January 2025

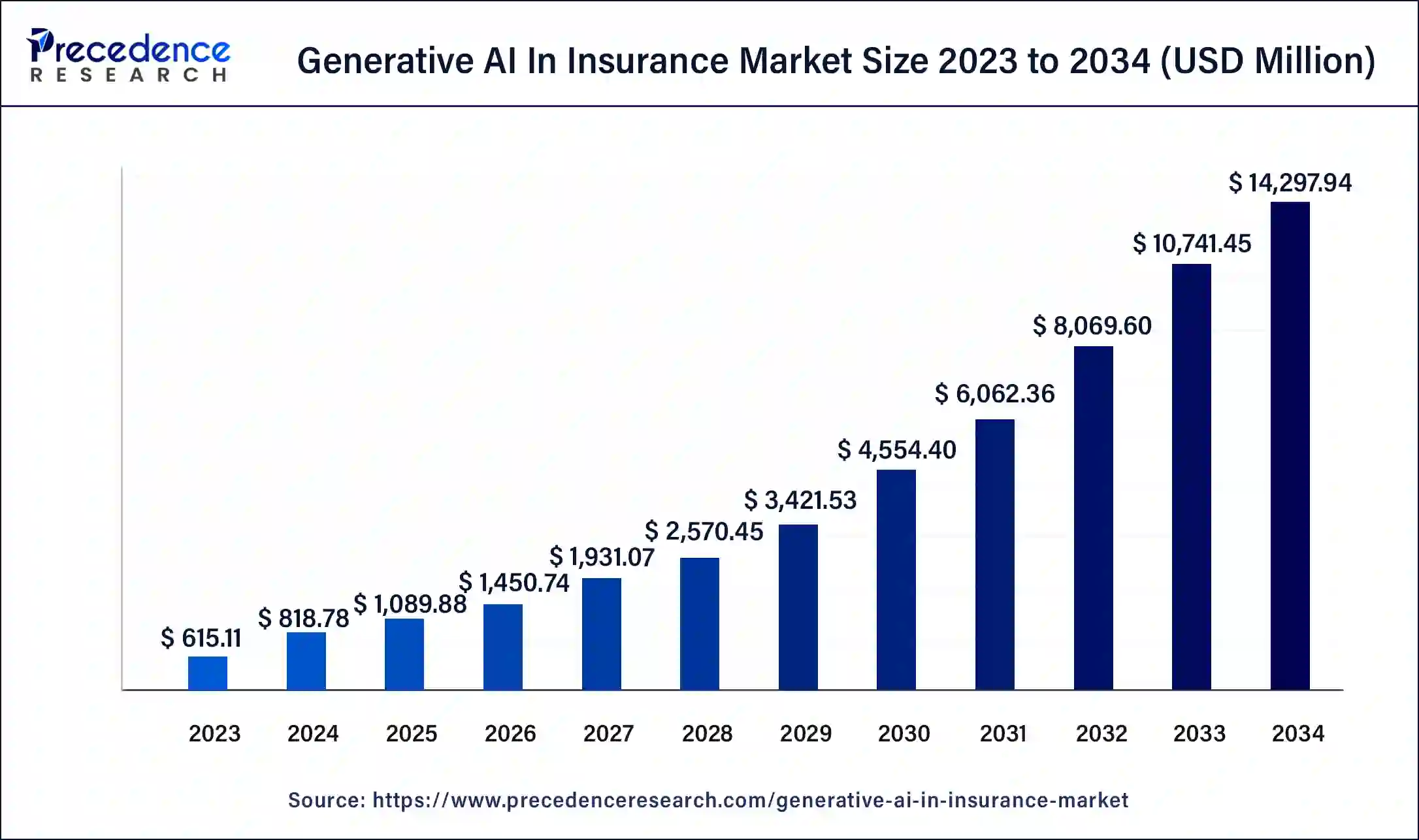

The global generative AI in insurance market size was USD 615.11 million in 2023, calculated at USD 818.78 million in 2024 and is projected to surpass around USD 14,297.94 million by 2034, expanding at a CAGR of 33.1% from 2024 to 2034.

