April 2025

Hydrogen Generation Market (By Technology: Coal Gasification, Steam Methane Reforming, and Others; By Application: Methanol Production, Ammonia Production, Petroleum Refinery, Transportation, Power Generation, and Others; By System Type: Merchant and Captive; By Type, By Source) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024 - 2033

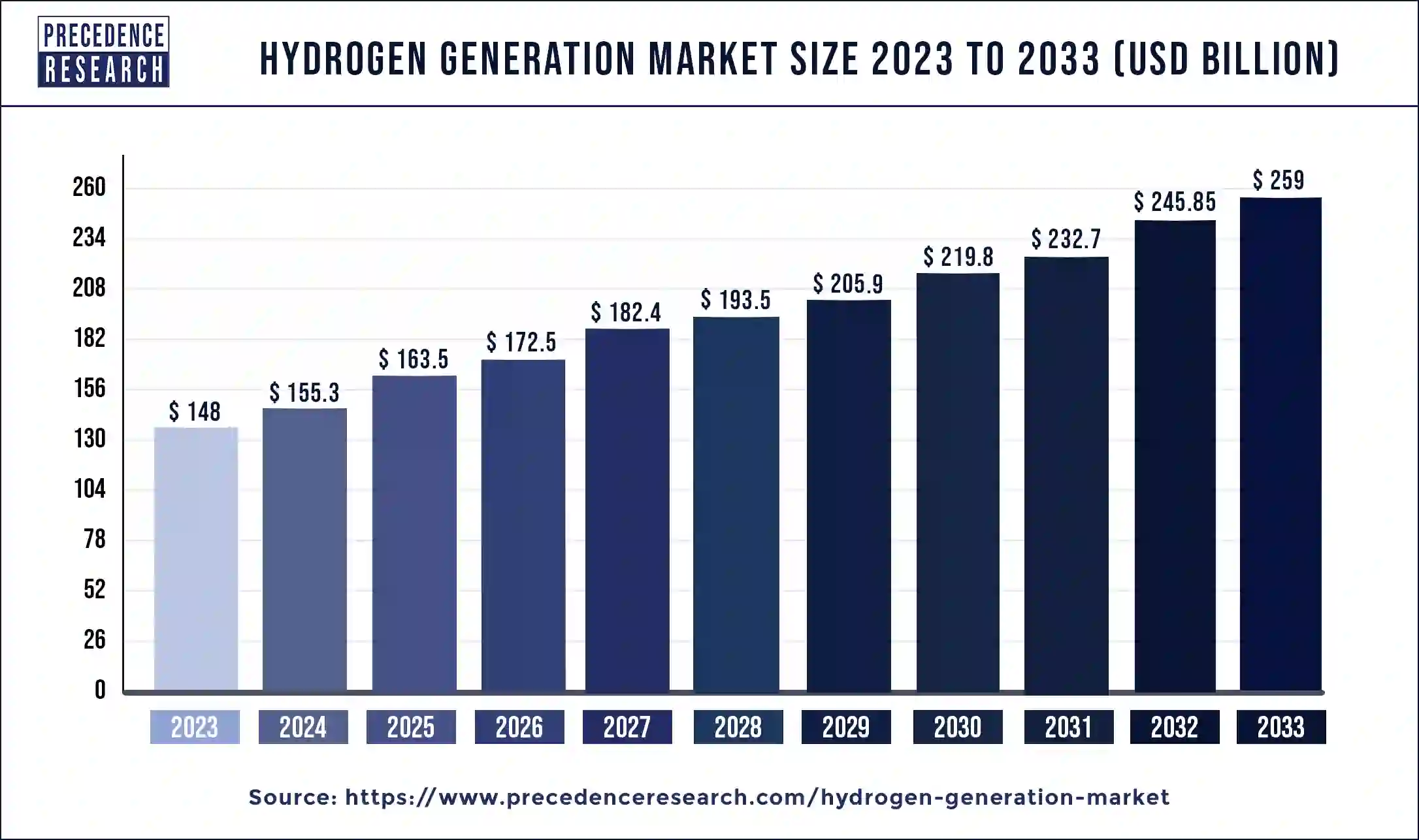

The global hydrogen generation market size was valued at USD 148 billion in 2023 and is expected to hit around USD 259 billion by 2033, poised to grow at a noteworthy compound annual growth rate (CAGR) of 5.75% from 2024 to 2033.

