November 2024

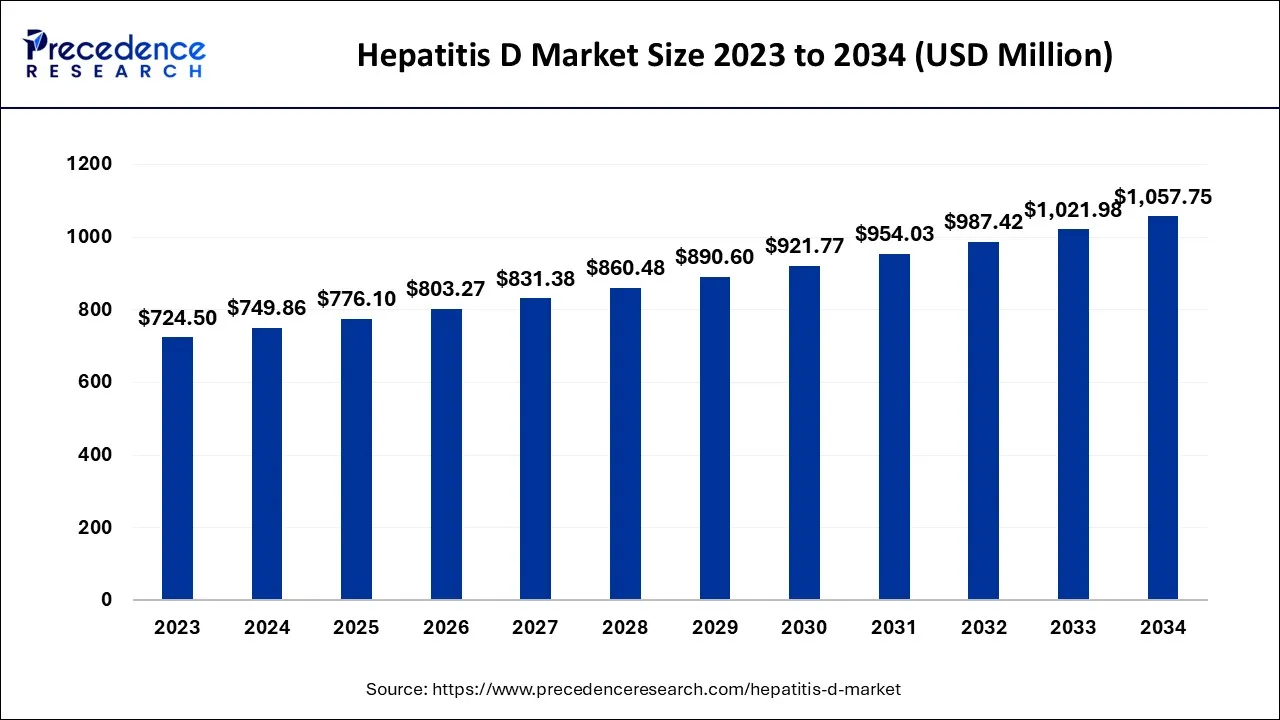

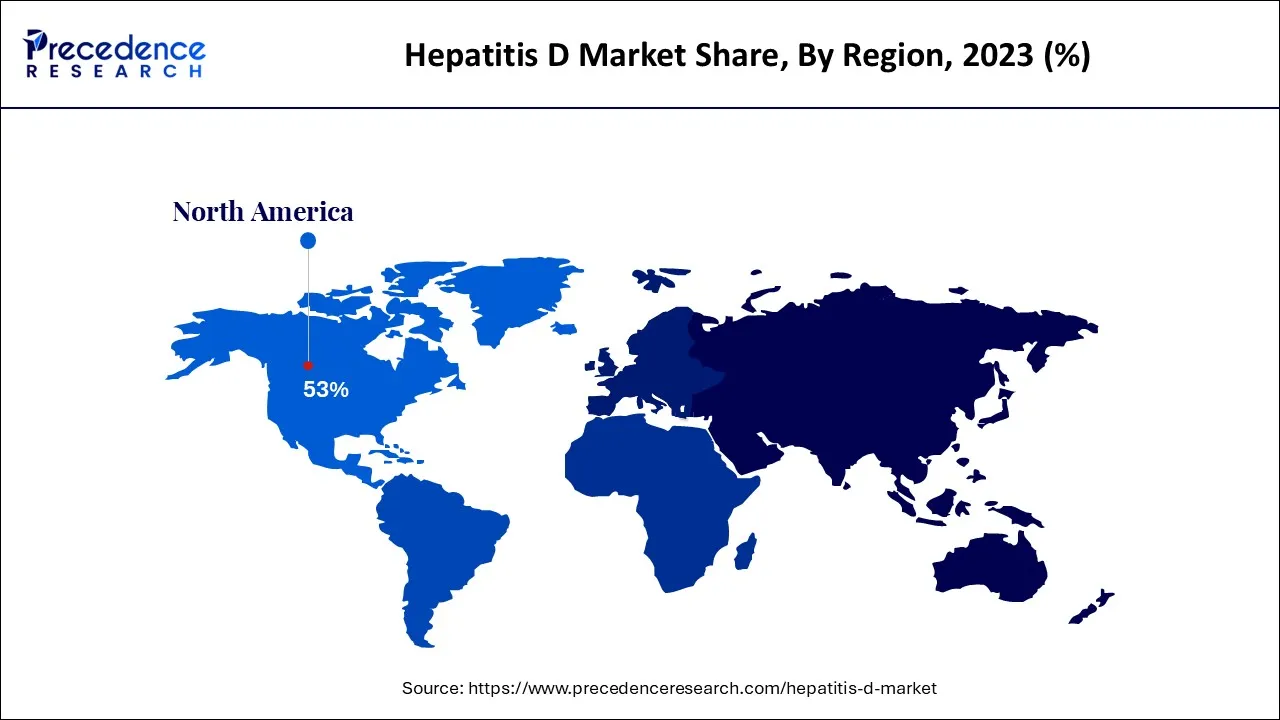

The global hepatitis D market size accounted for USD 749.86 million in 2024, grew to USD 776.10 million in 2025 and is expected to be worth around USD 1,057.75 million by 2034, registering a CAGR of 3.5% between 2024 and 2034. The North America hepatitis D market size is calculated at USD 397.43 million in 2024 and is estimated to grow at a CAGR of 3.6% during the forecast period.

The global hepatitis D market size is calculated at USD 749.86 million in 2024 and is projected to surpass around USD 1,057.75 million by 2034, growing at a CAGR of 3.5% from 2024 to 2034.

