February 2025

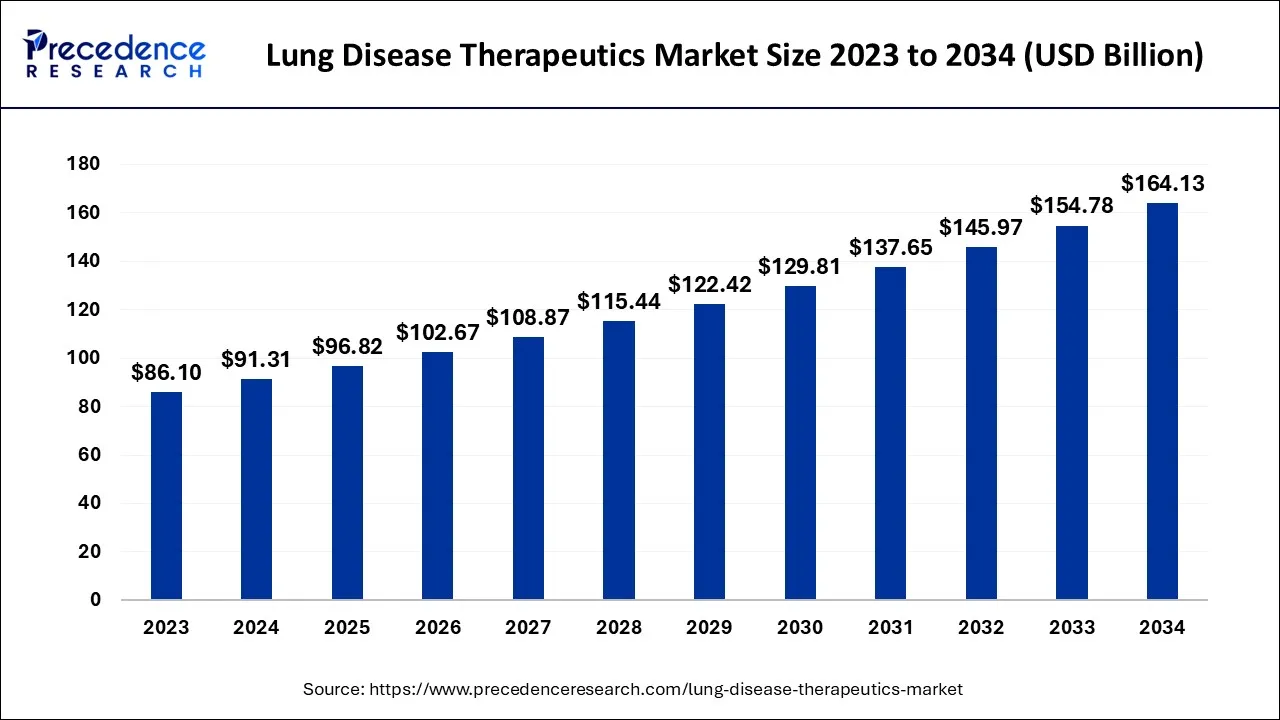

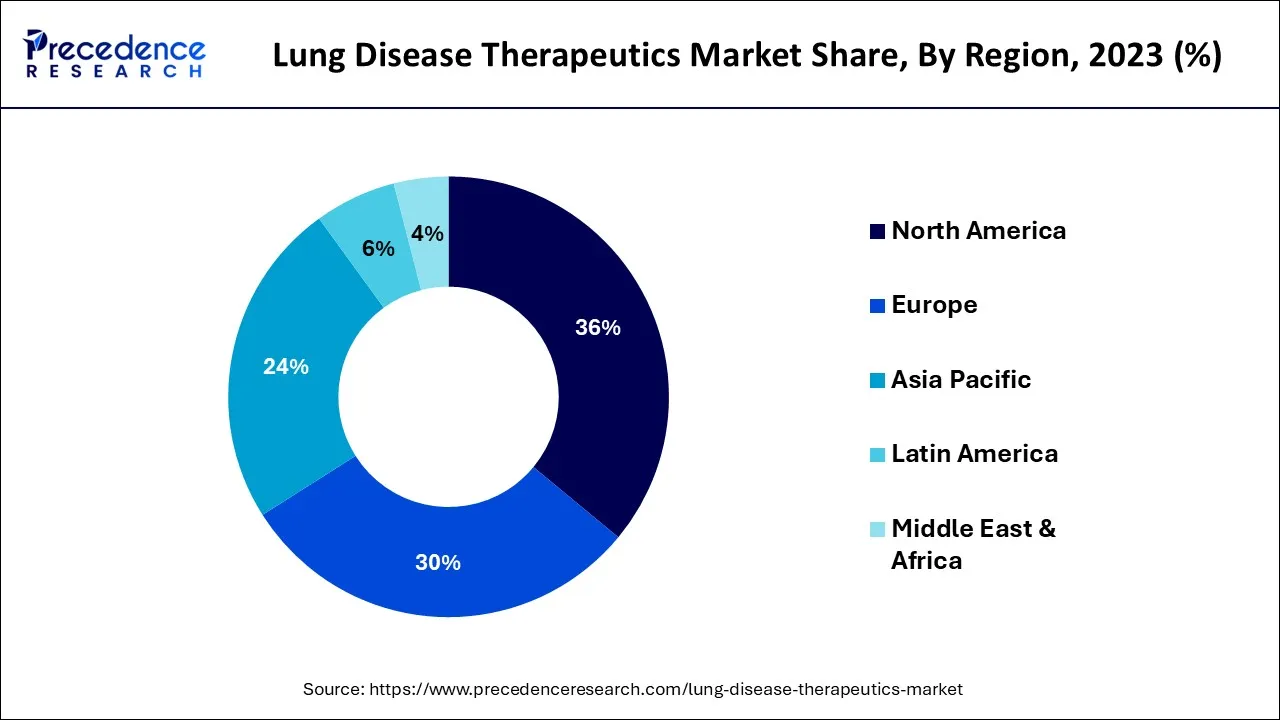

The global lung disease therapeutics market size accounted for USD 91.31 billion in 2024, grew to USD 96.82 billion in 2025, and is expected to be worth around USD 164.13 billion by 2034, registering a healthy CAGR of 6.04% between 2024 and 2034. The North America lung disease therapeutics market size is predicted to increase from USD 32.87 billion in 2024 and is estimated to grow at the fastest CAGR of 6.19% during the forecast year.

The global lung disease therapeutics market size is expected to be valued at USD 91.31 billion in 2024 and is anticipated to reach around USD 164.13 billion by 2034, expanding at a CAGR of 6.04% over the forecast period 2024 to 2034.

