December 2024

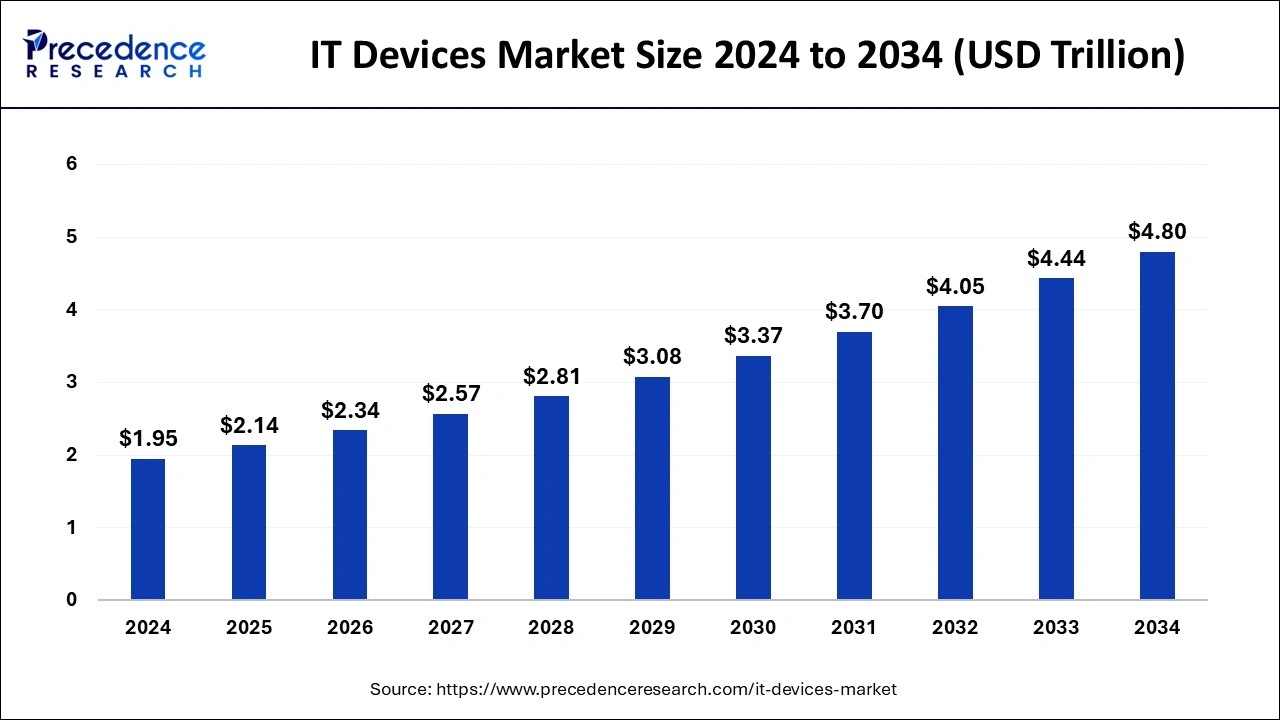

The global IT devices market size is calculated at USD 2.14 trillion in 2025 and is forecasted to reach around USD 4.80 trillion by 2034, accelerating at a CAGR of 9.43% from 2025 to 2034. The Asia Pacific IT devices market size surpassed USD 770 billion in 2025 and is expanding at a CAGR of xx% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global IT devices market size was estimated at USD 1.95 trillion in 2024 and is predicted to increase from USD 2.14 trillion in 2025 to approximately USD 4.80 trillion by 2034, expanding at a CAGR of 9.43% from 2025 to 2034.

