April 2025

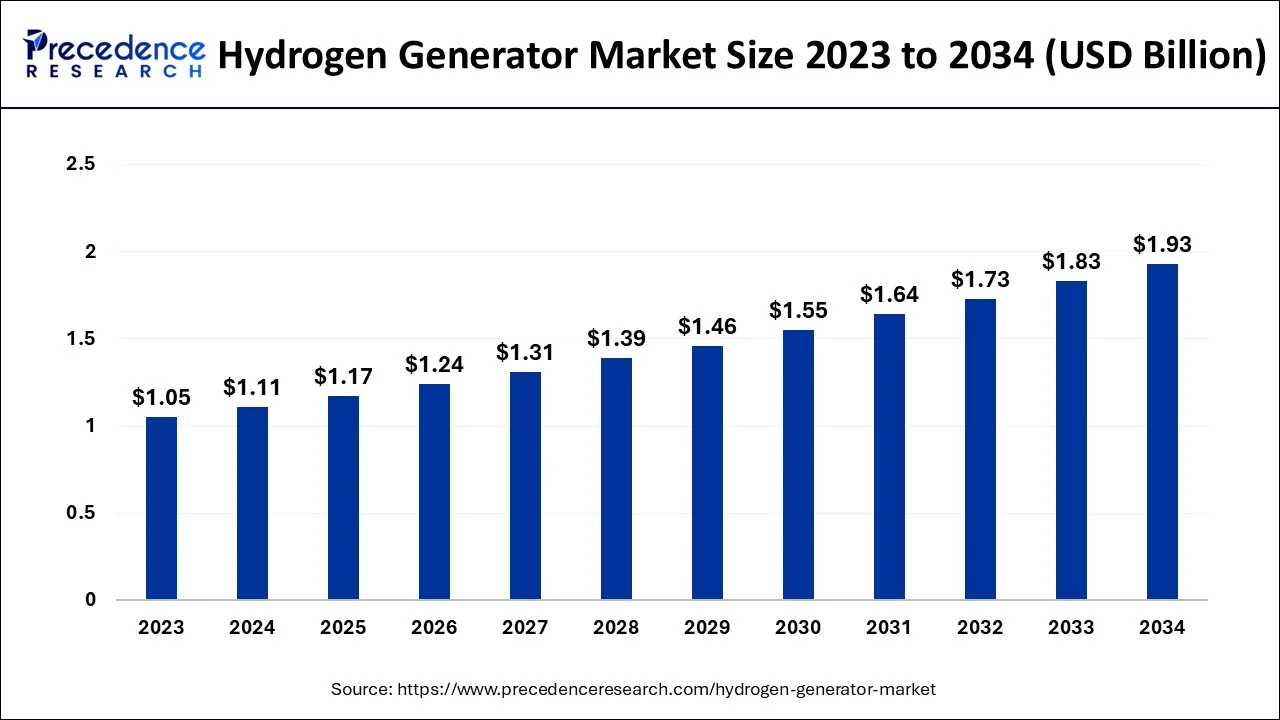

The global hydrogen generator market size accounted for USD 1.11 billion in 2024, grew to USD 1.17 billion in 2025 and is predicted to surpass around USD 1.93 billion by 2034, representing a healthy CAGR of 5.70% between 2024 and 2034.

The global hydrogen generator market size is estimated at USD 1.11 billion in 2024 and is anticipated to reach around USD 1.93 billion by 2034, expanding at a CAGR of 5.70% from 2024 to 2034.

