January 2025

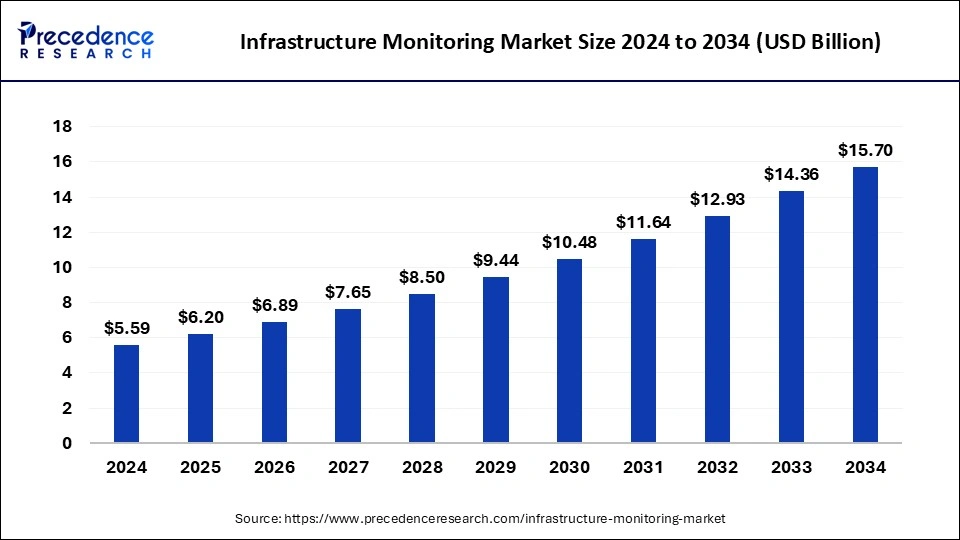

The global infrastructure monitoring market size is calculated at USD 6.20 billion in 2025 and is forecasted to reach around USD 15.70 billion by 2034, accelerating at a CAGR of 10.88% from 2025 to 2034. The North America infrastructure monitoring market size surpassed USD 1.84 billion in 2024 and is expanding at a CAGR of 10.91% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global infrastructure monitoring market size was estimated at USD 5.59 billion in 2024 and is predicted to increase from USD 6.20 billion in 2025 to approximately USD 15.70 billion by 2034, expanding at a CAGR of 10.88% from 2025 to 2034. The infrastructure monitoring market is driven by the growing requirement to guarantee the durability, dependability, and safety of vital infrastructure assets.

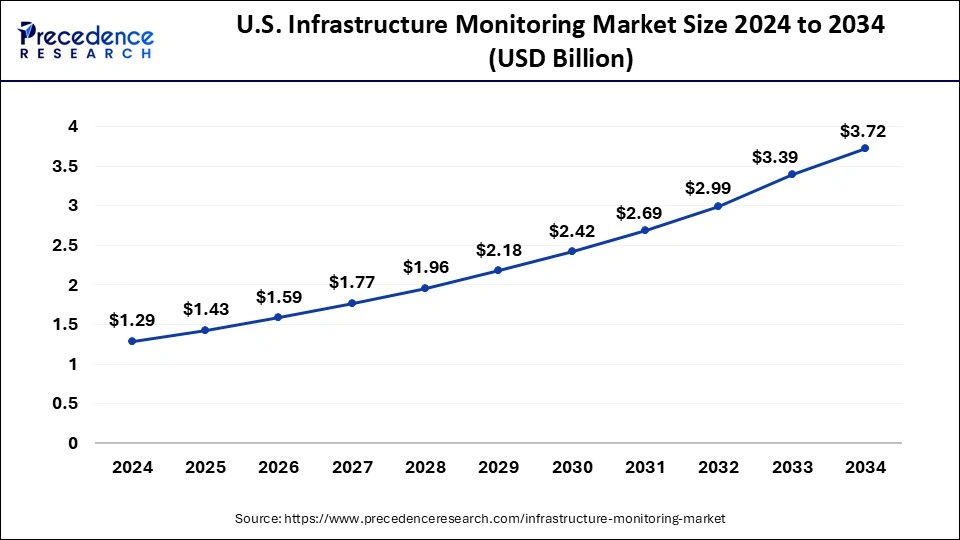

The U.S. infrastructure monitoring market size reached USD 1.29 billion in 2024 and is expected to be worth around USD 3.72 billion by 2034, at a CAGR of 11.17% from 2025 to 2034.

