April 2025

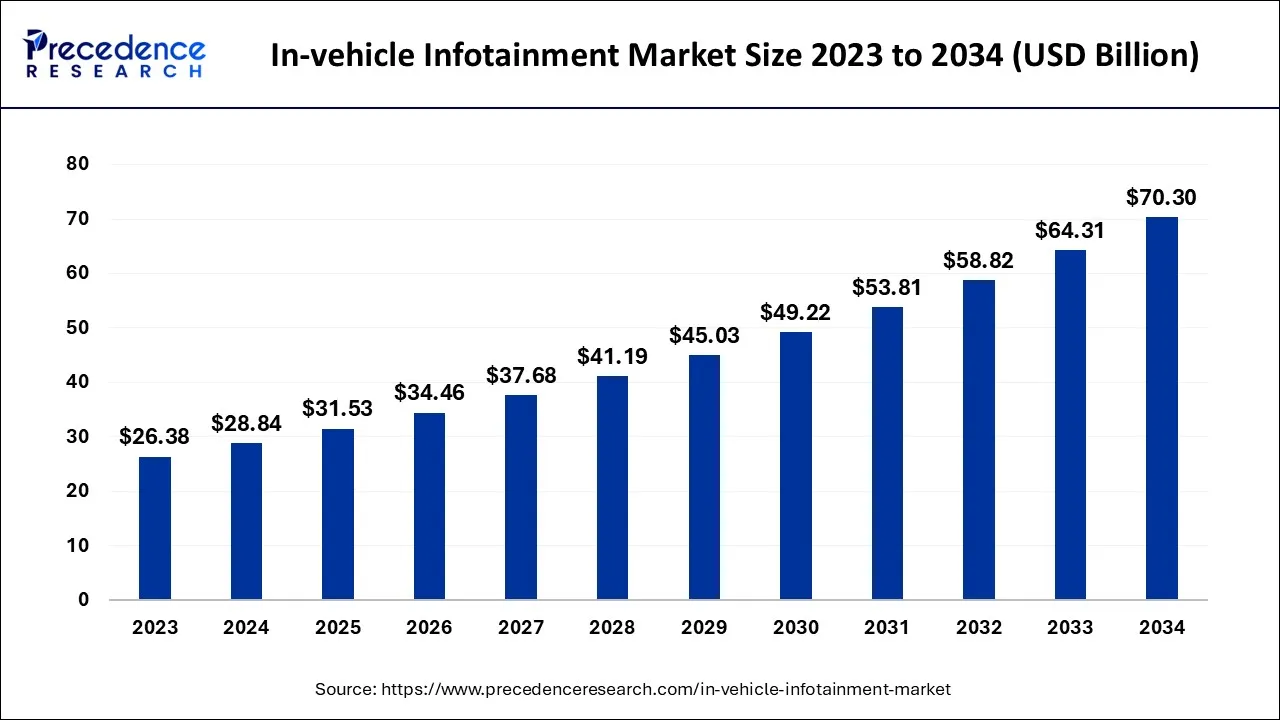

The global in-vehicle infotainment market size accounted for USD 28.84 billion in 2024, grew to USD 31.53 billion in 2025 and is expected to be worth around USD 70.3 billion by 2034, registering a CAGR of 9.32% between 2024 and 2034.

The global in-vehicle infotainment market size is calculated at USD 28.84 billion in 2024 and is projected to surpass around USD 70.3 billion by 2034, growing at a CAGR of 9.32% from 2024 to 2034. Technological advancements such as driver assistance, smart navigation and voice recognition are considered to boost the market's growth.

The automotive sector is leaning toward developing a revolutionary system to enable improved connectivity, boost vehicle safety, and enhance the in-car user experience. The in-vehicle infotainment system is an essential technology that serves as the focal point of all conventional automotive systems and integrates their capabilities to be controlled and monitored from one central unit. The in-vehicle infotainment system is a combination of the system that offers entertainment as well as information. A few prominent features of in-vehicle infotainment systems are high-resolution screens, smartphone pairing, digital tuners, multi-standard radio systems, advanced vehicular functions and android auto compatibility.

Moreover, an advanced in-vehicle infotainment system comprises a control panel. The newest in-car entertainment systems have voice commands, a touchscreen panel on the head unit, a button panel, and steering wheel controls that can be used to access and operate every feature. To provide entertainment and information to the driver and passengers, in-vehicle infotainment integrates with numerous different in-vehicle and external systems. The in-vehicle infotainment system offers an enjoyable and safe driving experience by allowing the integration of other smart devices, such as smartphones.

The improved technology that boosts the user’s safety while driving has increased the demand for advanced in-vehicle infotainment systems in the global market. Considering the rising importance of electric vehicles, multiple prominent key players in the market have already taken the infotainment systems on next level through their electric cars. Tesla Model X, Tesla Model S, BMW iDrive, Audi MMI and Ford Sync are top electric cars with advanced infotainment systems with touchscreen displays, cloud-based connectivity and aesthetic looks.

| Report Coverage | Details |

| Market Size in 2024 | USD 28.84 Billion |

| Market Size by 2034 | USD 70.3 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 9.32% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Component, By Vehicle, By Product Type, By Location, and By Connectivity |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The global in-vehicle infotainment market is expected to grow significantly due to rising demand for luxurious, smart and advanced vehicles across the globe. The rapid adoption of cloud technology in automobiles for various purposes has raised the demand for advanced in-vehicle infotainment systems. The automobile industry, and the infotainment market in particular, is evolving in the direction of cloud technologies; this is the significant variable that plays a critical role in the advancements of in-vehicle infotainment. The easy user interface of in-vehicle infotainment systems that integrates smartphones for numerous operations is fueling the market's growth. Rising demand for entertainment while driving is boosting the development of the market. The rapidly growing automotive industry, new product launches and increasing deployment of automated driving assistance systems in cars are a few other factors to fuel the growth of the global in-vehicle infotainment market. Moreover, the rising importance of Original Equipment Manufacturers (OEM) has forced many automotive companies to invest in the in-vehicle infotainment market, boosting the market's growth.

