January 2025

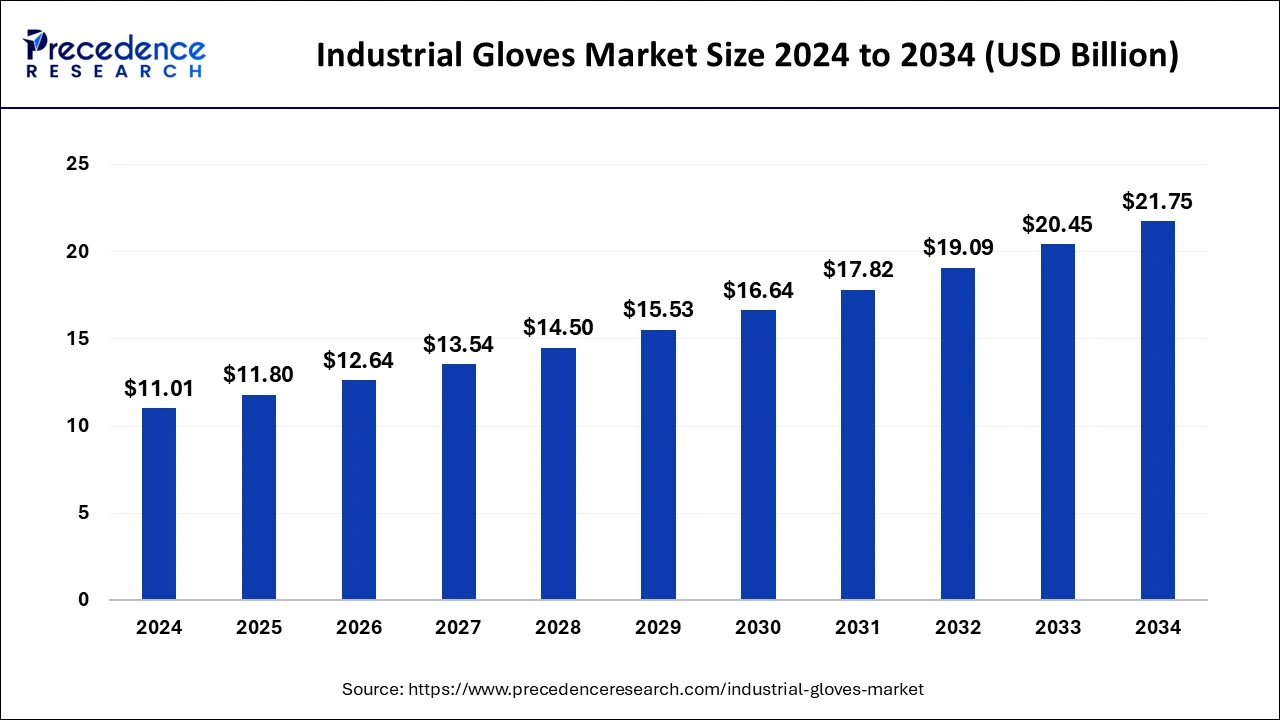

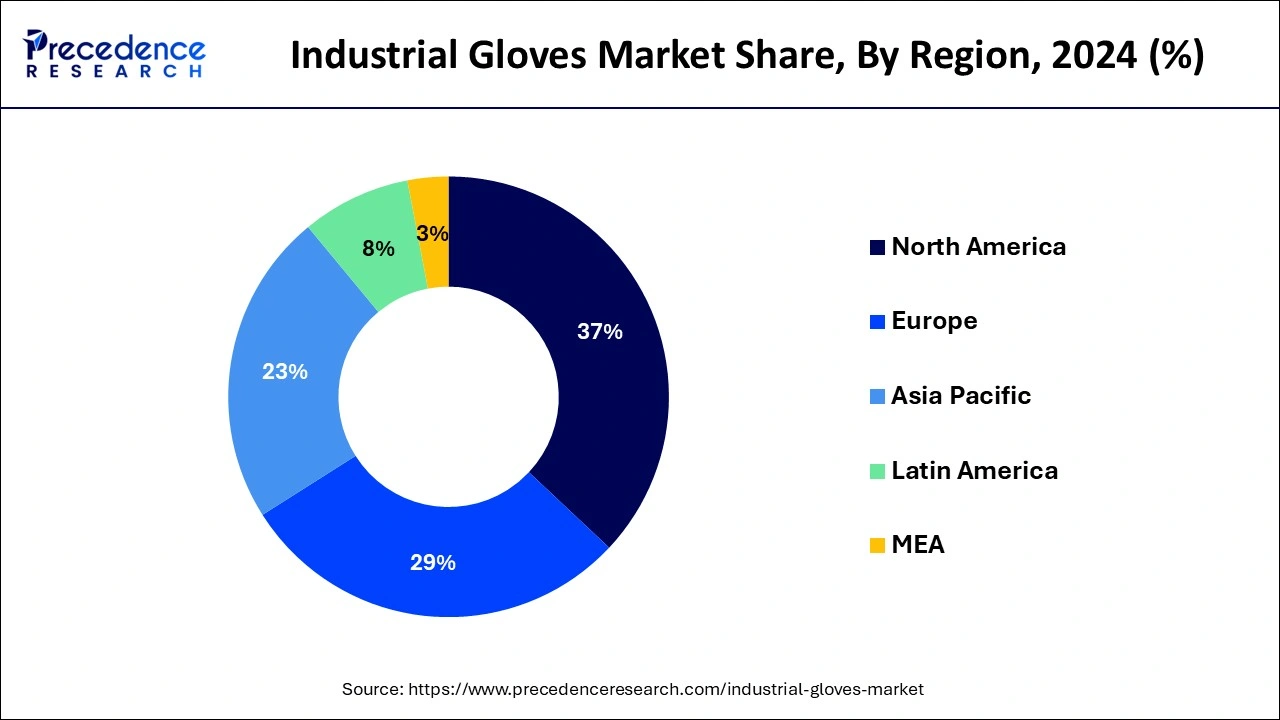

The global industrial gloves market size is calculated at USD 11.80 billion in 2025 and is forecasted to reach around USD 21.75 billion by 2034, accelerating at a CAGR of 7.05% from 2025 to 2034. The North America industrial gloves market size surpassed USD 4.07 billion in 2024 and is expanding at a CAGR of 7.06% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global industrial gloves market size was estimated at USD 11.01 billion in 2024 and is predicted to increase from USD 11.80 billion in 2025 to approximately USD 21.75 billion by 2034, expanding at a CAGR of 7.05% from 2025 to 2034. The need for industrial gloves has increased due to the growth of sectors like oil and gas, automotive, healthcare, chemicals, and food processing.

