May 2025

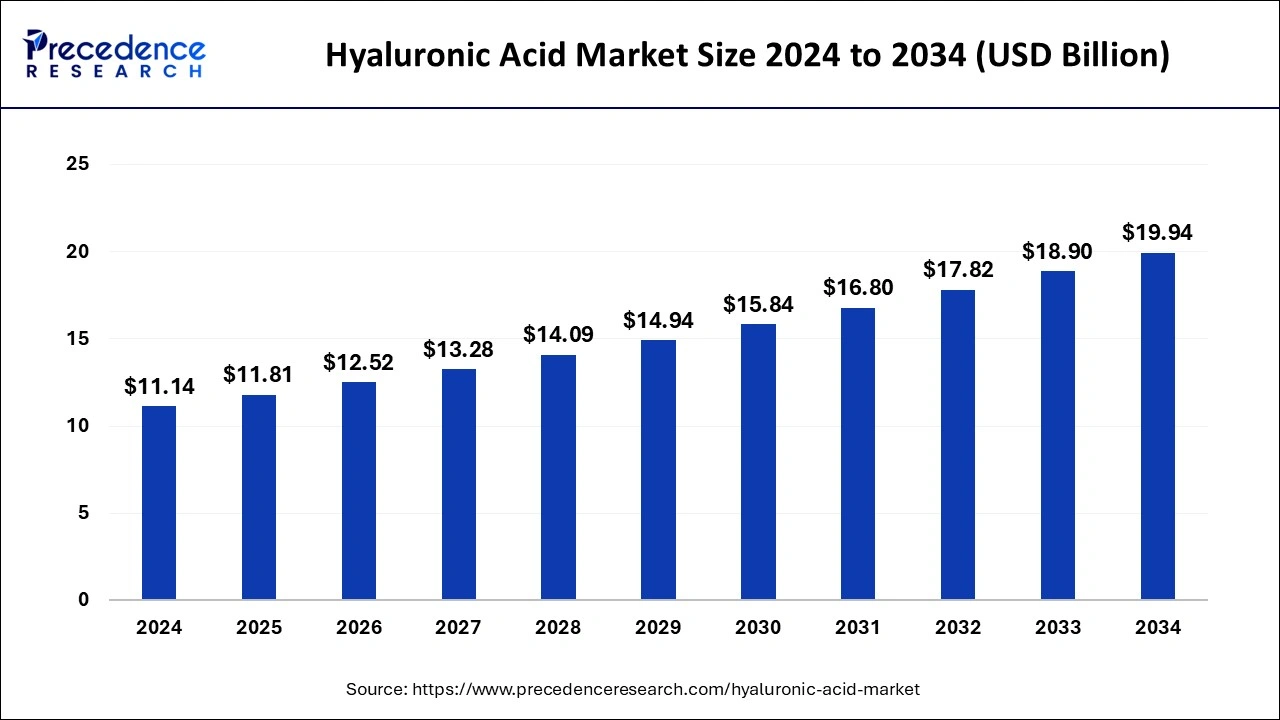

The global hyaluronic acid market size is calculated at USD 11.14 billion in 2025 and is forecasted to reach around USD 19.94 billion by 2034, accelerating at a CAGR of 5.99% from 2025 to 2034. The North America hyaluronic acid market size surpassed USD 4.90 billion in 2024 and is expanding at a CAGR of 6.11% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global hyaluronic acid market size was estimated at USD 11.14 billion in 2024 and is predicted to increase from USD 11.81 billion in 2025 to approximately USD 19.94 billion by 2034, expanding at a CAGR of 5.99% from 2025 to 2034. The world's population is getting older, and people are becoming more conscious of the value of good skincare and strong joints. This demographic trend is anticipated to drive the demand for hyaluronic acid-based products in the medical and cosmetics industries.

