January 2025

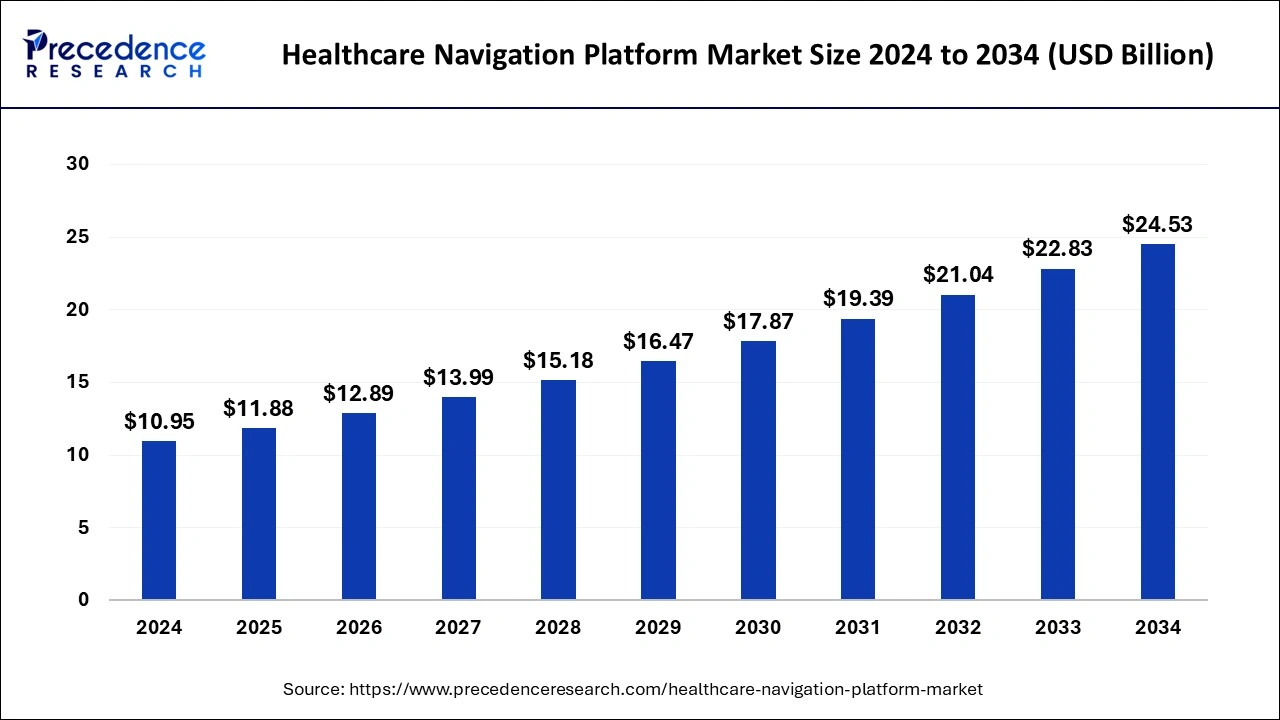

The global healthcare navigation platform market size is accounted at USD 11.88 billion in 2025 and is forecasted to hit around USD 24.53 billion by 2034, representing a CAGR of 8.40% from 2025 to 2034. The North America market size was estimated at USD 4.60 billion in 2024 and is expanding at a CAGR of 8.44% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global healthcare navigation platform market size was calculated at USD 10.95 billion in 2024 and is predicted to increase from USD 11.88 billion in 2025 to approximately USD 24.53 billion by 2034, expanding at a CAGR of 8.40% from 2025 to 2034. The rising prevalence of chronic diseases worldwide needs to cater to premium healthcare platforms to reduce health expenditure so that cost-effective treatment can be provided to the maximum number of people, which are some of the major factors driving the global market.