Hydrogen generation has captured significant share in the green energy technology these days. Most of the nations have diverted their focus towards green hydrogen generation owing to their abundant presence in the earth’s crust. However, majority of hydrogen produced today is from hydrocarbons i.e., natural gas and coal that are the main sources of carbon dioxide emission. As per an analysis conducted by Wood Mackenzie, China accounted for the highest global CO2 emissions that for 10,877 million tons of CO2 per year. This was followed by U.S. and India respectively in the highest CO2 emission rate per year.

| Report Highlights | Details |

| Market Size in 2024 | USD 155.3 Billion |

| Growth Rate | CAGR of 5.75% from 2024 to 2033 |

| Market Size | USD 259 Billion by 2033 |

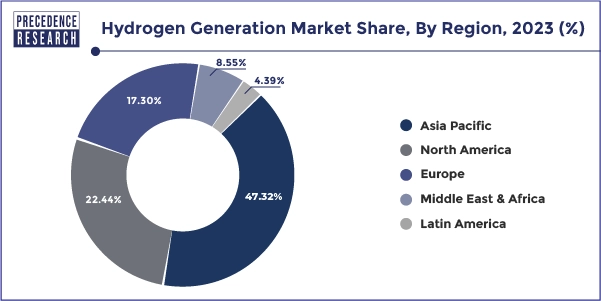

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Historic Data | 2020 to 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Technology, System Type, Application, Region |

| Companies Mentioned | Linde plc, Air Liquide International S.A., Hydrogenics, Inox, Messer Group GmbH, Weldstar, Inc., Praxair, Inc., McPhy, LNI Swissgas |

The rising global warming issues coupled with deteriorating climatic and environmental conditions due to the excess pollution have necessitated the development and adoption of clean and green energy. Therefore, the hydrogen is a source of clan and green energy and is expected to grow at a significant rate during the forecast period. Rising government initiatives to reduce carbon footprint is encouraging the production and consumption of hydrogen thereby boosting the hydrogen generation market across the globe. The demand for hydrogen has witnessed three-fold growth since 1975. The rising demand for the green energy across various industries is boosting the growth of the hydrogen generation market globally. At present natural gas is the main source of hydrogen generation followed by coal. Around 6% of the natural gas and 2% of the coal is used in the generation of hydrogen. Hydrogen is commonly used as an alternative to electric energy. The hydrogen fuel is extensively used in fuel cell devices. This is a major factor that propels the growth of the global hydrogen generation market.

Various developmental strategies such as partnerships and agreements are being adopted by the market players to manufacture hydrogen energy, using zero-emission technology. For instance, Brookfield Renewable Partners and Plug Power, Inc. entered into a partnership agreement to develop a hydrogen plant in the US. This plant aims at producing around 15 metric tons of liquid hydrogen daily using 100% renewable resources to reduce carbon footprint. These type of developmental strategies is expected to offer new growth avenues in the upcoming future and boost the growth of the global hydrogen generation market. Moreover, the government policies favoring the hydrogen generation has a crucial role to play in the development of the market. The government in developed and developing economies are coming forward with various policies that supports the reduction of carbon emission and encourages the adoption of clean energy. For instance, the US and India decided to include low carbon technology in their strategic energy collaboration.

