August 2024

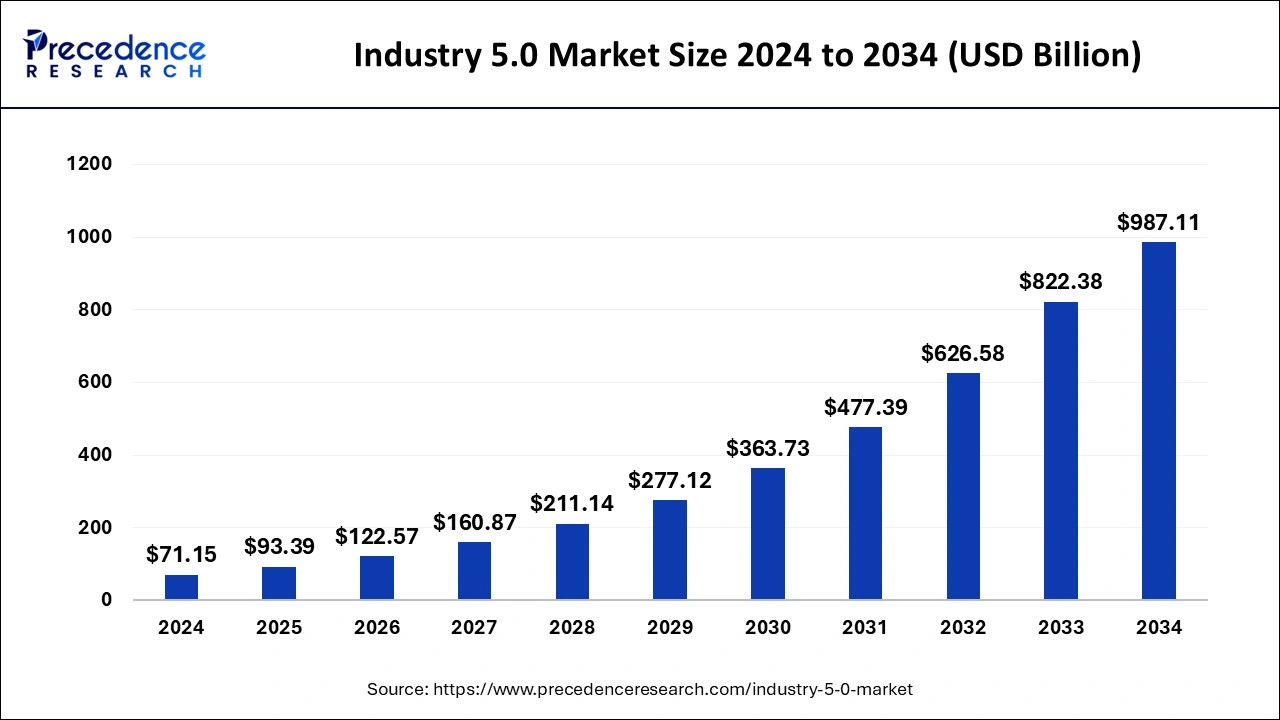

The global industry 5.0 market size is accounted at USD 93.39 billion in 2025 and is forecasted to hit around USD 987.11 billion by 2034, representing a CAGR of 30.08% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global industry 5.0 market size accounted for USD 71.15 billion in 2024 and is predicted to increase from USD 93.39 billion in 2025 to approximately USD 987.11 billion by 2034, expanding at a CAGR of 30.08% from 2025 to 2034. The industry 5.0 market is driven by the growing need for large-scale customization.

Industry 5.0 market refers to the industry that offers cooperation between machines and humans. The industry aims to create resilient and sustainable economic models to safeguard the procedures. The emerging technology with the integration of advanced solutions has made widespread customization and individualized production possible with technological breakthroughs. By using flexible production techniques, businesses could customize products to match specific customers' needs while remaining cost-effective. Industry 5.0 is observed to boost overall efficiency, forecast maintenance requirements, and optimize operations using AI and machine learning algorithms.

Data analytics was employed by smart factories to make choices in real time, cutting down on downtime and increasing efficiency. Industry 5.0 witnessed a rise in the use of digital twin technology, which allows producers to model and replicate real assets virtually. This made testing, simulations, and predictive maintenance possible, which reduces costs and raises the caliber of the final product.

Industry 5.0 Market Data and Statistics

The growth of the Industry 5.0 market is driven by increased adoption of new technologies like blockchain, IoT, robotics, and AI, which improve productivity and operational efficiency. Industry 5.0 measures to reduce risks and disruptions are being adopted more quickly as supply chains and manufacturing processes post-pandemic place a greater emphasis on resilience, agility, and flexibility.

The adoption of Industry 5.0 is expanding due to the growing need for smart manufacturing solutions, which include automation technology, linked devices, and smart sensors, as companies strive for more responsive and agile operations.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 30.08% |

| Market Size in 2025 | USD 93.39 Billion |

| Market Size by 2034 | USD 987.11 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology and Technology |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing availability of cost and energy-efficient robots

Substantial safety features enable the safe interaction of cost-effective and energy-efficient robots with humans and other machinery. This consists of integrated fail-safe devices to avert mishaps and sensors to identify objects or people nearby. Improved safety lowers liability risks for corporations and downtime and worker safety. Contemporary robots are engineered to be highly performant while using less energy, due to their energy-efficient design. Advanced parts including energy-efficient motors, sensors, and control systems are used to accomplish this. In addition to lowering operating expenses, energy efficiency supports the worldwide movement for environmental preservation and sustainability.

