March 2024

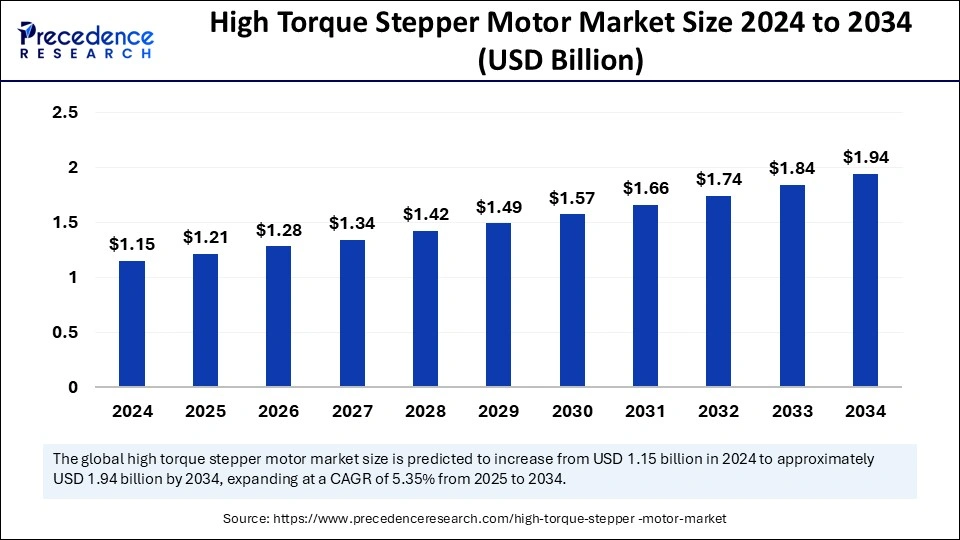

The global high torque stepper motor market size is calculated at USD 1.21 billion in 2025 and is forecasted to reach around USD 1.94 billion by 2034, accelerating at a CAGR of 5.35% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global high torque stepper motor market size accounted for USD 1.15 billion in 2024 and is predicted to increase from USD 1.21 billion in 2025 to approximately USD 1.94 billion by 2034, expanding at a CAGR of 5.35% from 2025 to 2034. The market growth is attributed to the increasing adoption of automation, robotics, and precision motion control solutions across the industrial, automotive, and healthcare sectors.

Industrial automation experiences a fundamental transformation through artificial intelligence as it improves the operational effectiveness of motion control systems while delivering enhanced precision and adaptable functionality. The performance of motors receives optimization through advanced algorithms that use load predictions to modify torque outputs during real-time operations. AI-based predictive maintenance systems avoid breakdowns by detecting malfunctions in advance, which results in uninterrupted operation in robotics manufacturing and aerospace industries. The technological improvements enhance automated systems through improved operational reliability along with lower maintenance costs, and increased operational flexibility.

The high torque stepper motor market demonstrates substantial growth with numerous industries adopting automation systems. Step motors convert electrical commands into mechanically exact motions to perform accurate positioning with no need for additional monitoring systems. These electromechanical devices are known as high torque stepper motors. These motors excel in delivering exact movements, which makes them perfect for use in devices such as medical equipment, along with CNC machines and 3D printers. Developments in miniaturized electronics enabled producers to create powerful, compact stepper motors, which increased the applications these motors support. These motors enable renewable energy system growth through their use in solar tracking mechanisms.

| Details | Details |

| Market Size by 2034 | USD 1.94 Billion |

| Market Size in 2025 | USD 1.21 Billion |

| Market Size in 2024 | USD 1.15 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.35% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Power, Drive Type, Torque, Speed, Motion, Application, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising adoption of high-performance robotics

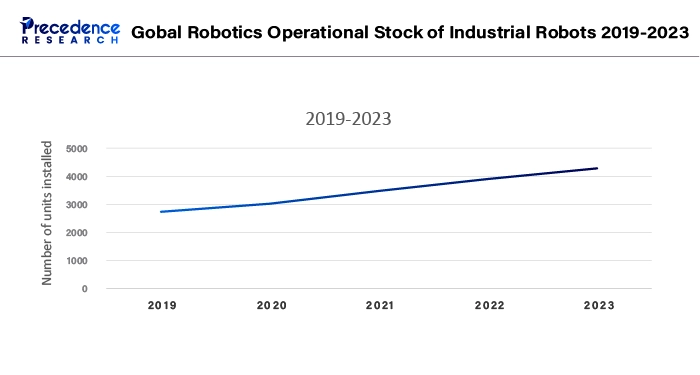

The growing demand for high-performance robotics drives the high torque stepper motor market expansion in the coming years. Robots continue to penetrate deeper into multiple segments of industries as the data demonstrates an increase in their widespread adoption. Furthermore, the high torque stepper motors face growing demand as new developments advance the robotics for various sectors.

