February 2025

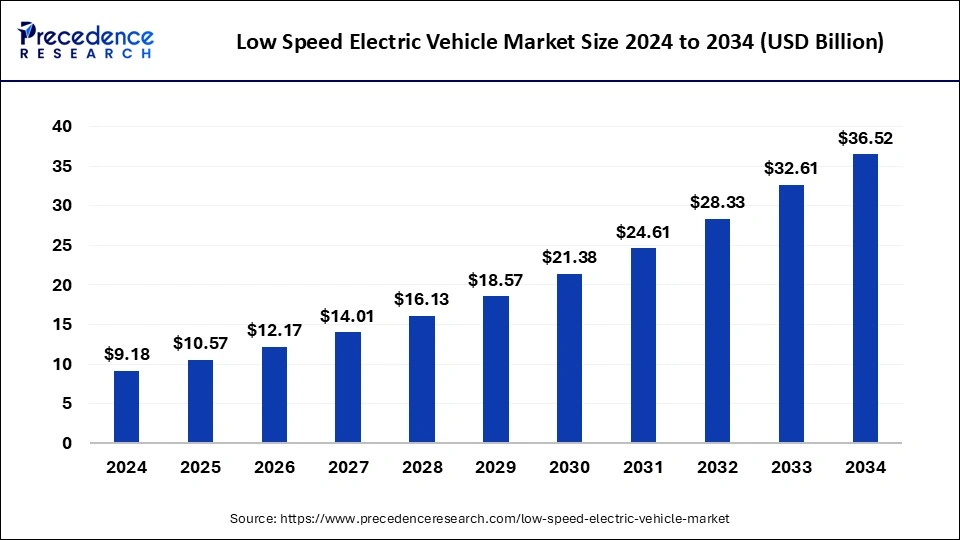

The global low-speed electric vehicle market size is calculated at USD 10.57 billion in 2025 and is forecasted to reach around USD 36.52 billion by 2034, accelerating at a CAGR of 14.81% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global low-speed electric vehicle market size was estimated at USD 9.18 billion in 2024 and is predicted to increase from USD 10.57 billion in 2025 to approximately USD 36.52 billion by 2034, expanding at a CAGR of 14.81% from 2025 to 2034. The rising demand for low-speed electric vehicles in commercial places drives the growth of the low speed electric vehicle market.

Low-speed electric vehicles are gaining popularity in the electric vehicle segment due to their compact and small size and lower consumption of batteries. It is primarily designed for low-speed and short-range urban commuting. The rising concern about environment-friendly vehicles and the increasing demand for modern personal transportation is driving the demand for low-speed electric vehicles. Low-speed electric vehicles are less expensive to operate in terms of maintenance and fuel. It is quieter than the other electric vehicles and easy to navigate and park. The rising demand for low-speed compact electric vehicles in the tourist and sports centers also drives the growth of the low speed electric vehicle market.

| Report Coverage | Details |

| Market Size by 2034 | USD 36.52 Billion |

| Market Size in 2025 | USD 10.57 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 14.81% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Vehicle Type, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing demand due to its advantages

The increasing adoption of low-speed electric vehicles due to rising environmental concerns and the rising technological advancements in low-speed electric vehicles are driving the popularity of the vehicles that contribute to the expansion of the low-speed electric vehicles market. Further, technological advancements such as smart and flexible charging help in maintaining and managing the electricity used by electric vehicles. Smart charging uses the intelligent connecting method for monitoring vehicle usage, grid, and stored capacity.

Additionally, the low-speed electric vehicles are environmentally friendly and fuel efficient. Low-speed electric vehicles use a power grid powered by various sources such as fossil fuels and other renewable energy. Thus, it produces a lower carbon footprint than gasoline-powered vehicles. Low-speed electric vehicles are less maintenance-efficient; though they are powered by electricity, they do not require any kind of regular maintenance such as lubrication, oiling, and other maintenance that are required for the other types of gasoline vehicles.

Underdeveloped technology

The low speed electric vehicle market is facing challenges due to the underdeveloped state of its technology and the lack of charging infrastructure in many regions. As a result, the growth of this market is being restrained. Low-speed electric vehicles have the potential to offer sustainable and cost-effective transportation solutions, particularly in urban areas and for short commutes. However, the need for a robust charging infrastructure is crucial for the widespread adoption of these vehicles.

Without easy access to charging stations, potential buyers may be hesitant to invest in low-speed electric vehicles, thus hindering market growth. It's essential for stakeholders to work together to develop the necessary infrastructure and advance the technology to unlock the full potential of the low speed electric vehicle market.

Technological advancements in electric vehicles

The rising demand for sustainable and eco-friendly vehicles is the major factor that is driving the growth of the market. Additionally, the ongoing research on the technological advancements in electric vehicles, such as artificial intelligence, IoT (Internet of Things), and machine learning technologies integration into the electric vehicles, are further driving the opportunity in the growth of the market.

The integration of technologies such as AI-powered health checks, advanced driver assistance systems (ADAS), improved connectivity features, smart grids, charging infrastructure development, sustainable material disposable, advancement in battery technology, energy efficiency and generative braking, and hydrogen fuel cell vehicles (FCVs) in the electric vehicles for enhancing quality, speed, and efficiency are collectively driving the opportunity in the growth of the low speed electric vehicle market.

The passenger segment had the largest revenue in the low speed electric vehicle market in 2024. The growth of the segment is attributed to the rising demand for sustainable and eco-friendly passenger vehicles, which is driving the demand for the low speed electric vehicle market. The increasing global population is fueling the demand for passenger vehicles. The rising concern about environmental pollution and having a tendency to contribute to environmental safety is fueling the adoption of passenger electric vehicles.

The increasing shift towards electric vehicles from gasoline-powered vehicles due to the rising fuel prices in various countries and the increasing environmental pollution globally and the stringent regulation by the various regional governments for limiting environmental pollution and providing various subsidies in the purchase of passenger electric vehicles is further boosting the growth of the passenger low-speed electric market.

The golf courses segment dominated the low speed vehicle market with the largest share in 2024. The increasing adoption of the low speed electric carts or vehicles in the golf courses for transportation from one point to another. The low-speed golf carts have a maximum speed of 20-25 miles per hour and are equipped with safety features such as headlights, seatbelts, reflectors, rear lights, and mirrors. The number of golf courses in several countries and the investment in the development of large golf spaces drive the demand for low-speed electric golf carts.

Asia Pacific, in 2024, held the largest share of the low speed electric vehicle market. The growth of the market in the region is owing to the rising regional countries populations like China and India, which are driving the demand for the automotive industry, and the rising awareness about global warming by gasoline vehicles is driving the demand for low-speed electric vehicles by the population. Asia Pacific is emerging as a great opportunity for the expansion of electric vehicles due to its larger population, increasing economic development, and popularity of electric vehicles. Thus, all these factors are collectively contributing to the expansion of the low speed electric vehicle market in the region.

North America is observed to grow at the fastest pace during the forecast period. The growth of the market is attributed to the rising development in the automotive industry, and the rising research on the development of electric vehicles is driving the demand for the low-speed electric vehicles market.

The rising rate of adaptation of electric vehicles by the population due to the rising awareness about environmental pollution and the rising disposable income and lifestyle standards in the population in the region is driving the growth of the market. The investment by the public and private investors in the development and integration of smart technologies in electric vehicles contributes to the growth of the low-speed electric vehicles market in the region.

By Vehicle Type

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

April 2025

January 2025

January 2025