February 2025

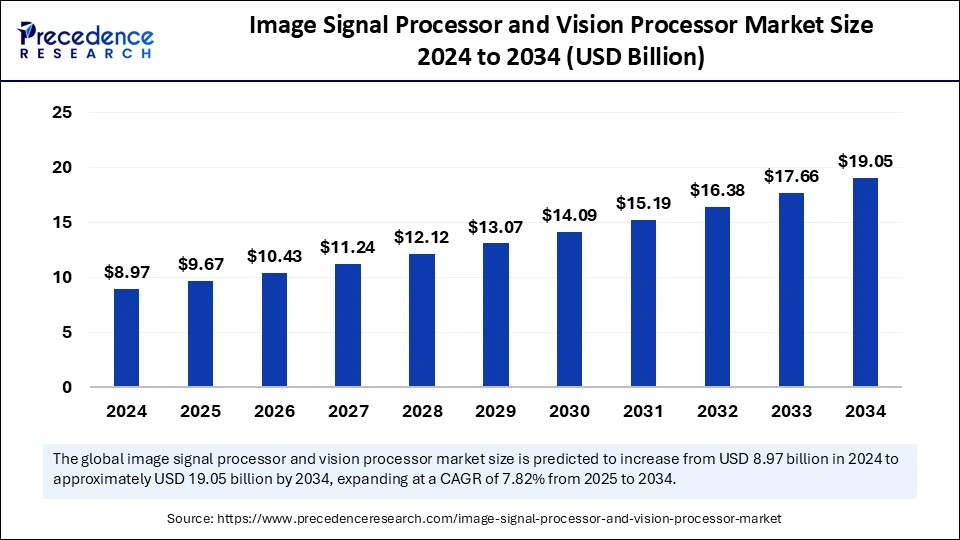

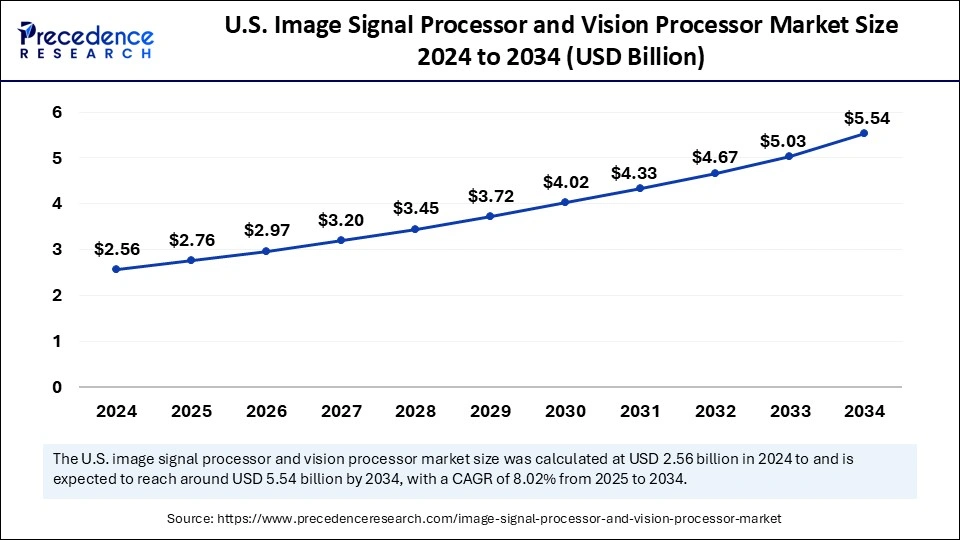

The global image signal processor and vision processor market size is calculated at USD 9.67 billion in 2025 and is forecasted to reach around USD 19.05 billion by 2034, accelerating at a CAGR of 7.82% from 2025 to 2034. The North America market size surpassed USD 2.56 billion in 2024 and is expanding at a CAGR of 8.02% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global image signal processor and vision processor market size accounted for USD 8.97 billion in 2024 and is predicted to increase from USD 9.67 billion in 2025 to approximately USD 19.05 billion by 2034, expanding at a CAGR of 7.82% % from 2025 to 2034. The rising strategic collaborations for fostering technological advancements, surge in innovative platform launches, surging demand for high-throughput image processing capabilities and increased research for developing energy-efficient processing technologies is boosting the growth of image signal processor and vision processor market

Growing emphasis on integrating artificial intelligence in image signal processors (ISPs) and vision processor units (VPUs) for enhancing image quality and advancing vision capacities like scene understanding and recognition of objects is driving the market growth. Utilization of advanced technologies such as neural processors, multi-sensor fusion, edge AI, Dynamically Reconfigurable Processor for AI inference (DRP-AI) and AI-powered ISP architectures leveraging neutral networks. Furthermore, increased utilization of ISPs and VPUs powered by AI algorithms for enhancing image processing by with real-time image recognition and object detection, for metadata extraction and for real-time denoising among others is enabling applications in various sectors such as robotics, healthcare, autonomous vehicles, consumer electronics, for security management and in smart manufacturing for automating tasks.

