What is the Generative AI in Financial Services Market Size?

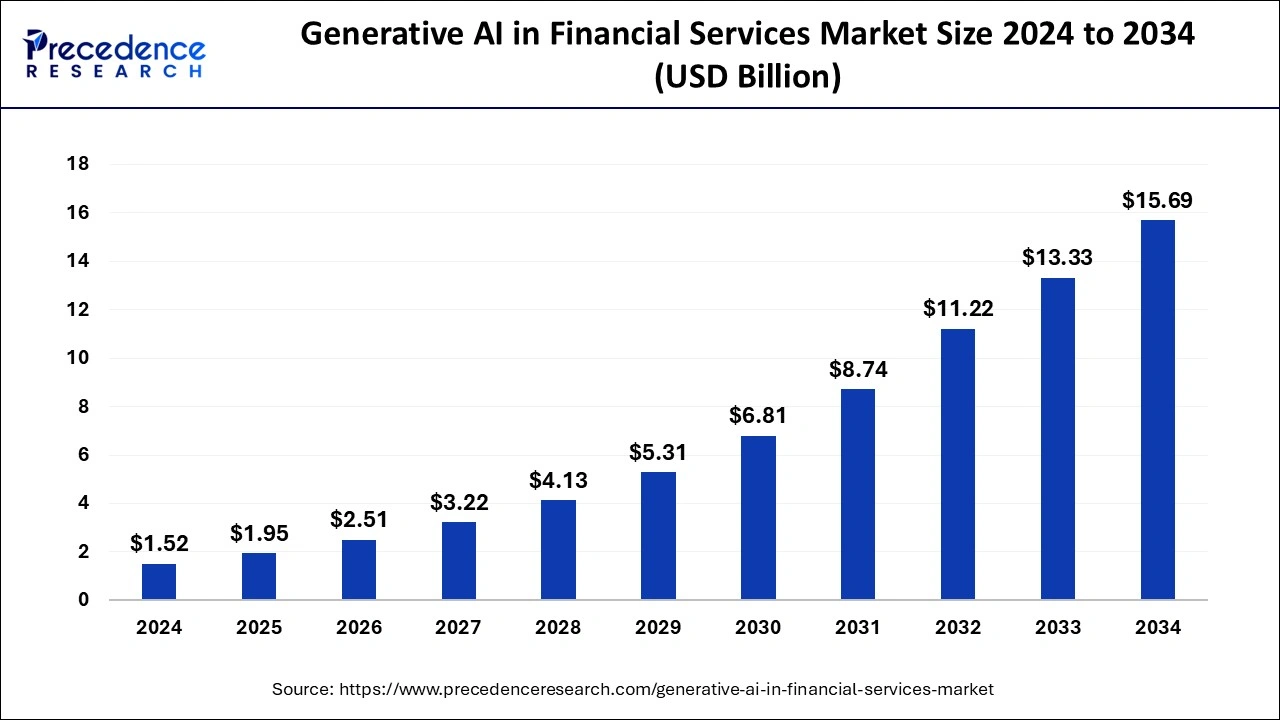

The global generative AI in financial services market size is calculated at USD 1.95 billion in 2025 and is predicted to increase from USD 2.51 billion in 2026 to approximately USD 17.88 billion by 2035, expanding at a CAGR of 24.81% from 2026 to 2035.

