November 2024

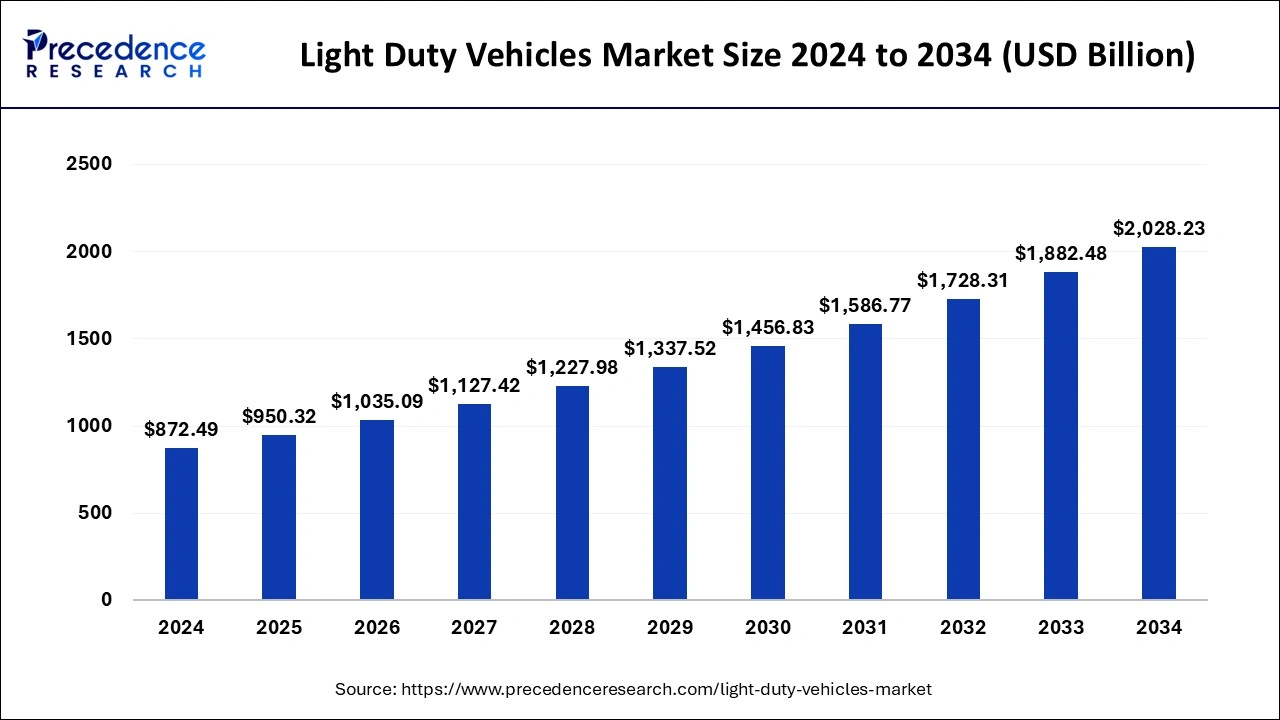

The global light duty vehicles market size is calculated at USD 950.32 billion in 2025 and is forecasted to reach around USD 2,028.23 billion by 2034, accelerating at a CAGR of 8.80% from 2025 to 2034. The North America light duty vehicles market size surpassed USD 296.65 billion in 2024 and is expanding at a CAGR of 8.90% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global light duty vehicles market size was estimated at USD 872.49 billion in 2024 and is predicted to increase from USD 950.32 billion in 2025 to approximately USD 2,028.23 billion by 2034, expanding at a CAGR of 8.80% from 2025 to 2034. The rising demand for light-duty electric trucks worldwide is driving the growth of the light duty vehicles market.

