January 2023

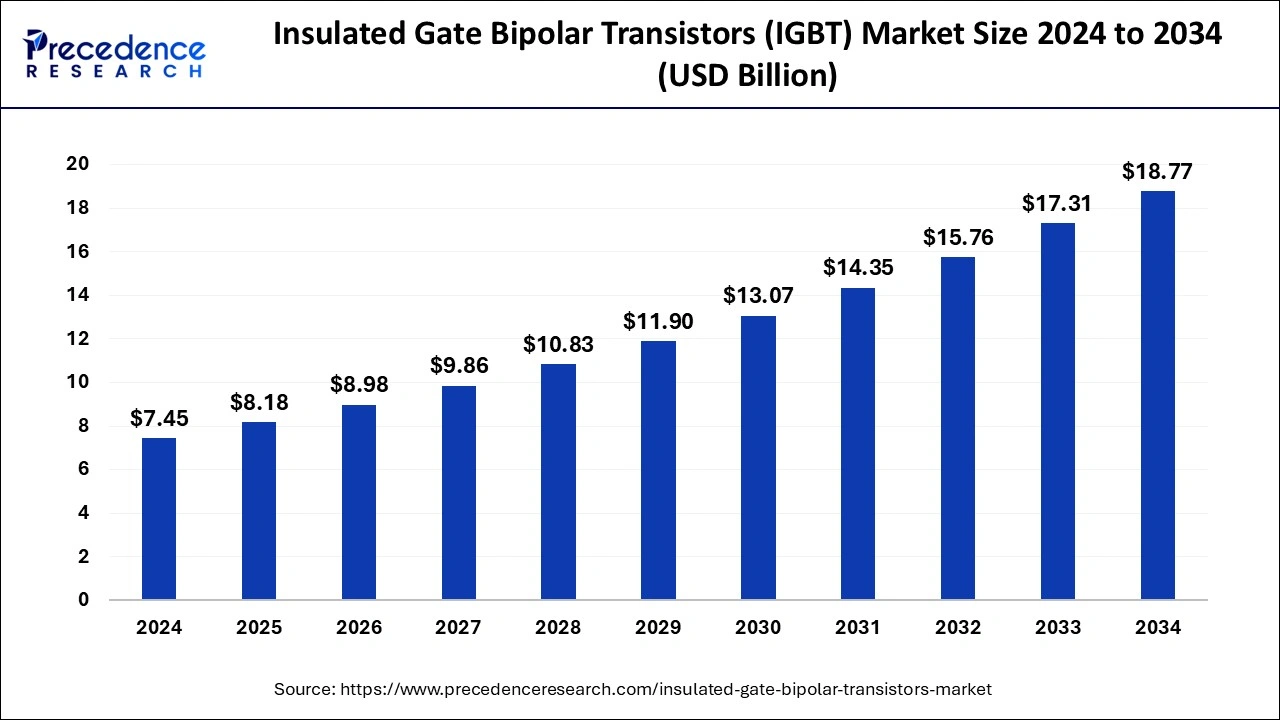

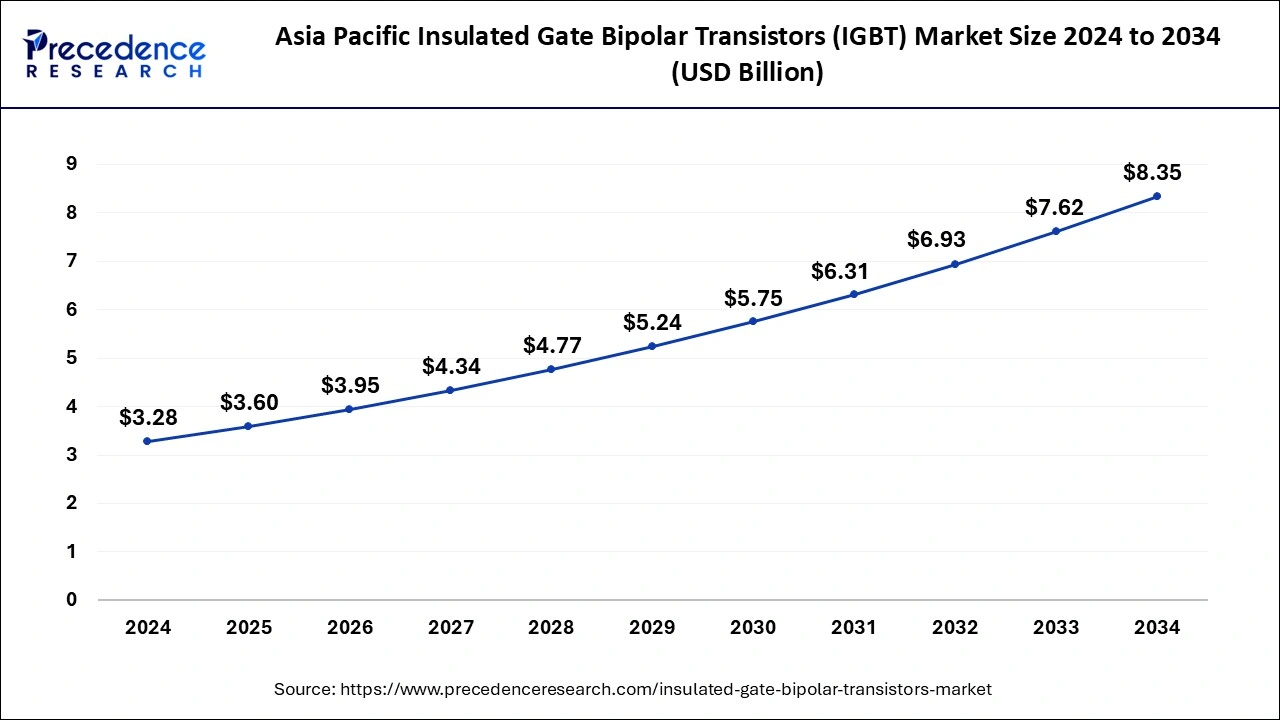

The global insulated gate bipolar transistors (IGBT) market size is calculated at USD 8.18 billion in 2025 and is forecasted to reach around USD 18.77 billion by 2034, accelerating at a CAGR of 9.68% from 2025 to 2034. The Asia Pacific insulated gate bipolar transistors (IGBT) market size surpassed USD 3.60 billion in 2025 and is expanding at a CAGR of 9.79% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global insulated gate bipolar transistors (IGBT) market size was estimated at USD 7.45 billion in 2024 and is predicted to increase from USD 8.18 billion in 2025 to approximately USD 18.77 billion by 2034, expanding at a CAGR of 9.68% from 2025 to 2034.

The Asia Pacific insulated gate bipolar transistors (IGBT) market size was estimated at USD 3.28 billion in 2024 and is projected to surpass around USD 8.35 billion by 2034 at a CAGR of 9.79% from 2025 to 2034.