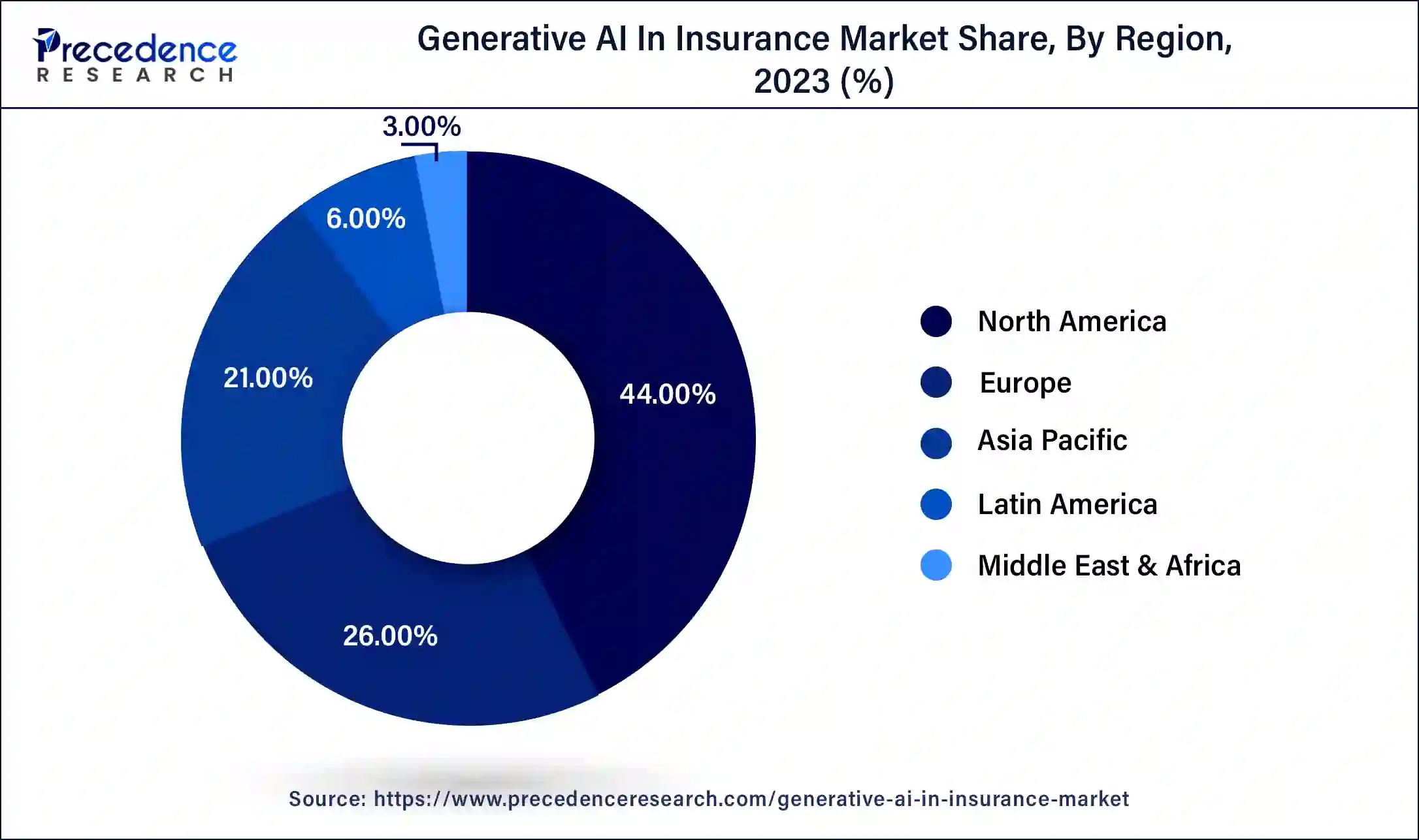

The global generative AI in insurance market size accounted for USD 818.78 million in 2024 and is expected to be worth around USD 14,297.94 million by 2034, at a CAGR of 33.1% from 2024 to 2034. The North America generative AI in insurance market size reached USD 270.65 million in 2023.

