February 2025

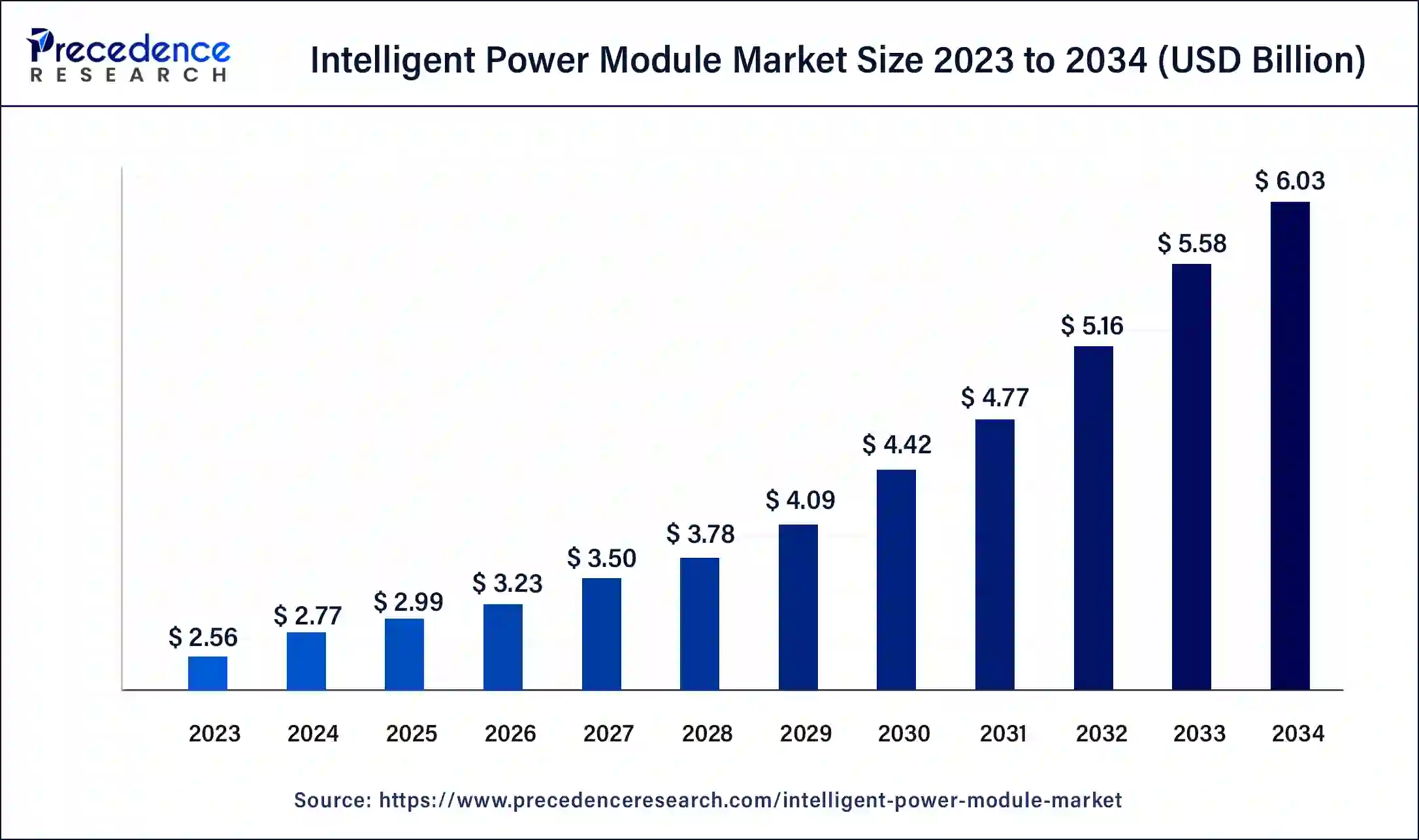

The global intelligent power module market size was USD 2.56 billion in 2023, calculated at USD 2.77 billion in 2024 and is projected to surpass around USD 6.03 billion by 2034, expanding at a CAGR of 8.1% from 2024 to 2034.