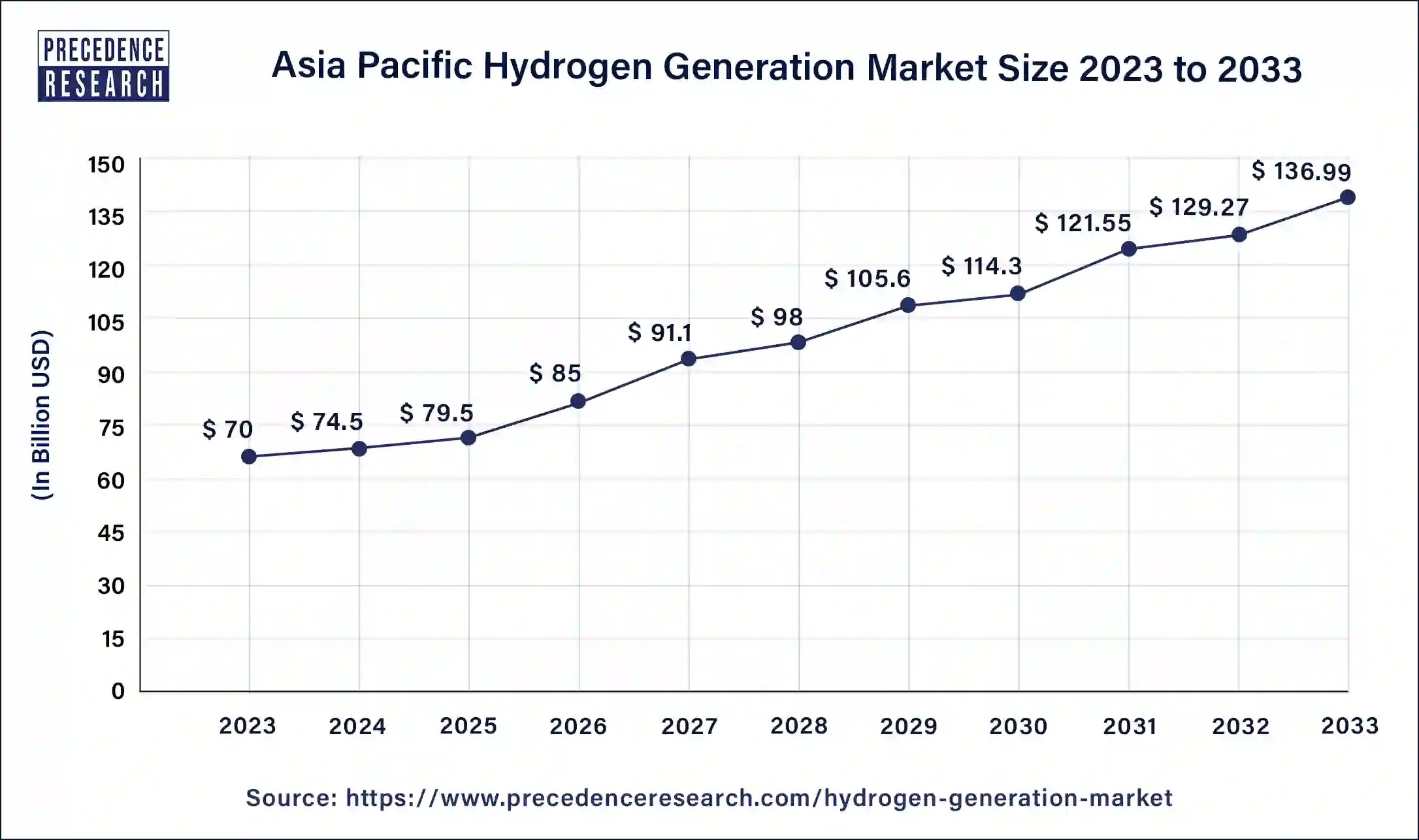

The Asia Pacific hydrogen generation market size was valued at USD 70 billion in 2023 and is expected to hit around USD 136.99 billion by 2033 and expanding at a CAGR of 6.94% from 2024 to 2033.

Asia Pacific is the top consumer of the hydrogen power. The rapid growth of various industries in the various economies such as South Korea, China, Japan, and India showed a robust economic development that fostered the growth of the hydrogen generation market in this region. The attractive growth of the region is mainly attributed to the increasing demand for fuel cell powered electric vehicles in the region. Other than this, power generation through renewable energies is also booming in the region. China is the front-runner in the Asia Pacific region accounting for majority of revenue share in the year 2023. Major research activities and developments in the region targeting to reduce the cost of green hydrogen generation is the major factor behind the exponential growth of the region.

Asia Pacific is also estimated to be the fastest growing market owing to the rising demand for hydrogen for power generation in countries like China and India. Moreover, rising government initiatives in the nations like India, Japan, and Australia to promote clean and green energy is boosting the market growth.

Market Drivers

Increasing focus towards clean hydrogen generation

Clean hydrogen production is a nascent market and offer enormous opportunities for development and growth. Increasing carbon footprint in the atmosphere significantly drives the clean hydrogen production in the recent as well as coming years.

