September 2024

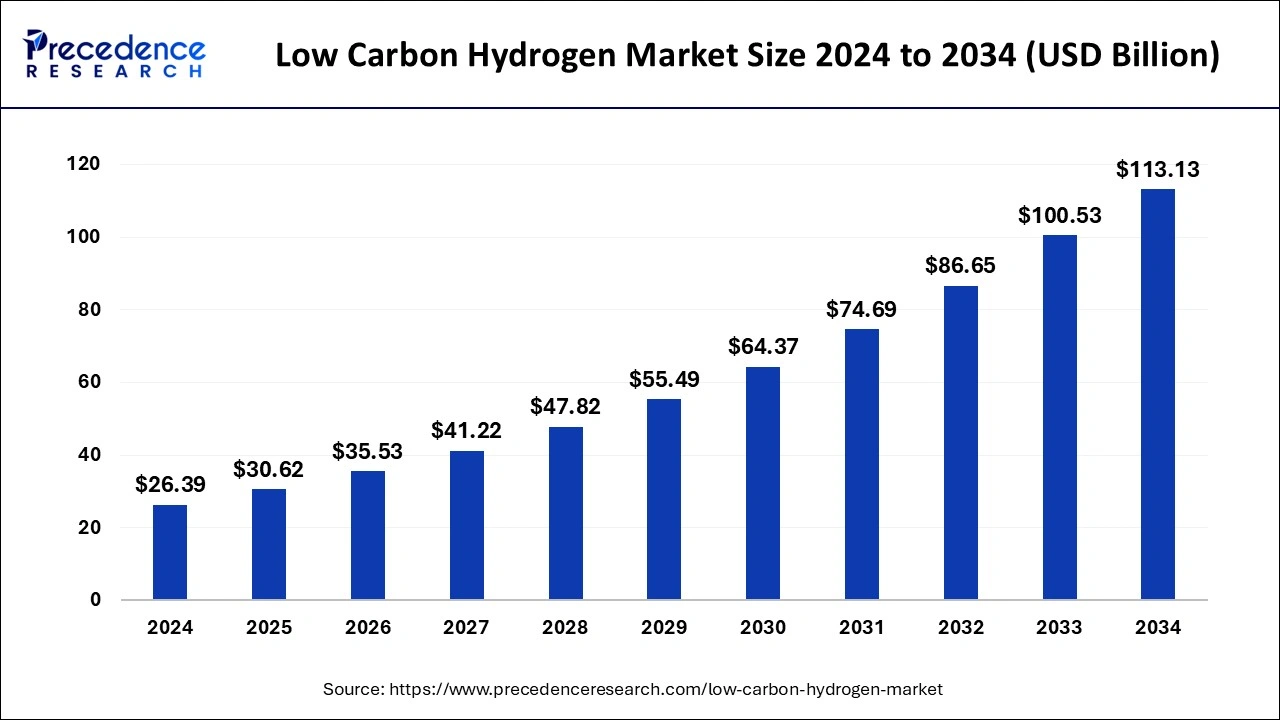

The global low carbon hydrogen market size is calculated at USD 30.62 billion in 2025 and is forecasted to reach around USD 113.13 billion by 2034, accelerating at a CAGR of 15.66% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global low carbon hydrogen market size was estimated at USD 26.39 billion in 2024 and is predicted to increase from USD 30.62 billion in 2025 to approximately USD 113.13 billion by 2034, expanding at a CAGR of 15.66% from 2025 to 2034. The market is expanding at a solid CAGR of 16.02% over the forecast period 2024 to 2033. This rapid growth is driven by increasing awareness about decarbonization through the hydrogen synthesis process and the rapid development of technologies to eliminate greenhouse gas emissions, including government support across the globe.

The low carbon hydrogen market is experiencing rapid growth, driven by the global push towards decarbonization and sustainable energy solutions. Governments and industries are increasingly investing in low carbon hydrogen technologies, including green hydrogen produced via electrolysis using renewable energy, and blue hydrogen derived from natural gas with carbon capture and storage (CCS).

Europe, North America, and Asia-Pacific are leading the charge with significant policy support and financial incentives. Countries like Japan, South Korea, China, and India are at the forefront, making substantial investments in hydrogen technologies and infrastructure. Key sectors like transportation, power generation, and industrial processes, pivotal in the global decarbonization efforts, are adopting low-carbon hydrogen to reduce emissions. Technological advancements and declining production costs are further propelling market expansion.

