September 2024

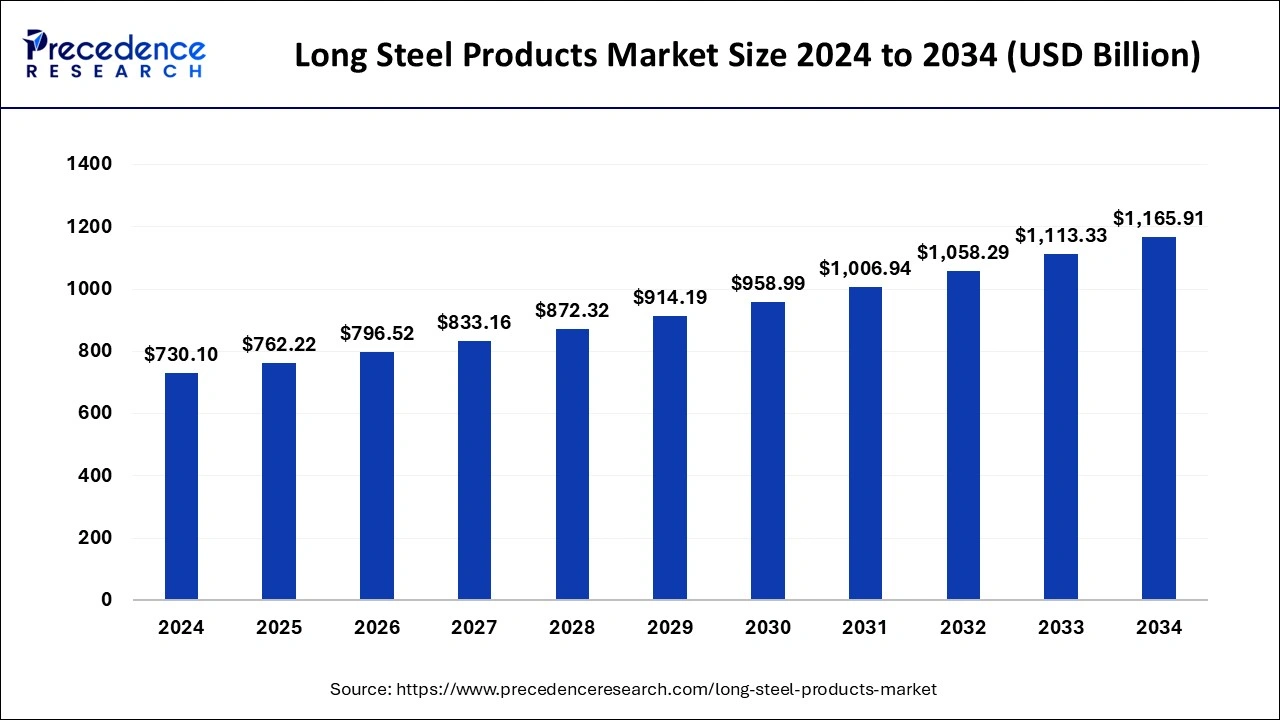

The global long steel products market size is calculated at USD 762.22 billion in 2025 and is forecasted to reach around USD 1,165.91 billion by 2034, accelerating at a CAGR of 4.79% from 2025 to 2034. The Asia Pacific long steel products market size surpassed USD 510.69 billion in 2025 and is expanding at a CAGR of 4.87% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global long steel products market size was estimated at USD 730.10 billion in 2024 and is predicted to increase from USD 762.22 billion in 2025 to approximately USD 1,165.91 billion by 2034, expanding at a CAGR of 4.79% from 2025 to 2034.

The Asia-Pacific long steel products market size was valued at USD 489.17 billion in 2024 and is expected to reach around USD 786.99 billion by 2034 with a CAGR of 4.87% from 2025 to 2034.

