April 2025

High Performance Fibers Market (By Product: Carbon Fiber, Polybenzimidazole (PBI), Aramid Fiber, M5/PIPD, Polybenzoxazole (PBO), Glass Fiber, High Strength Polyethylene, Others; By Application: Electronics & Telecommunication, Textile, Aerospace & Defense, Construction & Building, Automotive, Sporting Goods, Others, and Others.) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

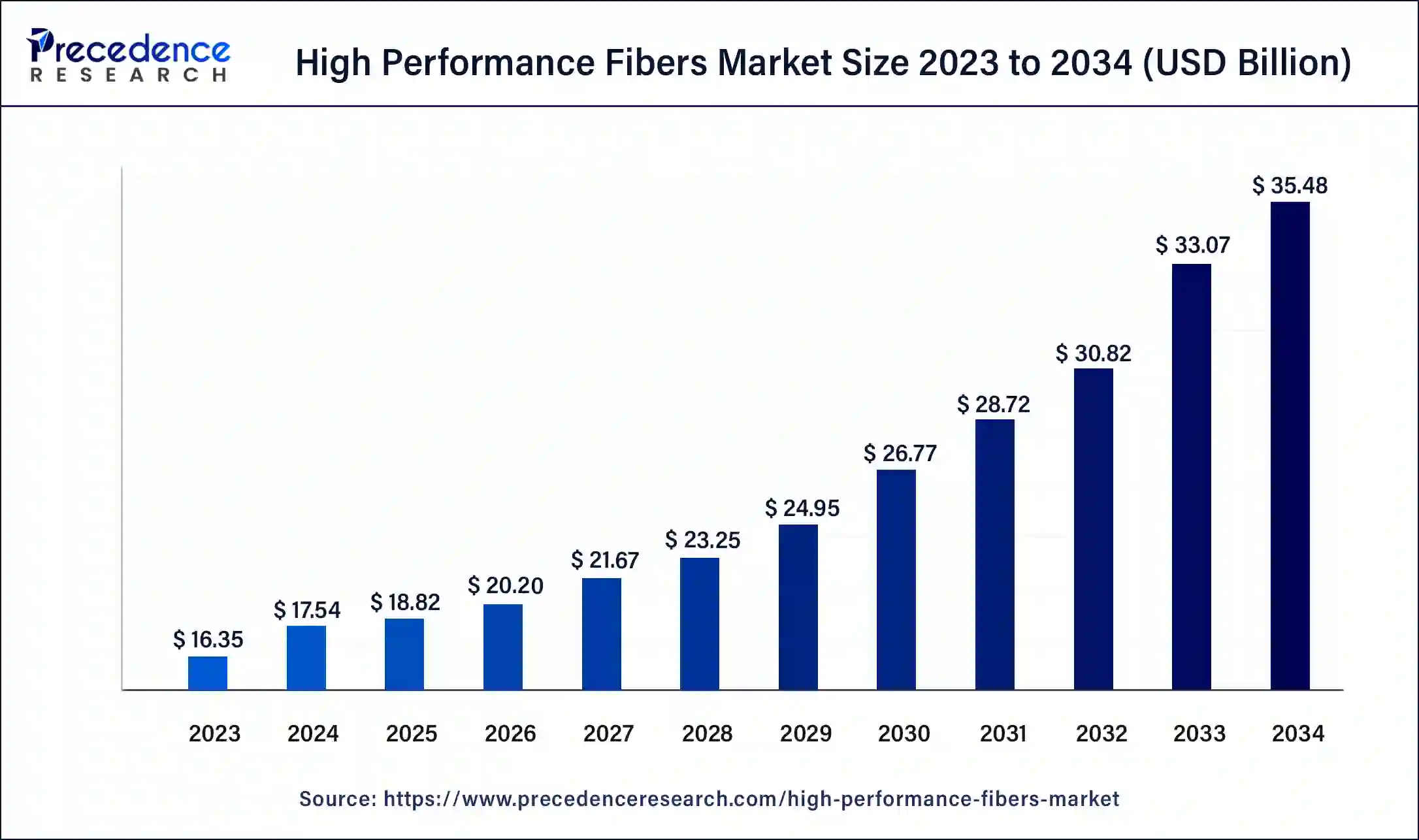

The global high performance fibers market size was USD 16.35 billion in 2023, calculated at USD 17.54 billion in 2024 and is expected to reach around USD 35.48 billion by 2034, expanding at a CAGR of 7.29% from 2024 to 2034. The high-performance fibers market is driven by the growing need across a range of applications for lightweight materials with exceptional strength.

