January 2025

IT Professional Services Market (By Type: Project-oriented Services, ITO Services, IT Support & Training Services, Enterprise Cloud Computing Services; By Deployment: On-premise, Cloud; By Enterprise-size: Small & Medium-sized Enterprises (SMEs), Large Enterprises; By End-use: Technology Companies, Consulting Companies, Marketing & Communication Companies, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

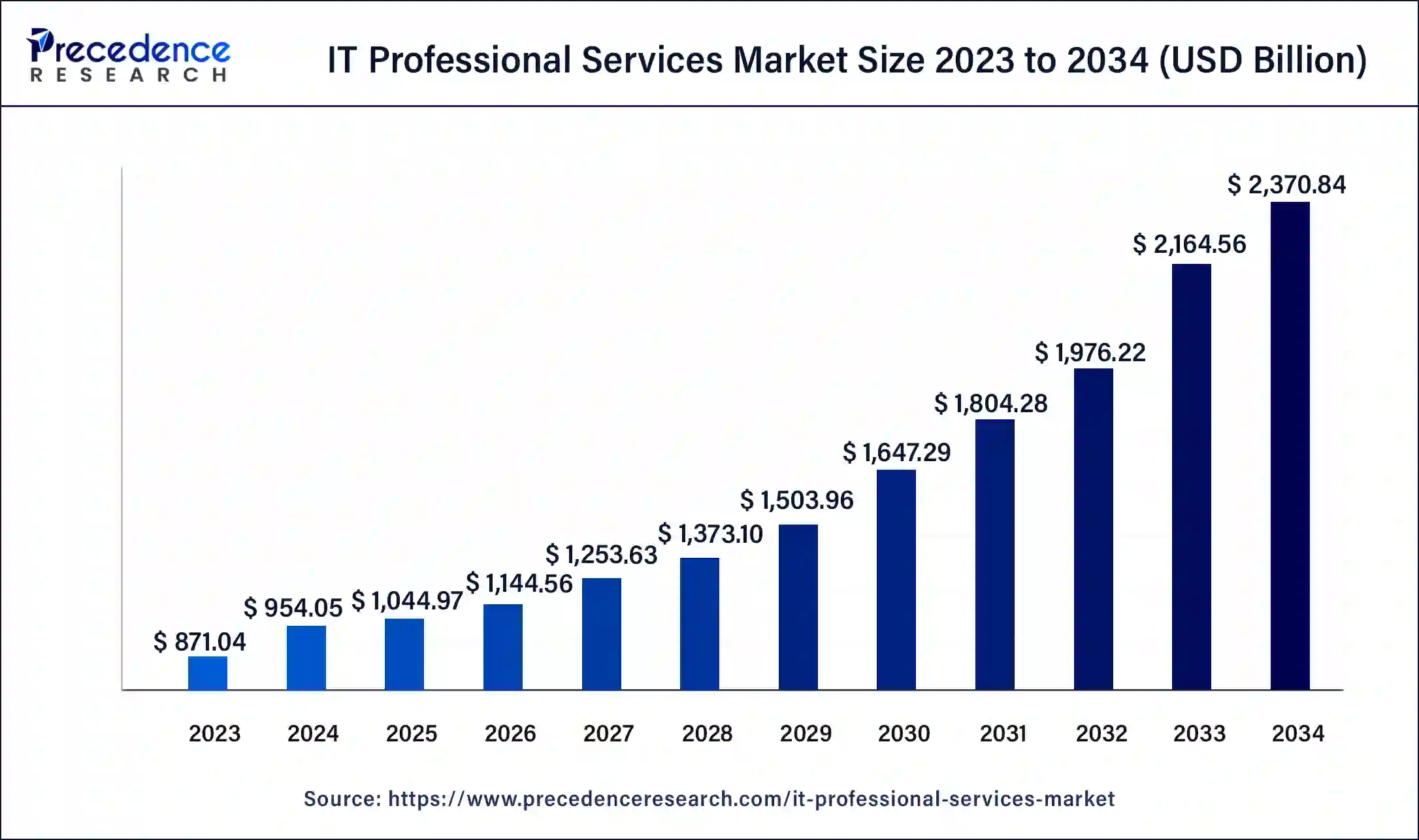

The global IT professional services market size was USD 871.04 billion in 2023, calculated at USD 954.05 billion in 2024 and is expected to reach around USD 2,370.84 billion by 2034. The market is expanding at a solid CAGR of 9.53% over the forecast period 2024 to 2034. The North America IT professional services market size reached USD 331 billion in 2023. The rise in automation for the elimination of everyday tasks and shift in customer demand, are key market drivers.

