May 2025

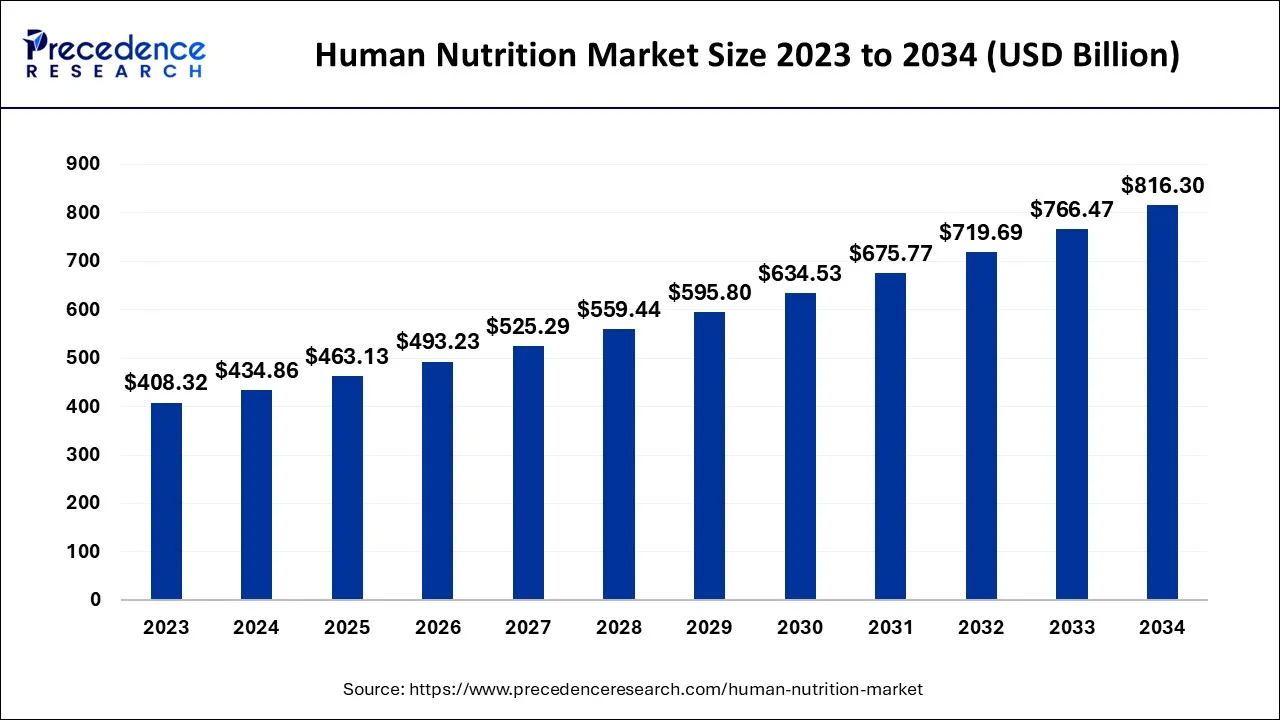

The global human nutrition market size accounted for USD 434.86 billion in 2024, grew to USD 463.13 billion in 2025 and is expected to be worth around USD 816.30 billion by 2034, registering a CAGR of 6.5% between 2024 and 2034. The North America human nutrition market size is calculated at USD 1.51 billion in 2024 and is estimated to grow at a CAGR of 7.29% during the forecast period.

The global human nutrition market size is calculated at USD 434.86 billion in 2024 and is projected to surpass around USD 816.30 billion by 2034, growing at a CAGR of 6.5% from 2024 to 2034.

