Inertial Measurement Unit Market (By Component: Accelerometers, Gyroscopes, Magnetometers; By Technology: Fiber optics Gyro, Mechanical Gyro, Ring laser Gyro, Mems; Others; By Platform: Airborne, Ground, Maritime, Space; By End user: Aerospace And Defense, Consumer Electronics, Marine, Automotive, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

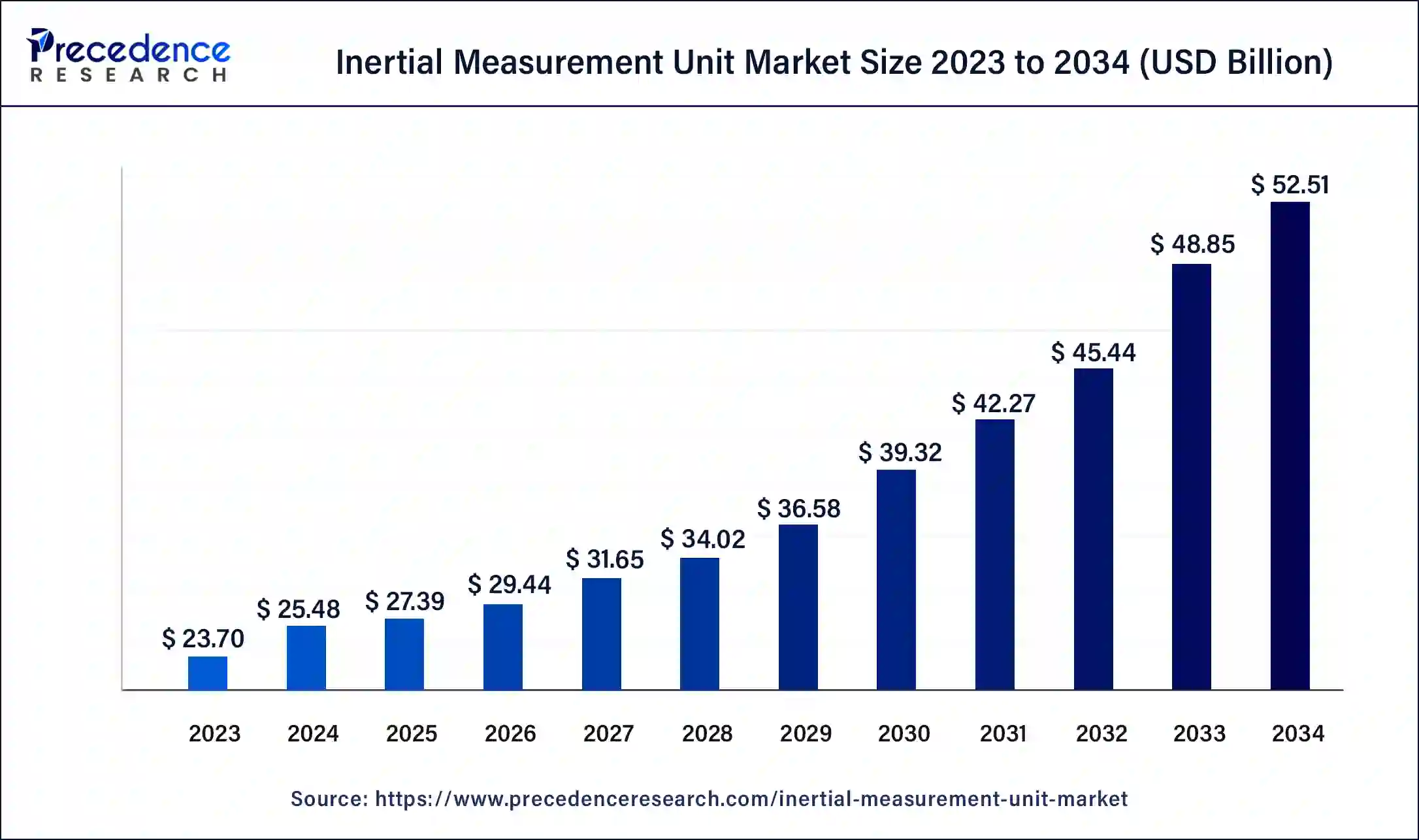

The global inertial measurement unit market size was USD 23.70 billion in 2023, accounted for USD 25.48 billion in 2024, and is expected to reach around USD 52.51 billion by 2034, expanding at a CAGR of 7.5% from 2024 to 2034. The North America inertial measurement unit market size reached USD 9.48 billion in 2023. The market is expanding due to the quick modernization of military hardware and defense systems.

