September 2024

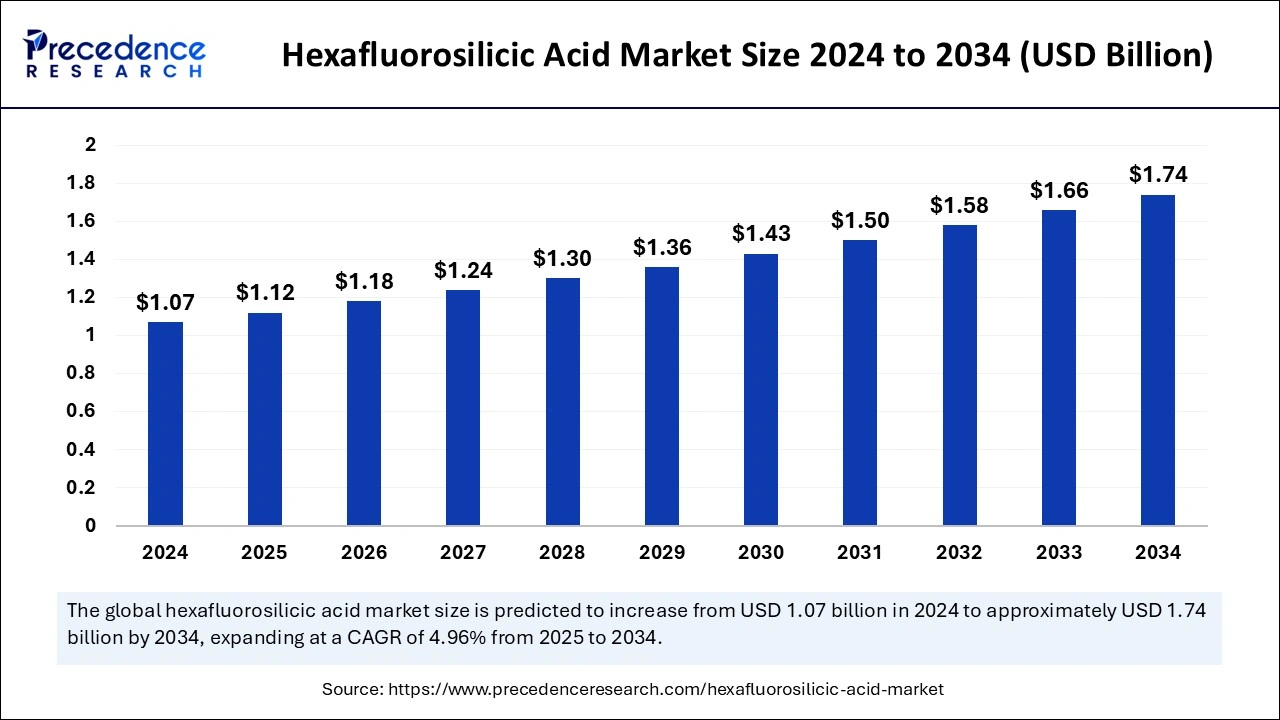

The global hexafluorosilicic acid market size is evaluated at USD 1.12 billion in 2025 and is forecasted to hit around USD 1.74 billion by 2034, growing at a CAGR of 4.96% from 2025 to 2034. The North America market size was accounted at USD 390 million in 2024 and is expanding at a CAGR of 4.91% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global hexafluorosilicic acid market size was estimated at USD 1.07 billion in 2024 and is predicted to increase from USD 1.12 billion in 2025 to approximately USD 1.74 billion by 2034, expanding at a CAGR of 4.96% from 2025 to 2034. Rising applications of hexafluorosilicic acid in sterilization technologies are the key factor driving market growth. Also, increasing awareness regarding oral hygiene coupled with the growing regulatory approvals on products can fuel market growth further.

Industrial Artificial Intelligence (AI) is a type of AI technology used for critical operations like force chain operation and storehouse of goods using advanced analytics. The hexafluorosilicic acid market is highly reliant on external factors such as temperature and pressure. AI considers all these factors to give real-time temperature and pressure control advice to generate the enhanced yield. Furthermore, AI can be utilized through the product and process development steps to boost product innovation.