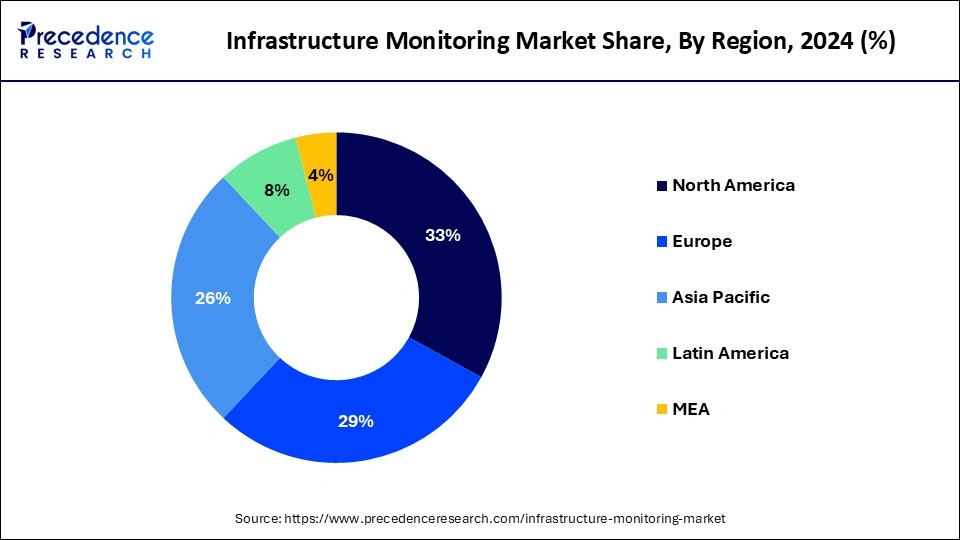

North America had dominated in the infrastructure monitoring market in 2024. Large sums of money have long been invested in infrastructure projects in North America in various industries, including telecommunications, electricity, utilities, and transportation. The United States has committed significant financial resources to modernizing and preserving its deteriorating transportation network, which includes highways, bridges, trains, airports, and water systems. Infrastructure monitoring solutions are in high demand due to these investments since they ensure these assets' performance, safety, and dependability.

Asia- Pacific is the fastest growing in the infrastructure monitoring market during the forecast period. Technological innovations such as cloud computing, big data analytics, artificial intelligence, and the Internet of Things (IoT) are quickly adopted in Asia-Pacific. These technologies provide real-time data collecting, analysis, and decision-making, essential to contemporary infrastructure monitoring solutions. The need for sophisticated monitoring solutions keeps rising as businesses and governments in the region look to use these technologies to improve the sustainability, dependability, and efficiency of their infrastructure assets. Due to this urban spread, dependable and effective infrastructure systems are required to sustain the growing population.

Adopting monitoring solutions across multiple sectors, including transportation, utilities, and buildings, is driven by the critical role infrastructure monitoring plays in guaranteeing the safety, resilience, and optimal performance of complex urban systems.

Infrastructure monitoring is the act of gathering and evaluating data from IT systems, processes, and infrastructure to enhance business results and create value for the entire company. Monitoring the infrastructure aids in locating errors and the underlying reasons for system malfunctions or decreased performance. By examining metrics and logs, IT teams can identify the root causes of problems, such as hardware malfunctions, software configuration errors, network outages, or application flaws.

Infrastructure Monitoring Market Data and Statistics

| Report Coverage | Details |

| Market Size by 2034 | USD 15.70 Billion |

| Market Size in 2025 | USD 6.20 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 10.88% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Technology, Application, Vertical and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Development in the cities, telecom industries, and IT sectors

Due to the global urbanization trend, cities are growing and updating their infrastructure to accommodate increased populations and improve quality of life. Buildings, roads, bridges, and utilities like waste management and water supply systems are all included in this. Cities depend increasingly on sophisticated monitoring systems to guarantee the sustainability, dependability, and safety of their infrastructure as they work to become smarter and more efficient.

These systems use sensors, Internet of Things (IoT) gadgets, and data analytics to track vital asset performance and condition over time, identify problems or breakdowns, and streamline maintenance and repair procedures. Thus, the requirement to efficiently manage and maintain the intricate infrastructure of contemporary metropolitan areas drives the demand for such monitoring solutions. This drives the growth of the infrastructure monitoring market.

