December 2024

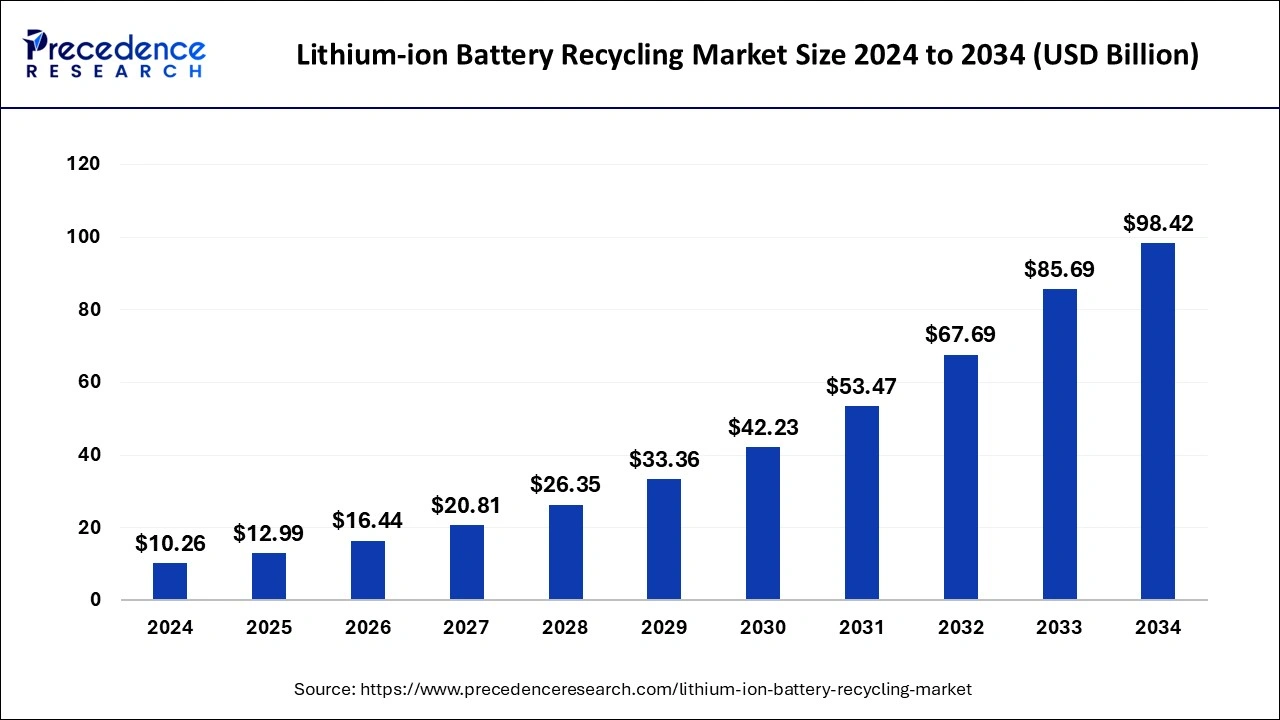

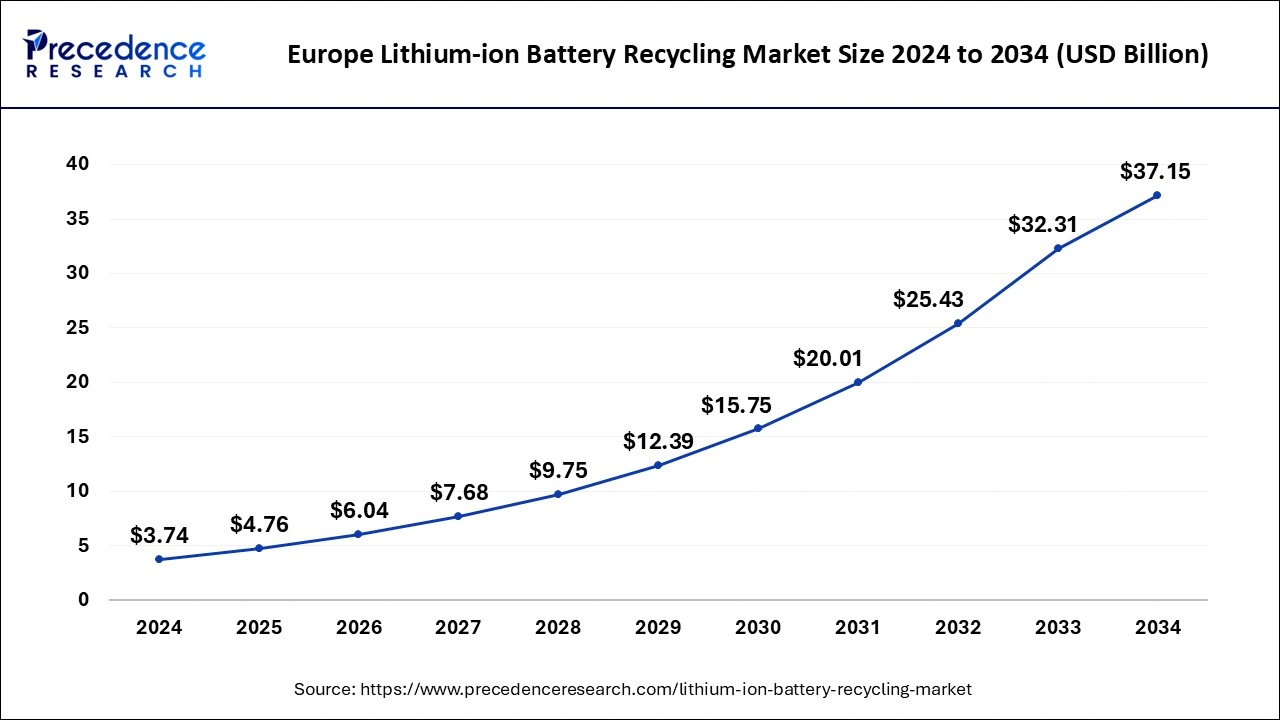

The global lithium-ion battery recycling market size is calculated at USD 12.99 billion in 2025 and is forecasted to reach around USD 98.42 billion by 2034, accelerating at a CAGR of 25.37% from 2025 to 2034. The Europe lithium-ion battery recycling market size surpassed USD 4.76 billion in 2025 and is expanding at a CAGR of 25.81% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global lithium-ion battery recycling market size was accounted for USD 10.26 billion in 2024, and is expected to reach around USD 98.42 billion by 2034, expanding at a CAGR of 25.37% from 2025 to 2034. The lithium-ion battery recycling market is driven by growing demand for electric vehicles.

AI is revolutionizing the game in various industries, including lithium-ion battery recycling. Its robotic systems can detect and sort different types of batteries with high clarity.

Its models determine chemical compositions and optimize recovery methods to maximize the extraction of valuable metals such as cobalt, nickel, and lithium. This ensures that it gets the highest possible output from each recycled battery. By enhancing recycling efficiency, AI helps reduce the environmental footprint of battery disposal, contributing to a greener planet.

The Europe lithium-ion battery recycling market size was estimated at USD 3.74 billion in 2024 and is predicted to be worth around USD 37.15 billion by 2034, at a CAGR of 25.81% from 2025 to 2034.

