What is the Industrial Energy-Efficiency Services Market Size?

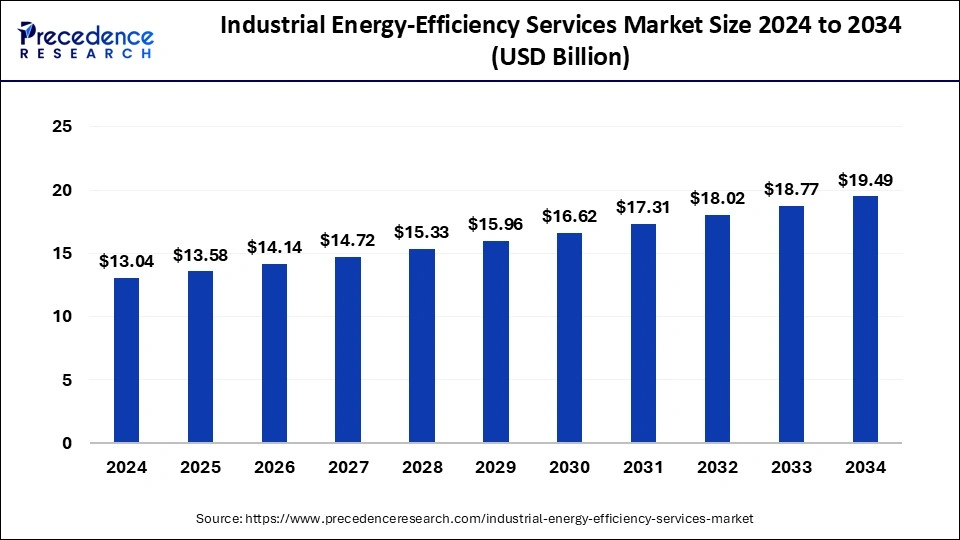

The global industrial energy-efficiency services market size is accounted at USD 13.58 billion in 2025 and is predicted to increase from USD 14.14 billion in 2026 to approximately USD 20.23 billion by 2035, expanding at a CAGR of 4.07% from 2026 to 2035. Reduced energy use results in lower energy costs, which helps businesses' bottom lines.

Industrial Energy-Efficiency Services Market Key Takeaways

- North America held the largest share of the industrial energy-efficiency services market in 2025.

- Europe is expected to host the fastest-growing market during the forecast period.

- By type, the energy auditing or consulting segment led the market in 2025.

- By type, the monitoring & verification segment is expected to grow at the fastest rate in the market in the coming years.

- By application, the petrochemical segment dominated the market in 2025.

- By application, the electric power segment is expected to expand rapidly in the market over the projected period.

- By end use, the commercial segment held the largest share of the market in 2025.

- By end use, the industrial segment is expected to grow at the fastest rate in the market in the coming years.

- By service type, in 2023, the outsourced segment dominated the market.

- By service type, the in-house is expected to develop significantly in the market over the years studied.

What is the Industrial Energy-Efficiency Services Market?

The industrial energy-efficiency services market is a developing industry with the goal of optimizing energy use in industrial operations to increase productivity, cut expenses, and lessen environmental effects. Governments all throughout the world are putting strict laws into place with the goal of lowering carbon emissions and encouraging industry energy efficiency. More efficient energy monitoring and optimization are made possible by developments in smart grids, IoT, and energy management systems.

The industrial energy-efficiency services market is expected to increase significantly due to a combination of technological, legal, and economic considerations. The market will continue to advance due to the emphasis on sustainability and cost-cutting, making it an essential area of investment for industrial sectors all over the world. It is anticipated that these technologies will improve energy management systems, giving them greater predictability and flexibility.

The industrial energy-efficiency services market will be supported by the expansion of microgrids and distributed energy resources. Enhanced cooperation to create comprehensive energy efficiency solutions amongst industrial businesses, service providers, and technology providers. Certain areas lack knowledge regarding the advantages and prospects associated with energy efficiency.

Artificial Intelligence: The Next Growth Catalyst in Industrial Energy-Efficiency Services

AI is transforming the industrial energy efficiency services industry by shifting focus from manual, reactive maintenance to proactive, automated, and AI-driven optimization, with the market for such solutions expected to grow significantly.

By leveraging machine learning and real-time sensor data, AI allows manufacturing plants to optimize energy consumption and reduce costs by predicting machinery failures, reducing downtime, and automating complex processes like HVAC control.