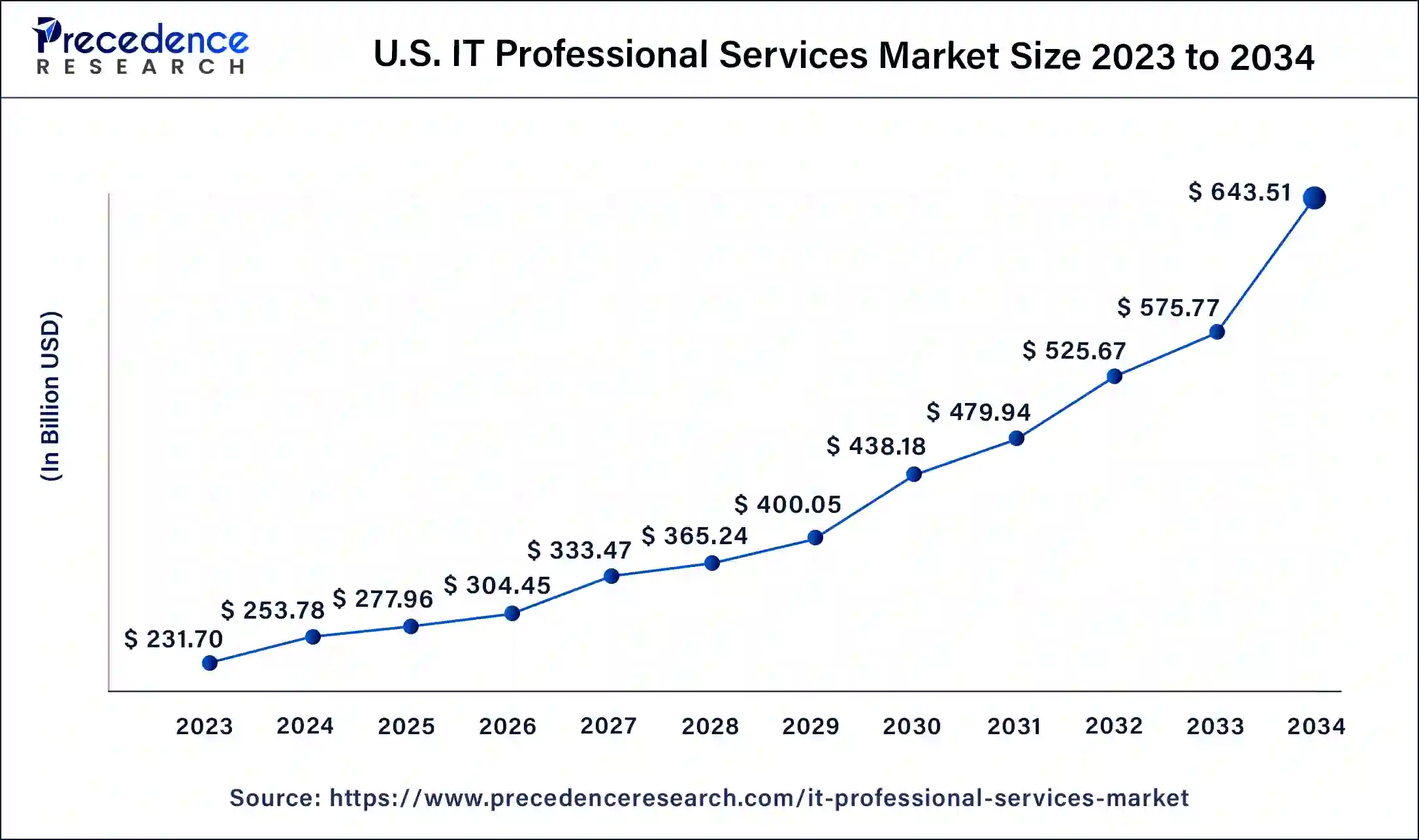

The U.S. IT professional services market size was exhibited at USD 231.70 billion in 2023 and is projected to be worth around USD 643.51 billion by 2034, poised to grow at a CAGR of 9.73% from 2024 to 2034.

