomes. Healthcare providers may be cautious in prescribing gabapentin due to these potential side effects, impacting its market demand, especially in cases where alternative treatments with fewer side effects are available.

Innovative formulations of gabapentin have the potential to significantly boost market demand. The development of new delivery methods, such as extended-release versions or alternative dosage forms, can enhance patient convenience and compliance. These innovations can offer improved treatment options, reduce the frequency of dosing, and potentially enhance the therapeutic efficacy of gabapentin. Patients and healthcare providers are likely to be more inclined to choose these innovative formulations, thus driving increased demand within the gabapentin market.

Moreover, Combination therapies involving gabapentin can significantly surge market demand. These therapies leverage gabapentin's effectiveness in managing neurological conditions and neuropathic pain while complementing it with other medications to achieve synergistic therapeutic effects. This approach not only enhances treatment outcomes but also broadens the scope of gabapentin's applications. Healthcare providers and patients seek comprehensive treatment regimens that address multiple aspects of their medical conditions, driving the demand for gabapentin in combination therapies.

By dosage, the capsules segment registered its dominance over the global market in 2024. Gabapentin capsules are oral dosage forms of the medication used to treat neurological conditions and neuropathic pain. In the gabapentin market, there is a growing trend toward the development and availability of extended-release capsules, which offer convenient once-daily dosing and improved patient adherence. These formulations enhance the therapeutic experience for patients by reducing the frequency of medication administration, a trend that aligns with patient-centric healthcare approaches and fosters market growth.

The tablet segment is anticipated to grow with the highest CAGR in the market during the study. Tablets are oral pharmaceutical forms of the medication, providing measured doses of Gabapentin. Gabapentin tablets are oral pharmaceutical forms of the medication, providing measured doses of Gabapentin. In the gabapentin market, tablet formulations have witnessed trends towards the development of extended-release versions, enhancing dosing convenience and patient adherence. These formulations offer sustained gabapentin release, reducing the frequency of daily doses. Patients and healthcare providers increasingly favor such tablet innovations for improved treatment outcomes and enhanced patient comfort in managing neurological and pain-related conditions.