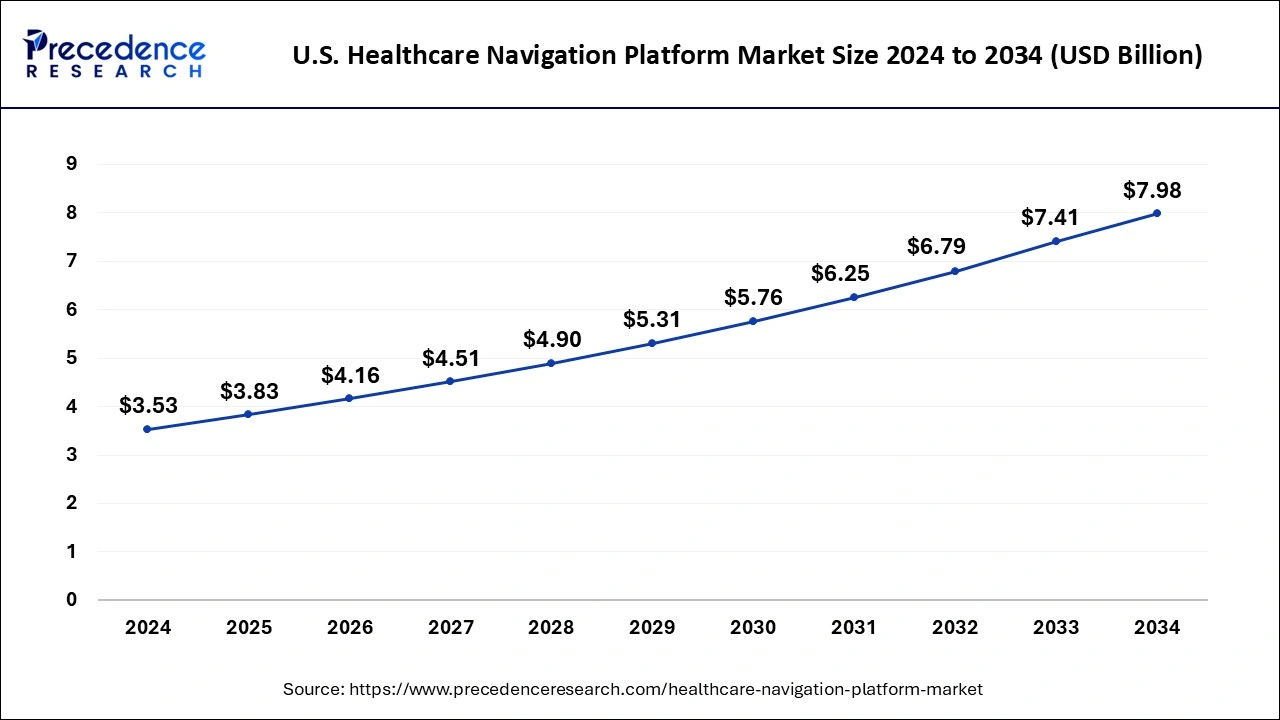

The U.S. healthcare navigation platform market size was exhibited at USD 3.53 billion in 2024 and is projected to be worth around USD 7.98 billion by 2034, growing at a CAGR of 8.50% from 2025 to 2034.

