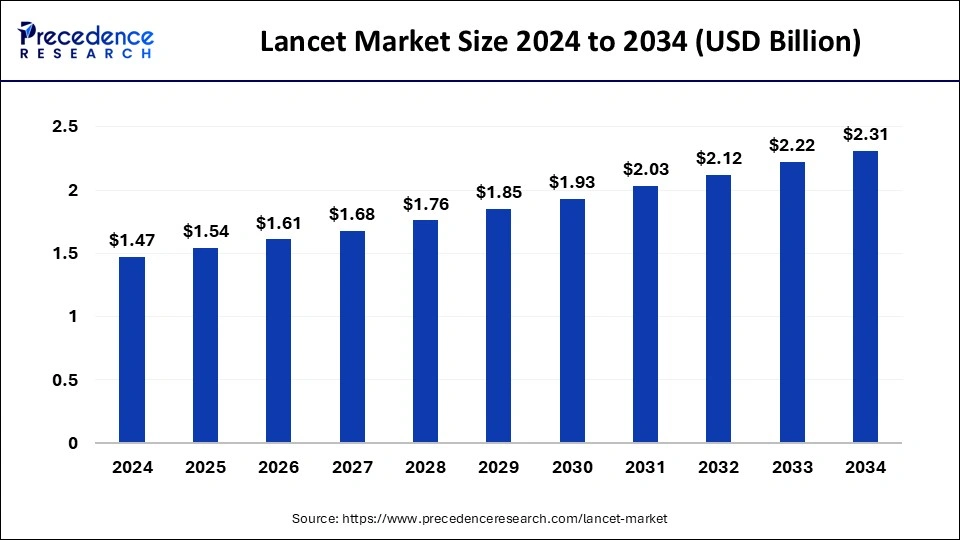

The global lancet market size is calculated at USD 1.54 billion in 2025 and is forecasted to reach around USD 2.31 billion by 2034, accelerating at a CAGR of 4.62% from 2025 to 2034. The North America lancet market size surpassed USD 600 million in 2024 and is expanding at a CAGR of 4.70% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global lancet market size was estimated at USD 1.47 billion in 2024 and is predicted to increase from USD 1.54 billion in 2025 to approximately USD 2.31 billion by 2034, expanding at a CAGR of 4.62% from 2025 to 2034. The need for frequent blood glucose monitoring is driven by the increasing number of diabetes patients worldwide, which is driving up demand for lancet devices.

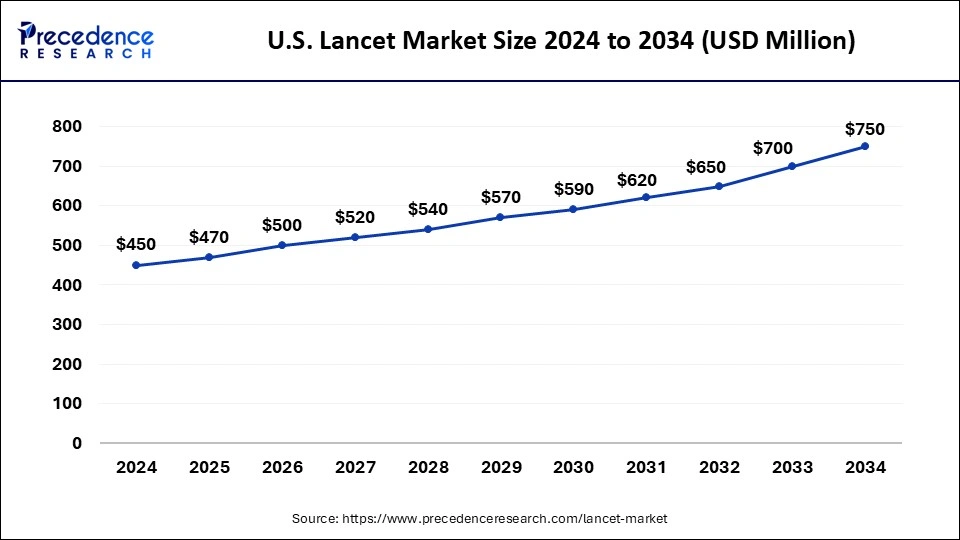

The U.S. lancet market size was exhibited at USD 450 million in 2024 and is projected to be worth around USD 750 million by 2034, poised to grow at a CAGR of 5.24% from 2025 to 2034.

