January 2025

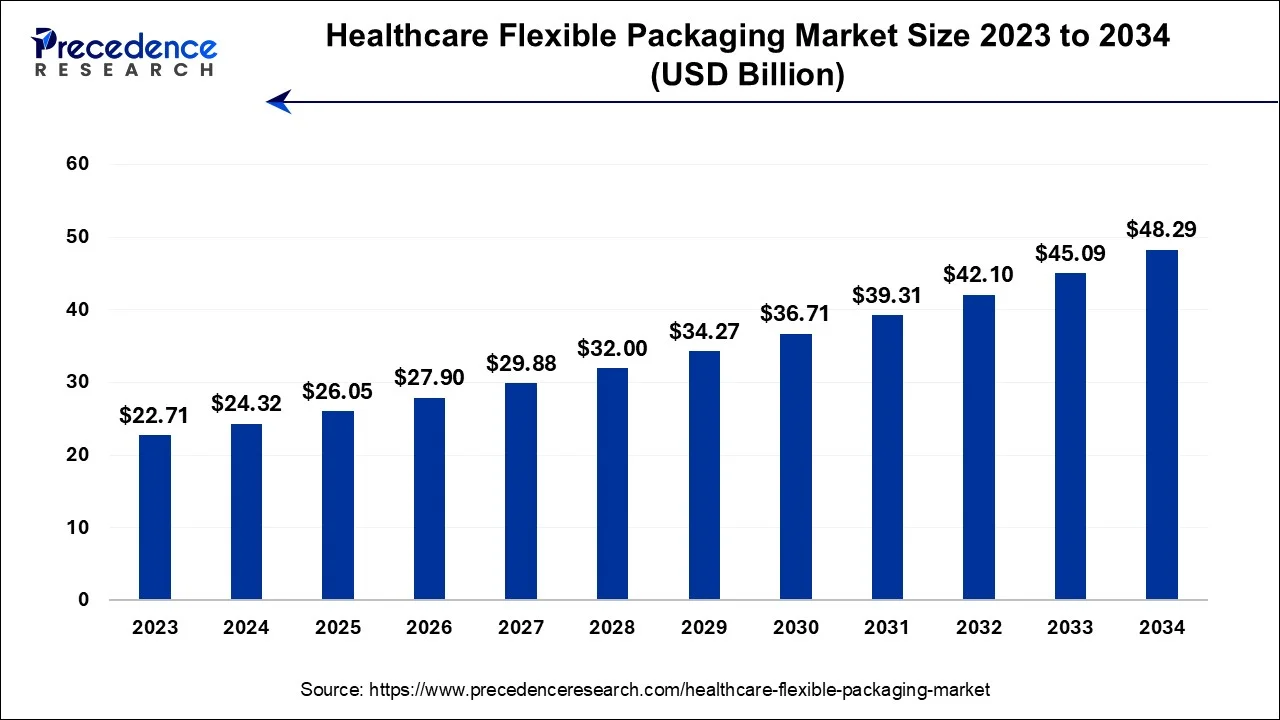

The global healthcare flexible packaging market size is estimated at USD 24.32 billion in 2024, grew to USD 26.05 billion in 2025 and is predicted to surpass around USD 48.29 billion by 2034, expanding at a CAGR of 7.10% between 2024 and 2034.

The global healthcare flexible packaging market size accounted for USD 24.32 billion in 2024 and is anticipated to reach around USD 48.29 billion by 2034, expanding at a CAGR of 7.10% between 2024 and 2034.