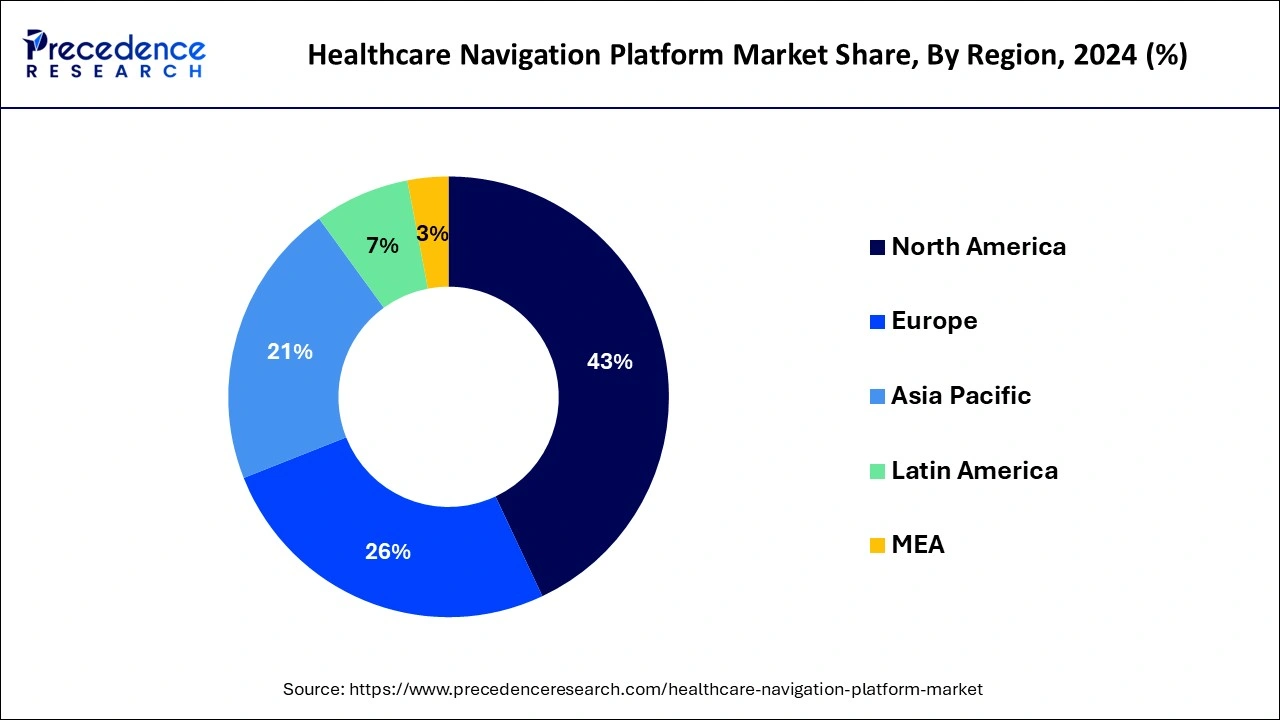

North America dominated the healthcare navigation platform market in 2024 and is expected to grow further. North America stands as the dominant region in the market, encompassing countries such as the United States and Canada. This dominance is attributed to several factors, including the presence of advanced healthcare infrastructure, high adoption rates of digital technologies, and a strong emphasis on patient-centric care.

In the United States, the Affordable Care Act has spurred investments in healthcare IT solutions, driving the adoption of navigation platforms across various healthcare settings. Additionally, the region boasts many healthcare technology companies and research institutions, fostering innovation and driving market growth. Moreover, the well-established regulatory framework and reimbursement policies further support the widespread adoption of healthcare navigation platforms in North America, solidifying its position as a key player in the global healthcare navigation platform market.

Asia Pacific is expected to grow significantly in the global healthcare navigation platform market. Countries such as China, India, Japan, and South Korea are witnessing rapid advancements in healthcare infrastructure and digitalization efforts. Factors such as rising healthcare spending, increasing awareness of the importance of patient engagement, and government initiatives to promote digital health technologies are driving the adoption of navigation platforms across the region. Moreover, the growing prevalence of chronic diseases and aging populations are fueling the demand for solutions that improve healthcare accessibility and efficiency. As a result, the region presents significant opportunities for market expansion and innovation in the healthcare navigation platform space.

The healthcare navigation platform market is experiencing significant growth driven by the increasing complexity of the healthcare system and the demand for improved patient outcomes. These platforms offer solutions to streamline patient navigation through the healthcare journey, including appointment scheduling, care coordination, and access to resources.

Key drivers of the healthcare navigation platform market growth include the rising adoption of digital health solutions, the need to reduce healthcare costs, and the emphasis on patient-centric care. Additionally, the COVID-19 pandemic has accelerated the shift towards virtual care and highlighted the importance of remote patient monitoring and telemedicine, further fueling demand for healthcare navigation platforms.

Major players in the healthcare navigation platform market are investing in technological advancements such as artificial intelligence, machine learning, and predictive analytics to enhance the efficiency and effectiveness of their platforms. Furthermore, partnerships and collaborations between healthcare providers, insurers, and technology companies are driving innovation and expanding market reach.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.40% |

| Market Size in 2025 | USD 11.88 Billion |

| Market Size in 2024 | USD 10.95 Billion |

| Market Size by 2034 | USD 24.53 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Deployment and End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing complexity

One major driver for the healthcare navigation platform market is the increasing complexity of the healthcare system. As healthcare delivery becomes more intricate due to factors such as evolving treatment modalities, regulatory changes, and diverse care settings, patients and providers alike face challenges in navigating the system effectively. Healthcare navigation platforms offer a solution by providing a centralized platform for patients to access information, schedule appointments, coordinate care across different providers, and access support services. By simplifying and streamlining the healthcare journey, these platforms improve patient satisfaction, reduce administrative burden on healthcare providers, and ultimately contribute to better health outcomes.

As the healthcare landscape continues to evolve, with the integration of new technologies and the emergence of value-based care models, the demand for healthcare navigation platforms is expected to grow as stakeholders seek innovative solutions to navigate and optimize the increasingly complex healthcare ecosystem.

Data integration

Restraint of the healthcare navigation platform market is the challenge of interoperability and data integration. Furthermore, concerns about data security and privacy compliance pose additional barriers to data sharing and integration efforts. Addressing these interoperability challenges requires collaboration among healthcare stakeholders, standardized data formats, robust data governance frameworks, and interoperability standards to ensure seamless data exchange and maximize the potential of healthcare navigation platforms.