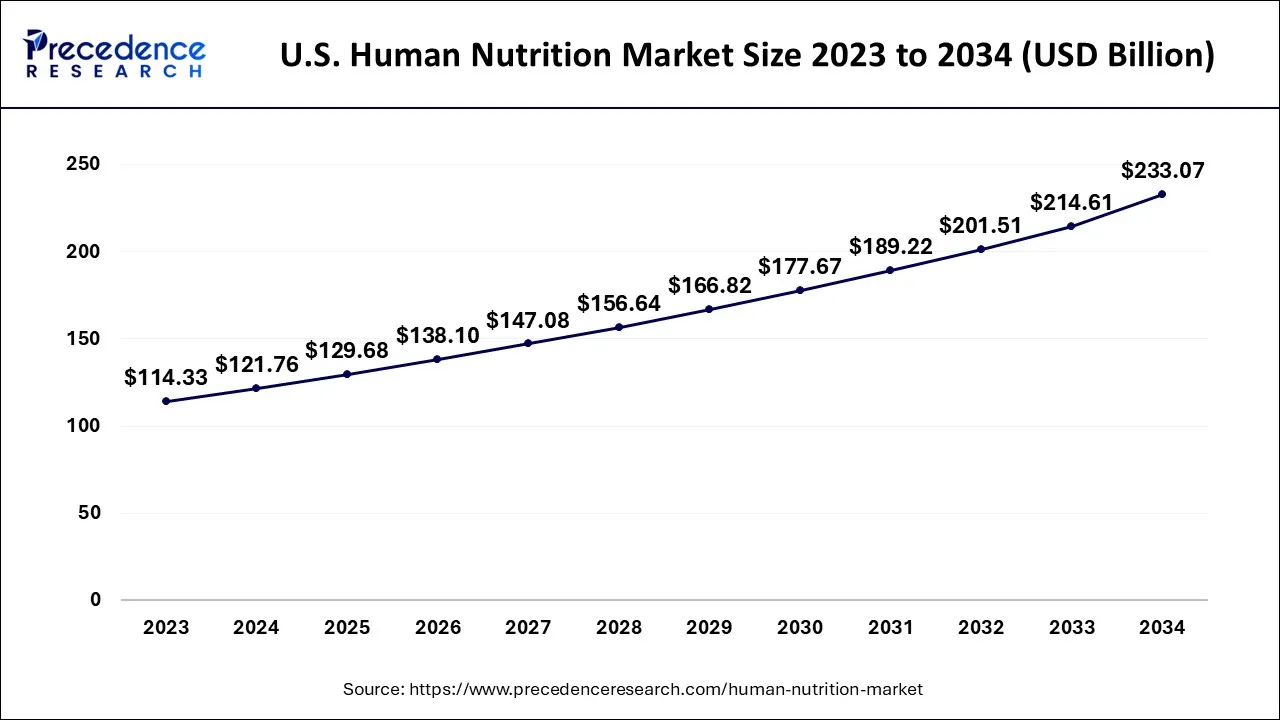

The U.S. human nutrition market size is exhibited at USD 121.76 billion in 2024 and is projected to be worth around USD 233.07 billion by 2034, growing at a CAGR of 6.71% from 2024 to 2034.