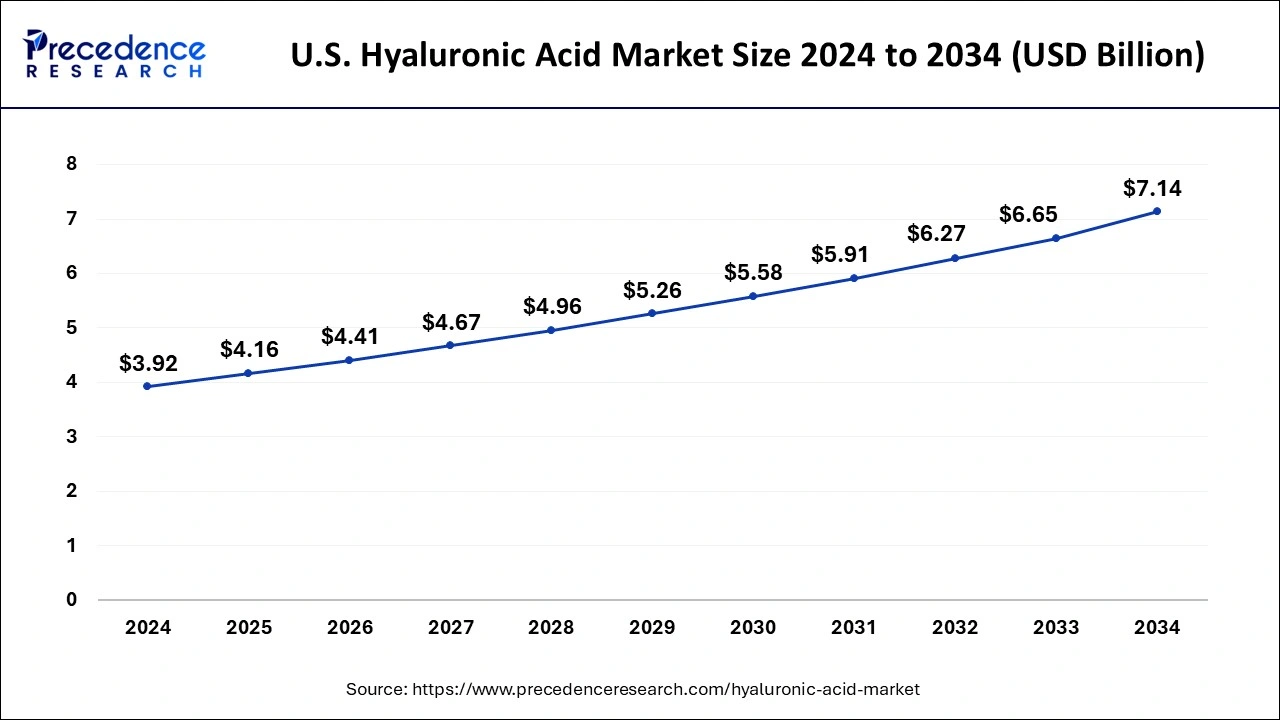

The U.S. hyaluronic acid market size surpassed USD 3.92 billion in 2024 and is expected to be worth around USD 7.14 billion by 2034 at a CAGR of 6.18% from 2025 to 2034.

