November 2024

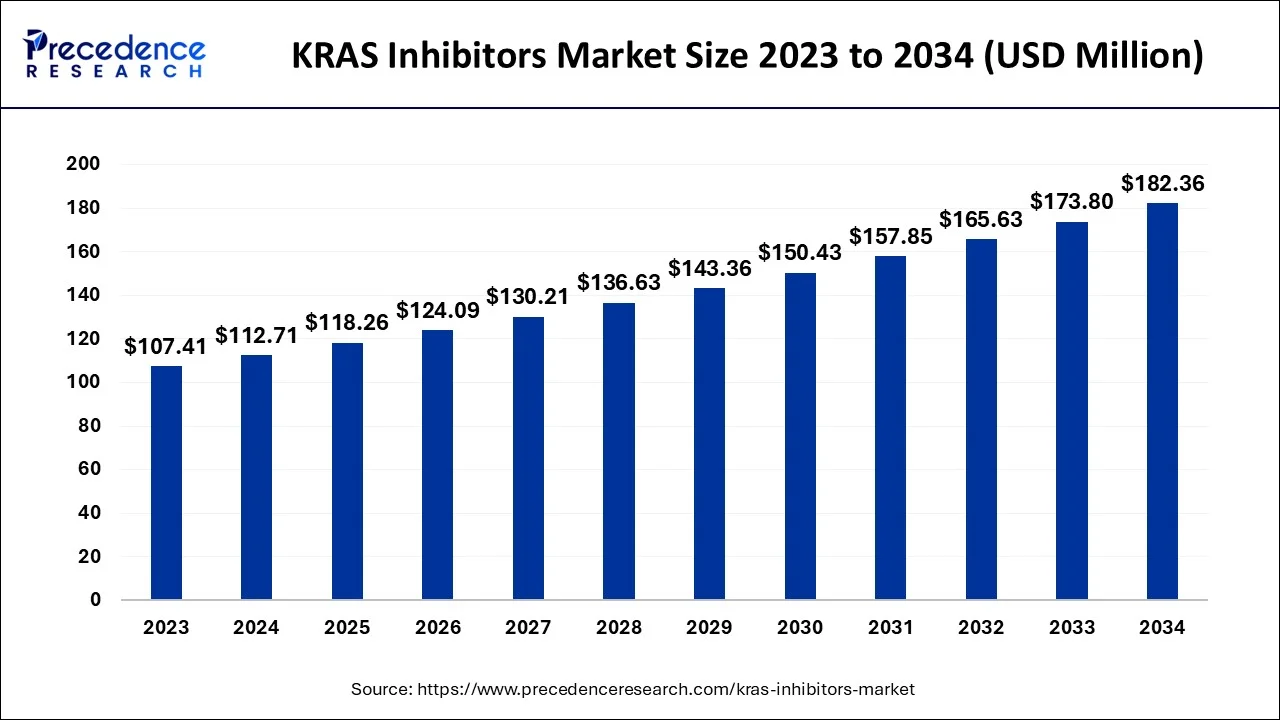

The global KRAS inhibitors market size accounted for USD 112.71 million in 2024, grew to USD 118.26 million in 2025 and is projected to surpass around USD 182.36 million by 2034, representing a healthy CAGR of 4.93% between 2024 and 2034.

The global KRAS inhibitors market size is estimated at USD 112.71 million in 2024 and is anticipated to reach around USD 182.36 million by 2034, expanding at a CAGR of 4.93% between 2024 and 2034.

KRAS, an oncogene, undergoes frequent mutations and is highly prevalent in pancreatic, colorectal, and non-small cell lung tumors. Mutations in the Kirsten rat sarcoma viral oncogene homolog (KRAS) are prevalent in solid tumors, particularly lung cancer, colorectal cancer, and pancreatic ductal adenocarcinoma. The sustained activation and signaling of KRAS play a critical role in these cancers, making it a promising target for therapeutic interventions. Currently, there are several KRAS inhibitors in development, including small molecule inhibitors and monoclonal antibodies. These drugs work by targeting the KRAS protein and inhibiting its activity, which in turn can slow or stop the growth of cancer cells.

