January 2025

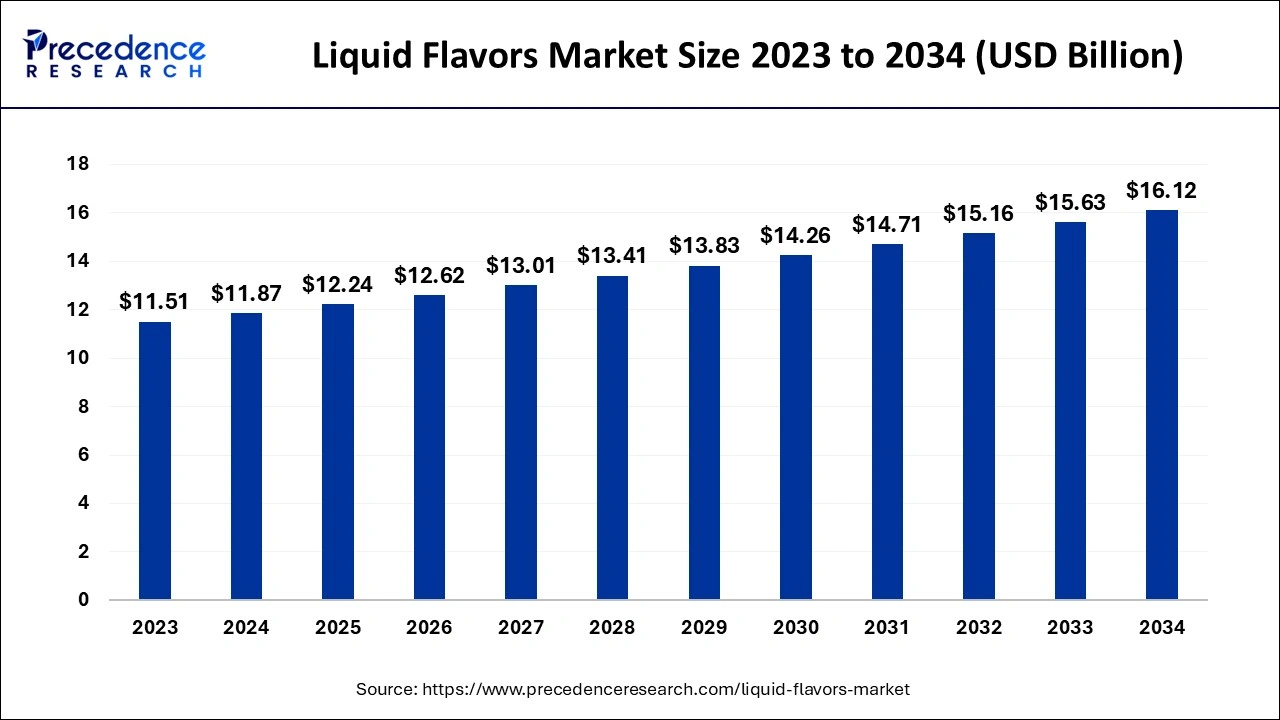

The global liquid flavors market size is evaluated at USD 11.87 billion in 2024, grew to USD 12.24 billion in 2025 and is projected to reach around USD 16.12 billion by 2034. The market is expanding at a CAGR of 3.11% between 2024 and 2034.The North America liquid flavors market size is calculated at USD 4.15 billion in 2024 and is expected to grow at a CAGR of 3.23% during the forecast year.

The global liquid flavors market size is calculated at USD 11.87 billion in 2024 and is projected to surpass around USD 16.12 billion by 2034, expanding at a CAGR of 3.11% from 2024 to 2034. The liquid flavors market is driven by the increasing consumer demand for organic and natural food items.