The logistics and healthcare sectors, together with precision manufacturing, use cobots that cooperate with humans while requiring high torque motors to ensure performance quality without producing vibrations. High torque stepper motors are essential to accurate and dependable operations, as they play a vital role in robotic process automation for warehouses and surgical robotics applications in healthcare.

Competitive pressure from alternative motor technologies

Competition from alternative motor technologies is expected to hinder the market in the coming years. Market growth remains restricted as alternative motor systems diminish the demand for stepper motors. The market growth of high torque stepper motors faces resistance from alternative motor technologies, which include servo motors and brushless DC motors. High-end applications currently restrict the utilization of stepper motors, as advanced motor technologies provide superior speed control and reduced vibration performance.

Rising hybrid technologies

Increasing advancements in hybrid stepper motor technology are expected to enhance adoption, thus further creating immense opportunities for the players competing in the market. Hybrid stepper motor technology is growing stronger due to continual advancements, which boost its market acceptance. Hybrid stepper motors unite the features from permanent magnet and variable reluctance designs to provide enhanced torque density along with enhanced efficiency.

Modern research investigates methods to decrease thermal output and enhance power effectiveness with AI-controlled system operations. The competitive position of stepper motors in exacting industries increases through ongoing technological developments. Furthermore, hybrid stepper motors are finding new application areas within electric vehicles (EVs) with the rising requirements for advanced motion control capabilities.

The hybrid stepper motors segment dominated the high torque stepper motor market during the forecasting period due to its high efficiency and low stepping rate capabilities, which provide necessary motion control accuracy to diverse applications. Their device combines permanent magnet and variable reluctance principles to provide exceptional performance attributes, including high torque density and precise control. High inertia loads, together with precise positioning requirements, lead these motors to work well in industrial automation robotics and medical equipment applications of this combo design.

The permanent magnet (PM) stepper motors segment is expected to grow at the fastest rate during the forecast period of 2024 to 2034, owing to their basic structure and affordable price points relative to hybrid designs in applications when cost becomes fundamental. Permanent magnets inside these motors enable better torque operation and efficiency levels. The market demands PM stepper motors as they deliver reliable performance and cost-effectiveness suitable for consumer electronics and office automation equipment applications.

The medium (100 W to 500 W) segment held the largest share of the high torque stepper motor market in 2024. Various industrial applications used medium power, high torque stepper motors in the 100 W to 500 W power range as their dominant operating component throughout recent years. The increasing automation throughout manufacturing operations has provided the additional foundation for medium power stepper motors' status, as they efficiently manage tasks that need both precision and efficiency.

The high (500 W to 1000 W) segment is anticipated to grow with the highest CAGR during the studied years as businesses require motors that fulfill heavy work processes without sacrificing precision. The manufacturing sector, along with automation, deserves credit for powering this market expansion because high-torque, reliable motors represent their requirements. The acceptance of high-power stepper motors in different industrial applications increases as the technological advancements in motor design merge permanent magnet and variable reluctance elements into hybrid stepper motors.

Full-step drive configurations dominated the market as they offered simple operation at an affordable price suitable for applications that needed strong torque control. The industries that employed industrial machinery together with material handling equipment accepted full-step drives, as these devices delivered reliable performance combined with straightforward setup.

The micro-stepping segment is projected to expand rapidly in the coming years. Each single step gets divided through micro-stepping into smaller areas, which the motor windings power through proper current proportions. The industries of robotics and CNC machinery, along with medical devices, use micro-stepping drives for achieving enhanced positioning accuracy combined with noise reduction goals.

The 5 Nm to 10 Nm segment dominated the global market in 2024, as they provide flexibility that matches various industrial requirements. These motors serve industrial automation systems and robotics applications, and CNC machinery as they enable precise control of motion at varying load levels. This torque-output size ratio delivers an excellent choice for equipment designers who need efficiency alongside peak performance. The production costs of motors within this torque specification area make them widely accessible for many industrial sectors.

The 10 Nm to 15 Nm segment is projected to grow at the fastest rate in the future years. Industrial applications demand higher torque motors, which explains why this projection has emerged. The manufacturing of automotive components, together with heavy machinery production and the aerospace industry, continue to adopt motors with torque between 10 Nm and 15 Nm as they improve system operational effectiveness while satisfying advanced equipment standards. Furthermore, the growing utilization of automation and production line machinery for higher torque motors.