Industrial Energy-Efficiency Services Market Outlook

- Industry Growth Overview: Between 2025 and 2030, the market for industrial energy efficiency services is anticipated to experience rapid growth as factories integrate advanced monitoring, automation, and retrofit solutions. The increase in demand for energy efficiency services was driven by rising energy costs, carbon emissions requirements, and industry pressure to reduce waste. Industries that saw stronger growth included chemicals, automotive, metals, and food processing.

- Sustainability Trends: Sustainability has transformed the landscape for energy efficiency services, as many firms have invested in reducing carbon emissions across their processes and operations. The demand for and investment in energy audits, recycling waste heat, digital optimization, and integrating renewables increased across the board. In addition, firms committed increased capital toward net-zero pathways to meet and exceed climate commitments established by global interventions.

- Global Expansion:Multiple leading service providers expanded operations to the Asia Pacific, the Middle East, and Eastern Europe, following increased industrial activity in those regions and available incentive programs. Several developers set up regional centers to provide compliance services for customers who could not afford to hire an energy service provider. They collaborated with government programs designed to reduce their overall energy consumption.

- Major Investors: Private equity participants and strategic investors were experiencing an increase in interest, driven by stable demand and long-term contracts. The combination of favorable ESG attributes also created additional demand. The investment followed in areas such as digital energy management, IoT sensor-based optimization, and industrial decarbonization solutions. Asset managers like Blackstone and Brookfield increased their equity positions in companies providing analytics, efficiency consulting services, and retrofit technologies.

- Startup Ecosystem:The startup ecosystem grew at a rapid pace, with new companies providing AI-based energy monitoring systems, predictive maintenance systems, and heat-recovery solutions. Start-ups focused on carbon intelligence, advanced sensors, and digital twins attracted significant venture capital investment from traditional investors. Other established businesses, like EnerCrest (USA) and GreenOptix (Europe), gained traction for launching easy-to-scale, software-based efficiency solutions.

What are the Growth Factors in the Industrial Energy-Efficiency Services Market?

- Important motivators include strict environmental laws and initiatives to cut carbon emissions and boost the energy economy. Governments globally are implementing legislation and incentives to encourage the industrial energy-efficiency services market.

- Businesses are realizing more and more that energy efficiency can result in significant cost savings. Reduced energy use lowers operating expenses, which boosts profitability. Industries find it financially viable to engage in energy efficiency solutions due to rising energy costs.

- Technological innovations like machine learning, IoT, AI, and smart grids offer new means of enhancing energy efficiency. These technologies make better energy use monitoring, control, and optimization possible. The industrial energy-efficiency services market is driven by the advancement and uptake of sophisticated energy management systems, which enable more efficient energy use.

- A lot of businesses are establishing challenging targets for corporate social responsibility (CSR) and sustainability. Services for energy efficiency assist businesses in achieving these objectives and improving their reputation.

- The need for energy efficiency services to support new and expanding businesses is driven by the growth of industrial activity, particularly in emerging economies. There is a market for retrofit services since older industrial facilities frequently need to be upgraded to increase energy efficiency.

- Industry investment in energy efficiency enhancements is facilitated by the emergence of finance models such as energy performance contracts (EPCs) and third-party financing options.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 20.23Billion |

| Market Size in 2026 | USD 14.14 Billion |

| Market Size in 2025 | USD 13.58 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.07% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, End-use, Service Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Development of renewable energy sources

One of the most important steps toward attaining sustainable industrial growth and lowering greenhouse gas emissions is the development of renewable energy sources in the industrial energy efficiency services sector. In order to increase energy efficiency, lower operating costs, and improve environmental performance, this entails incorporating renewable energy technologies and solutions into industrial operations.

Various industrial processes use biomass, biogas, and biofuels to generate heat and electricity. Trash-to-energy systems help with trash management and energy efficiency by turning industrial waste into usable energy. Thorough energy audits are useful in locating inefficiencies and potential areas for process improvement in industrial settings. This involves assessing how well renewable energy sources might be integrated.

Restraint

Limited access to financing

There are a number of reasons why the industrial energy-efficiency services market has limited finance availability. By being aware of these, stakeholders may better resolve obstacles and increase access to money that is required. Energy efficiency initiatives may take several years to pay for themselves, which makes them less appealing than other projects with quicker payback times. Investors may be discouraged by unclear information regarding the performance and real energy savings of the deployed systems. It can be challenging for traditional bankers to comprehend and accept the complicated financial models and specialized financing methods that energy efficiency projects frequently demand, such as shared savings agreements and Energy Performance Contracts (EPCs).

