January 2025

Glucose Biosensors Market (By Type: Self-Monitoring Blood Glucose, Continuous Glucose Monitoring; By Technology: Electrochemical Biosensors, Optical Biosensors; By End-Use: Home Care, Hospitals, Diagnostics Centers and Clinics, Other) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2033

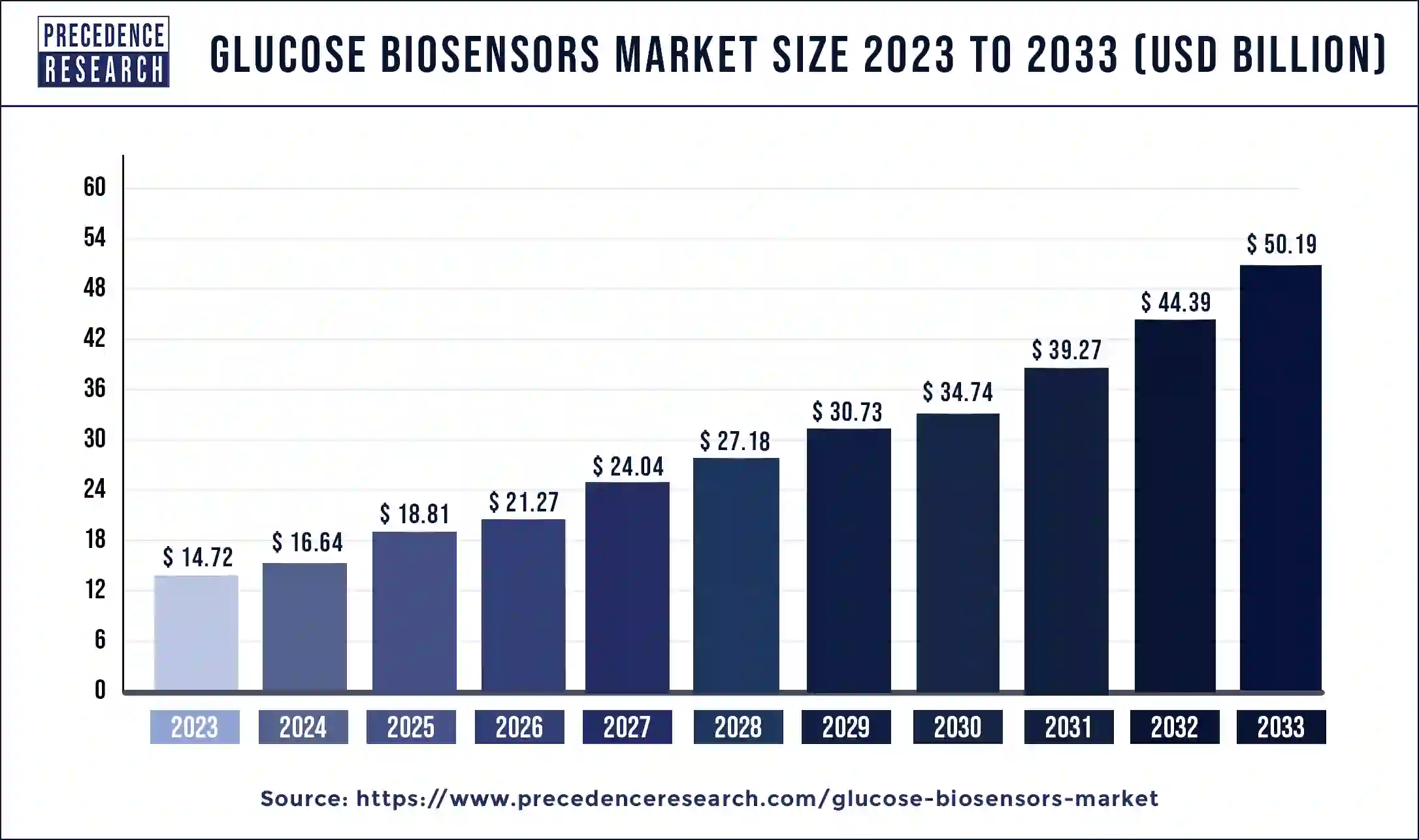

The global glucose biosensors market size was valued at USD 14.72 billion in 2023 and is predicted to hit around USD 50.19 billion by 2033, growing at a CAGR of 13.05% from 2024 to 2033. The rising number of diabetes cases due to the rise in the geriatric population and the changing lifestyle preferences are driving the growth of the market.