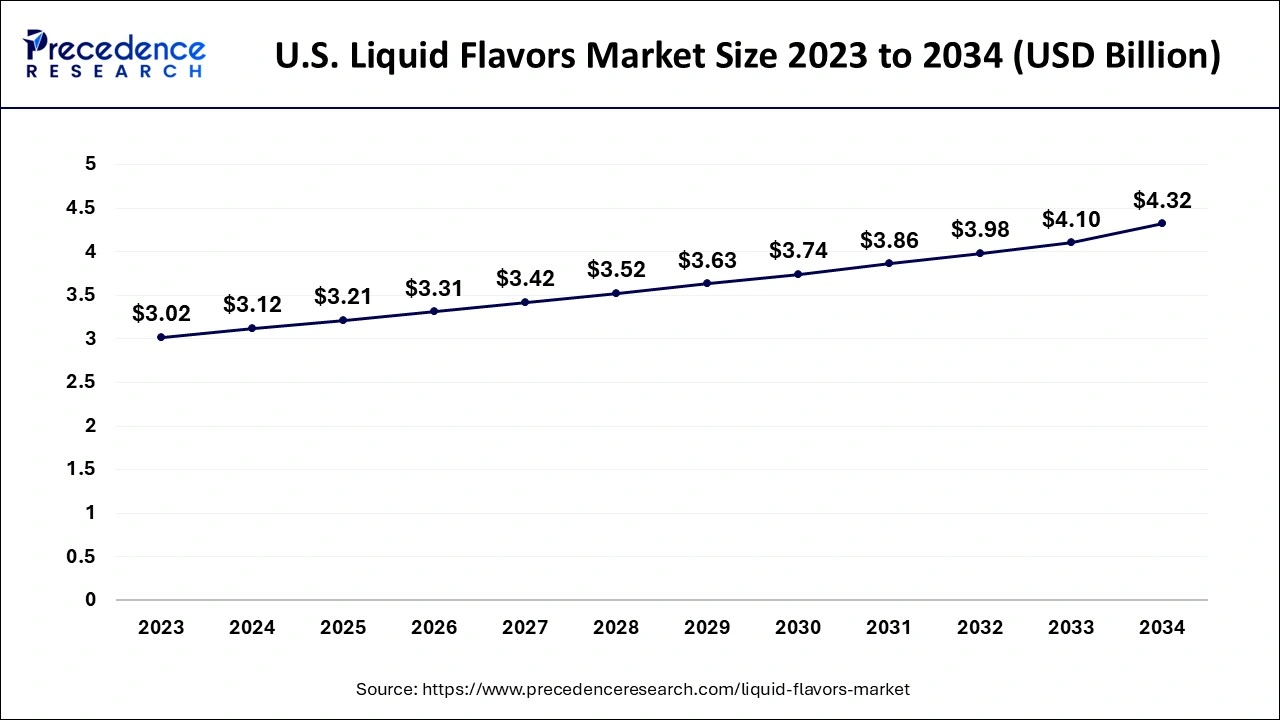

The U.S. liquid flavors market size is exhibited at USD 3.12 billion in 2024 and is projected to be worth around USD 4.32 billion by 2034, growing at a CAGR of 3.30% from 2024 to 2034.