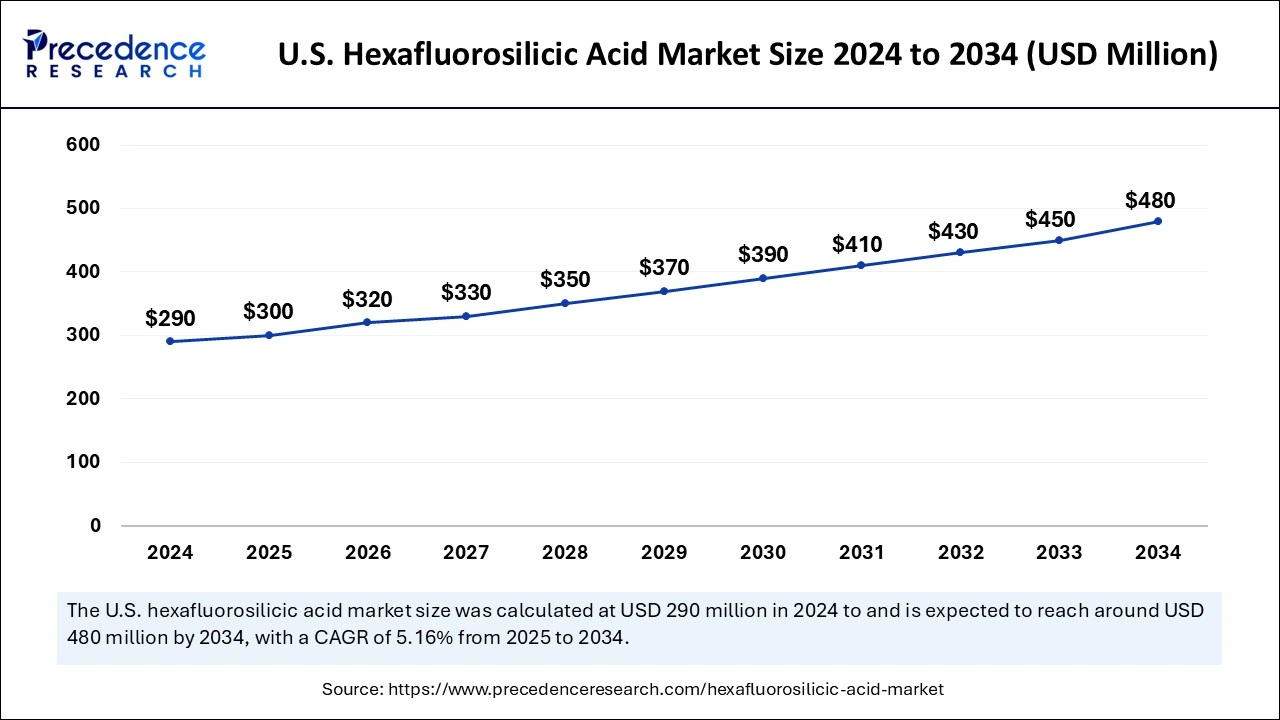

The U.S. hexafluorosilicic acid market size was exhibited at USD 290 million in 2024 and is projected to be worth around USD 480 million by 2034, growing at a CAGR of 5.16% from 2025 to 2034.