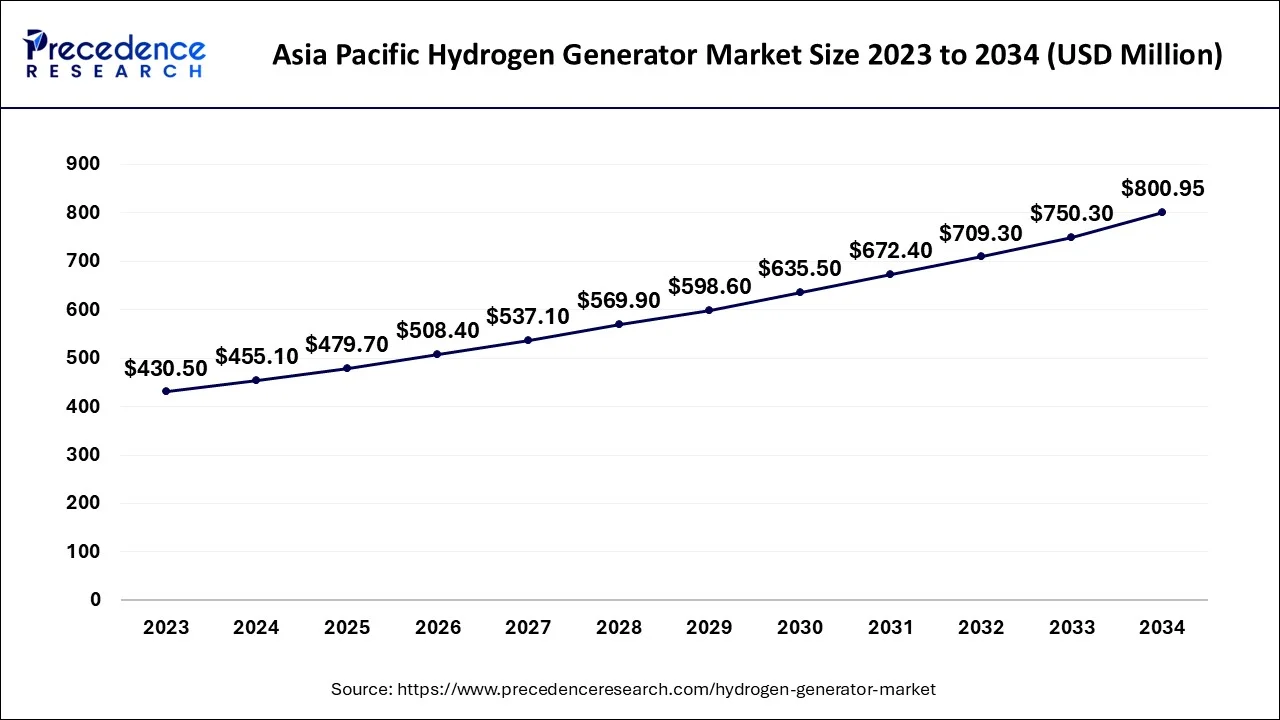

The Asia Pacific hydrogen generator market size is estimated at USD 455.1 billion in 2024 and is expected to be worth around USD 800.95 billion by 2034, rising at a CAGR of 5.81% from 2024 to 2034.

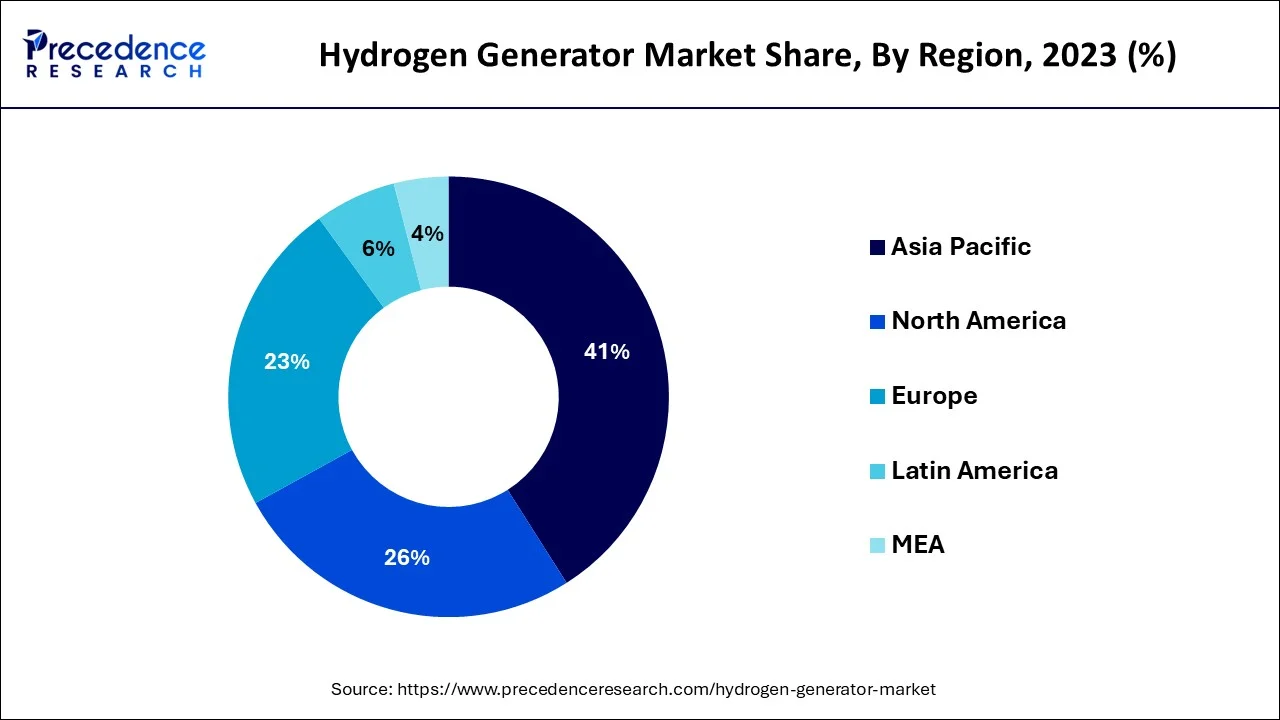

Since a few years ago, the hydrogen-generating sector has been expanding in North America. Each application and technology has contributed to the industry's rapid growth. The fastest-growing industry is the manufacturing of methanol and ammonia, which has seen tremendous expansion in the previous five years in nations like the U.S. and Canada.