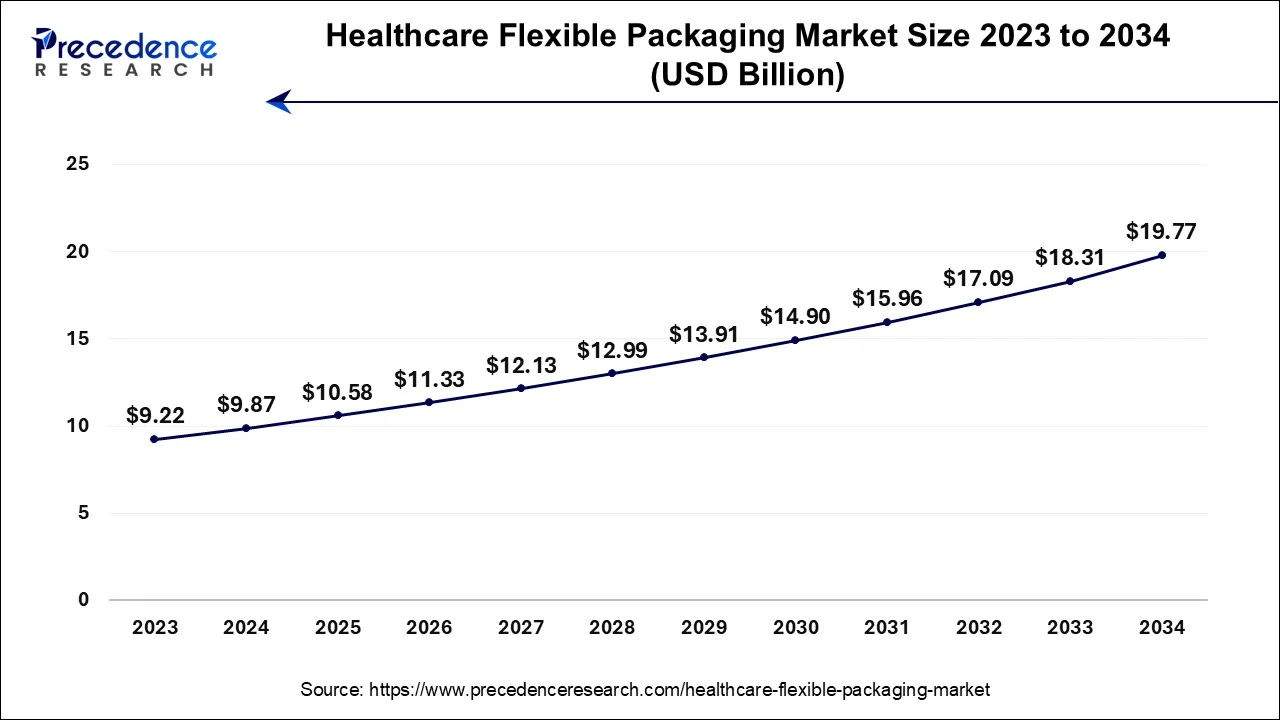

The U.S. healthcare flexible packaging market size accounted for at USD 9.87 billion in 2024 and is expected to be worth around USD 19.77 billion by 2034, growing at a CAGR of 7.19% from 2024 to 2034.