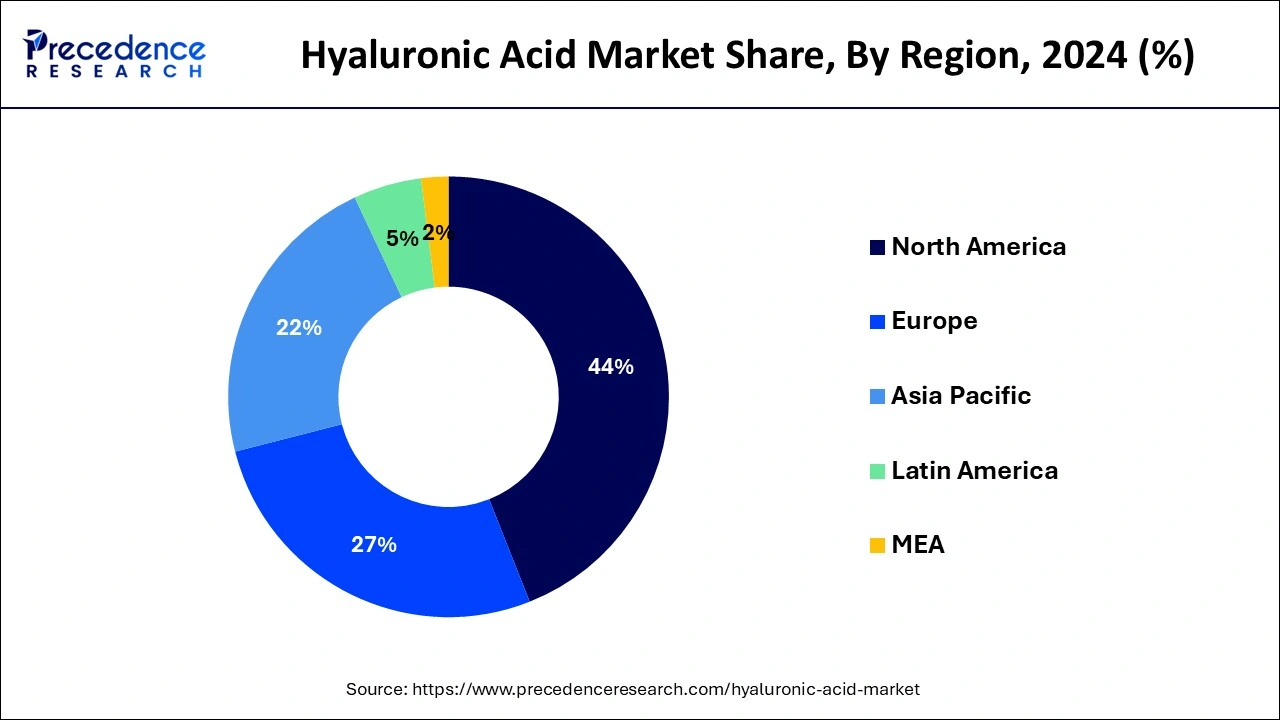

North America holds the largest share of the hyaluronic acid market. North America's aging population has significantly fueled the need for anti-aging skincare products. Because HA can retain moisture and fill up the skin, it is frequently utilized in these cosmetics to reduce the appearance of fine lines and wrinkles. Customers are growing more aware of the need to follow skincare regimens and utilize goods with potent ingredients.

Hyaluronic acid is now more frequently included in skincare formulations because of its well-deserved reputation as a moisturizing and skin-rejuvenating ingredient. Dermal fillers based on HYALURONIC ACID are frequently used to enhance volume and minimize wrinkles in non-surgical cosmetic procedures. The hyaluronic acid industry as a whole is expanding thanks in part to the growing popularity of these procedures in North America.

Asia Pacific is expected to hold the fastest-growing market during the forecast period. Because it is hydrating and anti-aging, hyaluronic acid is widely used in cosmetics and personal care products. Due to shifting lifestyle patterns, rising awareness of skincare regimens, and rising disposable income, the area has seen a sharp increase in demand for skincare and cosmetic products.

Medical tourism, including cosmetic operations, has become popular in countries like Thailand and South Korea. This has increased the need for aesthetic procedures such as dermal fillers based on hyaluronic acid. A favorable environment for the growth of the hyaluronic acid market in the Asia Pacific has been created by government initiatives focused on advancing healthcare infrastructure and stimulating the expansion of the pharmaceutical and cosmetic sectors.

Because of its hydrating and anti-aging characteristics, hyaluronic acid is frequently used in skincare products. It contributes to moisture retention, which keeps the skin hydrated and plump. Hyaluronic acid has become more and more in demand in cosmetics and personal care items, including serums, lotions, and moisturizers. As a result, new products have entered the hyaluronic acid market, further accelerating its expansion. Furthermore, the aging population and the frequency of joint problems are driving the need for hyaluronic acid in the healthcare industry.