Market Highlights

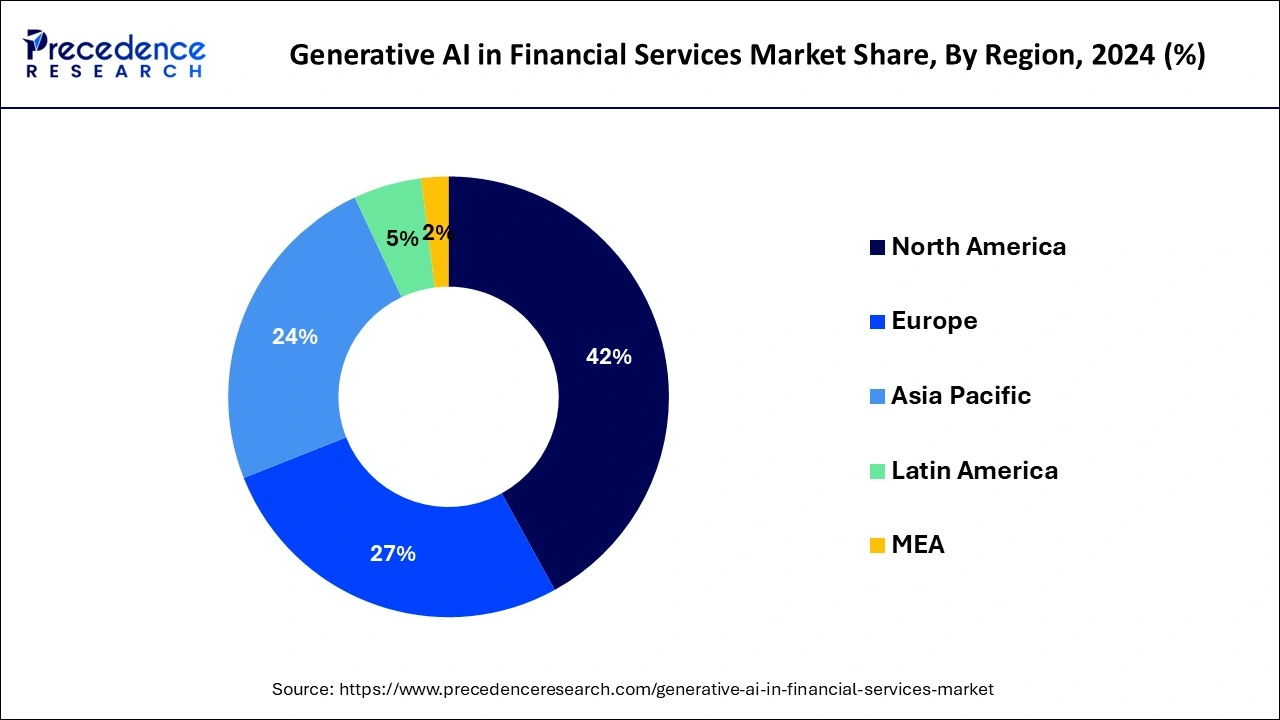

- North America region contributed more than 42% of revenue share in 2025.