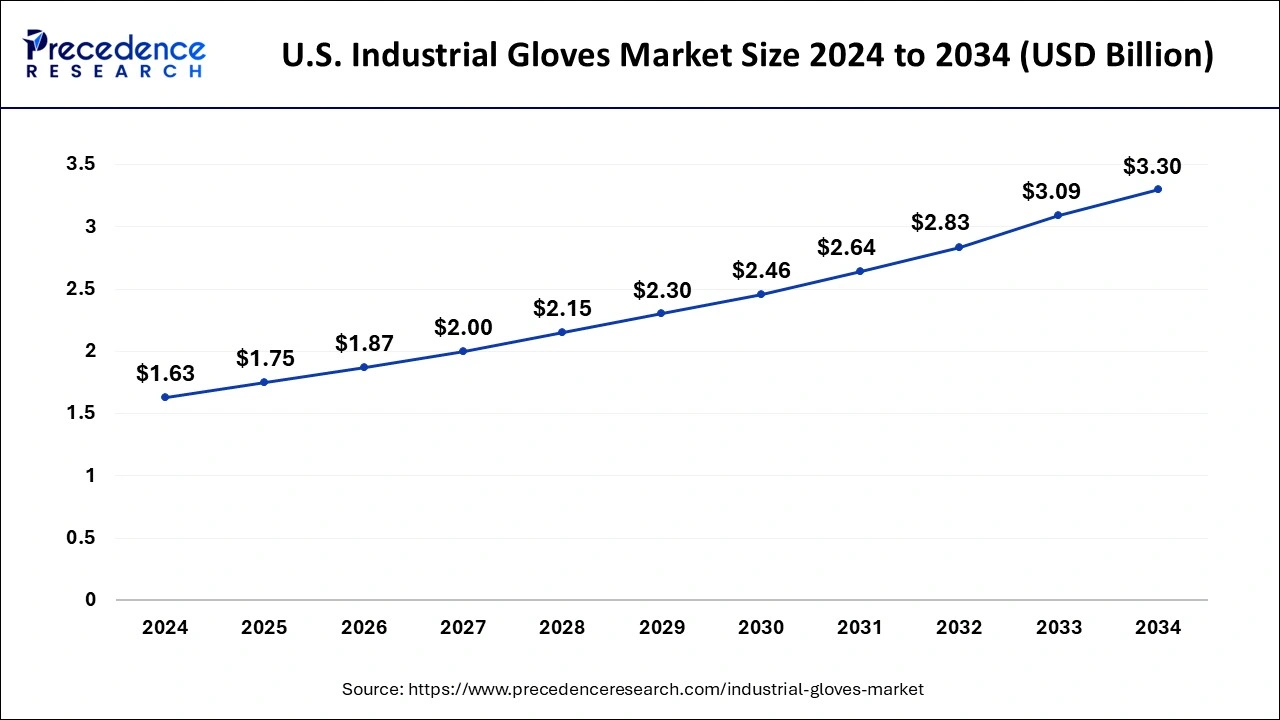

The U.S. industrial gloves market size was estimated at USD 1.63 billion in 2024 and is predicted to be worth around USD 3.30 billion by 2034 with a CAGR of 7.31% from 2025 to 2034.

North America dominated the industrial gloves market in 2024. The burgeoning construction and electronics sectors in Canada and Mexico are primarily responsible for this expansion, as they generate a significant need for industrial gloves to guarantee worker safety. One of the main drivers is the implementation of stricter safety requirements in areas including manufacturing, chemicals, and oil and gas. The need for protective equipment, such as gloves, has increased in the United States due to a greater emphasis on worker safety. Because disposable gloves are always needed, the healthcare industry is a major user. In a similar vein, the food and beverage, pharmaceutical, and automobile industries also make substantial contributions to market demand. Businesses are spending money on R&D to create gloves with better features, such as touchscreen compatibility, more dexterity, and environmentally friendly materials.

Europe is expected to show rapid growth in the industrial gloves market in the upcoming years. Europe's industrial gloves market is expanding rapidly due to a number of factors, such as stricter safety laws, heightened awareness of workplace dangers, and improvements in glove materials and technologies. Because of their affordability and ease of use, they are expected to rule the market, especially in industries where hygiene is crucial, such as food processing and healthcare. Reusable gloves are essential in businesses that need long-lasting protection against harsher circumstances like chemicals and heavy machinery, even though they are less common. Better protection and comfort are being provided by items like gloves with improved grip and chemical resistance, which are the result of material and glove design innovations.

The industrial gloves market includes businesses involved in the production and sale of a wide variety of protective gloves that are used in many different industries to guarantee worker and process safety and cleanliness. Depending on the sector, these gloves are vital for shielding workers from risks like heat, contamination, cuts, abrasions, and chemical exposure. Widely used to maintain hygienic conditions in pharmaceuticals and food manufacturing.

Mostly utilized in sectors including healthcare, food, and pharmaceuticals, where hygienic practices and contamination control are essential. Utilized in sectors such as oil and gas, construction, and automotive, where resistance to chemicals and mechanical harm is crucial. It is used for defense against corrosive substances, high temperatures, and physical risks.

