February 2025

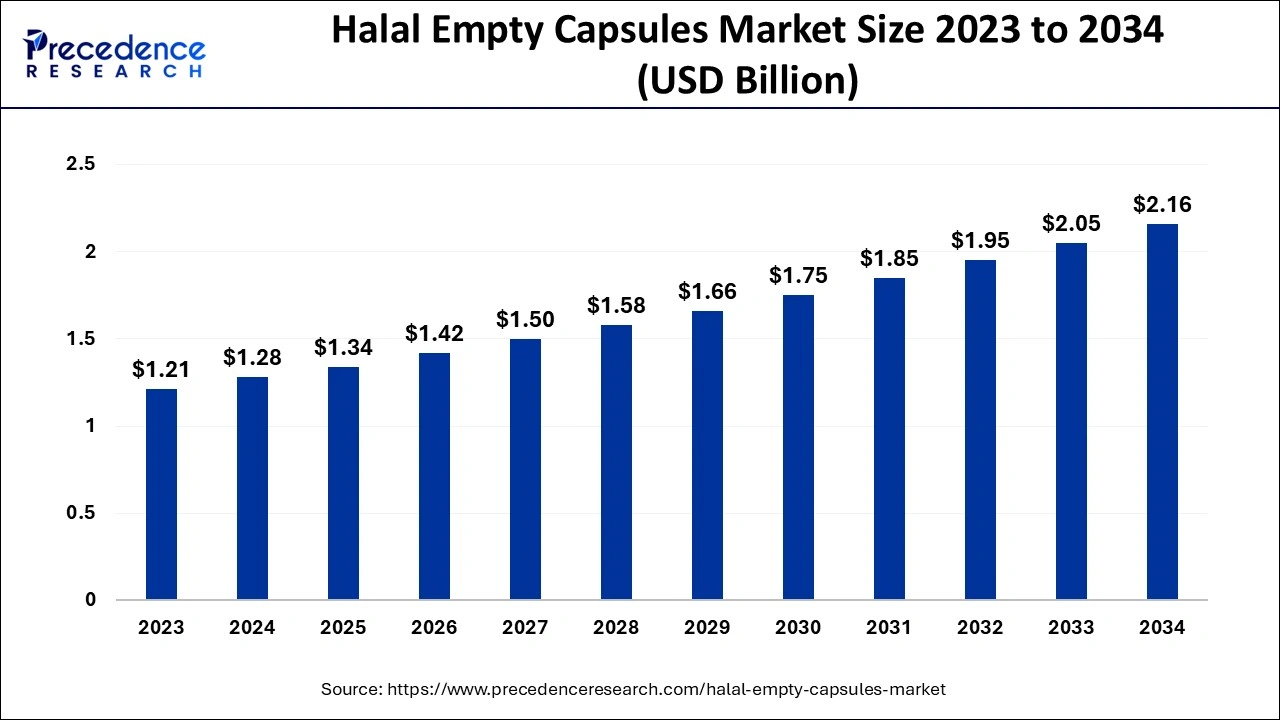

The global halal empty capsules market size is evaluated at USD 1.28 billion in 2024, grew to USD 1.34 billion in 2025 and is projected to reach around USD 2.16 billion by 2034. The market is expanding at a CAGR of 5.43% between 2024 and 2034.

The global halal empty capsules market size accounted for USD 1.28 billion in 2024 and is expected to exceed USD 2.16 billion by 2034, growing at a CAGR of 5.43% from 2024 to 2034. Increasing demand for halal-certified products in the pharmaceutical sector is the key factor driving the growth of the halal empty capsules market. Also, rising consumer preference for plant-based capsules coupled with the key players' focus on expanding production facilities across the globe can fuel market growth further.

Halal empty capsules are manufactured according to Islamic dietary laws and do not contain non-halal substances or pork. They are mainly used in the nutraceutical and pharmaceutical industries, drug production, and dietary supplements. In addition, vegetarian capsules are increasingly becoming popular due to shifting consumer preferences and dietary restrictions. There is also regulatory compliance for halal certification standards.