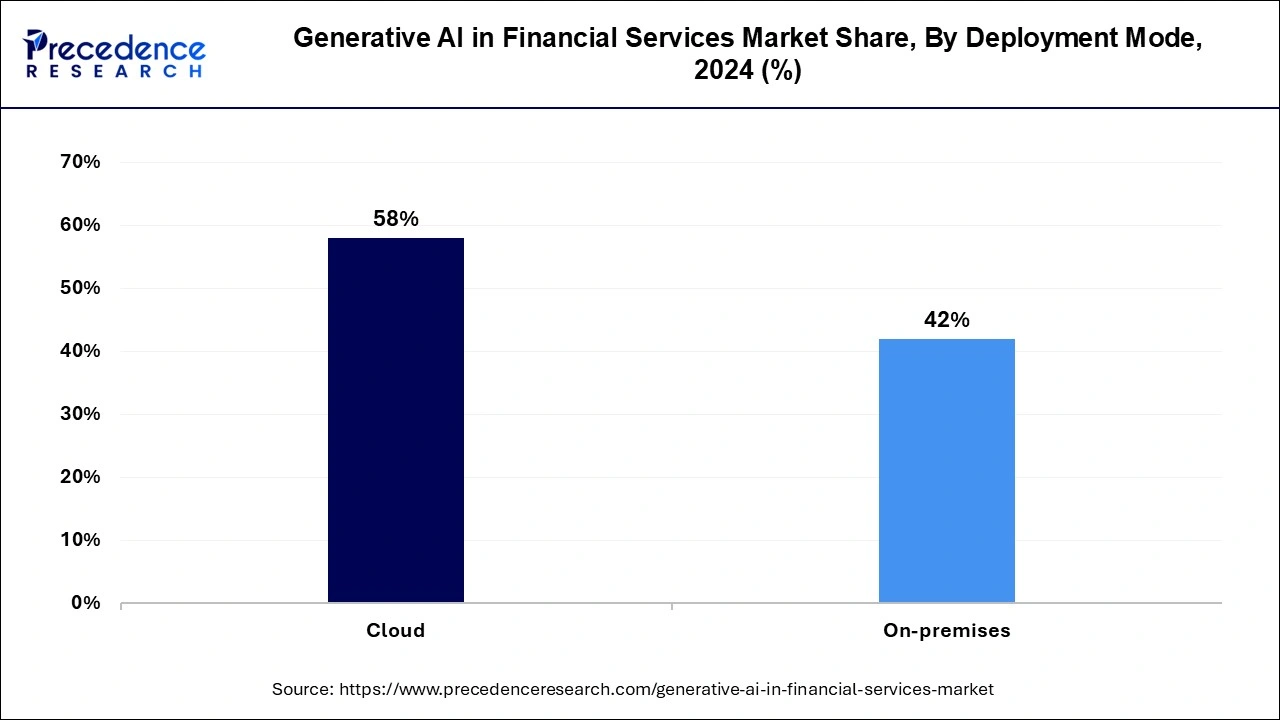

- By deployment model, the cloud-based segment generated more than 58% of revenue share in 2025.

- By type, the solutions segment is dominating the generative AI in the financial services market.

- By application, the risk management segment is expected to hold the maximum CAGR during the projection period.

Market Size and Forecast

- Market Size in 2025: USD 1.95 Billion

- Market Size in 2026: USD 2.51 Billion

- Forecasted Market Size by 2035: USD 17.88Billion

- CAGR (2026-2035): 24.81%

- Largest Market in 2025: North America

- Fastest Growing Market: Asia Pacific

Market Overview

Generative AI in financial services serves various applications, such as improving risk management, fraud detection, personalized services, refining investment strategies, and overcoming data limitations. It even helps expand the diversity and size of the data sets by creating data points that will assist in training accurate and strong machine learning models that will enhance the decision-making process. AI-generated models assist customers in managing risk.

A survey from NVIDIA published in February 2023 shows that the top AI use cases in financial services are large language models, natural language processing (NLP), which is about 26%, portfolio optimization to be 23%, recommender systems, and next-best-action considered for about 23%. Whereas fraud detection is 22%.

Generative AI in Financial Services Market Growth Factors

The demand for generative AI in financial services is increasing as financial corporations focus on improving basic knowledge of investing and finance by continuous learning and improving by taking effective risks. This involves a check-out model performance rate and dealing with feedback from risk managers. Generative AI can accelerate development in pharmaceutical industries, where drug discovery will take a decade or more, and machine learning models can suggest application code to increase developer productivity. ChatGPT, for example, can assist with website development and debugging and JavaScript codes. Chatbots that provide a more human-like response to customer inquiries benefit client interaction. All these benefits of generative AI are expected to accelerate the growth of the market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.95 Billion |

| Market Size in 2026 | USD 1.95 Billion |

| Market Size by 2035 | USD 17.88 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 24.81% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Deployment Mode, By Type, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Faster decision making

Generative AI can provide imprompt data analysis and insights, facilitating financial institutions to make quicker and more informed decisions. Also, it can aid financial institutions in assessing risks, identifying investment opportunities, and optimizing business strategies that can result in quick decision-making and raised scalability in a fast-paced financial market. Further, it is most helpful in banking and financial services by robotizing artificial processes, reducing errors, and bettering accuracy, generative AI can process and progress lending more efficiently, accurately, and transparently. For instance, a large language model (LLM) is skilled in a company's user chats and product specification data, which can answer all queries about the products. Thus, the faster decision-making offered by generative AI and substantial demand for quick solutions are observed to acts as a driver for the market growth.

Restraint

High risk of errors

The financial services industry operates under strict regulatory frameworks to protect consumers and maintain market integrity. Implementing generative AI systems involves navigating complex compliance requirements. Regulators demand transparency, fairness, and ethical use of AI. However, generative AI models, especially deep learning models, often lack interpretability, making it difficult to explain their decision-making process and comply with regulatory guidelines. This hurdle slows down the adoption of generative AI in the financial sector.

