April 2025

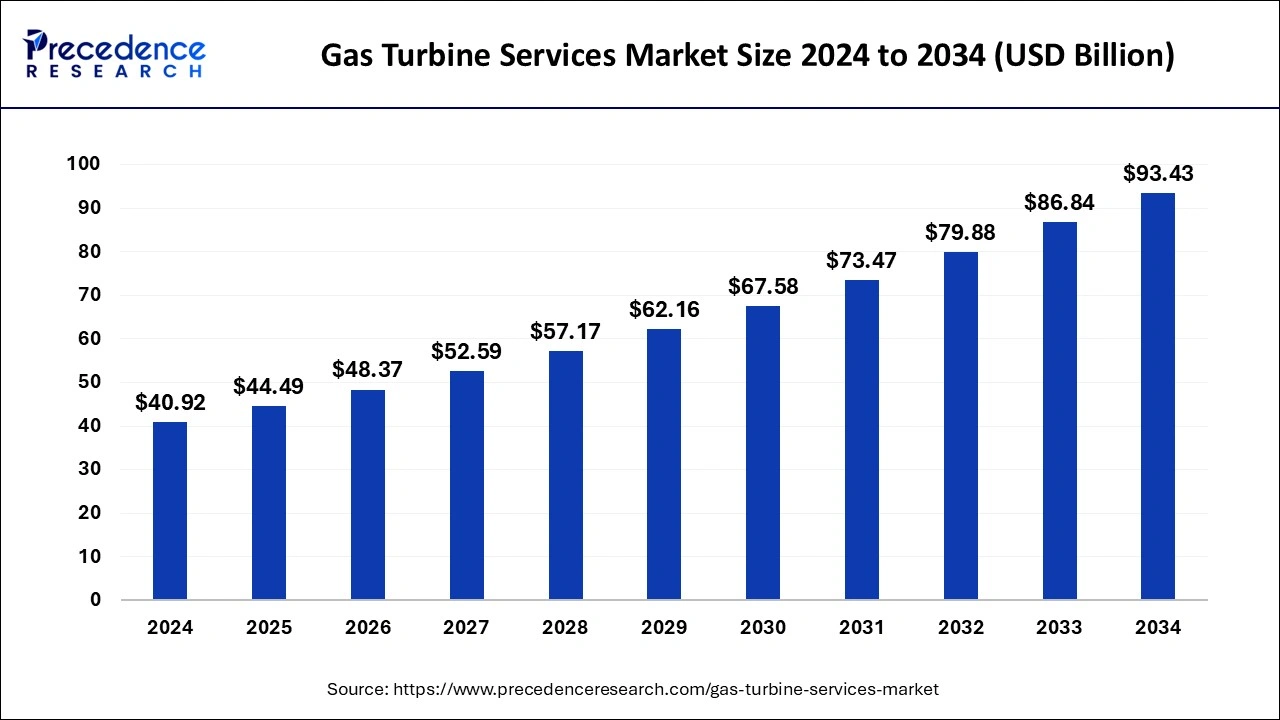

The global gas turbine services market size is calculated at USD 44.49 billion in 2025 and is forecasted to reach around USD 93.43 billion by 2034, accelerating at a CAGR of 8.61% from 2025 to 2034. The Asia Pacific gas turbine services market size surpassed USD 17.80 billion in 2025 and is expanding at a CAGR of 8.74% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global gas turbine services market size was estimated at USD 40.92 billion in 2024 and is predicted to increase from USD 44.49 billion in 2025 to approximately USD 93.43 billion by 2034, expanding at a CAGR of 8.61% from 2025 to 2034. The appeal of gas turbines is increased by ongoing technological advancements in the field, including operational flexibility, efficiency, and emissions reduction.

