June 2024

The global in vivo CRO market size was USD 4.62 billion in 2023, calculated at USD 4.99 billion in 2024 and is expected to be worth around USD 10.89 billion by 2034. The market is slated to expand at 8.11% CAGR from 2024 to 2034.

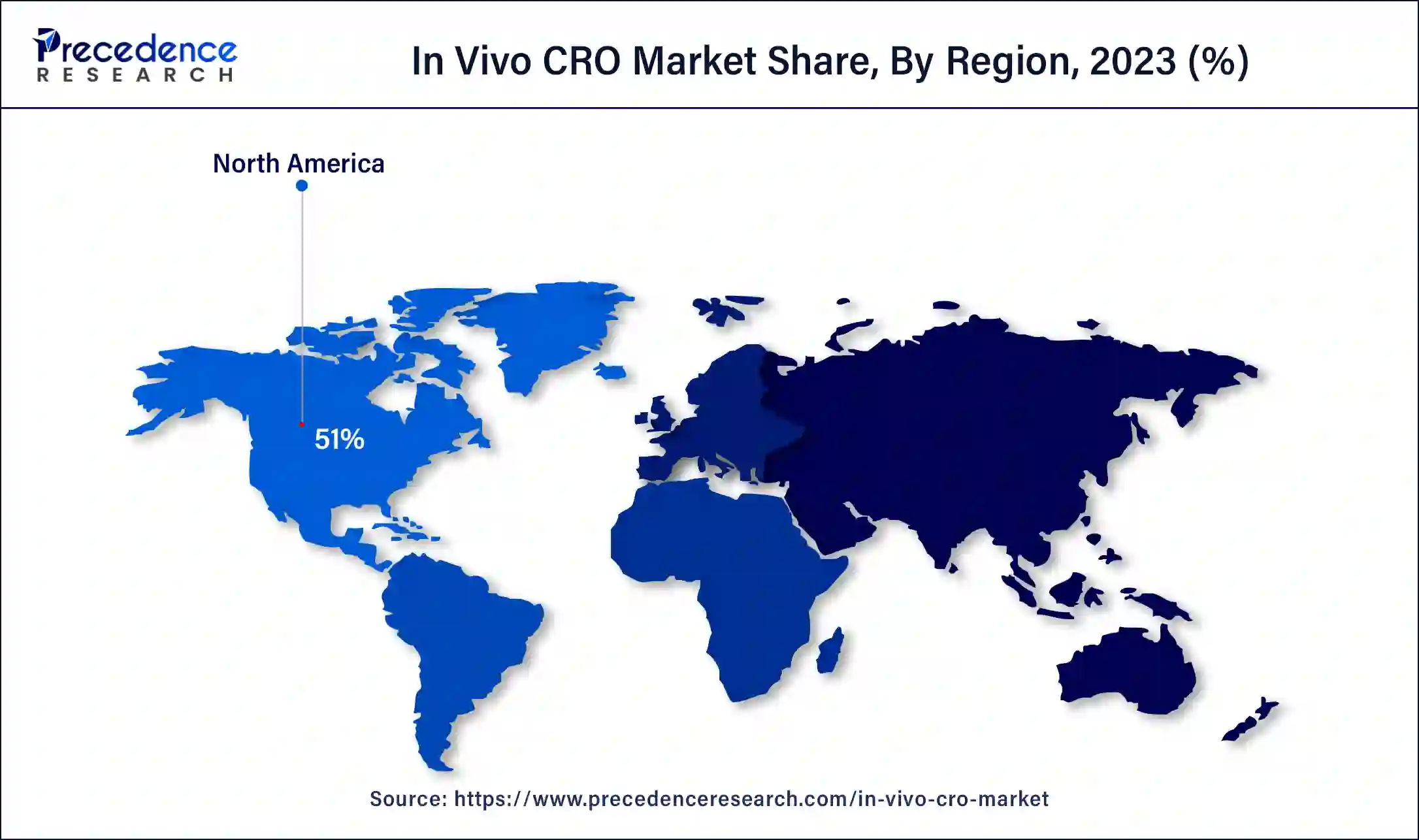

The global in vivo CRO market size is projected to be worth around USD 10.89 billion by 2034 from USD 4.99 billion in 2024, at a CAGR of 8.11% from 2024 to 2034. The North America in vivo CRO market size reached USD 2.36 billion in 2023. The rising demand for the clinical research outsourcing is driving the growth of the market.