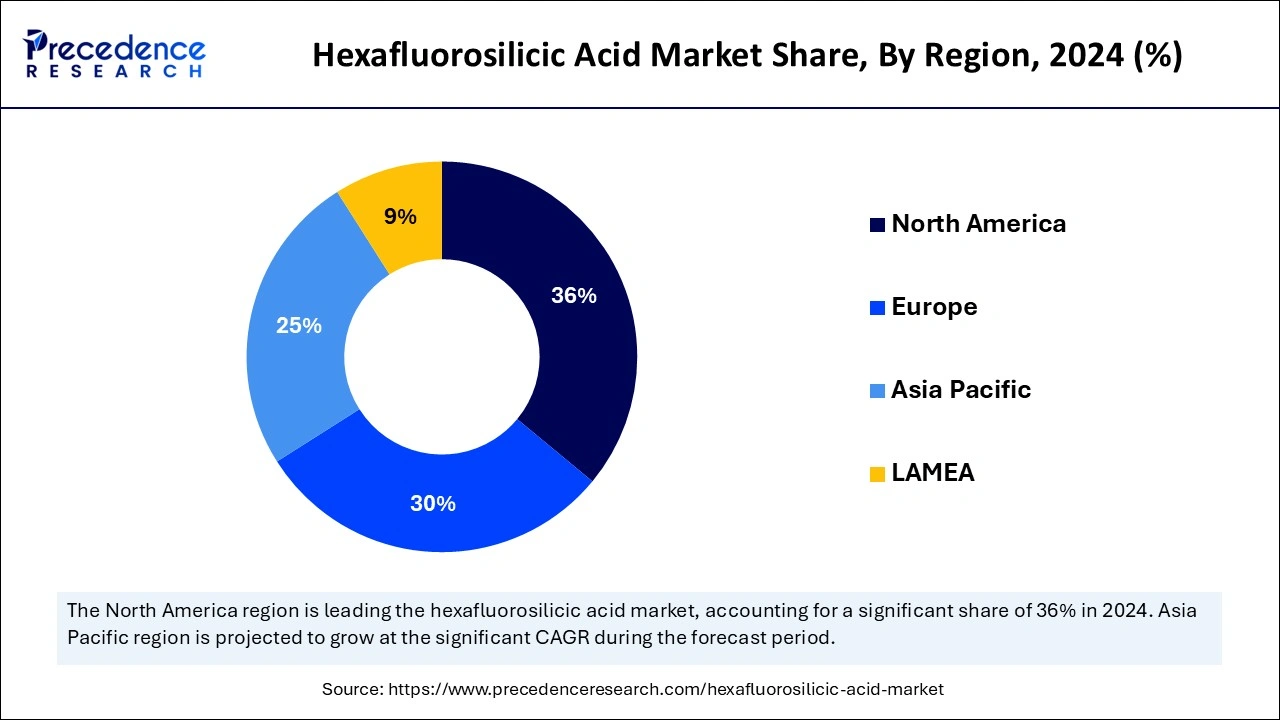

North America dominated the global hexafluorosilicic acid market in 2024. The dominance of the segment can be attributed to the region's escalating metal surface treatment and textile industries coupled with the rise in water fluoridation applications. Furthermore, the region's focus on improving dental health facilities can boost market growth during the forecast period. Future innovations and advancements in the region will likely help with market expansion soon.

Asia Pacific is expected to show the fastest growth in the hexafluorosilicic acid market over the studied period. The growth of the region can be credited to the increasing awareness of health benefits and government support for fluoridation practices across the region. Moreover, developing economies such as China and India have experienced significant growth in the chemical and textile industry.

Hexafluorosilicic acid is a type of chemical generally utilized as a source of fluoride. It is a corrosive, colorless liquid and can also be found in the gas state. It can be converted into various useful hexafluorosilicate salts. It's a key reagent for cleaving Si-O bonds. It is widely used in the surface transformation of calcium carbonate and in wood preservation, too. This compound can be produced industrially and naturally.

Top 5 Chemical companies in the world in 2025

| Country | Market Capitalization |

| ExxonMobil | USD 405.99 billion |

| Chevron Phillips Chemical | USD 283.03 billion |

| Reliance Industries | USD 200.2 billion |

| Linde | USD 193.46 billion |

| PetroChina | USD 166.89 billion |

| Report Coverage | Details |

| Market Size by 2034 | USD 1.74 Billion |

| Market Size by 2025 | USD 1.12 Billion |

| Market Size in 2024 | USD 1.07 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.96% |

| Leading Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Form, Purity Level, Application, End Use Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Surge in the agricultural sector

The hexafluorosilicic acid market is substantially impacted by the growth in the agriculture sector. Hexafluorosilicic acid is utilized in agricultural applications, especially as a raw material of fluorine in fertilizers, acting as a key nutritional ingredient for crops. In addition, the push for more agricultural yields and the increasing requirement for sustainable farming solutions have enabled farmers to seek advanced solutions to improve crop performance and overall soil health.

Environmental concerns

Using hexafluorosilicic acid can create environmental concerns, especially if not disposed of and handled properly. Its future impact on human health and aquatic ecosystems has facilities regulatory challenges and increased scrutiny. Moreover, strict safety and health regulations associated with the handling, preservation, and transportation of this acid can cause hurdles for manufacturers and end-users in the hexafluorosilicic acid market.

Growth of fluorosilicic acid facilities

The expansion of fluorosilicic acid facilities is the latest market trend. The hexafluorosilicic acid market is witnessing growth due to market players' escalation in production and storage facilities. This expansion trend enables companies to strengthen their product offerings to propel their market share. Furthermore, key market players are emphasizing increasing their operations to specific to the growing need for this versatile chemical. Commercially,hexafluorosilicic acid is used as a raw material in the manufacturing of glass, animal hides, and ceramics.

The liquid segment held the largest hexafluorosilicic acid market share in 2024. The dominance of the segment is due to the wide utilization of liquid compounds, particularly in municipal water systems, along with the growing demand for fluoridated water. The expansion in industrial processes increasingly requires liquid hexafluorosilicic acid for various purposes.

The powder segment is anticipated to grow at the fastest rate during the projected period. The growth of the segment is because of the ongoing developments in product applications and innovation in various forms. However, the powder form of the compound is very toxic and, hence, should avoid direct contact with the hands of the operator.

In 2024, the more than 90% segment led the hexafluorosilicic acid market by holding the largest share. The dominance of the segment can be credited to the increasing use of this range of purity compounds in high-end applications, which need strict control over impurities, hence holding a significant market share. Furthermore, the application of compounds across end-use chemical industries should be increased to ensure proper treatment.