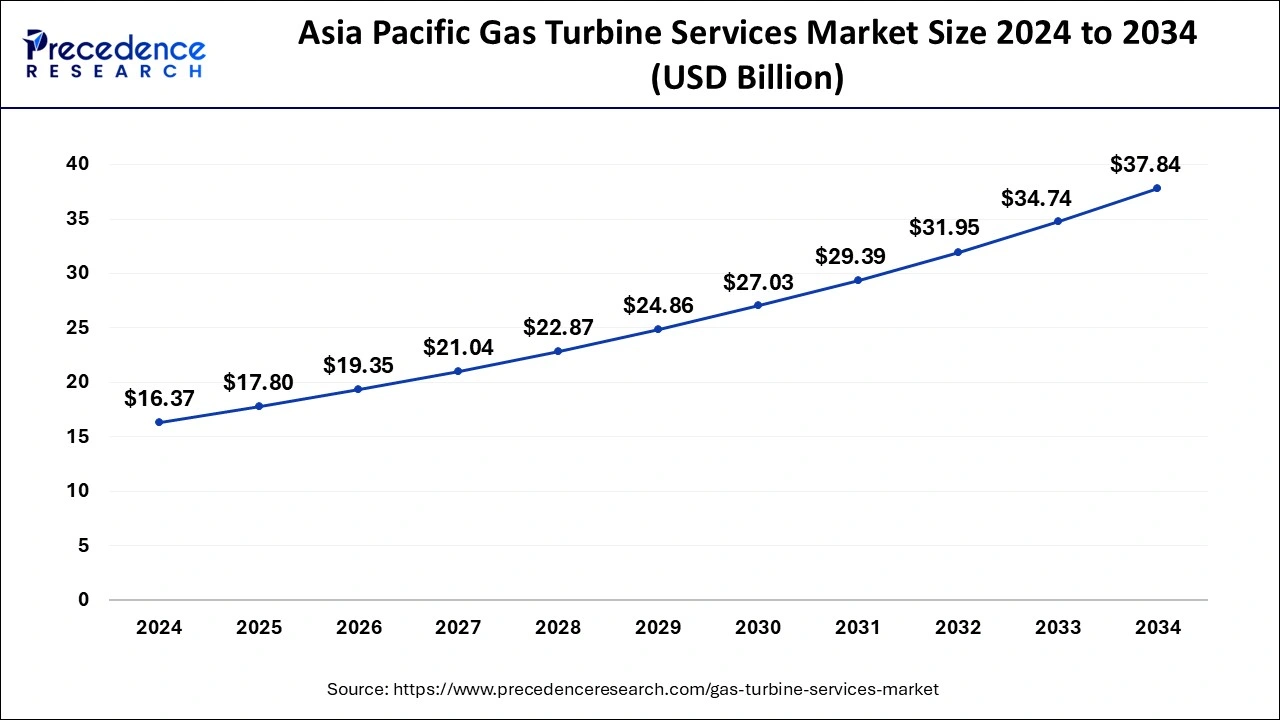

The Asia Pacific gas turbine services market size was estimated at USD 16.37 billion in 2024 and is predicted to be worth around USD 37.84 billion by 2034 with a CAGR of 8.74% from 2025 to 2034.