The healthcare navigation platform market aims to provide comprehensive support throughout the healthcare journey; they often need to integrate with various systems and databases, including electronic health records (EHRs), insurance systems, and third-party applications. However, achieving seamless interoperability and data exchange among these disparate systems can be challenging due to differences in data formats, standards, and privacy regulations. This can result in fragmented patient information, redundant data entry, and inefficiencies in care coordination, undermining the effectiveness of healthcare navigation platforms.

Personalized health management

The future opportunity for the healthcare navigation platform market lies in the integration of personalized health management features. As healthcare continues to shift towards personalized and precision medicine approaches, there is growing recognition of the importance of tailoring healthcare interventions and services to individual patient needs preferences, and characteristics. Healthcare navigation platforms can capitalize on this trend by incorporating features such as personalized health assessments, treatment recommendations, and care plans based on factors such as genetic predispositions, lifestyle habits, and social determinants of health.

By leveraging advanced analytics, artificial intelligence, and machine learning algorithms, these platforms can analyze large volumes of patient data to generate personalized insights and recommendations, empowering patients to make informed decisions about their health and well-being.

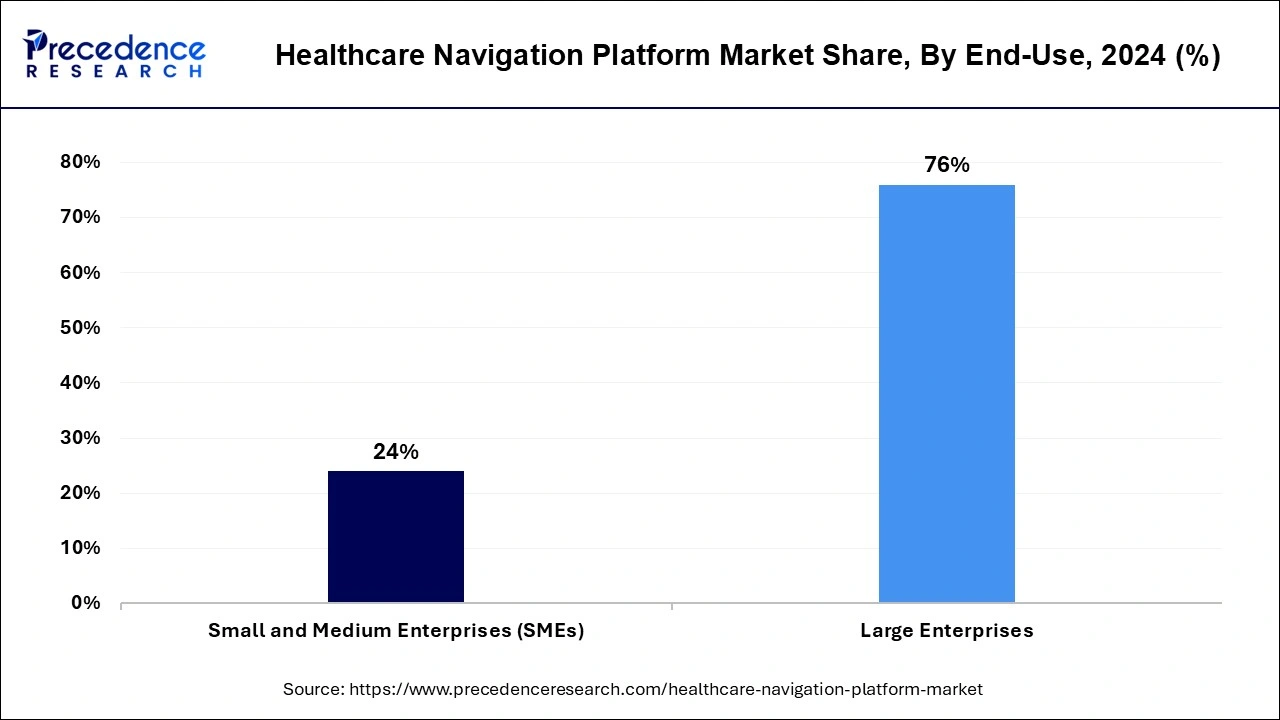

The healthcare navigation platform market is dominated by the large enterprises segment in 2024. The market sees large enterprises as the dominant segment, owing to their substantial resources and expansive operations. Large enterprises, encompassing hospitals, healthcare systems, and insurance providers, seek comprehensive solutions to manage the complexities of healthcare delivery effectively. These entities require robust platforms capable of handling large volumes of data, integrating with existing systems, and facilitating seamless communication across departments.