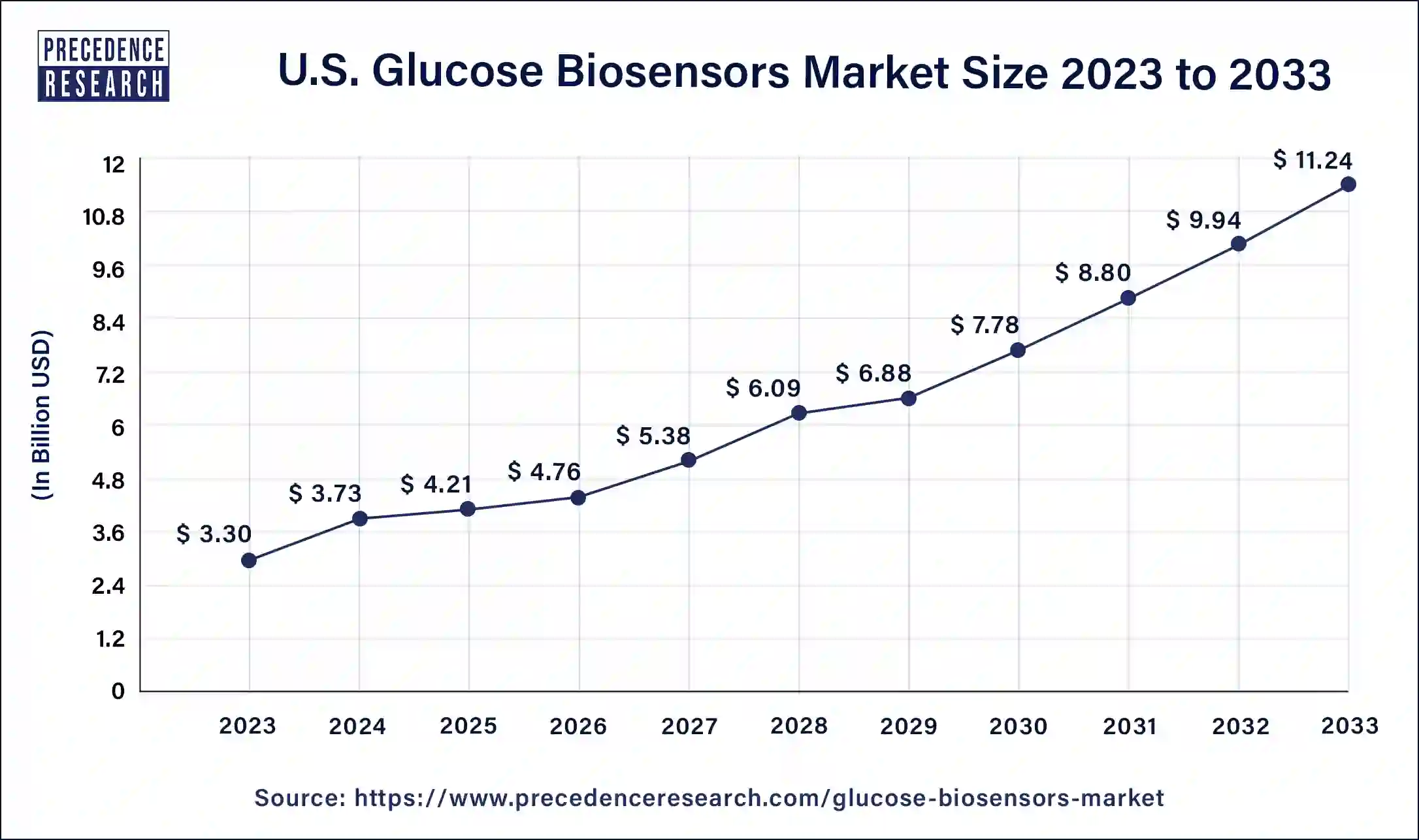

The U.S. glucose biosensors market size reached USD 3.30 billion in 2023 and is anticipated to be worth around USD 11.24 billion by 2033, poised to grow at a CAGR of 13.10% from 2024 to 2033.