Revenue of top 5 generic pharma companies of 2024

| Company | Generic Segment Revenue |

| Sandoz | USD 9.64 billion |

| Teva Pharmaceuticals | USD 8.73 billion |

| Sun Pharma | USD 5.7 billion |

| Viatris | USD 5.58 billion |

| Fresenius Kabi | USD 4.63 billion |

Impact and Role of AI in the Halal Empty Capsules Market

Artificial Intelligence (AI) optimizes easy identification of the drug to be used for specific disease treatment and can process molecular patterns and large data sets to search for new compounds and molecules. In the halal empty capsules market, AI technologies help in enhancing the drug manufacturing process with proper standards and compliance. Early detection of safety risks to Pharma manufacturing plants is possible because of the use of AI.

| Report Coverage | Details |

| Market Size by 2034 | USD 2.16 Billion |

| Market Size in 2024 | USD 1.28 Billion |

| Market Size in 2025 | USD 1.34 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.43% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Rise in demand for dietary supplements

The surge in the dietary supplement industry substantially influences the business of the halal empty capsules market. The dietary supplement market offers products such as minerals, herbal extracts, vitamins, and other compounds. Additionally, these capsules provide and versatile and reliable system for these ingredients, enabling manufacturers to produce a wide range of products. Halal empty capsules further enable manufacturers to personalize their formulations based on dosages and ingredients.

Lack of raw material availability

Halal-certified raw materials like gelatin are not available easily. It is an essential component of capsules and is extracted from animal sources, which is not convenient for the halal empty capsules market. Moreover, the overall certification process of halal is costly and time-consuming. There are also many halal certification bodies according to each region.

Rising demand for generic drugs

Empty capsules play a key role in the manufacturing of nutraceuticals, which are supplements that offer health benefits above basic nutrition. The halal empty capsules market provides versatile and cost-effective solutions for incorporating numerous nutraceutical ingredients. Furthermore, there is an increasing trend towards the utilization of capsules made of collagen because of religious beliefs and ethical issues.

The gelatin segment dominated the halal empty capsules market in 2023. The dominance of the segment can be attributed to the increasing use of bovine gelatin especially from halal-certified suppliers along with its widespread adoption and cost-effective production. In addition, the growing number of clinical trials emphasizing the use of softgels is creating lucrative opportunities for the segments. Also, there is an increase in the manufacturing rate of plant-based soft gels leading to segment growth further.

The non-gelatin segment is expected to grow at a significant rate in the halal empty capsules market over the forecast period. The growth of the segment can be linked to the increase in consumers' need for vegan products in developing countries like Pakistan and India. These capsules are more stable than gelatin capsules. Moreover, non-gelatin capsules easily fulfill consumer demand for non-GMO and clean-label products which can boost segment growth shortly.

The pharmaceutical industry segment led the global halal empty capsules market. The dominance of the segment can be linked to the rising requirement for pharmaceutical products that are compatible with dietary laws and the growing preference of pharma companies towards halal-certified products. Furthermore, the pharmaceutical industry invests extensively in R&D activities to develop and discover advanced drug formulations that necessitate new drug delivery options. Hence, halal empty capsules can offer a flexible alternative for various drug delivery options.

The nutraceutical segment is anticipated to grow at the fastest rate in the halal empty capsules market over the projected period. The growth of the segment is driven by the rising prevalence of lifestyle-associated diseases coupled with the increasing importance of preventive healthcare practice, which is fuelling the demand for nutraceuticals. Also, consumers are becoming aware of the health benefits of nutraceuticals and their capability to safeguard individuals from the onset of health conditions.

North America dominated the halal empty capsules market in 2023. The dominance of the region is attributed to the presence of a large elderly population, top market players, and a well-established distribution network in the region. The region also has an expanding pharmaceutical industry which can fuel the market growth further. Within North America, the U.S. held a significant market share owing to the growing incidence of chronic diseases.

Asia Pacific is anticipated to grow at the fastest rate in the halal empty capsules market over the projected period. The growth of the region can be linked to the strong presence of key market players in the region along with the major exporters of halal empty capsules around the globe, including Africa, Europe, and the Middle East, with the raised need for halal-compliant products. Furthermore, in Asia Pacific, China held the dominant position due to an increase in the expenditure on healthcare infrastructure in the country.

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

March 2025

June 2024