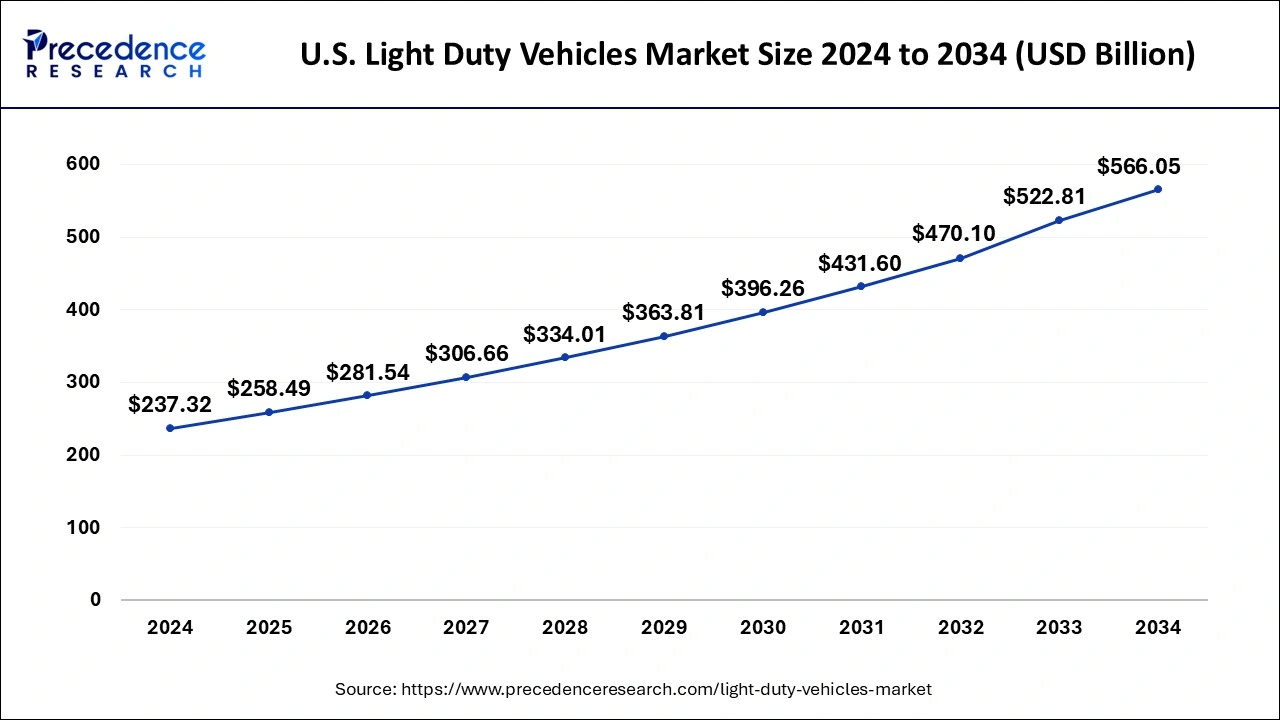

The U.S. light duty vehicles market size was valued at USD 237.32 billion in 2024 and is expected to be worth around USD 566.05 billion by 2034, at a CAGR of 9.08% from 2025 to 2034.