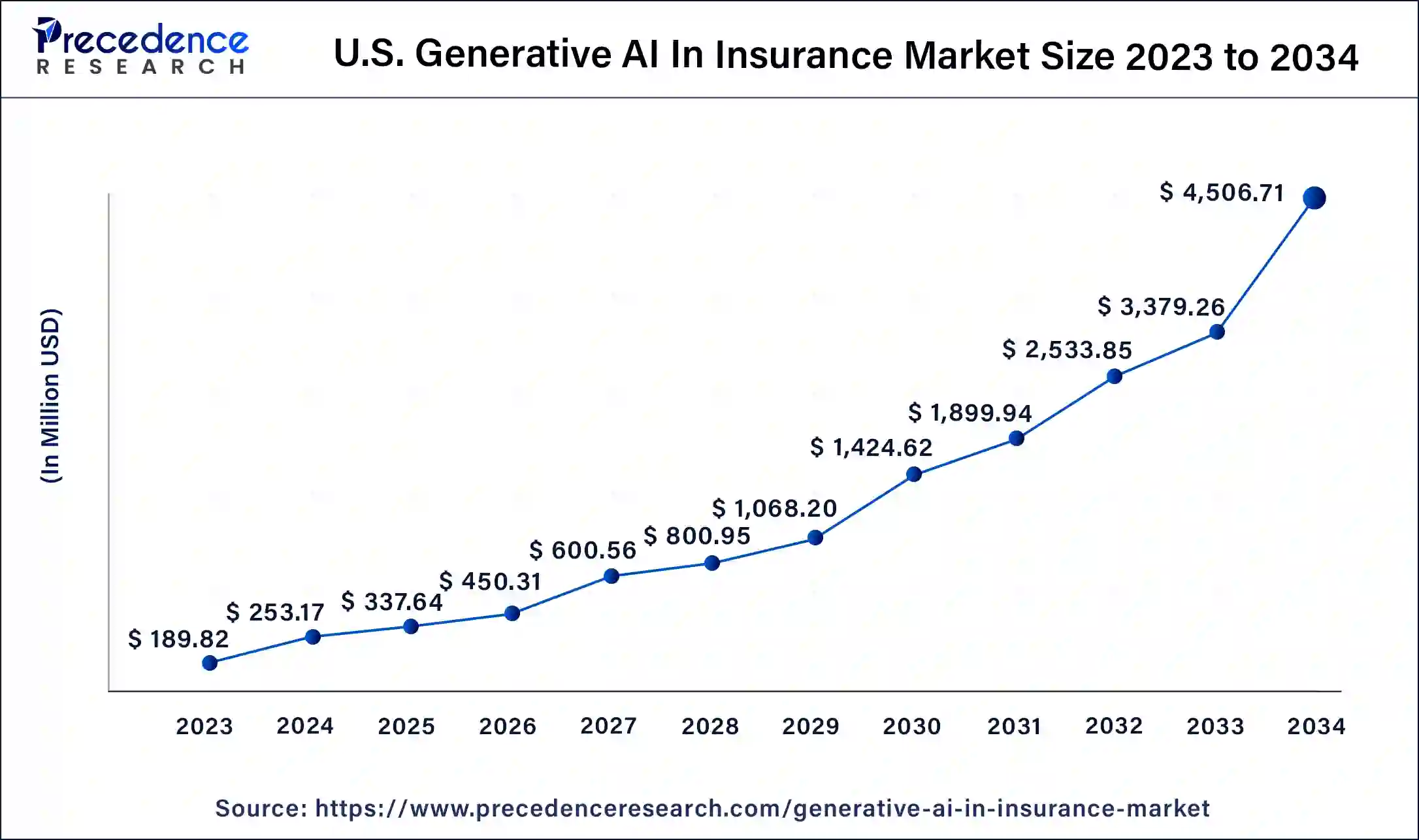

The U.S. generative AI in insurance market size was estimated at USD 189.82 million in 2023 and is predicted to be worth around USD 4,506.71 million by 2034, at a CAGR of 33.4% from 2024 to 2034.

