March 2025

Gas Separation Membrane Market (By Product: Polymeric Membranes, Inorganic Membranes, Metallic Membranes; By Application: Nitrogen Separation, Oxygen Separation, Acid Gas Separation, Hydrogen Separation, Other Applications; By End-use: Chemicals, Petrochemicals, Oil & Gas, Food & Beverage, Power Generation, Pharmaceuticals, Pollution Control, Other End-Uses) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

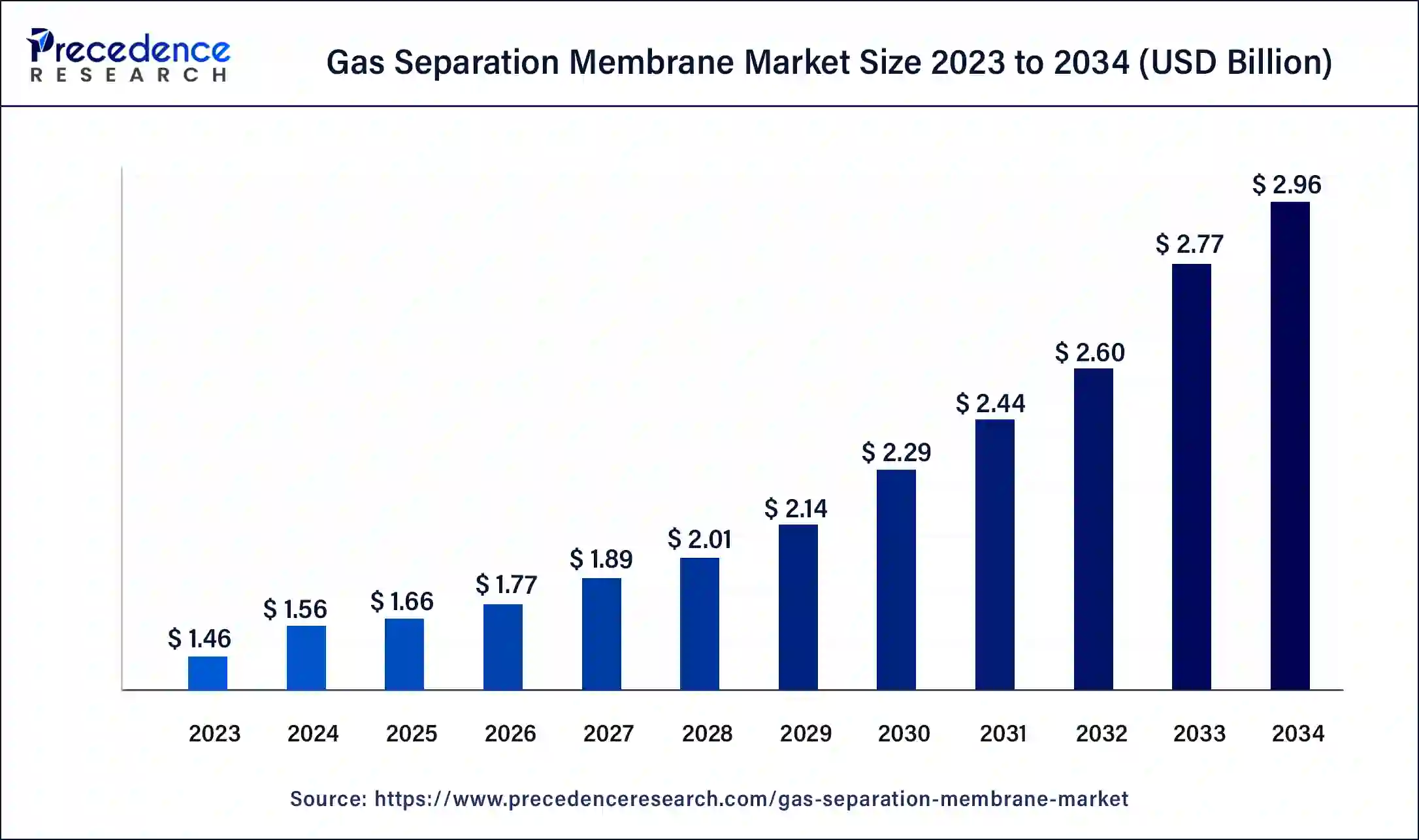

The global gas separation membrane market size was USD 1.46 billion in 2023, calculated at USD 1.56 billion in 2024 and is expected to reach around USD 2.96 billion by 2034, expanding at a CAGR of 6.52% from 2024 to 2034. The growth of the gas separation membrane market is anticipated to be driven by the rise of the petrochemical and chemical industries.

