April 2025

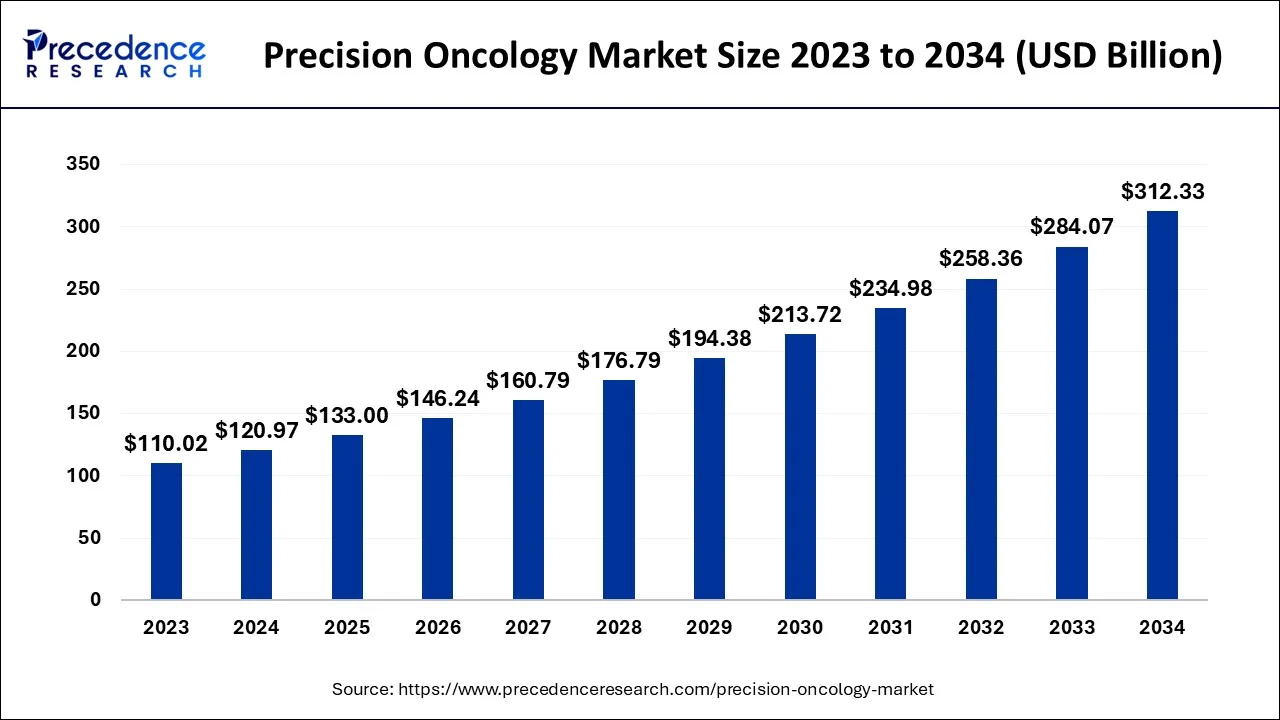

The global precision oncology market size is estimated at USD 120.97 billion in 2024, grew to USD 133 billion in 2025 and is predicted to surpass around USD 312.33 billion by 2034, expanding at a CAGR of 9.95% between 2024 and 2034.

The global precision oncology market size accounted for USD 120.97 billion in 2024 and is anticipated to reach around USD 312.33 billion by 2034, expanding at a CAGR of 9.95% between 2024 and 2034.