Hydrogen is present in limited quantity as molecules in the Earth’s atmosphere, yet is present abundantly in the form of atoms within different molecules (e.g., water, biomasses, and methane). Electrolysis, solar PV, and offshore wind energy are some of the renewable and green technologies used presently for hydrogen generation without including the cost of carbon emission. These technologies cost higher compared to hydrogen production through natural gas and coal; whereas technological development and innovations expected to commercialize these technologies for green & clean hydrogen generation by the year 2030.

As per analysis and forecast, breakthrough in technologies can upend the clean hydrogen generation technologies; although the relative costs are largely uncertain. Fuel switching towards blue and turquoise hydrogen production using sustainable biomethane possibly absorb the GHG emission from atmosphere and will be frequently used in transport sector as an alternate renewable fuel source. As a result, clean hydrogen production technology likely to propel the market growth for hydrogen generation in the upcoming years.

Government regulations for desulfurization and greenhouse gas emissions

Rising concern for air pollution has impelled governments of various regions to issue stringent emission regulations for passenger vehicles, light & heavy commercial vehicles, and other types of vehicles, as transportation mainly road transportation is the major contributor of air pollution in any country or region. In accordance to the same, the Environmental Protection Agency of United States, has issued revised GHG emission standards for passenger vehicles & light duty trucks that aim to significantly reduce the GHG emission along with reductions in other pollutants.

In addition, fuel gas desulphurization aids an advantage in reducing emissions and pollutants from the environment. The Clean Air Act amendments and related fuel regulations in the U.S. aim to reduce the sulfur content along with other harmful contents in the atmosphere. These all factors, anticipated to drive the market growth for hydrogen generation in the near future.

Market Restraints

High capital cost of hydrogen energy storage

Presently, hydrogen is most commonly stored as a gas or liquid in tanks for small scale mobile and stationary applications. Compression and cooling systems are required for transportation and storage of hydrogen. Storage tanks required for hydrogen storage should provide non-reactive media, low-temperature, and quick reversible adsorption/ desorption of hydrogen without the requirement of thermal energy.

On the other hand, storing hydrogen as ammonia requires thermal energy to decompose the molecules when hydrogen molecules are needed. Henceforth, large cost is associated with the hydrogen storage for the customized tanks. Apart from this, hydrogen storage is the key technological barrier to the development and widespread application of fuel cell technologies in stationary, transportation, and portable applications. This in turn, expected to further restrict the market growth in the coming years.

Market Opportunities

Development of green hydrogen production technologies

Mainly hydrogen produced today are through gasification of coal and steam reforming of natural gas that contribute approximately 95% of the total hydrogen production per year. Other methods for hydrogen generation are recently nascent and still under development process. These processes of hydrogen generation include electrolysis and carbon capture & storage (CCS) technologies. The hydrogen generated from CCS technology is known as blue hydrogen that capture and store carbon dioxide emitted during the production process. Secondly, hydrogen produced from electrolysis is known as green hydrogen as it uses renewable energy sources.

Green hydrogen and blue hydrogen are the most opportunistic and demanded technologies of hydrogen generation as they also fulfil emission standards as well as curb the rate of carbon dioxide emission in the atmosphere. Henceforth, these hydrogen technologies likely to prosper the growth of hydrogen generation market in the coming years.