The rising prevalence of KRAS mutations in various types of cancers across the globe is anticipated to augment the growth of the KRAS inhibitors market during the forecast period. Additionally, the advancements in drug discovery and development are also likely to fuel the growth of the market in the near future. Significant progress has been made in understanding the biology of KRAS and developing technologies to target it. This has led to the identification of novel drug candidates and the advancement of clinical trials for KRAS inhibitors. Ongoing research and technological advancements are augmenting the development of more potent and selective KRAS inhibitors, contributing to the growth of the market in the years to come.

The rising government investments, biotechnological advancements, and the digitalization of health profiles have propelled the progress of personalization beyond therapy selection and into drug research, with the aim of improving healthcare outcomes. This growing trend reflects the faster translation of research discoveries into clinical practice. Also, significant progress has been made in the development of KRAS inhibitors, with several promising candidates in clinical trials. The discovery of novel inhibitors and the advancement in structure-based drug design have facilitated the development of effective KRAS inhibitors and opened up new avenues for market growth in the years to come.

| Report Coverage | Details |

| Market Size in 2024 | USD 112.71 Million |

| Market Size by 2034 | USD 182.36 Million |

| Growth Rate from 2024 to 2034 | CAGR of 4.93% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segments Covered | By Cancer Type and By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing ongoing clinical trials

The increasing clinical trials are anticipated to augment the growth of the KRAS inhibitors market within the estimated timeframe. For instance, Amgen sponsored a Phase 1b/2 clinical study (CodeBreak 101) that investigated the safety, pharmacokinetics, tolerability, and effectiveness of sotorasib as a monotherapy and in combination with other anti-cancer treatments in individuals with advanced solid tumors carrying the KRAS p.G12C mutation. Additionally, there was a Phase 2 trial evaluating the use of MRTX849 as a monotherapy and in combination with pembrolizumab, as well as a Phase 3 trial comparing the effectiveness of adagrasib in combination with pembrolizumab versus pembrolizumab plus chemotherapy in patients with advanced non-small cell lung cancer harboring the KRAS G12C mutation.

Further, A Phase 1/2 clinical trial, known as KRYSTAL-1, was sponsored by Mirati Therapeutics Inc. This trial focused on evaluating the use of MRTX849 in patients with advanced solid tumors carrying the KRAS G12C mutation. Additionally, Mirati Therapeutics Inc., in collaboration with Novartis, sponsored a Phase 1/2 trial named KRYSTAL 2. This trial investigated the combination of MRTX849 with TNO155 in patients with advanced solid tumors harboring the KRAS G12C mutation. Thus, this is likely to contribute to the growth of the KRAS inhibitors market during the forecast period.

Difficulties in targeting the protein

Previous studies have examined the inhibition of downstream signaling pathways of KRAS, such as RAF/MEK/ERK and PI3K/AKT/mTOR pathways, but the outcomes have been unsatisfactory. One likely reason for this failure is the presence of multiple feedback mechanisms that regulate these pathways. Despite encouraging results from a phase II trial, the phase III SELECT-1 trial revealed that the combination of the MEK inhibitor selumetinib with docetaxel did not show improved progression-free survival (PFS) compared to chemotherapy alone in 510 patients with KRAS-mutated non-small cell lung cancer (NSCLC). Tackling this obstacle is a crucial focus as it has the potential to impede market growth during the forecast period.

Rising collaborations & partnerships among key players

The increasing collaborations and partnerships among companies are anticipated to create growth opportunities for the market in the years to come. For instance, in September 2020, Boehringer Ingelheim and Mirati Therapeutics, Inc. disclosed a clinical partnership aimed at assessing the effectiveness of combining BI 1701963, a SOS1::pan-KRAS inhibitor that targets KRAS regardless of mutation type, with MRTX849, a selective inhibitor specifically designed for the KRAS G12C mutation.