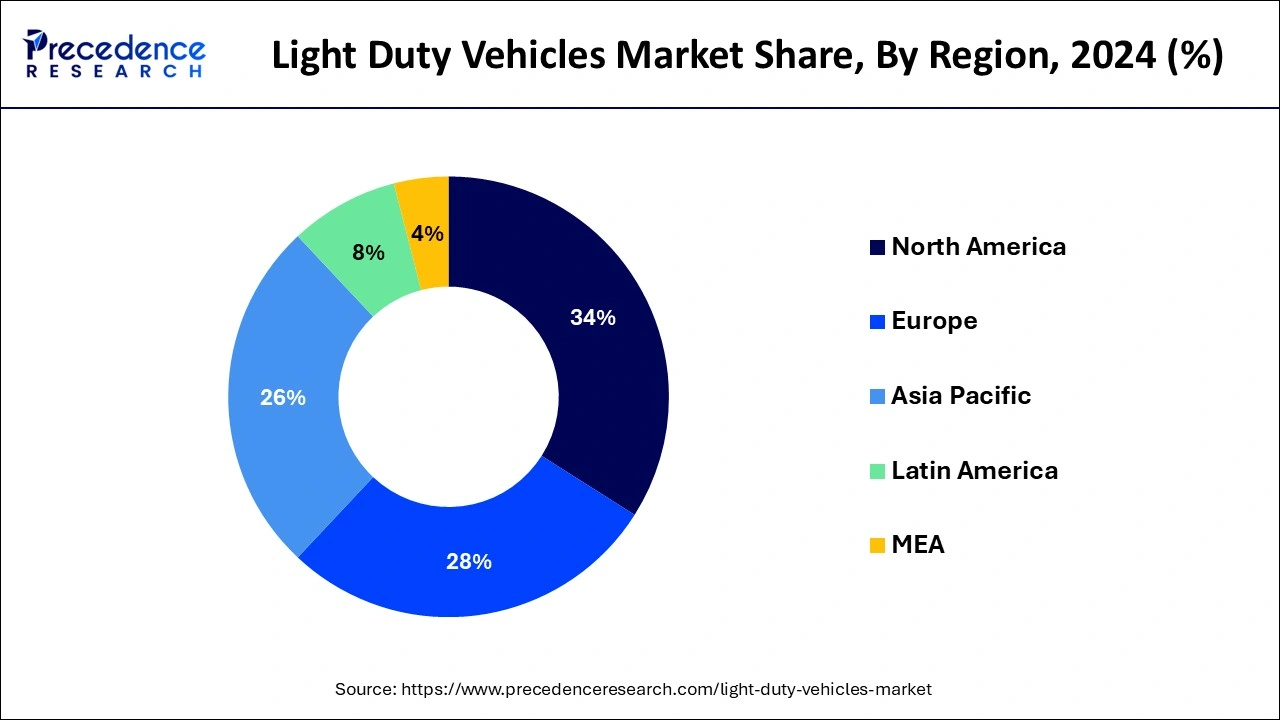

North America held the largest share of 34% in the light duty vehicles market share in 2024. The growth of this region is mainly driven by the rising developments in the automotive industry in countries such as the U.S., Canada, and Mexico. Detroit is also known as the automotive capital of the world, and it has the largest automotive industry in North America. This city has also experienced rapid innovations and scientific advancements to strengthen the automotive infrastructure that drives the market growth.

Moreover, rising government initiatives for strengthening EV infrastructure in countries such as the U.S., Canada, Mexico, and some others have boosted the light duty vehicles market growth. Additionally, the presence of ADAS manufacturers such as Magna International, Texas Instruments, Hella, and some others are adopting strategies such as product launches, collaborations, partnerships, and others, that drive the growth of the light duty vehicles market in this region. Furthermore, the growing trend of autonomous vehicles among the people of North America tends to lead automotive companies such as Tesla, Ford, GM, and others to launch autonomous vehicles that further drive market growth.

Asia Pacific is observed to grow at the fastest rate during the forecast period. Governments in the Asia Pacific region have implemented supportive policies, such as subsidies, tax incentives, and favorable regulations, to boost the automotive industry and promote the adoption of light duty vehicles. Governments in the Asia Pacific region have implemented supportive policies, such as subsidies, tax incentives, and favorable regulations, to boost the automotive industry and promote the adoption of light duty vehicles. Continuous investment in research and development by regional manufacturers has led to technological advancements in vehicle design, fuel efficiency, and safety features, making light duty vehicles more attractive to consumers.

Europe is observed to grow at a notable rate during the forecast period. The growth of this region is mainly driven by scientific advancements in the automotive sector, along with the presence of a well-established automobile industry in countries such as the UK, Germany, France, Italy, the Netherlands, and Switzerland. Also, the growing interest from the public and private sectors for development & research related to light duty vehicles has boosted the market growth. Moreover, the rise in government initiatives to reduce taxes for purchasing electric vehicles (EVs) has fostered light duty vehicles market growth.

In addition, the rising integration of ADAS in vehicles to ensure vehicle safety is an ongoing trend in Europe. Thus, ADAS components companies such as Autoliv, Bosch, Valeo, Delphi Technologies, and some others are constantly engaged in the research and development of ADAS systems and started adopting strategies such as product launches, collaboration, partnerships, and others that further drive the growth of the light-duty vehicles market. Additionally, the presence of global automotive manufacturers such as Audi, BMW, Volkswagen, Mercedes Benz, Ferrari, Lamborghini, Renault, and some others are continuously engaged in developing new vehicles with superior features, which in turn is expected to drive the growth of the light vehicles market in this region.

The light duty vehicles market is one of the most important industries in the automotive domain. This industry has gained serious attention recently with the rising demand for passenger cars and SUVs across the world. Light-duty vehicles are mainly classified as vehicles that weigh less than 10,000 pounds. These vehicles have several applications in various domains ranging from passenger touring to goods transportation. There are several classes of light-duty vehicles, mainly including Passenger cars, vans, Sports Utility vehicles (SUVs), and Pickup Trucks, which have different applications in various fields. This industry has experienced rapid growth due to growing technological innovations in automotive sectors coupled with the rising interest of automotive companies in manufacturing these vehicles.

| Report Coverage | Details |

| Market Size in 2025 | USD 950.32 Billion |

| Market Size by 2034 | USD 2,028.23 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.80% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Vehicle Type, Fuel Type, Drivetrain, Transmission Type and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Integration of ADAS in modern vehicles

The growing preference of customers towards superior driving experience and safety features increases the demand for ADAS features in vehicles. Several automotive manufacturers, such as BMW, AUDI, MG, TATA, and others, started launching ADAS-enabled vehicles in the market. Thus, the growing integration of ADAS in vehicles is expected to drive the growth of the light duty vehicles market.