The global intelligent power module market size accounted for USD 2.77 billion in 2024 and is expected to be worth around USD 6.03 billion by 2034, at a CAGR of 8.1% from 2024 to 2034. The intelligent power module market is growing significantly because of the growing usage of electric vehicles and electronics.

The incorporation of artificial intelligence (AI) for improved functionality is another noteworthy development in the intelligent power module market. Prominent businesses are integrating AI algorithms into IPMs to provide more intelligent control and management of electricity. This trend is meeting the increasing need for intelligent systems that can adjust to changing operating circumstances.

Leading the way in implementing AI-powered IPMs are nations like Japan, which are renowned for their precision electronics, mirroring the worldwide trend toward increasingly complex and adaptable electronic solutions. By incorporating machine learning and artificial intelligence (AI) into the Intelligent Power Module Market, companies like Infineon Technologies and Wolfspeed are driving innovations and improving overall performance and predictive maintenance.

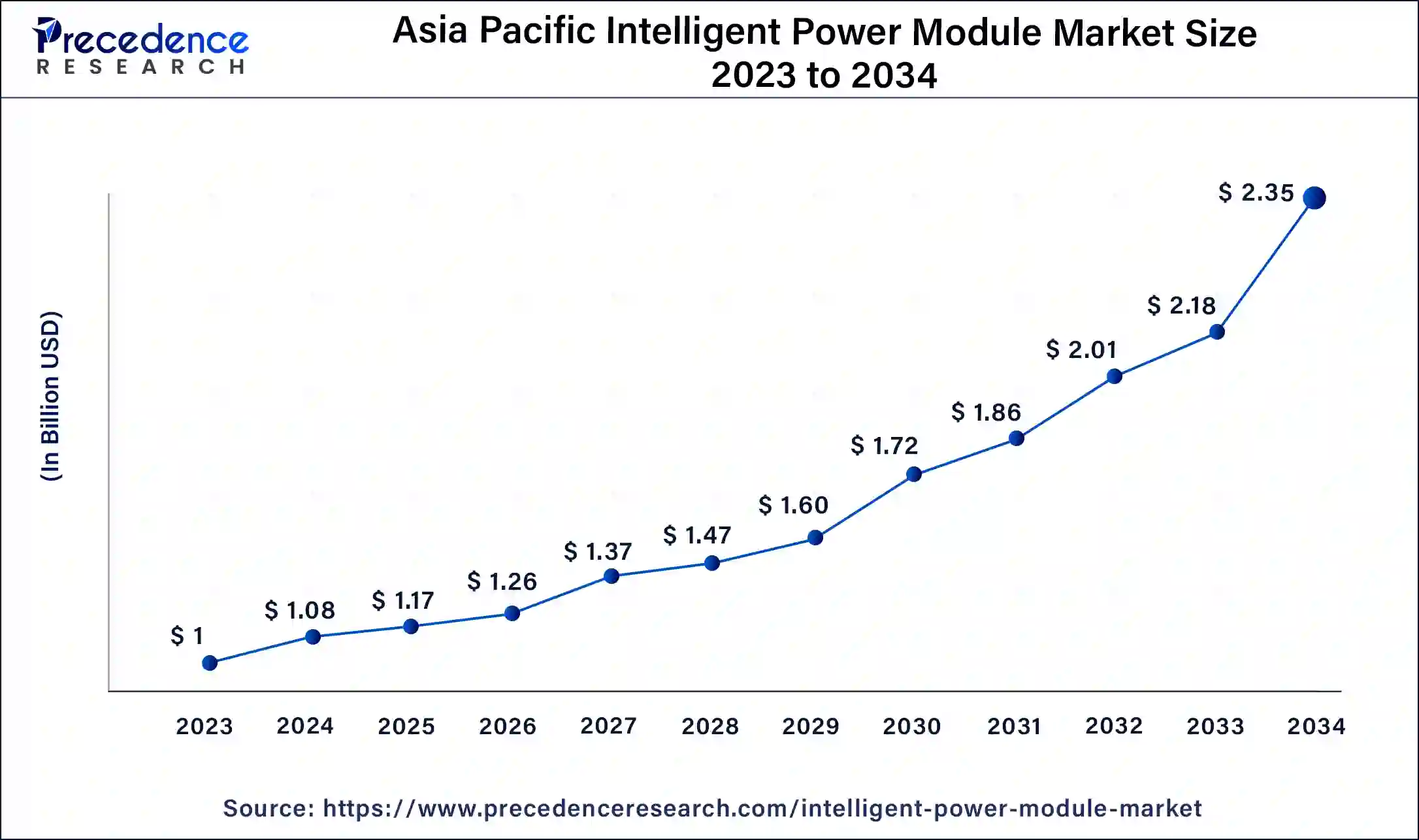

The Asia Pacific intelligent power module market size was estimated at USD 1 billion in 2023 and is predicted to be worth around USD 2.35 billion by 2034, at a CAGR of 8.3% from 2024 to 2034.