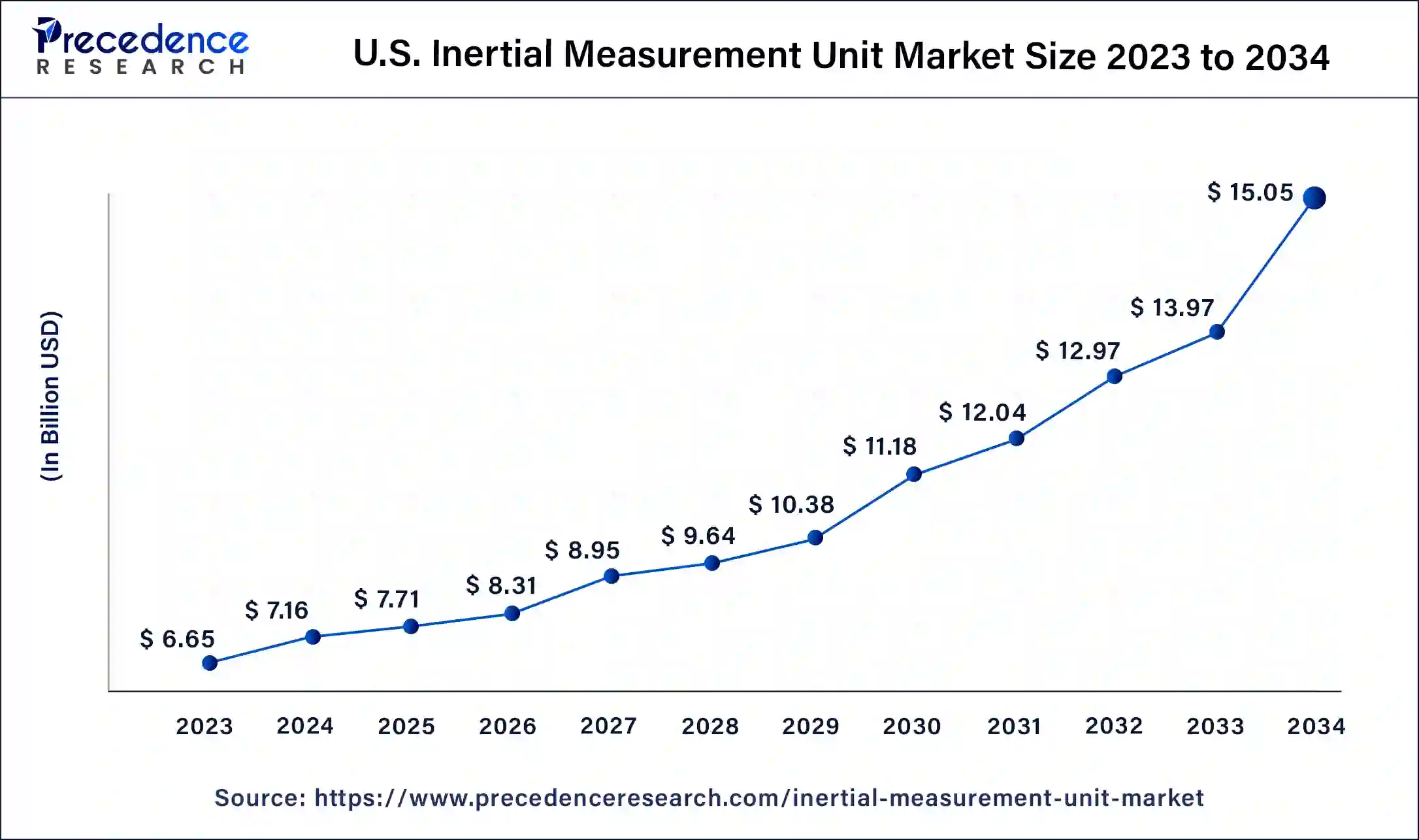

The U.S. inertial measurement unit market size was estimated at USD 6.65 billion in 2023 and is predicted to be worth around USD 15.05 billion by 2034, at a CAGR of 7.7% from 2024 to 2034.