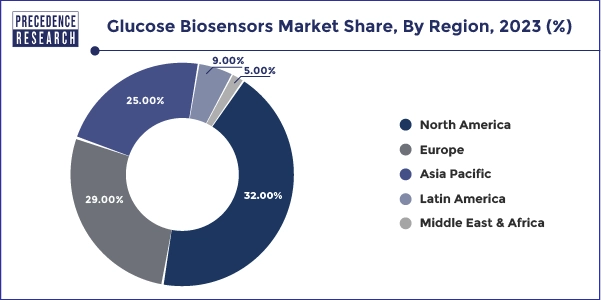

North America dominated the glucose biosensors market with the largest share of 32% in 2023. The growth of the market in the region is increasing due to the increasing number of diabetic patients in the region due to the changing lifestyle and rising disposable income is resulting in the increased number of diabetic patients and the higher requirement for the regular diabetic monitoring for diabetes management, this becomes the major factor to promote the growth of the market in North America.

Additionally, the market in the region is observed to expand at a notable rate with considerable technological advancements and development of advanced healthcare devices. The rapid adoption of such products and devices from both healthcare settings and patients promotes the expansion of the glucose biosensors market. North America is a hub for technological innovation and research in the healthcare sector. The region is home to leading medical device manufacturers and research institutions that continually develop and commercialize advanced glucose biosensor technologies. These technological advancements contribute to the dominance of North America in the global market.

Asia Pacific is observed to become the second-largest marketplace with the majority of key players revolving in the glucose biosensors market. Many countries in Asia Pacific are investing in the expansion and modernization of healthcare infrastructure, including hospitals, clinics, and diagnostic laboratories. This expansion facilitates better access to healthcare services, including diabetes management and glucose monitoring, driving the demand for glucose biosensors. The glucose biosensors market in Asia Pacific benefits from ongoing technological advancements and innovations in sensor technology, miniaturization, and connectivity. These advancements have led to the development of more accurate, user-friendly, and affordable glucose monitoring devices, making them accessible to a wider population.

Glucose Biosensors Market Overview

The glucose biosensors market refers to the industry involved in the development, manufacturing, and distribution of devices used for measuring glucose levels in biological samples, particularly blood. These devices, known as glucose biosensors, play a crucial role in the management of diabetes mellitus by enabling individuals to monitor their blood glucose levels regularly. Glucose biosensors typically consist of two main components: a biological recognition element (such as an enzyme) that reacts specifically with glucose and a transducer that converts the biochemical signal into a measurable electrical signal. The transducer may utilize various technologies, including electrochemical, optical, or thermal methods, to detect and quantify glucose levels accurately.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 13.05% |

| Global Market Size in 2023 | USD 14.72 Billion |

| Global Market Size by 2033 | USD 50.19 Billion |

| U.S. Market Size in 2023 | USD 3.30 Billion |

| U.S. Market Size by 2033 | USD 11.24 Billion |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Technology, and By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver: Rising prevalence of diabetes

The increasing cases of diabetes patients around the world are driving the growth of the glucose biosensors market. As the incidence of diabetes continues to rise globally, there is a growing demand for glucose monitoring devices among diabetic patients. Glucose biosensors offer a convenient and non-invasive method for individuals to monitor their blood glucose levels regularly, enabling them to manage their condition effectively and reduce the risk of complications. Diabetes management requires continuous monitoring of blood glucose levels to ensure optimal glycemic control and prevent hyperglycemia or hypoglycemia. Glucose biosensors provide real-time measurements of blood glucose levels, allowing diabetic patients to make timely adjustments to their diet, medication, and lifestyle to maintain stable blood sugar levels.

Advances in biosensor technology have led to the development of innovative glucose monitoring devices with improved accuracy, sensitivity, and reliability. These next-generation biosensors offer features such as wireless connectivity, smartphone integration, and continuous glucose monitoring (CGM), enhancing the user experience and expanding the adoption of glucose monitoring devices among diabetic patients.