Opportunity

Rising demand for automated solutions for fraud-detection

Generative AI models can be employed to continuously learn and adapt to new fraud patterns in real-time. By analyzing incoming transaction data and comparing it against learned patterns, these models can identify suspicious activities and trigger immediate fraud alerts. The ability to adapt and learn on the fly is particularly advantageous in the dynamic landscape of fraud, where new techniques and attack vectors emerge regularly. Generative AI algorithms can help identify anomalies in financial transactions by learning patterns and trends from genuine data. These algorithms can generate models that understand what "normal" transactions look like and flag any deviations as potential fraud. By incorporating generative AI techniques, fraud detection systems can become more robust and effective in identifying previously unseen or evolving fraudulent activities. Hereby, create a plethora of opportunities for the market.

Segments Insights

Deployment Mode Insights

The cloud-based segment is expected to be dominant in the generative AI in financial services market during the predicted period. With the help of cloud computing, plenty of necessary resources and infrastructure are available for scaling and deploying AI models, mainly in financial services. Financial institutions can access computational power by leveraging cloud platforms required to train and deploy a standard generative AI model. It can interpret data from the market history, identify the whole patterns, and create a generating signal. This helps in easy trading procedures by improving and making quick decisions and sharpening investment strategies.

For instance, In March 2025, Oracle expanded its alliance with NVIDIA to cover strategic NVIDIA AI approaches on the novel Oracle Cloud Infrastructure (OCI). The latter has selected OCI to provide NVIDIA DGX Cloud at a massive scale. Additionally, NVIDIA is working on NVIDIA AI Foundations, its new generative AI cloud services, accessible through DGX Cloud.

The on-premises segment is expected to witness noticeable growth during the forecast period. On-premises generative AI can assist financial institutions in meeting regulatory requirements by analyzing huge sums of financial data and creating compliance reports, including tailoring transactions for money censoring, analyzing client data for suspicious activities, and ensuring adherence to financial regulations.

Type Insights

The solutions segment is expected to be the dominant in the generative AI in financial services market during the predicted period. Generative AI helps individuals and companies deal with wealth management in financial planning and advising on investment strategies. These AI models can provide customized investment plans and suggestions by assaying customer financial data, goals, and risk preferences, helping individuals achieve their financial objectives. It can access credit, generate credit risk scores, and give insight for more accurate and efficient credit decision-making by understanding numerous data sources such as economic history on income, spending, and saving patterns.

The services segment is expected to be the attractive segment of the generative AI in financial services market during the forecast period. Generative AI can automate recognizing suspicious financial transactions and assist financial institutions in complying with Anti-Money Laundering (AML) regulations. The vast volumes of transactional data analysis and identifying patterns linked with money laundering activities can enhance the efficiency and accuracy of AML efforts. It can analyze client sentiment by processing social media data, consumer reviews, and feedback. This interpretation will assist financial institutions to understand and work on client preferences, improve products and services, and elevate user satisfaction.

Application Insights

The risk management segment is leading in the generative AI in financial services market throughout the forecast period.

Generative AI models can determine historical data sources and create synthetic data that captures the underlying patterns and dependencies. At the same time, the expanded dataset can aid risk managers in gaining deeper insights into potential risks and eventually deals with more accurate risk assessments. In addition, it can learn patterns of fraudulent behavior from historical data and generate synthetic examples of fraudulent transactions, improving the fraud detection systems by training them on a broader range of potential fraud patterns. Further, it can help optimize investment portfolios by developing synthetic data with characteristics of different asset classes, and building a robust data infrastructure is crucial to effectively capture, store, and analyze vast amounts of financial data. This infrastructure should support both risk management processes and generative AI modeling.

For instance, In June 2023, Moody's Corporation and Microsoft declared a novel strategic association to deliver next-generation data, research, analytics, partnership, and risk solutions for financial services and global knowledge workers. It was built by combining Moody's data and analytical abilities, including the Microsoft Azure OpenAI Service capacity and scale. The collaboration creates innovative offerings that improve insights into risk assessment and corporate intelligence generated by Microsoft AI and tied up by Moody's proprietary.