Despite these hurdles, the market outlook remains positive, with projections indicating substantial growth over the next decade as nations strive to meet ambitious climate goals and foster sustainable economic development. Challenges such as infrastructure development, high initial investments, and energy efficiency remain, but the market's resilience and potential for growth are undeniable.

| Report Coverage | Details |

| Market Size in 2025 | USD 26.39 Billion |

| Market Size by 2034 | USD 100.53 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 16.02% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Process, Energy Source, End-Product, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Net-zero carbon emissions

One significant driver for the growth of the low carbon hydrogen market is the global commitment to achieving net-zero carbon emissions by mid-century. Governments worldwide are setting ambitious climate goals to combat the adverse effects of climate change, and low-carbon hydrogen is emerging as a crucial component in this transition. To meet these objectives, decarbonizing energy-intensive industries and sectors that are difficult to electrify, such as heavy transportation, manufacturing, and chemical production, is essential. Low-carbon hydrogen offers a versatile and scalable solution to reduce emissions in these areas.

Governments are backing these efforts with robust policies, subsidies, and investment in research and development. For instance, the European Union’s Green Deal and the United States' Infrastructure Investment and Jobs Act include substantial provisions for advancing hydrogen technologies. These initiatives are driving substantial public and private investments, accelerating the development of hydrogen infrastructure, and reducing production costs through economies of scale. Consequently, the global push towards net-zero emissions is a primary driver propelling the low carbon hydrogen market's rapid growth and adoption.

Cost of production

A major restraint for the growth of the low carbon hydrogen market is the high cost of production and infrastructure development. Producing low-carbon hydrogen, especially green hydrogen through electrolysis, requires significant energy input from renewable sources, which can be expensive. Although renewable energy costs have been declining, the current cost of green hydrogen production remains higher compared to conventional hydrogen derived from fossil fuels.

Additionally, the infrastructure necessary for hydrogen production, storage, transportation, and distribution is underdeveloped and requires substantial investment. Building new hydrogen refueling stations, pipelines, and storage facilities involves high capital expenditure. The lack of existing infrastructure poses logistical challenges and limits the widespread adoption of hydrogen as a fuel source.

Moreover, the scalability of low-carbon hydrogen production is still in its nascent stages. Advanced technologies like carbon capture, utilization, and storage (CCUS) for blue hydrogen are also not yet commercially viable at large scales. This technological and economic uncertainty hinders large-scale deployment and integration into existing energy systems. Hence, high production costs, substantial infrastructure investment needs, and technological challenges are significant restraints that the low carbon hydrogen market must overcome to achieve broader adoption and competitiveness.

Decarbonizing the industrial sector

One promising future opportunity for the low carbon hydrogen market lies in its potential role in decarbonizing the industrial sector. Industries such as steel, cement, and chemicals are among the hardest to remove from the economy in terms of carbon emissions due to their reliance on high-temperature processes and fossil fuels. Low-carbon hydrogen offers a viable pathway to significantly reduce emissions in these sectors.

In steel production, traditional blast furnaces can be replaced with hydrogen-based direct reduction processes, which can produce steel with minimal CO2 emissions. Similarly, in the chemical industry, hydrogen can serve as a key feedstock for producing ammonia and methanol without the associated carbon footprint of conventional methods.

The adoption of low-carbon hydrogen in these industries not only helps in meeting stringent emission targets but also provides a competitive edge as global demand for green products increases. Companies and countries that invest early in hydrogen technologies and infrastructure can position themselves as leaders in the emerging green industrial economy. Furthermore, international collaborations and supportive policies can accelerate the development and deployment of hydrogen solutions in industrial applications, making it a cornerstone of the global transition to a low-carbon future.

Tsteam methane reforming (SMR) segment held the largest share of the low carbon hydrogen market in 2024. Steam methane reforming is the widely adopted process nowadays owing to its cost-effectiveness and its established techniques. It is basically the process where natural gas reacts with steam to produce hydrogen, carbon monoxide, and a smaller amount of carbon dioxide. When this complete outcome is combined with carbon capture, utilization, and storage technologies, it significantly reduces greenhouse emissions and produces hydrogen, which is known as blue hydrogen.