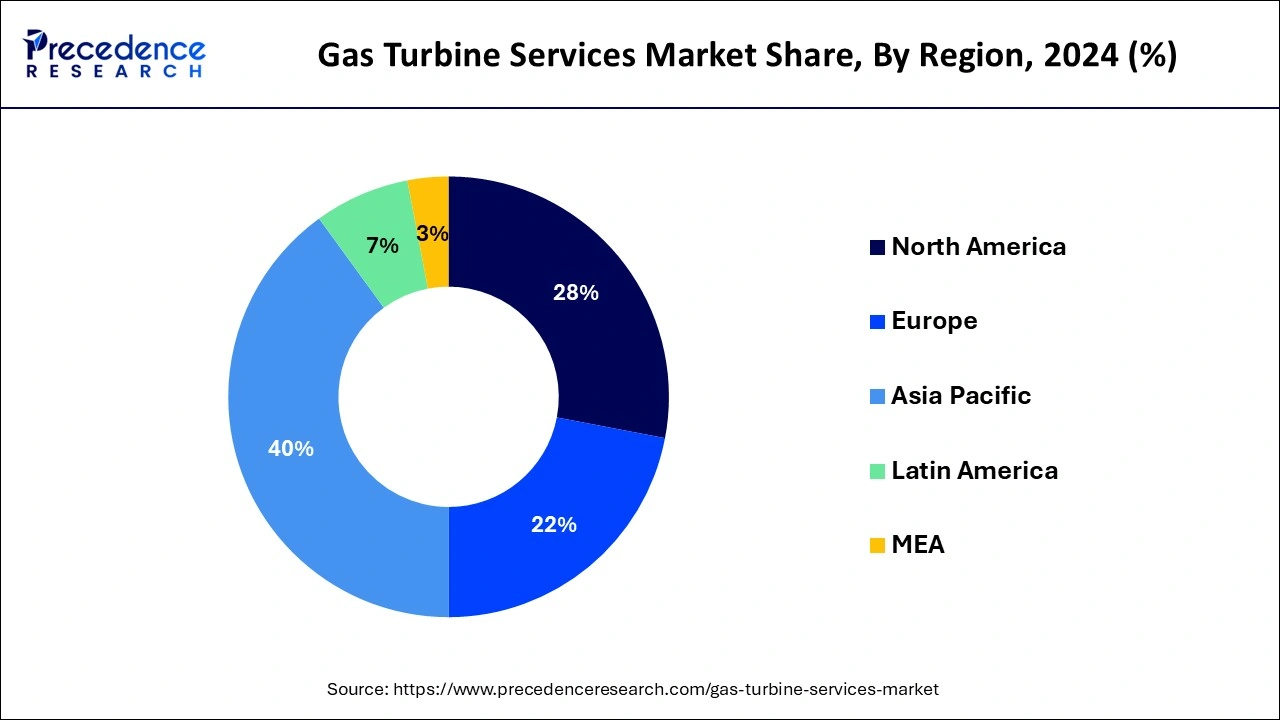

Asia Pacific held the largest share of the gas turbine services market in 2024. The region's gas turbine services market is expanding significantly due to rising energy consumption and a move toward greener energy sources. Numerous reasons, such as the expansion of gas-fired power plants around the region and government regulations encouraging the use of natural gas, contribute to this growth.

China, one of the region's largest customers, is increasing the capacity of its gas-fired power plants in an attempt to lessen its reliance on coal and increase the production of clean energy. Energy consumption is rising in the area as a result of rapid industrialization and urbanization. Due to its efficiency and reduced emissions, gas turbines are increasingly being chosen to supply this rising need for energy.

Europe is expected to hold the fastest-growing gas turbine services market during the forecast period. The switch from coal to natural gas and the rising demand for efficient power generation are driving substantial growth in the European gas turbine services market. This market includes a wide range of services like overhaul, repair, and maintenance for gas turbines, which are mostly employed in power generation, oil and gas, and other industrial sectors. Gas turbine utilization has increased due to the need for greener energy sources, especially as coal-fired power facilities are phased out in Europe.

Germany is a major player, replacing its outdated coal-fired power plants with more contemporary gas-fired power plants. Advancements like Siemens' combined cycle power plant projects and GE's MXL2 update for turbines are improving operational performance and efficiency, which is fueling the market's expansion.

Regular maintenance is essential for gas turbines to operate as efficiently as possible and avoid catastrophic failures. Turbine component replacements, repairs, and thorough inspections are all part of these services. Because gas turbines require frequent repair due to their demanding working conditions, the overhaul industry is likely to have significant growth.

