March 2025

The global genomic biomarker market size is estimated at USD 6.04 billion in 2025 and is forecasted to worth around USD 10.98 billion by 2034, accelerating at a CAGR of 6.83% from 2025 to 2034. The North America genomic biomarker market size crossed USD 2.55 billion in 2024 and is expanding at a CAGR of 6.86% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global genomic biomarker market size was valued at USD 5.67 billion in 2024 and is projected to reach around USD 10.98 billion by 2034, registering a notable CAGR of 6.83% during the forecast period 2025 to 2034.

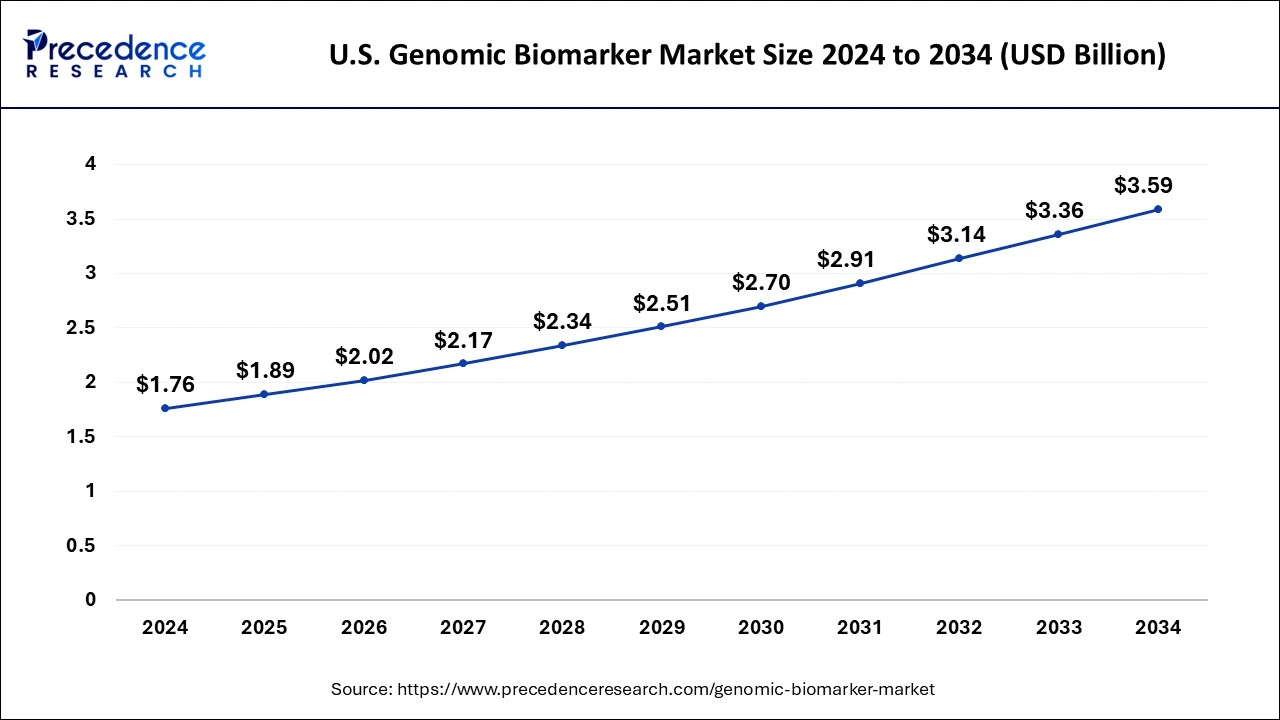

The U.S. genomic biomarker market size was estimated at USD 1.76 billion in 2024 and is predicted to be worth around USD 3.59 billion by 2034, at a CAGR of 7.39% from 2025 to 2034.