The biomass segment led the global low carbon hydrogen market in 2024. Biomass is used as a feedstock as it is widely available, and it can be produced by using natural wastages like agricultural waste, wastes from forestry, and special energy plants used for biological processes. Further, the energy source segment is divided into Natural Gas, Solar, Wind, Hybrid Biomass, Geothermal, Hydro Energy, and Tidal. Among these is hydrogen, which is derived from a biomass energy source known as low carbon.

The hydrogen segment dominated the low carbon hydrogen market in 2024. This segment is further subdivided into ammonia, liquified hydrogen, methane, and methanol. The hydrogen segment is witnessing increasing demand in the market owing to its high sustainability and established technologies to derive hydrogen. Hence, various industries, such as power generation and transportation, are using hydrogen as a preferable source for energy generation due to its adaptability. Moreover, the hydrogen segment is propelling due to its rising technological innovations, specifically in renewable energy generation sources like wind power and solar power.

North America dominated the global low carbon hydrogen market in 2024, driven by robust governmental support, substantial investments, and a strong commitment to decarbonization. North America's dominance in the market is further bolstered by the region's existing infrastructure, advanced R&D capabilities, and a growing network of hydrogen refueling stations. As the demand for clean energy solutions intensifies, North America is well-positioned to lead the global transition to a hydrogen-powered future. The United States and Canada are at the forefront of this growth, leveraging their technological advancements, abundant natural resources, and progressive policies.

The U.S. government has implemented comprehensive strategies to boost the hydrogen economy, including the Infrastructure Investment and Jobs Act, which allocates significant funding for hydrogen projects. The U.S. Department of Energy’s Hydrogen Shot initiative aims to reduce the cost of clean hydrogen within a decade, further accelerating market adoption. Major companies and research institutions are collaborating to develop and scale up hydrogen technologies, ensuring the U.S. remains a global leader. This drives the oveall growth of the low carbon hydrogen market.

Canada, with its vast renewable energy resources and strong environmental policies, is also investing heavily in the low carbon hydrogen market. The Canadian government’s Hydrogen Strategy outlines a framework to establish Canada as a global hydrogen leader, focusing on production, domestic utilization, and export potential.

Asia Pacific is projected to host the fastest-growing low carbon hydrogen market during the forecast period, driven by a combination of strong governmental support, ambitious decarbonization targets, and significant industrial demand. The concerted efforts across the region, supported by favorable policies, technological advancements, and substantial funding, position it as the fastest-growing region in the global market.

In Asia Pacific’s low carbon hydrogen market, Japan and South Korea have set aggressive hydrogen adoption targets as part of their national energy strategies. Japan aims to become a "hydrogen society," with plans to expand hydrogen use across various sectors, including transportation, power generation, and industry. South Korea's Hydrogen Economy Roadmap envisions widespread hydrogen adoption with extensive investments in production facilities and hydrogen refueling stations.

India and China, the world's largest emitter of greenhouse gases, are rapidly increasing their focus on low-carbon hydrogen as part of their broader

Efforts to achieve carbon neutrality. The country is investing heavily in hydrogen production and pilot projects, particularly in green hydrogen, leveraging its vast renewable energy resources. Thus driving the growth of the regions low carbon hydrogen market.

Europe is emerging as a significantly growing low carbon hydrogen market, driven by stringent climate policies, significant funding, and a strong commitment to achieving carbon neutrality by 2050. The European Union's Green Deal and Hydrogen Strategy are central to this growth, aiming to make Europe a global leader in hydrogen technology and deployment. These targets are supported by substantial investments from the EU and member states, as well as funding from programs like Horizon Europe and the Innovation Fund. The strategy focuses on creating a hydrogen economy that integrates production, infrastructure, and end-use applications across sectors such as industry, transport, and energy.

Additionally, the European low carbon hydrogen market benefits from strong public-private partnerships and a collaborative approach among countries to develop a cohesive hydrogen network. This includes projects and initiatives to establish hydrogen valleys and hubs where production, storage, and consumption are integrated. Hence, Europe's comprehensive policy framework, substantial financial backing, and collaborative efforts position it as the second-largest and one of the fastest-growing markets for low-carbon hydrogen globally.'

By Process

By Energy Source

By End-Product

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2024

January 2025

December 2024