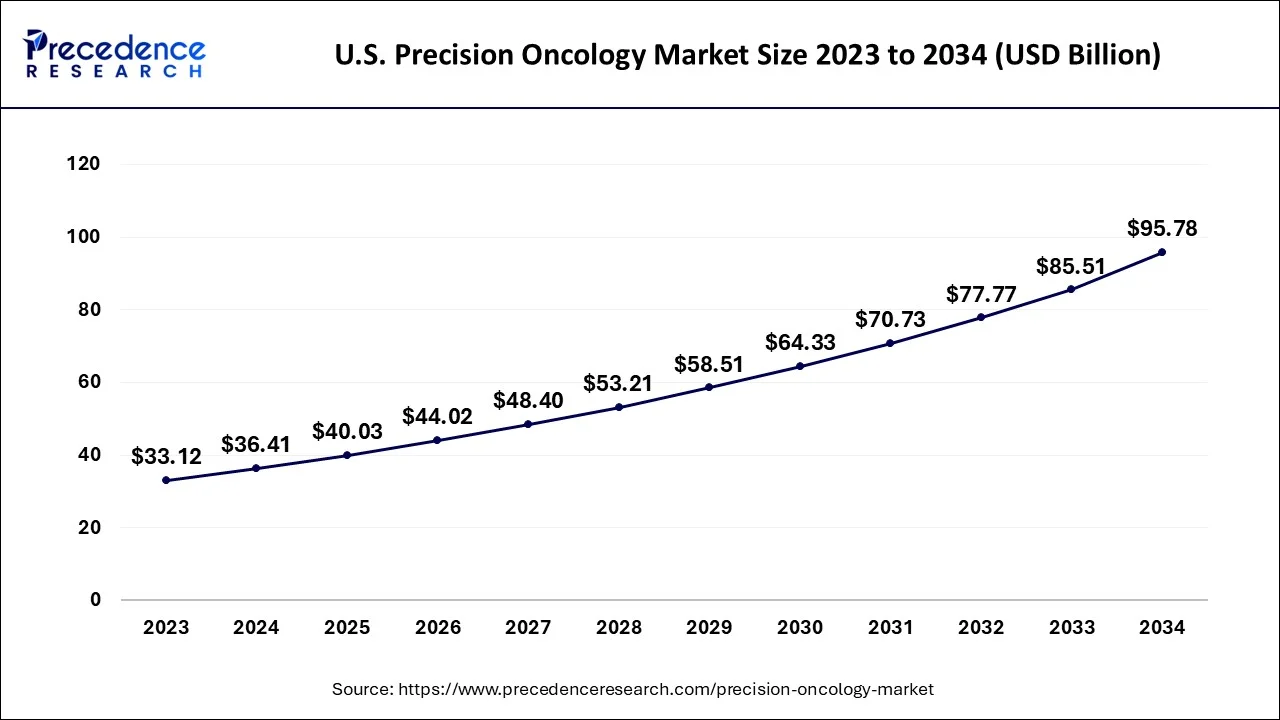

The U.S. precision oncology market size reached USD 36.41 billion in 2024 and is expected to be worth around USD 95.78 billion by 2034, at a CAGR of 10.13% between 2024 and 2034.