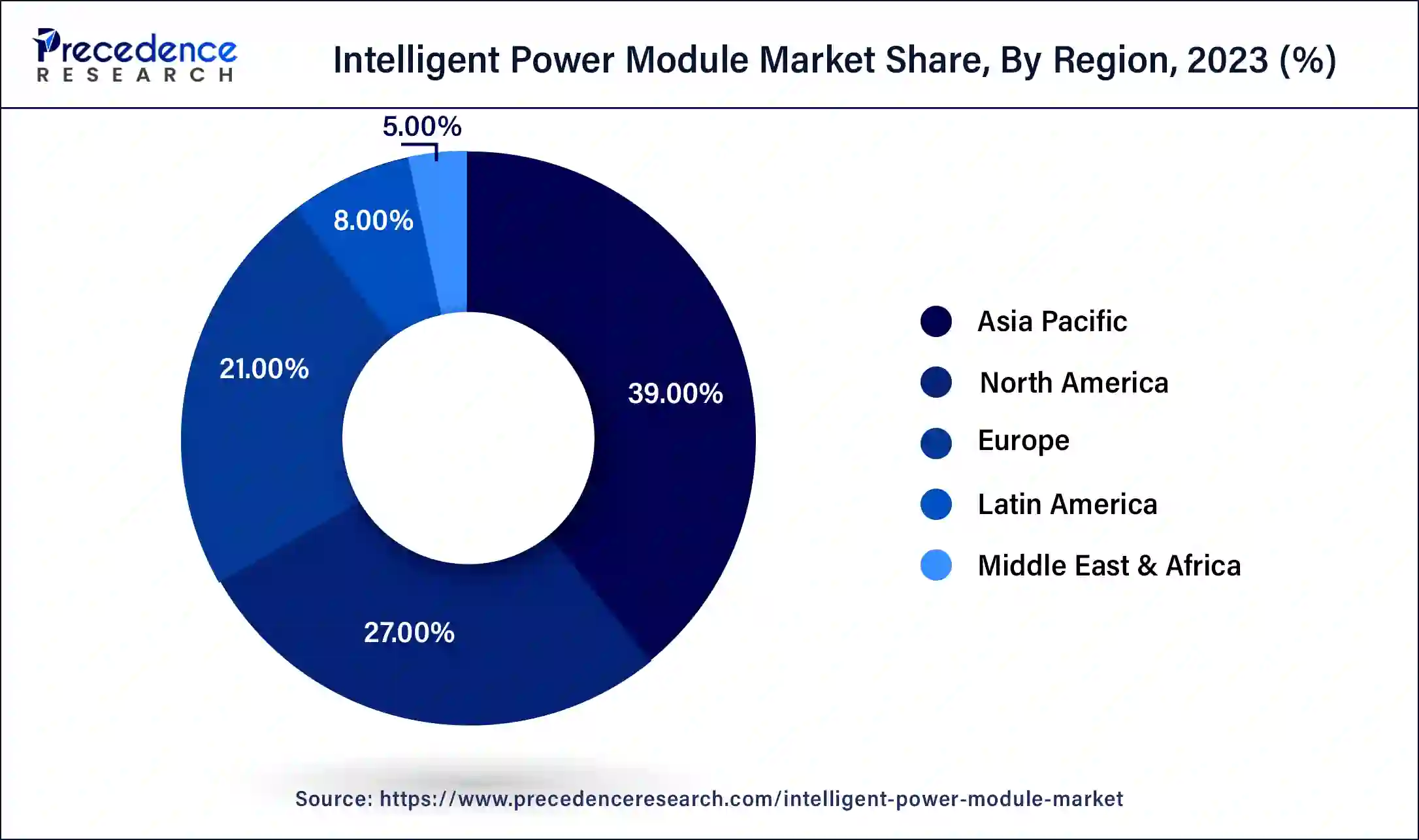

Throughout the forecast period, the intelligent power module market is anticipated to be most heavily influenced by the Asia Pacific, and region is anticipated to continue to rank among the most significant areas in the global market. The consumer electronics and automotive industries are expanding quickly in China, which is projected to raise demand for intelligent power modules there. This expansion is being fueled by rapid infrastructural development and industrialization. In addition, more industrial activity has been seen as a result of governments putting more emphasis on producing power from renewable sources.

India's economy is predicted to expand at a rate of 15.6% CAGR from 2024 to 2034 since the country's market is booming with innovative new technology and practices. The immediate, mid-term, and long-term phases of business development are strategically channeled by semiconductor businesses. The businesses are concentrating on solar energy, utility solar, consumer durables, and traction for the short run. In the medium term, they will concentrate their best efforts on developing electric car traction designs and electric vehicle chargers. Along with the expansion of the aforementioned segment, they are further advancing space for optical devices (OPTO), high frequency (HF), and high voltage direct current (HVDC).

China's semiconductor industry is anticipated to grow at a rate of 13.04% CAGR from 2024 to 2034, making it one of the largest in the world due to the existence of key companies and widespread output. Chinese auto suppliers and original equipment manufacturers (OEMs) are compelled to begin producing intelligent power modules as the market for automotive IGBTs shrinks. Due to the high demand for SiC MOSFET modules in Tesla's EVs, silicon carbide (SiC), a revolutionary material for EV power modules, is also being used by China-based EV companies.

North America is estimated to grow at a significant CAGR in the intelligent power module market during the forecast period. Significant demand is driven by the existence of major industrial and automotive electronics manufacturers in the United States and Canada. Intelligent power modules are becoming more and more common in the region's modern automobile industry, which focuses on electric and hybrid automobiles. Prior to the worldwide rollout, several innovative, intelligent power module designs were created and tested in North American labs with a focus on innovation. The usage of intelligent power modules, which