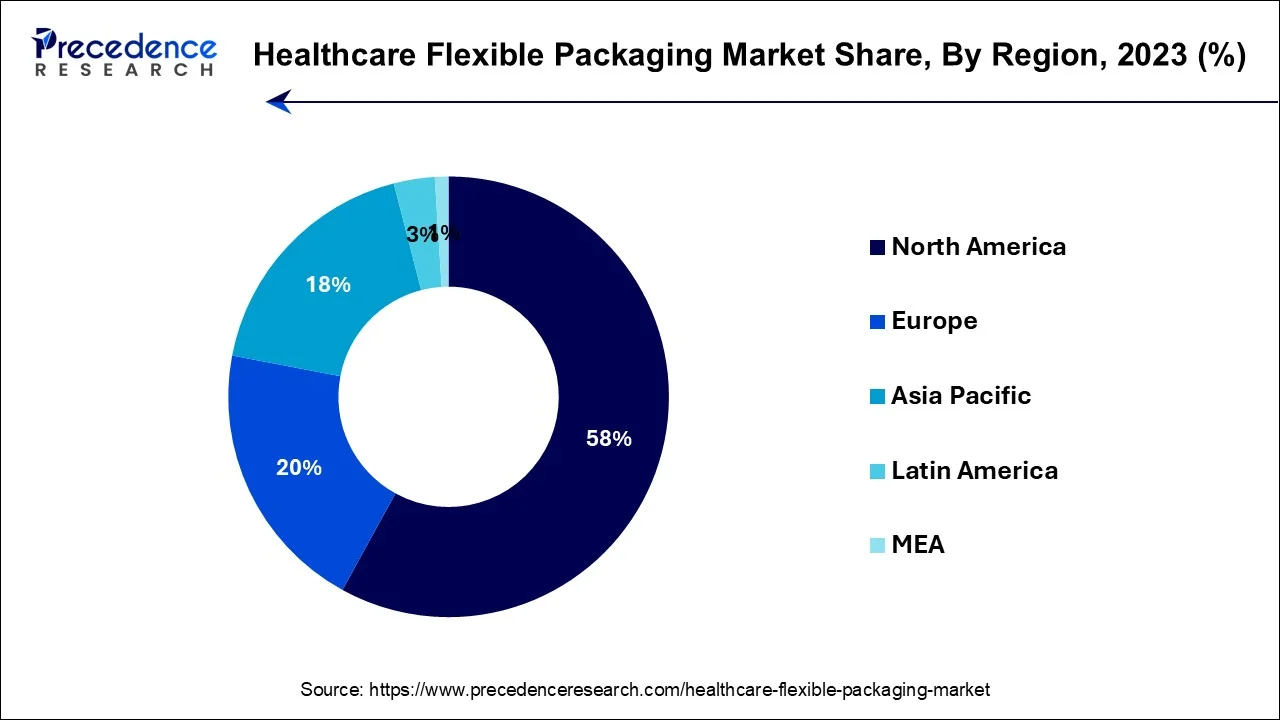

North America has held the largest revenue share 58% in 2023. In North America, the medical flexible packaging market has been witnessing robust growth trends. The increasing demand for healthcare products and the ongoing development of innovative packaging solutions have fueled this expansion. Stringent regulatory requirements for sterilization and product safety have further driven the adoption of specialized packaging materials. In North America, the medical flexible packaging market is undergoing a transformation fueled by sustainability considerations. There is a rising preference for eco-friendly packaging solutions. The market is characterized by a continued emphasis on safety, convenience, and environmental responsibility, reflecting the evolving needs of the healthcare industry.

Asia-Pacific is estimated to observe the fastest expansion In the Asia-Pacific region, the medical flexible packaging market is witnessing significant trends. Increasing healthcare expenditure, rising demand for pharmaceuticals, and a growing aging population are driving the demand for flexible packaging solutions. Moreover, there's a notable shift towards eco-friendly and sustainable packaging materials, reflecting the region's increasing environmental awareness. Additionally, advancements in packaging technology, such as tamper-evident and child-resistant features, are becoming more prevalent to ensure product safety and compliance with stringent regulations.

In Europe, the medical flexible packaging market has witnessed notable trends in recent years. Increasing demand for convenient and sustainable packaging solutions, stringent regulatory requirements for sterilization and safety, and a growing aging population driving the healthcare sector are key drivers. Furthermore, advancements in eco-friendly materials and the adoption of innovative packaging technologies are shaping the market's evolution. Overall, Europe's medical flexible packaging sector is marked by a focus on functionality, compliance, and environmental responsibility.

Healthcare flexible packaging is a specialized form of packaging designed to meet the unique needs of the healthcare and pharmaceutical industries. It encompasses a range of materials such as films, foils, and laminates, often combined into pouches, bags, or sachets. These packages are used to store and protect medical devices, pharmaceutical products, and sterile instruments. Healthcare flexible packaging must adhere to strict regulations, ensuring product integrity, sterility, and patient safety.

It often features attributes like tamper-evident seals, barrier properties to preserve product efficacy, and user-friendly designs for healthcare professionals and patients. This packaging plays a critical role in maintaining the quality and safety of medical products while offering convenience and compliance with regulatory standards.

Healthcare flexible packaging is a specialized packaging segment serving the unique needs of the healthcare and pharmaceutical industries. It encompasses various materials, including films and laminates, typically formed into pouches and bags. These packages play a crucial role in safeguarding medical devices, pharmaceuticals, and sterile instruments while adhering to stringent regulatory requirements to ensure product safety and integrity.

