November 2024

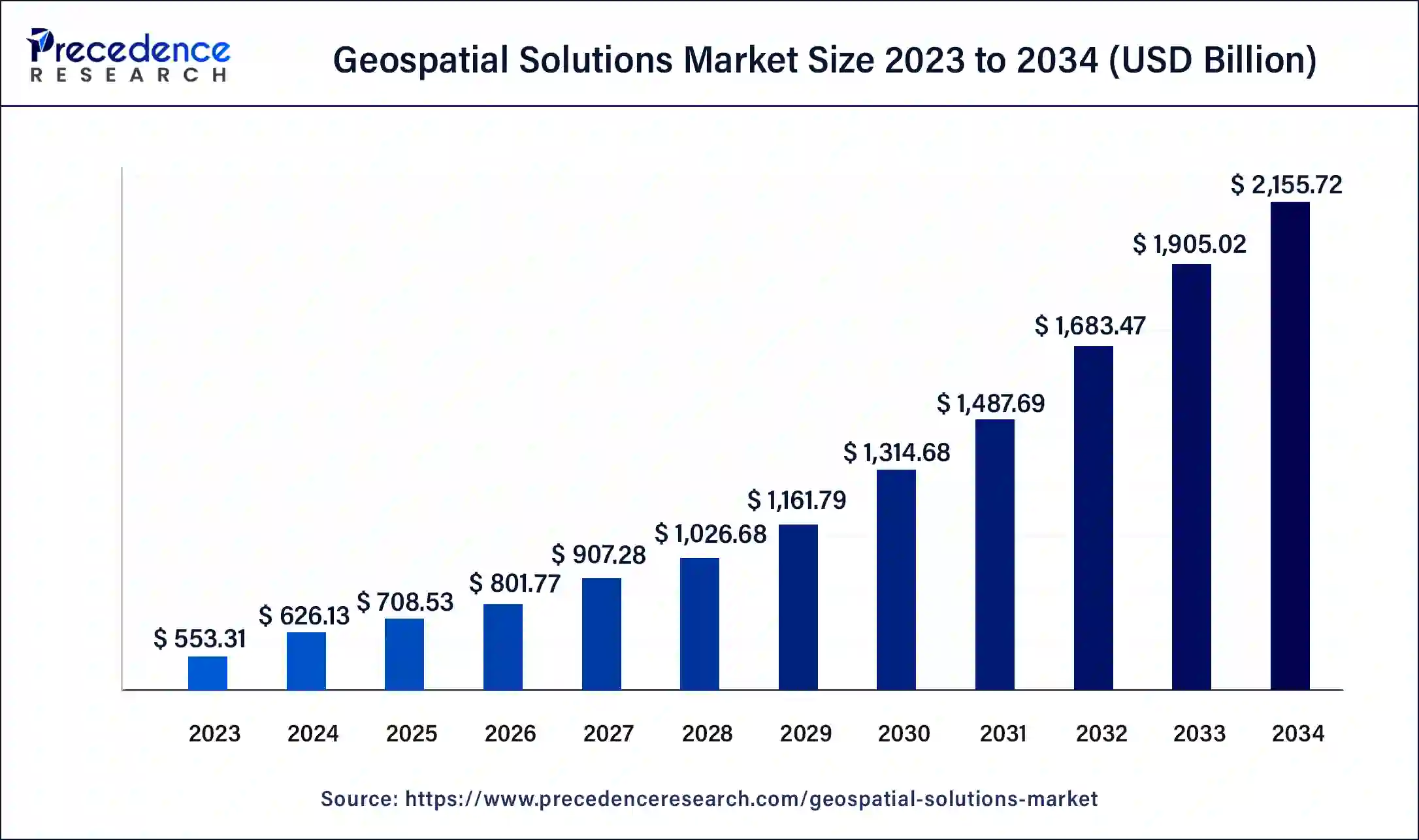

The global geospatial solutions market size was USD 555.31 billion in 2023, calculated at USD 626.13 billion in 2024 and is expected to be worth around USD 2,155.72 billion by 2034. The market is expanding at a double digit CAGR of 13.16% between 2024 and 2034.

The global geospatial solutions market size is expected to be worth USD 626.13 billion in 2024 and is anticipated to reach around USD 2,155.72 billion by 2034, expanding at a solid CAGR of 13.16% over the forecast period from 2024 to 2034. Globally, many governments are funding the development of geospatial infrastructure and promoting the geospatial solutions market.

The industry that deals with software, technology, and services linked to the capture, analysis, management, and visualization of geospatial data is known as the ‘geospatial solutions market.’ It includes a broad range of uses, including remote sensing, GPS navigation, satellite photography, mapping, surveying, and geographic information systems (GIS). In order to use spatial data to address different business, environmental, and societal concerns, the market comprises providers of hardware (such as GPS devices, drones, and sensors), software (GIS software, mapping software), and services (consulting, data analysis, and integration services).