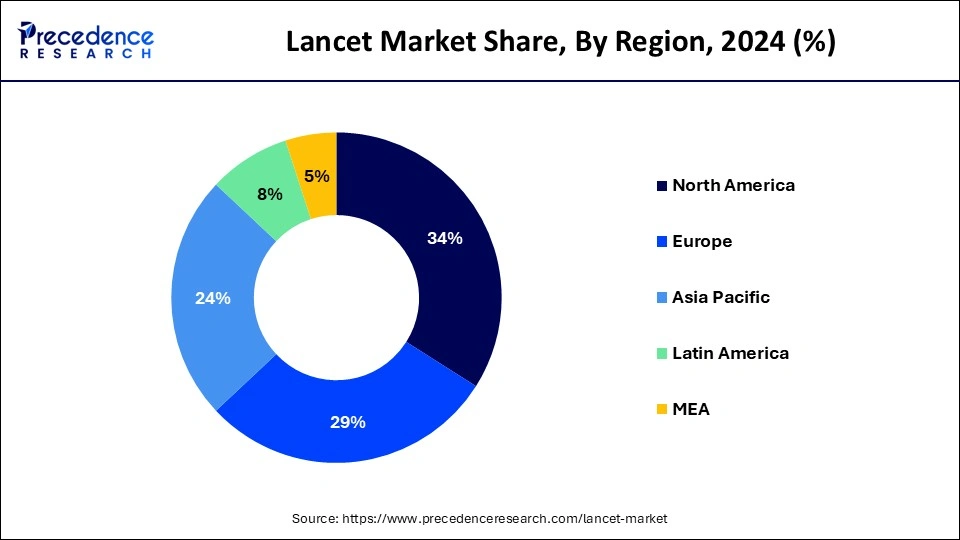

North America held the largest share of the global lancet market in 2024. The medical device industry's lancet market in North America is a vibrant and quickly expanding sector. The high prevalence of chronic diseases, including diabetes and cardiovascular problems, which call for frequent blood tests, is the main factor driving the region's market supremacy.

The market is expanding due to ongoing advancements in lancet design, such as safety lancets that lessen discomfort and lower the chance of infection. Leading companies in the development of efficient and user-friendly improved lancets are Abbott Laboratories. Because of the high prevalence of chronic diseases, technological developments, and the growing use of homecare diagnostics, the market in North America is expected to rise significantly.

Asia Pacific is expected to be the fastest-growing lancet market during the forecast period. The Asia Pacific market is expanding significantly due to rising rates of chronic diseases, including diabetes, advances in medical technology, and rising healthcare costs.

The market appeal of lancets is being increased by technological innovations, including the creation of safety lancets and user-friendly designs for home diagnostics. Lancet use at home is rising due to the shift toward home-based healthcare solutions, particularly for diabetes control. With the help of a growing emphasis on patient-centric healthcare solutions and technological advances, the Asia Pacific lancet market is expected to grow rapidly.

The term ‘Lancet Market’ describes the industry that deals with the production and commercialization of lancets, which are tiny medical instruments used to draw blood from capillaries. Diabetics frequently utilize these devices for additional diagnostic tests that call for small volumes of blood, such as glucose testing. Creation of devices with customizable penetration depths and painless lancets.

The lancet market, which is necessary for blood samples in medical diagnostics, is expanding significantly due to the increase in the incidence of infectious and chronic diseases, especially diabetes. The need for regular blood tests due to the rising prevalence of diabetes, cardiovascular illnesses, and other chronic ailments is driving up demand for lancets.

Companies are expanding their product ranges and reach through smart acquisitions and alliances. The lancet market is expected to develop significantly due to the rising demand for home healthcare solutions and diabetic monitoring. For manufacturers hoping to take advantage of the expanding market potential, innovation and calculated entry into emerging markets will be crucial.

| Report Coverage | Details |

| Market Size by 2034 | USD 2.31 Billion |

| Market Size in 2025 | USD 1.54 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.62% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Size, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising incidence of infectious diseases

The lancet market is being greatly impacted by the increased prevalence of infectious diseases. The need for lancet devices has increased due to the rise in blood testing and diagnostic procedures that are required due to the prevalence of diseases like COVID-19, malaria, dengue, chikungunya, and the Zika virus.

Lancet instruments, such as safety, standard, and specialty lancets, are frequently used for a variety of testing needs, such as cholesterol, hemoglobin, and blood glucose monitoring. The expansion of the lancet market is also driven by improvements in the infrastructure of healthcare, especially in emerging nations. Further propelling market expansion is the emphasis on preventative healthcare and the creation of quick diagnostic test kits.

Reputation risk

In the lancet market, reputation risk is the possibility of loss or damage to a brand or company's reputation when producing or selling lancets. Lancets are medical instruments used for blood collection, especially in diabetic patients for glucose monitoring. Fines, penalties, and reputational harm may result from breaking regulatory norms and obligations. It suggests to stakeholders and consumers that the business might not put quality and safety first. Poor customer service can cause unhappiness among customers and eventually harm the company's reputation. Examples of this include unresponsive support for product faults or complaints.