The healthcare flexible packaging market is undergoing significant expansion, propelled by several pivotal factors. Firstly, an aging population and heightened healthcare spending have driven increased demand for healthcare services and pharmaceutical products. Consequently, there is a growing necessity for dependable and secure packaging solutions. Furthermore, the industry has witnessed innovations in packaging technology, such as tamper-evident seals and user-friendly designs, enhancing both safety and convenience.

This sector confronts challenges, including rigorous adherence to regulatory standards, the ongoing requirement for material advancements to meet dynamic healthcare demands, and growing concerns about environmental sustainability. Amid these challenges, substantial business opportunities await. Companies can invest in research and development to create sustainable and eco-friendly packaging materials. Collaborations with pharmaceutical manufacturers to develop tailored solutions also present lucrative prospects. Moreover, expanding into emerging markets with burgeoning healthcare infrastructure offers promising growth avenues.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 7.1% |

| Market Size in 2024 | USD 24.32 Billion |

| Market Size by 2034 | USD 48.29 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Material, Product, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising healthcare demand and technological advancements

Rising healthcare demand and technological advancements propel the growth of the healthcare flexible packaging market. The escalating healthcare needs, primarily driven by an aging global population and increased healthcare spending, have led to a surge in the consumption of pharmaceuticals and medical devices. Consequently, there is an elevated requirement for packaging solutions that ensure the safety, integrity, and efficacy of these healthcare products. Technological advancements play a pivotal role in addressing these demands.

Innovations in packaging technology, such as tamper-evident seals, user-friendly designs, and advanced barrier properties, have significantly enhanced the functionality and reliability of healthcare packaging. Patients and healthcare providers benefit from packaging that is not only secure but also convenient and easy to use.

Moreover, advancements in material science have yielded packaging solutions that offer protection against moisture, light, and contaminants, preserving the potency of pharmaceuticals and medical products. This has garnered trust among consumers and healthcare professionals alike, driving further demand.

Material costs, counterfeit and tampering risks

The cost of high-quality, compliant materials for healthcare packaging can be substantial. Rising material costs can affect profit margins for packaging manufacturers and, in turn, healthcare product producers. Cost pressures may limit the adoption of flexible packaging solutions, especially for smaller manufacturers and those in price-sensitive markets. Counterfeit pharmaceuticals and medical products pose serious health risks to patients.

The packaging industry must invest in anti-counterfeiting technologies, adding expenses to production. These costs can discourage some companies from implementing flexible packaging solutions or lead to increased prices for end-users. Tampering with healthcare products is a significant concern. Packaging must provide tamper-evident features to ensure product integrity and patient safety.

These security features require additional investment in design and materials, potentially increasing costs and complexity. Balancing these restraints with the benefits of healthcare flexible packaging, such as convenience, customization, and sustainability, is crucial for packaging manufacturers and healthcare product producers to maintain market demand and ensure the safety and efficacy of healthcare products.

Sustainable packaging solutions and customization for specialty medications

The healthcare flexible packaging market is experiencing a surge in demand due to the growing emphasis on sustainability within the pharmaceutical and healthcare industries. Sustainable packaging solutions, such as recyclable and biodegradable materials, align with eco-conscious consumer preferences and environmental regulations. The use of eco-friendly materials not only contributes to environmental stewardship but also enhances the overall brand image of pharmaceutical companies.

Moreover, specialty medications often have unique requirements in terms of packaging due to their sensitivity to environmental factors and specific dosing needs. Customization capabilities in healthcare flexible packaging are crucial to meet these demands. Packaging that can precisely fit the medication's dimensions, provide protection from external elements and ensure proper dosing administration enhances patient safety and medication efficacy.

As the pharmaceutical industry continues to develop specialized medications for various conditions, the demand for tailored and customized healthcare flexible packaging solutions is surging. This trend allows packaging providers to offer unique and value-added services, fostering increased market demand in the healthcare sector. In summary, sustainability and customization are pivotal drivers in the healthcare flexible packaging market, aligning with industry needs and patient expectations, and ultimately fueling market growth.