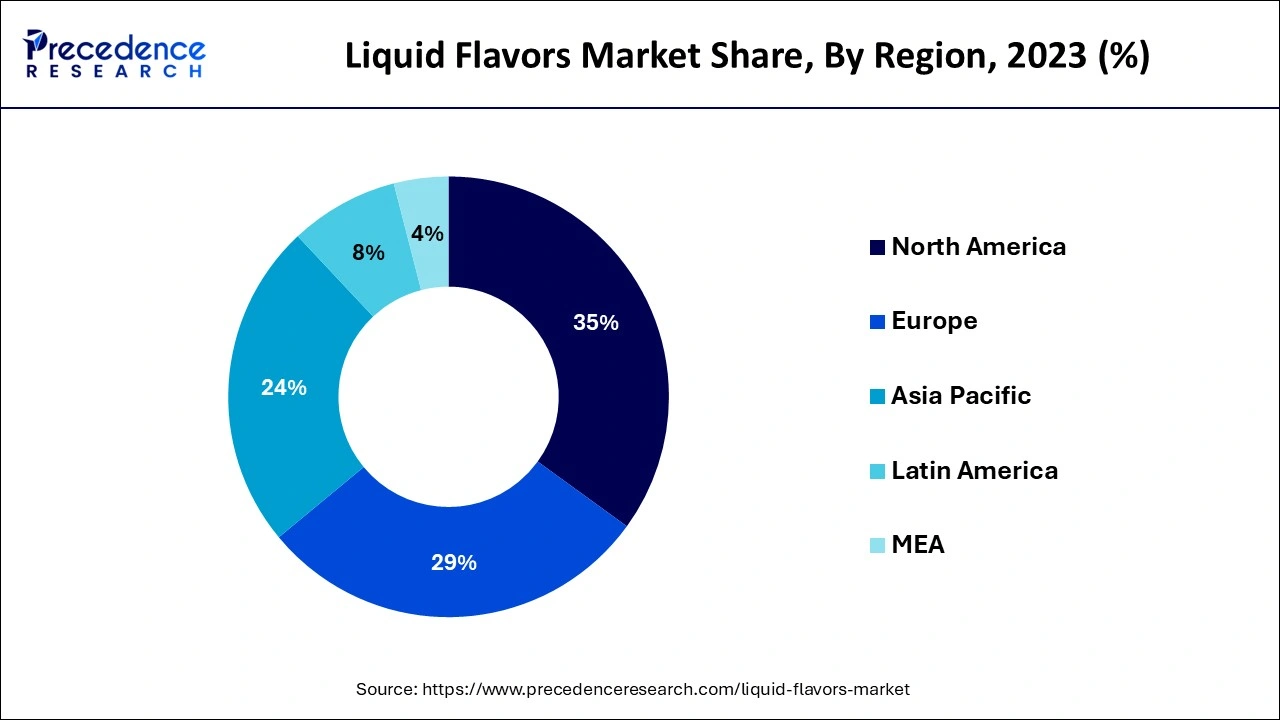

North America dominated the global liquid flavors market in 2023. With a sizable consumer base in the U.S. and Canada, the North American food and beverage sector is among the biggest in the world. From processed foods and snacks to soft and alcoholic beverages, liquid tastes are essential to creating a vast array of foods and drinks. It has taken the lead in offering specialized taste solutions to meet specific client needs. Manufacturers may design and test new tastes more quickly thanks to rapid prototyping processes, which also shortens the time it takes to launch active items.

Asia Pacific is observed to host the fastest-growing liquid flavors market during the forecast period. Consumers are looking for natural, organic, or low-flavor artificial additives as health and wellness concepts gain traction in the area. As a result, the need for liquid flavors that replicate natural tastes without sacrificing health has increased. For example, flavors found in protein shakes, functional drinks, and fortified foods are gaining popularity because they complement health-conscious decisions.

The governments of the Asia-Pacific region have urged foreign investments in the food processing and food service sectors and are actively supporting their expansion. Regulations governing food quality, policies encouraging foreign direct investment, and improvements in food processing technology have all contributed to the region's appeal to flavor producers and manufacturers.

Liquid flavors can be modified to satisfy clean-label standards as natural, organic, and health-conscious products become more popular. In the food and beverage industry, natural and organic liquid flavors are particularly alluring since they can improve the flavor of low-fat or low-sugar goods without sacrificing nutritional value. The demand for liquid flavors market goods, ranging from packaged foods and drinks to medications, is rising along with expanding markets. Due to the increased demand for scalable and reasonably priced liquid flavor solutions, businesses must accommodate a wide range of flavor characteristics in different regions.

How is AI Helping Liquid Flavors Market Growth?

Complex liquid flavors can be created more quickly thanks to AI-driven models predicting flavor interactions and evaluating large chemical libraries. By examining molecular structures and sensory profiles, AI can recommend novel combinations, cutting R&D time and expense. In the liquid flavors market, AI-powered quality control systems analyze real-time manufacturing data to identify deviations or irregularities, upholding high standards and cutting waste. This aids producers in growing quality and consistency from batch to batch. By analyzing sensory data from digital tasting tools or human taste panels, AI can forecast customer reactions and make adjustments before a product is released into the market.

| Report Coverage | Details |

| Market Size by 2034 | USD 16.12 Billion |

| Market Size in 2024 | USD 11.87 Billion |

| Market Size in 2025 | USD 12.24 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 3.11% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Increasing demand for ready-to-drink products

Convenience is becoming increasingly important to modern customers because of their hectic schedules. Demand has increased due to RTD products such as flavored teas, coffees, cocktails, and soft drinks, which have met this need. Manufacturers in the liquid flavors market are expanding their variety of flavors to appeal to customers. To satisfy intrepid customers seeking new flavors, unusual and exotic flavors (such as hibiscus or tropical fruit blends) are presented. This innovation drives the demand for liquid tastes utilized in various RTD products.

Increasing health concerns

Customers increasingly seek natural and organic substitutes as they become more conscious of the health risks associated with artificial substances. As a result of scrutiny, the demand for the liquid flavors market is decreasing. Sensitive people may experience adverse reactions to some flavorings. Because food allergies and intolerances are becoming more common, people are becoming pickier about what they eat and favor hypoallergenic or allergen-free products.

Expansion in pharmaceuticals

Many patients, especially the elderly and young, find it difficult to take drugs that taste bad. Flavored formulations to improve patient compliance are becoming more widely acknowledged in the pharmaceutical business. This fuels the need for liquid flavors that cover up the taste of active substances. Natural and organic flavors are becoming more popular as customers become more concerned about health and become more knowledgeable about product ingredients. The liquid flavors market can capitalize on this by providing tastes that complement current health trends.

The artificial flavor liquids segment dominated the liquid flavors market in 2023. t is generally less expensive to make artificial flavorings than natural ones. Manufacturers can scale production effectively thanks to the synthetic production process, which lowers the cost per unit and makes these tastes accessible to producers and final customers. Artificial flavors are particularly well-liked in international markets where consumers seek affordable, shelf-stable items. Because artificial flavors are more resilient to various environmental factors, they are chosen in developing nations where fresh or natural items may not be able to be stored or transported in the best possible conditions.