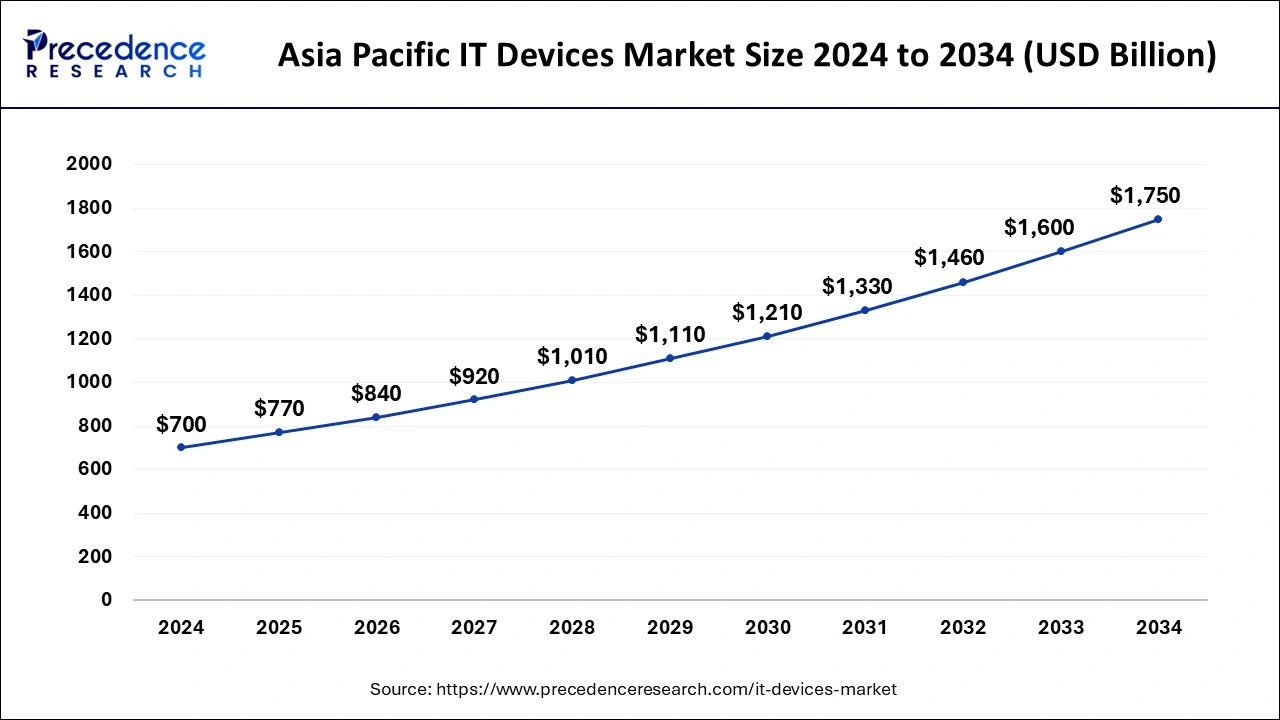

The Asia Pacific IT devices market size was estimated at USD 700 billion in 2024 and is anticipated to reach around USD 1750 billion by 2034, growing at a CAGR of 9.60% from 2025 to 2034.