allow for power savings, is also encouraged by strict energy efficiency standards for equipment and appliances. Research on emerging technologies that use intelligent power modules is encouraged by funding and tax incentives. Intelligent power module innovation is centered in North America. Additionally, the area exports intelligent power modules to markets in Europe and Asia.

The global intelligent power module market is expanding quickly due to the rising demand for consumer electronics. The growing acceptance of electric vehicle and hybrid vehicles is another factor driving the growth of this industry. An electrical device that has a high-voltage drive circuit to provide high power performance from either an IGBT power device or a MOSFET power device is referred to as an intelligent power module. Extreme temperatures, under-voltage fluctuations, and short circuits in systems are also all prevented by using it. Inverters, heating, ventilation, air conditioning, solar power generation, and several other sectors where it looks appropriate can all use intelligent power modules. They are suited for application in smart grids, consumer electronics, and other systems due to their great power efficiency and low power consumption. An intelligent power module is a practical tool in the electronics sector thanks to all these features.

| Report Coverage | Details |

| Market Size in 2023 | USD 2.56 Billion |

| Market Size in 2024 | USD 2.77 Billion |

| Market Size by 2034 | USD 6.03 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 8.1% |

| Fastest Growing Market | Asia Pacific |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Voltage, and By Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The global intelligent power modules market will be driven by an increase in renewable energy generation.

In the coming years, there will likely be an increase in demand for renewable energy sources like wind and solar due to rising greenhouse gas (GHG) emissions, mainly CO2 due to the excessive usage of fossil fuels for energy production. In addition, the increased demand for electricity in developing nations is refocusing attention on the production of renewable energy. The use of solar inverters, micro-inverters, and wind turbine inverters, where intelligent power modules are crucial components, may expand as a result of this rising demand. Therefore, it is projected that growth in the production of renewable energy around the world will propel the market for intelligent power modules over the forecast period.