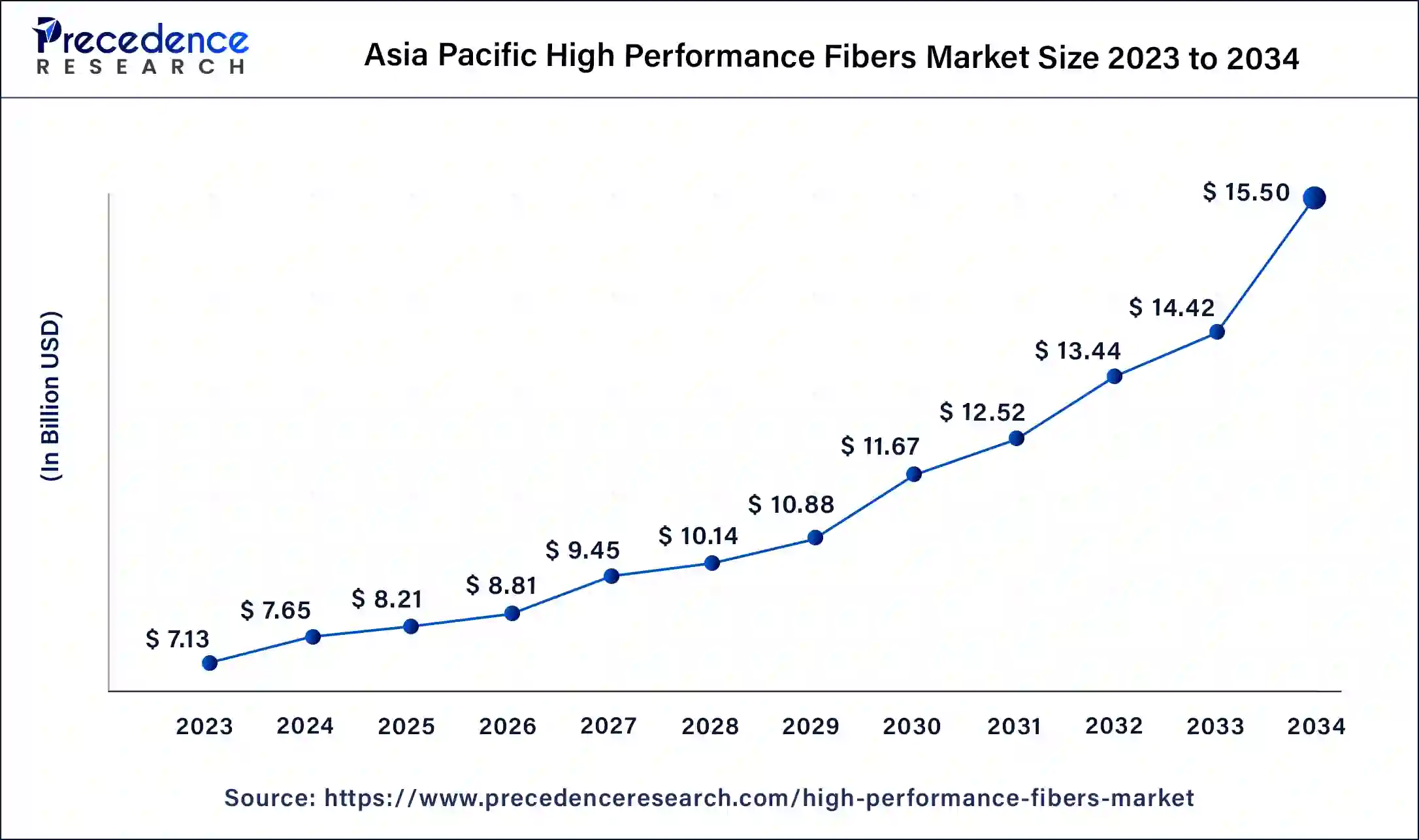

The Asia Pacific high performance fibers market size was exhibited at USD 7.13 billion in 2023 and is projected to be worth around USD 15.50 billion by 2034, poised to grow at a CAGR of 7.31% from 2024 to 2034.

Asia Pacific dominated in the high-performance fibers market in 2023. The area makes significant R&D investments to create cutting-edge fiber technologies. The nations of South Korea and Japan are renowned for their advances in material sciences and nanotechnology. Strong linkages between academic institutions and industrial participants foster ongoing innovation and advancements in fiber characteristics and applications. The area's governments support manufacturing and applying high-performance fibers by offering subsidies and other rewards. This assistance keeps regional producers competitive in the international market.

North America shows significant growth in the high-performance fibers market during the forecast period. North America, in particular the US and Canada, has a developed industrial infrastructure that facilitates the research and manufacturing of high-performance fibers. Many top industries and research centers that invest significantly in innovation and technical developments are in the region. New and improved high-performance fibers with improved qualities, such as higher tensile strength, better thermal stability, and more resistance to chemicals and abrasion, have been developed due to ongoing materials science research and development.

Specialized applications requiring superior strength, stiffness, heat resistance, or chemical resistance are why high-performance fibers are developed. In this market, aramid, carbon, polyethylene, glass, and others are some of the major high-performance fibers. The high performance fibers market is experiencing exponential growth with the rising development of sustainable solutions in the industry. Integration of cutting-edge technologies and innovation of new structures create significant opportunities for the market to grow.

| Report Coverage | Details |

| Market Size by 2034 | USD 35.48 Billion |

| Market Size in 2023 | USD 16.35 Billion |

| Market Size in 2024 | USD 17.54 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.29% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing focus on sustainable fiber development