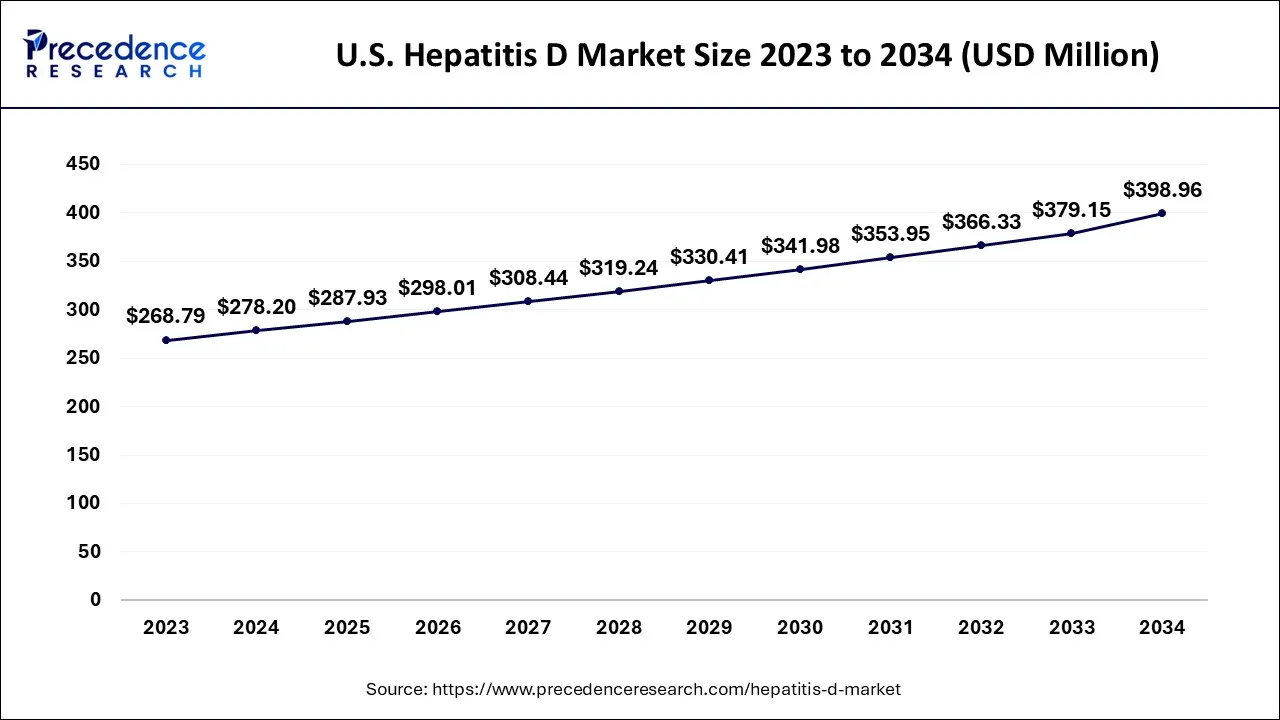

The U.S. hepatitis D market size is exhibited at USD 278.20 million in 2024 and is projected to be worth around USD 398.96 million by 2034, growing at a CAGR of 3.67% from 2024 to 2034.

Due to the rising rates of bacterial infection, changes in clinical procedures, and accessibility to the most effective treatments for viral infections in this area, North America currently holds a monopoly on the global market for Hepatitis D. Additionally, the expensive cost of healthcare in North America stimulates the local market. The European market is divided into Western Europe and Eastern Europe on a regional premise.

Due to the presence of cutting-edge medical facilities and growing viral infection rates among the populace, Europe is predicted to lead the market in terms of new cases of hepatitis B. Hepatitis D and C impact many people in the European area, according to a data sheet from the World Health Organization. In terms of the market for Hepatitis D treatments, Asia Pacific is anticipated to expand at the fastest rate through 2023. Market expansion is aided by the quickly expanding medical diagnostics industry, rising rates of bacterial infection, and a sizable population of HIV-positive individuals.

The Middle East and Africa, on the other hand, have the lowest market share for Hepatitis D treatments because of strict government regulations, the presence of underdeveloped economies, a lack of awareness, and low healthcare spending in the area.

Market Overview

The hepatitis D virus (HDV), which depends on HBV for reproduction, causes hepatitis D, an inflammation of the liver. Absence of the hepatitis B virus prevents hepatitis D transmission. The co-infection of HDV and HBV is regarded as the most severe type of chronic viral hepatitis because it leads to hepatocellular carcinoma and liver-related mortality more quickly. The only way to avoid contracting HDV is through hepatitis B vaccination.

The prevalence of hepatitis D and B is increasing, and eating an unbalanced diet frequently will slow the market's growth. Due to increasing healthcare costs, increased government funding, and increased efforts by both public and private groups to spread awareness of the disease, there will be an increase in demand for infections with the hepatitis delta virus (HDV). The market will continue to grow as a result of additional variables like alcohol abuse and the increasing prevalence of intravenous drug use. Additionally, concurrent HBV and HDV infection can cause a mild-to-severe or even fulminant hepatitis, whereas super-infection with HDV on chronic hepatitis B speeds up the progression of the disease in all ages and affects 70% to 90% of individuals.

| Report Coverage | Details |

| Market Size in 2024 | USD 749.86 Million |

| Market Size by 2034 | USD 1,057.75 Million |

| Growth Rate from 2024 to 2034 | CAGR of 3.5% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By Diagnosis, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rise in the prevalence of hepatitis D

The defective single-stranded RNA virus known as hepatitis delta virus (HDV) depends on the presence of the hepatitis B virus (HBV) for both expression and replication. The viral infection hepatitis D results in liver inflammation. This further impairs liver functions and results in chronic liver issues like liver cancer and scarring.

In addition, hepatitis D signs include nausea, vomiting, fatigue, lack of appetite, jaundice, joint pain, abdominal pain, and dark urine. Now a days, hepatitis D prevalence is on the rise, and a high intake of an unbalanced diet will affect the market's growth rate. For instance, the Hepatitis D virus (HDV) affects nearly 5% of people worldwide who have a chronic Hepatitis B virus infection, according to data released by the WHO in 2022. (HBV).