Increasing strategic collaborations between AI-driven chip developers and semiconductor developers, supportive government initiatives for advancing AI-driven technologies, rising investments, improved efficiency of processors for handling AI workloads with reduced developmental costs is fostering the integration of AI in image signal processor and vision processors further boosting the market growth.

The U.S. image signal processor and vision processor market size was exhibited at USD 2.56 billion in 2024 and is projected to be worth around USD 5.54 billion by 2034, growing at a CAGR of 8.02% from 2025 to 2034.

Robust Sensor Technology: North America to be the Leader

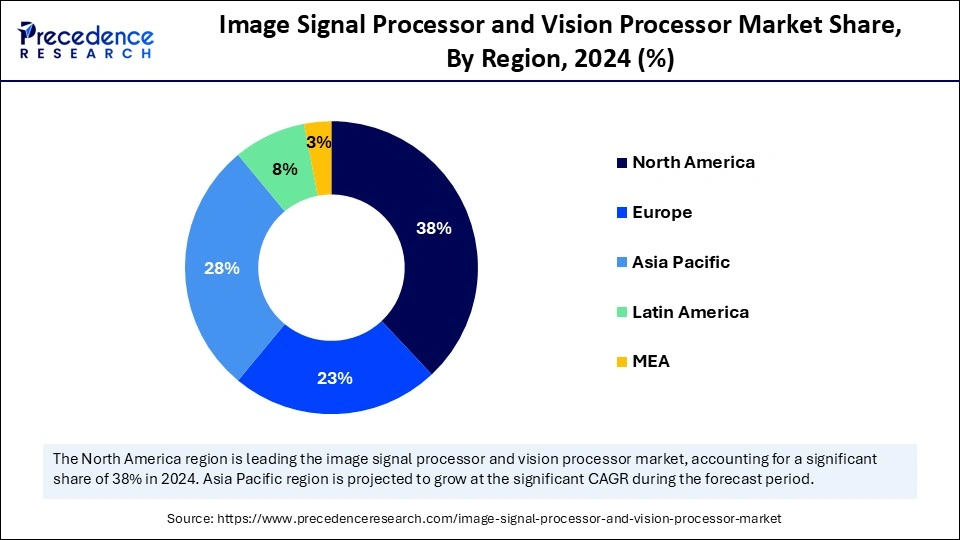

North America dominated the global image signal processor and vision processor market with the largest share in 2024. The continuous advancements in developing innovative technologies, increased adoption of image processing technologies throughout various industries, presence of major automotive and semiconductor industries, robust technological infrastructure and the growing consumer electronics sector are the factors driving the market dominance of this region.

U.S. is dominating the market with a significant share in North America owing to the rising investments in technological sectors, government influence and surging demand for high-quality image processors.

For instance, in July 2024, the Biden-Harris Administration, through the U.S. Department of Commerce’s Economic Development Administration (EDA) granted $40 million to the New York Semiconductor Manufacturing and Research Technology Innovation Corridor (NY SMART I-Corridor Tech Hub) for improving the regional semiconductor manufacturing capabilities.

What’s Fueling Image Processor Growth in Asian Countries?

Asia Pacific region is anticipated to witness lucrative growth in the image signal processor and vision processor market over the forecast period. The market is driven by the presence of robust electronics manufacturing sector in countries such as Japan and China, growing demand for high capacity image processing technologies in consumer electronics, innovations in smartphone technologies, focus on implementing AI and machine learning technologies in imaging and vision processing systems, rising disposable incomes and growing government initiatives for deploying smart city infrastructures.

China is anticipated to show the fastest growth in the market during the forecast period. The expanding production capacities of the electronics industries, presence of skilled labour and the Made in China 2025 initiative launched by the government for reducing dependability on foreign technology and boosting domestic semiconductor production favour the market growth.