High installation costs of the monitoring systems

It is frequently necessary for infrastructure monitoring systems to relate to the current infrastructure, which includes utility networks, buildings, highways, and bridges. This integration procedure necessitates specific physical infrastructure and monitoring technology knowledge, which can be labor-intensive and complex. The intricacy raises the overall installation cost because qualified workers and engineers must ensure functional and proper installation. Lastly, the potential advantages of monitoring systems in terms of increased safety, operational effectiveness, and risk mitigation must be evaluated against their high installation costs. This limits the growth of the infrastructure monitoring market.

The market for infrastructure monitoring may not expand if project stakeholders choose less costly or alternative monitoring options because they believe the benefits will not outweigh the required upfront expenditure.

Improvement and customization of services for infrastructure monitoring software

Infrastructure monitoring involves more than just gathering data; it also entails analyzing it to draw actionable conclusions supporting well-informed choices. Enhancing analytical skills like predictive analytics, anomaly identification, and root cause analysis might be the main emphasis of improvement services. Monitoring systems can assist firms in proactively identifying and addressing issues before they become more significant by giving them actionable real-time insights. Organizations in all sectors now place a high premium on security and compliance due to increased cybersecurity risks.

Enhancing the security elements of monitoring solutions, such as encryption, access controls, and threat detection, might be the main emphasis of improvement services. Due to customization, organizations can apply certain security rules and compliance standards, guaranteeing that their infrastructure is safe and complies with legal requirements. This opens an opportunity for the growth of the infrastructure monitoring market.

The hardware segment dominated in the infrastructure monitoring market in 2024. The dominance of the hardware market can be attributed mainly to the widespread use of smart gadgets. Consumers are adopting more and more connected gadgets due to the introduction of IoT (Internet of Things) technology to improve convenience, efficiency, and automation in their daily lives. Hardware producers now have significant growth prospects due to the spike in demand for smart gadgets. Smartwatches, fitness trackers, and augmented reality glasses are examples of wearable technology that have become widely popular because they blend in with users' daily lives and offer valuable features and insights.

Hardware producers have jumped at the chance to cash in on the booming market for wearables by launching cutting-edge, feature-rich products that satisfy a wide range of customer requirements and tastes.

The services segment shows a significant growth in the infrastructure monitoring market during the forecast period. Businesses' infrastructures get more sophisticated as they develop and digitize their activities. Because of this complexity, effective monitoring and managing numerous components requires specialist expertise. Service providers draw in companies looking for help managing their infrastructure efficiently because they give the knowledge and tools needed to negotiate this complex terrain.

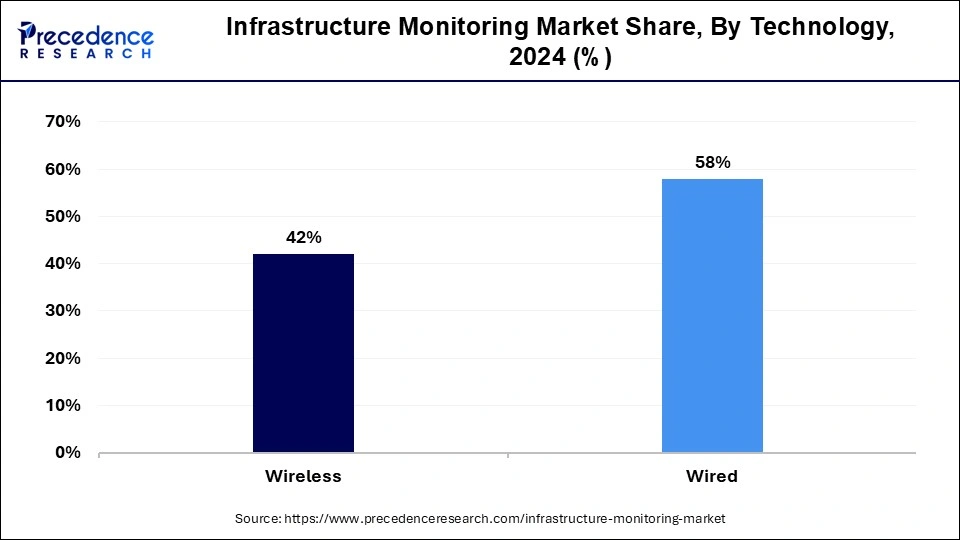

The wired segment dominated in the infrastructure monitoring market in 2024. Systems for monitoring wired infrastructure are solid and stable, which makes them perfect for essential applications where reliable data transfer is crucial. Wired systems are less vulnerable to interference, signal loss, and environmental conditions that could interfere with data transfer than their wireless counterparts. Since downtime can result in significant losses, this reliability is critical in the manufacturing, telecommunications, and energy sectors. Wireless connections often offer more bandwidth and quicker data transfer rates than wireless technology.

Applications for infrastructure monitoring that require real-time data gathering, analysis, and control depend on this benefit. Smart cities, utilities, and the transportation sector depend on fast data transmission for effective operations and prompt decision-making.

The wireless segment is the fastest growing in the infrastructure monitoring market during the forecast period. Wireless infrastructure monitoring systems help stakeholders monitor the condition and functionality of vital assets from a distance in real-time. Because instantaneous access to data, proactive decision-making and quick responses to possible problems or anomalies are possible, which minimizes downtime, lowers risk, and improves asset performance. Wireless infrastructure monitoring is incredibly flexible and can be used in a wide range of industries, such as manufacturing, construction, utilities, and transportation.

Wireless sensors can be used in manufacturing to enhance equipment performance and reduce costly downtime through predictive maintenance or in transportation to monitor the structural health of bridges and tunnels. The wireless segment of the infrastructure monitoring market has experienced significant adoption and growth due to its extensive applicability across many industries.

The vibration monitoring segment dominated in the infrastructure monitoring market in 2024. Considering the growing worldwide concern over aging infrastructure, there is a greater emphasis on monitoring the condition and integrity of constructions like buildings, bridges, dams, and tunnels. Vibration monitoring is essential for evaluating an organization's structural health by identifying anomalies like cracks, deformations, or material fatigue that may jeopardize safety. Even though vibration monitoring systems have a substantial upfront cost, the long-term financial advantages greatly exceed the costs.

With proactive maintenance based on real-time data, infrastructure assets can be made longer, downtime can be decreased, and the likelihood of catastrophic breakdowns can be decreased. Implementing vibration monitoring as a preventive measure is justified by the return on investment (ROI) from preventing expensive repairs or replacements.

The damage detection segment shows a significant growth in the infrastructure monitoring market during the forecast period. Infrastructure management now prioritizes safety, particularly after high-profile incidents and catastrophes. Governments, regulatory agencies, and stakeholders are increasingly emphasizing the significance of routine inspections and monitoring to guarantee the structural integrity of bridges, roads, dams, buildings, and other vital infrastructure assets. Stricter rules and guidelines are being implemented by governments and regulatory agencies across the globe regarding infrastructure upkeep and safety.

Adopting cutting-edge damage detection technologies is frequently necessary to comply with these rules and meet the required reporting and monitoring requirements. The infrastructure monitoring market's damage detection segment is expanding mainly due to the regulatory environment.

The construction segment dominated the infrastructure monitoring market in 2024. Global infrastructure development projects have increased unprecedentedly due to population growth and urbanization. These initiatives cover various industries, including utilities, telecommunications, energy, and transportation. Robust monitoring technologies are necessary to guarantee these infrastructures' safety, stability, and longevity as building activities increase. The monitoring and management of infrastructure assets have been completely transformed by the Internet of Things (IoT) and sensor technologies.

These technologies make real-time data gathering, analysis, and visualization possible, enabling stakeholders to act quickly and decisively. Construction organizations use IoT and sensor-based monitoring solutions to improve project visibility, maximize resource usage, and reduce downtime.

The manufacturing segment is the fastest growing in the infrastructure monitoring market during the forecast period. Manufacturers can use preventive maintenance procedures thanks to infrastructure monitoring technologies. By regularly checking machinery, production lines, and other infrastructure, manufacturers can identify possible problems before they become costly breakdowns or downtime. In the competitive manufacturing sector, this preventive strategy eliminates unplanned outages, lowers maintenance costs, and increases operational uptime. Infrastructure monitoring systems are becoming increasingly scalable and configurable, enabling manufacturers to expand them according to their changing needs and customize them to their exact specifications.

Manufacturers can use modular monitoring solutions to monitor inventory levels, check energy consumption, and keep an eye on equipment status. These solutions can be tailored to meet specific operational difficulties and growth objectives.

By Component

By Technology

By Application

By Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

December 2024

January 2025

October 2024