Due to the increased research and deployment of fuel cell systems in Europe brought on by initiatives announced by the European Commission through organizations like the Fuel Cells and Hydrogen Joint Undertaking, a rise in the region's hydrogen production is anticipated (FCH JU). These initiatives have been announced with the goal of increasing the use of fuel cell vehicles in Europe, which will aid in the creation of hydrogen infrastructure that will support fuel cell vehicles in the main European nations.

A hydrogen generator is a device that creates hydrogen from water and fossil fuels using a variety of techniques, including electrolysis and steam reforming. It produces high-quality hydrogen gas from water using a proton exchange membrane, and it is presently employed in a variety of end purposes, including chemical synthesis, fuel cells, refinement, and petroleum recovery.

The creation and use of clean and green energy have become necessary due to the growing concerns about global warming as well as the worsening climatic and environmental circumstances brought on by excessive pollution. Thus, hydrogen is a source of clean and renewable energy and is anticipated to see rapid growth throughout the course of the projection period. Rising government measures to lessen carbon emissions are promoting the production and use of hydrogen, which is driving up the market for hydrogen generation globally. Since 1975, the demand for hydrogen has increased thrice. The worldwide market for hydrogen generation is expanding as a result of the increasing need for green energy across several sectors. Currently, coal and natural gas are the two major sources for producing hydrogen. The production of hydrogen uses around 6% of natural gas and 2% of coal. A typical substitute for electric energy is hydrogen. In fuel cell technology, hydrogen fuel is widely employed. This is a significant driver of the worldwide market for hydrogen generation expansion.

The market participants are adopting a variety of development tactics, including partnerships and agreements, to produce hydrogen energy using zero-emission technologies. For instance, a collaboration deal was made to build a hydrogen plant in the US by Brookfield Renewable Partners and Plug Power, Inc. To lessen its carbon impact, this plant plans to produce about 15 metric tonnes of liquid hydrogen per day from 100 percent renewable resources. These kinds of development techniques are anticipated to open up new potential opportunities in the near future and accelerate the expansion of the market for hydrogen production worldwide. Furthermore, the market's development is greatly influenced by government regulations that support the production of hydrogen. Governments in both developed and emerging markets are introducing a variety of policies to assist the reduction of carbon emissions and promote the use of renewable energy. For instance, in their strategic energy partnership, the US and India opted to integrate low-carbon technologies.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.11 Billion |

| Market Size by 2034 | USD 1.93 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.70% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered |

|

| Regions Covered |

|

Extensive research and development have been done to create technology for creating hydrogen

Hydrogen is a synthetic energy transporter, which results in energy loss along the value chain.

Rising focus on achieving net zero emission target by 2050

Market growth for onsite hydrogen generators is anticipated to exceed 5% CAGR. Increasing hydrogen gas demand is projected in the oil, gas, refinery, and other sectors due to its low emission features. The market for portable hydrogen generators is anticipated to grow at the fastest rate through 2032 as a result of a shift in emphasis toward renewable energy. Sustainable environmental practices, a high power-to-weight ratio, and noise-free properties are some of the factors that may help drive up demand for a product.

In 2023, the market for steam reformer electrolysis was the highest. From hydrocarbon fuels like methanol and methane (CH4) found in natural gas, the process creates hydrogen gas (CH3OH). Hydrogen generator growth steam reformer electrolysis is anticipated to be boosted by the rising demand for hydrogen in chemical manufacturing and processing. The CAGR for the electrolysis process is expected to exceed 5%. By breaking apart the water molecule, hydrogen gas is created in this process. Demand for energy from clean, renewable sources like water is set to increase.

In 2023, the value of chemical processing applications the greatest. From 2024 to 2034, rising demand for hydrogen in various chemical processes is anticipated to drive hydrogen generator growth. Applications for fuel cells are expected to grow at a rate of over 6% CAGR. Growth in the business might be fueled by rising demand in the residential and transportation sectors due to low emissions and cheap operating costs.

By 2033, it is anticipated that refinery applications would total USD 120 million. Hydrogen generator market growth for refinery application is projected to be boosted by rising hydrogen utilization to refine crude oil into refined fuels like diesel and gasoline and eliminate impurities like Sulphur from these fuels.

By Product Type

By Process

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

September 2024

May 2024

March 2025