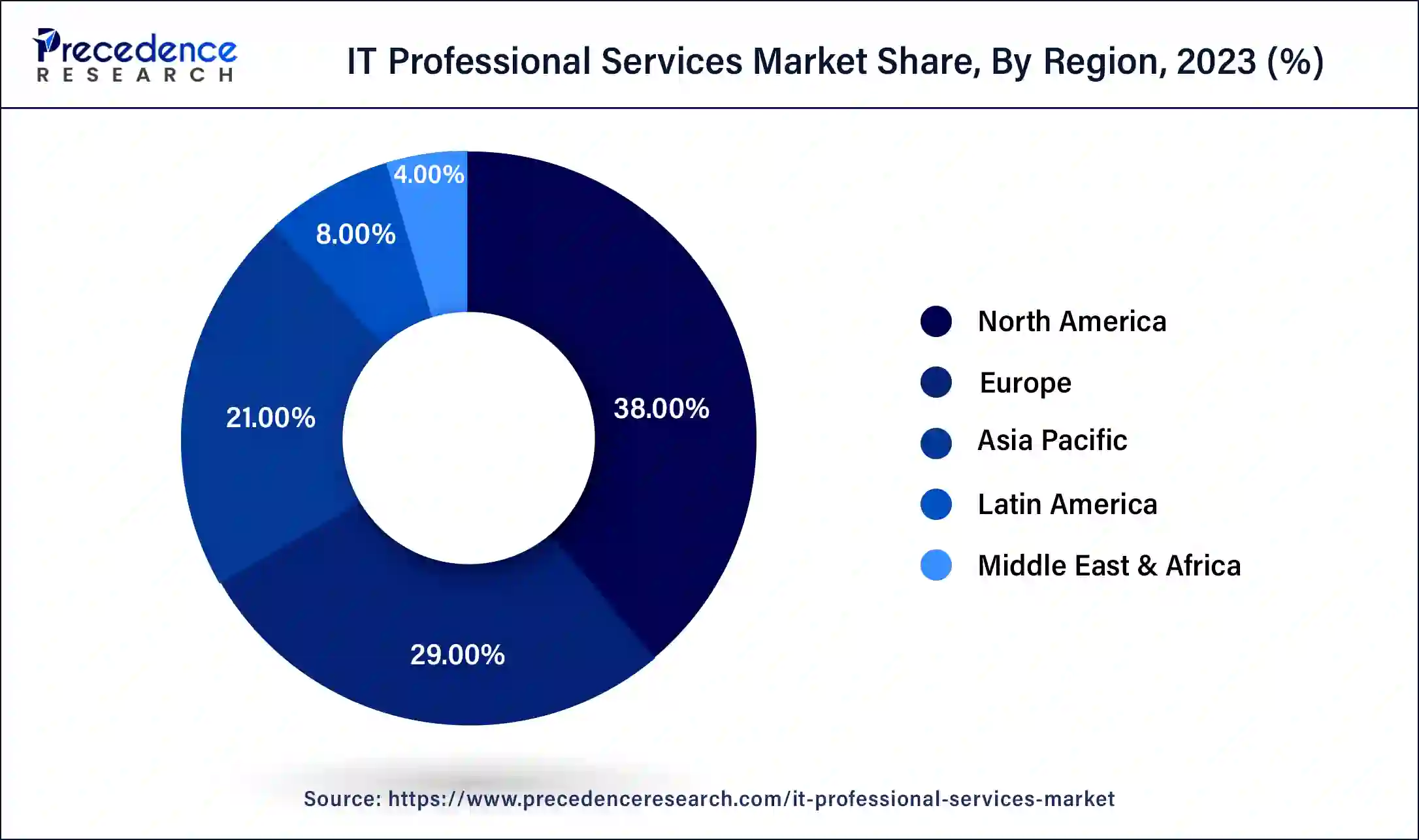

North America led the global IT professional services market in 2023. North America has consistently been a lucrative market due to its early adoption of advanced technologies in the manufacturing, retail, and financial services industries. The region's market growth can be attributed to the significant presence and penetration of major industry players. Because of some of the world's largest economies, North America sees rising demand for data processing, outsourcing, Internet services, and infrastructure.

The U.S. IT professional services market will dominate North America by providing lucrative opportunities for services such as outsourcing and data processing. Additionally, the growing adoption of cloud-based services will further propel market growth.