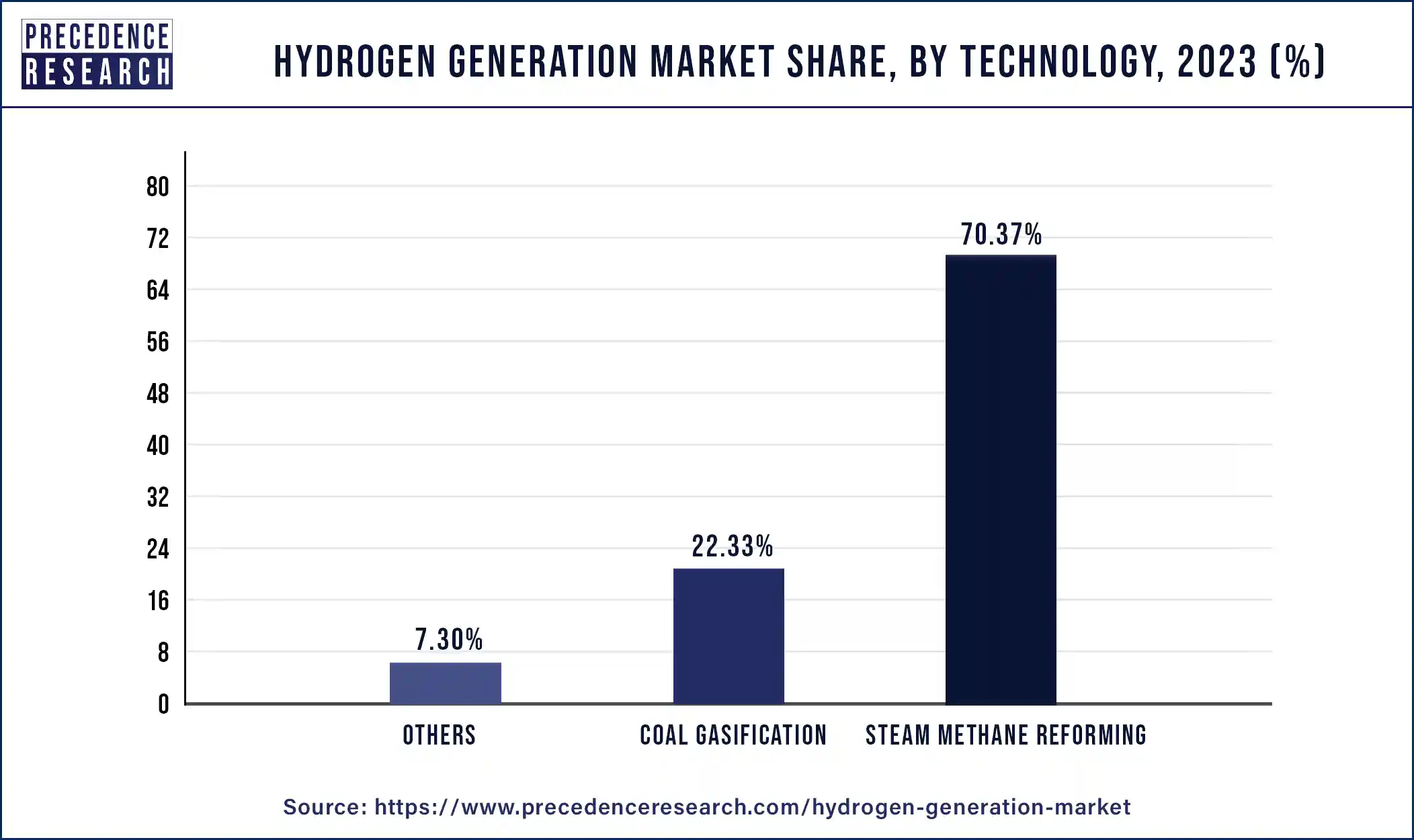

The steam methane reforming segment dominated the market with around 70.37% share in terms of revenue of the total market in 2023. This is attributable to the extensive use of the steam methane reforming technology in the hydrogen generation process across the globe. The rapidly growing demand for the hydrogen energy had resulted in the exponential growth of this segment across the globe. Hydrogen is a diverse product that is used across multiple industries, hence steam reforming gained popularity to meet the increasing demand of consumer across various verticals.

On the other hand, others is the fastest growing technology as it covers electrolysis of water. Presently, electrolysis of water has gained significant popularity owing to its clean and green hydrogen generation technology by emitting less or no CO2 in the atmosphere.

The coal gasification is projected to be the fastest-growing segment during the forecast period. Coal gasification is also a widely used technology just after the steam methane reforming technology. The abundant availability of coal in various nations like India has propelled the usage of coal in the hydrogen generation market in the past.

Hydrogen Meneration Market Revenue (USD Billion) By Technology (2020-2023)