Stricter safety laws, growing worker safety consciousness, and the expansion of end-use industries are the main factors driving the need for industrial gloves. Particularly in the healthcare and general public sectors, the COVID-19 pandemic greatly increased demand for disposable gloves, which resulted in supply chain issues and price rises. Manufacturers are always coming up with new materials and designs for gloves that offer enhanced protection, improved ergonomics, and extra features like touchscreen compatibility. The ongoing demand for worker safety and hygiene across a variety of industrial industries is driving the expansion of the industrial gloves market.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.05% |

| Market Size in 2025 | USD 11.80 Billion |

| Market Size by 2034 | USD 21.75 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Material, Sales Channel, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing awareness of workplace safety

Diverse tactics and programs can be used to raise worker safety awareness in the industrial glove sector. Organize frequent seminars and workshops on workplace safety and the value of wearing the proper protective equipment, such as industrial gloves. Provide webinars and online courses that address safety regulations, how to use gloves properly, and the most recent developments in glove technology.

Organize practical training sessions in the workplace to guarantee that staff members understand how to handle and care for industrial gloves. Make sure the gloves fulfill all industry safety requirements, including those set forth by the International Organization for Standardization (ISO), the American National Standards Institute (ANSI), and the Occupational Safety and Health Administration (SHA).

Labor shortages and costs

The lack of workers and growing expenses are posing serious problems for the industrial glove business. The aftermath of the COVID-19 outbreaks and continuous supply chain interruptions have made these problems worse. There is an especially severe labor shortage in the industrial sector, which includes glove production. The epidemic caused a decline in labor force participation, from which there has been a sluggish rebound. About 4 million fewer workers than before the epidemic are employed in the U.S., while high job vacancy rates in Europe are being caused by disruptions in migrant labor flows. Because businesses are paying more to recruit and keep employees in a competitive market, labor expenses have increased.

Investment and expansion

Global governments have enforced strict policies to guarantee worker safety, including the requirement to wear industrial gloves and other personal protective equipment (PPE). The objectives of these rules are to improve worker health and safety and lessen occupational injuries. Gloves with improved protection, durability, and comfort have been developed as a result of advancements in material science and glove production methods.

Gloves with enhanced chemical resistance, enhanced grip, and cutting-edge ergonomic designs are a few examples. Industrial gloves are widely used in industries like manufacturing, automotive, chemical processing, and healthcare, all of which demand adherence to safety regulations and standards. Disposable glove demand has increased as a result of the pandemic, particularly in healthcare and other vital industries.

The disposal gloves segment held the largest share of the industrial gloves market in 2024. Because it requires the highest standards of hygiene and infection control, the medical industry is the biggest user of disposable gloves. Exam and surgical gloves were in high demand during the COVID-19 pandemic, and this need is now rising as a result of aging populations and increased health consciousness in areas with sophisticated healthcare systems.

Throughout the food processing, automotive, oil & gas, chemical, and manufacturing industries, disposable gloves are a common tool for shielding workers from risks like contamination, sharp objects, and chemicals. Vinyl gloves are frequently used in less dangerous areas, while nitrile gloves are preferred for their longevity and chemical resistance. Despite their exceptional elasticity, latex gloves are less used because of allergy concerns.

The reusable glove segment is expected to witness the fastest growth in the industrial gloves market over the projected period. Reusable gloves are becoming more and more popular in the industrial gloves market because of their potential cost-saving advantages and environmental sustainability. Because they may be used again and again, reusable gloves are a more cost-effective option than single-use gloves. In order to offer superior protection against hazards in industrial contexts, they are usually thicker than disposable gloves and are composed of sturdy materials like rubber, nitrile, or latex.

Because they can be cleaned and repurposed several times, reusable gloves save organizations money by reducing the need to replace them more frequently. Because reusable gloves are frequently made to be more resilient and protective than disposable gloves, they are a good choice for jobs requiring extended use or contact with abrasives, oils, or harsh chemicals.

The natural rubber gloves segment dominated the industrial gloves market in 2024. Because natural rubber gloves are regarded as being durable, they can be used in a variety of industrial settings where extended use is necessary. They offer workers' hands dependable protection by withstanding abrasions, punctures, and general wear and tear. Natural rubber gloves frequently fit snugly and comfortably, enabling workers to execute jobs with accuracy and dexterity.