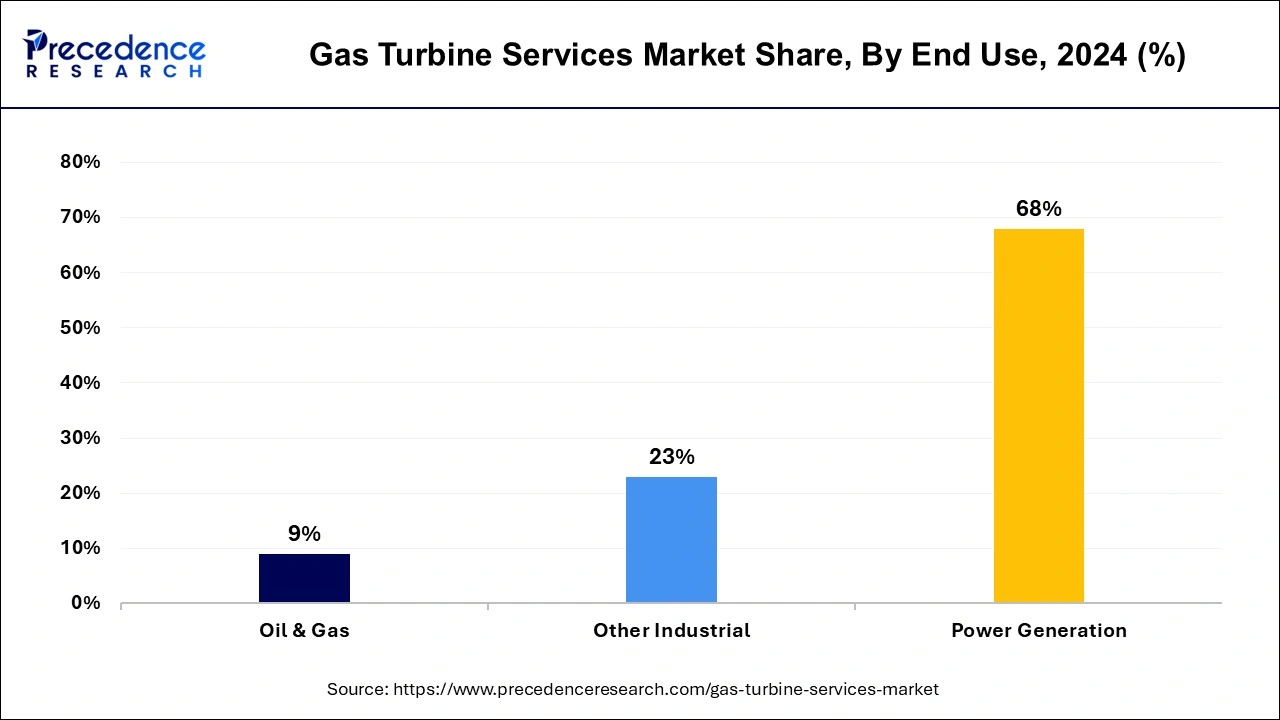

Due to the growing demand for energy brought on by urbanization and population increase, this segment has the biggest share. Gas turbines are also widely used in the oil and gas industry, especially in areas with a high concentration of industrial activity. Dominates the industry as a result of its extensive service offerings and cutting-edge technological skills. Leading companies in this field are OEMs like Siemens and GE.

A significant market propelled by the widespread usage of gas turbines in industrial and electric utility applications, among other sectors. Here, the emphasis is on preventative maintenance and technological improvements, which are critical growth drivers. The market is changing as a result of innovations, including hybrid power solutions, digital twin technology, and predictive maintenance.

For improved performance, businesses such as Mitsubishi Power are creating new combustor technology. Growing laws pertaining to efficiency and emissions are pressuring service providers to create more complete and legally compliant service packages. Continuing infrastructure spending, particularly in developing nations, is anticipated to propel market expansion considerably in the ensuing ten years.

| Report Coverage | Details |

| Market Size in 2025 | USD 44.49 Billion |

| Market Size by 2034 | USD 93.43 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.61% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Turbine Type, Turbine Capacity, Service Type, Service Provider, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing demand for power generation

Gas turbines are in high demand because they provide consistent and significant power production, which is essential for large-scale industrial processes and utility grids. This is especially true of their capacities of more than 200 MW. Because combined cycle power plants are highly efficient and can react quickly to changes in power demand, these turbines are especially well-suited for integration with renewable energy sources such as solar and wind power.

