The global glycerol market size is evaluated at USD 5.19 billion in 2025 and is forecasted to hit around USD 6.16 billion by 2034, growing at a CAGR of 1.93% from 2025 to 2034. Asia Pacific market size was accounted at USD 1.88 billion in 2024 and is expanding at a CAGR of 2.08% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global glycerol market size was estimated at USD 5.09 billion in 2024 and is predicted to increase from USD 5.19 billion in 2025 to approximately USD 6.16 billion by 2034, expanding at a CAGR of 1.93% from 2025 to 2034. The market is gaining traction due to its versatility for various industries, including personal care, food and beverages, and pharmaceuticals, where it is primarily used as a humectant.

Integrating artificial intelligence into glycerol facilitates predicting the activity of heterogeneous catalyst systems involving glycerol. The techniques used in the prediction of glycerol activity include the AI-Cat method, which uses two neural networks, and a Monte Carlo tree search to predict reaction patterns and energy barriers. It can be used to build a reaction database and predict the activity of heterogeneous catalytic systems. Global neural network (G-NN) has the potential to explore reactions on the surface.

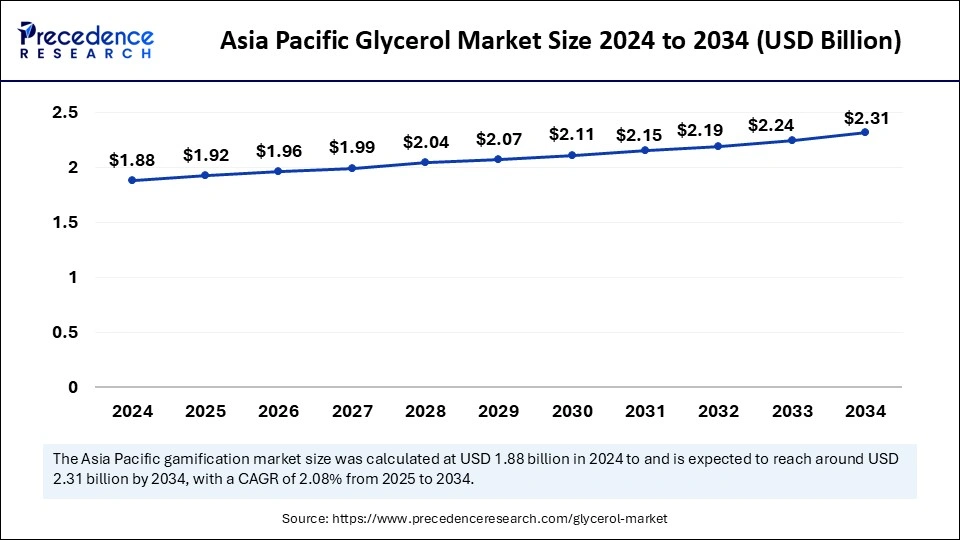

Asia pacific glycerol market size was exhibited at USD 1.88 billion in 2024 and is projected to be worth around USD 2.31 billion by 2034, growing at a CAGR of 2.08% from 2025 to 2034.