There are a number of major players in the hyaluronic acid industry, including both larger international companies and smaller producers. These firms compete fiercely, with businesses concentrating on strategic alliances, acquisitions, and new product development to improve their positions in the hyaluronic acid market. To guarantee the security and effectiveness of their goods, manufacturers must abide by rules established by organizations like the European Medicines Agency in Europe and the Food and Drug Administration in the United States.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.99% |

| Market Size in 2025 | USD 11.81 Billion |

| Market Size by 2034 | USD 19.94 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Application and By End-users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Natural and safe ingredient

Aloe vera, which has calming and moisturizing qualities of its own, can relieve dry or irritated skin and enhance the moisturizing benefits of hyaluronic acid. Packed with antioxidants, green tea extract can help shield the skin from damage caused by the environment and reduce inflammation, which helps support the skin-rejuvenating properties of hyaluronic acid. Vitamin C functions as an antioxidant that helps brighten the skin encourages the formation of collagen, and guards against damage from free radicals. It can improve the skin's general health and look when mixed with hyaluronic acid. Ceramides are lipids that are present in the outermost layer of skin by nature and are essential for preserving the integrity of the skin barrier.

Economic factors

The affluence and growing disposable income in North America, Europe, and the Asia-Pacific drive up the cost of hyaluronic acid-containing skincare products and cosmetic procedures. Hyaluronic acid demand is increased because higher income levels are frequently associated with a greater desire to spend on high-end skincare products.

The demand for hyaluronic acid market products, such as dermal fillers, viscosupplements, and wound care products, is influenced by both public and private healthcare spending. Because hyaluronic acid is moisturizing and anti-aging, there is an increasing demand for it as people become more aware of the contents of the skincare products they use.

Cosmetics and personal care industry

Because of its capacity to draw and hold onto moisture from the skin, hyaluronic acid is a vital component of many moisturizers, serums, and face creams. These products are frequently marketed to people who want to prevent the indications of aging as well as those who have dry or dehydrated skin. This also drives the hyaluronic acid market.

Hyaluronic acid's anti-aging benefits are well-known. It plumps up the skin and minimizes the appearance of wrinkles and fine lines. It is frequently present in eye creams, anti-aging creams, and skin care products meant to encourage younger-looking skin. In the hyaluronic acid market, sheet masks and hyaluronic acid-infused under-eye patches have gained popularity.