Opportunity

Energy performance contracting

An energy service company (ESCO) first does an energy audit to find possible areas for an industrial operation to save energy. Analyzing equipment efficiency, trends in energy use, and possible areas for improvement are all part of this. After the plan is approved, the ESCO puts the agreed-upon actions into action. These could involve installing energy-efficient technologies, streamlining procedures, or updating equipment. The savings resulting from the measures themselves frequently cover the cost of the energy efficiency upgrades. This implies that the project's cost is covered by the energy savings realized by the industrial facility, usually over a predetermined length of time.

Segment Insight

Type Insights

The energy auditing or consulting segment led the industrial energy-efficiency services market in 2025. Large volumes of energy are consumed by industrial facilities. Therefore, even modest increases in efficiency can result in substantial cost savings. Energy audits assist in locating inefficient regions and make recommendations for ways to cut energy use, which lowers operating expenses for industrial clients. The use of energy in industries is a significant source of pollution in the environment, including carbon emissions.

Businesses can lessen their environmental impact, support sustainability initiatives, and improve their reputation by increasing energy efficiency. Every industrial plant is different, posing different opportunities and problems for increasing energy efficiency. Energy auditing and consulting services maximize the efficiency of energy-saving activities by offering customized solutions that cater to the unique requirements and limitations of each customer.

The monitoring & verification segment is expected to grow at the fastest rate in the industrial energy-efficiency services market in the coming years. Setting a baseline for energy usage is the first step in M&V. This acts as a benchmark for measuring the energy savings that come from efficiency improvements. M&V includes gathering and examining data on production output, energy usage, and other pertinent variables. Patterns, abnormalities, and areas for development can be found with the aid of advanced analytics.

M&V uses a baseline energy usage comparison to confirm that energy-saving solutions are performing as intended. This verification procedure guarantees that the anticipated energy savings are realized. M&V produces reports that include performance indicators, energy savings, and other pertinent data. Stakeholders such as industrial facilities, energy service companies (ESCOs), and regulatory authorities need to have access to these reports.

Application Insights

The petrochemical segment dominated the industrial energy-efficiency services market in 2025. The market for industrial energy efficiency services is heavily influenced by the petrochemical sector. Because the complicated processes required in refining crude oil and natural gas into various chemical compounds are involved,petrochemical plants are usually energy-intensive enterprises. These facilities use a lot of energy as a result, which makes energy efficiency crucial for both cost-cutting and environmental sustainability.

Large volumes of waste heat are frequently produced by petrochemical operations; this waste heat can be collected and repurposed via heat recovery systems to warm feedstock or provide steam for other uses. By installing CHP systems, petrochemical factories can increase total energy efficiency by producing electricity on-site and using waste heat for other industrial processes, such as heating.

The electric power segment is expected to expand rapidly in the industrial energy-efficiency services market over the projected period. The market for industrial energy efficiency services is heavily influenced by the electric power industry. Since companies use a large amount of the world's energy, it is essential to maximize their energy use for both cost and sustainability.

One of the main inputs used by industry is electricity. Energy service companies (ESCOs) frequently analyze patterns of electric power consumption, spot inefficiencies, and suggest ways to improve usage during energy audits and assessments. Electric utilities frequently offer DSM programs with the goal of lowering peak electricity consumption. Industrial facilities can take advantage of these programs by lowering their peak electricity consumption periods through the implementation of energy-saving solutions.

The industrial segment held the largest share of 48.60% in the 2024 global industrial energy-efficiency services market. Mainly, the mining, oil and gas, utilities, and power plants industry has transformed the global industrial services with the rising demand for services that bring environmental impact and are affordable. The manufacturing industry benefits from the market through contracts and partnerships. The development in this segment involves the integration of smart technologies such as data analytics, IoT, and AI.

The institutional and government segment is expected to grow at a CAGR of 8.40% during the forecast period. This segment is emerging with the new policy frameworks and applicable targeted incentives, such as tax credits and performance standards that enable access to details and financing. The cross-sector collaboration and the focus on excellent practices leverage the growth in the industrial energy efficiency services globally. The municipal buildings, educational institutions, military and defense facilities, hospitals, and public healthcare contribute added value to the market.