| Technology | 2020 | 2021 | 2022 | 2023 |

| Coal Gasification | 28.2 | 29.7 | 31.3 | 33 |

| Steam Methane Reforming | 92.1 | 95.7 | 99.6 | 104 |

| Others | 9.3 | 9.8 | 10.3 | 10.9 |

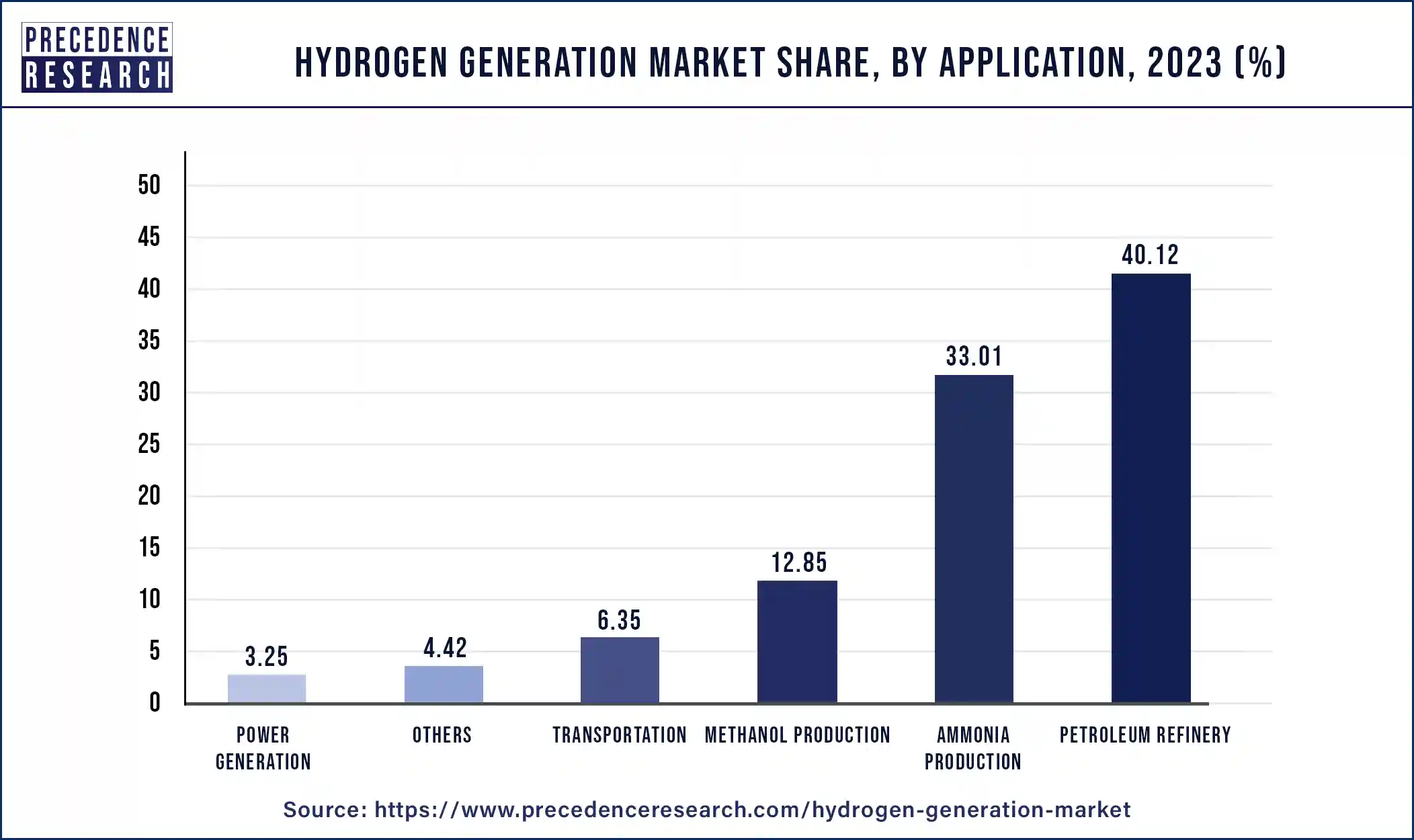

In 2023, petroleum refinery segment dominated the market with around 40.12% share in terms of revenue of the total market.

The ammonia production segment accounted second largest revenue share holder because of the rising government regulations in order to encourage desulphurization of fuels to conserve the environment. The ammonia manufacturing plants are the highest consumer of the hydrogen energy. The on-site production of hydrogen has further boosted its consumption in the ammonia plants. Ammonia is commonly used to manufacture fertilizers. On the other side, power generation and transportation are the most lucrative segments that promises attractive growth over the analysis period.

Ammonia application for hydrogen generation market accounted for nearly 33.01% in the year 2023. Out of total industrial application for hydrogen only 0.3 million tons of hydrogen demand was met with low-carbon hydrogen that was nearly 20% more than the year 2019. Among these renewable hydrogen generation, most of the demand was met through large-scale CCUS plants and small electrolysis units in the chemical subsector.