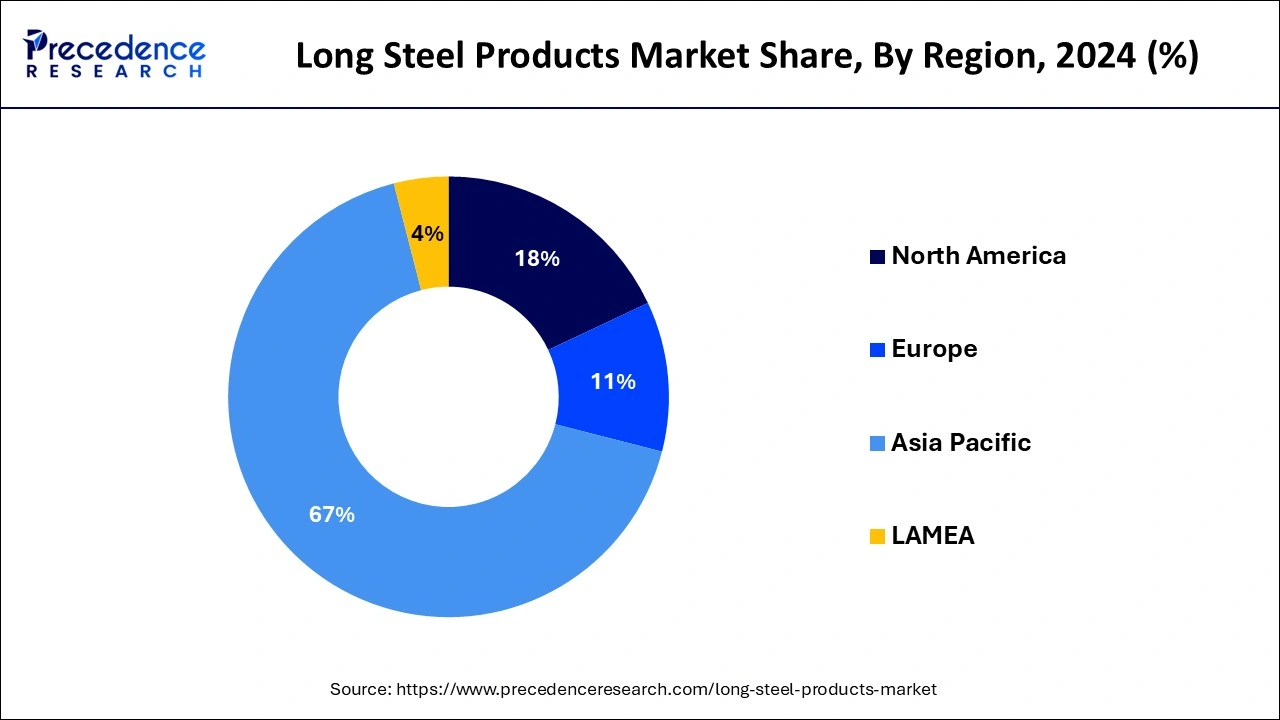

Asia-Pacific held the largest market share of 67% in 2024 due to rapid urbanization, robust industrialization, and substantial infrastructure development in countries like China and India. The region's burgeoning construction sector, driven by population growth and economic expansion, significantly boosts the demand for long steel products. Moreover, Asia-Pacific's strong presence in industries like automotive and manufacturing further propels the market. With increasing investments in construction and infrastructure projects, the region remains a key player, driving the growth and dominance of the long steel products market.

North America is poised for rapid growth in the long steel products market due to robust construction activities, infrastructure investments, and a resurgence in manufacturing. The region's focus on upgrading and modernizing aging infrastructure, coupled with a strong demand for residential and commercial construction, creates a favorable environment. Additionally, initiatives supporting sustainable building practices and the adoption of advanced technologies contribute to the anticipated growth. These factors position North America as a promising market for long steel products, reflecting the region's economic momentum and development prospects.

Meanwhile, Europe is experiencing notable growth in the long steel products market due to robust construction activities and infrastructure development across the region. The demand for long steel products, including beams and reinforcement bars, has surged with increased urbanization and large-scale building projects. Additionally, the emphasis on sustainable construction practices and the implementation of stringent building standards contribute to the rising adoption of long steel products. These factors collectively propel the growth of the long steel products market in Europe, creating opportunities for manufacturers and suppliers in the steel industry.