The collaboration aims to explore the potential of this combination therapy to offer improved and long-lasting responses for patients with lung and colorectal cancers who currently face limited treatment choices. Also, in November 2022, Incyte and Mirati Therapeutics, Inc. unveiled a clinical trial collaboration and supply agreement. The partnership aims to explore the potential of combining INCB99280, Incyte's small molecule PD-L1 inhibitor, with adagrasib, a selective inhibitor that targets the KRASG12C mutation. Therefore, this is likely to accelerate the growth of the market in the years to come.

The lung cancer segment held the largest market share in 2023. Lung cancer is one of the most common cancers associated with KRAS mutations. The high prevalence of KRAS mutations in lung cancer patients creates a significant market opportunity for KRAS inhibitors. Targeting these specific mutations can potentially provide effective treatment options for a substantial number of lung cancer patients. Lung cancer, particularly non-small cell lung cancer (NSCLC), is a challenging disease to treat, and there is a significant unmet medical need for effective therapies. KRAS inhibitors offer a promising approach to specifically target these mutations, addressing the unmet medical need in the treatment of KRAS-mutant lung cancer.

Furthermore, the growth of the lung cancer segment in the KRAS inhibitors market is also expected to be fueled by the growing focus on research for lung cancer treatments. Also, the increasing awareness of these therapies among physicians and researchers is projected to contribute significantly to the expansion of this segment within the specified forecast period.

The cancer research centers segment held revenue share in 2023. This is owing to the increasing clinical research along with increasing partnerships among research institutes and biotech companies. For instance, in May 2023, Mirati Therapeutics, Inc., a biotechnology company in the commercial stage, and Sarah Cannon Research Institute (SCRI), a renowned oncology research organization specializing in community-based clinical trials, joined forces through a strategic partnership.

The objective of this collaboration is to enhance diversity in the recruitment practices of clinical studies. Also, the increasing funding by cancer institutes is likely to support the segmental growth of the market. For instance, in February 2023, the National Cancer Institute has planned to provide funding to support Waters' laboratory through a career development grant of approximately $587,000 over a period of three years. This grant aims to facilitate the testing of clinically relevant drugs that specifically target two prevalent KRAS mutations observed in pancreatic cancer. The drugs being investigated are innovative formulations that have not yet been published, and their efficacy will be assessed using cell lines and animal models.

North America held the largest revenue share in 2023. US accounted for the largest share of the North America KRAS inhibitors market. This is owing to the increasing prevalence of cancer in the region. Among all lung cancer diagnoses, non-small cell lung cancer (NSCLC) represents approximately 81%. It is estimated that in 2023, about 238,340 adults (117,550 men and 120,790 women) will receive a lung cancer diagnosis in the United States alone. Globally, the number of new lung cancer cases in 2020 was estimated to be 2,206,771. It's important to note that these figures encompass both small cell lung cancer and NSCLC. Thus, this is increasing the demand for KRAS inhibitors therapies in the region. Furthermore, the presence of key competitors along with rising research has also contributed to the growth of the market in the region. Additionally, the availability of advanced infrastructure for healthcare is also likely to support the regional growth of the KRAS inhibitors market during the forecast period.

Asia-Pacific is expected to grow at the fastest CAGR during the forecast period. The increasing research and development along with investment in the healthcare infrastructure is anticipated to augment the regional growth of the KRAS inhibitors market during the forecast period. Furthermore, the growing demand for personalized medicine for effective treatment increasing along with the aging population is also likely to support the regional growth of the market in the years to come. Additionally, the advancement and rising focus on the development of biotechnology is also expected to fuel market growth in the region.

Segments Covered in the Report:

By Cancer Type

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

August 2024

January 2025

July 2024