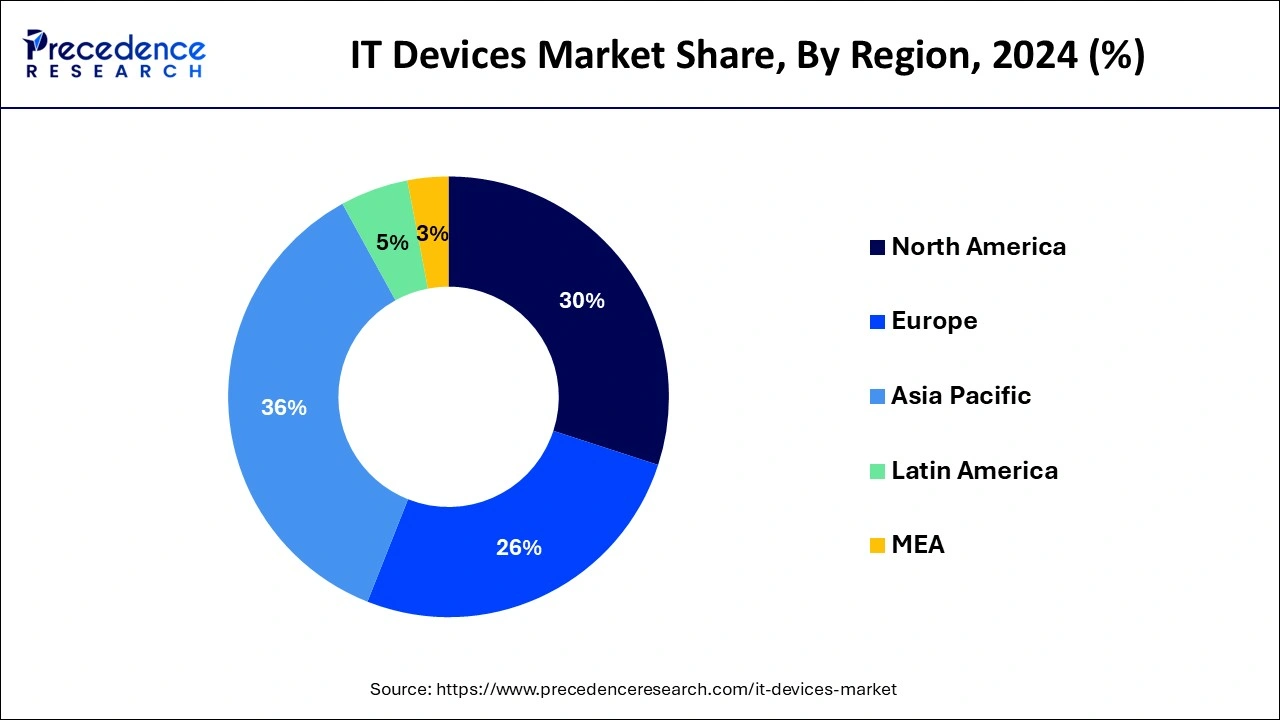

Asia Pacific led the market with the biggest market share of 36% in 2024. The region is observed to sustain the position throughout the forecast period. Asia Pacific, particularly countries like China, Taiwan, South Korea, and Japan, serves as a global manufacturing hub for IT devices such as smartphones, tablets, laptops, and other consumer electronics. The region benefits from a well-established ecosystem of suppliers, manufacturers, and assembly facilities, enabling cost-effective production and efficient supply chain management.

The rapid growth of e-commerce and online retail platforms in Asia Pacific has facilitated greater accessibility and affordability of IT devices to consumers across the region. Online marketplaces such as Alibaba, JD.com, Amazon, and Flipkart offer a wide selection of IT devices from various brands, providing consumers with convenient shopping experiences and competitive pricing.

North America is expected to witness the fastest rate of expansion in the IT devices market during the forecast period. North America, particularly the United States, is a global hub for technological innovation and research and development (R&D). Many of the world's leading technology companies, including Apple, Microsoft, Google, and IBM, are headquartered in North America. These companies drive innovation in IT devices, such as smartphones, tablets, laptops, and wearables, by investing heavily in R&D, product development, and design.

The IT devices market refers to the industry involved in the production, distribution, and sale of various types of information technology (IT) devices. These devices encompass a wide range of hardware products designed to facilitate the processing, storage, transmission, and retrieval of digital information. The IT devices market includes both consumer and enterprise-oriented products, serving diverse needs and applications across different sectors.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 9.43% |

| Market Size in 2025 | USD 2.14 Trillion |

| Market Size by 2034 | USD 4.80 Trillion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Operating System, By Distribution Channel, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Integration of 5G technology

The rollout of 5G networks presents opportunities for IT device manufacturers to expand their market reach and penetrate new customer segments. As 5G coverage becomes more widespread, there is growing demand for 5G-enabled devices across consumer, enterprise, and industrial markets. IT device manufacturers can capitalize on this trend by offering a wide range of 5G-enabled products and services tailored to the needs of different user segments, driving revenue growth and market share expansion.

Security concerns

The increasing sophistication and frequency of cybersecurity threats, such as malware, ransomware, phishing attacks, and data breaches, pose significant risks to IT devices and the data they store or transmit. Vulnerabilities in hardware, software, and firmware can be exploited by malicious actors to gain unauthorized access, steal sensitive information, disrupt operations, or cause financial and reputational damage to organizations.

Expansion of smart cities

Smart cities rely on interconnected networks of sensors, devices, and infrastructure to collect and analyze data for various applications, including traffic management, public safety, energy efficiency, waste management, and healthcare. This increased connectivity drives demand for IT devices such as routers, switches, gateways, and access points to enable seamless communication and data exchange within smart city ecosystems. Expansion of smart cities act as a major lucrative opportunity for the IT devices market.