Consumer attitudes are shifting in favor of ecologically friendly items. Products that are both high-performing and made responsibly are becoming increasingly in demand. To meet this demand, producers have been forced to give the creation of sustainable fibers top priority. Businesses are using sustainable fibers as a major differentiator for their products in the marketplace. A wide range of people are drawn to eco-conscious branding, including customers who care about the environment and companies trying to boost their sustainability credentials. This drives the growth of the high-performance fibers market.

Advancements in manufacturing processes

Automation and sophisticated control systems have increased the accuracy and consistency of fiber production processes. This guarantees homogeneity in the fiber qualities for high reliability and performance applications. Real-time monitoring and feedback systems are integrated to enable quick manufacturing adjustments, lowering faults and raising overall product quality.

High-performance fibers are guaranteed to meet strict quality standards due to improved testing and characterization methods. Techniques like scanning electron microscopy (SEM) and atomic force microscopy (AFM) offer in-depth knowledge of the characteristics and structure of fibers. Creating global standards and certification procedures guarantees that fibers fulfill the necessary performance standards for specific uses. Adherence to these guidelines is essential for gaining market acceptance and maintaining competitiveness.

Issues surrounding the recycling and disposal of high -performance fibers

Complex polymers and cutting-edge materials are frequently used to create high-performance fibers. Its intricacy adds difficulty to the recycling process. These materials are typically unsuitable for traditional recycling techniques, which makes it challenging to decompose and reprocess the fibers. High-performance fiber disposal done incorrectly can have serious adverse effects on the environment. These fibers can linger in the atmosphere for extended periods and are frequently non-biodegradable, which adds to pollution. The expenses and complications involved with disposing of non-biodegradable items are rising due to the tightening of environmental restrictions. This limits the growth of the high-performance fibers market.