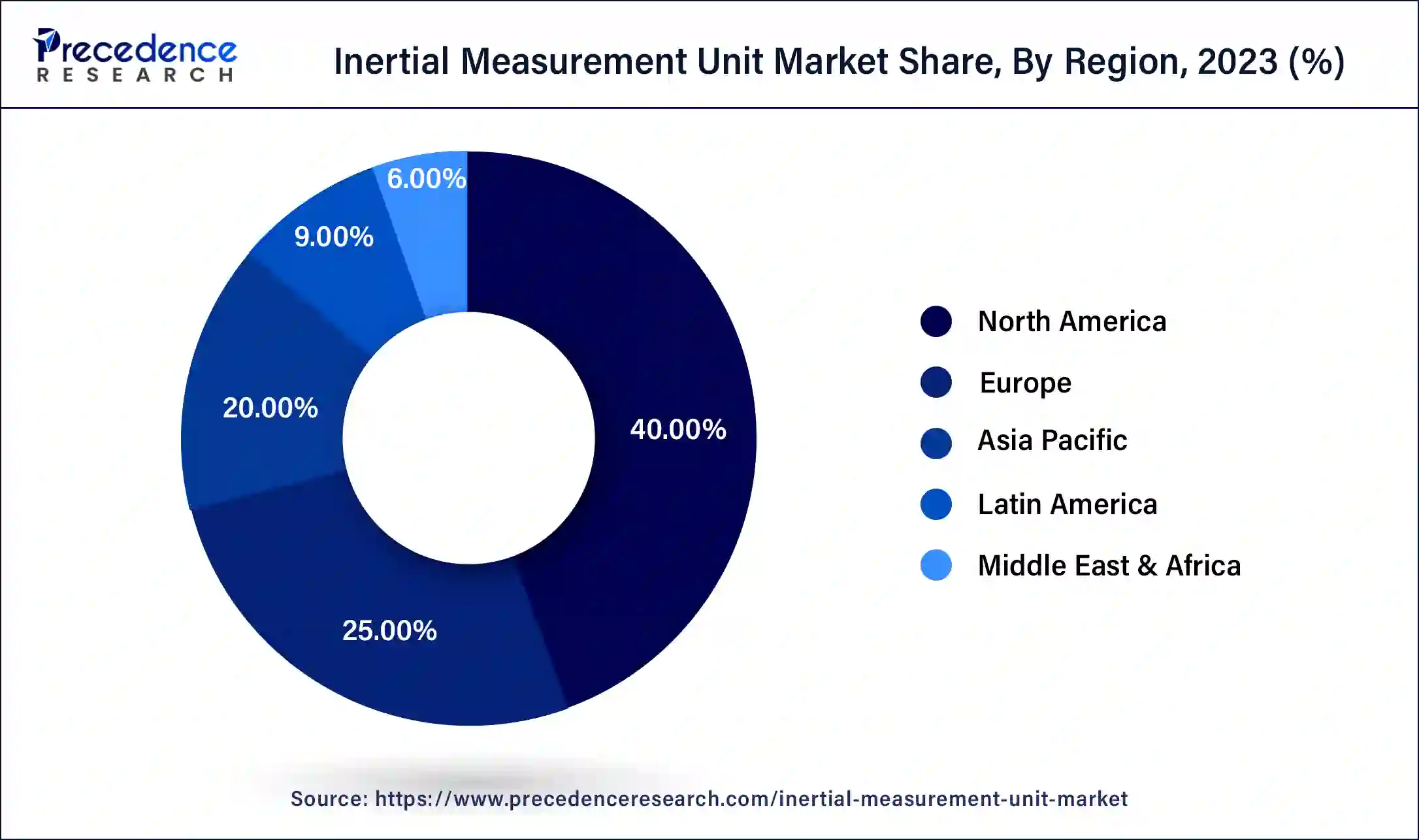

North America dominated the inertial measurement unit market in 2023 and is at the forefront of adopting augmented reality (AR). Many AR applications are being developed for iOS and Android devices in this region. Several companies that produce smart glasses, such as VUZIX, Microsoft, and ODG, are based here. Smart glasses come with various wearable sensors.

The Vuzix Blade 3000 has built-in GPS and directional sensors, including a gyroscope, accelerometer, and hull sensors. Despite North America having a mature inertial measurement unit market, the demand for new types of wearables will stem from this region. The demand for inertial measurement units (IMUs) is expected to increase steadily during the forecast period.

Asia Pacific has captured a 22.3% revenue share in 2023 and is expected to experience the highest growth over the forecast period. Additionally, based on data from the OICA, China and Japan are projected to contribute a significant share of global car production over the forecast period. Both domestic and international companies have established large factories in these countries for both export and domestic consumption.