Rising demand for collaborative robots (Cobots)

The rising popularity of collaborative robots or cobots is observed to promote the expansion of the Industry 5.0 market. Cobots are adaptable and simple to reprogram or redeploy for various activities and production settings, in contrast to fixed automation systems. Because of its adaptability, producers can swiftly adjust to shifting consumer preferences, product variants, and production needs without incurring large expenses or downtime. Cobots are adaptable assets on the manufacturing floor since they can carry out a wide range of duties, from quality inspection and packaging to assembly and pick-and-place operations.

A paradigm shift in the dynamics of the workforce is encouraged by the deployment of collaborative robots. Cobots augment human workers' strengths and skills rather than taking their place, opening doors for skill development and upskilling.

High-cost investment

Real-time analytics and data-driven decision-making are key components for Industry 5.0. This necessitates a strong data infrastructure that can manage massive data volumes produced by networked devices. To guarantee data integrity and defend against cyber-attacks, businesses must invest in data storage solutions, cloud computing services, cybersecurity precautions, and compliance frameworks. There are inherent risks and uncertainties associated with the shift to Industry 5.0.

New technological investments do not necessarily pay off right away, and there might be issues with scalability, interoperability, and technology integration. These risks must be considered by businesses when budgeting and planning for Industry 5.0 efforts, which may discourage some from making significant expenditures.

Tackling cyber security threat

Industry 5.0 environments are extremely complicated, with linked devices and systems sharing data instantly. Because of this complexity, there are several points of entry for cybercriminals to target, including cloud computing platforms, network infrastructure, IoT devices, and industrial control systems (ICS). It can be difficult to deploy and maintain comprehensive cybersecurity measures at every level necessary to secure such a complex and linked set of systems. The integrated supply chains that span numerous vendors, partners, and service providers are crucial to Industry 5.0.

Every organization in the supply chain is a possible cybersecurity weak point. Any point in the supply chain could be the target of a cyberattack, which could have a domino effect and interfere with logistics, delivery, and production.

Increase in use of automation technologies

Massive amounts of data are produced by automation systems, and these data can be examined to provide important information. Businesses can make data-driven decisions, streamline workflows, spot patterns, and forecast results with the aid of AI and ML algorithms. This makes strategic planning and proactive management possible, increasing market competitiveness. A better overall customer experience can result from the automation of support services and client interactions. Automated emails, self-service portals, and chatbots can effectively handle common questions and transactions, freeing up human resources to concentrate on more intricate problems and individualized interactions.

The industrial sensors segment had a significant share in 2024. Industry 5.0 emphasizes sustainability and environmental stewardship, driving the adoption of energy-efficient practices and green technologies. Industry sensors enable precise monitoring of energy consumption, emissions, and resource utilization, facilitating the implementation of sustainable manufacturing practices and reducing environmental impact. Industry sensors offer scalability, versatility, and customization options to adapt to diverse manufacturing requirements and environments. Whether it's temperature sensors, pressure sensors, proximity sensors, or motion sensors, their versatility allows for tailored solutions to meet specific industry needs and applications.

The digital twin segment is observed to grow at a notable rate during the forecast period in the Industry 5.0 market in 2024. When putting manufacturing processes into practice in the real world, businesses can use digital twins to replicate and optimize them in a virtual setting. This simulation-driven method aids in workflow optimization, waste reduction, bottleneck identification, and overall efficiency improvement. Industry 5.0 emphasis on adaptability and agility, and digital twins let producers quickly adjust to shifting consumer expectations and production specifications. Supply networks are extremely dynamic and linked in Industry 5.0.

By building digital twins of suppliers, logistical networks, and distribution channels, supply chains may be seen from beginning to finish. This integrated strategy facilitates lead times reduction, inventory level optimization, increased stakeholder participation, and improved logistics efficiency.

The automotive segment dominated the Industry 5.0 market in 2024. There has been a global shift toward greener transportation solutions due to growing concerns about environmental sustainability and climate change. Manufacturers are making significant investments in electric vehicles and hybrid vehicles, which has drawn support from regulators in the form of incentives, pollution rules, and environmentally aware consumers.

With the growing popularity of Mobility as a Service, consumers now have more options for transportation than just owning a car. In addition to giving consumers more flexibility and affordable options, ride-sharing platforms, car subscription services, and on-demand mobility solutions have upended the auto industry and put automakers' conventional sales strategies to the test.

North America, held the largest market share in 2024. Whereas the region also promises sustained growth for the predicted timeframe. In general, it upholds a business-friendly regulatory framework that promotes investment, entrepreneurship, and technical advancement. Industry standards, data privacy, and intellectual property rights regulations are frequently clearly outlined, giving businesses an even playing field on which to grow and innovate. New technologies that provide observable advantages including lower costs, increased operational effectiveness, better customer experiences, and sustainable practices are used in this region.

Asia Pacific is the fastest growing region in the Industry 5.0 market during the forecast period. It has a solid industrial foundation in many sectors, including consumer goods, electronics, automobiles, and medicines. Industry 5.0 processes and technology can be successfully implemented on this robust industrial basis. Furthermore, because of the widespread availability of high-speed internet and the implementation of Industry 4.0 technologies, there is a tremendous increase in digitalization and connectedness. Supply chain optimization and smart factories are two examples of modern manufacturing concepts that require this digital infrastructure to be implemented.

By Technology

By Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

July 2024

July 2024

July 2024