Service Type Insights

The outsourced segment dominated the industrial energy-efficiency services market in 2025. The fraction of services offered by external third-party service providers in the market that are not handled internally by the industrial enterprises themselves is referred to as the outsourced segment. These services may include energy audits, the installation of energy-saving devices, energy management systems, performance monitoring, and continuous maintenance, among other initiatives targeted at enhancing energy efficiency in industrial operations. Industrial businesses can benefit from outsourcing these services in a number of ways, such as cost savings, flexibility, and the opportunity to concentrate on core business operations while leaving energy efficiency responsibilities to professionals.

The in-house is expected to develop significantly in the industrial energy-efficiency services market over the years studied. The term "in-house segment" in the context of the industrial energy-efficiency services market describes energy-saving measures that are applied directly in a business's own premises or activities. This section covers the steps that industrial businesses themselves have made to maximize energy use, cut waste, and enhance general efficiency in their buildings, machinery, and production processes. To find places where energy is wasted and potential for improvement, businesses audit and evaluate their facilities. Teaching staff members energy-saving techniques and motivating them to participate in energy-saving initiatives. Furthermore, internal efforts may be customized to meet the unique requirements and conditions of particular businesses, which makes them extremely flexible and efficient energy management solutions.

The implementation services segment held the largest share of 32.70% in the 2024 global industrial energy-efficiency services market. The implementation services include energy-efficient equipment installation, HVAC system upgrades, building envelope improvements, motors and drives efficiency, lighting retrofits (sensors, LED, etc), and boiler and steam system optimization. The segment is merging by polishing its target on building smart strategies and designing to control energy consumption, cut greenhouse gas emissions, especially for industrial clients. The development of this segment is influenced by regulatory requirements and rapid demand for sustainable operations. The advanced technologies, such as AI and IoT, are an addition to the growth.

The energy performance contracting (EPC) segment is expected to grow at a CAGR of 9.30% during the forecast period. The EPC segment involves a guaranteed savings and shared savings model. EPC in the global industrial services helps companies to engage in energy efficiency upgrades, eliminating upfront costs. EPC focuses on renewable energy, and the development is influenced by the advantage of guaranteed savings and the contribution from the financial and government institutions in various market models, such as the joint guaranteed and savings model.

Component/technology focus Insights

The HVAC systems segment held the largest share of 21.50% in the 2025 global industrial energy-efficiency services market. The HVAC systems are crucial for the global industrial services by promoting air quality and regulating temperature. Though there are energy consumers, the development of new intelligent technology such as data analytics, sensors, and AI is initiating upgradation to reduce energy waste, enhance air quality. The innovation, such as digital twins and heat pumps, merged with the smart grids, is a sustainable achievement of the HVAC systems.

The renewable integration (eg, solar PV +EE) segment is expected to grow at a CAGR of 10.20% during the forecast period. The renewable integration and energy efficiency services are revolutionizing the global industrial sector. The segment involves natural alternatives, such as solar and wind, working on emission reduction. Alongside, the developmental services attend to technologies such as energy storage, Industry 4.0, and smart grids to initiate automated operations.

Business Model Insights

The ESCO (energy service company) model segment held the largest share of 34.90% in the 2025 global industrial energy-efficiency services market. The ESCO business model delivers energy efficiency in industries through execution, closely monitoring the energy saving projects, and upfront financing. ESCO's dedication to enabling a budget-neutral idea and being an excellent, considerate shop for energy solutions helps to achieve regulations and sustainability. The development of the ESCO model is fueled by the climate change issue, upgrading government policies, and elevating energy costs.

The public-private partnerships (PPPs) segment is expected to grow at a CAGR of 9.10% during the forecast period. The PPPs business model is gaining traction with the innovative factor to achieve climate goals and identify the infrastructure deficits. The PPPs enable expertise and private sector capital status and deploy best practices for the industrial and business advantage. The worthy development relies on transparent contracts, fairness in profit and risk sharing between the private and public sectors, and a robust framework. With this successful development, the market will expand through the smart strategic collaborative arrangements.

End user type Insights

The large enterprises segment held the largest share of 41.80% in the 2025 global industrial energy-efficiency services market. The large enterprises bolster global industrial energy efficiency services, accelerating efficient equipment improvement and adopting intelligent automation. The deployment of digital technologies for real-time monitoring and achieving sustainability goals will be a strategic move. The partnership to drive solutions will improve productivity and align with climate regulations. Large enterprises manage to employ advanced technologies and expertise that accelerate productivity and the market size as well.