Original equipment manufacturers (OEMs) are the industry leaders in terms of service providers because of their extensive service offerings, technical know-how, and capacity to offer multiyear service agreements. Nonetheless, by providing more affordable options, non-OEM service providers are becoming increasingly popular in markets where prices are crucial.

Competition from renewable energy sources

Over the past ten years, there have been significant cost reductions in renewable energy technology, especially in the areas of solar and wind. Since traditional gas turbines are becoming less economically appealing due to their fuel prices and associated carbon pricing, renewable energy sources are now more competitive with them. Cleaner energy sources are replacing fossil fuels, such as natural gas, as the primary source of energy.

Policies like carbon pricing, emissions trading schemes, and subsidies for renewable energy projects are promoting this transition. The need for cleaner energy sources is rising among businesses and consumers. Businesses are devoting more and more time to sustainability initiatives, such as switching to renewable energy.

Digital and smart technologies

Data analytics and machine learning algorithms are used in predictive maintenance to identify possible problems before they happen. Through data analysis of sensors mounted on gas turbines, service providers can spot trends and abnormalities that point to future problems. IoT-enabled remote monitoring devices gather operational data on gas turbine characteristics continually.

Experts can assess the performance and condition of the turbines by using this real-time data that is sent to centralized monitoring centers. A virtual version of a real gas turbine is called a digital twin. Real-time data and sophisticated simulation models are used in its creation. Engineers can test various situations and optimize performance without physically adjusting the turbine, thanks to digital twins.

The heavy duty segment held the largest share of the gas turbine services market in 2024 and is expected to continue doing so during the forecast period. The growing need for energy worldwide is the main driver of the need for heavy-duty turbines in gas turbine services. Turbines that are dependable and efficient are necessary for a variety of industries, including aviation, power generating, and the oil and gas sector. The sector is dominated by a few major firms, making the market extremely competitive. Among the leading firms in this market are General Electric, Siemens, Mitsubishi Hitachi Power Systems, and Rolls-Royce. In the market for gas turbine services, aftermarket services, including maintenance, repair, and overhaul (MRO), are essential. Turbines need periodic repairs and routine maintenance as they get older in order to function at their best and last as long as possible.

The industrial segment is expected to show rapid growth in the gas turbine services market in the upcoming years. Industrial applications, including power generation in factories, refineries, chemical plants, and other industrial facilities, are the focus of the design of industrial turbines. They are designed for continuous operation in harsh settings and are frequently bigger and more durable than turbines used in aviation, for example. Operators may decide to update their industrial turbines as technology develops in order to boost environmental performance, dependability, or efficiency. Older turbines can be made to operate better and last longer by retrofitting them with new parts or control systems. Ensuring that operators possess the necessary knowledge and skills to safely and successfully operate and maintain industrial turbines requires the implementation of training programs and consultancy services.

The >200 MW segment dominated the gas turbine services market in 2024. Gas turbines are essential for supplying cities, regions, and nations with energy in the >200 MW category. Usually, these turbines are found in sizable power facilities that meet significant demand for electricity. In order to guarantee consistent and effective power generation, the services related to maintaining, repairing, and optimizing these turbines are crucial. Gas turbine service suppliers have the know-how to maximize turbine performance for reduced emissions and increased efficiency. This could be adjusting the turbine's operation, putting sophisticated control algorithms into place, or using predictive analytics to perform preventative maintenance. To efficiently run and maintain gas turbines, operators need competent workers.

The 100 to 200 MW segment is expected to grow rapidly in the gas turbine services market during the forecast period. Within the gas turbine services business, a range of gas turbines with power outputs ranging from 100 to 200 megawatts (MW) is commonly referred to as the 100 to 200 MW segment. This power range of gas turbines is widely used for a variety of purposes, including industrial processes, naval propulsion, and power production. A number of variables, including the aging turbine fleets, the growing global use of gas-fired power generation technologies, and the increased emphasis on efficiency and emissions reduction, affect the demand for gas turbine services in the 100 to 200 MW category. The dynamics of this market sector are additionally influenced by variables, including fuel pricing, technological improvements, and regulatory constraints.