However, the risk of cyber attacks will likely hinder the market's growth. Additional data expenses required in the vehicles' infotainment systems are another factor restraining the market's development. Moreover, advanced and touchscreen infotainment systems are costly; this hampers the purchase as well as installation rate of advanced infotainment systems. Furthermore, the cost related to routine maintenance of software and hardware involved in the infotainment system is a major restraining factor for the market’s growth.

Based on components, the global in-vehicle infotainment market is segmented into software and hardware. The hardware segment acquires the largest share of the global in-vehicle infotainment market. At the same time, the software segment is expected to witness significant growth in the upcoming years. The hardware component in the in-vehicle infotainment system is the interface of the system. Hardware provides easy connectivity with external devices as well as networks, and this helps in the integration of smartphone and infotainment systems effectively and efficiently.

Based on vehicle, the global in-vehicle infotainment market is segmented into passenger cars, light commercial vehicles and heavy commercial vehicles. The rapidly increasing sale of passenger cars/vehicles has shown a positive influence on the passenger car segment. Strong demand for luxurious SUVs in the passenger vehicle segment is forecasted to have a significant effect on the market for automotive infotainment systems.

The desire for personal transportation and rising consumer purchasing power primarily drive the global passenger vehicle market. Advanced infotainment systems are needed since luxury automobiles have more advanced technology and safety features. The availability of options such as free services, better financing, and many others have changed consumer behavior.

Based on product type, the global in-vehicle infotainment market is segmented into the audio unit, display unit, heads-up display, navigation unit and communication unit. The display unit segment dominates the global in-vehicle infotainment market; the segment is expected to maintain growth during the forecast period. Display unit offers video streaming, weather forecast, navigation, calling access and many other benefits for front row location in a vehicle. The rising deployment of touchscreen display units for faster and easy access is boosting the growth of the segment. Moreover, the navigation unit segment is increasing significantly due to rising dependence on the global navigation satellite system.

Furthermore, High-end infotainment systems typically involve automotive heads-up displays, which reflect real-time car data onto a transparent screen built into the windscreen. Heads-up display supply driver with crucial data like speed, navigation maps, electronic digital cluster, multimedia options, etc. This helps in minimizing the driver's distraction.

Based on location, the global in-vehicle infotainment market is segmented into the front row and rear row. The front row location segment leads in the global in-vehicle infotainment market. Generally, the infotainment system is installed in the front row of the vehicle for proper display. The in-vehicle infotainment system installed in the front row is preferred for offering a realistic experience. The infotainment system that includes woofers, amplifiers and speakers needs to reproduce the sound correctly. The segment is growing with the rising deployment of small-sized speakers at the top of the front doors to offer proper distribution of sound.

Moreover, with increasing awareness about kids’ safety and security, the demand for rear row mounted cameras is expected to boost. Considering the safety concern, the rear row segment is predicted to gain a significant increase in the upcoming years. Along with the safety, rear row infotainment systems allow movie streaming, gaming and many other entertaining activities with a seat-back display.

Based on connectivity, the global in-vehicle infotainment market is segmented into 3G, 4G and 5G. The 5G connectivity segment is projected to dominate the global in-vehicle infotainment market during the estimated period. Vehicles will be able to carry out whole new functions due to the brand-new mobile network standard 5G. It will be feasible to have future mobility, automated driving, and better vehicle multimedia and entertainment systems. In addition to other infotainment amenities, 5G connectivity will allow a seamless streaming experience, and the integration of traffic and weather forecasts is possible with the fastest mobile network service.

More immediate data transfer and cheaper operating expenses are two advantages of 5G connectivity. Due to these features, worldwide automakers are emphasizing the rollout of 5G technology. The 5G network provides real-time data that enables the driver to conclude immediately. The speed of navigation in cars will be faster than ever. Moreover, 5G connectivity will increase the dependence on the infotainment system, which will boost the growth of the overall market.

Geographically, North America acquires the largest revenue share in the global in-vehicle infotainment market. Rising concerns about safety while driving are considered the major driving factor for the market's growth. The growing automotive industry, rise in adoption of connected cars, and rapid deployment of advanced technology in the region are a few other factors to fuel the market growth. Europe is the prominently growing marketplace for in-vehicle infotainment systems owing to the rapidly revolutionizing automotive industry. The presence of major automotive brands such as BMW, Mercedes, Renault and Daimler has provided lucrative opportunities for the in-vehicle infotainment market to grow in recent years. Germany and France are significant contributors to the market’s growth in Europe. The rising adoption of electric cars in the region is seen as an essential driver for the market to uplift during the projected period.

Asia Pacific is expected to witness a significant increase in the in-vehicle infotainment market during the forecast period. China is the largest marketplace in the Asia Pacific owing to its widespread automotive industry and availability of low-cost raw materials. India, Japan and South Korea are anticipated to show gains in upcoming years. Moreover, the rising adoption of smart integrated car infotainment systems and the deployment of artificial intelligence and virtual reality (VR) in the automotive industry are a few other factors to boost the market’s growth.

Emerging economies and developing infrastructure of the automotive industry are projected to propel the growth of the in-vehicle infotainment market in Latin America. The presence of prominent automakers in the gulf countries of the Middle East is considered to boost the market's growth in the region. The market shows steady growth in Africa.

By Component

By Vehicle

By Product Type

By Location

By Connectivity

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

January 2025

December 2024