Impact of COVID-19

The COVID-19 pandemic had a multifaceted impact on the healthcare flexible packaging market. Initially, there was a surge in demand for medical supplies, pharmaceuticals, and personal protective equipment (PPE), which led to increased production and consumption of healthcare packaging. Flexible packaging played a vital role in safely storing and transporting these critical healthcare products, contributing to its elevated demand.

However, the industry faced challenges as well. Disruptions in supply chains, including the availability of raw materials and logistics constraints, impacted manufacturing and distribution. Strict hygiene and safety protocols also affected production processes. Moreover, the pandemic underscored the importance of sterile and tamper-evident packaging, prompting increased investment in advanced packaging solutions to ensure product integrity and patient safety.

According to the material, the plastics segment has held 76% revenue share in 2023. Plastic, a versatile synthetic material derived from polymers, plays a crucial role in the medical flexible packaging market. It encompasses a diverse range of synthetic polymers, including polyethylene and polypropylene, prized for their resilience, flexibility, and sterilization capabilities. Recent market trends feature the embrace of environmentally friendly bioplastics to mitigate ecological footprints, the integration of cutting-edge barrier technologies for prolonged product preservation, and the innovation of user-centric packaging designs for pharmaceuticals and medical equipment. These developments respond to the rising need for secure and sustainable healthcare packaging solutions.

The plastic segment is anticipated to expand at a significant CAGR of 12.8% during the projected period. Paper is a versatile material made from wood pulp fibers and is integral to the medical flexible packaging market. It offers eco-friendliness and is used for packaging medical devices, pharmaceuticals, and hygiene products. Recent trends show a growing demand for sustainable and recyclable paper-based packaging due to environmental concerns. Additionally, advancements in barrier coatings and printing technologies have enhanced paper's suitability for preserving medical products, making it a prominent choice in the evolving medical flexible packaging landscape.

Based on the product, pouches & bags segment held the largest market share of 35% in 2023. Pouches and bags in the medical flexible packaging market refer to versatile containers designed to safely store and transport medical supplies, pharmaceuticals, and devices. Current trends in this sector include the adoption of sustainable materials, such as recyclable plastics and biodegradable films, to reduce environmental impact. Additionally, advancements in barrier technologies and tamper-evident features enhance product protection and patient safety. These innovations contribute to the growth and evolution of medical pouches and bags in the healthcare industry.

On the other hand, the high-barrier films segment is projected to grow at the fastest rate over the projected period. High-barrier films, in the context of the medical flexible packaging market, refer to specialized packaging materials designed to provide exceptional protection and preservation of medical devices and pharmaceutical products. These films have advanced barrier properties, offering resistance to oxygen, moisture, and other external factors, ensuring product integrity. Recent trends in the medical flexible packaging market include the growing demand for sustainable and eco-friendly materials, enhanced convenience features like easy-open seals, and increased emphasis on regulatory compliance to meet stringent quality standards.

In 2023, the pharmaceutical manufacturing segment had the highest market share of 33% on the basis of the installation. Pharmaceutical manufacturing encompasses the mass production of pharmaceutical drugs, encompassing drug formulation, rigorous testing, and efficient packaging. Within the medical flexible packaging sector, notable trends encompass the embrace of environmentally friendly materials, heightened utilization of tamper-proof packaging to ensure safety, and the integration of smart packaging technologies aimed at improving product traceability and engaging patients more effectively. These trends aim to meet regulatory standards, improve product protection, and enhance user convenience in the pharmaceutical industry.

The Contract packaging is anticipated to expand at the fastest rate over the projected period. Contract packaging in the medical flexible packaging market refers to the outsourcing of packaging services to specialized companies. It involves designing, filling, and sealing medical products within flexible packaging materials. Trends in this sector include a growing emphasis on sustainability, the use of advanced materials for improved barrier properties, and increased demand for smaller, single-dose packaging to enhance patient convenience and safety. Additionally, stringent regulatory compliance and custom packaging solutions are gaining importance to meet evolving healthcare needs.

Segments Covered in the Report

By Material

By Product

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

February 2025

April 2024