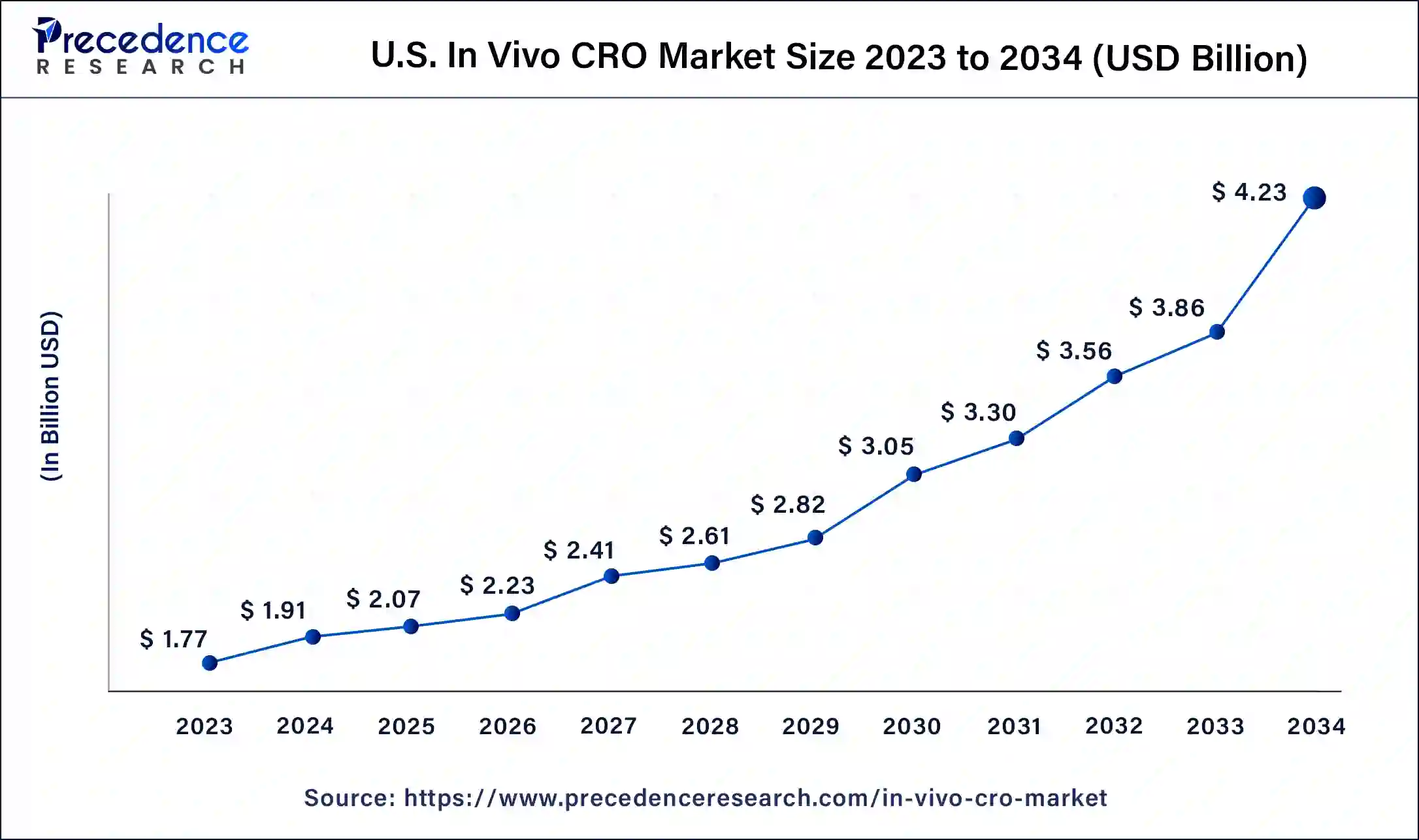

The U.S. in vivo CRO market size was exhibited at USD 1.77 billion in 2023 and is projected to be worth around USD 4.23 billion by 2034, poised to grow at a CAGR of 8.24% from 2024 to 2034.

North America dominated the in vivo CRO market with the largest market share in 2023. The growth of the market is attributed to the higher availability of the major pharmaceutical and biotechnological firms and the increasing investment in the innovations and discovery of the drugs are driving the growth of the market. Additionally, the rising demand for the discovery drugs and clinical studies for the formulation and the development of drugs for the treatment of rising number of chronic conditions are driving the growth of the in vivo CRO market in the region.

Asia Pacific is expected a significant growth in the market during the forecast period. The growth of the market is expected to rise due to the increasing population and the rising development in the pharmaceutical and biotechnology sector. The increasing regional population and the increasing prevalence of the several disease in the population is driving the demand for the drug development that boost the clinical research cases in the pharmaceutical and biotech laboratories that boosts the outsourcing of the clinical trials that drives the growth of the in vivo CRO market.

The contract research organization is the independent organization or body that help in the clinical trial or medical studies for the drug discovery. The organization works in providing research services to the pharmaceutical, biotechnology, medical devices, government agencies, academic institutions, and foundation. The contract research provides the number of services to the various healthcare institutes such as it offers clinical trial management, preclinical research, biostatics, data management, regularity affairs. There are three major types of CROs such as full-service CROs, functional services provider (FSPs), and specialty CROs. The rising demand for the drug discovery are driving the growth of the in vivo CRO market.