Restraint: Lack of product awareness

Thereby, the lack of product awareness is observed to act as a restraint for the glucose biosensors market. Many potential users, including healthcare professionals and patients with diabetes, may not be fully aware of the availability and benefits of glucose biosensors. This lack of awareness limits market penetration and adoption rates, hindering the growth potential of glucose biosensor manufacturers. Inadequate product awareness may result in delayed diagnosis and treatment of diabetes, as patients and healthcare providers may not prioritize regular glucose monitoring. This can lead to poorer health outcomes, increased healthcare costs, and higher rates of diabetes-related complications.

Opportunity: Rising demand for non-invasive glucose biosensors

Non-invasive glucose biosensors eliminate the need for painful finger pricks, offering a more comfortable and convenient monitoring solution for individuals with diabetes. This can lead to improved patient compliance with glucose monitoring regimens and better long-term management of the condition. By eliminating the need for skin puncture, non-invasive glucose biosensors help reduce the risk of infection and skin irritation associated with traditional fingerstick methods. This can improve patient safety and reduce healthcare costs associated with treating complications. The growing popularity of non-invasive glucose monitoring technologies is driving market expansion and innovation within the glucose biosensors market. Companies investing in research and development of non-invasive sensor technologies are poised to capture a larger share of the market and gain a competitive edge. Thereby, the factor is observed to offer lucrative opportunity for the glucose biosensors market.

The self-monitoring blood glucose segment dominated the glucose biosensors market in 2023. The dominance of the segment is attributed to the rising awareness about diabetes monitoring and risks associated with the diseases, which are driving the demand for self-monitoring blood glucose devices. The self-monitoring offers personalization and convenience in usage. The devices record the level of glucose, identifying patterns, and fluctuation of glucose levels throughout the day in response to certain types of foods and activities.

Blood glucose is a portable hand-held machine called a glucose meter. Both the type of patients with type 1 diabetes and type 2 diabetes can measure their insulin levels as recommended by the physician. Most glucose meters require a drop of blood to check the insulin level from the finger of the patient through the pin-prick. All the data like time and blood glucose readings is stored in the device memory. The higher consumption of the glucose meter due to its easy-to-use and reliability properties is driving the demand for the self-monitoring blood glucose segment.

The electrochemical biosensors segment dominated the glucose biosensors market in 2023. The growth of the segment is attributed to the reliability and technological advancements in the biosensors market. Electrochemical glucose biosensors provide real-time information about intestinal glucose levels. The electrochemical glucose biosensors are based on amperometric methods, which represent the most relevant group of glucose and comprise the enzymatic and non-enzymatic sensors. Electrochemical biosensors offer the transition of simple, one-step blood glucose testing and also provide remote blood sugar testing. Advancements like electrochemical glucose biosensors were rapidly adopted by people due to their accuracy and reliability.

The optical biosensors segment is expected to grow at a significant rate in the glucose biosensors market during the forecast period. The optical biosensors offer the benefits such as electrical-interference-free operations, remote sensing, and a faster reaction time all these factors are driving the growth of the segment. The optical biosensors use fiber optics to analyze illumination, absorption, light scattering, or refraction principles, which include absorptiometry, fluorescence, and surface plasmon resonance (SPR).