This is crucial in sectors where complex movements are required, such as the manufacturing of electronics or the assembly of automobiles. Natural rubber gloves are a better option for companies trying to strike a balance between price and quality because they are more reasonably priced than gloves manufactured from synthetic materials.

The nitrile gloves segment is expected to grow rapidly in the industrial gloves market during the forecast period. Excellent resistance to a wide variety of chemicals, such as oils, solvents, and other harsh compounds frequently encountered in industrial environments, is provided by nitrile gloves. Because of this, workers who handle chemicals or other hazardous items tend to choose them. Gloves made of nitrile are renowned for their dependability and resilience to punctures, offering trustworthy defense against cuts, abrasions, and punctures. Because of their resilience, gloves can endure the demanding conditions of industrial settings, extending their lifespan and lowering the frequency of glove replacements. Today's nitrile gloves are made to fit snugly and comfortably, enabling dexterity and tactile sensitivity. This improves worker productivity and safety for tasks requiring fine motor skills and precision.

The direct sales segment led the industrial gloves market in 2024. In the industrial gloves market, direct sales often refer to the sale of gloves to end users, such as factories, building sites, laboratories, and other industrial settings, straight from the manufacturer or distributor. By avoiding middlemen like wholesalers or merchants, this method enables a more direct exchange of information between the buyer and supplier.

It is the duty of the producer or distributor of industrial gloves to get the gloves from manufacturers and guarantee their quality. Usually, the business has a sales crew whose job it is to make direct contact with prospective customers. Direct sales entail discussions that take place between the buyer and the vendor. The sales team may bargain over conditions of sale, pricing, and other specifics to reach a win-win arrangement.

The distribution sales segment is expected to show the fastest growth in the industrial gloves market during the forecast period. Various factors, including geographic location, industry types served, and client wants, might affect how sales are distributed in the industrial gloves market. Industrial gloves may be sold directly to end users by certain manufacturers, especially bigger industrial facilities or groups with particular needs.

Many producers utilize wholesale distributors to spread their products, which subsequently resell to shops or to customers directly. These distributors frequently have connections and networks that are well-established within particular industries. Many distributors and manufacturers of industrial gloves now offer their goods online due to the growth of e-commerce. This streamlines the purchasing process and makes a large range of clients easily accessible.

The pharmaceuticals segment held the largest share of the industrial gloves market in 2024. The creation of specialized gloves intended for pharmaceutical manufacturing settings is the main application of medicines in industrial gloves. These gloves are designed to fulfill certain specifications like sterility, resistance to chemicals, and contamination protection. To avoid medication contamination during the pharmaceutical production process, a sterile atmosphere must be maintained. Certain gloves undergo sterilization procedures such as autoclaving or gamma irradiation to guarantee they fulfill sterile standards. Handling a variety of chemicals and materials is part of the pharmaceutical production process. To shield workers from exposure to these substances and possible injury, gloves must provide resistance to them. Strict quality control procedures are followed by producers of gloves suitable for use in pharmaceuticals to guarantee product dependability and uniformity.

The automotive & transportation segment is expected to grow rapidly in the industrial gloves market during the forecast period. When handling numerous mechanical parts and tools, assembly line workers, mechanics, and automotive technicians frequently need to wear gloves to protect their hands from cuts, abrasions, and punctures. In these situations, gloves with strengthened fingers and palms are typical. Workers may come into touch with lubricants, solvents, and cleansers, among other chemicals, when performing transportation and auto maintenance. Gloves resistant to chemicals are necessary to prevent burns, irritation of the skin, and absorption of toxic substances. Maintaining an automobile requires handling greasy and oily surfaces. Oil-resistant gloves offer a solid grip and guard against slips and spills. To avoid shocks and injuries, electricians who work on cars or other transportation equipment need gloves that provide insulation against electrical currents.

By Product

By Material

By Sales Channel

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

September 2024

October 2024