How AI can impact the in vivo CRO Industry?

The integration of the artificial intelligence is revolutionizing the healthcare, pharmaceutical, and biotechnology industry. Artificial intelligence improves the overall efficiency, accuracy of the services. The rising integration of AI into the clinical research driving the new opportunities in the drug discovery and development process. The adaptation of AI in CRO is drives the operations in the clinical research it increased the data quality, rapid trial completion, and enhanced patient safety. Data analysis by the artificial intelligence is helps in detecting anomalies and outliners that affect the clinical trial. AI could lead data reliability and integrity. AI streamline trial operations to increase the patient outcomes and disease and disease detection. Artificial intelligence play an important role in the advancement in the medical knowledge and improves the drug discovery process.

| Report Coverage | Details |

| Market Size by 2034 | USD 10.89 Billion |

| Market Size in 2023 | USD 4.62 Billion |

| Market Size in 2024 | USD 4.99 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.11% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Model Type, Modality, Indication, GLP Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising acceptance of the CRO in the clinical trial

The clinical development is the challenging operations in the healthcare sector. The CRO plays an important role in the improving the clinical and pharmaceutical development, it ensure the ethical and safer clinical trial that necessary for the development of the innovative drug, treatment procedures, and medical devices that helps in better outcome of millions of patients. With the changing regularity standards and rising demand of the pharmaceutical and biotechnology companies, there are several CRO companies enhanced their services including AI, decentralized trials, various innovatory services that helps in enhancing the patient recruitment.

Top CRO Companies that offer clinical trials in 2024

Several limitation are associated with the CROs

There are several limitation in association with the CROs including limitation in control over research, communication challenge, and lower familiarities with the project, intellectual property ownership concern, and several other limitations are restraining the growth of the in vivo CRO market.

Technological advancements in the CROs

The technological adoption in the CRO is driving the revolution in the clinical trial and drug discovery. The technological advancements drives the opportunities in improving services in the CROs. The integration of the tech-enabled patient-recruitment and management, decentralized and remote trials, wearable technology, and biosimulation. Additionally, the rising investment by the public and private firm in the clinical trial and drug discovery is driving the growth of the in vivo CRO market.