The forecasting & reporting is the fastest growing segment in the generative AI in financial services market. Generative AI can create sophisticated trading algorithms which analyze market data, identify trading opportunities, and execute trades with minimal human involvement. AI-powered chatbots and virtual assistants provide customized financial advice with many other supporting assistantships, such as answering customer queries and assisting with routine financial tasks. Furthermore, it generates optimal investment portfolios by considering various factors such as risk tolerance, expected returns, and market conditions which aid in maximizing returns while managing risks.

Regional Insights

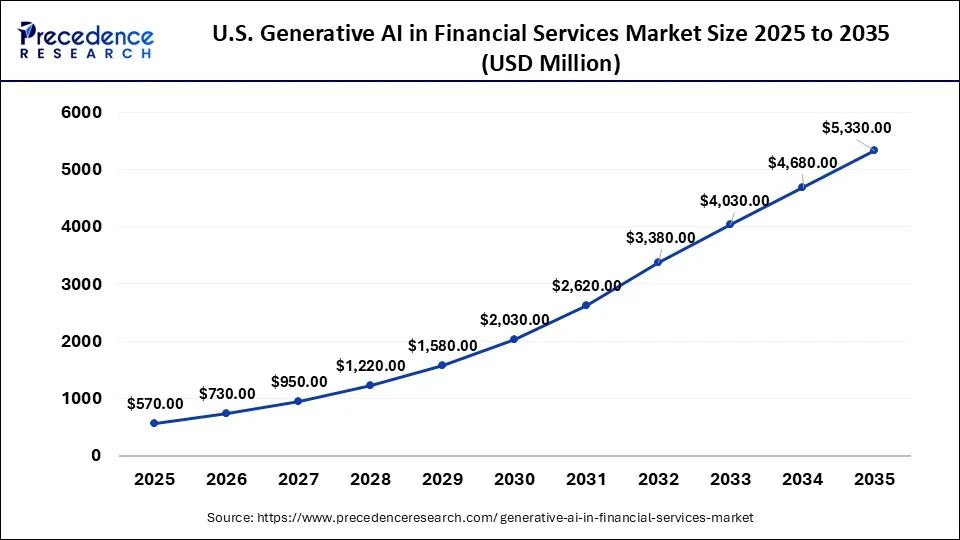

What is the U.S. Generative AI in Financial Services Market Size?

The U.S. generative AI in financial services market size reached USD 570 million in 2025 and is projected to be worth around USD 5,330 million by 2035, poised to grow at a CAGR of 25.05% from 2026 to 2035.

North America is dominating and expected to remain a significant region in the generative AI in financial services market throughout the predicted timeframe. This is due to the availability of quick data access from a vast volume of datasets, technological advancement, the robust financial industry, and the presence of key players and talent pools to invest and fund by collaborating. North America is considered the hub of the world's largest and most influential financial institutions, including banks, asset management firms, and insurance providers that will recognize the potential of generative AI in various applications within the financial sector, such as fraud detection, risk assessment, trading algorithms, and customer experience enhancement.

North America, with its mature financial markets, much transactional data, and regulatory frameworks promoting data sharing and open banking, has a significant advantage regarding access to diverse and high-quality data sets. In addition, a collaborative ecosystem where researchers, academics, industry experts, and AI enthusiasts collaborate to boost the boundaries of generative AI in financial services. Prominent universities and research centers like MIT and Stanford contribute to developing the latest AI technologies. North America has witnessed substantial investments in AI research and development from private and public sources.

Asia- Pacific shows lucrative growth in the generative AI in financial services market during the forecasted timeframe. This is due to the increasing availability of data, advanced technological infrastructure, fintech innovation, and growing customer expectations. Asia Pacific has a large population and an expanding digital ecosystem that has led to the generation of vast amounts of data, a valuable resource for training and utilizing generative AI models in financial services. Asia Pacific has seen significant growth in the fintech sector, with numerous startups and established financial institutions leveraging advanced technologies, including generative AI, to offer innovative financial services. Customers in the Asia Pacific region increasingly expect personalized and convenient financial services. Many countries in the Asia Pacific region have been investing heavily in technological infrastructure, including high-speed internet connectivity, cloud computing, and data centers.

