January 2025

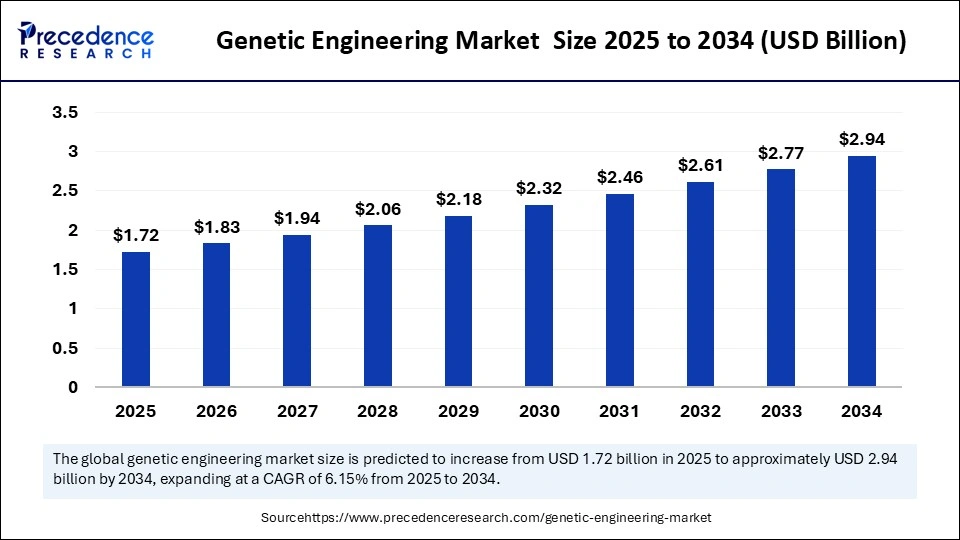

The global genetic engineering market size is accounted for USD 1.72 billion in 2025 and is forecasted to hit around USD 2.94 billion by 2034, representing a CAGR of 6.15% from 2025 to 2034. The North America market size was estimated at USD 664.20 million in 2024 and is expanding at a CAGR of 6.27% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global genetic engineering market size was calculated at USD 1.62 billion in 2024 and is predicted to increase from USD 1.72 billion in 2025 to approximately USD 2.94 billion by 2034, expanding at a CAGR of 6.15% from 2025 to 2034. The growth of the market is driven by increasing government grants and funding to biotech startups. The rising production of vaccines and biologics further contributes to market growth.

Artificial intelligence (AI) plays a crucial role in genetic engineering, driving innovations in various aspects. AI technology uses sophisticated computational processes to interpret and analyze genetic data. By accurately interpreting genetic data, AI technology provides academics and medical professionals with a greater understanding of the complex functions of the genome. This further improves the reliability and accuracy of genetic processes, which are central to the modern diagnosis and management of different health conditions. AI algorithms are also used to analyze vast datasets of genetic information, identify potential drug targets, and design novel therapies.

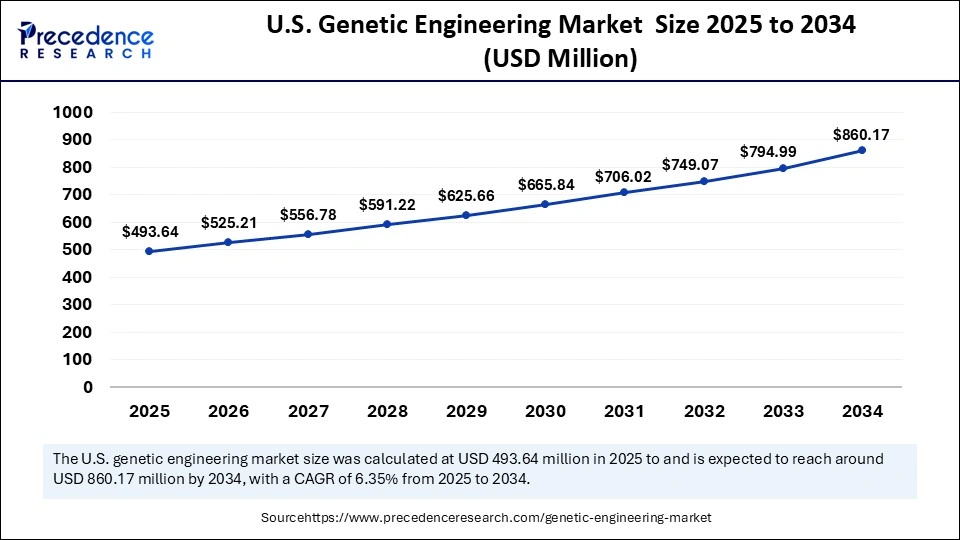

The U.S. genetic engineering market size was exhibited at USD 464.94 million in 2024 and is projected to be worth around USD 860.17 million by 2034, growing at a CAGR of 6.35% from 2025 to 2034.

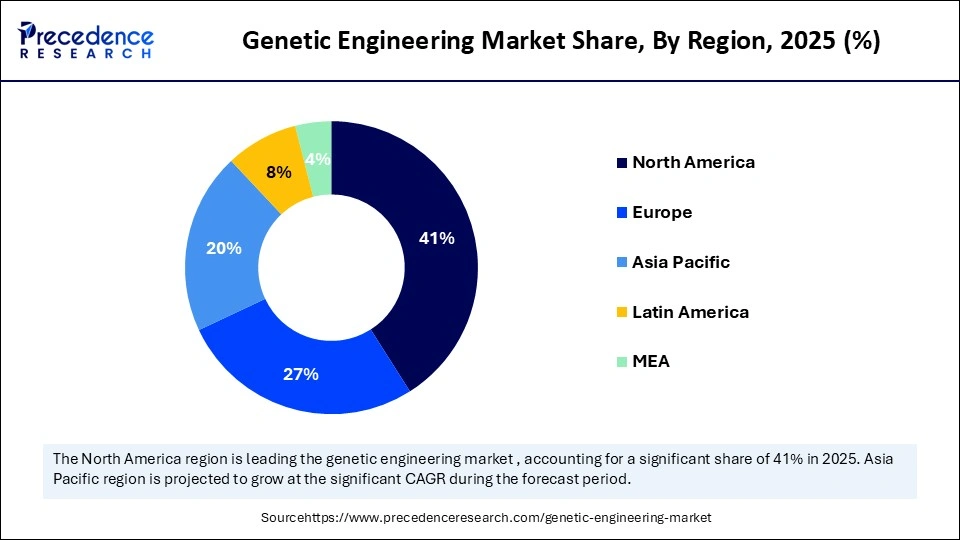

North America dominated the genetic engineering market in 2024 by capturing the largest share. This is mainly due to the increased government funding in research and development of genetic engineering. A large pool of skilled researchers and a robust research infrastructure further bolstered the market in the region. Increasing healthcare innovations, advances in healthcare technology, and increasing prevalence of chronic and genetic diseases further bolstered the market. The U.S. is a major contributor to the North American genetic engineering market. The strong presence of major bioscience companies such as eGenesis, Intellia Therapeutics, Editas Medicine, Caribou Biosciences, Synthego, and Inari further support the growth of the market. There is a high demand for personalized medicines.

Asia Pacific is projected to witness the fastest growth during the forecast period, driven by escalating government investments in biotechnology research and the increasing demand for biologics. With the growing prevalence of chronic diseases, there is a high demand for gene therapies. Rising healthcare expenditure and favorable government policies contribute to the market's expansion. China is expected to have a stronghold on the Asia Pacific genetic engineering market. The rising investments in R&D activities drive market growth. In China, CRISPR/Cas gene-editing technology is transforming the crop breeding sector due to its simplicity, speed, and precision in generating the necessary genetic mutations for crop development.

Europe is projected to grow significantly during the forecast period due to advancements in biotechnology. Increasing awareness of early disease detection is boosting the demand for genetic testing. The region is at the forefront of healthcare and biotech innovations. The rising funding programs for R&D activities support regional market growth.

Genetic engineering is quickly modernizing fields such as medicine, agriculture, and biotechnology, accelerating the production of gene therapies, vaccines, and disease-resistant crops. Progression in high-throughput sequencing processes enabled the development of robust technology for quantitatively measuring the transcriptome, the expressed genes in a sample. The genetic engineering market is witnessing rapid growth due to the rising demand for personalized medicines. Genetic engineering is increasingly used in agriculture to improve crop yield and nutrient content. Synthetic biology is growing beyond modifying existing organisms to constructing and designing wholly new biologics. However, genetic engineering permits scientists to simulate biologics and predict results before experimental operation. The rising research and development activities focusing on genetic engineering and the increasing demand for gene therapies further contribute to market expansion.

| Report Coverage | Details |

| Market Size by 2034 | USD 2.94 Billion |

| Market Size in 2025 | USD 1.72 Billion |

| Market Size in 2024 | USD 1.62 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.15% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Device, Technique, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Expanding Applications of Genetic Engineering in Climate Resilient Agriculture

The rising impact of environmental change on global food security has accelerated research and investments in gene editing applications for crop and livestock enhancement, acting as a major driver for the genetic engineering market. Emerging genome editing initiatives are focused on increasing drought, heat, and salt tolerance in staple crops, such as maize and rice, with advancements already leading to the development of high-yield, climate-resilient rice varieties. These innovations enable the creation of cultivars that are not only more resistant to environmental stress but also promote sustainability by reducing input needs and improving productivity. Additionally, gene editing holds noteworthy potential in advancing livestock genetics for enhanced disease resistance and adaptability to changing climatic conditions. Genome editing plays a critical role in driving sustainable agriculture as agricultural stakeholders progressively adopt precision biotechnology solutions to address food system susceptibilities.

Intellectual Property Complexities

Intellectual property surrounding genetic technologies, especially gene-editing platforms such as CRISPR, restrain the growth of the genetic engineering market. The intricate and often contentious patent landscape raises concerns related to access, affordability, and the equitable distribution of benefits from these transformative technologies. Disputes over ownership and licensing rights can create legal uncertainty, increase development costs, and hamper the ability of smaller organizations. Moreover, ethical concerns surrounding genetic modification, particularly in human applications, limit the growth of the market.

Advancements in Neuroinflammation-Targeted Gene Therapies

Gene therapy is rapidly emerging as a transformative therapeutic platform, providing the ability to deliver functional genetic material directly to cells to correct underlying genetic defects with potentially long-lasting effects from a single administration. Recent innovations in gene therapy strategies, predominantly those targeting neuroinflammation pathways in neurodegenerative diseases (NDs), are creating novel opportunities within the genetic engineering market. These approaches include the delivery of functional genes, RNA interference to silence mutant alleles, and disease-modifying interventions using gene-editing technologies. By addressing the root causes of neuroinflammatory responses in conditions like Alzheimer's and Parkinson's diseases, these novel gene therapy strategies not only solve a new class of treatments for complex central nervous system disorders but also position genetic engineering as a critical enabler of next-generation neurology solutions.

The genetic markers segment dominated the genetic engineering market with the largest share in 2024. Genetic markers are beneficial for the analysis of crop genomes, making them a significant tool in plant breeding. These markers are a small sequence of DNA that describes a specific trait. Genetic markers help to link hereditary disease with the responsible gene. The rise in the demand for genetic crops and precision medicine bolstered the segment.

The biochemical segment is expected to grow at a significant rate in the coming years. Biochemicals find applications in different sectors, from medicine and agriculture to environmental preservation and manufacturing. Biochemicals offer resistance against viruses, herbicides, and insects. They enhance the crops’ tolerance to high salinity levels in soil and enhance nutritional content. Biochemicals contribute to increasing production processes, improving the quality of products, and ensuring the nutritious value of food products.

The PCR segment held the largest share of the genetic engineering market in 2024. Polymerase chain reaction (PCR) enables the manipulation and analysis of genes, making it a preferred choice in laboratory settings. Its unique characteristics, like more sensitivity, enable us to detect smaller quantities of targeted DNA than many other testing processes. This makes it an ideal tool for identifying viruses and other pathogens in a sample that is present at very low concentrations. PCR tests permit the rapid and sensitive detection of particular nucleic acid sequences. They are broadly used in a variety of applications, including the diagnosis of communicable diseases.

The gene gun segment is anticipated to expand at the fastest rate during the projection period. Gene guns are widely used in genetic engineering to introduce RNA, DNA, or proteins into cells. These devices are easy to use, fast, and versatile, transferring large DNA fragments as well as small interfering RNA (siRNA) for gene silencing and transfecting many cell types, including non-dividing cells and plant cells.

The gene splicing segment led the genetic engineering market with the largest share in 2024. This is mainly due to the rise in the demand for gene therapies. Gene splicing plays a key role in gene therapy to correct genetic defects and develop new treatments for diseases. Gene splicing allows a single gene to surge its capability of coding, enabling the synthesis of protein isoforms that are functionally and structurally distinct. Gene splicing is used to create a high proportion of genes.

The artificial selection segment is projected to grow at the fastest rate in the upcoming period as it enhances the speed and advances in genetic engineering to meet requirements and produce organisms with preferred traits. This technique is widely applied to a range of traits, from yield and disease resistance to stress tolerance and nutrient content. This technique allows for the analysis of border ranges of genetic variation that are found in nature. The increased need for sustainable and climate-resilient agriculture drives the growth of the segment.

The medical industry segment dominated the market in 2024. Genetic engineering is heavily used in the medical sector to mass-produce insulin, human growth hormones, vaccines, antihemophilic factors, monoclonal antibodies, human albumin, and other drugs. Genetic engineering allows researchers to improve the production of medicinal compounds by engineering the host organisms for greater yields and higher purity. With the increasing prevalence of chronic diseases, the demand for precision medicine has increased, in which genetic engineering is essential. Moreover, the rise in government investments in novel drug discovery and development bolstered segment growth.

The agriculture segment is likely to expand at a rapid pace in the coming years. The growth of the segment can be attributed to the rising demand for genetically modified crops. Genetic engineering is used in agriculture to improve crop yields, nutrient content, and disease resistance. The rising concerns about food safety further boost segmental growth.

By Product

By Device

By Technique

By Application

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

March 2025

July 2024