The future analysis for clean hydrogen demand for the ammonia production expected to rise exponentially owing to current pipeline projects in the sector that suggested to meet the 18% of overall hydrogen demand in the sector by the year 2030. Further, actions aim to meet projected Net Zero Emissions by 2050 Scenario for the ammonia production industry sector hydrogen demand.

On the other hand, power generation is projected to grow at the highest CAGR during forecast period from 2024 to 2033. This is attributed to the growing government initiatives regarding reducing the use of Sulphur fuels for the betterment of the environment. The others segment includes chemical industry, iron & steel industry, oil refining industry, and others. The others segment is expected to be the fastest-growing segment owing to the growing production and consumption of hydrogen in the chemical industry. In the chemical industry, hydrogen is obtained as a by-product and is consumed on the site and also supplied to other industries. Hence, the chemical industry is expected to witness a significant growth rate during the forecast period.

Hydrogen Meneration Market Revenue (USD Billion) By Application (2020-2023)

| Application | 2020 | 2021 | 2022 | 2023 |

| Methanol Production | 16.4 | 17.2 | 18.1 | 19 |

| Ammonia Production | 42.6 | 44.5 | 46.6 | 48.8 |

| Ptrolium Refinary | 53 | 54.9 | 57 | 59.3 |

| Transportation | 7.8 | 8.3 | 9.4 | 10.1 |

| Power Generation | 4 | 4.3 | 4.5 | 4.8 |

| Others | 5.8 | 6 | 6.3 | 6.5 |

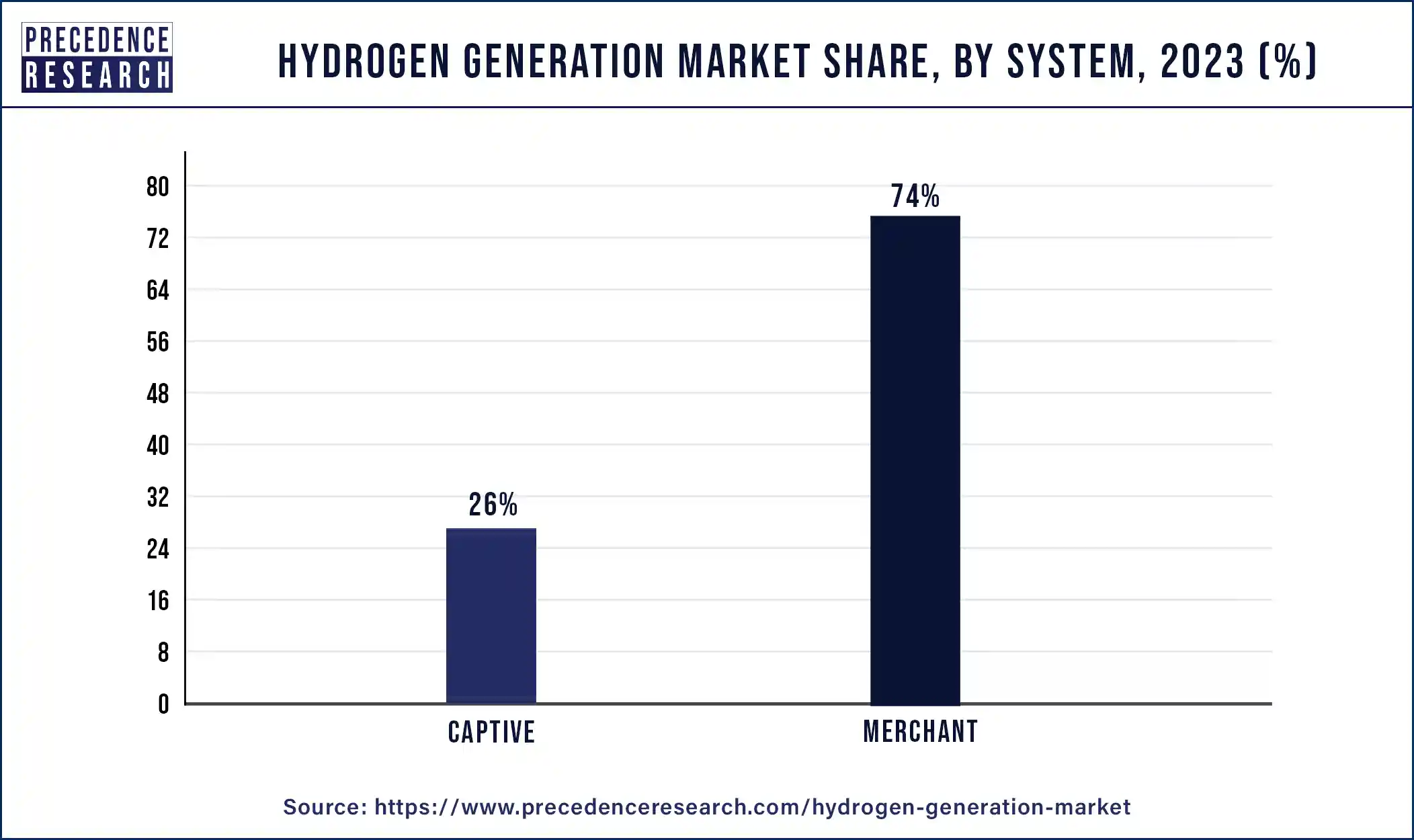

The hydrogen is produced in bulk and is supplied through pipeline or other means to the consumers. The developed pipeline networks in the mature markets like North America and Europe is boosting the growth of this segment.

Merchant generation of hydrogen means hydrogen is produced at a central production facility and is transported and sold to a consumer by a bulk tank, cylinder truck, or pipeline. In many countries such as the U.S., Canada, and Russia, there is an extensive existing natural gas pipeline network that could be used to transport and distribute hydrogen. In emerging economies of the Asia Pacific region, new infrastructure is being developed, with dedicated pipeline and shipping networks potentially allowing large-scale overseas hydrogen transport.

On the other hand, the captive segment is estimated to be the most opportunistic segment during the forecast period. Captive segment means the on-site generation of hydrogen. The increased penetration of this segment in the developed markets like North America and Europe is fueling the growth of this segment in the upcoming years.