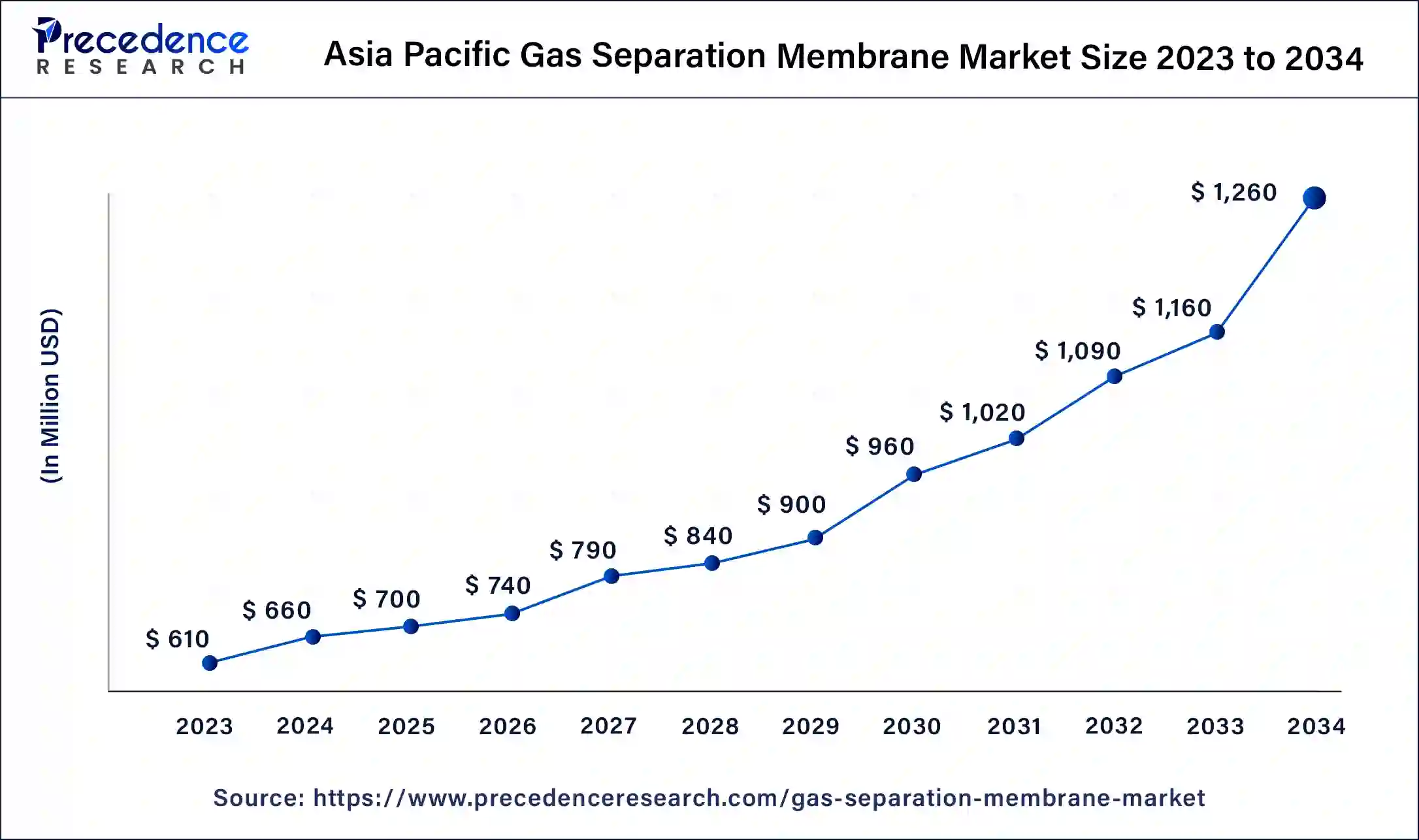

The Asia Pacific gas separation membrane market size was exhibited at USD 610 million in 2023 and is projected to be worth around USD 1,260 million by 2034, poised to grow at a CAGR of 6.81% from 2024 to 2034.