Additionally, their focus on optimizing operational efficiency and improving patient outcomes drives the adoption of advanced healthcare navigation technologies. As a result, large enterprises wield significant influence in shaping the direction and growth of the market.

The SME segment is expected to show significant growth in the healthcare navigation platform market. SMEs, including independent clinics, physician practices, and outpatient facilities, are increasingly recognizing the value of navigation platforms in enhancing patient care and operational efficiency. With limited resources compared to their larger counterparts, SMEs seek cost-effective solutions that offer essential features such as appointment scheduling, billing management, and electronic health records.

The growing availability of cloud-based and subscription-based platforms tailored to the needs of SMEs further accelerates their adoption of healthcare navigation technologies, driving growth in this segment of the market.

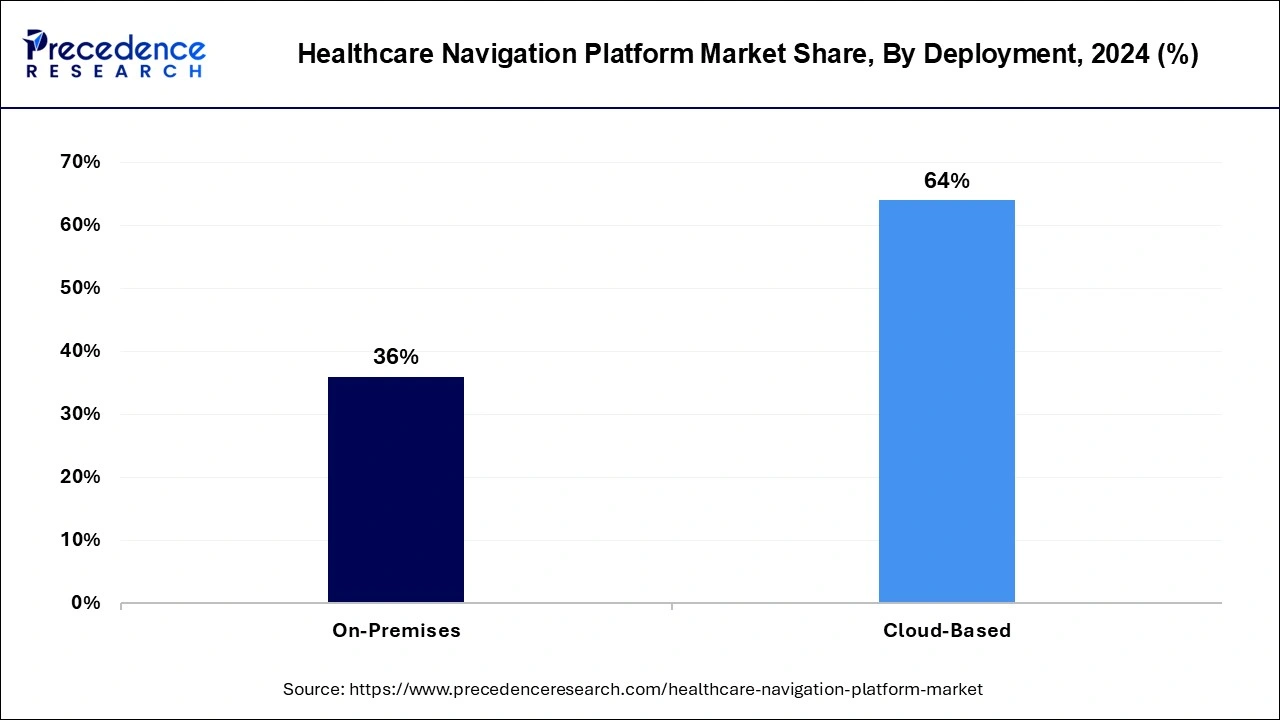

The cloud-based segment accounted for the highest share of the healthcare navigation platform market in 2024. By harnessing the power of remote servers, cloud-based platforms provide real-time updates, enhanced security measures, and simplified access from any location with internet connectivity. This dominance is fueled by the growing demand for scalable and cost-effective solutions that can adapt to the evolving needs of healthcare providers and patients alike.

The on-premises segment is projected to grow with a notable CAGR in the global healthcare navigation platform market. Despite the dominance of cloud-based solutions, some healthcare organizations prefer to maintain control over their data by hosting navigation platforms on-site. This preference is driven by factors such as data security concerns, regulatory compliance requirements, and the need for customization to fit specific organizational workflows. As a result, the on-premises segment is experiencing rapid growth as healthcare providers seek flexible deployment options that align with their unique operational needs.

By Deployment

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

February 2025

April 2024