The geospatial solutions market gathers and processes spatial data through the use of technologies such as geographic information systems (GIS), global navigation satellite systems (GNSS), remote sensing, and different mapping approaches. Network planning, asset management, and maintenance for telecommunications, water, and energy. Keeping an eye on mining, forestry, agriculture, and environmental preservation. Utilized for border control, disaster management, urban planning, and defense intelligence.

Integration with artificial intelligence (AI) and the Internet of Things (IoT) to enable real-time data analysis and decision-making. Application of geographic information technology to optimize resources and practice precision farming. Because of its early adoption in sectors including utilities, government, and defense, North America and Europe are in the lead.

| Report Coverage | Details |

| Market Size by 2034 | USD 2,155.72 Billion |

| Market Size in 2023 | USD 553.31 Billion |

| Market Size in 2024 | USD 626.13 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 13.16% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Solution Type, Technology, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising adoption in commercial applications

Technological developments, the growing need for location-based services, and the significance of data-driven decision-making are some of the main drivers behind the increased use of geospatial solutions in commercial applications. With more advanced features like 3D mapping, real-time data processing, and interaction with other technologies like IoT and AI, geospatial information systems have gotten more sophisticated. The quality and detail of geographical data have increased due to high-resolution satellite imaging and aerial photography, increasing its utility for commercial applications. Companies are delivering targeted marketing and advertising campaigns depending on the location of potential customers by leveraging geospatial data.

Integration issues with legacy systems

Data from legacy systems is frequently kept in antiquated formats that are unusable with contemporary GIS applications. This calls for a large amount of data migration and conversion work. It can be challenging to guarantee smooth communication and data sharing between older systems and modern geospatial technologies since separate systems may employ different protocols and standards.

It can be difficult to integrate new geographic software with legacy programs that already exist; middleware and customized interfaces are needed to connect the two systems. Performance constraints may result from outdated hardware and network infrastructures being unable to handle the sophisticated geospatial systems' high processing and storage requirements. Legacy system integration can be an expensive and time-consuming procedure that demands a large financial and material commitment.

Smart cities development

Efficient planning and management of cities is necessary due to the rapid urbanization and population growth. Resource allocation, infrastructure development, and land usage are all optimized with the use of geospatial technologies. Modern technologies like IoT, AI, and big data combined with geospatial solutions improve smart cities' ability to efficiently manage energy, transportation, public services, and urban infrastructure.

Geospatial technologies make urban infrastructure planning, development, and upkeep possible. For the purpose of constructing buildings, roads, utilities, and other infrastructure, they offer precise maps and models. Data and instruments for effective zoning, land use planning, and urban growth management are provided via geospatial solutions. They aid in the visualization of how new constructions affect the environment and infrastructure already in place.

The software segment held the largest share of the geospatial solutions market in 2023. The geospatial solutions market's software sector includes a range of tools and applications for gathering, processing, and displaying geographical data. Many businesses, such as transportation, agriculture, urban planning, defense, and environmental monitoring, depend on this area. Data accuracy and analysis capabilities have been greatly improved by the development of sophisticated geospatial software tools, such as GIS, remote sensing software, and spatial analytics platforms.

The software market is expanding as a result of laws and government initiatives that encourage the use of geospatial data and technologies for smart cities and sustainable development projects. The research and application of geospatial technologies are receiving increased financing and investments from the public and private sectors, which supports the expansion of the software market.

The hardware segment is expected to grow at the fastest rate in the geospatial solutions market during the forecast period. The geospatial solutions market's hardware category includes an array of instruments and apparatuses utilized in the acquisition, manipulation, and interpretation of geospatial data. Devices with large capacities for storing and organizing large amounts of geographical data. Hardware innovations that promote market expansion include improved GPS accuracy and sophisticated imaging sensors.

The need for geospatial hardware is increased by the expanding usage of drones in a variety of businesses for mapping and surveying. The hardware market is driven by the growing use of remote sensing in agriculture, disaster relief, and environmental monitoring. Precise geospatial data is necessary for large-scale infrastructure projects, which raises the need for sophisticated surveying and mapping tools.

The GNSS & positioning segment held the largest share of the geospatial solutions market in 2023. The market's GNSS (global navigation satellite system) & positioning sector is essential to the provision of precise location data and positioning services to a range of businesses. This component provides real-time locating, navigation, and timing data by utilizing satellite-based systems such as GPS, GLONASS, Galileo, and BeiDou. GNSS, in conjunction with big data analytics, AI, and machine learning, to improve operational effectiveness and decision-making.

Government laws encourage the application of GNSS for efficiency and safety in a range of industries. Investment in satellite networks and ground-based augmentation technologies, as well as GNSS infrastructure. Driven by innovations and efficiency across numerous sectors, the GNSS & positioning segment plays a critical role in the growth and improvement of the market.