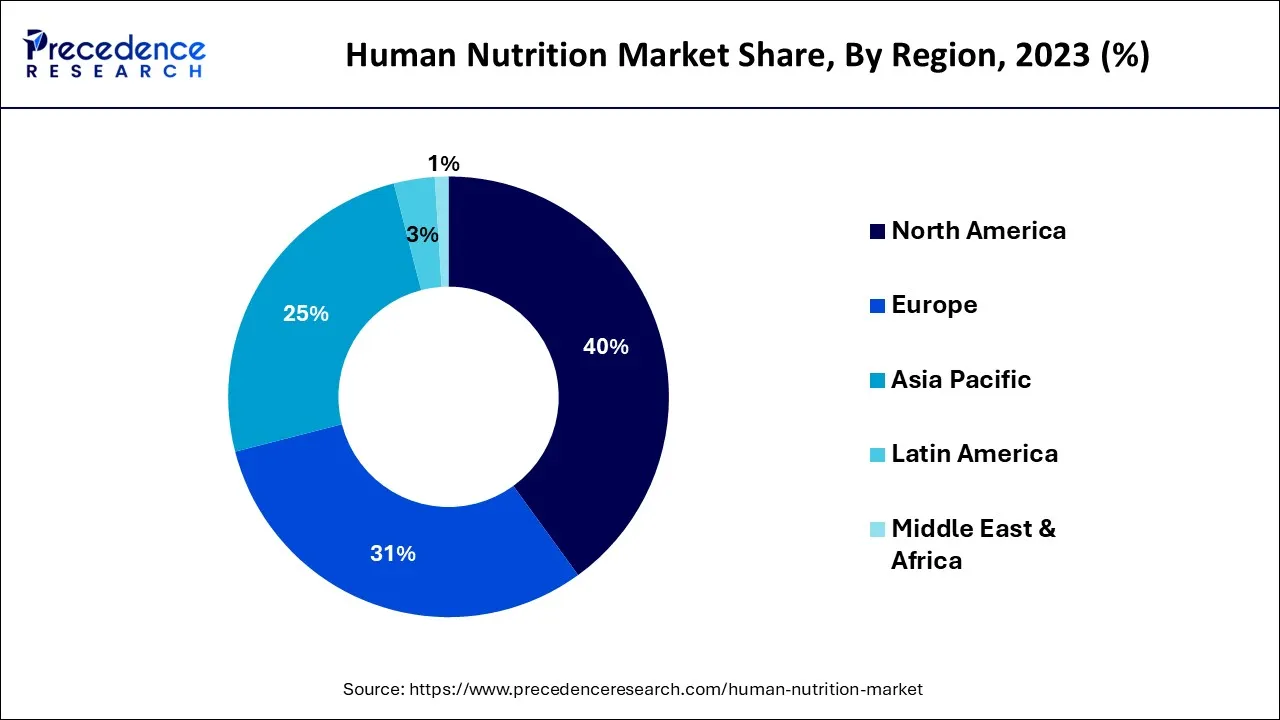

North America dominates the global market for human nutrition. The high prevalence of chronic diseases like diabetes, cancer, hypertension, heart disease, stroke, respiratory illnesses, rheumatoid arthritis, obesity, and oral diseases, as well as the growing emphasis on healthy lifestyles in the region have been supplementing the growth of human nutrition market in North America. Additionally, the willingness of people to buy premium nutrition-based products for health benefits acts as a driver for the market’s growth in North America

The region will sustain its dominance in the market due ot the well-established nutraceutical and functional food industries. The United States and Canada are expected to be the largest contributors to the market’s development owing to the rising population and enormous demand for nutrition supplements and dietary supplements in the countries. Moreover, the expanding health & wellness and clean label trends are primarily to drive this region's high market share.

Asia Pacific is expected to witness the fastest growth during the forecast period. The rapid population growth and urbanization, rising disposable income and rising standards of living, growing emphasis on eating a healthy diet are subject to propel the growth of the market during the forecast period. In addition, the growing knowledge of the health advantages of nutritional supplements are all factors that are contributing to the region's rapid growth.

The global human nutrition market revolves around the production, development, innovation and distribution/sales of nutritional products such as supplements. Human nutrition is an established science of food and its relation to health, and it is the process of people receiving and processing the nutrients necessary for life. Nutrients are the chemical compounds extracted from food required for a person's diet. Nutrients are necessary for living a healthy life, and they are essential for playing a variety of vital life roles, like the promotion of growth and development, the provision of energy, and the regulation of bodily processes.

In recent years there has been an introduction of many unhealthy dietary trends, such as eating foods with high sugar, salt, and fat content that may appear more rewarding but are detrimental to health. This contributes to the growth of the human nutrition market as there is a rising demand for an intervention for a healthier diet.

Growing awareness about healthy food alternatives and fortified food products in the market is leading to the growth of the human nutrition market.

Developed economies have a higher disposable income when compared to underdeveloped or developing countries. People with a higher disposable income can choose the best diet per their preferences and health conditions. The rising disposable income is one of the factors leading to the growth of the human nutrition market.

