January 2025

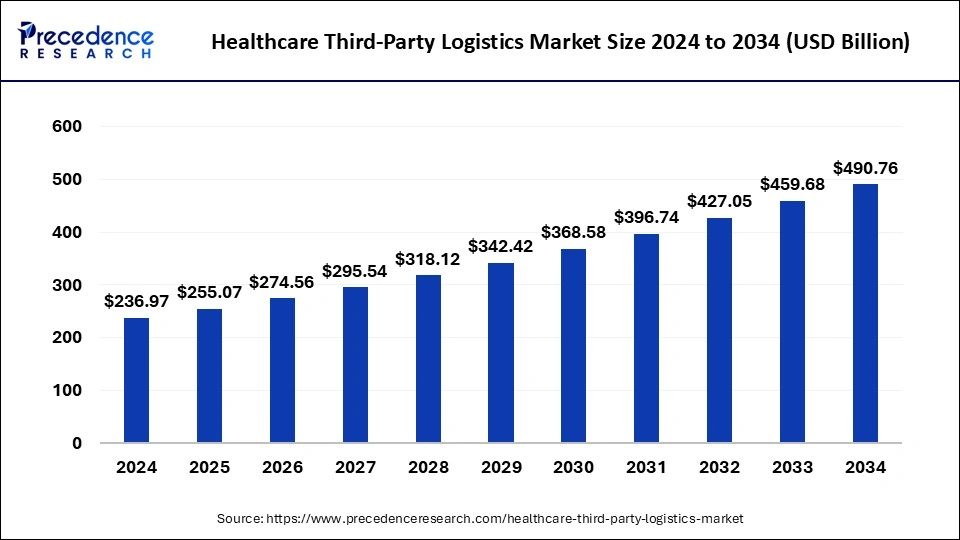

The global healthcare third-party logistics market size is calculated at USD 255.07 billion in 2025 and is forecasted to reach around USD 490.76 billion by 2034, accelerating at a CAGR of 7.55% from 2025 to 2034. The North America healthcare third-party logistics market size surpassed USD 101.90 billion in 2024 and is expanding at a CAGR of 7.68% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global healthcare third-party logistics market size was estimated at USD 236.97 billion in 2024 and is predicted to increase from USD 255.07 billion in 2025 to approximately USD 490.76 billion by 2034, expanding at a CAGR of 7.55% from 2025 to 2034. The rising developments in the pharmaceutical industry across the world are driving the growth of the healthcare third-party logistics market.

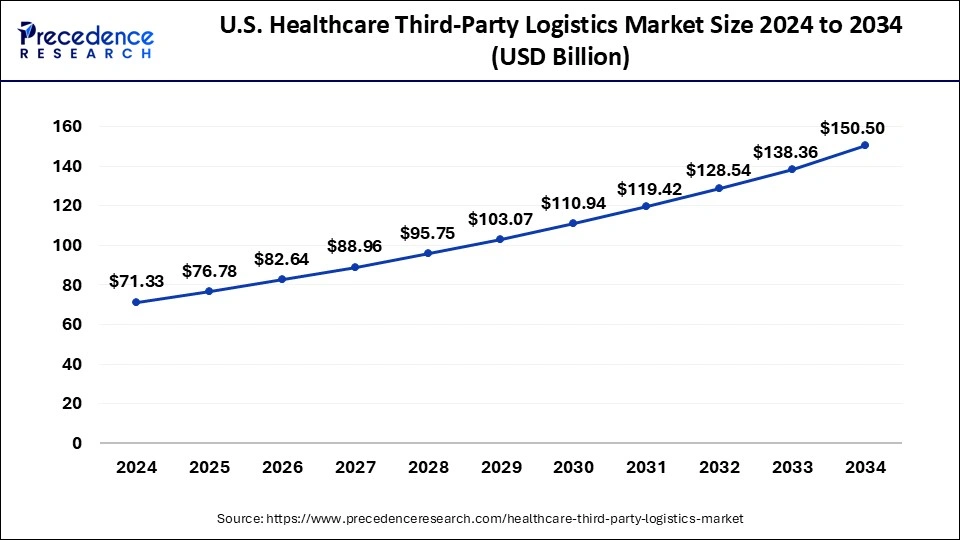

The U.S. healthcare third-party logistics market size was valued at USD 71.33 billion in 2024 and is expected to be worth around USD 150.50 billion by 2034, at a CAGR of 7.75% from 2025 to 2034.