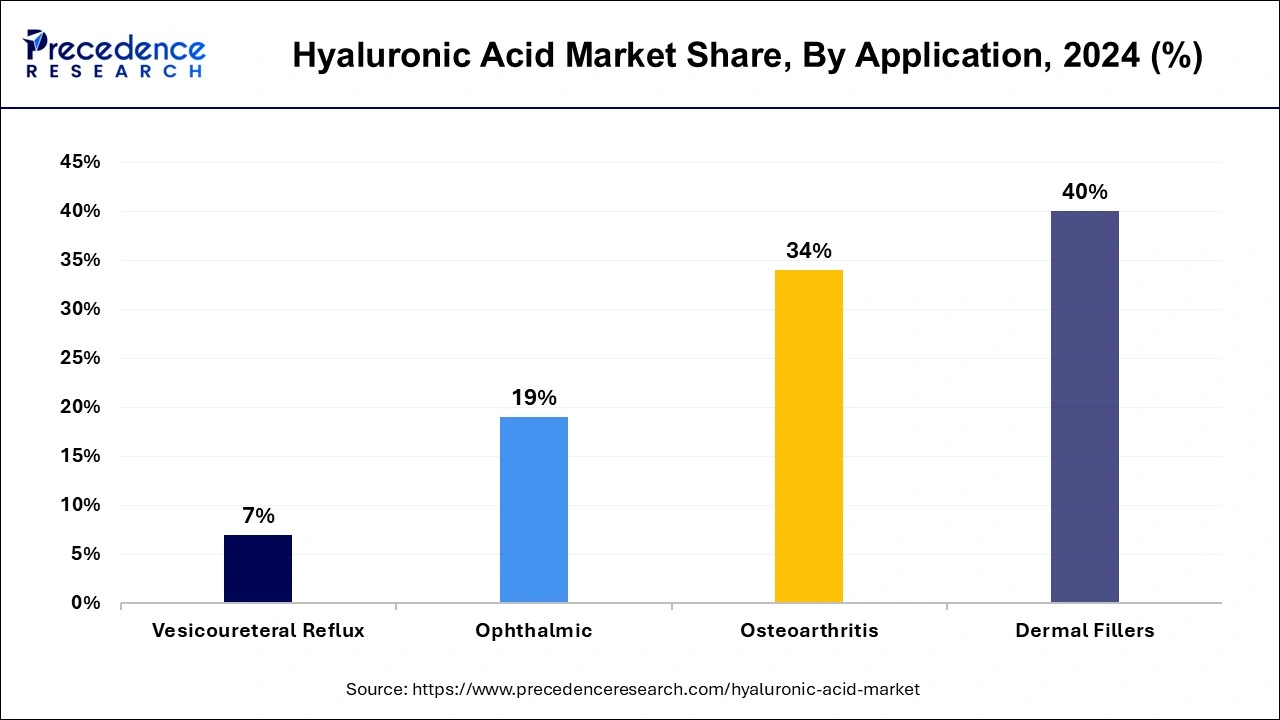

The dermal fillers segment held the largest share of the hyaluronic acid market in 2024 and is expected to maintain its position during the forecast period. Hyaluronic acid-containing dermal fillers have been in high demand due to a number of variables, including an aging population, rising public awareness of cosmetic procedures, and developments in aesthetic medicine. Customers are looking for more natural-looking outcomes that accentuate their features without coming across as excessive.

Hyaluronic acid is the material of choice for dermal fillers since it is a naturally occurring component in the body and is generally well-tolerated. These filters are renowned for their ability to produce outcomes that look natural with little chance of problems or negative responses. Hyaluronic acid-based fillers have witnessed constant innovation in the hyaluronic acid market, including changes in formulation, cross-linking strategies, and delivery systems. The fillers now perform and last longer because of these advances. The quest for minor changes and faster recovery times has fueled a growing trend towards less invasive cosmetic procedures, such as dermal fillers.

Although historically, the biggest markets for dermal fillers have been in North America and Europe, emerging regions like Asia Pacific and Latin America offer substantial development potential. These regions are growing because of things like growing disposable incomes, growing awareness of beauty, and the growing aesthetics sector. Obtaining regulatory permits and adhering to safety regulations are essential for businesses functioning in this industry. Dermal fillers are manufactured, marketed, and distributed under strict rules that guarantee patient safety and product quality.

The osteoarthritis segment is expected to witness the fastest growth in the hyaluronic acid market by application. In the medical field, hyaluronic acid is also utilized, especially in the treatment of osteoarthritis. It is injected into the joints to act as a cushion and lubricant, decreasing discomfort and increasing joint range of motion. New uses for hyaluronic acid are being investigated through ongoing research and development. In order to increase the effectiveness of hyaluronic acid-based medicines, manufacturers are concentrating on creating cutting-edge formulations and delivery methods.

The dermatology clinics segment, in 2024, held the largest share of the hyaluronic acid market. This accomplishment reflects the pivotal role dermatology clinics play in the skincare industry and underscores the increasing demand for hyaluronic acid-based products in dermatological treatments and procedures.

Dermatology clinics serve as primary destinations for individuals seeking professional skincare solutions, ranging from routine dermatological consultations to advanced cosmetic procedures. These clinics are staffed with qualified dermatologists, skincare specialists, and medical professionals who specialize in diagnosing and treating various skin conditions, such as acne, aging, hyperpigmentation, and dermatitis.

By Application

By End users

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

May 2025

March 2025

December 2024

August 2024