Smart cities generate vast amounts of data from IoT devices and sensors deployed throughout the urban environment. Edge computing technologies process and analyze this data locally at the network edge, closer to the data source, to reduce latency, improve responsiveness, and optimize bandwidth usage. IT devices such as edge servers, gateways, and storage solutions play a critical role in supporting edge computing and data analytics capabilities in smart city deployments. These devices enable efficient data processing, storage, and transmission at the edge of the network, enabling real-time insights and actionable intelligence for city administrators and stakeholders.

The mobile devices segment dominated the IT devices market with the largest share in 2024. The dominance of the segment is attributed to the increasing demand for smartphones, rising telecommunication infrastructure, and new product launches. Mobile devices, such as smartphones and tablets, have become ubiquitous tools for communication, productivity, entertainment, and information access. They offer users convenient and on-the-go access to a wide range of digital services, applications, and content, making them essential devices in today's connected world.

The rapid pace of technological advancements in mobile devices, including improvements in processors, displays, cameras, battery life, and connectivity, has driven continuous innovation and product differentiation in the market. Manufacturers invest heavily in research and development to introduce new features, functionalities, and form factors that appeal to consumers and maintain competitive advantage.

The peripheral devices segment is expected to grow at the fastest pace in the IT devices market during the forecast period. The growth of the segment is attributed to the changing preferences and the advancements in the peripheral devices that drive the demand for the segment. The rising demand for connected devices that can store external storage, the reduced cost of peripheral devices, and the rising per-capital income in developing countries are the factors that collectively contribute to the growth of the segment in the market.

The android segment dominated the IT devices market with the largest share in 2024. Android holds a significant share of the global smartphone and tablet market. The widespread adoption of android devices by consumers worldwide has established it as a dominant platform for IT devices. Android's open-source nature allows multiple manufacturers to produce devices running on the android operating system, contributing to its market share dominance.

Android offers a wide range of devices across various price points, form factors, and specifications. Consumers have the flexibility to choose from a diverse selection of smartphones, tablets, smartwatches, and other IT devices running on the Android platform. This variety caters to different consumer preferences and budget constraints, expanding Android's market reach and appeal.

The iOS segment is expected to grow in the IT devices market with the highest CAGR during the forecast period. Apple's iOS devices, including iPhones and iPads, are known for their seamless integration within the Apple ecosystem. Users who own iOS devices often find it convenient to remain within the ecosystem due to features such as iCloud synchronization, continuity across devices, and access to exclusive apps and services. This strong brand loyalty and ecosystem integration contribute to the dominance of the iOS segment in the IT devices market.

iOS devices are renowned for their intuitive user interface, sleek design, and high build quality. Apple's emphasis on user experience, attention to detail, and minimalist design philosophy resonates with consumers who prioritize aesthetics and ease of use. The cohesive integration of hardware and software results in a smooth and responsive user experience, further enhancing the appeal of iOS devices.

The offline segment dominated the IT devices market with the largest share in 2024. Offline distribution channels, including electronics stores, department stores, specialty retailers, and authorized resellers, formed extensive distribution networks that reached a wide range of consumer demographics. Manufacturers leveraged these existing networks to distribute their IT devices to diverse geographic locations, including urban, suburban, and rural areas, where online access might be limited or less prevalent.

In emerging markets with lower internet penetration rates or limited e-commerce infrastructure, offline distribution channels remained the primary mode of purchasing IT devices. Consumers in these markets relied on local retailers and distributors to access a variety of IT products and receive personalized assistance in their purchasing decisions.

The online segment is expected to grow at the fastest rate in the IT devices market during the forecast period. The growth of the segment is attributed to the rising e-commerce industry and the numbe of population shifting towards the online medium for buying products. Online shopping of IT devices offers discounts, offers, product information along with convenient shopping experiences.

Online distribution platforms offer consumers convenient access to a wide range of IT devices, including laptops, tablets, smartphones, and accessories, from the comfort of their homes or offices. With just a few clicks, consumers can browse through various products, compare prices, read reviews, and make purchases at any time of the day or night, without the constraints of physical store hours or locations.