Furthermore, the demand for inertial navigation systems in Asia Pacific has seen a significant rise due to the increasing use of unmanned vehicles, such as autonomous underwater vehicles (AUVs), unmanned aerial vehicles (UAVs), and remotely operated vehicles (ROVs), in recent years across various civilian and defense applications.

An inertial measurement unit (IMU) is a crucial sensor device used in various applications to measure an object's velocity, orientation, and acceleration relative to a fixed frame of reference. It combines different sensor types, such as gyroscopes, accelerometers, and sometimes magnetometers, to provide comprehensive motion data for different dynamic systems. IMUs find wide applications in robotics, navigation, virtual reality, aerospace, and other industries due to their ability to function independently of external references.

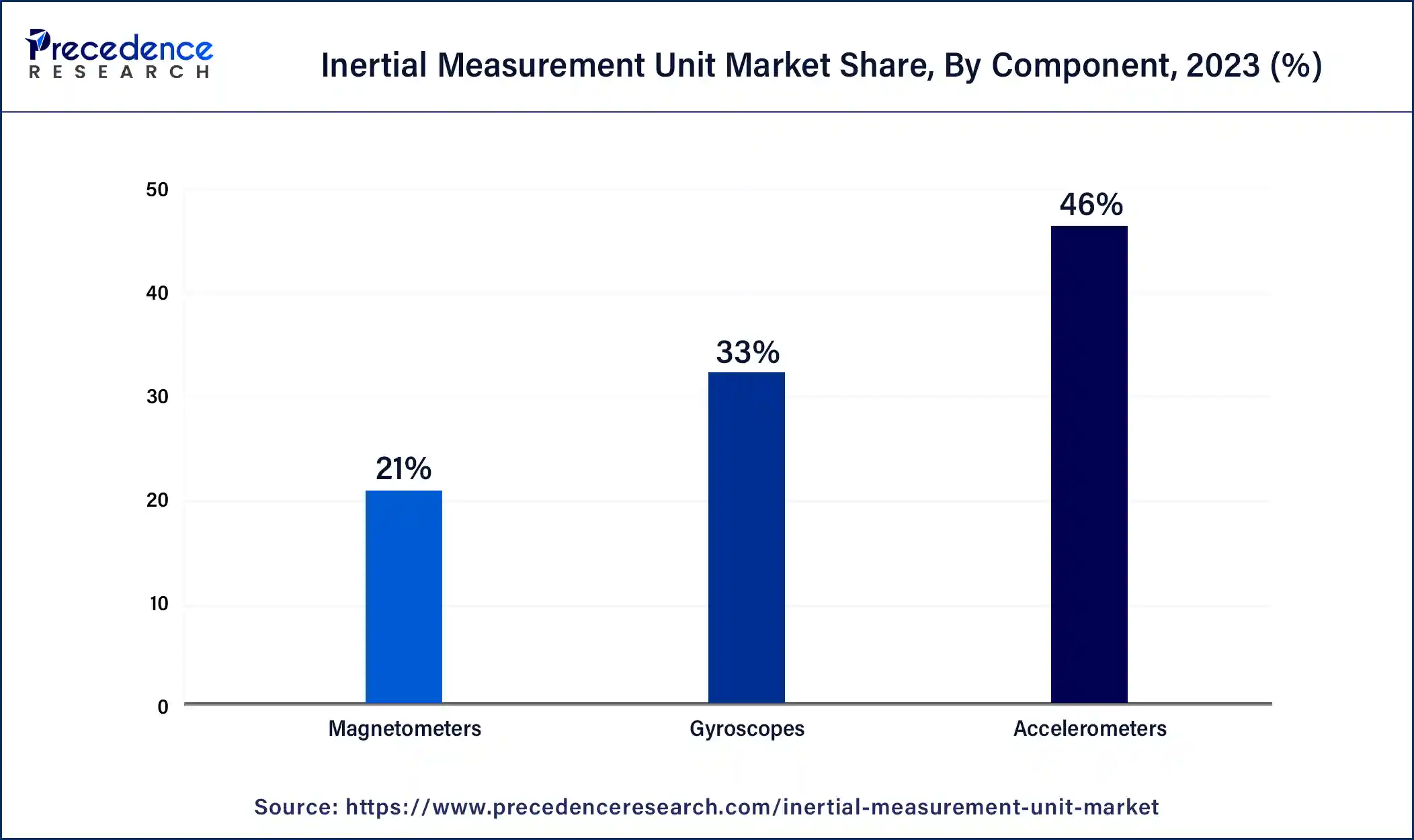

The core components of an IMU are accelerometers and gyroscopes, which detect linear acceleration along different axes and measure angular velocity around those axes, respectively. Accelerometers operate based on the principle of inertia, which describes an object's resistance to changes in motion (acceleration). Gyroscopes, however, detect changes in rotational orientation by relying on the principles of angular momentum and precession.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 7.5% |

| Global Market Size in 2023 | USD 23.70 Billion |

| Global Market Size in 2024 | USD 25.48 Billion |

| Global Market Size by 2034 | USD 52.51 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Component, By Technology, By Platform, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Advancement in military equipment technology