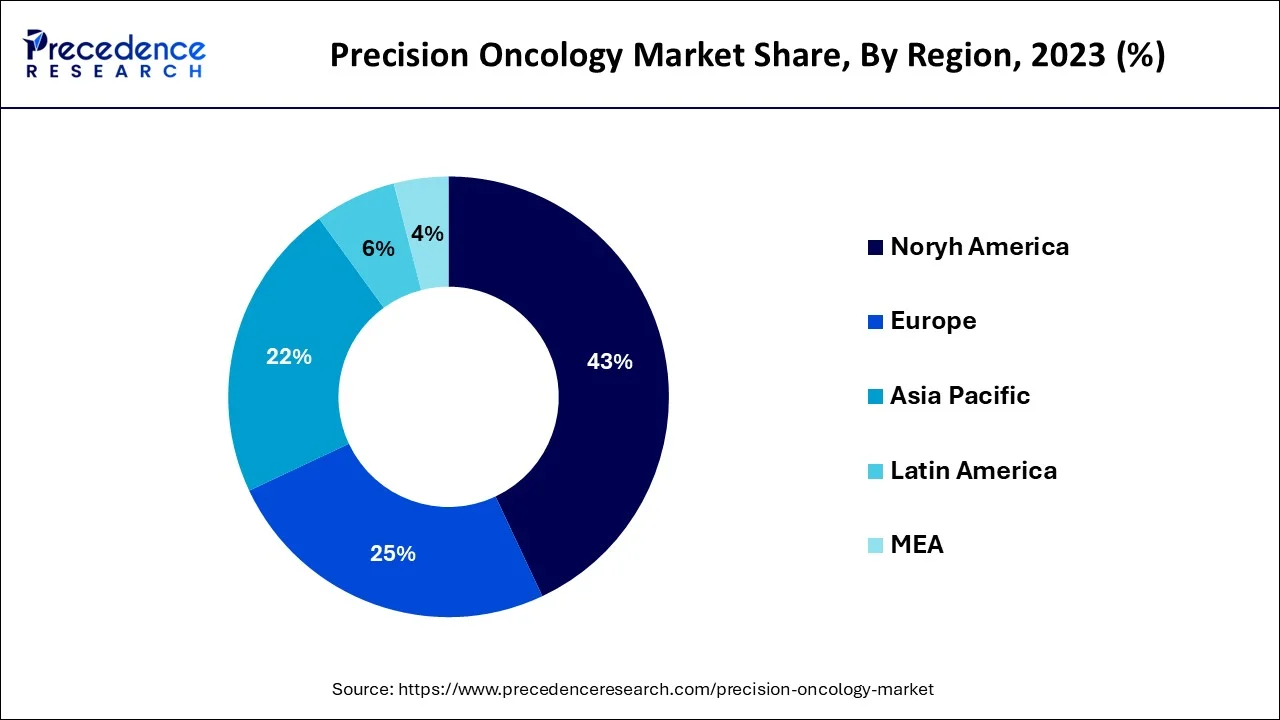

North America held the largest revenue share of 43% in 2023. US accounted for the largest share in the North America precision oncology market. This is owing to the increasing prevalence of cancer in the region. According to CDC, around 1,752,735 new cancer cases were reported in the US in 2019 and approximately 599,589 people died due to cancer. Also, approximately 439 new cancer cases were reported for every 100,000 people along with 146 people died of cancer. Thus, this is increasing the demand for precision oncology therapies in the region.

Furthermore, the presence of key competitors such as Thermo Fisher Scientific Inc., Illumina, Inc. and Invitae Corporation, among others along with rising research funding in the region have also contributed to the growth of the market. Additionally, the availability of developed healthcare infrastructure is likely to support the regional growth of the precision oncology market during the forecast period.

Asia-Pacific is expected to grow at the fastest CAGR during the forecast period. The increasing investment in the healthcare infrastructure along with research and development is anticipated to augment the regional growth of the precision oncology market during the forecast period. Furthermore, the growing aging population along with the increasing demand for personalized medicine for effective treatment is also likely to support the regional growth of the market in the years to come. Additionally, the advancement in gene mapping technologies and rising focus on the development of biotechnology is also expected to fuel the market growth in the region.

Precision oncology is the molecular profiling of tumors to find changes that can be targeted. In layman's words, it's the science of tailoring a patient's treatment to the molecular characteristics of their cancer by using genetic information from the patient. An exciting period in the fight against cancer is being ushered in by the emergence of precision oncology and the development of more individualized and targeted treatment approaches.

Precision oncology is a dynamic, interesting field of study that is increasingly finding its way into conventional oncology practice. Improving patient outcomes is precision oncology's ultimate goal. Targeted therapy, which focuses on a specific genetic biomarker, is made possible by precision oncology. By protecting healthy cells and reducing side effects, targeted medicines can prevent cancer cells carrying that genetic biomarker from proliferating and developing.

The rising prevalence of cancer across the globe is anticipated to augment the growth of the precision oncology market during the forecast period. Additionally, the development of advanced technologies like next-generation sequencing technology is also likely to fuel the growth of the market in the near future. The increasing investment in discovering new diagnostics along with growing efforts by numerous players to develop medicines via rapid cycles of innovation to bring advances to patients more swiftly is further expected to support the market growth in the years to come.

Personalization has advanced beyond therapy selection and into the area of drug research to enhance health thanks to governmental investment, biotechnology advancements, and digitization of health profiles. Diagnostic, digital, and imaging advancements as well as a plethora of analytics tools operating across numerous institutions and stakeholders are what are powering this transition. Academic research workers have typically been in charge of biomarker discovery. The extensive clinical engagement in biomarker research is particularly intriguing. The prevalence of this trend has increased as research discoveries are put to use in the clinic more quickly.

| Report Coverage | Details |

| Market Size in 2024 | USD 120.97 Billion |

| Market Size by 2034 | USD 312.33 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 9.95% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product, By Cancer Type, and By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing demand for personalized medicine

The increasing demand for personalized medicine due to the benefits it offers is anticipated to augment the growth of the precision oncology market within the estimated timeframe. Patients are more engaged with their treatment plan as they receive more individualized information that enables them to make better health decisions. Other advantages of patient participation include better patient outcomes, more revenue for healthcare providers, and improved patient-therapist relationships. Patients with high levels of patient engagement and activation are more likely to stick with their physical therapy regimen. Patient activation is the degree to which a patient is knowledgeable, competent, and self-assured in controlling their own health.

Companies in the pharmaceutical and biotech industries have used various strategies to seize the benefits of personalized medicine. Others have chosen a "wait-and-watch" policy with targeted investments, while some have integrated these therapeutics into their business goal by integrating them into all processes. Since there is a great deal of ambiguity around many crucial issues, including the degree to which practitioners will adopt next-generation sequencing and other cutting-edge technology, diagnostics businesses have also investigated a variety of methods to personalized medicine. Additionally, in the present regulatory and reimbursement environment, diagnostics companies are still looking for ways to successfully capture value for their innovation. Thus, these factors are likely to contribute to the growth of the precision oncology market during the forecast period.