The SMEs segment is expected to grow at a CAGR of 8.70% during the forecast period. The SMEs are vital for the growth of the global industrial energy efficiency services because of the massive number and joint energy consumption. By developing certain awareness, studying financial fluctuation dynamics, the SMEs tend to emerge beyond any limitation and are confidently heading towards the development to meet environmental sustainability, competition, with the need for policies and access to energy efficiency networks and training. The low-cost technologies and customization are the beginning to address the potential of the SMEs sector.

Regional Insights

North America held the largest share of the industrial energy-efficiency services market in 2025. To encourage the use of energy-efficient technology, governments are putting stricter rules into place. This is especially true in the United States and Canada, where big manufacturing operations are big energy users and are, therefore, the main targets of these rules. Reducing the environmental impact of industrial activities and promoting sustainability are becoming more and more important. Because of this, there is a growing need for energy efficiency services as businesses work to achieve these objectives. Despite obstacles such as high starting prices and implementation difficulties, the North American industrial energy efficiency services industry is expected to increase steadily due to regulatory demands, technology advancements, and sustainability aspirations.

U.S. Industrial Energy-Efficiency Services Market Trends

The U.S.'s shift towards a reactive cost-cutting to a proactive, data-centric strategy centered on AI integration and scalable cloud architectures. The dominance of EaaS models and strategic cross-industry partnerships is effectively dismantling traditional capital barriers, enabling high-intensity sectors like petrochemicals to meet aggressive net-zero benchmarks.

Europe is expected to host the fastest-growing industrial energy-efficiency services market during the forecast period. Europe's market for industrial energy efficiency services has been expanding gradually as a result of a number of causes, such as stricter laws and regulations, escalating energy prices, and greater public awareness of environmental sustainability. Energy audits are required by directives like the Energy Efficiency Directive (2012/27/EU), which also promotes energy management systems in all companies. Industries are forced to optimize energy consumption in order to stay competitive due to rising energy prices. Organizations are being pushed to embrace energy-efficient techniques by expanding corporate social responsibility (CSR) programs and environmental objectives. More efficient energy consumption monitoring and reduction are made possible by advancements in energy management systems, IoT, and AI-driven analytics.

Germany Industrial Energy-Efficiency Services Market Trends

Germany's transition toward thermal process optimization and AI-driven IEMS, addressing the energy drain from process heat. Stringent mandates from the Energy Efficiency Act have transformed energy audits from periodic checks into continuous, digitally-monitored requirements for climate neutrality.

Why did the Asia-Pacific Region Experience Rapid Growth in the Industrial Energy-Efficiency Services Market?

Asia Pacific demonstrated solid growth because industries were expanding quickly and had added pressure to reduce energy consumption. Countries in the region allocated considerable investments toward digital services and tools, automation, and efficiency programs. In part, rising electricity costs and government rules supported retrofits and monitoring systems. Furthermore, the region provided large opportunities for sensor-based solutions, waste-heat recovery, and renewable energy integration in factories.

China Industrial Energy-Efficiency Services Market Trends

China led the region because of its massive industrial production and strong government policies championing efficiency. Factories adopted automation, digital monitoring, and energy-saving retrofits. National programs encourage clean energy use and carbon-reduction strategies that have created a significant market for advanced solutions. Service providers also identified strong opportunities with heavy industry (i.e., steel, chemicals, electronics) where efficiency upgrades had large potential for energy cost reduction

Why did the Latin American Region Experience Steady Growth in the Industrial Energy-Efficiency Services Market?

Latin America has recorded steady growth as industries sought to trim operating costs while also enhancing reliability. Governments have advocated a cleaner approach to energy use and provided resources as benefits for efficiency projects. Manufacturers across the region embraced monitoring tools, performed energy audits, and adopted automation in an effort to boost productivity. The region is adapted to create retrofit service work, support for renewable energy generation, and improve digital disposition toward more advanced energy systems as manufacturers modernized their production lines while pursuing sustainable practices.

Brazil Industrial Energy-Efficiency Services Market Trends

Brazil led the Latin American region due to its large industrial base in food, chemicals, and metals, which has a greater demand for the enhancement and upgrade of efficiency. Rising electricity costs led the industry to invest in automation, large-scale retrofits, and energy-management tools. Government-led, more efficient clean-energy programs encouraged even more updates and revisions of efficiency.

Why did the Middle East & Africa Region Experience Steady Growth in the Industrial Energy-Efficiency Services Market?