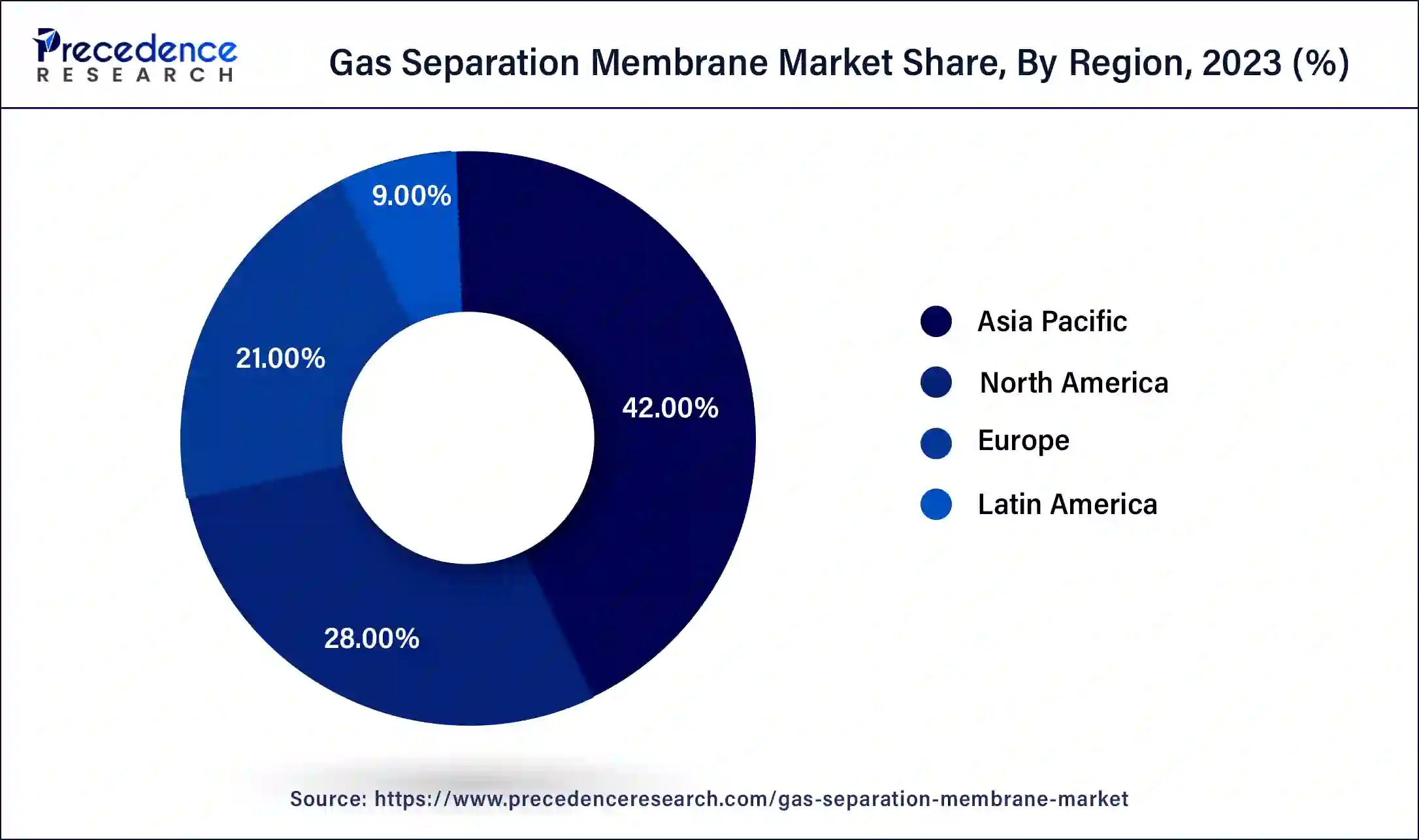

Asia Pacific dominated the gas separation market in 2023. This is due to the rising use of these membranes to manage CO2 emissions. The extensive industrial base in this region drives a higher demand for CO2 control. Additionally, stringent gas emission regulations are significantly contributing to the growth of the gas separation membrane sector. The region’s adoption of cost-effective and energy-efficient techniques, driven by expanding industrial activities, further supports this market's development.

North America is expected to grow at the fastest rate in the gas separation membrane market over the projected period. The gas separation membrane market in North America, especially in the United States and Canada, holds a notable share. This is driven by a solid industrial infrastructure, rising shale gas production, and an increased emphasis on environmental sustainability, which has triggered the demand for gas separation technologies.

The gas separation membrane market represents the global sector dedicated to producing, distributing, and utilizing membranes specifically engineered for gas separation. These membranes play a crucial role in various fields, including gas processing, industrial gas production, and environmental conservation. Compared to traditional separation techniques, gas separation membranes provide benefits such as enhanced selectivity, cost efficiency, and operational effectiveness, which drive their adoption across multiple industries. Increased environmental awareness and regulations aimed at reducing greenhouse gas emissions have created a demand for cleaner energy sources, like natural gas. Gas separation membranes are vital for natural gas processing, as they are instrumental in the efficient separation and purification of gases.

| Report Coverage | Details |

| Market Size by 2034 | USD 2.96 Billion |

| Market Size in 2023 | USD 1.46 Billion |

| Market Size in 2024 | USD 1.56 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 6.62% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for natural gas

The growing demand for natural gas and chemical industries, along with key applications in food and beverage processing, wastewater treatment, and the medical sector, is creating significant opportunities for the gas separation membrane market during the forecast period. Additionally, the advantages of gas separation membrane technologies compared to other methods, such as cryogenic distillation and adsorption, are anticipated to further drive the growth of the gas separation membrane sector throughout the forecast period.

Technical limitations

Gas separation membranes, despite their effectiveness in various applications, encounter challenges in specific scenarios. For example, issues related to selectivity, permeability, and stability may not always align with the demands of certain gas separation processes or harsh operating conditions. These technical constraints can limit the growth of the gas separation membrane market in applications where these factors are important. However, ongoing research and development efforts are dedicated to overcoming these limitations and improving the performance and versatility of gas separation membranes across a broader range of industries and applications.

Demand for biogas

The expansion of the gas separation membrane market is largely driven by the increasing demand for biogas. Membrane technology shows promise in industries such as pharmaceuticals and biomedical devices, where high-purity oxygen is necessary for medical applications. As a versatile energy carrier, biogas is gaining attention due to its potential to fulfill the rising demands in the power, heating, and fuel sectors by providing significant resource efficiency.

Furthermore, biogas, derived from the byproducts of biodiesel and ethanol, is also produced through the anaerobic digestion of energy crops and organic residues. During these materials' decomposition, methane is generated, which can be directly burned as gas or converted into electricity. Given the rapid growth of the biogas market, it is expected to continue expanding throughout the forecast period.

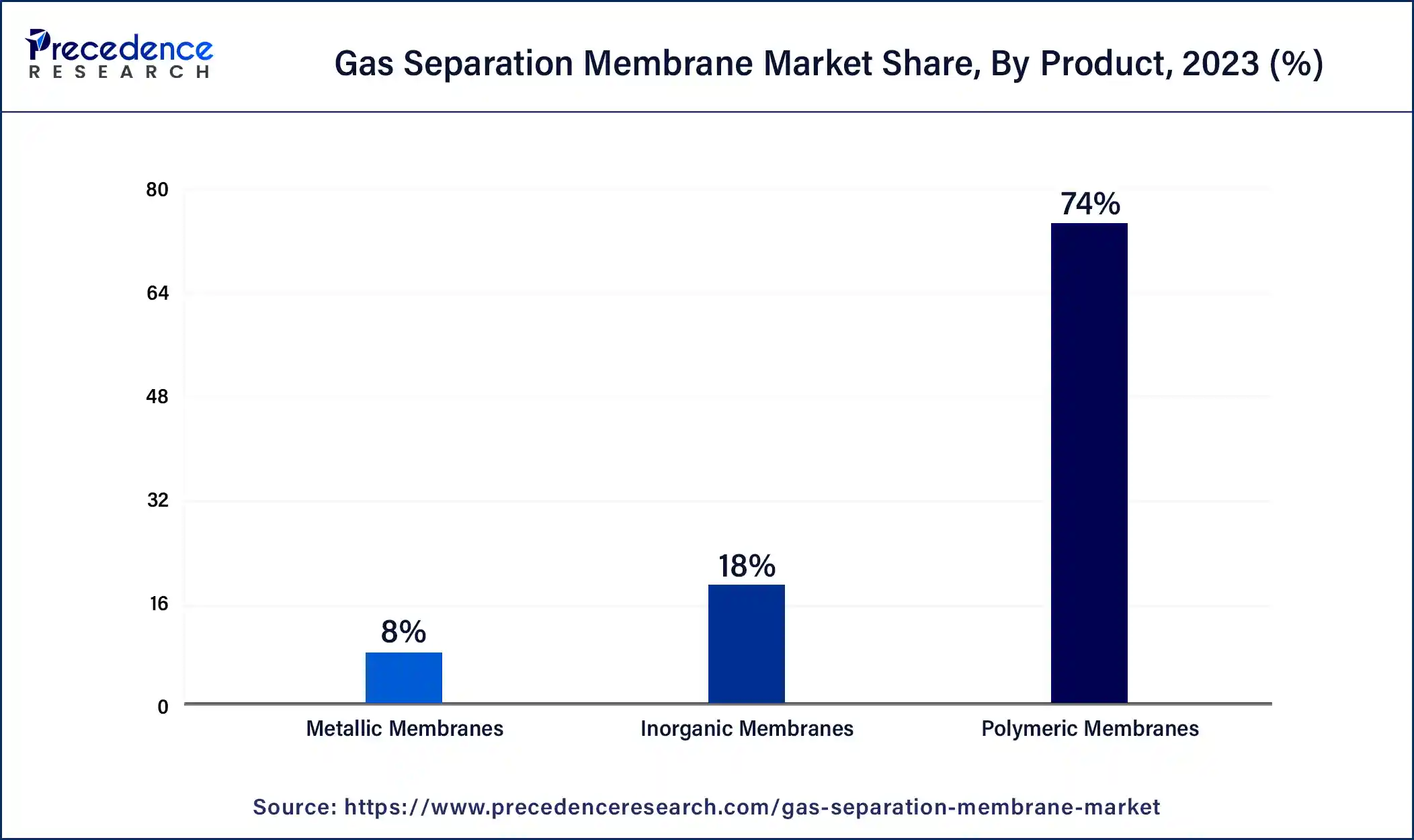

The polymeric membrane separation segment dominated the global gas separation membrane market in 2023. The segment is growing due to the broad range of applications in industries like pharmaceuticals, food and beverage, and water treatment. Characterized by technological advancements and rising demands for efficient separation processes, it is also influenced by strict environmental regulations promoting the use of membrane separation technologies. Also, Ongoing innovations in membrane technology are improving separation efficiency and creating new market opportunities.

The inorganic membrane separation segment is expected to grow at the fastest rate in the gas separation membrane market throughout the forecast period. Made from inorganic materials like metal oxides, ceramics, and metals, inorganic separation membranes provide excellent gas selectivity along with thermal and chemical stability. Their resistance to fouling is a key driver for the growth of this segment.

The nitrogen separation segment dominated the gas separation membrane market in 2023. Gas separation membranes are used to extract nitrogen from the air, generating nitrogen of high purity. This nitrogen finds applications in several sectors, such as electronics, food and beverage packaging, pharmaceuticals, and chemical processing. Additionally, these membranes are incorporated into nitrogen generation systems that produce nitrogen on-site from compressed air. In various industries, including oil and gas production, natural gas processing, chemical manufacturing, and environmental protection, gas separation membranes are also widely utilized in acid separation processes.

The oxygen separation segment is expected to show notable growth in the gas separation membrane market over the forecast period. Methods for separating oxygen from the air without relying on liquefaction include temperature swing adsorption (TSA) and pressure swing adsorption (PSA). In these techniques, a sorbent selectively absorbs nitrogen, which is more polarizable than oxygen, and allows the oxygen gas to pass through unobstructed. Industrial air separation processes typically employ cryogenic distillation, solvent absorption, and adsorption techniques to isolate oxygen from the air.

The petrochemicals, oil & gas segment led the gas separation membrane market in 2023. This can be attributed to the rise in the precise control of gas composition, non-invasive packaging techniques, and compatibility with a variety of food products. Furthermore, Membrane gas separation technology offers significant potential in the oil and gas sector for boosting refining efficiency and optimizing crude oil processing. By effectively separating oxygen and nitrogen in jetliners' fuel tanks, these membranes improve fuel efficiency and lower emissions, supporting global climate change mitigation efforts.

The power generation segment is anticipated to grow at the fastest rate in the gas separation membrane market over the forecast period. The segment is expected to expand due to the product's improved performance efficiency, cleaner energy production techniques, and reduced emissions. This product finds applications in various processes, including carbon capture and storage, pre-combustion carbon capture, hydrogen purification, and oxygen enrichment. Additionally, it is used to selectively remove impurities like carbon dioxide (CO2) and water vapor from natural gas streams. These aspects are anticipated to drive market growth.

Segments Covered in the Report

By Product

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

October 2024

August 2024