The geospatial analytics segment is expected to grow at the fastest rate in the geospatial solutions market during the forecast period. Geospatial analytics is becoming increasingly powerful and accurate thanks to advancements in artificial intelligence, machine learning, and big data analytics. Geospatial analytics is being used more and more in industries like environmental monitoring, urban planning, transportation, logistics, and agriculture to improve decision-making and operational effectiveness.

The need for geospatial analytics is increased by the growing number of smart cities, which necessitate the significant use of geospatial data for planning, resource management, and service improvement. The industry is expanding as a result of numerous governments funding geospatial infrastructure and promoting the use of geospatial data in public projects. Geospatial analytics is used to manage natural resources and monitor environmental changes in light of the increased emphasis on environmental conservation and sustainable development.

The surveying, navigation & mapping segment held the largest share of the geospatial solutions market in 2023. This includes measuring and charting the surface of the planet with cutting-edge equipment like GPS, LiDAR, and total stations. It is essential for precise urban planning, construction layout, and land surveying. Comprises the GPS and GNSS technology used in the transportation, logistics, and outdoor recreation industries for accurate location tracking, route planning, and navigation.

It involves integrating remote sensing technology and GIS to create, update, and visualize maps. Applications for mapping are crucial for infrastructure development, environmental monitoring, and disaster management. Precision farming in agriculture, network management in utilities, site planning in telecoms, urban development, and disaster response in government are just a few of the sectors that depend on these technologies.

The planning & analysis segment is expected to grow at the fastest rate in the geospatial solutions market during the forecast period. Within the market, the planning and analysis segment primarily focuses on software and services that assist organizations in using geospatial data for infrastructure development, urban planning, environmental management, and strategic decision-making. Spatial analysis tools, GIS software, and consulting services that interpret spatial data for different applications are frequently considered essential components. This area is essential for a variety of businesses, including government, urban planning, logistics, and natural resource management. It facilitates risk assessment, effective resource allocation, and scenario planning based on insights from geographic data.

The defense & intelligence segment held the largest share of the geospatial solutions market in 2023. Situational awareness, terrain analysis, and mission planning are all aided by geospatial solutions. They offer up-to-date information on topographical features, adversary positions, and logistics arrangements. Information about enemy movements, infrastructure, and natural resources is gathered through the use of satellite photography, GIS, and remote sensing technology.

With real-time surveillance and monitoring, geospatial technologies improve security by tracking border changes and keeping an eye out for illicit activity. During humanitarian crises and natural disasters, geospatial data helps with disaster management by offering situational awareness, damage assessment, and resource allocation. For military operations to ensure the correct movement of troops, vehicles, and equipment in a variety of terrains, precise mapping and navigation systems are essential.

The infrastructural development segment is expected to grow at the fastest rate in the geospatial solutions market during the forecast period. For smooth data sharing and analysis, it is crucial to integrate several data sources and provide compatibility across diverse platforms and systems. Improving decision-making and promoting collaboration entails standardized data formats, protocols, and interfaces.

Scalable storage, processing power, and real-time data analysis are made possible by utilizing cloud computing and big data analytics. This skill is essential for managing massive amounts of geographic data and extracting insightful information for a variety of uses, such as environmental monitoring and urban planning. Beyond more conventional fields like mapping and navigation, geospatial technologies are finding new uses in driverless cars, augmented reality, disaster relief, and logistics optimization.

North America held the largest share of the geospatial solutions market in 2023. Thanks to developments in technologies such as remote sensing, spatial analytics, GPS, GIS, and remote sensing, the geospatial solutions market in North America is currently growing significantly. Geospatial data is being used by the transportation, logistics, urban planning, and agricultural industries to improve decision-making and operational efficiency.

Geospatial solutions are necessary for precise mapping and monitoring in projects pertaining to smart cities, utility networks, and environmental monitoring. Predictive analytics and real-time monitoring capabilities are being improved by the increasing integration of geospatial technologies with the IoT and AI. The industry is expanding as a result of public sector expenditures in geospatial infrastructure for environmental preservation, national security, and disaster management.

Asia Pacific is expected to host the fastest-growing geospatial solutions market during the forecast period. The need for geospatial technologies is increasing as a result of significant government investments in infrastructure development, urban planning, and disaster management made by governments in Southeast Asia, China, and India. Being one of the world's most rapidly urbanizing regions, Asia Pacific is seeing a rise in the need for geospatial data to support effective urban planning, transportation planning, and environmental monitoring.

Geospatial solutions are becoming more capable and useful in a wider range of industries thanks to innovations like satellite images, GPS, remote sensing, and GIS. Geospatial data is being used by various industries, including telecommunications, transportation, forestry, mining, oil and gas, and agriculture, to enhance decision-making, resource management, and operational efficiency.

Segment Covered in the Report

By Solution Type

By Technology

By Application

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

October 2024

February 2025

November 2024