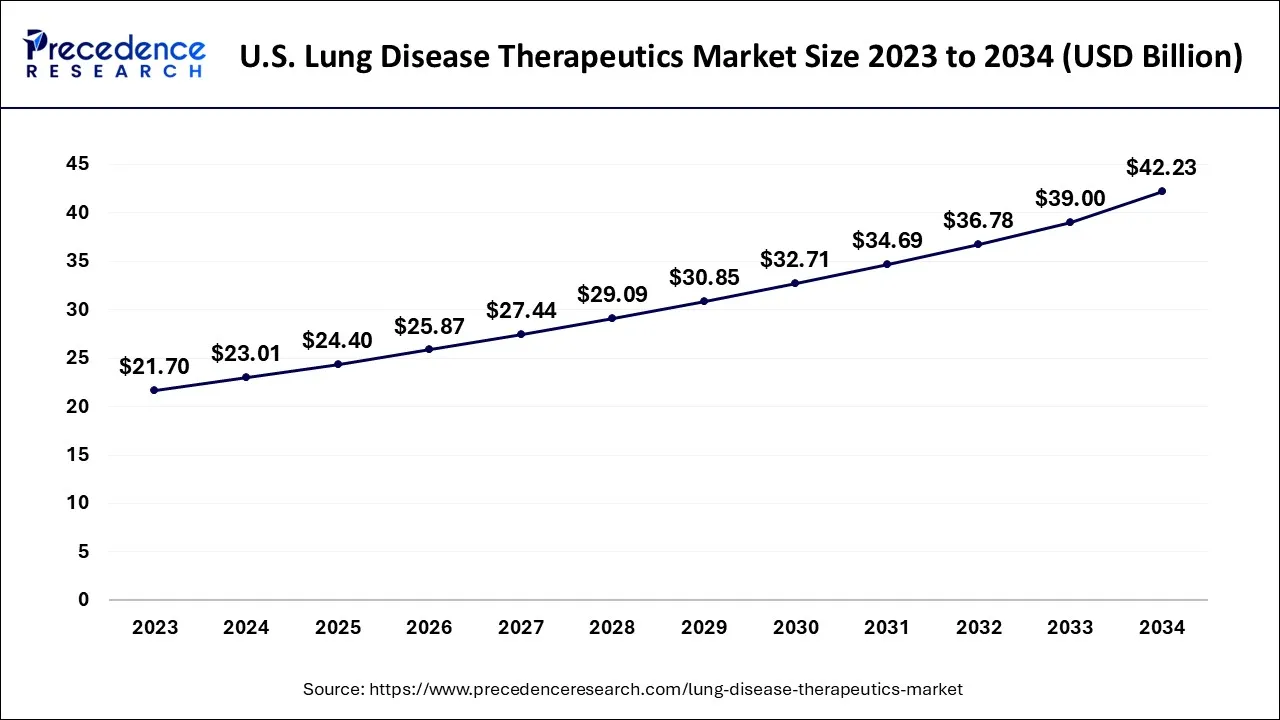

The U.S. lung disease therapeutics market size is exhibited at USD 23.01 billion in 2024 and is projected to be worth around USD 42.23 billion by 2034, growing at a CAGR of 6.26% from 2024 to 2034.

North America is the dominating lung disease therapeutic market throughout the projection period. The United States is North America's largest lung disease therapeutics market regarding regional dominance accounting for a significant market share. This is due to the country's high prevalence of lung diseases, the availability of advanced healthcare infrastructure, and technological advancements in treatment options. Canada is also a significant market for lung disease therapeutics, owing to the country's rising prevalence of respiratory diseases.

Asia-Pacific is the fastest-growing lung disease therapeutics market during the forecast period. The region is home to some of the world's largest populations, particularly India, China, and is experiencing a rise in chronic respiratory diseases such as asthma, chronic obstructive pulmonary disease (COPD), and lung cancer. These diseases significantly burden healthcare systems in the region, driving demand for innovative and effective treatments, the increasing prevalence of lung cancer, rising healthcare expenditure, and a growing focus on early diagnosis and treatment.

The lung disease therapeutics market refers to the drugs and cures involved in treating lung disorders. Symptoms include shortness of breath, cough, and chest pain. According to the National Heart, Lung, and Blood Institute, May is considered "National Asthma and Allergy Awareness Month." According to the Centers for Disease Control and Prevention external link, the United States has asthma of about 1 in 13 people, which affects people of every age group and often starts in childhood. It occurs due to external factors such as pollen grains, viral infections, cold air, or exercise.

The global lung disease therapeutics market is projected to grow significantly due to active research and development on lung disease. In lung diseases, it promotes the regeneration of damaged lung tissue and improves lung function. Few growth factors (proteins) such as insulin-like growth factor (IGF), epidermal growth factor (EGF), transforming growth factor-beta (TGF-β), and fibroblast growth factor (FGF) are studied under various lung diseases, including chronic obstructive pulmonary disease (COPD), pulmonary fibrosis (IPF).