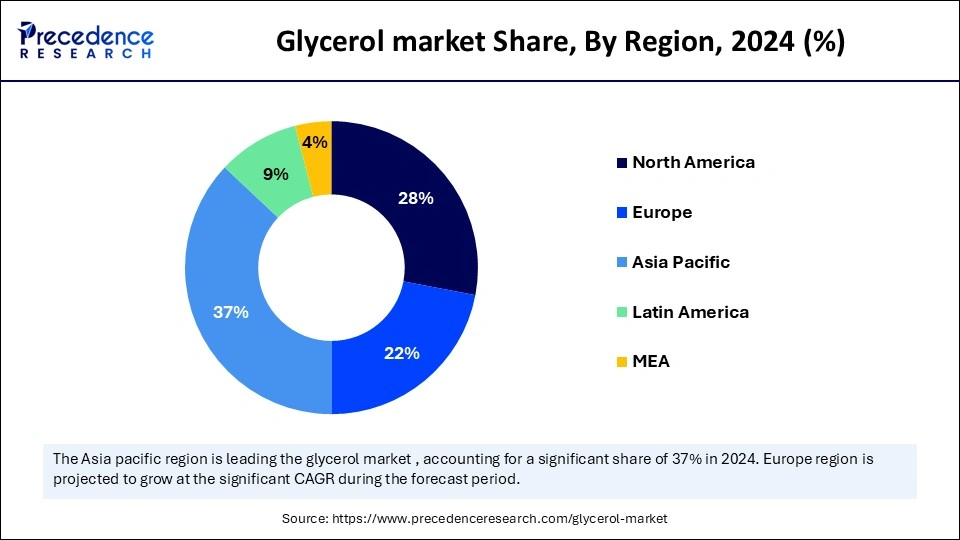

Asia Pacific dominated the glycerol market with the largest share in 2024. The dominance of this region is observed in the robust growth of end-user industries such as pharmaceuticals, food processing, and personal care. The expansion is particularly noted in countries such as China and India, as they have rising usage of glycerol in products, including soaps, cosmetics, and medication. Malaysia is the largest producer and exporter country of glycerin products. Along with this, the population of Asia Pacific has an increasing demand for convenience food, a growing pharmaceutical industry that is expanding various applications, and growing personal care products.

Europe is expected to grow at the fastest CAGR in the glycerol market between 2025 and 2034. The expansion of this region has led to the largest import and export of glycerol, particularly in countries such as Germany, Spain, and the Netherlands. Europe is continuously increasing biodiesel production, which is linked with the European Union directive- Transport Biofuels Direct 2003/30/EC. This promotes the use of biodiesel as an alternative to fossil fuels (diesel/petrol). Additionally, Europe has set some strict quality standards for glycerol, according to the European regulatory bodies, which ensure high-purity products.

Glycerol is a colorless, odorless, sweet-tasting liquid, which is a naturally occurring alcohol used in various industries such as food, pharmaceutical, and cosmetics. Also known as glycerine, Glycerol is a chemical name, and glycerine is a commercial name. Glycerol, the sugar alcohol, is derived either from plant or animal sources. Glycerin occurs naturally in plants through the fermentation of sugar; nowadays, most of the glycerin is produced from the hydrolysis of fats and oils. At present times, the glycerin used in commercial products is 95% pure. Several commercially produced glycerin products consist of different amounts of glycerin and other impurities, including organic compounds, salt, water, and many more.

| Report Coverage | Details |

| Market Size by 2034 | USD 6.16 Billion |

| Market Size in 2025 | USD 5.19 Billion |

| Market Size in 2024 | USD 5.09 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 1.93% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Source, Product, Application and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Wide application of Glycerol

Glycerol has more than 1,500 applications, and its versatility and safety make it a staple in various industries. Some common applications are pharmaceuticals, food and beverages, cosmetics, and even the production of explosives. Its ability to attract water makes it ideal for use in skin and hair products because of its moisturizing properties.

The standard of living is rising across the world, especially in developing countries that have a growing demand for pharmaceutical and personal care products. This leads to a larger international consumption of glycerol. However, the high consumption of glycerol is continuous, but the prices are low. One factor that may increase the price is biodiesel production, which is also known as bio-diesel-revolution. The rising innovation and expanding applications are growing more.

Fluctuating prices

A fluctuation in raw material prices has been noticed in the glycerol market, which hinders its growth. Fluctuations in raw material prices have an extensive impact on glycerol production costs. When there is a change in supply and demand, the prices may differ. This makes it challenging for manufacturers to maintain a stable profit market. Other factors that interfere with price changes are currency rates, production facilitates disruption, international trade disruptions, and Middle East tension.

Rapid urbanization

The growing demand for personal care products, expanding pharmaceutical and healthcare sectors, increasing demand for food and beverages, and infrastructure development and industrial growth are boosting the glycerol market and will continue to do so. There will be a rising demand for cosmetics and toiletries within urban populations that have disposable incomes. People are becoming aware of skincare and hygiene, promoting more glycerol-based products. The increasing investment in healthcare and pharmaceutical infrastructure includes hospitals, clinics, labs, and research institutes.

The biodiesel segment captured most of the shares of the glycerol market in 2024. Glycerol is a byproduct derived during the biodiesel manufacturing process. For every 100 pounds of biodiesel product, there is approximately 10 pounds of crude glycerol created. The biodiesel industry is rapidly expanding with the mass production of glycerol. Generally, for the separation of glycerol from biodiesel, the traditional method of removal is used, which is mainly by gravity separation of centrifugation.

The fatty alcohol segment is expected to expand at a CAGR between 2025 and 2034. Glycerol cannot be obtained directly from fatty alcohol; however, it is created from triglyceride (fats or oil) through the process of hydrolysis. Triglycerides are hydrolyzed into three molecules of fatty acids and one molecule of glycerol by the enzyme lipase. It is primarily used as a precursor for the body to synthesize new triglycerides.

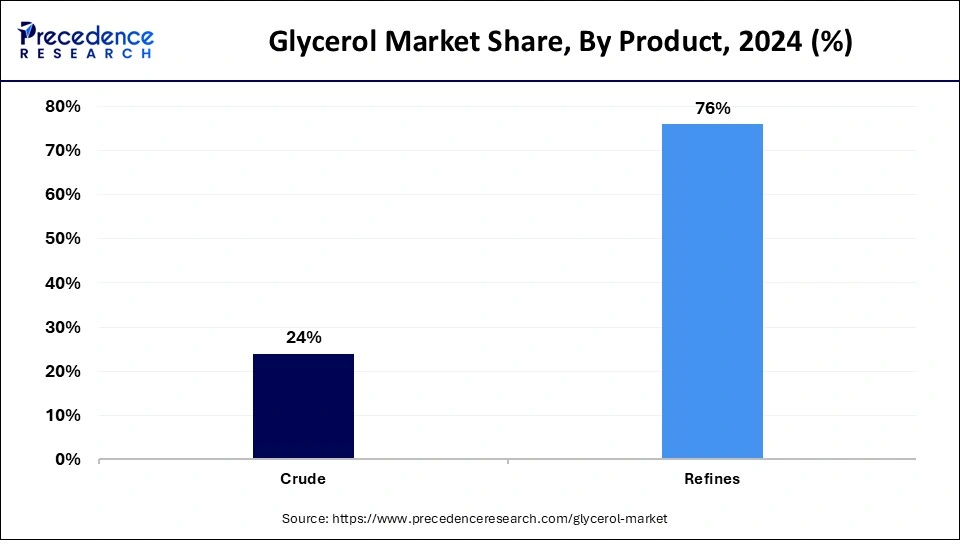

The refined segment has generated the largest share of the glycerol market in 2024. The broad utility of refined glycerine contributes to the dominance of this segment. It is used in many products, including food, pharmaceuticals, and personal care. Refine glycerin is well-known for its safety profile and biodegradability. Its unique properties, such as solubility in water, non-toxicity, and hygroscopic nature, make it an ideal ingredient in various products and processes.

The personal care segment held a significant glycerol market share in 2024. The antimicrobial nature of glycerol makes it a suitable product for personal care, contributing to the dominance of this segment. It is commonly observed in products such as shaving cream, toothpaste, mouthwash, soaps, skin care products, and hair care products. According to the Personal Care Product Council, glycerin is used at a concentration of 99.4% in some beauty products that offer effective skin care. Additionally, people suffering from meningitis, encephalitis, central nervous system trauma, and stroke are given glycerin intravenously to lower the pressure inside the brain.

The pharmaceutical is anticipated to grow at a remarkable CAGR during the forecast period. The growth of this segment is observed with the rising utilization of glycerol in the pharmaceutical industry to treat wounds and certain types of burns with its antiviral and antimicrobial ability. Using an 86% solution of glycerol helps in reducing inflammation in the wounded area. However, glycerol is strictly prohibited to use on third-degree burns. Furthermore, glycerol is also used in cough syrups, allergen immunotherapies, and elixirs. In cough syrups, glycerol acts as a thickening agent, a humectant that is also sweet and lubricating to the sore throats associated with colds.

By Source

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client