Stringent CO2 emission rules implemented by governments throughout the world and rising environmental consciousness among the populace are both responsible for the electric car industry's notable rise. High-density power modules are being integrated into power management circuits and motor drives in electric vehicles as a result of technological advancements that have improved the reliability and efficiency of the vehicles while reducing system size and cost. Thus, it is anticipated that the worldwide intelligent power module market will have plenty of opportunities in the near future as electric vehicle (EV) and hybrid electric vehicle (HEV) adoption picks up pace.

The slow acceptance of new technologies and the challenging design of clever power modules

The rapid expansion of the IPM market requires the adoption of new trends and technology in IPMs. Although new technology and its advantages appeal to engineers, designing a control structure is difficult. As a result, the IPM market adopts new technologies at a relatively moderate rate, which would impede the technology's development. The companies in the intelligent power module market also put a lot of effort into combining many functions onto a single chip, which leads to complicated designs. Complex device design and integration need specialized skill sets, reliable methodologies, and expensive toolkits, which raises the entire cost of the devices. The transfer to more expensive, high-tech devices is predicted to be hampered by their high cost, which is predicted to impede the growth of the intelligent power module market throughout the forecast period.

Participants Introduce Upgraded Intelligent Power Modules for a Variety of Applications

It is anticipated that market participants in the intelligent power module space will launch new products that comply with the needs of the modern industrial sector. Improved versions of intelligent power modules are being released by major industry participants, and they are expected to be used in a variety of applications. Stakeholders are concentrating on the design features of their intelligent power modules in addition to the introduction of new power semiconductor technologies.

For industrial motor drives, Infineon Technologies introduced a new intelligent power module in October 2018. The CIPOS Maxi, according to Infineon, is the best low-power drive for air conditioning, pumps, motors, fans, ventilation, and power factor correction. The company also introduced a new 3-phase intelligent power module, which is intended to maximize the efficiency of washing machines, industrial drives, compressors, fans, and other devices, as part of their effort to diversify their current product offerings.

The market is divided into four categories based on voltage rating: 601 V - 1200 V, Up to 600 V, Above 1200 V, and Others. According to the applicable cable standard or specification, the voltage rating of a cable refers to the maximum voltage that can be continuously applied to a finished cable structure. It is the highest voltage that a cable can operate at while still remaining stable. Intelligent power modules can be used with cables that have a rating of 601 V to 1200 V. They can be used on cables of 600 V or more, as well as 1200 V cables.

The market segment for vehicles up to 600 V held the most market share in 2023. IPMs with voltage ratings up to 600 V has a number of advantages, including a quicker time to market, higher dependability, and less expensive and smaller systems. IGBTs and high-voltage MOSFETs that are reliable and efficient are used in IPMs with voltage ratings up to 600 V that are designed specifically for variable frequency drives. IPMs like this is frequently seen in consumer devices. AC motor drives offer a small design and good performance. Industrial applications include driving fans, pumps, and compressors that use IPMs with 600 V IGBTs. All these attributes are anticipated to increase demand for the aforementioned segment of intelligent power modules.

The market is divided into categories for automotive, information and communication technology, industrial, consumer electronics, and other sectors based on vertical. An application for intelligent power modules is encouraged by the growing popularity of electric and hybrid vehicles in the automotive industry. They can be used to boost an IGBT chip's performance by integrating them into the car's electric circuit. A high power supply for diverse electric and electronic components is made possible by the intelligent power module, which is being used and integrated into the data center business. Air conditioners are one example of a consumer product where intelligent power modules have been used to provide physical containment for diverse power components.

The intelligent power module market is expected to expand more quickly in the consumer electronics category during the anticipated period. The demand for power electronics devices in power management applications is anticipated to increase as consumer electronics device usage rises. Examples of these devices include smartphones, tablets, and smart wearables. Additionally expected to accelerate the expansion of the consumer electronics sector is the growing use of power electronics in home appliances. Fixed-speed drives are being replaced with inverter-based motor controllers by manufacturers of consumer devices. Instead of just turning the motor on and off as fixed-speed drives do, inverter-based control can change the motor's speed and torque. Consumers gain from the interiorization trend as well as the efficiency advantages of this sort of control because digital inverter products last longer, are quieter, use less energy, and ultimately save the consumer money. It is anticipated that these trends would increase demand for IPMs in the consumer electronics sector.

By Voltage

By Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

December 2024

August 2024

December 2024