The less than 50% segment is expected to show fastest growth during the forecast period. The growth of the segment is owing to the increasing demand for high-grade materials from several end-use industries, as this range purity compound is needed to carry out certain industrial processes. Moreover, the growing demand for water fluoridation in emerging economies like China and India can influence positive segment growth.

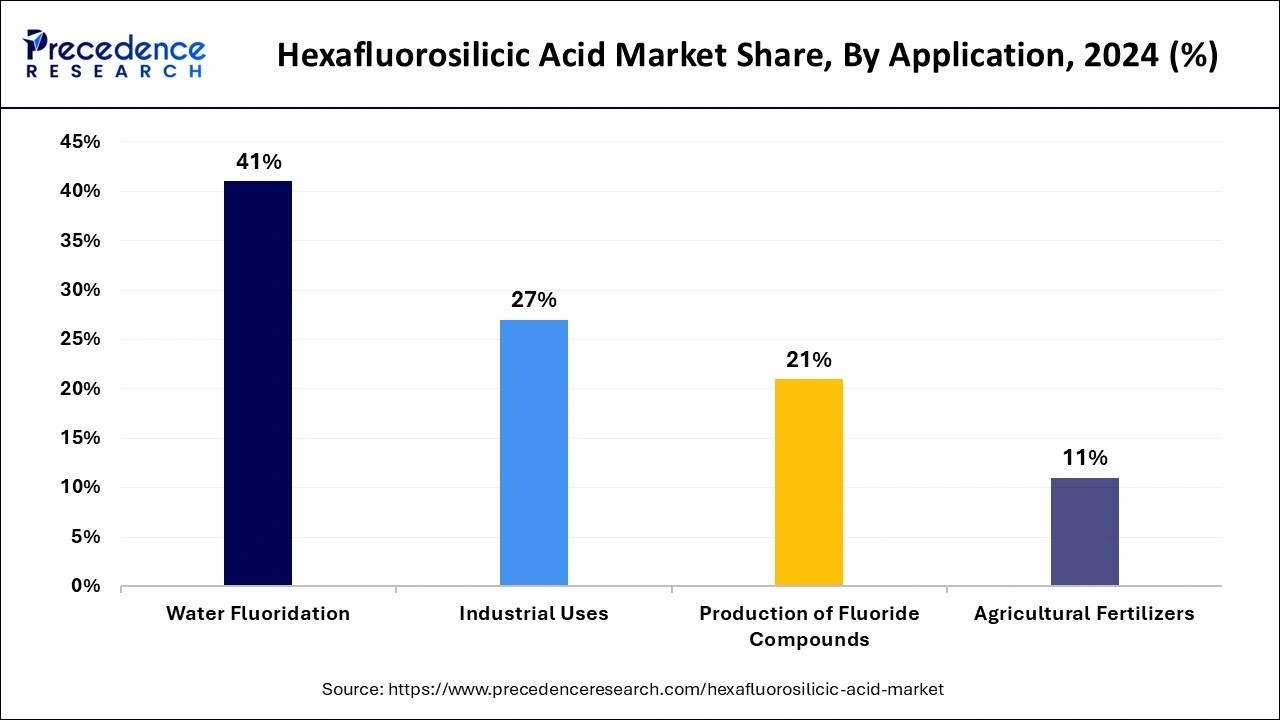

The water fluoridation segment dominated the global hexafluorosilicic acid market in 2024. The dominance of the segment can be attributed to the increasing focus on public health initiatives aimed at preventing dental issues. This application is important because it focuses on the significance of fluoride in community water supplies and its impact on decreasing cavities. Additionally, maximum levels of fluoridation can prevent caries by offering consistent and frequent contact with low levels of fluoride, preventing tooth decay further.

The industrial uses segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be linked to the rising importance and demand for compounds from various end-use industries for numerous industrial applications such as glass production and metal surface treatment. Also, the industrial segment requires hexafluorosilicic acid for many manufacturing processes.

The water treatment segment led the hexafluorosilicic acid market in 2024. The dominance of the segment can be credited to the extensive adoption of hexafluorosilicic acid for fluoridation purposes to improve overall dental health. Water treatment facilities are important to remove hazardous substances and contaminants from the water, which makes it safer and cleaner to drink. However, the large amount of fluoride used in water can be toxic, causing fluoride-induced tooth discoloration.

The chemical manufacturing segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be driven by the growing use of the compound in chemical manufacturing settings because it is a main ingredient in manufacturing various fluorinated chemicals. Moreover, the growth in the chemical industry, especially in emerging economies, is fuelling the demand for chemical intermediates like hexafluorosilicic acid.

By Form

By Purity Level

By Application

By End Use Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

March 2025

December 2024

August 2024