North America dominated the market with the largest market size in 2023, the region is expected to maintain its dominance throughout the forecast period. The growth of the region is attributed to the presence of leading insurance companies in the region. The United States had the largest market in the insurance sector for the year 2023, the country will continue to contribute the largest share for the market in the upcoming years followed by Canada. In the United States, the insurance sector is led by Prudential Financial, MetLife, and Berkshire Hathaway. Health Insurance is the ever-expanding part of the insurance sector. The rising number of individual policyholders and emphasis on providing quicker services for consumers to stay competitive in the industry by insurance carriers promote the market’s growth in North America.

Asia Pacific is expected to register the fastest rate of growth during the predicted timeframe. The growth of the region is attributed to the rising population and increasing need for the protection of lives and the availability of cost-effective products or services for insurance. The rapid growth in the middle-class population across the region will directly propel the demand for the insurance plans in the region, the rise consumer base will subsequently promote the adoption of advanced generative solutions from the insurance company operators. The ageing population is fueling the demand for health insurance and related products in the Asia Pacific.

The potential to adopt advanced services for enhancing the operational efficiency of industries in countries of Asia Pacific highlights the growth of generative AI in the insurance market for the region. The growing risk of cybercrimes in the region also highlights the demand for effective risk management solutions. Moreover, substantial government support for the utilization of generative AI-based services in multiple industries is observed to supplement the growth of the market in Asia Pacific.

Generative AI is the term used to describe a system with artificial intelligence that can analyze data and generate relative content in various forms to manage operations and enhance efficiency. It is able to provide pre-determined replies due to models that identify, map, and build meaning from patterns within the data inputs. The science behind the technology analyzes data from enormous datasets, gains expertise from past performance, and improves performance even with unorganized and unstructured data. Today, every sector of the economy is riding the success and efficiency of generative AI. Generative AI is observed to be useful for financial organizations, such as insurance companies, it helps the organization to understand the behavior of the clients. Generative AI helps to improve the services and products of the firm by analyzing consumer behavior and data.

Generative AI is the latest emerging technology across the world. Generative AI is evolving in many industries such as automobiles, pharmaceuticals, telecommunication, etc., one in which generative AI is emerging in the field of insurance. Generative AI has the latest prospects in the insurance sector. Generative AI helps the process of insurance such as marketing and distribution, strategy and product design, pricing and underwriting the claims, and operations and governance. Generative AI can provide new efficiencies that can enhance the solution to transform the insurance business model. Generative AI can provide great services and insights to the customers of insurance companies. Considering such advantages of generative AI along with a substantial expansion of the finance and insurance sector, the market is anticipated to grow at a significant rate.

Generative AI provides better assistance to companies to improve their services and a better understanding of their clients. Generative AI combines the customers' information and generates customized solutions according to the need and requirements of the clients and enhances customer satisfaction. Considering another growth factor for the insurance sector, generative AI is expected to help in automating the task, providing ease in the claim process. These factors collectively would drive the growth of generative AI in the insurance market.

| Report Coverage | Details |

| Market Size in 2023 | USD 615.11 Million |

| Market Size in 2024 | USD 818.78 Million |

| Market Size by 2034 | USD 14,297.94 Million |

| Growth Rate from 2024 to 2034 | CAGR of 33.1% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Deployment, By Technology, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Management of huge data

Insurance underwriting and other major responsibilities in the insurance field used to primarily rely on staff to analyze previous data and draw informed judgments. By providing machine learning algorithms that compile and make sense of vast quantities of data, intelligent process automation streamlines the underwriting procedure. Another area where generative AI is predicted to improve is by lowering the efforts of human agents in the insurance sector to lower risks and deliver value services to customers. Such algorithms are also capable of working with chaotic systems, processes, and workflows. One of the most prevalent applications of artificial intelligence in the insurance industry is to manage a large amount of unstructured data. In addition, generative AI improves rule speed, manages straight-through acceptance (STA) rates, and prevents application errors. All these factors are expected to contribute to the growth of generative AI in the insurance market.