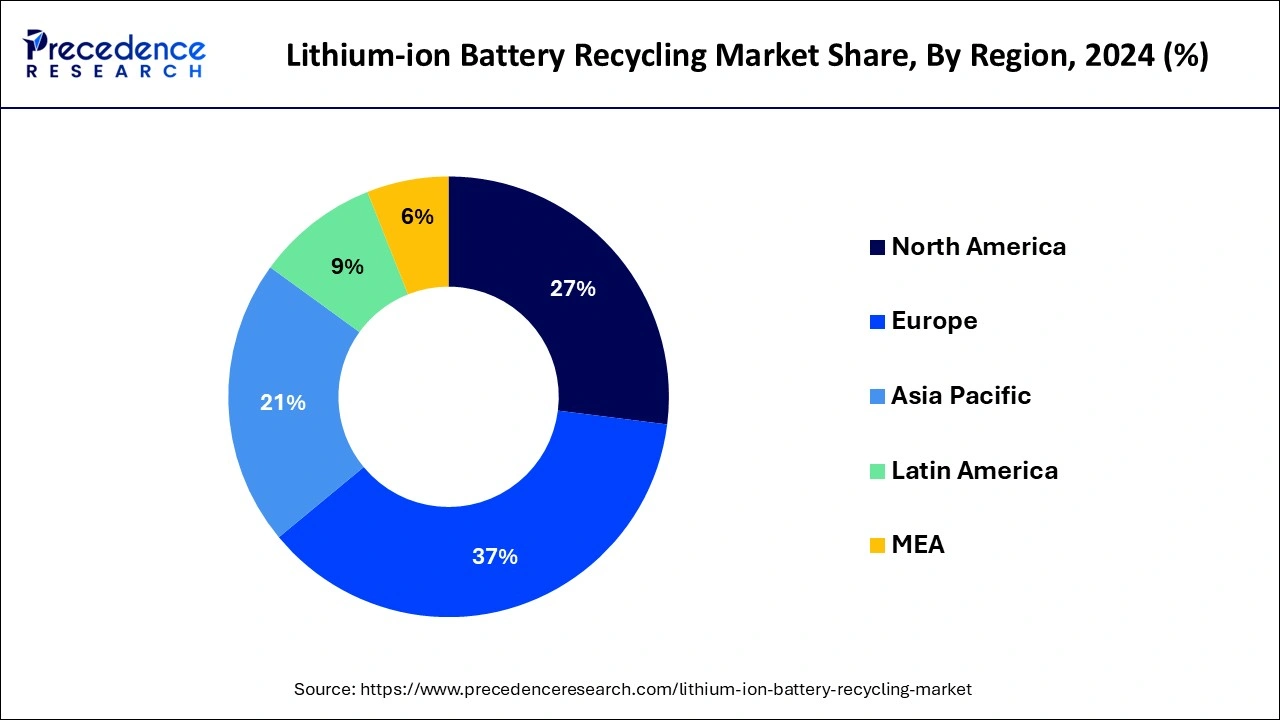

Europe dominated the global lithium-ion battery market with revenue share of 37% in 2024. While United States is anticipated to grow the fastest CAGR between 2025 and 2034. Among the biggest economies for recovering lithium-ion batteries is the United States. During the forecast timeframe, the industry of lithium-ion battery recycling is anticipated to develop as a result of the expansion of electrical automobiles in the region and regulatory laws regarding lithium-ion battery recovery. The marketplace for electrical automobiles in the region would be improved by rising investments from major participants in the industry, and by expanding infrastructures for electric cars, which will favorably affect the lithium-ion recycling programs.

North America is the fastest growing in the lithium-ion battery recycling market during the forecast period.

Major key players are formulating significant plans concerning the treatment of battery systems that have been established. Governments of North America offer tax credits, financial incentives, or subsidies to businesses engaged in responsible recycling activities. These incentives encourage compliance with regulations and boost the market's growth by making it economically attractive for companies to invest in recycling infrastructure and technologies.

Lithium-ion battery regeneration refers to the gathering of lithium-ion batteries from a variety of sources, such as automobiles, consumer goods, industrial equipment, and electronic devices, as well as the extraction of metal using recycling procedures. The world market estimate includes income from sales of such reclaimed elements or components, regardless of whether they are used in additional battery recovery and other uses that necessitate a secondary use. It is said that the majority of elements retrieved are simply used to make batteries.

The worldwide lithium-ion recycling market is anticipated to expand as a result of variables including governmental laws, environmental protection, and increasing understanding. Furthermore, inappropriate lithium-ion battery recycling global growth is anticipated to be hampered during the forecast timeframe by incorrect separating of hazardous lithium batteries, incorrect disassembly, and inappropriate shredding. The availability of coating materials to decrease the likelihood of flame as well as the beautiful appearance of cells are predicted to open up new development potential in the global marketplace.

| Report Coverage | Details |

| Market Size in 2025 | USD 12.99 Billion |

| Market Size by 2034 | USD 98.42 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 25.37% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | End User, Battery Components, Battery Chemistry, Recycling Process, and Source |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising Interest in Electric Vehicles

The usage of renewable biofuels is becoming more prevalent in the automotive sector. The transport network is heavily dependent on oil as a resource, which is raising worries among economics and the environment alike. The use of electric cars is growing along with ecological sustainability. EDVs are being used more frequently, which is causing an increase in the demand for fuel cells, that are necessary for a constant energy supply. The industry for EVs is anticipated to expand as a result of variables like fuel efficiency, reduced emissions, and customer choice. Due to better battery tech as well as the minimal downtime needs of these fuel cells, the electric vehicle market is rising.