Asia Pacific is projected to witness significant growth in the IT professional services market during the projected period. The demand for knowledge-based services in the region is projected to grow rapidly, particularly in the legal, advisory, and accounting sectors. This trend will drive regional growth throughout the forecast period. Similarly, APAC will experience significant benefits from the increasing emphasis on IT in emerging economies like India and China, creating numerous opportunities for IT professionals. Many SMEs in the Asia Pacific region depend on professional services to manage their daily operations.

IT professional services are intangible offerings provided to organizations or customers to manage specific business aspects. These services encompass a range of integrated solutions, including project-oriented services, IT outsourcing (ITO), IT support and training, and enterprise cloud computing. By implementing IT services such as business analytics and cloud-based solutions, companies can optimize their operations and boost revenue. The global deployment of the IT professional services market is increasing as businesses automate routine tasks and respond to evolving customer demand for personalized pricing and it improved customer experiences.

| Report Coverage | Details |

| Market Size by 2034 | USD 2,370.84 Billion |

| Market Size in 2023 | USD 871.04 Billion |

| Market Size in 2024 | USD 954.05 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 9.53% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Deployment, Enterprise-size, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Services provided by IT firms

In the IT professional services market, companies are reshaping their business models to adapt to the evolving environment and prepare for potential challenges. IT professional services play an important role in helping organizations identify cost-saving opportunities. They also provide numerous other advantages, such as business intelligence (BI), reduced resource usage, improved operations, and precise forecasting. Moreover, many companies are leveraging IT services to accelerate business growth in the post-pandemic era. Professional service firms provide various services, including consulting, auditing, accounting, and implementation support, along with financial risk mitigation. These firms also deliver business information management and analytic capabilities.

Security concerns

Concerns about security related to cloud-based professional services and the inability to promptly address consumer demands are anticipated to impede the IT professional services market growth. Additionally, the market can be greatly affected by regulations initially aimed at ensuring data security, which influences service delivery models and shapes industry standards. Companies must adhere to the General Data Protection Regulation (GDPR), the NIST Cybersecurity Framework, and various industry-specific regulations, among others.

Rising adoption of hybrid and multi-cloud environments

A major trend in the IT professional services market is the increasing adoption of hybrid and multi-cloud environments. Driven by the need for flexibility, scalability, and optimized resource allocation, there has been a general shift toward embracing hybrid and multi-cloud solutions. Furthermore, one of the primary benefits of these environments is their ability to provide organizations with the flexibility to select the most appropriate cloud solutions for their specific needs. By adopting a hybrid or multi-cloud strategy, organizations can choose the optimal solution for any given workload or application.

The project-oriented services segment dominated the IT professional services market in 2023. Project-oriented services encompass timely maintenance, modernization, project installation, and decommissioning. Often customized to address the client's unique requirements, these services help maximize operational efficiency and ensure projects are completed on time and within budget. Organizations gain numerous advantages from project-oriented services, including revenue management, scope management, the preparation of improved quotations, resource management, and effective project delivery. These factors are the main drivers of demand in this segment.

The information technology outsourcing (ITO) service segment is expected to grow fastest in the IT professional services market. These services also offer a broad spectrum of resources to help achieve a robust return on investment (ROI), effectively bridging the gap between legacy IT systems and innovation. ITO services provide organizations with access to technical expertise, automation, and cost reduction by choosing the appropriate delivery model. The growth of ITO services is anticipated due to their ability to deliver high-performance computing, compliance, security, and scalability.