Europe is predicted to see a notable growth in the market in the upcoming years. The growing focus on advancing automotive and surveillance systems, increased investments in research and development activities, strong industrial base, surging demand for advanced imaging technologies and the emergence of edge computing technology is driving the market growth.

An Image Signal Processor (ISP) is implemented for processing raw image data from a sensor and converting it into viewable and high quality image, whereas a Vision Processor unit (VPU) or Computer Vision Processor is utilized for performing tasks such as scene understanding, edge detection, image analysis and object recognition by leveraging artificial intelligence and machine learning methodologies, frequently using outputs from the ISP’s. The image signal processors are applied for several image processing tasks such as white balance, lens shading correction, sharpening and other aesthetic enhancements.

Growing demand for advanced imaging tools for various industrial applications, rising disposable incomes, increased adoption of AI and machine learning technologies, strategic collaborations among industries, government initiatives and policies for boosting the growth of technology sectors, surfacing economies implementing advanced technologies for strengthening infrastructure development, need for developing Augmented Reality and Virtual Reality devices and ongoing research and development activities for expanding product portfolios and meeting the changing consumer demands while keeping up with the rising market competition are the factors boosting the image signal processor and vision processor market growth.

| Report Coverage | Details |

| Market Size by 2034 | USD 19.05 Billion |

| Market Size in 2025 | USD 9.67 Billion |

| Market Size in 2024 | USD 8.97 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.82% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Technology, Device Type, End use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing demand for advanced and high-resolution imaging technologies

Increased consumer awareness about advanced technologies, availability and accessibility of integrated and smart image processing technologies, surging use of digital camera systems for various applications and rising disposable incomes are creating demand for high-quality imaging technologies further driving the market growth. Furthermore, integration of AI and machine learning algorithms and computer vision technologies in new smart devices, ongoing research for developing smart processors, the flourishing semiconductor industry and growing use of high-resolution imaging technologies for AR (Augmented Reality), VR (Virtual Reality) and MR (Mixed Reality) applications is boosting the market expansion.

Shortage of skilled workforce and higher production costs

The high capital investments for development and production of advanced image signal processors and vision processors, cost-associated with resource allocations and supply chain logistics as well as the rising consumer demand creating the need for robust and efficient manufacturing infrastructure can potentially restrain the market growth. Furthermore, the shortage of skilled personnel required for the development, execution and maintenance of these complex technologies can limit the growth of the image signal processor and vision processor market.

Rising applications in various industries

The recent developments in image signal processing and vision processing technologies integrated with computer vision, AI technologies is driving applications in various sectors. The ISPs and VPUs are being applied in various sectors such as consumer electronics like smartphones, for security and surveillance purposes in drones and CCTV systems, industrial applications for automation, in healthcare for medical imaging purposes, in automotive industries for advanced-driver assistance systems (ADAS) and infotainment systems and in aerospace and defence for target tracking, surveillance and reconnaissance is further creating opportunities for market growth.

The consumer electronics segment dominated the market with the largest share in 2024. The growing consumer demand for futuristic imaging technologies offering high quality images and videos, increased applications in consumer electronics devices, ongoing advancements in image processing technologies such as development of innovative processing algorithms and high resolution sensors for improving user experience, increased accessibility and availability at affordable prices for consumers, rising disposable incomes and integration of AI and computer vision in consumer devices such as smartphones, VR headsets and drones are driving the market dominance of this segment.

The automotive segment is anticipated to show the fastest growth during the forecast period. The market growth of this segment is driven by the rising investments by automotive industries for the adoption of advanced driver-assistance systems and autonomous driving which requires high quality image processing capabilities and sophisticated vision systems. Growing need for real-time processing of raw camera images with utilization of image signal processors and vision processors for various tasks such as identification of objects and pedestrians, lane detection, environment analysis, recognizing traffic signals and avoiding vehicle collisions as well as in surround view systems for creating a 360-degree view of the vehicle’s surroundings. Furthermore, the integration of AI and machine learning algorithms is creating opportunities for market expansion of this segment.

For instance, in October 2024, Sony Semiconductor Solutions Corporation declared the launch of its first-of-a-kind ISX038 CMOS (Complementary Metal-Oxide-Semiconductor) image sensor in the industry for automotive cameras enabling simultaneous process and output of RAW and YUV images.