The flavor extracts segment is observed to grow at the fastest rate in the liquid flavors market during the forecast period. Consumers' understanding of health and well-being grows, so they choose more natural and organic items. As a result, natural flavor extracts are preferred over artificial flavorings. Flavor extracts, which are generally made from fruits, spices, herbs, and other natural sources, meet this need. This leads to strong growth prospects in several businesses, particularly the food and beverage sector. Pharmaceutical and nutraceutical products increasingly use flavor extracts to improve the taste of items like dietary supplements, cough syrups, and chewable tablets. This application tackles the problem of hiding unpleasant or bitter odors, especially in drugs taken by elderly and pediatric patients.

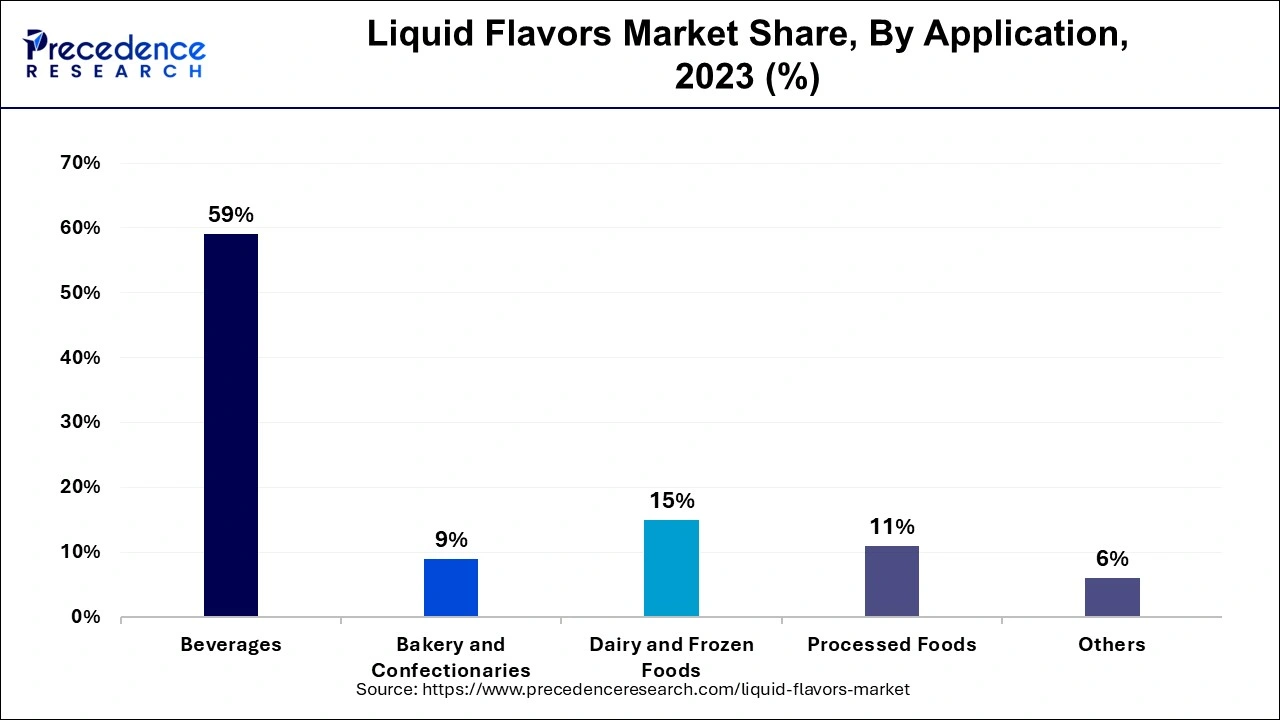

The beverages segment dominated the global liquid flavors market in 2023. The popularity of alcoholic beverages, particularly ready-to-drink (RTD) cocktails and flavored spirits, has raised the demand for a wide variety of premium liquid flavors. Flavored alcoholic beverages need liquid flavors that blend well without changing the stability or profile of the alcohol. They combine classic liquors with additional fruit, citrus, or herbal flavors. Coffees, teas, smoothies, and sparkling waters are ready-to-drink beverages that have grown in popularity, mainly among younger, busy consumers. These drinks frequently rely on liquid flavoring to improve taste, increase shelf stability, and offer a consistent product experience.

The processed foods segment is expected to grow rapidly in the liquid flavors market during the forecast period. Processed foods have become increasingly popular as consumers' preferences for convenience have grown. They provide time-saving options for hectic lives, which fits in with the current trend of consumers looking for meal options that are ready to eat or simple to make. The need for liquid tastes has increased dramatically due to advanced flavor delivery techniques like microencapsulation, which also aid in slowing down flavor degradation over time, mainly in complex processed foods.

Segments Covered in the Report

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2024

August 2024

June 2024