Healthcare innovation

In the lancet market, the idea of making blood sampling less painful is becoming more and more important. One example of such innovation is the use of ultra-thin needles in lancets, which minimize discomfort and tissue damage. Automated lancet devices are becoming more and more common, particularly in situations where several blood samples are needed. Depending on the requirements of each patient, these devices can be programmed to change the penetration depth and speed.

Another trend is integration with digital health technologies. In order to track blood glucose levels, certain lancets now connect to smartphones or other devices. This can be especially helpful for individuals who have diabetes. Lancets are becoming easier to use and more accessible for patients who self-monitor their blood glucose levels or perform other diagnostic procedures at home, thanks to improvements in ergonomics.

The standard lancets segment dominated the lancet market in 2024 and is projected to sustain its position throughout the forecast period. Standard lancets are widely accessible in the market and are used for a variety of medical applications, most notably the measurement of blood glucose in individuals with diabetes. Lancets are tiny, sharp devices that puncture the skin to draw blood. Patients with diabetes mostly use them to check their blood glucose levels. Standard lancets are commonly accessible online, at pharmacies, and at medical supply stores. Considerations including needle gauge, compatibility with lancing devices, and user comfort are crucial when buying conventional lancets.

The safety lancets segment is expected to grow at the fastest rate in the lancet market during the projected period. Within the market, safety lancets are a significant category that is mostly used for single-use blood sampling in medical settings. Safety lancets are used for capillary blood collection, usually for diagnostic tests that need a little blood sample or glucose monitoring (as in diabetes treatment). Safety lancets are made with inbuilt safety features, as opposed to conventional lancets, which must be removed and disposed of manually. After usage, these devices automatically retract or shield the needle, reducing the possibility of needle stick accidents and guaranteeing safe disposal. In order to guarantee user safety and product efficacy, safety lancet manufacturers are required by law to comply with stringent safety and performance criteria in the majority of countries where medical devices are regulated.

The 23G-33G segment dominated the lancet market in 2024. The gauge sizes of lancets used in medical devices, such as lancing devices for blood glucose monitoring, are denoted by the designations ‘23G’ and ‘33G’. The patient's pain threshold, the amount of blood required for the test, and the particular specifications of the lancing equipment are some of the variables that influence the decision between these gauges. Users may have varied preferences for different gauge sizes.

Thinner lancets (higher gauge numbers, such as 33G) are frequently preferred because of their smaller needle size and, hence, decreased pain perception. But, in comparison to thicker lancets (lower gauge numbers, such as 23G), they might yield a smaller blood sample, which might be taken into account based on the testing specifications.

The 22G and below segment is expected to grow at the fastest rate in the lancet market during the projected period. Lancets are commonly available in various gauge sizes, commonly denoted as G (gauge). The term ‘22G and below size segment’ describes lancets with gauge sizes of no more than 22.

The thickness of the lancet needle is determined by gauge size; thinner needles are indicated by bigger gauge numbers, and thicker needles are indicated by smaller gauge numbers. Smaller gauge sizes (22G and below) of lancets are usually reserved for special uses in medicine and diagnostics when a finer needle is needed, including pediatric blood collection or for individuals with extremely sensitive skin. These lancets reduce pain and trauma while drawing blood.

The hospital segment held a significant share of the lancet market in 2024. Compared to those used at home, hospital-grade catheters frequently have to adhere to stricter regulations. Features including sterile packaging, healthcare professionals' simplicity of use, and interoperability with a range of testing methods and equipment might be necessary. Regulatory frameworks that are strict are usually in place for hospitals (depending on the country or location). All hospital-use Lancets must follow these rules in order to guarantee patient safety and efficacy. Hospitals typically purchase medical equipment through official procurement procedures that entail assessing variables like quality, cost-effectiveness, supplier dependability, and post-purchase assistance. Suppliers of Lancet aiming for the hospital market need to manage these procedures successfully.

The ambulatory surgical centers segment is expected to register significant growth in the lancet market over the forecast period. Within the market, the ambulatory surgical centers (ASCs) segment usually concentrates on offering specialized lancets and related products used in outpatient surgical operations. Lancets are essential medical instruments in many healthcare settings, including ASCs, where they are used for capillary blood samples.

ASCs are made for outpatient operations that don't need to remain overnight. For a variety of medical operations, including minor surgeries and diagnostic procedures involving the use of lancets for blood samples, they provide convenient, affordable, and specialized care. Medical gadgets that are user-friendly, safe, and efficient are given priority by ASCs. Lancets used in these environments must adhere to strict quality requirements in order to guarantee patient safety and precise blood collection.

By Type

By Size

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client