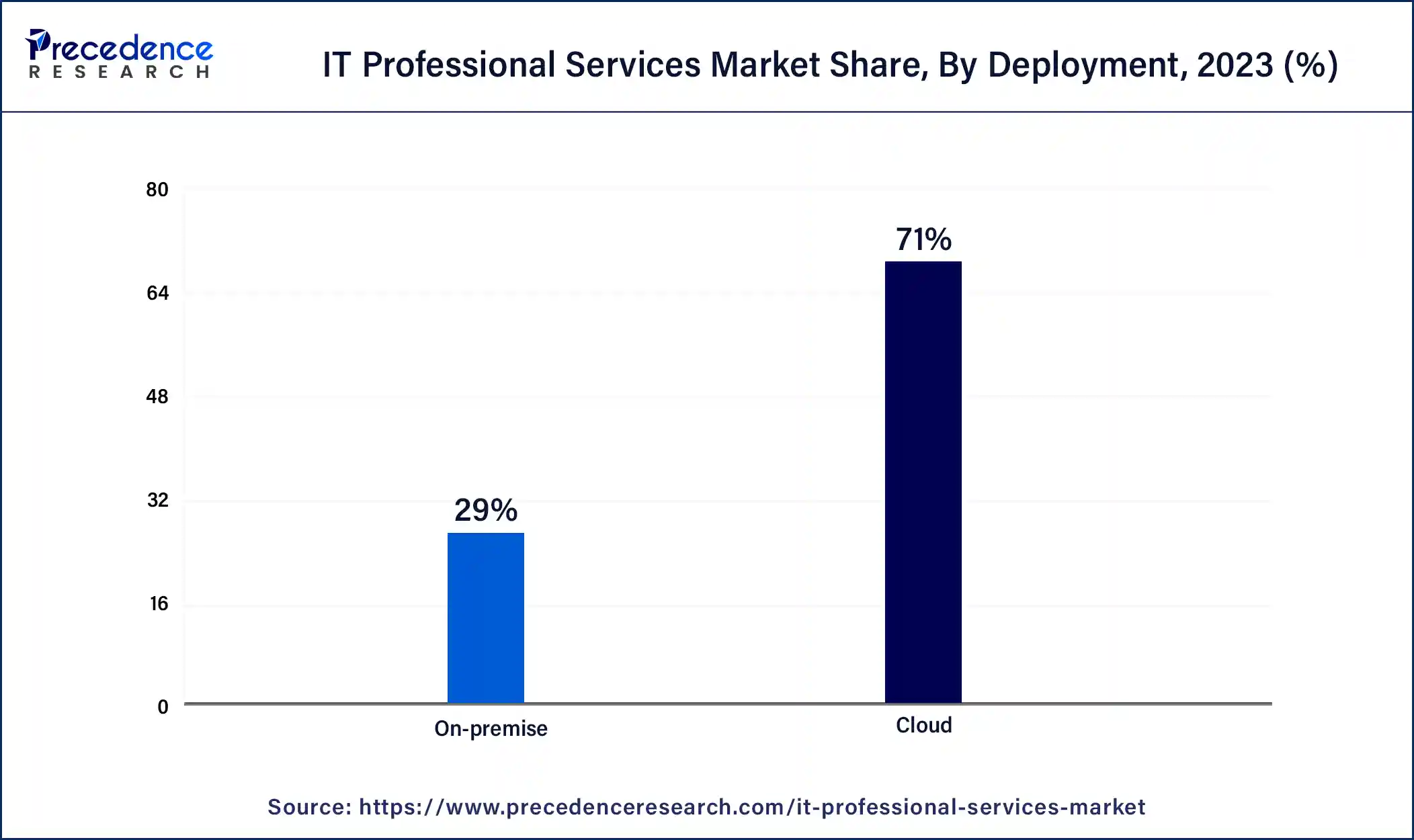

The cloud segment led the global IT professional services market in 2023. Cloud computing is gaining momentum due to various benefits, including enhanced accessibility, reduced technology infrastructure expenses, and lower implementation costs. Additionally, the improved infrastructure for Internet services is accelerating the adoption of cloud-based solutions. Increasing competition across various end-use industries is compelling companies to reduce spending, hence driving the demand for cost-effective services. These features and capabilities are expected to boost the growth of the further segment during the forecast period.

The on-premise segment is projected to show the fastest growth in the IT professional services market during the forecast period. Organizations choose on-premise deployment because it allows for greater control over their IT infrastructure and the flexibility to tailor it to their specific needs. Moreover, this approach is also appealing due to its reduced reliance on internet connectivity, ensuring that employees can access data even during network outages. These advantages are expected to drive the demand for on-premise deployment.