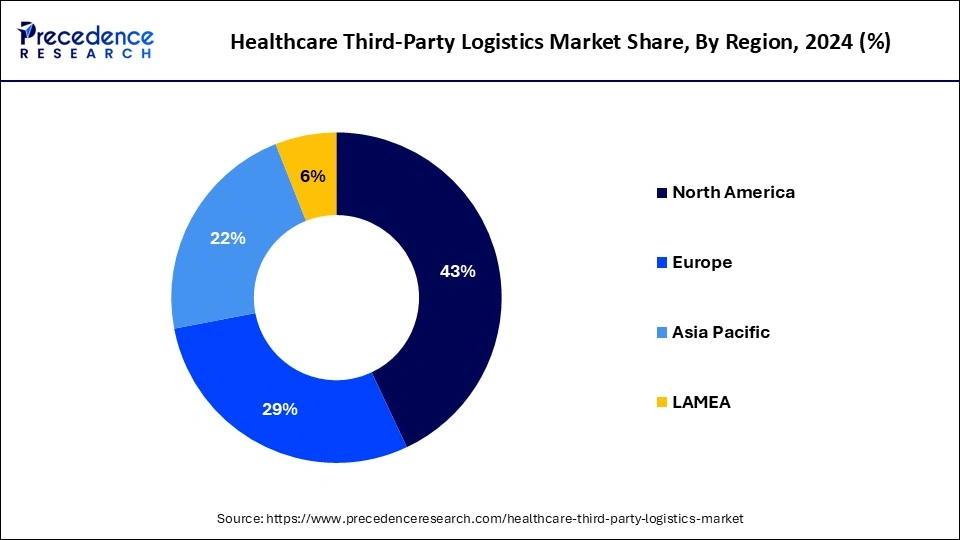

North America held the largest market share in 2024 and is expected to maintain its dominance throughout the forecast period. The growth of this region is mainly driven by rising government initiatives in countries such as the US, Canada, and Mexico to develop healthcare infrastructure. For instance, in May 2024, the FDA (the U.S. Food and Drug Administration) announced a new initiative named ‘the Home as a Health Care Hub’ for developing the healthcare sector across the U.S. The rising developments in healthcare warehouses, along with the growing presence of well-established air and sea freight, are driving the market growth in this region. Moreover, the advancement in internet facilities, along with the rising penetration of smartphones, has boosted the healthcare third-party logistics market growth in this region.

The presence of a well-developed pharmaceutical and biopharmaceutical sector in this region propels the market growth. Furthermore, the presence of several healthcare third-party logistics companies such as C. H. Robinson, Amerisource Bergen, United Parcel Service, Barrett Distribution, Xpo Logistics, and some others boost the growth of the healthcare third-party logistics market.

Asia Pacific region is expected to be the fastest-growing region during the forecast period. The growth of this region is mainly driven by the growing developments in the medical devices industry in several countries such as India, China, South Korea, and others. Also, the growing interest from the public and private sectors for development & research for developing healthcare logistics industries has boosted the market growth. The growing advancements in pharmaceutical industries, along with rising developments in bio-therapeutics sectors, are driving the market growth. Furthermore, the presence of several healthcare logistics providers, such as Kerry Logistics Network Ltd. and Agility, drives the growth of the healthcare third-party logistics market.