Furthermore, the market for hepatitis delta virus (HDV) infections will grow as a result of rising healthcare costs, rising government funding, and rising government and private organization initiatives to raise awareness of the disease. In addition to this, other factors including alcohol abuse and increasing incidence of intravenous drug abuse will drive the market growth.

Research and development efforts have advanced

The rise in the prevalence of Hepatitis D increased R&D efforts, clinical trials of hepatitis drugs, an increase in the number of product launches and item endorsements, and the development of new hepatitis drugs for the treatment of various hepatitis types are the main factors driving the growth of the hepatitis therapeutics market.

The market is growing rapidly due to increasing collaborative research activities for the pipeline development of effective drugs. In addition, continued awareness of hepatitis treatment due to collaborations and associations in major organizations and the presentation of less approach to hepatitis treatment are other factors driving the market growth.

Government programs to raise knowledge of hepatitis and how to treat it

Hepatitis D is extremely prevalent and can cause serious liver cirrhosis, which can be fatal. Furthermore, it is anticipated that over the course of the forecast period, government initiatives to raise awareness about hepatitis and its treatment will spur market development. For instance, a virtual gathering called the "World Hepatitis Summit (WHS)" took place in June 2022.

The World Health Organization co-sponsored the World Hepatitis Summit 2022. (WHO). The summit offers a venue for the large hepatitis community to assess current development and exchange thoughts, stories, and best practices for overcoming the many difficulties associated with viral hepatitis.

The cost of hepatitis treatments is high

However, the high cost of treatment and side effects from hepatitis D like liver failure, liver cirrhosis, and hepatocellular carcinoma will limit market expansion. The hepatitis delta virus (HDV) infection market will face additional challenges during the forecast period due to a lack of knowledge about preventative measures.

Furthermore, the hepatitis medications is predicted to grow slowly over the anticipated period due to the high capital needed for hepatitis pharmaceutical production. Because they are made from expensive basic materials like active pharmaceutical ingredients (APIs) and pharmacological intermediates, hepatitis medications are expensive. Since a skilled labor is needed, the intricate process of producing, separating, and utilizing raw materials for the creation of pharmaceutical and biopharmaceutical treatments raises the price of medications overall.

Rising ongoing clinical trials

Pegylated interferon is the only medication for hepatitis D that is currently authorised. (PEG-IFN). It works by boosting the immune system's ability to combat the infection. When administered once a week for 48 weeks, a tiny proportion of patients (30%) go into remission. New study indicates longer-term injections have higher success rates. Although they have no impact on hepatitis D, oral nucleosides (antivirals) approved for hepatitis B are occasionally used in conjunction with interferon therapy to help control high hepatitis B viral loads. In addition, seven medications are currently undergoing clinical studies to determine how well they work to treat the hepatitis D virus. (HDV). Therefore, an increase in clinical trials will also present market possibilities.

By type, Hepatitis D is further classified into chronic and acute. In 2023, the segment of chronic hepatitis had the largest proportion. In addition, new hepatitis drugs are being developed for the treatment of different hepatitis types, along with increased research and development efforts and hepatitis drug clinical trials.

Expanding study collaboration for the development of potent medications in the pipeline also encourages significant market growth. A unique factor that encourages market development is the promotion of affordable hepatitis therapeutics. This knowledge is being raised through alliances and joint efforts within significant organizations.

On the basis of diagnosis the market is categorized into blood tests, elastography, liver biopsy, serologic testing and others. In order to identify hepatitis D, doctors primarily use blood tests. High levels of anti-HDV immunoglobulin G (IgG) and immunoglobulin M (IgM) are also used to identify and confirm HDV infection, and HDV RNA can be found in serum. HDV RNA assays, which are used to assess response to antiviral therapy, are not standardized, and HDV diagnostics are not generally accessible.

In 2023, the segment of hospital & retail pharmacies had the largest revenue share. The hospital & retail pharmacies sector is predicted to have the highest income in 2021 and to dominate the market throughout the projection period. The significant market share can be attributed to the numerous patients who seek Hepatitis D diagnosis and treatment immediately at the hospital. In addition, the sector is anticipated to have significant growth opportunities due to the rising number of hospital & retail pharmacies providing Hepatitis D treatments in emerging economies.

Segments Covered in the Report

By Type

By Diagnosis

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

October 2024

November 2024

July 2024