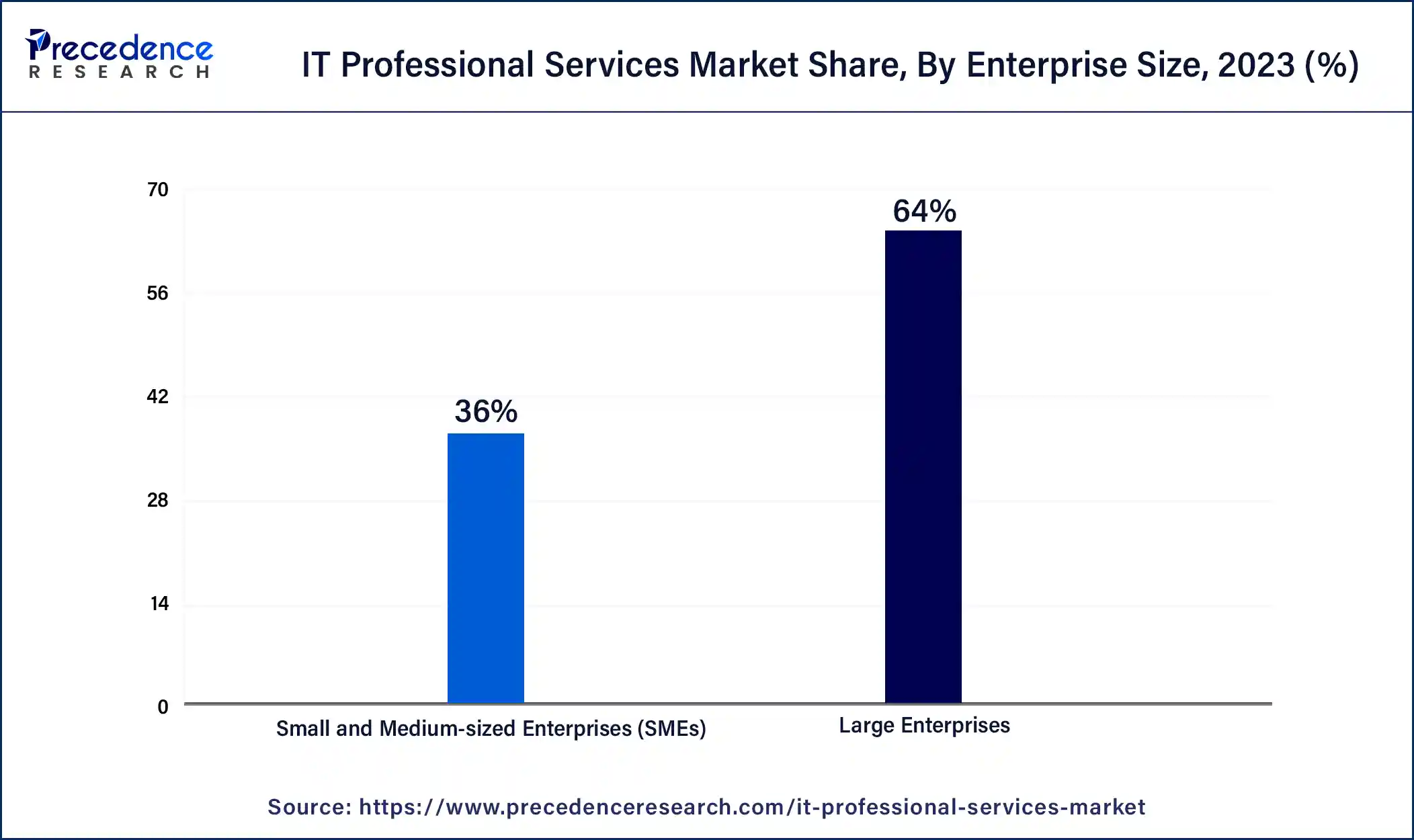

The large enterprises segment dominated the IT professional services market in 2023. This can be attributed to enhanced customer experience, improved team collaboration, reduced operating costs, and lowered workforce expenses; these organizations are significant users of IT professional service solutions. To minimize software costs and ensure their employees quickly become proficient with various IT professional services, these enterprises often enter into long-term agreements with IT professional services software providers.

The small & medium enterprise (SMEs) segment is projected to show the fastest growth in the IT professional services market during the forecast period. The SME sector, recognized as an untapped market, has garnered attention from industry players. According to the World Bank, SMBs constitute 95% of all businesses. The demand for cloud-based IT professional services tools in the SME sector is expected to increase due to their affordability.