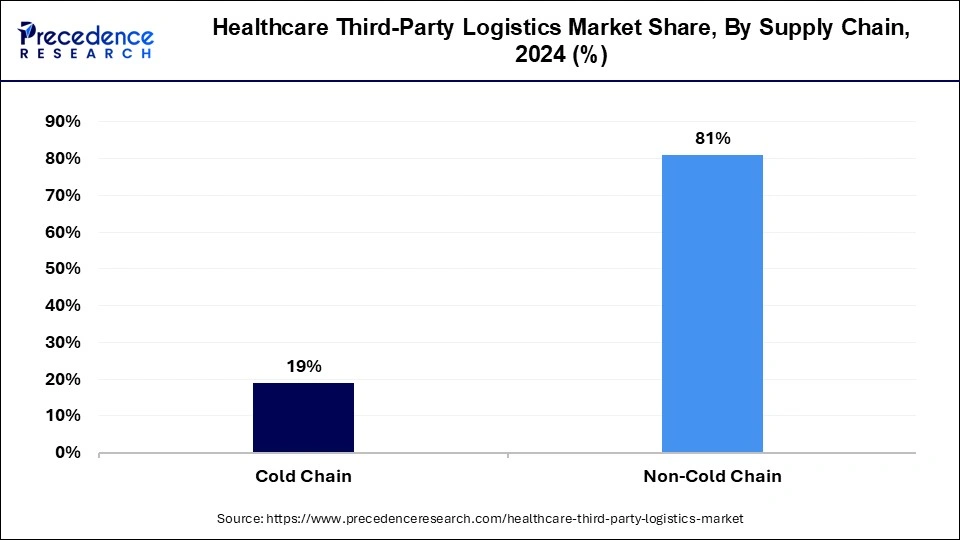

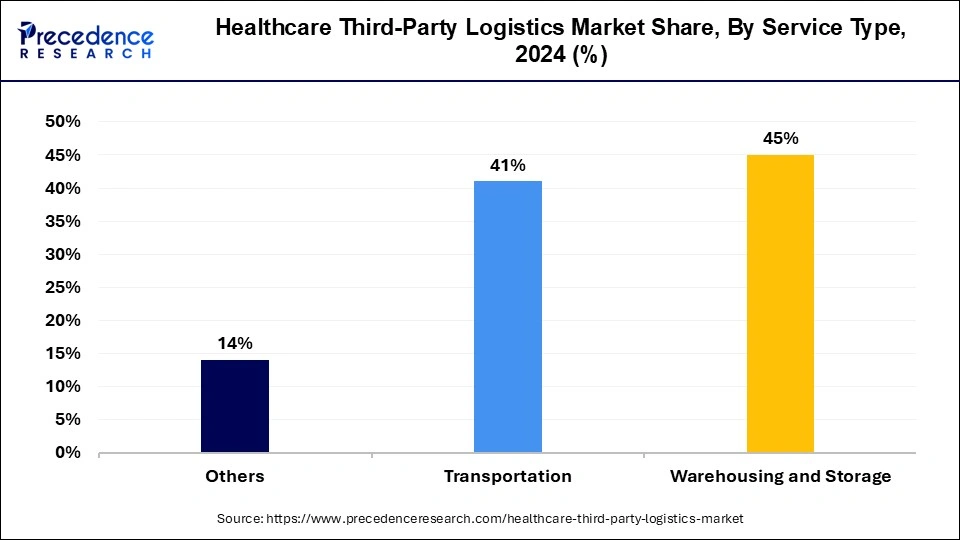

The third-party logistics market is an important industry in the healthcare domain. This industry deals in the storage and transportation of healthcare products across the globe. The healthcare third-party logistics market is expected to grow significantly with the rise in government initiatives to develop the healthcare sector. This industry mainly deals with delivering products such as biopharmaceutical, pharmaceutical, and medical devices to people across the world. It comprises two supply chains, the cold chains, and the non-cold chains. There are several services associated with healthcare third-party logistics, such as freight services, warehousing & storage, database management, and other custom operations. Logistics companies have also started developing modern warehouses to store healthcare products and boost market growth. This industry is expected to grow exponentially with the growth in the healthcare and logistics sectors.

| Report Coverage | Details |

| Market Size by 2034 | USD 490.76 Billion |

| Market Size in 2025 | USD 255.07 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.55% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Industry, Service Type, Supply Chain, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising developments in warehouses for storing medicinal products

The growing demand for medicines across the world increases the demand for modern warehouses with superior facilities. Also, the growing proliferation of smartphones has increased the demand for purchasing medicines and other associated products from online platforms, which increases the demand for storage facilities across the world.

The advancements in logistics sectors associated with the storage and distribution of healthcare products are developing rapidly. Moreover, healthcare and logistics companies started establishing new storage facilities to maintain the demand and supply chains of healthcare products across the world.

Theft-related issues, along with a lack of logistics infrastructure in rural areas

The logistics industry is developing significantly with the growing trend of online shopping across the world. However, there are various problems associated with healthcare logistics. Firstly, there are theft-related issues during the transportation of medical goods and a mismatch of medical products in warehouses. Secondly, the logistics sector in rural areas faces several transportation and storage issues for medicinal products. Thus, the absence of well-established logistics in rural areas, along with theft-related issues in the logistics sector, is expected to restrain the growth of the healthcare third-party logistics market.

Adoption of modern technologies in logistics

The logistics industry has developed rapidly due to the advancements in sciences and modern technologies. The ongoing development of modern technologies such as Big Data Analytics, AI, Blockchain, and others have also contributed significantly to the development of the logistics sector. The integration of technologies in modern warehouses also helps in packaging, manufacturing, database management, enhanced warehouse safety, and some others that help in maintaining logistics operations. Thus, rising developments in technologies in the logistics sector are expected to create ample growth opportunities for the market players in the future.