Limited availability of precision treatments linked to biomarkers

A prerequisite for biomarker testing is the availability of precision medicines related to biomarkers since most doctors won't order tests unless the results can be used to guide treatment choices. Before medications that have been approved by regulatory agencies are released and added to national or regional reimbursement lists, there are often significant delays. For instance, according to the EFPIA's Patients W.A.I.T. indicator Survey, the average wait time for patients to receive treatments across the European Economic Area and EU is 504 days; however this time can vary from 127 days in Germany to over 823 days in Poland. Additionally, for the prescription of precision medicines in several nations, public funding is insufficient.

The root causes of delayed patient access to medications in various economies are obstacles to the readiness of the health system, challenges with the reimbursement process, differences in and a lack of clarity regarding the reimbursement criteria, as well as evidence gaps and a misalignment on value and price between decision-makers for reimbursement and pharmaceutical companies. Addressing this challenge is one of the key priorities since it is likely to limit the growth of the market.

Integration with other technologies

The integration of precision oncology with other technologies such as artificial intelligence, big data analytics, and digital health tools has the potential to improve patient outcomes and accelerate drug development. With technological breakthroughs, nanotechnology and artificial intelligence (AI) have been employed as tools to increase the precision of cancer treatment. The personalized precision medicine treatment for cancer patients has improved as a result of the significant advancement in obtaining patient data with better nanomaterial designs. Combining AI with nanotechnology has improved the accuracy of the rational design of diagnostic and treatment platforms. Definitive outcomes in nanomedicine which encompasses everything from biological and nanomaterial devices to nanoelectronic biosensors has also shown promise, with special praise going to the use of AI.

Reforms in AI and ML have led to the booming development of tools and algorithms that aid in the efficacy of treating cancer patients with customized precision medicine. The prediction obtained from the algorithms created by AI technologies to evaluate therapies is quite meticulous and gives a significant reduction in the likelihood of errors in terms of the prescribed treatment. Additionally, predictive analytics is essential for identifying people who are at a high risk of developing certain ailments and diseases, like cancer, and for creating individualized treatment strategies. Therefore, the rising implementation of various technologies is expected to create immense growth opportunities for the market in the years to come.

Impact of COVID-19:

The COVID-19 pandemic revealed the flaws and injustices in the world healthcare system, but it also had the potential to spark long-needed transformational reform. Not only did the covid-19 pandemic result in dramatic drops in cancer diagnoses, but it also markedly decreased the use of biomarker testing, which is frequently essential for choosing the best course of treatment for many common malignancies. Additionally, patients were naturally hesitant or unwilling to seek out regular general and specialized care during the pandemic, which frequently includes essential preventative cancer tests. Although there have long been significant obstacles preventing the advancement of precision medicine oncology, covid-19 has also brought to light the urgent need for accelerated development of cancer care technologies and greater international cooperation on shared health threats. As a result, some of these challenges will be easier to overcome in a post-covid world.

On the basis of product, the therapeutics segment held largest revenue share of 72% in 2023. The development of various targeted drug therapy such as angiogenesis inhibitors & monoclonal antibodies and immunotherapies are expected to contribute to the segment growth of the precision oncology market during the forecast period. In order to kill a cancer cell, monoclonal antibodies may transfer drug- or drug-containing molecules into or onto the cancer cell. Examples include cetuximab (for some head, colon, lung, and neck cancers), trastuzumab (certain breast malignancies), and alemtuzumab (certain chronic leukaemias). Furthermore, extensive ongoing research in these types of therapies is also likely to support the segment growth of the precision oncology market during the forecast period. Additionally, rising awareness about these therapies amongst physicians as well as patients is further anticipated to augment the growth of the segment within the estimated timeframe.

Based on the cancer type, the breast cancer segment held the largest market share of 42% in 2023. One of the first medical fields to use precision medicine is cancer care. There are various genetic and nongenetic testing for breast cancer that can aid in individualized treatment. Some genetic tests are specifically designed to assess hereditary risk, which means they examine the individual's genetic profile to assess their lifelong risk of acquiring breast cancer or other cancers. The growth of the segment is being supported by the increasing research and development of precision medicines for breast cancer along with rising strategic moves by various key players. For instance, in March 2022, in order to develop complete molecular profiling, Avera Health (Avera) and Theralink Technologies established a strategic alliance. As a result, Avera Health's physicians and patients will get access to data-driven insights that guide tailored cancer treatments. In addition, the introduction of advanced technologies for DNA sequencing is also expected to drive the segment growth of the market.

Segments Covered in the Report:

By Product

By Cancer Type

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

September 2023

January 2025

April 2025