The therapeutics market for lung disease is still in its early phase, with most drugs still in the preclinical or early clinical stages. Furthermore, a few therapeutics are prospered for lung diseases, including biologics and small-molecule drugs. The market for lung disease therapeutics is expected to grow significantly in the forthcoming years, driven by factors such as increasing rates of lung diseases, an aging population, and advances in medical technology.

| Report Coverage | Details |

| Market Size in 2024 | USD 91.31 Billion |

| Market Size by 2034 | USD 164.13 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.04% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Disease Type, By Drug Class, By Molecule Type, By Distribution Channel, and By Treatment Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rise in the prevalence of lung cancer

According to the American Cancer Society, it is estimated that around 238,340 current cases of lung cancer, 117,550 in men and 120,790 in women, and approximately 127,070 deaths from lung cancer, 67,160 in men and 59,910 in women are detected for lung cancer in the US 2023.

The rise in the prevalence of lung cancer is probably to have a significant impact on the lung disease therapeutics market. Advances in medical research and technology have led to the development of new and innovative therapies for lung diseases. These therapies may include targeted therapies, immunotherapies, and other novel approaches that may be more effective than traditional treatments. The growing focus on personalized medicine is driving the lung disease therapeutics market. Technological advancements in genetic testing and biomarker identification enable doctors to identify specific patient populations more appropriately to aid from certain therapies.

High cost of research and development

The cost associated with research and development can be a primary barrier for industries. Creating a new drug from inception to approval can take over a decade and cost billions of dollars. This cost is mainly due to the complex and lengthy process of discovering and developing a new drug, which involves extensive research, clinical trials, and regulatory approvals. Lung diseases such as chronic obstructive pulmonary disease (COPD), cystic fibrosis, and pulmonary fibrosis are often chronic and progressive, making it challenging to develop effective treatments. The lungs are a complex organ system; developing drugs that can effectively target specific cells or tissues can be tricky. Despite these challenges, significant progress has been made in developing new lung disease therapeutics in recent years.

Advances in technology and medicine

Technological advances have allowed for identifying specific genetic mutations and proteins that play a role in lung diseases, leading to the development of targeted therapies to treat specific types of lung cancer or pulmonary diseases with greater precision and effectiveness. The advancement in drug delivery systems has allowed for more targeted and efficient delivery of medications to the lungs. Inhalation devices, for example, can deliver drugs directly to the disease site by minimizing the side effects and upgrading therapeutic outcomes. During the COVID-19 pandemic, telemedicine has immensely expanded and has the potential to improve access to lung care and increase patient engagement. Remote monitoring devices and virtual consultations can help patients manage their lung conditions more efficiently, enabling healthcare providers to deliver care more accurately.

Asthma is the most prominent disease to raise the lung disease therapeutics market during the analyzed period. The rise in the lung disease therapeutics market can be attributed to an increasing prevalence of asthma and other lung diseases, growing awareness and diagnosis of the conditions, and advancements in medical technology and treatments. It includes the development of new and innovative drugs, increasing investment in research and development, and rising healthcare expenditure in emerging markets. Furthermore, the growing demand for personalized medicine and targeted therapies for asthma is expected to boost the growth of the asthma segment.

The corticosteroids segment is expected to be the dominant drug class segment during the predicted period. Corticosteroids are a class of medications that have anti-inflammatory and immunosuppressive properties and are mainly used to treat lung diseases such as asthma, chronic obstructive pulmonary disease (COPD), and interstitial lung disease (ILD). The corticosteroids market has the highest revenue and is currently generated by the segment of respiratory infections, which includes lung diseases such as asthma, COPD, and ILD due to the high prevalence of respiratory diseases worldwide and the widespread use of corticosteroids in their treatment. Therefore, corticosteroids are widely used in treating respiratory diseases, including lung diseases, and generate the highest revenue in the market.

A bronchodilator is expected to be the most lucrative segment throughout the forecast period

The bronchodilator and lung disease therapeutics market is expected to grow significantly in the coming years, driven by the rising prevalence of respiratory diseases, a growing geriatric population, and rising levels of air pollution. These are medications that relax the airways' muscles, making breathing easier. At the same time, lung disease therapeutics refer to drugs used to treat respiratory conditions such as asthma, chronic obstructive pulmonary disease (COPD), and cystic fibrosis. The COVID-19 pandemic has significantly impacted the bronchodilator and lung disease therapeutics market by contributing to an increase in respiratory illnesses and increasing demand for bronchodilators and lung disease therapeutics.