There is rising health consciousness worldwide as consumers are becoming more aware of their food choices and more concerned about living healthier lives. This is increasing the demand for food products like health supplements, increasing the growth of human nutrition.

| Report Coverage | Details |

| Market Size in 2024 | USD 434.86 Billion |

| Market Size by 2034 | USD 816.30 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.5% |

| Largest Market | North America |

| Fastest Growth Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By Distribution Channel, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising disposable income

People have a more remarkable ability to spend or save money as they see fit when their disposable income rises, which increases the consumption of nutrient-rich food. With more money available, households can choose to eat more hygienically and by preference. Low-income individuals consume foods with poor nutritional value, such as sugary beverages. People experiencing food insecurity or poverty may find it challenging to maintain good health, manage a chronic illness, eat a healthy diet, or combine all three for various reasons, such as lack of money or resources, conflicting priorities, and stress. Additionally, those affected by food insecurity or poverty will likely encounter additional resource-related difficulties, such as housing instability and energy insecurity, which can harm their ability to manage their health, nutrition, and diseases. Thus, disposable income is necessary for consuming a healthy and nutritious diet that drives the human nutrition market.

Socioeconomic limitations

It is a well-known fact that the diets that are healthy cost more than the ones that are unhealthy. Economic factors have a significant influence on what people eat, and this is especially true for those who are less well-off. Studies have revealed that lower socioeconomic groups frequently choose less expensive foods. Sadly, these inexpensive food options are also less wholesome. While considered nutritious by lower income groups, fruits and vegetables are also seen as being more expensive or unaffordable; as a result, wealthy families enjoy vegetables and fruits of greater variety than poorer families are unable to. Low-income families typically choose diets primarily on cost; their meals are less nutrient-dense, more expensive, and have fewer vegetables and fruits. These decisions may result in insufficient essential micronutrients, poverty-driven hidden hunger, excessive calorie consumption, and increased obesity rates. These factors restrain the human nutrition market.

Growing demand for fortified food products

According to the Food and Agricultural Organization of the United Nations (FAO) and the World Health Organization (WHO), food fortification is intentionally enhancing food's nutritional quality. The nutrients lost during food processing or storage can be replaced by fortifying or enriching the food. Micronutrients include vitamins, minerals, and vital nutrients found in fortified foods, and they are essential for creating enzymes, hormones, and other compounds contributing to growth and development. Our bodies need these micronutrients in tiny quantities.

Fortified food prevents diseases brought on by nutritional deficiencies, benefits during pregnancy, aids in the growth and development of children, fulfills dietary requirements, and benefits the elderly. Fortified food is becoming increasingly popular due to its many advantages, which will support the expansion of the human nutrition market.

The probiotics segment dominated the human nutrition market. Live beneficial yeasts and bacteria already present in the body are combined to produce probiotics. Usually, bacteria are regarded negatively as an organism that causes sickness. However, our body constantly carries good and bad bacteria. Good bacteria in probiotics help keep the human body healthy and functioning efficiently. This beneficial bacterium assists us in various ways, including eradicating harmful bacteria when there is excess and improving overall health.

Recently, probiotics have become more and more popular. For instance, according to a report by the Natural Marketing Institute (NMI) that DuPont Nutrition & Biosciences commissioned, US consumers' daily use of probiotic supplements grew by 66%. During the anticipated period, the market for vitamins and proteins will also expand significantly.

The market for human nutrition was led by the OTC segment within the distribution channel segment in 2023. A substantial percentage can be ascribed to customers' widespread knowledge of the benefits of consuming various dietary supplements and their regular diet, which supports OTC sales. The prevalence of such sales channels in developing nations, the presence of a wide range of products, and the discounts offered are additional factors that have helped this segment take the lead in the market. These factors will likely positively impact the growth of this market segment during the forecast period.

The dietary supplements segment is expected to hold the largest share of the market during the forecast period. Dietary supplements improve the overall health of consumers and fill the nutrient gaps left in the daily diet. Human nutrition products like nutritional supplements are gaining popularity as people become more health conscious and the income levels of consumers are increasing. The rising focus on wellbeing and better health along with the rising risks of chronic diseases, especially cardiac diseases and diabetes will boost the demand for dietary supplements in the upcoming period while fueling the segment’s growth.

On the other hand, the infant nutrition segment is expected to show the fastest growth during the forecast period. The rising concerns over proper growth of children along with rising risks of pediatric diseases across the globe are propelling the segment’s growth. Infant nutrition products offer the proper amount of minerals, vitamins and other nutritional factors for kids. The demand for infant nutrition products is supposed to rise due to the rising cases of premature births.

Segment Covered in the Report

By Type

By Distribution Channel

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

May 2025

May 2025

November 2024