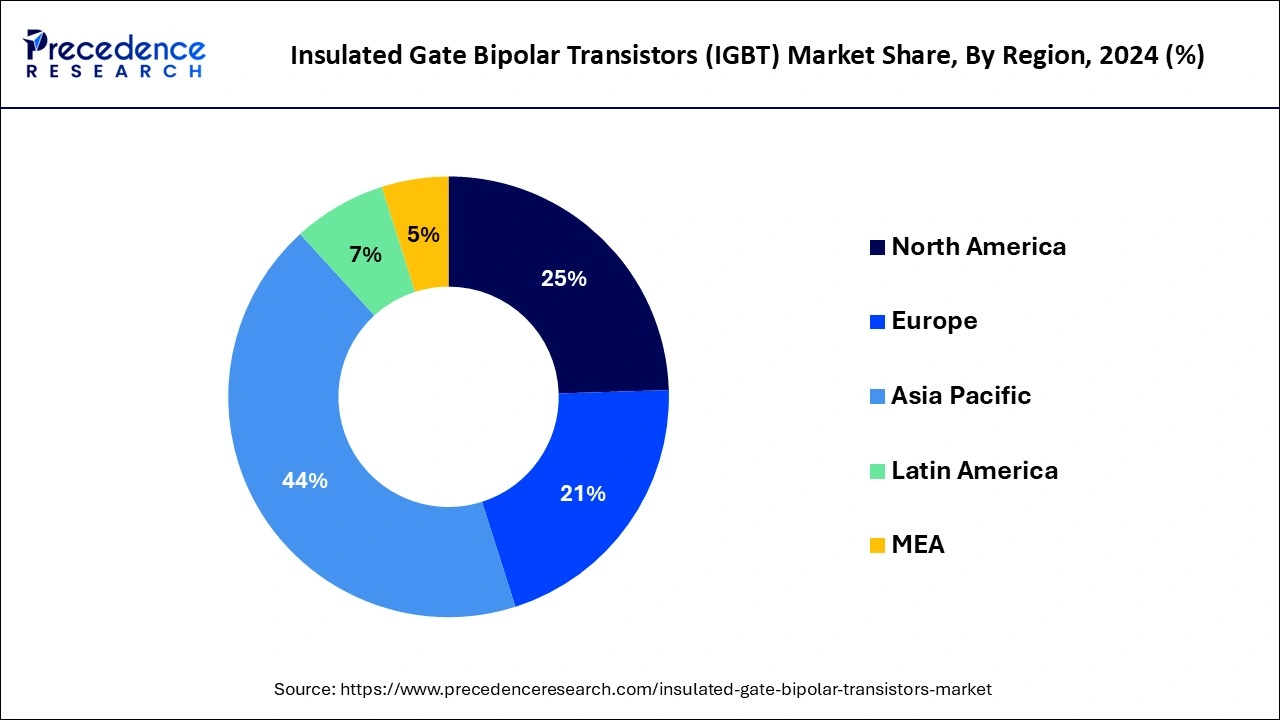

Asia Pacific dominated the insulated gate bipolar transistors market accounting for more than 44% of the market share in 2024. The Asia Pacific region is poised to dominate the market due to several key factors. China, a leader in electric vehicle manufacturing, is contributing significantly to the region's market share, driven by the rising adoption of electric vehicles. Moreover, countries like Japan and India are experiencing increased demand for energy-efficient solutions, spurring market growth. With a robust presence of electronic and semiconductor manufacturers in nations like China, South Korea, and India, coupled with technological advancements, the Asia Pacific region offers a fertile ground for the expansion of the insulated gate bipolar transistors market, ensuring sustained growth in the forecast period.

North America is anticipated to experience a significant CAGR of 5.7% throughout the forecast period. In North America, significant growth is driven by increasing awareness and the implementation of renewable resources. The region's market offers vast opportunities due to its emphasis on sustainability and energy efficiency. Insulated gate bipolar transistors (IGBTs) are particularly favored in North America for their low power consumption characteristics, aligning well with the region's focus on energy conservation. As industries and consumers prioritize environmentally friendly solutions, IGBTs emerge as essential components in various applications, contributing to the region's sustained growth trajectory in the coming years.

Insulated gate bipolar transistors (IGBTs) play a pivotal role in numerous applications across various industries due to their ability to efficiently control high to medium-voltage circuits. One primary function of IGBTs is to synthesize complex waveforms by rapidly switching on and off. This feature is particularly useful in switching amplifiers found in sound systems, where precise control over electrical signals is essential for optimal audio performance. Industrial control systems heavily rely on IGBTs for their ability to serve as switches, enabling the precise control of inputs using a combination of isolated gate FETs. Additionally, in high-voltage applications like traction motors and induction heaters, IGBTs demonstrate exceptional performance and reliability. IGBT modules, comprising multiple devices arranged in parallel, are capable of handling substantial current and voltage loads.

These modules provide high blocking voltages, typically around 6500 V, making them suitable for demanding industrial applications. Characterized by three terminals and a structure consisting of four layers, IGBTs are controlled using metal oxide semiconductor gates, facilitating fast switching and high operational efficiency. As a result, IGBTs find widespread use in electric vehicles, railway systems, welding machines, air conditioners, and induction hobs, where their robust performance and precise control capabilities are indispensable for reliable operation and enhanced energy efficiency in modern electrical systems.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 9.68% |

| Global Market Size in 2025 | USD 8.18 Billion |

| Global Market Size by 2034 | USD 18.77 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Voltage and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Improved power cycling and thermal capacity in electronic devices

The insulated gate bipolar transistors market is experiencing remarkable growth driven by several key factors that underscore its indispensability in modern electronics and industrial applications. One significant driver is the increasing demand for improved power cycling and thermal capacity in electronic devices. As electronic systems become more sophisticated and power-intensive, there is a growing need for components that can handle higher power loads and dissipate heat efficiently. IGBTs, with their ability to manage high currents and temperatures, are emerging as vital components in meeting these requirements.

Furthermore, there is a surge in demand for energy-efficient electronic devices across various sectors. IGBTs play a crucial role in enhancing the energy efficiency of appliances such as cookers, microwaves, electric cars, trains, and variable-speed refrigerators. Their ability to regulate power consumption and minimize energy loss makes them highly sought-after components in the quest for sustainability and reduced environmental impact.

The versatility of IGBTs is another driving force behind their market growth. They find widespread application in diverse industries, including automotive, manufacturing, renewable energy, and consumer electronics. From variable-frequency drives (VFDs) to industrial automation systems, IGBTs serve critical functions in controlling motors, regulating voltage, and converting power.

Additionally, factors such as urbanization and industrialization are contributing to the expansion of the insulated gate bipolar transistors market. As urban populations grow and industries evolve, the demand for electronic devices and industrial equipment equipped with IGBTs continues to rise. Moreover, supportive government incentives and regulations aimed at promoting energy efficiency and reducing carbon emissions further propel market growth by encouraging investment in IGBT-based solutions.

Therefore, the increasing need for enhanced power handling capabilities, the growing demand for energy-efficient devices, the wide-ranging applications across industries, and favorable government initiatives collectively drive the robust growth of the Insulated Gate Bipolar Transistor (IGBT) market. These factors position IGBTs as indispensable components in the modern electronic landscape, with significant opportunities for further expansion and innovation in the years to come.

High cost associated with IGBT devices and lack of awareness

The insulated gate bipolar transistors market faces several challenges that may hinder its expansion in the forecast period. One notable obstacle is the high cost associated with IGBT devices, which can pose a barrier to adoption, especially for budget-conscious consumers and businesses. The initial investment required for acquiring and implementing IGBT-based solutions may deter some potential users from embracing these technologies, particularly in cost-sensitive industries.

Furthermore, a significant challenge lies in the lack of awareness among consumers and businesses regarding the benefits and applications of IGBTs. Many potential users may not fully understand the advantages that IGBTs offer in terms of energy efficiency, power management, and device longevity. This lack of awareness could result in slower adoption rates and limited market penetration for IGBT-based products and solutions.

Another critical issue that poses a challenge to the insulated gate bipolar transistors market is the device's unstable characteristics in high-temperature environments. IGBTs are often subjected to elevated temperatures during operation, which can affect their performance and reliability. The instability of IGBTs under such conditions may lead to operational inefficiencies, reduced lifespan, and increased maintenance costs for electronic systems and equipment employing these devices. Addressing these challenges will require concerted efforts from industry stakeholders, including manufacturers, regulators, and technology advocates. Initiatives aimed at reducing manufacturing costs, raising awareness about IGBT benefits, and improving device stability in high-temperature environments can help mitigate these obstacles and foster the continued growth and adoption of IGBT technologies in various applications and industries.

Growth in utilization of SiC and GaN materials in power semiconductor and automotive applications

The technological advancement of power electronics and the deployment of smart grids present significant and lucrative opportunities for market players in the insulated gate bipolar transistors market during the forecast period. These advancements are reshaping the landscape of power management and distribution, offering enhanced efficiency, reliability, and flexibility in energy systems. The evolution of power electronics technologies, including advancements in semiconductor materials, packaging techniques, and device architectures, enables the development of more efficient and compact IGBTs.

These innovations result in improved power handling capabilities, reduced switching losses, and enhanced thermal performance, making IGBTs more suitable for a wide range of applications, including renewable energy systems, electric vehicles, industrial automation, and consumer electronics. Additionally, the deployment of smart grids, which integrate advanced communication, control, and monitoring technologies into conventional power distribution networks, creates opportunities for the adoption of IGBT-based solutions. Smart grids enable real-time monitoring and optimization of electricity generation, transmission, and consumption, facilitating better load balancing, fault detection, and grid stability.

IGBTs play a crucial role in smart grid infrastructure, offering high-performance switching and control capabilities necessary for grid modernization initiatives. Hence, the convergence of technological advancements in power electronics and the expansion of smart grid initiatives provides market players with opportunities to develop innovative IGBT-based products and solutions tailored to the evolving needs of modern energy systems. By leveraging these opportunities, manufacturers can strengthen their market position, drive market growth, and contribute to the advancement of sustainable and resilient energy infrastructures globally.

The high voltage segment held the highest market share of 54% in 2024, primarily due to their high-current-carrying capacity and precise gate control facilitated by voltage manipulation. These attributes make high voltage IGBTs indispensable in industries where robust power management is crucial, including automotive, aircraft, unmanned aerial vehicles (UAVs), and industrial sectors. The versatility of high voltage IGBTs enables their widespread application across diverse industries, driving their increasing adoption and market dominance. As technology advances and industries seek more efficient power solutions, the demand for high voltage IGBTs is expected to remain strong, fueling their market growth.

The medium voltage segment is anticipated to witness rapid growth at a significant CAGR of 5.1% during the projected period, driven by the escalating demand for transistors rated between 1700 V and 2500 V in various manufacturing industries, particularly for automation processes. This surge in demand reflects the critical role of medium voltage IGBTs in enhancing operational efficiency and reliability across industrial applications.

The industrial manufacturing segment has held a 31% market share in 2024. This trend is underpinned by the escalating adoption of factory automation and industrial Internet of Things (IoT) technologies within manufacturing plants worldwide. As industries increasingly prioritize efficiency, productivity, and connectivity, the demand for IGBTs is surging to facilitate power management, control systems, and motor drives in industrial machinery and equipment. This robust growth trajectory underscores the pivotal role of IGBTs in enabling the transformation of manufacturing processes, driving innovation, and optimizing operational performance across industrial sectors.

The automotive segment is anticipated to witness the fastest growth of 5.8% over the projected period. The demand for insulated gate bipolar transistors (IGBTs) in the automotive sector, particularly for electric vehicles (EVs), is experiencing robust growth due to their pivotal role in facilitating smooth power transfer to the grid. To ensure reliability, enhance power capabilities, and extend lifespan, IGBTs and FWD chips are integrated into modules featuring multiple devices, isolation layers, and protective components. These modules are engineered to withstand harsh operating conditions characterized by high temperatures, mechanical vibrations, humidity, shocks, and potential chemical contamination. This rugged construction enables the seamless operation of EVs in diverse environments, reinforcing the critical role of IGBT technology in advancing automotive electrification.

By Voltage

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2023

September 2024

July 2024