Long steel products refer to a category of steel items characterized by their elongated shape, including items like bars, rods, and structural sections. These products find extensive use in construction and infrastructure projects due to their strength and durability. Common examples include reinforcement bars (rebar) used in concrete structures, steel beams for building frameworks, and wire rods for various industrial applications. Long steel products play a crucial role in supporting the construction industry and are essential for creating sturdy and reliable structures. Whether it's in the form of beams providing structural support or rods reinforcing concrete, these products contribute to the integrity and longevity of buildings and infrastructure projects, making them foundational elements in the world of construction and engineering.

| Report Coverage | Details |

| Market Size in 2025 | USD 762.22 Billion |

| Market Size by 2034 | USD 1,165.91 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.79% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Global construction boom

The global construction boom has become a driving force behind the surge in market demand for long steel products. As countries worldwide experience rapid urbanization and a growing need for infrastructure, the construction industry is witnessing unprecedented growth. Long steel products, including beams, columns, and reinforcement bars, play a pivotal role in constructing sturdy buildings, bridges, and other essential structures. The increasing demand for new residential, commercial, and industrial spaces fuels the necessity for these durable and versatile steel products. Moreover, major infrastructure projects, such as roads, bridges, and energy facilities, require substantial amounts of long steel products. As a result, the global construction boom creates a robust market demand for long steel products, making them integral to the construction landscape and contributing significantly to the overall growth of the steel industry.

Overcapacity in the steel industry

Overcapacity in the steel industry poses a significant restraint on the market demand for long steel products. When there is excess production capability in the industry, it leads to intensified competition among manufacturers, creating a scenario where supply surpasses demand. This surplus often exerts downward pressure on steel prices, affecting the overall profitability of long steel product manufacturers. The resultant price decline can discourage investments and limit the financial viability of expanding or upgrading production facilities.

Furthermore, the presence of overcapacity can contribute to a lack of pricing power for steel producers, making it challenging to maintain stable and favorable pricing structures. In such a competitive environment, manufacturers may struggle to recoup their production costs, impacting their ability to invest in research, development, and sustainable practices. This overcapacity dynamic not only affects the economic health of individual steel producers but also hampers the overall growth and dynamism of the long steel products market.

Strategic partnerships and collaborations

Strategic partnerships and collaborations play a pivotal role in creating opportunities for the long steel products market. By forming alliances with construction firms, architects, and engineering companies, long steel product manufacturers gain early involvement in major projects. This proactive engagement allows them to align their product offerings with specific project requirements, fostering a more streamlined and efficient supply chain. Moreover, such collaborations enable knowledge sharing, technological exchange, and joint research initiatives, promoting innovation in long steel product manufacturing. By leveraging the expertise of diverse stakeholders, manufacturers can adapt to emerging trends, address industry challenges, and position themselves as preferred partners for large-scale construction projects. Strategic partnerships not only enhance market presence but also open avenues for sustained growth and competitiveness in the dynamic landscape of the long steel products market.

The rebars segment held the largest market share of 35% in 2024. Rebars, short for reinforcing bars, are a crucial segment in the long steel products market. These steel bars, commonly used in construction, provide strength and stability to reinforced concrete structures. The rebars segment is witnessing a trend towards increasing demand due to rising construction activities globally, particularly in infrastructure projects. As urbanization continues, the need for durable and resilient structures propels the use of rebars, reflecting a key trend in the long steel products market.

The wire rods segment is anticipated to witness rapid growth at a significant CAGR of 5.9% during the projected period. Wire rods are long steel products characterized by their round cross-section. Widely used in construction, automotive, and manufacturing, they serve as raw material for various applications like fencing, nails, and wire products. In the long steel products market, the wire rods segment is witnessing a trend towards increased demand driven by construction projects and industrial applications. As infrastructure development continues globally, the need for wire rods in creating durable and versatile products for diverse industries remains a prominent and growing aspect of the market.

The building and construction segment has held 81% market share in 2024. The building and construction segment in the long steel products market pertains to the use of steel in various structural applications, including beams, columns, and reinforcement bars. This segment is crucial for erecting residential, commercial, and industrial structures. Recent trends indicate a rising demand for long steel products in sustainable and energy-efficient construction practices. Additionally, the growth of urbanization, infrastructure projects, and the increasing popularity of steel-framed buildings contribute to the steady expansion of the building and construction segment in the long steel products market.

The automotive and aerospace segment is anticipated to witness rapid growth over the projected period. In the long steel products market, the automotive segment involves the use of steel in manufacturing components like chassis, axles, and suspension systems. Increasing demand for automobiles globally has spurred the need for high-quality, durable long steel products in this sector. In aerospace applications, long steel products contribute to the construction of aircraft components such as beams and structural elements. The aerospace segment is witnessing a trend towards lightweight, high-strength materials, driving innovations in the development and application of long steel products to meet stringent industry standards.

By Product

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2024

January 2025

November 2024