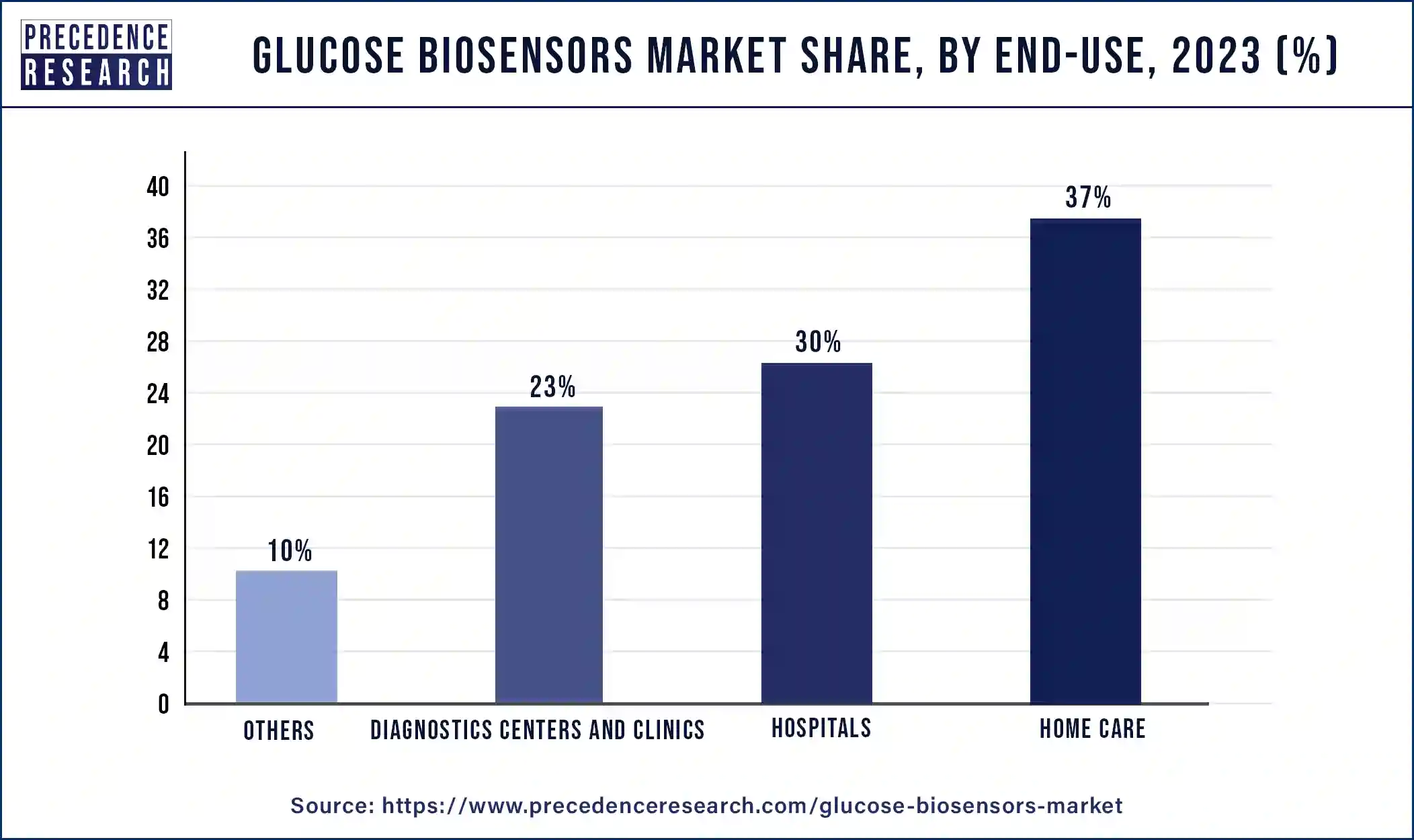

The home care centers segment had the largest market share of 37% in 2023. The growth of the segment is attributed to the rising preference for testing blood glucose in homes in the developed and developing economies that are driving the growth of the segment. The availability of skilled nurses for home care is further propelling the segment's growth. The growing technological advancements in glucose biosensors such as remote self-monitoring blood glucose devices, and electrochemical glucose biosensors which give real-time results to patients anywhere outside the clinical settings are boosting the home care centers segment. Additionally, the rising number of the geriatric population having diabetes and women patients is increasing demand for the glucose biosensors in home care settings.

The hospital segment is expected to grow as the second largest segment in the glucose biosensors market during the forecast period. The growth of the segment is increasing due to the presence of skilled professionals for attending to and treating the patients. The growth of the segment is further driven by the rising investments in the healthcare infrastructure and the technologies associated with the healthcare facilities. The rising availability of quick and simple results and efficient workflow is driving the growth of the segment.

Segments Covered in the Report

By Type

By Technology

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

July 2024

October 2024

July 2024