The spare parts segment held the largest share of the gas turbine services market in 2024. Ensuring the proper operation and maintenance of gas turbines is contingent upon the availability of spare parts in the gas turbine services sector. Gas turbines are intricate devices made up of numerous parts that eventually deteriorate. Consequently, in order to maintain the turbines' smooth and dependable operation, routine maintenance and the occasional part replacement are required. The usage of particular replacement parts or components may be necessary to comply with industry rules and standards, such as those pertaining to safety and emissions, which may have an impact on sourcing decisions. Sufficient supply chain management is necessary to guarantee prompt delivery of replacement components to clients, reduce downtime, and increase operational effectiveness.

The overhaul segment is expected to grow rapidly in the gas turbine services market during the forecast period. Gas turbine service providers are now focusing on other energy sources, such as wind and solar power, due to their growing popularity. Although gas turbines are still essential for maintaining grid stability and backup power, more attention is being paid to maximizing their efficiency in hybrid energy systems and combining them with renewable energy sources. A growing number of service providers are providing full lifecycle services for gas turbines, from installation and commissioning to decommissioning and disposal, covering the whole equipment lifespan. Gas turbine service options now include remote monitoring and diagnostics as standard features. These services enable operators to remotely carry out predictive maintenance tasks, identify anomalies, and continuously check the condition of their equipment.

The OEM segment led the gas turbine services market in 2024. Original equipment manufacturer is referred to as "OEM" in the gas turbine services industry. These are the businesses that create the designs and produce the gas turbines. Original equipment manufacturers frequently offer a variety of services linked to their goods, such as upkeep, repairs, spare parts, and technical assistance. They are in the greatest position to offer their clients excellent service and support since they usually have an extensive understanding of their turbines. On the other hand, there are also independent service providers on the market that supply gas turbine aftermarket services, frequently with cost-effective solutions for upkeep and assistance.

The non-OEM segment is expected to grow rapidly in the gas turbine services market during the forecast period. In the gas turbine services industry, the phrase "non-OEM" often denotes services rendered by businesses other than the gas turbine equipment's original equipment manufacturer (OEM). These businesses provide maintenance, overhaul, and repair (MRO) services for gas turbines made by other companies. Non-OEM service providers might offer competitive alternatives to OEM service contracts by specializing in particular brands or types of turbines. They frequently offer flexible service options and affordable solutions to meet the various needs of gas turbine operators. To guarantee quality and dependability, clients should carefully consider the standing, experience, and performance history of non-OEM service providers.

The power generation segment holds the largest share of the gas turbine services market. For gas turbines to operate at their best and last a long time, they need to have regular maintenance and overhauls. Service providers handle problems such as component wear, corrosion, and efficiency optimization by providing a range of maintenance packages, from minor overhauls to regular inspections. Gas turbine service providers frequently provide optimization services with the goals of raising power output, decreasing emissions, and enhancing efficiency. This could entail improving, retrofitting, or fine-tuning the control systems and turbine parts. Operators and maintenance staff can get training programs and technical help from gas turbine service providers. In order to ensure effective and secure turbine operation, these programs seek to improve operational expertise, troubleshooting techniques, and safety procedures.

The other industries are expected to witness the fastest growth in the gas turbine services market during the forecast period. Aircraft engines are powered by gas turbines, and keeping these engines serviced is essential to preserving the efficiency and safety of flight. In the aerospace industry, gas turbine services encompass maintenance, repair, and overhaul tasks. Gas turbines are used in mining operations to generate power and provide distant mining sites with electricity. In order to minimize operating expenses, gas turbine services in the mining sector prioritize dependable power delivery and maximizing turbine performance. In hybrid renewable energy systems, including combined cycle power plants with integrated solar or wind energy, gas turbines are occasionally employed. Gas turbine services in renewable energy entail maximizing the efficiency of turbine operation and combining them with other renewable energy sources.

By Turbine Type

By Turbine Capacity

By Service Type

By Service Provider

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

October 2024

March 2025

August 2024