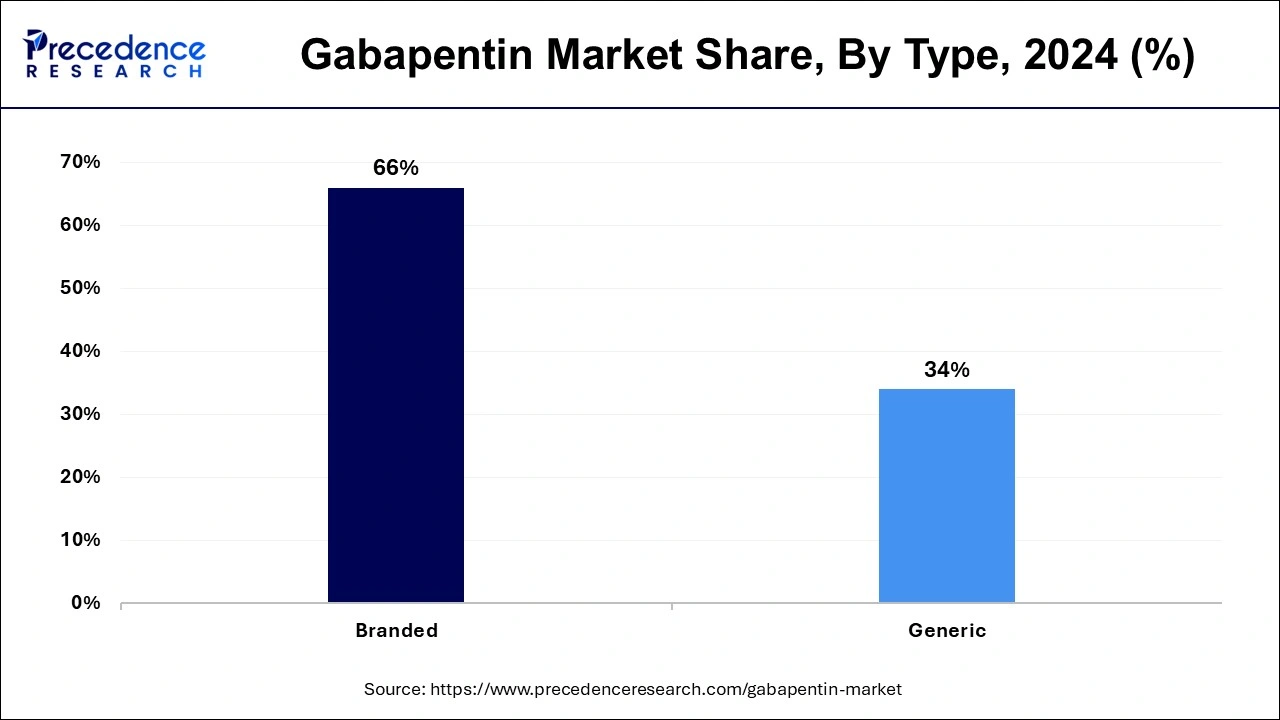

By type, the generic segment held a dominant presence in the market with share of 66% in 2024. In the gabapentin market, generic medications are non-brand-name versions of gabapentin. These generics contain the same active ingredient, but they are typically more affordable than brand-name counterparts. A key trend in the gabapentin industry is the increasing availability and adoption of generic gabapentin formulations. As patents expire for brand-name gabapentin, generic versions are becoming more prevalent, providing cost-effective alternatives for patients and healthcare systems while contributing to market competition and affordability.

By type, the branded segment is anticipated to grow with the highest CAGR in the market during the studied years. In the gabapentin market, the branded segment refers to pharmaceutical products marketed and sold under proprietary brand names. Branded gabapentin medications are typically developed by pharmaceutical companies, patented, and promoted for their unique qualities. Trends in the branded gabapentin segment include the introduction of innovative formulations to improve patient adherence, increased marketing efforts to differentiate products, and a focus on extended-release versions to enhance therapeutic convenience. Branded gabapentin products often command premium pricing due to their recognized quality and efficacy.

By application, the epilepsy segment dominated the market globally. Epilepsy, a neurological disorder characterized by recurrent seizures, is a primary application of gabapentin. Market trends indicate a growing demand for gabapentin in managing epilepsy. This aligns with the continuous mission to improve the quality of life for individuals with epilepsy by providing enhanced treatment choices, including gabapentin, well-known for its effectiveness in managing the condition.

On the other hand, the neuropathic pain segment is projected to grow at the fastest rate over the projected period. In the gabapentin market, there is a growing trend in utilizing gabapentin to alleviate neuropathic pain, given its established effectiveness. This trend reflects a rising awareness of gabapentin's therapeutic benefits in addressing this debilitating condition. As the prevalence of neuropathic pain continues to increase, the market for gabapentin as a treatment option for this specific application is expected to expand.

By distribution channel, the hospital pharmacy segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. Hospital pharmacy in the gabapentin market refers to the distribution channel within healthcare facilities where gabapentin and other medications are dispensed to inpatients and outpatients. Trends in hospital pharmacy include improved inventory management systems to ensure medication availability, increased emphasis on patient education regarding gabapentin use and potential side effects, and the integration of electronic health records to enhance prescription accuracy and tracking, all aimed at optimizing patient care and medication management within hospital settings.

The online pharmacies is anticipated to expand at the fastest rate over the projected period. Online pharmacies are digital platforms that enable consumers to purchase medications, including gabapentin, over the internet. These platforms offer convenience, cost savings, and easy access to medications. The gabapentin market has seen a growing trend of consumers opting for online pharmacies due to the increased adoption of telehealth and e-prescriptions. This trend aligns with the broader shift toward digital healthcare solutions, providing patients with a convenient and accessible way to obtain gabapentin and manage their health conditions.

By Dosage

By Type

By Application

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client