New techniques are being created to cut expenses and stop environmental pollution

By constructing new recycling facilities and collecting sites, businesses are trying to boost their level of competition. New techniques are being forced to cut expenses and stop environmental pollution. To collect the purpose of collecting used batteries, ECOBAT has created its collection mechanism. New techniques are also being explored to cut expenses and stop environmental contamination.

The escalating trend for personal electronics and lithium-ion batteries

The recycling business is predicted to increase quickly thanks to the transportation sector. Because of their highly efficient, extended lifespan, and low care requirements, fuel cells are becoming increasingly popular in portable electronics and electric cars, which is anticipated to have a beneficial effect on the market for goods produced.

Rising acceptance in novel applications, a drop in lithium-ion battery pricing, and recycling at the final moment are all anticipated outcomes of increased production

Modern lithium-ion batteries are made up of several parts that are offered at discounted prices. The costs of these cells are anticipated to significantly fall, according to recent advances and statements made by automakers and manufacturers of lithium-ion batteries. Costs are dropping as a result of innovations including mass production, decreasing unit cost, and the use of technologies to increase storage capacity. The industry for storage of renewable energies is predicted to expand as a result of falling lithium battery prices, and this industry is predicted to favor battery cells above all other rechargeables. The need for recovering used lithium-based batteries is then anticipated to rise as a result.

An increasing number of government recycling programs and R&D projects

There are many uses for lithium-ion batteries, and as additional development and research is done, more advanced qualities are now being created. To meet the increasing need for lithium-ion batteries used in electric mobility, healthcare gadgets, and communication system, businesses are new product manufacturing plants. New opportunities for the growth of the worldwide lithium-ion battery industry are being created by newly constructed factories and expanding research and development activities.

The market for recovering lithium-ion batteries is expected to be dominated by the automotive industry. Due to significant advancements in the automotive industry that are directly related to lithium-ion batteries, such as a decrease in the cost of lithium-ion batteries and an increase in the efficiency of electric vehicles, the automotive industry now accounts for the largest segment of the global lithium-ion battery recycling market. These factors increased the demand for battery-powered cars, which boosted the lithium-ion battery recycling business.

Also, regulations and subsidies related to battery recycling by countries such as China and Germany have fuelled the market growth for lithium-ion battery recycling. This stays accredited to the rise in demand for second-life applications of lithium-ion batteries in consumer electronics devices such as laptops, digital cameras, smartphones, and others that do not require longer battery life as compared to electric vehicles and industrial applications.

Due to its expanding use in energy storage technologies and the automobile industries in e-bikes or other e-mobility, the lithium-nickel Mn cobalt segment dominated the greatest proportion of the battery pack recycling industry. (Li-NMC) cells are in high demand due to their low cost, high efficiency, & extended life span. Due to the increased demand for battery oxide batteries for uses such as electric, gasoline, smart meters, flame and smoke detectors, security equipment, or other power storage technologies, the lithium-manganese oxide sector had the biggest market share in 2021. Additionally, it has benefits including lengthy dependability, a long life, and a high temp handling capacity, all of which are predicted to support market expansion throughout the projected timeframe.

In 2024, the hydrometallurgical procedure segment held the largest market position. This is ascribed to the benefits of hydrometallurgical recovery and recycling over other cell recycling technologies, like its capacity to handle low-grade components, regulate trash easily, use less power, and recycle aluminum and lithium.

By End User

By Battery Components

By Battery Chemistry

By Recycling Process

By Source

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

November 2024

November 2024

July 2024