Biologics is expected to be the dominating molecule type segment during the predicted period

The contributing factors for the biologics market for lung disease therapeutics include asthma, chronic obstructive pulmonary disease (COPD), and idiopathic pulmonary fibrosis (IPF), the growing geriatric population, and advancements in biologic drug development technologies. Even the increasing focus of biopharmaceutical companies on developing novel biologics for the treatment of lung diseases is expected to fuel the market's expansion. For instance, the development of monoclonal antibodies and other biologics that target specific molecules and pathways involved in the pathogenesis of lung diseases is expected to drive market growth. Furthermore, the growing trend of combination therapy, wherein two or more biologics are used together to treat lung diseases, is expected to further propel the growth of the lung disease therapeutics market.

The small molecules segment shows noticeable growth in the lung disease therapeutics market during the predicted period. There is a growing interest in developing small-molecule drugs for treating various lung diseases, including chronic obstructive pulmonary disease (COPD), asthma, and pulmonary fibrosis. Small molecules are organic compounds with low molecular weight, which allows them to easily penetrate cell membranes and interact with intracellular targets. These are designed to target specific molecular pathways involved in the development and progression of lung diseases, which can provide more targeted and effective treatments than traditional therapies. Moreover, small molecules often have better oral bioavailability and are easier to formulate into pill form, which can increase patient compliance and convenience.

Targeted therapy is the promising treatment type used in the lung disease therapeutics market during the forecast period. Targeted therapy has emerged as a promising approach for treating various lung diseases, including lung cancer and chronic obstructive pulmonary disease (COPD), where their process involves identifying and targeting specific molecules or pathways involved in the disease's development or progression, targeting to achieve better treatment outcomes and fewer side effects. Some other treatment options are bronchodilators, corticosteroids, and immunosuppressants, which dominate the therapeutics market for lung diseases. The market is highly competitive, with several key players competing to capture a larger market share.

Immunotherapy is expected to grow in the lung disease therapeutics market during the predicted period. Immunotherapy and lung disease therapeutics are both expanding markets, and the combination is predicted to be especially attractive for investors. It involves using a patient's immune system to fight cancer or other diseases. In contrast, the therapies aim to treat conditions such as asthma, chronic obstructive pulmonary disease (COPD), and pulmonary fibrosis. Both markets have been growing in recent years due to the prevalence of these diseases and a growing awareness of the potential benefits of these treatments. For instance, lung cancer is an apparent cause of mortality in patients with COPD, and immunotherapy effectively treats lung cancer.

Hospitals are the dominating lung disease therapeutic market. A few key players in the pharmaceutical industry dominated the hospital segment for lung disease by using therapies, including inhaled corticosteroids, bronchodilators, immune suppressants, and targeted therapies. In recent years, the demand for lung disease therapies has become increasingly competitive, with several fresh entrants. Some emerging players in this space include Vertex Pharmaceuticals, which holds a significant market share due to its established brands and extensive R&D pipelines. As new therapies continue, the competitive landscape of the hospital segment for lung disease will likely evolve.

Online shows lucrative growth in the lung disease therapeutics market. The online therapeutic market for lung diseases became focused due to Covid -19 pandemic, and the demand has risen for numerous reasons. According to the World Health Organization (WHO), lung diseases are responsible for approximately 3 million deaths worldwide yearly. The prevalence of Covid-19 in recent years along with multiple restrictions implemented across the globe boosted the growth of the online segment.

The growth of online segment for lung disease therapeutics is attributed to the rising number of home care settings, especially for geriatric population, more convenience offered by online medicine shopping and available options for door-step delivery.

Segments Covered in the Report

By Disease Type

By Drug Class

By Molecule Type

By Treatment Type

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

October 2024

September 2024

November 2024