The Middle East and Africa experienced steady growth as manufacturers sought to lessen energy dependency and to enhance operations. Government funding for sustainability programs, along with governmental support for precision plant upgrades toward clean energy goals, continued to grow. The rise in industrial activities in chemicals, metals, and construction sustained demand for energy audits, automation, and digital tools. The region provided an abundance of opportunities for heat-recovery systems, renewable energy integration, and advanced energy monitoring in countries that are modernizing their energy activities.

The UAE Industrial Energy-Efficiency Services Market Trends

The United Arab Emirates led the Middle East & Africa region due to its strong commitment toward industrial modernization as well as the goal of meeting stringent clean-energy expectations. Industrial facilities implemented smart controls, energy audits, and digital energy monitoring strategies to lessen energy use. Government funding and support for large-scale sustainability projects drove industrial facility upgrades toward improved efficiency and reduced energy use, creating opportunity (and demand) for service providers leveraging automation and heat-recovery systems in addition to advanced management systems.

Industrial Energy-Efficiency Services Market Companies

- Siemens: Siemens provides comprehensive, digitalized energy management solutions, ranging from smart, connected sensors and automation to AI-enabled, cloud-based analytics, allowing manufacturers to monitor and optimize energy usage.

- Honeywell: Honeywell offers specialized "Forge Performance+" software that uses artificial intelligence to identify energy savings potential in real-time, focusing on complex industrial environments like refineries and manufacturing plants.

- TERI: TERI focuses on providing comprehensive industrial energy audits and technology assessment studies, specializing in helping MSMEs (Micro, Small, and Medium Enterprises) adopt energy-efficient practices in energy-intensive sectors.

- DuPont: DuPont leverages its deep expertise in material science to optimize industrial energy usage, helping clients maximize asset productivity while reducing carbon and water footprints.

- Dalkia: Dalkia provides specialized energy services to industrial customers, focusing on optimizing heat recovery systems and implementing on-site, local renewable energy generation.

- ENGIE: ENGIE provides tailor-made industrial energy-efficiency services, specializing in the deployment of "as-a-service" solutions that include financing, design, and operation of energy infrastructure.

- Getec: Getec develops and operates custom, decentralized energy solutions, concentrating on increasing the efficiency of heating, cooling, and steam generation for industrial clients.

Other Major Key Players

- ISTA

- Johnson Controls

- Schneider Electric

- SGS

- Wood

Recent Developments

- In June 2024, ComEd intends to give people the tools and training they need to compete for jobs in the energy-efficiency sector while also advancing that sector in Illinois with the introduction of the new Market Development Initiative (MDI).

- In November 2023, in order to promote sustainability, TARSHID, the National Energy Services Company of Saudi Arabia, has partnered with Enova, a regional provider of integrated energy and facilities management services, to initiate energy savings guarantee initiatives in public sector buildings.

Segments Covered in the Report

By Service Type

Energy Auditing & Consulting

- Preliminary Energy Audit

- Detailed Energy Audit

- Investment-Grade Audit (IGA)

Implementation Services

- HVAC System Upgrades

- Building Envelope Improvements

- Lighting Retrofits (LED, Sensors, etc.)

- Boiler & Steam System Optimization

- Motors & Drives Efficiency

- Energy-Efficient Equipment Installation

Measurement & Verification (M&V)

- Baseline Consumption Measurement

- Continuous Monitoring & Reporting

- IPMVP-based M&V

Operation & Maintenance (O&M)

- Predictive & Preventive Maintenance

- Remote System Optimization

- Asset Performance Management

Retro-Commissioning & Re-Commissioning

- System Optimization (HVAC, lighting, etc.)

- Performance Restoration

Demand-Side Management (DSM) Services

- Load Management

- Peak Shaving Programs

- Demand Response Program Design

Energy Performance Contracting (EPC)

- Shared Savings Model

- Guaranteed Savings Model

By Application Area

Industrial

- Manufacturing (Metals, Chemicals, Cement, etc.)

- Oil & Gas

- Mining

- Utilities & Power Plants

Commercial

- Offices & IT Parks

- Retail Chains & Malls

- Hospitality (Hotels, Resorts)

- Warehouses & Logistics Centers

Residential

- Multi-family Housing

- Individual Homes & Apartments

- Public Housing

Institutional & Government

- Educational Institutions

- Municipal Buildings

- Hospitals & Public Healthcare

- Military & Defense Facilities

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting