January 2025

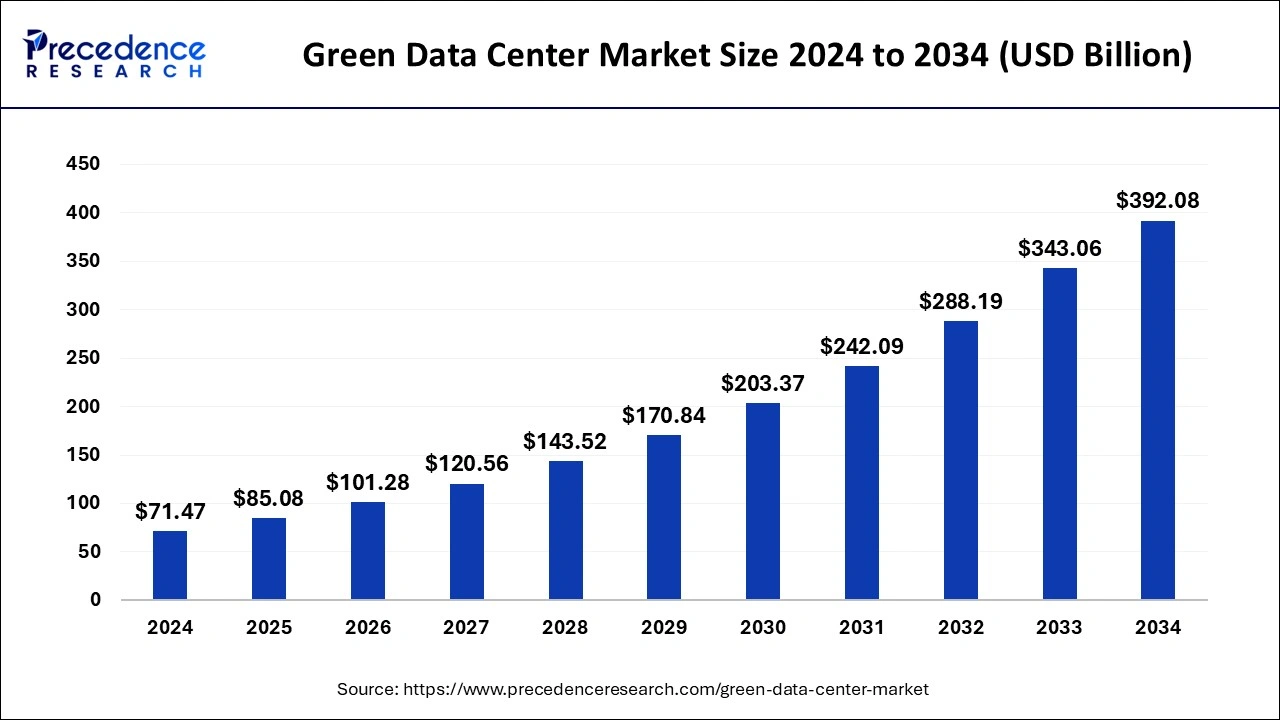

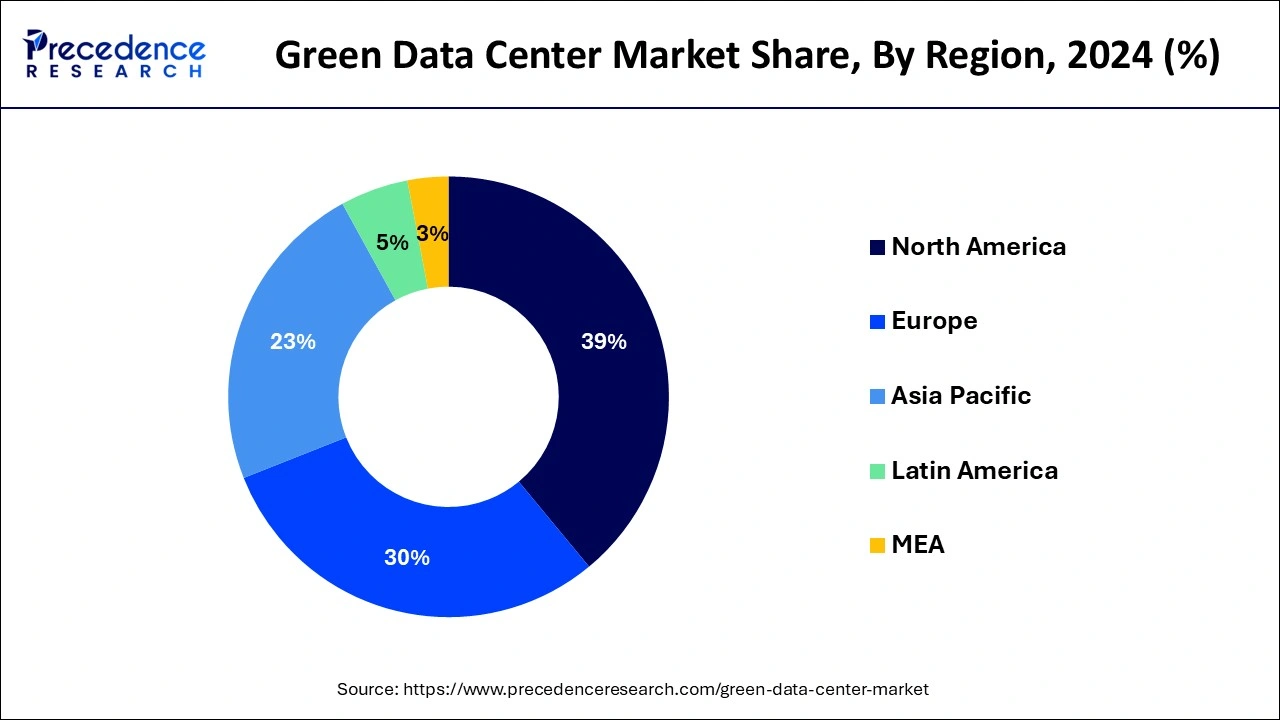

The global green data center market size is calculated at USD 85.08 billion in 2025 and is forecasted to reach around USD 392.08 billion by 2034, accelerating at a CAGR of 18.56% from 2025 to 2034. The North America green data center market size surpassed USD 27.87 billion in 2024 and is expanding at a CAGR of 18.71% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global green data center market size was estimated at USD 71.47 billion in 2024 and is predicted to increase from USD 85.08 billion in 2025 to approximately USD 392.08 billion by 2034, expanding at a CAGR of 18.56% from 2025 to 2034. The green data center market is driven by increasingly strict environmental laws.

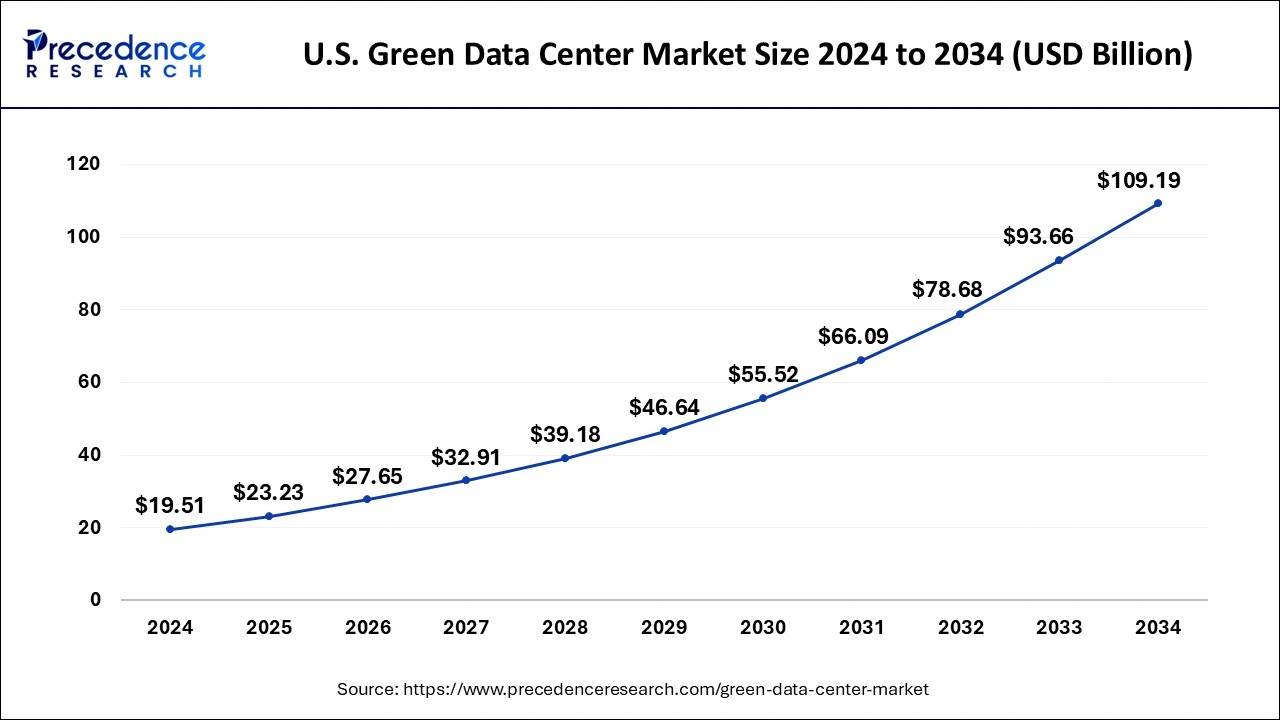

The U.S. green data center market size was valued at USD 19.51 billion in 2024 and is expected to be worth USD 109.19 billion by 2034 with a noteworthy CAGR of 18.79% from 2025 to 2034.

North America held the largest share of the green data center market in 2024. The United States and Canada along with other countries in North America are leading the way in technological developments for green data center infrastructure. This covers advancements in intelligent management techniques, integration of renewable energy sources, and energy-efficient cooling systems. It has made significant investments in the infrastructure of green data centers, bolstered by a strong financial environment and demand for data services. The implementation of green methods is spearheaded by significant tech corporations operating big data centers in the region, such as Google, Amazon, and Microsoft.

Companies and the public are becoming more conscious of data centers' environmental effects. The increasing emphasis on sustainability in company operations drives demand for green data center solutions.

Asia-Pacific is the fastest-growing in the green data center market during the forecast period. Data centers are increasing due to the region's growing demand for data processing and storage capacity, driven by the region's developing economy and population. By lowering energy usage and running costs over time, green data centers can provide significant cost savings over regular data centers, making them a desirable choice for companies trying to streamline their operations.

Building and running green data centers is one of the more sustainable practices businesses and governments are being forced to use due to increased awareness of environmental issues, including energy usage and climate change.

Leading the way in deploying 5G, cloud computing, and big data analytics demand a large amount of data processing and storage. The green data center market offers a solution to the safe and dependable data management of banks and other financial institutions. The industrial Internet of Things (IoT) and smart manufacturing drive the need for effective data centers to handle complicated operations. Healthcare businesses are implementing green data centers to ensure patient data security and privacy due to the growing use of telemedicine and electronic health records. Concentrate on technologies such as liquid immersion, free cooling, and energy-efficient servers to reduce energy usage.

Government policies encourage the use of green data centers and offer incentives, while promising sustainable growth for the green data center market. The significance of certifications such as LEED and Energy Star is increasing in terms of proving a commitment to the environment and proving quickly deployable, scalable data centers with less environmental effect and construction time. Green data centers are becoming more popular among public sector organizations to cut expenses and achieve sustainability objectives.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 18.56% |

| Market Size in 2025 | USD 85.08 Billion |

| Market Size by 2034 | USD 392.08 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Component, By Enterprise Size, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing environmental concerns and regulations

There is a significant push in the IT industry towards more sustainable practices due to growing awareness of climate change and the carbon footprint of typical data centers. Green data centers reduce their environmental impact using cutting-edge cooling methods, renewable energy sources, and energy-efficient systems. Businesses are also encouraged to use greener data center solutions by strict laws and obligations about emissions and energy consumption.

Rising energy costs and operational efficiency

Green data centers use renewable energy sources and energy-efficient technologies to cut operating costs and energy consumption over time. Companies are increasingly concerned about reaching sustainability targets and lowering their carbon footprint. Green data centers reduce energy use and carbon emissions to help accomplish these goals. Technological advancements in server architectures, energy management software, and cooling systems allow green data centers to run at higher performance levels more efficiently. Thereby, the rising energy cost and operational efficiency act as driver for the green data center market.

High initial investment

It costs a lot of money upfront to build or upgrade data centers using green technology and equipment, such as renewable energy sources, cooling systems, and energy-efficient servers. Despite their long-term advantages, some investors might view green data center technologies as unproven or hazardous compared to standard alternatives. This could discourage investment by acting as a major restraint for the green data center market. The original investment is increased by training employees in new technology and sustainable practices, which call for resources for education and skill development.

Implementing state-of-the-art green technologies such as energy management software, sophisticated power distribution systems, and effective HVAC (heating, ventilation, and air conditioning) systems can be costly.

Emerging technologies and their adoption

Data centers can use less energy due to smart power management systems, enhanced server designs, and sophisticated cooling systems. The energy needed to cool servers can be significantly reduced, for example, by implementing immersion and liquid cooling systems. Within data centers, task scheduling, resource allocation, and energy consumption may all be optimized using artificial intelligence (AI) and machine learning algorithms. The integration of such technologies is observed to create a significant potential for the green data center market. These technologies anticipate demand patterns and dynamically modify server operations, increasing efficiency and lowering overall energy use. Intelligent lighting systems, cutting-edge building materials, and environmentally friendly construction techniques all play a part in creating green data centers. Data center operators can reduce environmental effects by optimizing building designs for environmental sustainability and energy efficiency.

The solution segment dominated the green data center market with the largest share in 2024. Solution providers maximize data center performance while minimizing environmental effects by holistically combining hardware, software, and services. This all-inclusive strategy appeals to companies looking for complete solutions instead of fragmented deployments. Options for incorporating renewable energy sources, such as solar or wind power, into data center operations are widely available from solution vendors. Organizations can align with sustainability goals by reducing carbon emissions and dependency on fossil fuels through clean energy sources.

Solution providers help businesses acquire green certifications like Energy Star or LEED (Leadership in Energy and Environmental Design) and comply with environmental legislation. Brand reputation is improved, and ecological responsibility is demonstrated by adhering to these requirements.

The service segment shows notable growth in the green data center market during the forecast period. The need for consultancy and advisory services to evaluate current data center operations and provide strategies for greener alternatives is rising as businesses work to implement sustainable practices. Many firms use managed services to offload the complexity of managing and maintaining the infrastructure of green data centers. This trend fuels the expansion of services designed to manage and maximize energy-efficient technologies.

Since each data center environment differs, integrating green technologies into existing ones requires specialized solutions and integration services. Tailored solution providers rise as businesses look to maximize energy efficiency without affecting daily operations.

The large enterprise segment dominated the green data center market with the largest share in 2024. These businesses are excellent candidates for implementing green data center solutions since they often have extensive IT infrastructures and data storage requirements. Furthermore, stakeholders, consumers, investors, and regulators are frequently under pressure to lessen their environmental impact. Large businesses have been early adopters of cutting-edge cooling systems, renewable energy sources, and energy-efficient technology to maximize their data center operations while reducing their environmental effects.

The small and medium enterprises (SMEs) segment show a significant growth in the green data center market during the forecast period. In comparison to larger businesses, small and medium-sized enterprises (SMEs) sometimes have stricter budgets, green data centers lower operating costs for SMEs by providing energy-efficient infrastructure and cost-effective solutions. Because green data centers are scalable, SMEs can grow their operations without seeing appreciable increases in energy use or environmental effects. Using green technologies helps SMEs project a more ecologically conscious image. This can draw partners and consumers who care about the environment, offering SMEs a competitive edge in the market.

The BFSI segment dominated the green data center market in 2024. BFSI firms handle enormous data from financial analytics, customer information, and transactions. This calls for a reliable, scalable, and efficient data center infrastructure. A growing number of businesses in all industries, including BFSI, are concentrating more on sustainability initiatives due to the increasing awareness of environmental issues. Green data center solutions can help a business attract clients and investors by enhancing its brand image and committing to corporate social responsibility.

Energy-efficient technology, including virtualization, effective cooling systems, and renewable energy sources, are employed in green data centers. In the long term, BFSI businesses can save money by consuming less energy.

The IT & telecom segment is the fastest growing in the green data center market during the forecast period. Data centers are desperately needed to handle the demand resulting from the exponential rise of data supplied by telecom and IT services effectively. Companies in the telecom and IT sectors are under pressure to increase energy efficiency and lower their carbon footprint. With cutting-edge cooling systems, renewable energy sources, and energy-efficient technology, green data centers provide solutions that support these objectives.

Numerous telecom and IT firms promote environmental responsibility and corporate social responsibility. These businesses can show their dedication to sustainability and draw in eco-aware clients by investing in green data centers.

By Component

By Enterprise Size

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

November 2024

April 2025

January 2025