Europe: Innovation Hub Driven by Regulation:

Europe, the emergence of a developed generative AI financial services market based on strong laws regarding data (e.g., GDPR) and other initiatives regarding the regulatory framework of AI requires that financial institutions focus on ethics, explainability, and data security regarding data processing. This sets the stage for a significant demand for compliant generative AI solutions across the banking and insurance sectors.

Germany is experiencing tremendous growth due to heavy investment from the banking sector into AI-based risk analytics and automated risk-based reporting processes aimed at increasing operational transparency.

Latin America: Fintech-Led AI Acceleration

Latin America has a rapidly growing fintech ecosystem, driven by generative AI to increase financial inclusion and automate the credit score process; additionally, this capability provides more personalized digital banking. Furthermore, the use of AI by financial institutions allows for the provision of services to those who were previously considered, while also enabling institutions to create cost efficiencies.

In Brazil, digital banks and payment processors are beginning to implement generative AI to engage customers and reduce their risk of fraud by creating a more seamless user experience.

Middle East & Africa: Digital Finance Transformation Zone

In the MEA region, the focus on the use of generative AI is part of many countries' national agendas for digital transformation through the implementation of smart banking, automation of Islamic banking services, and the use of AI in wealth management for institutions. As a result, governments and banking institutions are placing a premium on the widespread deployment of AI in order to improve upon the existing infrastructure of the financial services industry.

Value Chain Analysis of Generative AI in Financial Services Market

- AI Infrastructure & Model Development Layer: This extremely significant layer is the backbone of generative AI within the financial services sector and consists of the necessary high-performance computing capabilities, cloud infrastructures, foundational AI models, and data engineering capabilities to build and deploy generative AI-based applications for financial purposes.

Key Players: NVIDIA, Microsoft Azure, Google Cloud, Amazon Web Services, OpenAI - AI Integration, Customization & Platform Enablement: This third step in the generative AI value chain will support the customization of generative AI models to meet the needs of specific financial workflows such as fraud detection, algorithmic trading, customer personalization, credit risk modeling, and regulatory reporting.

Key Players: IBM, Accenture, Capgemini, Infosys, Tata Consultancy Services (TCS) - Deployment & Financial Application Layer: This layer consists of real-time decision making, conversational artificial intelligence, automated compliance, and hyper-personalized financial products, all of which will have a direct impact on both the customer experience and overall business efficiency for the financial services sector.

Key Players: JP Morgan Chase, Goldman Sachs, PayPal, Stripe, Salesforce Financial Services Cloud.

Generative AI in Financial Services Market Companies

- IBM Corporation

- Intel Corporation

- Narrative Science

- Amazon Web Services, Inc.

- Microsoft

- Google LLC

- Salesforce, Inc.

Recent Developments

- In May 2023, Amazon Web Services, Inc. launched Amazon Aurora input/output (I/O)-Optimized. It is a new composition for Amazon Aurora, which offers improved price performance and predictable pricing for clients with intensive input/output applications. The clients will only have to pay for the database and storage consumption excluding charges for I/O operations. As a result, clients will now confidently forecast the price of the most I/O-intensive workloads, accelerating the decision to migrate workloads to AWS.

- In June 2023, Accenture declared that it would associate with AWS, Microsoft, and Google to speed up the company's expertise around generative AI, which resulted in the company becoming the first to be a multi-cloud generative AI solution. The partnership with AWS is made around its latest ML and AI technologies, and these investments will span spheres, including financial services, customer support, life sciences, supply chain, cybersecurity, and others.

- In June 2022, SurePay supported Virgin Money by incorporating its UK confirmation of Payee solution to defend clients against scams and misdirected online expenses.

Segments Covered in the Report

By Deployment Mode

- Cloud

- On-premises

By Type

- Solutions

- Services

By Application

- Credit Scoring

- Fraud Detection

- Risk Management

- Forecasting & Reporting

- Other Applications

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting