August 2024

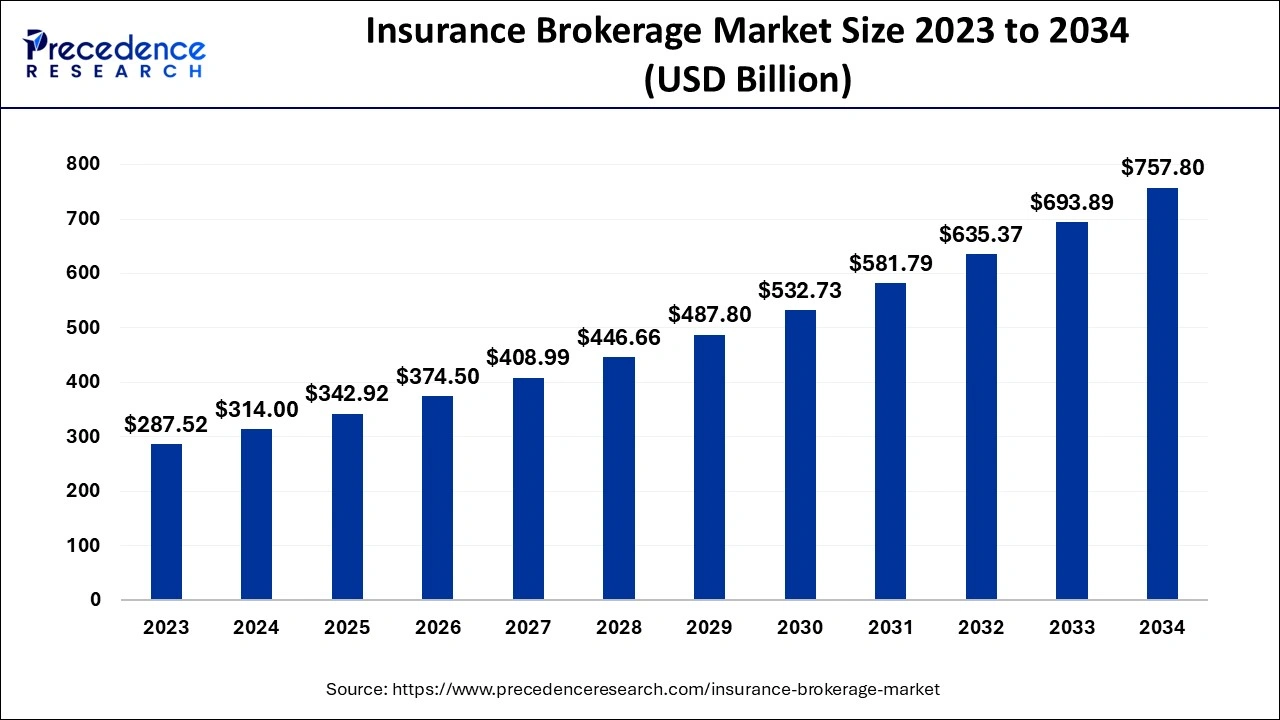

The global insurance brokerage market size accounted for USD 314.00 billion in 2024, grew to USD 342.92 billion in 2025 and is expected to be worth around USD 757.80 billion by 2034, registering a solid CAGR of 9.21% between 2024 and 2034. The North America insurance brokerage market size is calculated at USD 106.76 billion in 2024 and is expected to grow at a CAGR of 9.35% during the forecast year.

The global insurance brokerage market size is calculated at USD 314.00 billion in 2024 and is projected to hit around USD 757.80 billion by 2034, expanding at a CAGR of 9.21% from 2024 to 2034. The insurance brokerage market is set to rise due to consumer awareness, digitalization, and customized insurance plans.

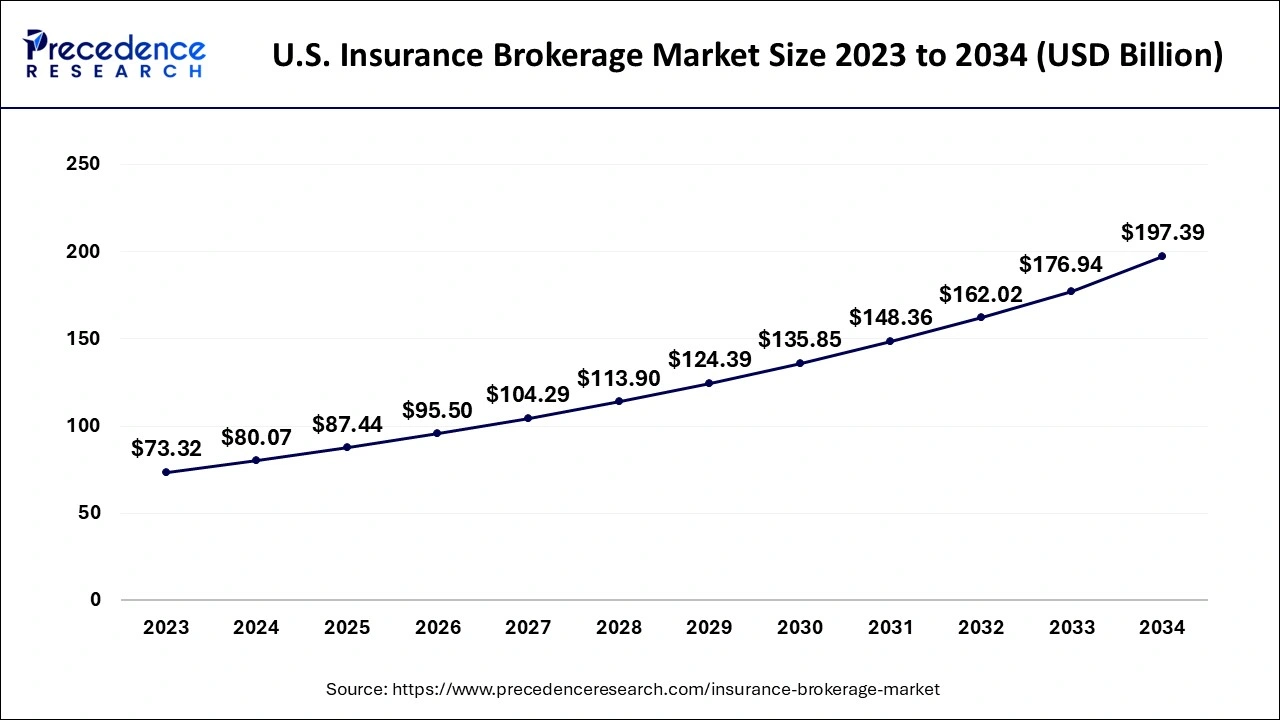

The U.S. insurance brokerage market size is evaluated at USD 80.07 billion in 2024 and is anticipated to reach around USD 197.39 billion by 2034, growing at a CAGR of 9.42% from 2024 to 2034.

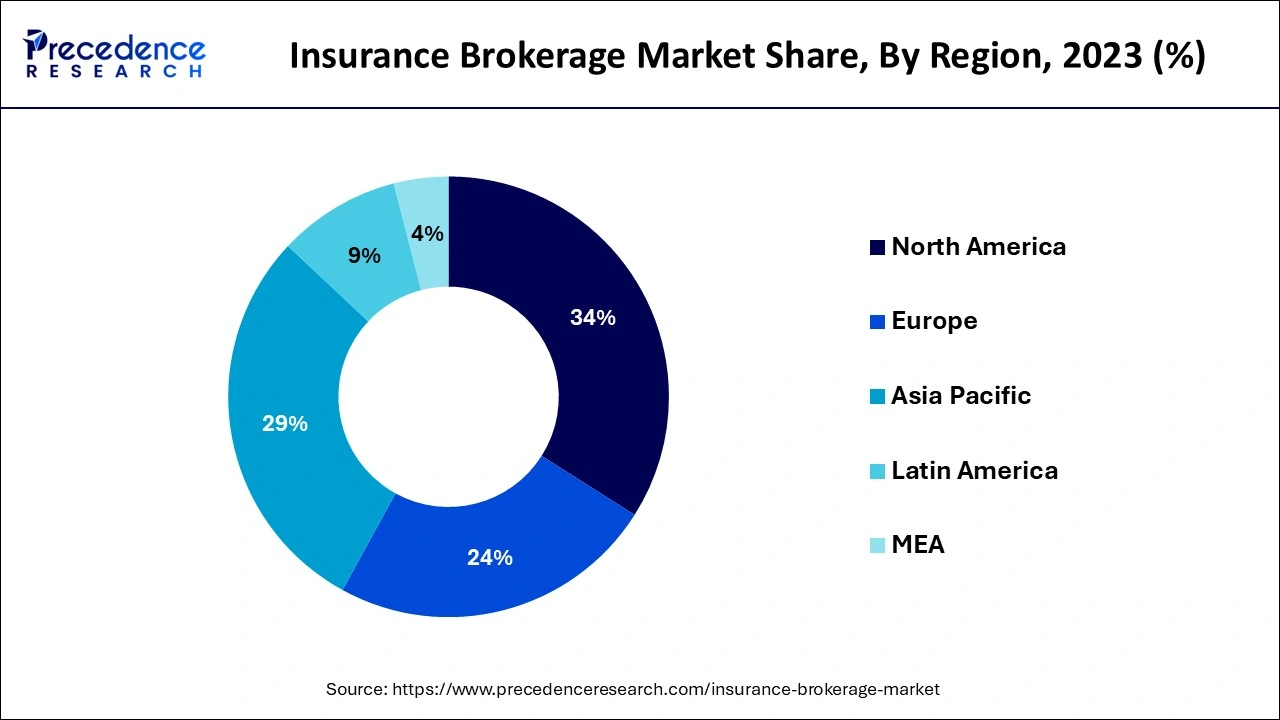

North America led the global insurance brokerage market in 2023. Facilitated by the qualitative technological requirements, high insurance density, and a sound legal environment in the region. The insurance market in the U.S. is very developed, and there is high competition among brokers. Hence, it helps to deliver better services and encourages the use of hi-tech solutions.

Asia Pacific is expected to host the fastest-growing market throughout the forecast period. The growing awareness is complemented by the increased density of both life and non–life insurance products. The emergence of the market is primarily due to the insurance brokers who actively inform potential consumers and help them choose an appropriate insurance plan.

Insurance brokerages are businesses that act as mediators between insurance companies and customers. The insurance products that brokers provide include medical insurance, property and casualty insurance, and health insurance. The development of the insurance brokerage market is driven by conditions like awareness of the current insurance products, risk management, and changes in the regulation of insurance products. Professional responsibilities of insurance brokers include consulting on risks, advising on policies, administrating policies, assisting with claims, and providing risk management services. Insurance brokers try to provide insurance products for numerous companies based on clients’ requirements and situations by paying attention to understanding the needs of their clients. Hiring a broker for insurance has its benefits. It is time-saving, personalized, and comes with risk management information.

How AI Impacts on Insurance Brokerage Market

Artificial Intelligence (AI) is in the insurance industry for efficiency, customers, and all operations improvement purposes. AI can be beneficial to insurance brokers and companies. AI can help insurers predict market trends, customer behaviour, and the threats that might ensue, thereby aiding in insurers' strategic planning. This capability is very helpful and even essential in attempting to forecast the various aspects of the insurance sector to make good business decisions. These solutions use complex computations and data analysis to perform various activities or situations, including risk analysis.

| Report Coverage | Details |

| Market Size by 2034 | USD 757.80 Billion |

| Market Size in 2024 | USD 314.00 Billion |

| Market Size in 2025 | USD 342.92 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 9.21% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Insurance, Brokerage, End Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Increase in demand for insurance policies

The insurance brokerage market is characterized by an escalating consumer demand for health, car, and life insurance policies. These policies help one protect his/her health, property, and financial status in case of unexpected situations, so people opt for the coverage. This need is fueled by prevailing economic risks. Also, requirements for compulsory motor insurance play their part in this direction. Since there are different insurance products available online, the consumers can easily choose between the options, thus making insurance attractive, while brokers can provide recommendations based on a consumer’s needs, making insurance more attractive. Due to the increase in asset holding and increasing emphasis on insurance, the need for insurance solutions is very important, continuing to show the relevance of brokers in helping their clients make the right insurance decisions.

Regulatory framework

The insurance brokerage market experiences several obstacles, one of which is the regulatory structure. The laws and regulations surrounding brokers include licensing, as well as disclosure and consumer protection laws. These regulations can vary significantly between regions, and this is likely to cause difficulties for brokers doing business. It can shade off their primary activities and hence fail to provide adequate client services and grow their markets as required by regulation. Further, even if there’s a great degree of clarity with set rules, frequent alterations and revisions can cause more confusion that forces the brokers and other related entities to shift their operations.

Supportive governmental landscape

Government authorities are launching initiatives to increase insurance consciousness and, consequently, enable consumers to avail themselves of a wider range of insurance offers. The programs that promote insurance accessibility and improve knowledge of its needs contribute to the clarification of insurance for consumers. Such measures are equally beneficial in enhancing the general welfare of its citizens by laying down measures for financial security, besides providing brokers with a favorable vantage to grow. Governments remain very keen on insurance as one of the measures to stabilize the economy and boost the security of citizens.

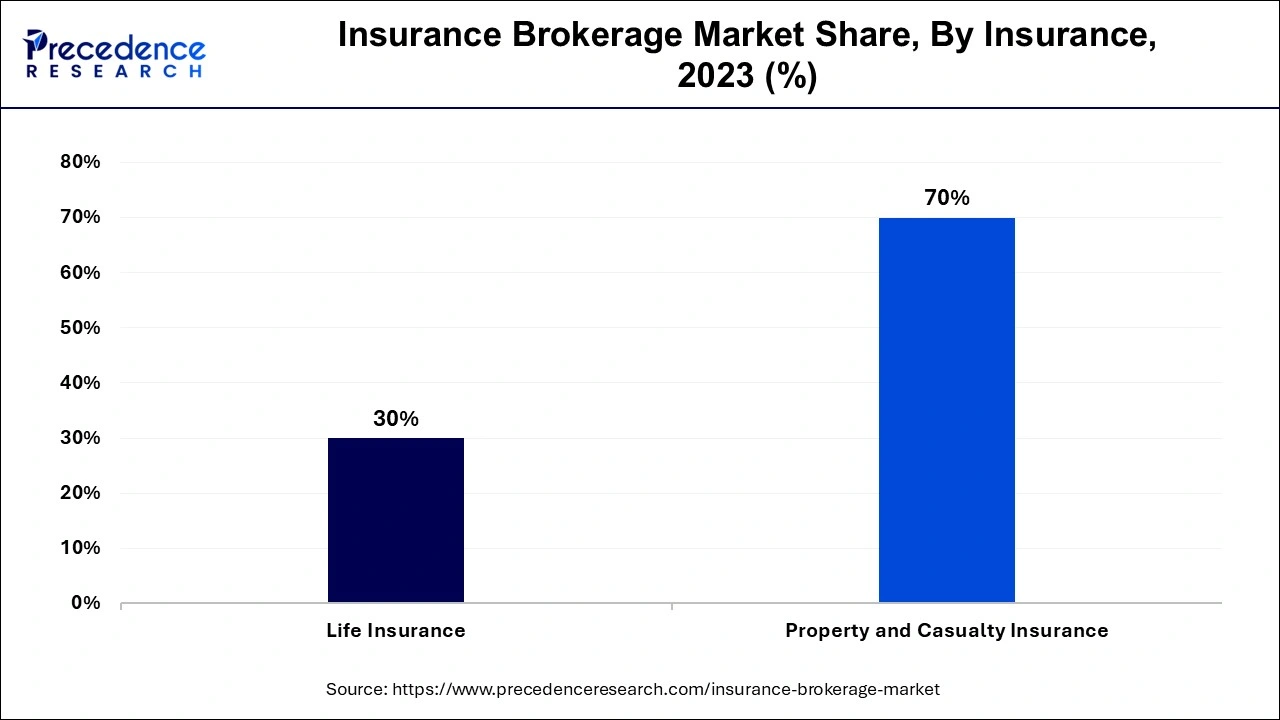

The property & casualty insurance segment contributed the largest share of the market in 2023. P&C insurance consists of car insurance, home insurance, boat or ship insurance, and professional liability insurance as the rate of urbanization increases and people groping for houses, shelter, apartments, etc, come to the same extent of demand for property insurance. Owners of residential and commercial properties, investment properties, and companies alike are looking for comprehensive insurance solutions to guarantee against loss and other incidents. Besides selling insurance policies that enable policyholders to recover certain costs and losses that may be occasioned by events such as fires, burglaries, traffic accidents, and other disasters, property and casualty insurance agents and brokers perform several tasks.

The life insurance segment is expected to show considerable growth in the market over the forecast period. Individuals who attain financial literacy are inclined to secure their property and families with compensation in case of uncertain occurrences. Life insurance is a kind of risk management that financial organizations provide policy to the client where the target is to ensure that the insurer will pay money to the beneficiaries upon the death of the insured. The policyholder offers a premium amount to the insurer at the time of policy granting and during his/ her lifetime. Both Asia Pacific and North America have also reported raised needs for life insurance. Life Insurance has also become essential in today's world.

The retail segment accounted for the largest share of the market in 2023. Retail insurance brokerage is used particularly to include simple insurance policies for retail shops, and ordinary choices may include general/operation liability, product selling liability, and commercial property insurance. Brokers can ensure that their customers are sold a comparably smooth experience that involves such processes as comparison, quotation, and general information retrieval via online tools and mobile apps. Retail insurance brokers assist retailers in searching for insurance coverage for risks such as property, legal liability, and general liability. Independent insurance agents or retail brokers help customers purchase a policy they need at a reasonable price and often deal with less sophisticated policies.

The wholesale segment is anticipated to witness significant growth in the market over the studied period. Wholesale brokers also offer assessment and management solutions concerning risk profiling with client susceptibility and insurance coverage solutions. A wholesale insurance broker is defined as an industry professional who sells insurance on behalf of a retail broker to an insurance carrier. Most of these salespeople do not frequently engage with insurance buyers. Rather, retail brokers go to them for other policies, which address difficult-to-obtain risks, then re-sell them to clients.

The wholesale segment has contributed the largest market share in 2023. This emphasis on personalization aids in the selection of clients, and their subsequent maintenance also contributes to the further development of the market among individuals. In recent years, the demand for insurance has increased due to the need for financial assistance in areas like health, life, and auto insurance.

The corporate segment is expected to show considerable growth in the market over the forecast period. Business insurance is the insurance that a company acquires to shield them against different risks affecting their property, employees, or activities. Insurance brokers assist corporations in running compliance in such an environment and manage their insurance risk portfolios. Most jurisdictions have laid down some rules on compulsory corporate insurance products like workers’ compensation and business liability insurance.

Segments Covered in the Report

By Insurance

By Brokerage

By End use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

September 2024

July 2024

January 2025