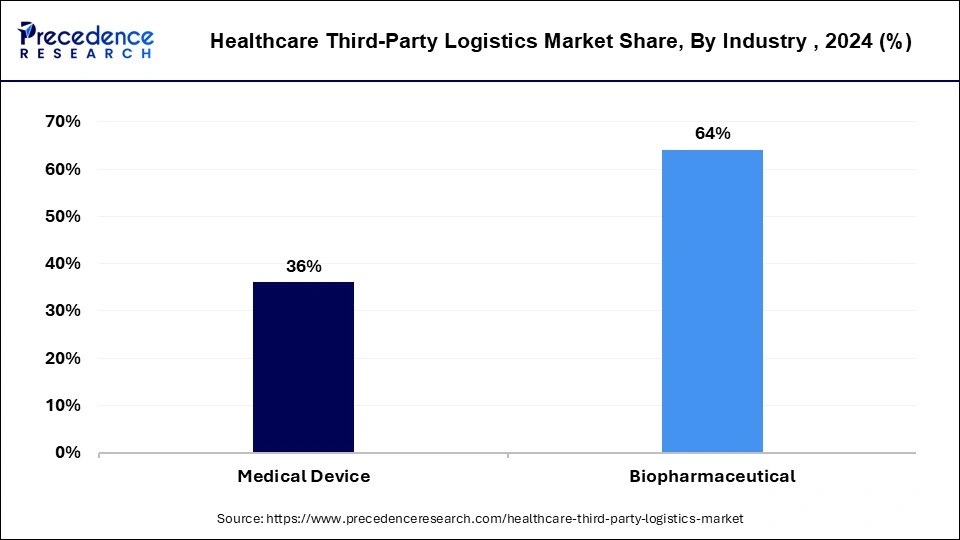

The biopharmaceutical segment held the largest healthcare third-party logistics market share in 2024 and is expected to continue its dominance during the forecast period. The growth of this segment is generally driven by the growing demand for biopharmaceutical therapies for treating diabetes, autoimmune disorders, and cardiovascular diseases across the world. Moreover, the growing research and development activities associated with bio-based drugs, along with a rising number of clinical trials associated with biosimilars, also boosts the market growth. Also, biopharma companies have started adopting several strategies such as product launches, approvals, partnerships, acquisitions, collaborations, and some others for treating several diseases, which in turn drives the growth of the healthcare third-party logistics market during the forecast period.

The medical devices segment is expected to be the fastest-growing segment in 2023. The growth of this segment is generally driven by the growing development of healthcare infrastructure across the world. Also, the rising use of medicinal devices in hospitals and laboratories for various diagnostic procedures drives market growth. Moreover, the rise in the number of surgeries associated with chronic diseases increases the demand for medical devices, thereby driving market growth. Furthermore, the presence of well-established medical device companies that are engaged in R&D activities for developing medical devices and adopting strategies such as product launches, partnerships, and approvals, thereby driving the growth of the healthcare third-party logistics market.

The non-cold chain segment dominated the market in 2024. The growth of this segment is generally driven by the growing development in logistics sectors across the world. Moreover, the rising trend of online shopping for purchasing medicines has increased the demand for non-cold chain warehouses for storing medicines, thereby driving market growth. Also, the rise in the number of SKUs (Stock Keeping Units) for inventory management of medicinal devices, tablets, capsules, and other medicinal products further drives the growth of the healthcare third-party logistics market.

The cold chain segment is estimated to grow with the highest CAGR during the forecast period. The growth of this segment is driven by the growing number of immunization initiatives across the world. For instance, in February 2024, the government of India announced a new vaccination initiative to prevent cervical cancer among girls children aged 9-14 years. Moreover, the rising prevalence of chronic diseases such as cardiovascular diseases, stroke, arthritis, and others increases the demand for vaccines associated with their treatment. These vaccines must be kept in cold-chain warehouses, thereby driving the growth of the healthcare third-party logistics market. Also, the rising trend of connected cold chain solutions due to added advantages compared to conventional storage methods boosts market growth.

The warehousing and storage segment held the largest market share in the healthcare third-party logistics market. The growing demand for medicines across the world has driven the market growth. Also, the rising integration of artificial intelligence (AI) and other technologies in modern warehouses to automate several tasks such as packaging, inventory management, data analysis, and others is driving the growth of the healthcare third-party logistics market.

The growing number of medicine storage warehouses in several countries, such as India, the U.S., and Canada, has driven the market growth. Moreover, the growing investment by 3PL companies in developing new healthcare warehouses with modern facilities across the world is boosting the growth of the market.

By Industry

By Service Type

By Supply Chain

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

February 2025

April 2024