Expensive technology

Due to the necessary computational resources, generative AI technology may become costly and complicated to get transformed into. Enterprises may also encounter new difficulties when integrating generative AI with their existing technological infrastructures. IT executives or skilled personnel are required to choose whether to completely replace the old system or just integrate the new technology with it, which puts an additional cost on the companies. Considering the complications caused by the cost factor, the higher operational costs are likely to hamper the growth of the market. To address this restraint insurance companies will thus probably soon embrace generative AI using cloud APIs with little customization, this element is expected to lower the cost of transformation slightly as compared to the transformation into on-premises.

Digitization of insurance distribution

In the pre-digital era, clients or consumers used to prefer direct interaction with a financial advisor or visit a local provider to learn about coverage options. There would frequently be a dominant carrier for a certain product in a niche market. The carrier would perform underwriting activities and provide an insurance plan depending on the information the consumer provided while considering the client’s requirements. This situation is currently reversed by digitalized insurance distribution techniques. Nowadays, practically every carrier has a website where clients may browse the available goods and services before making a decision. The insurance sector was significantly transformed as a result of this shift in customer behavior.

Generative AI has the potential to completely transform the sales and distribution phase of the insurance value chain by applying state-of-the-art AI algorithms that are already available. Algorithms of generative AI can reduce the intervention of human agents by analyzing data collected from consumers to generate a precise and unbiased insurance plan/service. This can reduce the time taken for the decision-making process and will also enhance the productivity of the operator. Thus, the rising shift towards digitization in the insurance distribution process is expected to open a plethora of opportunities for generative AI in the insurance market.

The cloud segment dominated the market with the highest market share in 2023. The growth of the segment is attributed to the increasing use of cloud-based solutions by operators in the overall BFSI sector across the globe. Insurance companies are well-positioned to advance due to cloud-integrated products and AI-assisted client data collecting. The cloud enables insurers to collect client information for a comprehensive understanding of behavior, preferences, and risk level. Generative AI converts the data into useful insights that decision-makers at all levels, from agents to executives, may employ. Insurance companies can provide more individualized or personalized client experiences while making the best decisions along the whole value chain, from underwriting to the creation of new products with the help of cloud-based deployment that offers precise scalability and adaptability.

The machine learning segment dominated the market with the largest market revenue in 2023, the segment will continue to witness a significant growth rate during the forecast period. In the past few decades, cutting-edge technologies such as machine learning have been the most extensively adopted trend. Simply because of the operational advantages that businesses may get for their value chain, they have been embraced by the majority of firms across all industries. One sector that has benefited greatly from incorporating machine learning into its operations is the insurance sector.

Automating routine daily tasks and improving workflows are both possible with machine learning in the insurance industry. Additionally, these technologies may assist businesses in analyzing and using a wealth of consumer data to make smarter decisions and provide more lucrative and individualized insurance plans to their clients. Generative AI, when used by the technology of machine learning is capable of generating content in the form of text, images and even videos. This capability of machine learning offers unbiased outputs taken from original datasets.

The fraud detection and credit analysis segment dominated the market with the largest market share in 2023. The growth of the segment is arising due to the increasing ratio of cybercrimes in insurance companies. Generative AI is capable of helping insurance company operators by detecting fraud by several software like SAS. SAS is software which provides predictive analysis to insurance companies to help them to detect the fraud process or unauthorized activities taking place. The predictive analysis process specifically helps health insurance companies to detect the fraud claim of insurance.

The generative AI algorithms analyze the discern data points and relate with the previous fraud attempts. An increasing number of financial fraud results in the higher demand of generative AI for fraud detection in the insurance market. On the other hand, generative AI chatbots are capable of analyzing the history of credit score for consumers to generate a precise service from the available insurance services.

Segments Covered in the Report

By Deployment

By Technology

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

July 2024

January 2025

October 2024