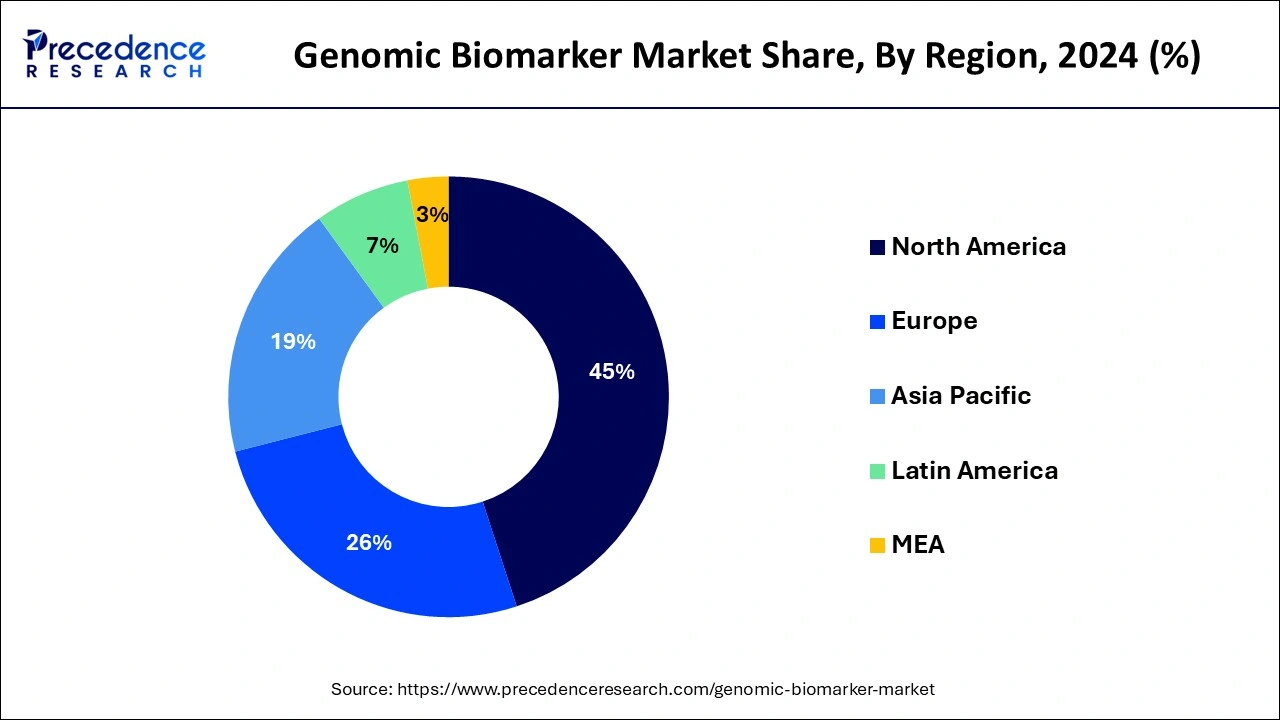

North America led the world market in 2024 and is anticipated to maintain its dominance going forward due to the region's expanding healthcare and life science research initiatives as well as the increased usage of genetic biomarkers in the early diagnosis of illnesses. For instance, Color Genomics announced the completion of the implementation of clinical genomics in regular healthcare under its US program in January 2020 in collaboration with NorthShore University Health System.

Asia has experienced the most development in the healthcare sector during the past several decades. The need for biomarkers is anticipated to be fueled by the expansion of healthcare infrastructure projects in the Asian economy and the substantial presence of highly advanced research facilities in growing countries like China, India, and Japan. For instance, genetic discoveries are made possible across the Asian economy by the GenomeAsia 100K Project sequencing (WGS) project. To capture the largest extent of genetic variation, the research included various Asian nations, including South Korea, Malaysia, India, Indonesia, and others. The worldwide biomarkers market's future growth are anticipated to benefit from this.

Genomic biomarkers are characteristics of Deoxyribonucleic Acid (DNA) and Ribonucleic Acid (RNA) that are utilized as a diagnostic indicator, illness characterization tool, and therapeutic selection tool. It represents pathological and biochemical processes as well as the body's reaction to treatment or other interventions. The market for genetic biomarkers is being favorably impacted by the healthcare sector's growing use of innovative medications, increased R&D initiatives to identify chronic illnesses, and expanding use of less invasive procedures.

The rising focus on the availability of personalized medicine for enabling better patient care is also augmenting the growth outlook for the global market along with the favorable government initiatives related to genomic research. The biomarkers are very important in detecting and diagnosing COVID-19 disease. Additionally, favorable government efforts connected to genetic research and the growing focus on the availability of personalized medications for enabling improved patient care are also enhancing the growth forecast for the worldwide market. By 2040, the International Agency for Research on Cancer (IRAC) projects that there will be 27.5 million additional cases of cancer worldwide.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.89% |

| Market Size in 2025 | USD 5.32 Billion |

| Market Size by 2034 | USD 10.33 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Disease Indication, and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Constant development in laboratory tests and technological advancements in genomics have accelerated the market scenario. In addition, among other important factors driving the global market are the growth in ovarian cancer incidence and the growing use of genetic biomarkers in medicine. The Alzheimer's Association estimates that 5.8 million Americans over 50 are expected to have Alzheimer's dementia in 2019, and that number is expected to rise to 14 million by the year 2050. Thus, there is an urgent demand for genetic biomarkers that might support market growth globally due to the rising number of patients with neurological diseases.

Companion diagnostics and biomarkers are becoming more important in medical practice, which ultimately results in more disease-specific diagnosis, therapy, and intensive care. As a result, genetic biomarkers have further increased in popularity and are now in high demand from both pharmaceutical firms and healthcare providers, which has a substantial influence on the global market's growth. Also anticipated to positively affect market growth is the rising need for genetic biomarkers in prostate cancer.

The market for genomic biomarkers is being driven by a number of factors, including an increase in the development of clinical laboratory tests and technological advancement, as well as due to an increase in the incidence of ovarian and gastric cancer, the demand for genomic biomarker-based medicine, and the burden of chronic diseases increases.

Over the forecast period, a few problems related to the application and analysis of genetic biomarkers are expected to restrain market growth. For instance, some genomic biomarkers, like miRNA found in stool samples, cannot be used as a stand-alone diagnostic tool for the detection of colon cancer due to concerns about the stability of the biomarker and the inability to establish an adequate predictive value for the diagnosis of colon cancer, according to an article published by the Intestinal Journal in November 2019.

Based on the type, the genomic biomarkers are segmented into predictive biomarkers and prognostic biomarkers. Biomarkers known as protein markers help in the identification of a variety of illnesses, including cardiovascular ailments. These protein markers detect molecules released by cells that function as antigens and trigger an immune response when they come into contact with circulating antibodies. By using prognostic biomarkers, it is possible to track the development of cancer treatment, determine the tumor's stage and potential malignancy, and predict the likelihood of disease remission for every individual case. Patients are likely to suffer relapses and recurrences of chronic diseases as a result of their bad lifestyle, genetic code, family history, and other factors. According to estimates, this will increase demand for prognostic biomarkers, which can forecast a patient's health condition and recurrence risks.

Clinical trial designs that examine the dose and efficacy of a novel drug candidate in a particular population commonly include predictive biomarkers. Predictive and prognostic biomarkers have been successfully established to support treatment decisions in various therapeutic areas, such as cancer. For instance, the MammaPrint signature and OncotypeDx recurrence score are used to assess whether a woman with node-negative hormone-positive breast cancer has a good enough prognosis with local therapy and adjuvant hormonal therapy to avoid cytotoxic chemotherapy. Less commonly, gene expression profiles have been utilized as predictive biomarkers for novel medications.

Based on the disease indication, the genomic biomarkers are segmented into oncology, neurological diseases, cardiovascular diseases, renal disorders, and others. Cancer is the second-leading cause of death worldwide, accounting for 70% of mortality in low- and middle-income nations, according to the World Health Organization (WHO). Additionally, according to the WHO, 9.6 million cancer-related deaths and 18.1 million new cases were recorded globally in 2018. The demand for the genomic biomarkers market is being influenced by factors like the increase in cardiovascular disease incidence and the impressive use of genomic biomarkers in ischemic heart disorders. The growing incidence of CVD has a direct influence on the need for genetic biomarkers since it increases access to high-quality, dependable health interventions.

The market for genetic biomarkers worldwide is dominated by the oncology segment. Global market growth for genetic biomarkers has been significantly impacted by the growing popularity of these markers and the demand for them from pharmaceutical and healthcare organizations. In addition, the market expansion is anticipated to benefit from the rising need for genetic biomarkers in prostate cancer.

Based on the end user, the genomic biomarkers are segmented into hospitals, diagnostic centers, and others. The use of genetic biomarkers for the rapid and accurate diagnosis of several diseases, including cancer, infectious diseases, neurological disorders, and cardiovascular problems. During the forecast period, the hospital sector is anticipated to develop significantly faster than the entire market. The market is projected to develop as a result of factors such the expanding availability of genetic biomarkers in hospitals, rising government expenditures on healthcare, and numerous hospital initiatives that treat chronic diseases. For instance, the Centers for Medicare & Medicaid Services (CMS) estimates that national health spending in the United States increased at an average rate of 5.5% each year from 2018 to 2027 and is projected to reach around USD 6.0 trillion by the same year. As a result, this element will be crucial in boosting the growth of the global market for biomarkers.

Hospitals use genetic biomarkers primarily for the diagnosis and treatment of cancer. This is mostly due to the fact that an early diagnosis can more effectively prevent mortality. They can also assist doctors in predicting which patients will respond to a certain treatment and the amount that may be the most effective (pharmacodynamics).

By Type

By Disease Indication

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

October 2024

May 2024

October 2024