Volatility in raw materials prices

The automobile sector has experienced regular fluctuations in the prices of raw materials associated with the production of vehicles. Due to the rising prices of raw materials, automotive manufacturers tend to increase the overall prices of the vehicles to gain maximum profits. This, in turn, restrains the growth of the light duty vehicles market in the forecast period.

Technological innovations to change the future

The automotive industry has experienced rapid developments due to advancements in modern science and technology. The integration of technologies such as artificial intelligence (AI), Blockchain, internet of things (IoT) , Predictive technology, and some others in vehicles has attracted investors from various domains to gain the interest of people around the world in buying smart cars. Thus, technological innovations in the automotive sector are expected to create growth opportunities for market players in the future.

The passenger car segment dominated the light duty vehicles market in 2024. The growth of this segment is driven by the growing use of passenger cars for personal and office use. Also, the growing demand for low-maintenance and fuel-efficient cars in developing countries such as India increased the demand for passenger cars, which in turn drives the market growth. Moreover, the growing demand for passenger cars from the tourism industry also boosts the growth of the market. In addition, several car manufacturers such as Ford, Tata, Mahindra, Maruti Suzuki, Toyota, and others are constantly developing cars with maximum efficiency and higher longevity, which in turn drives the growth of the light duty vehicles market.

The pickup truck segment is expected to be the fastest-growing segment during the forecast period. The growth of this segment is attributed to the growing use of pickup trucks from the construction and logistics industry. Also, the rising application of pickup trucks for towing and transporting goods, along with the growing trend of mountain rides and others by moto riders, has boosted the demand for pickup trucks, thereby driving the growth of the light duty vehicles market. Moreover, automotive companies such as Ford, Toyota, BYD, Mahindra, and others started developing pickup trucks with efficient mileage and superior performance, which, in turn, drove the growth of the light-duty vehicles market.

The gasoline segment held the largest share of the light duty vehicles market in 2024. The growing application of gasoline-based passenger cars for daily commute and rental purposes boosts the market growth. Also, gasoline vehicles are pocket-friendly and deliver high performance as compared to diesel vehicles, which increases the demand for gasoline vehicles, thereby driving the growth of the market. Moreover, gasoline-powered vehicles produce less noise, and their maintenance charges are also nominal as compared to other vehicles, which drives the market growth. In addition, automobile companies around the world are launching gasoline cars with superior features and improved performance, thereby driving the growth of the light duty vehicles market.

The electric vehicle segment is estimated to be the fastest-growing segment during the forecast period. The rising awareness regarding eco-friendly and fuel-efficient vehicles has boosted the demand for electric vehicles, thereby driving the market growth. Also, the rise in government initiatives to control C02 emissions, along with several subsidy schemes to promote electric vehicles (EV), boosts the growth of the light duty vehicles market. Moreover, automotive manufacturers such as Tata Motors, Mahindra, MG, and others are launching electric vehicles (EVs) at low prices that attract customers to adopt EVs, which in turn drives the growth of the market.

The rear-wheel drive (RWD) segment dominated the light duty vehicles market in 2024. The growing use of rear-wheel drive (RWD) in vehicles due to factors such as high traction control, acceleration-handling balance, and some others increases the demand for rear-wheel drive (RWD) cars, thereby driving the growth of the light duty vehicles market. Also, rear-wheel drive (RWD) cars are less costly and require less maintenance as compared to all-wheel drive cars (AWD) and front-wheel drive (FWD) cars, which increases the demand for rear-wheel drive (RWD) cars that, in turn, drive the growth of the light-duty vehicles market. Also, automotive manufacturers are launching rear-wheel drive (RWD) cars at pocket-friendly prices, which in turn drives the growth of the light duty vehicles market.