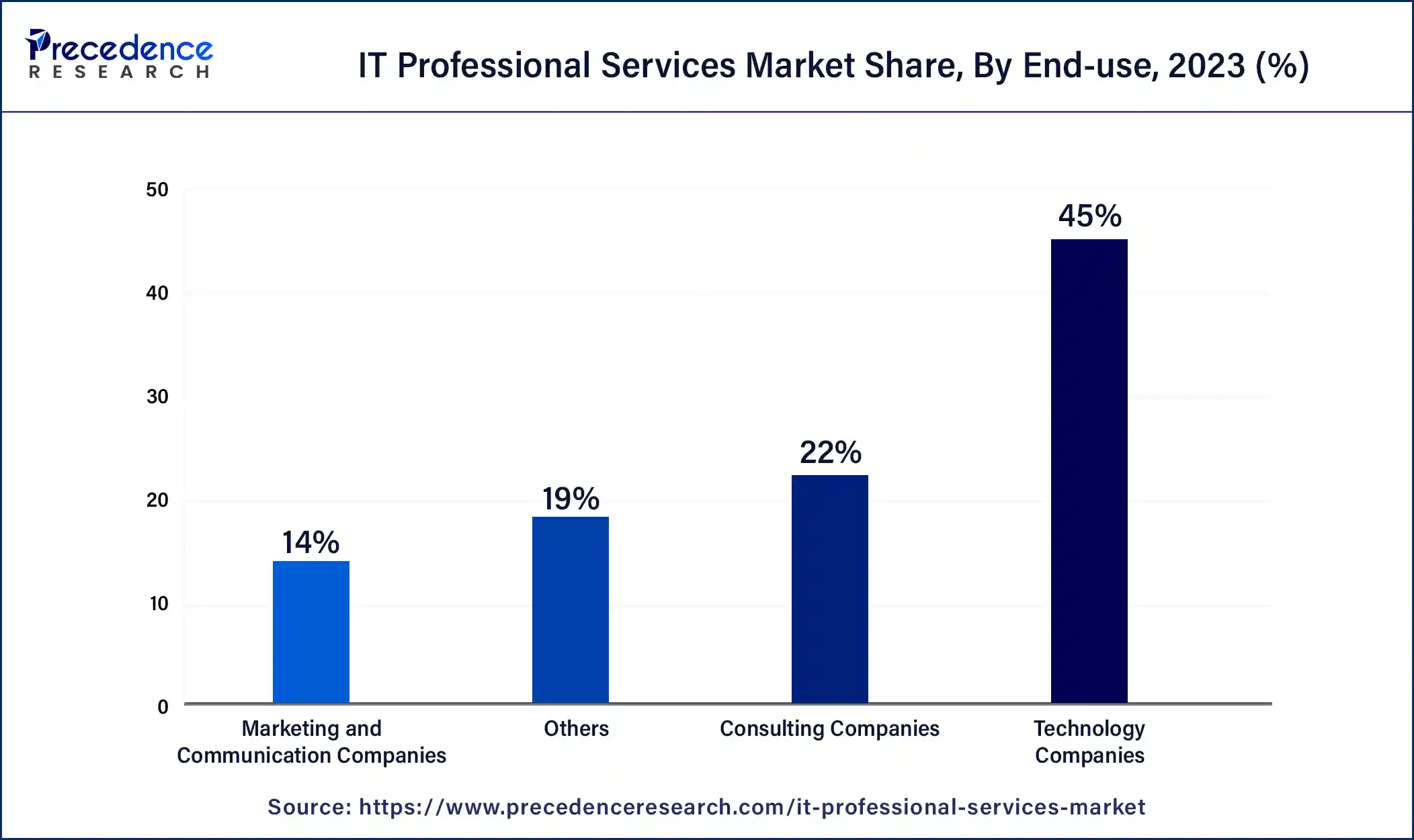

The technology companies segment led the IT professional services market in 2023. IT professional services play a crucial role for companies leveraging data analytics. With technology constantly advancing, many firms, particularly those in Technology as a Service (TaaS), opt for IT professional services to support their business operations. This adoption has driven significant shifts in work cultures, such as remote work and IT infrastructure maintenance. Together, These factors contribute to the growth of the IT services market and segment.

The marketing & communication companies segment is projected to show the fastest growth in the IT professional services market during the forecast period. These companies rely on comprehensive market research, website analysis, budget management, and reputation management, all of which can be facilitated by professional IT services. Furthermore, the increasing prominence of digital media and the focus on improving customer experience is expected to further drive the growth of this segment.

Segments Covered in the Report

By Type

By Deployment

By Enterprise-size

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

July 2024

August 2024

April 2024