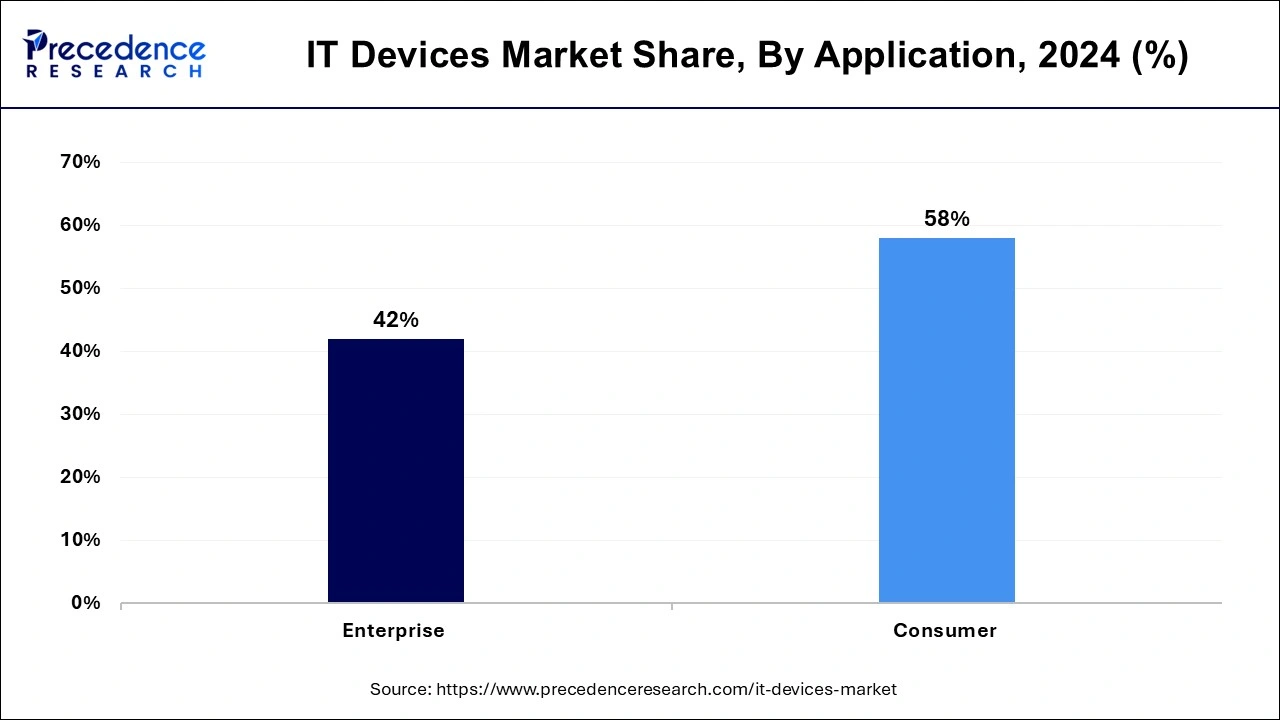

The enterprise segment dominated the IT devices market with the largest share of 58% in 2024. Enterprises allocate significant budgets for IT infrastructure, hardware, and software investments to support their business objectives, digital transformation initiatives, and technology modernization efforts. IT devices represent a critical component of corporate IT spending, with enterprises prioritizing investments in devices that offer performance, reliability, security, and compatibility with enterprise applications and systems. The enterprise segment's purchasing power and budget allocations drive market demand and shape product development trends in the IT devices market.

Enterprises prioritize security and data protection when selecting IT devices for their organizations, especially given the growing cybersecurity threats and regulatory compliance requirements. IT devices designed for the enterprise segment often incorporate advanced security features such as biometric authentication, encryption, secure boot, remote management, and endpoint protection. These security capabilities address enterprise concerns about data breaches, malware attacks, and unauthorized access, making enterprise-grade devices preferred choices for businesses.

The consumer segment is expected to witness a significant expansion in the IT devices market during the predicted time. The growth of the segment is attributed to the rising demand for electronic devices in residential properties. Increasing disposable income and the rising demand for technologically advanced IT devices such as smartphones, laptops, smart home appliances, etc. are boosting the segment’s overall growth in the market.

By Product

By Operating system

By Distribution Channel

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

February 2025

July 2024

July 2024