The 100 to 200 rpm segment dominated the high torque stepper motor market during the forecasting period. These motors combine sufficient speed rates with powerful torque capabilities, which makes them practical for multiple industrial usages. The manufacturing industry, along with automation, selects motors that operate between 100 to 200 RPM as these motors deliver precise control while maintaining consistent performance. The ability to deliver high torque at standard workflow speeds makes operations that involve conveyor systems and assembly lines function with optimal efficiency.

The 200 to 300 rpm segment is projected to grow rapidly in future years, owing to the rising needs for faster yet accurate motion control systems in high-tech manufacturing and robotic applications. The domain of automated pick-and-place machines along with high-speed printing equipment sees a rise in demand for motors from this range, as it enables both fast operation and torque retention. Modern stepper motors receive technological improvements that improve their ability to output reliable torque at elevated speeds.

The open loop segment led the global market in 2024 due to their low cost and straightforward design, which enables accurate position control without real-time feedback systems. Consumer electronics and robotic industries chose open-loop systems as they provide reliable, straightforward performance while requiring minimal implementation. Furthermore, the open-loop stepper motor operates by a pulse sequence that provides limited time intervals, so it matches applications needing both position and speed control.

The closed-loop segment is anticipated to grow at the fastest rate in the market during the forecast period, as it requires precision automation alongside enhanced efficiency resulting from the rising demand for industrial automation. Modern technologies incorporated into closed-loop systems enable better control together with improved efficiency that matches the prevailing industrial trend toward automated systems and precise operations across different industrial sectors.

The automotive segment dominated the high torque stepper motor market. The high level of prominence in the automotive sector results from stepper motors being integrated into essential automotive systems, such as throttle control systems, headlight positioning mechanisms, and HVAC systems. Vehicle performance and safety improve due to high-torque stepper motors, which provide reliable and accurate functions. Automobile industries continue to drive up their demand for these motors as they are fundamental components in battery management and energy-efficient systems of electric and hybrid vehicles. The rising demand for automated systems and advanced driver-assistance systems (ADAS) in automobiles proves that the automotive sector remains at the forefront of market leadership.

The medical equipment segment is expected to grow at the fastest rate during the forecast period of 2025 to 2034, owing to the growing medical usage of stepper motors, which

includes crucial devices and high-speed manufacturing systems. High torque stepper motors are becoming more prevalent in medical devices, as required precise motion control among equipment, including MRI scanners and robotic surgical instruments. The medical demands for minimally invasive procedures, together with accurate diagnostic tools, contribute to the rising market demand for these motors in healthcare applications.

The direct sales segment held the largest share of the high torque stepper motor market during the forecasting period, as manufacturers endorse this method to develop strong client relationships for customized solutions alongside urgent technical help. High torque stepper motors achieve better customer satisfaction and increased loyalty through this sales method, which serves industries dependent on customized motor specifications. Through direct sales, manufacturers gain enhanced control over pricing together with branding, which results in better profitability.

The indirect sales segment is anticipated to grow with the highest CAGR in the studied years, owing to the growing demand for stepper motors across multiple industries, including industrial equipment alongside consumer electronic devices. The segment grows rapidly as different industries need precise control systems. High torque stepper motors have gained increased market adoption as different applications require accurate motion control capabilities.

Asia Pacific led the high torque stepper motor market, capturing the largest share in 2024, owing to its expanding automation industries together with investments aimed at precise manufacturing. The Production Linked Incentive (PLI) scheme launched by the Indian government stimulates stepper motor manufacturing in regional markets, thereby strengthening local production capabilities.

The semiconductor manufacturing progress in Taiwan, together with advancements in semiconductor production, has resulted in the acceptance of high torque stepper motors for wafer processing and electronic assembly applications. Furthermore, the increasing demand for high torque stepper motors with growing automation and robotics adoption further facilitates the high torque stepper motor market in this region.

North America is projected to host the fastest-growing high torque stepper motor market in the coming years. The growing market demand for high torque stepper motors continues, as these motors are essential for precise robotics systems, automotive assembly lines, and CNC machinery. Japan, together with South Korea, showed major investment in smart manufacturing along with IoT-integrated motor systems.

By Type

By Power

By Drive Type

By Torque

By Speed

By Motion

By Application

By Distribution Channel

By Regions

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2024

March 2025

September 2024

August 2024