The all-wheel drive (AWD) segment is expected to be the fastest-growing segment during the forecast period. The growth of this segment is mainly due to the growing interest of people towards off-roading activities along with the rising number of sporting events in snowy, muddy, and rocky terrains that increase the demand for all-wheel drive (AWD) cars, thereby driving the growth of the light-duty vehicles. Moreover, the rising interest of the young generation to buy sports utility vehicles (SUVs) increases the demand for all-wheel drive (AWD) cars, which, in turn, drives market growth. Also, vehicle manufacturers started developing all-wheel drive (AWD) SUVs that produce maximum power and provide high safety, which in turn drives the growth of the light duty vehicles market.

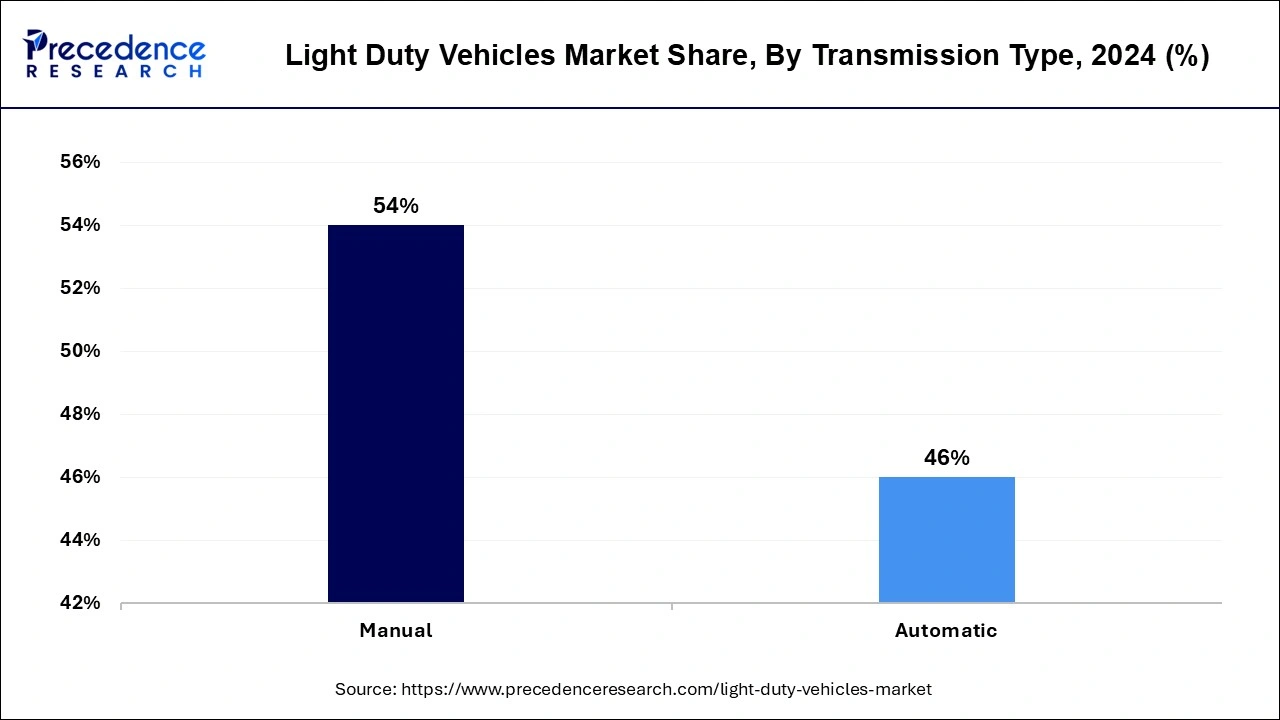

The manual segment dominated the light duty vehicles market in 2024. This segment is generally driven by the growing demand for affordable cars across the world. Also, manual cars are equipped with features such as superior control, fuel efficiency, less maintenance, ease of use, and some other features that increase the demand for manual cars, thereby boosting the growth of the light duty vehicles market. Moreover, automotive companies around the world have started launching manual cars to maintain the demand-supply chain that, in turn, drives the growth of the light duty vehicles market.

The automatic segment is estimated to be the fastest-growing segment during the forecast period. The growth of this segment is generally driven by the growing demand for luxury cars by rich people across the world. Also, automatic transmission cars are easy to use in heavy traffic and allow a simple driving experience along with better comfort than manual cars, which increases the demand for automatic cars, thereby driving the growth of the market. Moreover, automotive companies are engaged in developing high-performance automatic vehicles and launching luxury cars to gain customer attention, which increases the demand for automatic vehicles, thereby driving the growth of the light duty vehicles market.

By Vehicle Type

By Fuel Type

By Drivetrain

By Transmission Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

February 2025

November 2024

October 2024