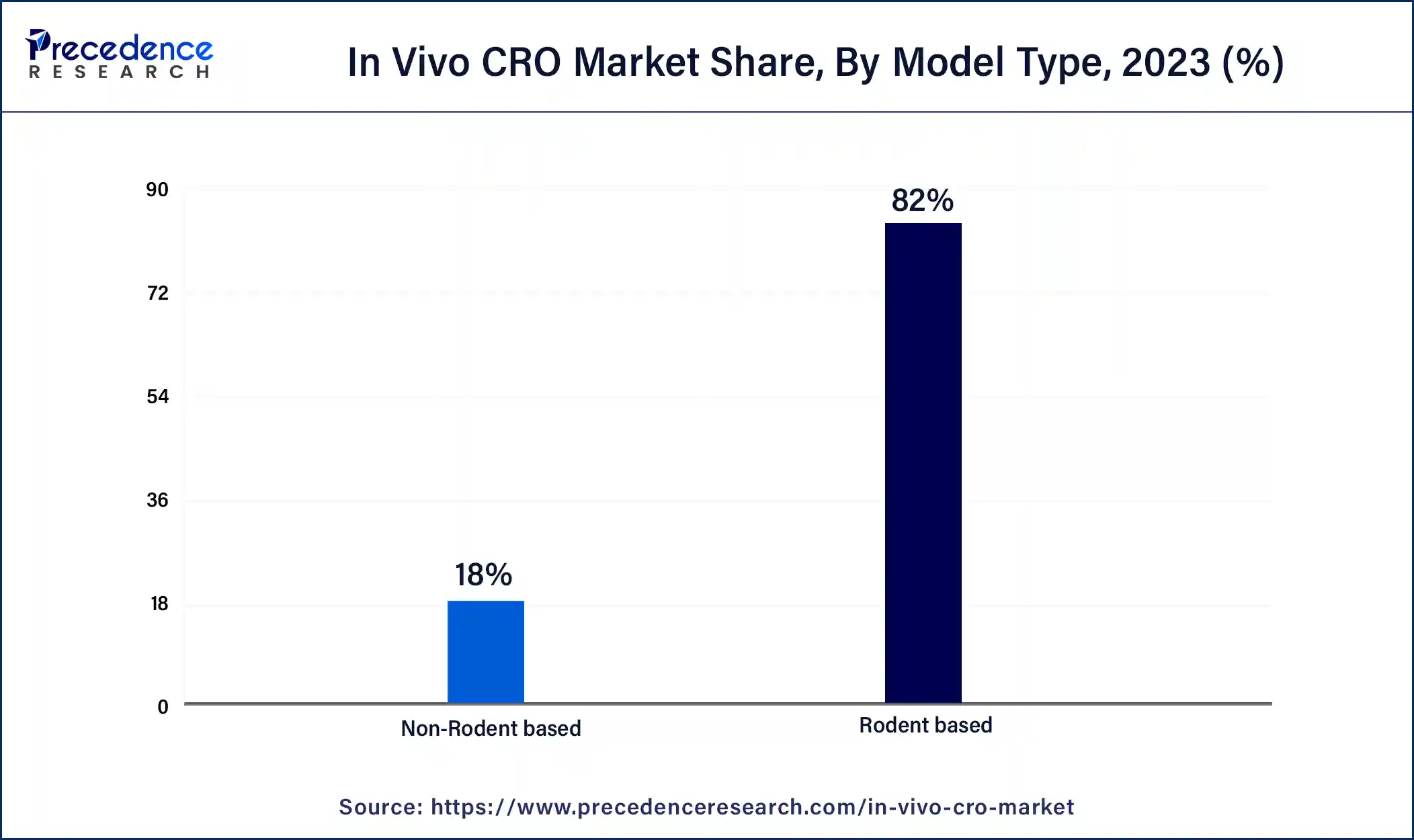

The rodent-based segment dominated the in vivo CRO market with the largest share in 2023. The segment's growth is owing to the higher use of rodents as the model for research in several clinical trials for drug and treatment innovations. It is highly used in the medical study and trials. Rodents are extensively used in medical research due to their similar behaviors, genetics, and biology to humans. Rodents have almost the same immune system as humans. They might experience the same disease and similar types of organs and bodily systems as humans. It is stated that around 95% of the gene codes of rodents are identical to those of humans. Thus, they are the ideal model for clinical trials for human diseases. Rodents are efficiently used in clinical trials for cardiovascular disease. Therefore, the higher use of rodent models for clinical trials and medical studies drives the demand for the segment.

The non-rodent-based segment is expected to have significant growth in the market during an anticipated period. The rising use of the non-rodent segment for offering research and several benefits in terms of drug development, homology to humans, body weight, metabolism, organ structure, etc.

The small molecules segment held the largest market share in 2023. Small molecule plays an essential role in various medical breakthroughs, meeting medical demands; it is vital as the chemical probe in biomedical research and understanding disease biology. Small molecule drug discovery develops the drugs used for particular targets in the body, like receptors, enzymes, and ion channels. It helps maintain their activity for the treatment or prevention of various diseases. It is used in different stages, including validation, target identification, lead optimization, and hit identification.

The large molecules segment is anticipated to increase its growth in the market during the predicted period. The increasing development of large-molecule drug products due to their higher efficiency in disease treatment has improved the large-molecule bioanalysis CROs. The large molecule drug products, including protein, peptides, antibody-drug conjugates, and monoclonal antibodies, effectively help treat and prevent several disease indications. The most common large molecule bioanalytical studies are pharmacokinetic (PK) studies, immunogenicity testing, pharmacodynamics (PD) studies, and biomarker assays.

The GLP toxicology segment dominated the in vivo CRO market in 2023. The GLP toxicology plays an important role in the any type of the medical study or the clinical trials. The GLP toxicology studies helps in identifying the toxicological effects on the dosage that lower than in use for human clinical trials. The GLP toxicology majorly involves in the model organisms like rodents and offer valuable insights about the toxicity of the drug on the various organs and biological system.

The non-GLP segment expected a significant growth in the market during the anticipated period. The non-GLP segment is the drug development procedure that involves in the clinical or medical studies. These clinical studies are comply on the GLP regulation. The non-GLP toxicology studies can be comply on the various drug development and detection process that boosts the growth of the market.

The oncology segment dominated the market with largest share in 2023. The increasing prevalence of the cancer all around the world due to the changing lifestyle habits, and other issues that contributing in the demand for the drug development for the treatment of the disease. There are ongoing investment by the private and public firm on the development of the drug or the treatment procedures that drives the adoption of the CROs for the clinical trial and medical studies in the development of the drug for the oncology. Thus, the increasing number of patients with the various types of cancer that drives the growth of the segment.

The CNS conditions segment is expected to capture the fastest growth over the predicted period. The increasing cases of the CNS diseases including Huntington’s disease (HD), Epilepsy, Parkinson’s disease (PD), stroke, and Traumatic Brain Injury (TBI). CROs provides the informative insights, understanding for conducting preclinical investigation and specialized services. The rising demand for drug discovery for the various types of the CNS conditions is contributing in the growth of the market.

Segments Covered in the Report

By Model Type

By Modality

By GLP Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

June 2024

July 2024

July 2024