Development of bio-based and sustainable high-temperature fibers

The development of bio-based and sustainable fibers is greatly aided by the pressing need to minimize carbon footprints and the public's increased awareness of environmental issues. Traditional high-performance fibers, such as those derived from petrochemicals, have difficulties in recycling and are derived from non-renewable resources, contributing to environmental damage. Because bio-based fibers are made from renewable resources like plants and biopolymers, they have a smaller negative influence on the environment. Sustainable fibers can be made recyclable or biodegradable, encouraging a circular economy and lowering waste. Rising customer aversion to eco-friendly items may propel the market need for high-temperature bio-based fibers. This opens an opportunity for the growth of the high-performance fibers market.

The rising popularity of aramid fibers owing to their durability and recyclability

The development of bio-based and sustainable fibers is greatly aided by the pressing need to minimize carbon footprints and the public's increased awareness of environmental issues. Traditional high-performance fibers, such those derived from petrochemicals, have difficulties in recycling and are derived from non-renewable resources, contributing to environmental damage. Because bio-based fibers are made from renewable resources like plants and biopolymers, they have a smaller negative influence on the environment. Sustainable fibers can be made recyclable or biodegradable, encouraging a circular economy and lowering waste. Rising customer aversion to eco-friendly items may propel the market need for high-temperature bio-based fibers. This opens an opportunity for the growth of the high-performance fibers market.

The polybenzimidazole (PBI) segment is observed to be the fastest growing in the high-performance fibers market in 2023. PBI is increasingly demanding protective gear for industrial workers, firefighters, and military personnel. PBI is crucial in these industries due to its resilience to flames and capacity to retain its integrity in extreme heat. Materials that exhibit dependable performance in harsh environments are essential to the aerospace and defense industries. PBI fibers have high strength and thermal stability, which makes them a popular choice for insulation and heat shielding in aircraft components.

PBI is becoming the material of choice for insulating components in electronic devices due to the downsizing of these devices and the demand for materials that can survive extreme temperatures and severe conditions.

The carbon fiber segment shows a significant growth in the high-performance fibers market during the forecast period. Because carbon fiber composites give design engineers better materials, they alter the production process and the characteristics of the final product. Because of their high stiffness, high tensile strength, high chemical resistance, low weight, high-temperature tolerance, and low thermal expansion, they have become increasingly popular in various industries.

Carbon fiber is twice as stiff as steel, weighs less, and is more essential. Therefore, it can be used to maximize part performance and is especially helpful in the construction, military, aerospace, automobile, and other industries. When other materials in a design have poor performance or higher lifecycle costs, carbon fiber might be used in their stead.

The aerospace & defense segment dominated the high-performance fibers market in 2023. Lightweight aircraft and defense vehicles are essential for increased maneuverability and fuel efficiency. High-performance fibers can save a lot of weight because they are significantly lighter than conventional materials like metals. For example, aircraft constructions substantially use carbon fiber composites, which reduce weight without sacrificing strength or performance. High-performance fibers are crucial in defense applications because they absorb and distribute energy to improve protection against bullets, shrapnel, and other dangers in personal protective equipment (PPE) like helmets, vests, and other gear. Since they are so durable and impact-resistant, armored materials like Kevlar are widely used in body armor.

The automotive segment shows significant growth in the high performance fibers market during the forecast period. A key tactic for increasing fuel economy is lightening the car's weight. Compared to traditional materials like steel and aluminum, high-performance fibers are substantially lighter while still providing the required strength and durability. In addition to using less gasoline, lightweight cars perform better in handling, braking, and acceleration. Because of these improved qualities, high-performance fibers are a material of choice for automakers.

Segments Covered in the Report

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

November 2024

February 2024

October 2024