Hydrogen Meneration Market Revenue (USD Billion) By System (2020-2023)

| Syatem | 2020 | 2021 | 2022 | 2023 |

| Merchant | 96.1 | 100.1 | 104.5 | 109.4 |

| Captive | 33.5 | 35 | 36.7 | 38.6 |

Key Companies & Market Share Insights

The global market for hydrogen generation is highly fragmented owing to the presence of large number of market players both on regional as well as global level. Analyzing future scope and application of hydrogen energy as a renewable energy along with the introduction to green hydrogen generation has diversified the scope and opportunities int eh global hydrogen generation market. Several players are investing prominently in the strengthening their foothold on the global scale by adopting numerous inorganic growth strategies such as merger & acquisition, strategic alliance, collaboration, joint venture, regional expansion, and product development.

In addition, large number of players believe in collaborating with electric vehicle manufacturers or with power distribution companies to secure their future growth prospects after analyzing the significant growth of hydrogen in power generation and transportation. Hydrogen fuel cell vehicles are the emerging vehicle type that has gained prominent momentum across several developing as well as developed countries such as China, Japan, Germany, USA, UK, and many others. Hence, hydrogen generation is highly competitive and fragmented market that offers numerous future growth opportunities to the market players.

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

The various developmental strategies like partnerships, joint ventures, and agreements fosters market growth and offers lucrative growth opportunities to the market players.

Hydrogen Generation Market Revenue (USD Billion) Analysis by Manufacturer (2016-2020)

| Top Manufacturer | 2016 | 2018 | 2020 |

| Linde plc | 2120.7 | 2296.2 | 2502.9 |

| Air Liquide International S.A. | 2339.6 | 2513.4 | 2752.6 |

| Hydrogenics | 41.3 | 44.0 | 45.1 |

| Inox | 1037.3 | 1088.8 | 1175.1 |

| Air Products and Chemicals, Inc. | 3376.8 | 4018.5 | 3985.2 |

Key Strategies Adopted by Players

Some of the basic growth strategies adopted by the market players include merger & acquisition, investment for technology development towards clean hydrogen generation.

Segments Covered in the Report

By Technology

By Application

By Type

By System Type

By Source

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

September 2024

March 2025

March 2025