Digital signal processing segment held the largest market share in 2024. Incorporation of digital signal processing (DSP) algorithms in image signal processors (ISPs) is applied for performing tasks such as image sharpening, HDR correction, colour correction, noise reduction, demosaicing and optimizing image capturing parameters such as auto-exposure and auto-focus. Furthermore, in vision processors DSP is used for analysing images, implementing machine learning models such as Convolutional Neural Networks (CNNs) for object recognition and for processing large volumes of imaging data with DSP algorithms. The increased demand for high quality images with structured processing capabilities across various industries and fields such as automotive, industrial automation, consumer electronics and medical imaging as well as the ability of DSP algorithms for optimizing power consumption while performing complex tasks with high accuracy is fostering the market growth of this segment.

Analog signal processing segment is expected to witness lucrative growth over the forecast period. Analog signal processing is essential for transforming raw analog signals from image sensors into digital format which can be achieved with an image signal processor (ISP) using an ADC (analog-to-digital conversion) for further processing and analysis of generated images. ISPs help in optimizing various functions such as noise reduction and image enhancement, whereas vision processors are used in various applications for connecting sensors with real-time sensors such as autonomous driving systems, industrial automation and smartphone cameras.

The smartphones segment accounted for the largest market share in 2024. The market growth of this segment can be linked to the rising number of smartphones incorporated with advanced imaging technologies, high-resolution technologies and integrated features such as multiple lenses (telephoto, wide, ultrawide), RAW photo format support, optical image stabilization (OIS) and enhanced zooming capabilities which creates the need for sophisticated image signal processors and vision processors. Furthermore, the integration of AI and machine learning algorithms in smartphones is enabling tasks such as scene understanding and image enhancements, rising disposable incomes, ongoing technological collaborations among various semiconductor industries, AI-driven platforms and smartphone companies as well as the burgeoning consumer demand for smartphones laced with advanced processors and high-capacity cameras drives the market expansion of this segment.

For instance, in October 2024, Qualcomm, an American chipmaker, launched its innovative flagship Snapdragon 8 Elite System-on-Chip (SoC) processor integrated an Oryon CPU. The processor has a dedicated neural processing unit (NPU) which powers the Qualcomm’s AI ISP (image signal processor) further allowing AI-powered camera features such as an on-device video object eraser for removing unwanted elements from videos and Semantic Segmentation at 4K resolution.

The CCTV systems segment is expected to witness lucrative growth over the forecast period. The rising demand for advanced security and surveillance solutions and the increased adoption of CCTV (Closed-Circuit Television) systems is creating the need for high-quality image processors for effective capture and analysis of video footage. Moreover, CCTV systems are vastly being adopted in various places and areas including public places such as malls and supermarkets, for monitoring traffic, in commercial sector, for enhancing security in residential complexes and personal homes among others for different applications like reducing crime rates, enhancing public safety and monitoring industrial processes among others. Furthermore, the incorporation of computer vision technologies in CCTV systems for object detection and facial recognition as well as the growing usage of vision processor units (VPUs) in automobiles, unmanned aerial vehicles (UAVs) and security and surveillance cameras is fostering the market growth of this segment.

The personal use segment captured the largest market share in 2024. The increased adoption of smartphones equipped with high-resolution cameras and AI technologies, installation of security surveillance cameras in personal homes and residential complexes, rising applications of mixed reality (MR) devices for personal use as well as surge in purchase of digital cameras for capturing high quality pictures is creating the need for advanced image signal processors and vision processors. Furthermore, ongoing research in developing state-of-the-art processors and surge in innovative product launches is driving the market growth of this segment.

The commercial use segment is expected to show the fastest growth during the forecast period. The market growth of this segment can be attributed to the surging demand for high-quality imaging technologies in various sectors such as automotive, surveillance and security and healthcare for medical imaging applications which enhances the performance, efficiency and streamlines operational workflows in these sectors further boosting customer engagement. Additionally, the progress in computer vision technologies and AI/ML applications is anticipated to foster market growth of this segment in the upcoming years.

The industrial use segment is predicted to grow significantly during the predicted timeframe owing increased emphasis on accelerating industrial processes with automated technologies while maintaining the quality and adherence to the stringent regulations in profitable sectors such as production and logistics. Furthermore, rising adoption of digitally advanced camera systems, increased use of smartphones, surging demand for high quality visual output and growing use of ISPs and VPUs for monitoring industrial processes is expected to significantly boost the market growth of this segment.

By Application

By Technology

By Device Type

By End Use

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

July 2024

August 2024

January 2025