The continuous improvement of military equipment is a key factor driving the growth of the inertial measurement unit market, particularly in defense systems. Fiber optic IMUs are commonly used in unmanned aerial vehicles (UAVs) for autonomous navigation, allowing them to operate in adverse weather conditions. They are utilized for intelligence, surveillance, and reconnaissance (ISR) missions, as well as firefighting and bomb detection. The increasing use of virtual and augmented reality (V/AR) systems, along with the need for precise measurements of speed, orientation, and acceleration, also contributes to the market growth.

IMUs are being integrated as orientation sensors in upcoming smartphones, tablets, and gaming consoles. Other factors driving growth include technological advancements such as the development of microelectromechanical (MEMS)--based IMUs that can be integrated with the Internet of Things (IoT). R&D efforts are also expected to boost the inertial measurement unit market further.

Challenges in the protection of IMU components

Protecting the internal components of MEMS IMU sensors in harsh mounting environments, which involve moisture, heat, and corrosive materials, is challenging. The development, commercialization, and packaging of micromachined gyroscopes are particularly difficult because they are sensitive to manufacturing and environmental variations. To ensure optimal performance without excessive cost, a durable MEMS sensing unit is required. Packaging these components is also complex due to the increased ruggedness of MEMS-packaged modules.

Rise in sales and shipments of smartphones globally

There's been a notable increase in the sales and shipments of smartphones worldwide. Demand for smartphones is particularly high in major markets like China, the U.S., Brazil, and Japan. In countries with large populations, smartphone usage is growing rapidly, which will continue to drive market growth shortly. Many smartphones now come equipped with inertial measurement units, which typically include a gyroscope, accelerometer, and magnetometer.

IMUs enable smartphones to measure human movement characteristics such as gait and tremors. The growing popularity of smartphones is fueling the demand for inertial measurement units. Additionally, regulations such as the International Traffic in Arms Regulations (ITAR) and the Export Administration Regulations play a significant role in governing defense-related applications, particularly in the United States.

The accelerometer segment dominated the inertial measurement unit market in 2023. this is linked to the rising number of autonomous cars, rapid extension in space technologies, and increasing expenditure on the aviation sector in developing countries like China and India, which are helping to fuel market growth in the future.

The magnetometer segment has accounted for 21% revenue share in 2023 and is expected to grow at a notable rate over the forecast period. This is attributed to the use of magnetometers in various aviation equipment. Magnetometers measure the Earth's magnetic field to show orientation.

The ring laser gyro segment held the largest share of the inertial measurement unit market in 2023. This is due to the increasing space program activities from developing countries of the Asian Pacific region, which will fuel the segment growth in the foreseeable future.

The MEMS segment is anticipated to grow at the highest CAGR over the projected period. This is linked to the growing use of miniaturized sensors in automotive applications and devices like wearables, etc. Moreover, MEMS components handle processing and sensing data while mechanical parts give physical feedback; these features make MEMS sensors reliable, cost-effective, and small.

The space segment held the largest market share in 2023. Focusing on the use of inertial sensors in space-based systems such as satellite navigation. In spacecraft, the guidance, navigation, and control systems rely on inertial sensors to receive information about attitude and velocity. This data is crucial for translating steering inputs into commands for control surfaces, engine gimbal adjustments, and thruster firings on systems like the space shuttle.

The airborne segment is expected to grow with the highest CAGR in the inertial measurement unit market during the forecast period. With the increasing demand for global air travel and growing military investments in enhancing space-based capabilities, the airborne segment is expected to expand. Also, due to the rising demand in this market segment, air-based platforms are anticipated to experience the fastest growth.

The aerospace and defense segment dominated the inertial measurement unit market in 2023. These devices are important for navigation guidance, control, and stability of UAVs and aircraft. The rise in demand for UAVs and aircraft fleets is expected to drive the growth of this segment shortly.

Segments Covered in the Report

By Component

By Technology

By Platform

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client